40% OFF Sale

40% OFF all other accounts

Most futures traders struggle with limited capital and frustratingly slow payment cycles. Finding a reliable partner that actually delivers on its promises is becoming increasingly difficult in the prop industry. If you are tired of waiting weeks for your profits, this Lucid Trading review examines whether the firm is a real game-changer or just another bold promise.

Lucid Trading positions itself as a futures-focused prop firm offering funded accounts with profit splits of up to 90% and a highly promoted daily payout system. But does the real trading experience live up to the marketing claims? Many traders often question the trading rules, trailing drawdown, and long-term account sustainability.

In this Lucid Trading review, H2T Funding will break down everything you need to know, from funding programs and trading rules to payout structure, platforms, and real trader feedback. By the end of this article, you will clearly understand how Lucid Trading works, who it is best for, and whether it is the right prop firm for your futures trading goals.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Lucid Trading websites before purchasing any challenge.

1. Overview Lucid Trading

Lucid Trading is a modern proprietary trading firm that launched in 2024. Operated under the legal entity Lucid Prop Ltd, the firm was built to provide a professional-grade bridge between retail traders and traditional proprietary desks.

The company is led by Lucid Trading CEO AJ, who envisioned a platform where transparency and speed are the core values. Unlike many competitors, Lucid Trading focuses exclusively on the CME futures contracts market, ensuring high liquidity and a regulated environment for all evaluation accounts.

The firm’s mission is to offer a step-by-step path for traders to move from testing strategies to trading with real capital. They aim to set a new standard by removing the ambiguity often found in the funded futures accounts industry.

2. Our take on Lucid Trading

Lucid Trading stands out as a high-performance bridge between retail traders and professional proprietary desks. By focusing solely on CME futures contracts, they offer a high-liquidity environment that removes many traditional hurdles found in forex-focused firms.

The headline feature of daily payouts is a genuine disruptor for those managing funded futures accounts. In my experience, allowing traders to access capital almost immediately reflects a level of transparency and trust that is rare in today’s industry.

However, this isn’t a playground for beginners. The Lucid Trading rules are logical but strict, especially regarding the consistency percentages. It feels like a partnership designed for the self-sufficient professional; the firm provides the institutional-grade capital. In return, they expect a repeatable, disciplined process rather than a few lucky home-run trades.

| Pros | Cons |

|---|---|

| Daily payouts are available in the LucidLive stage | Strict consistency rules (20% to 50%) |

| 90% profit split and FREE activation fees (Pro/Flex) | Buffer balance requirements for Pro withdrawals |

| End-of-day (EOD) drawdown is more trader-friendly | Relatively new firm (Launched late 2024) |

| Supports TradingView, NinjaTrader, and Quantower | No educational resources or mentorship |

| Instant funding option via LucidDirect | Daily Loss Limits on larger Pro accounts |

3. Funding program Lucid Trading

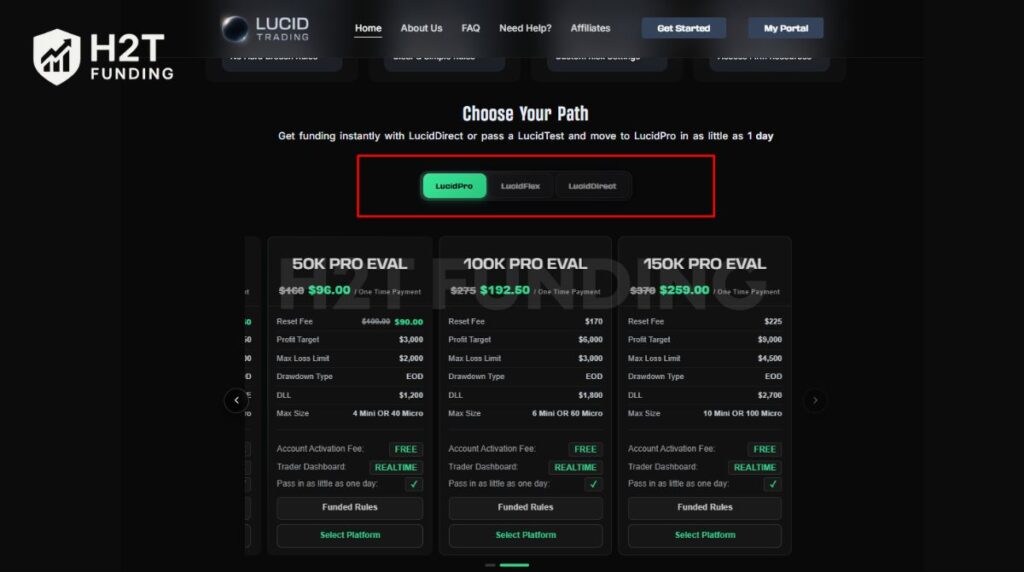

Lucid Trading offers three main funding pathways: Lucid Pro, Lucid Flex, and Lucid Direct. This variety allows you to choose between a standard low-cost evaluation or gaining immediate access to capital without any testing phase.

All programs are geared toward reaching the LucidLive stage, where daily payouts become available. Traders enjoy a high 90% profit split and a streamlined setup process that allows for real-time account activation within minutes of purchase.

3.1. Lucid Pro account

The Lucid Pro pathway is a streamlined 1-step evaluation designed for traders who want to prove their consistency without jumping through multiple hoops. By hitting a specific profit target in as little as one day, you can transition quickly from a simulated environment to a funded status.

A massive advantage of this program is the FREE account activation fee, which significantly lowers the total cost of ownership compared to other firms. Furthermore, all Pro accounts utilize End of Day (EOD) drawdowns, giving you more flexibility to hold trades throughout the session without being stopped out by intraday peaks.

| Plan Type | Profit Target | Max Loss Limit (EOD) | Daily Loss Limit (DLL) | Max Contract Size | One-Time Fee |

|---|---|---|---|---|---|

| 25K | $1,250 | $1,000 | NONE | 2 Mini / 20 Micro | $72.00 |

| 50K | $3,000 | $2,000 | $1,200 | 4 Mini / 40 Micro | $96.00 |

| 100K | $6,000 | $3,000 | $1,800 | 6 Mini / 60 Micro | $192.50 |

| 150K | $9,000 | $4,500 | $2,700 | 10 Mini / 100 Micro | $259.00 |

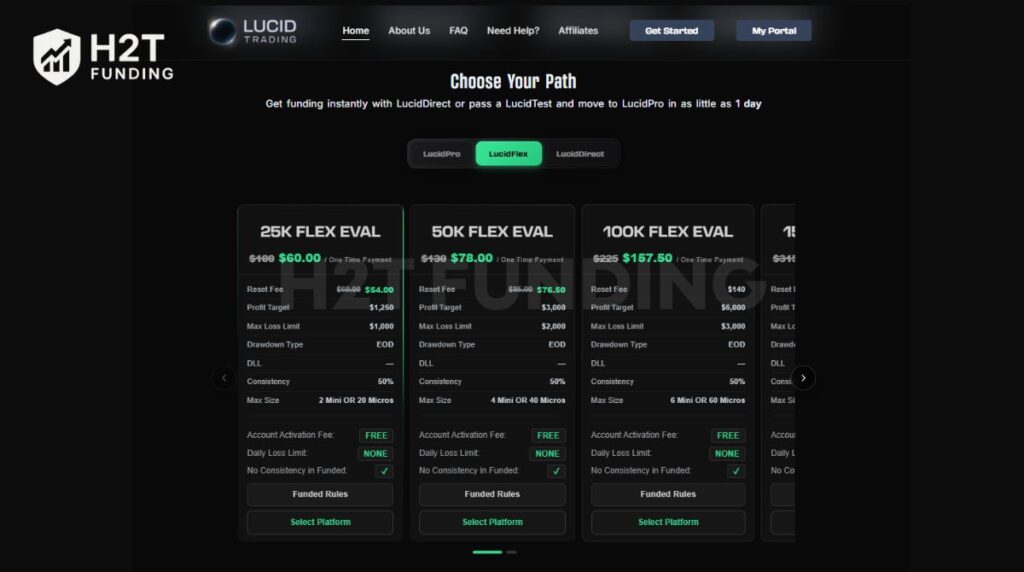

3.2. Lucid Flex account

The Lucid Flex plan is a 1-step evaluation designed for traders who want even more freedom than the Pro model provides. Like its counterpart, this pathway features a FREE account activation fee and focuses on the trader-friendly End of Day (EOD) drawdown system.

The core difference is that Lucid Flex has NO Daily Loss Limit (DLL) across any account size, whereas larger Pro accounts have strict daily caps. However, to maintain quality, theuation requires a 50% consistency rule, ensuring your profits are spread across multiple sessions.

Once you transition to a funded status, the consistency rule is removed entirely. Traders can focus on reaching their goals and securing a lucid trading payout by meeting a minimum of 5 days of profit (ranging from $100 to $250, depending on the account size).

| Plan Type | Profit Target | Max Loss Limit (EOD) | Daily Loss Limit (DLL) | Consistency Rule (Eval) | One-Time Fee |

|---|---|---|---|---|---|

| 25K | $1,250 | $1,000 | NONE | 50% | $60.00 |

| 50K | $3,000 | $2,000 | NONE | 50% | $78.00 |

| 100K | $6,000 | $3,000 | NONE | 50% | $157.50 |

| 150K | $9,000 | $4,500 | NONE | 50% | $220.50 |

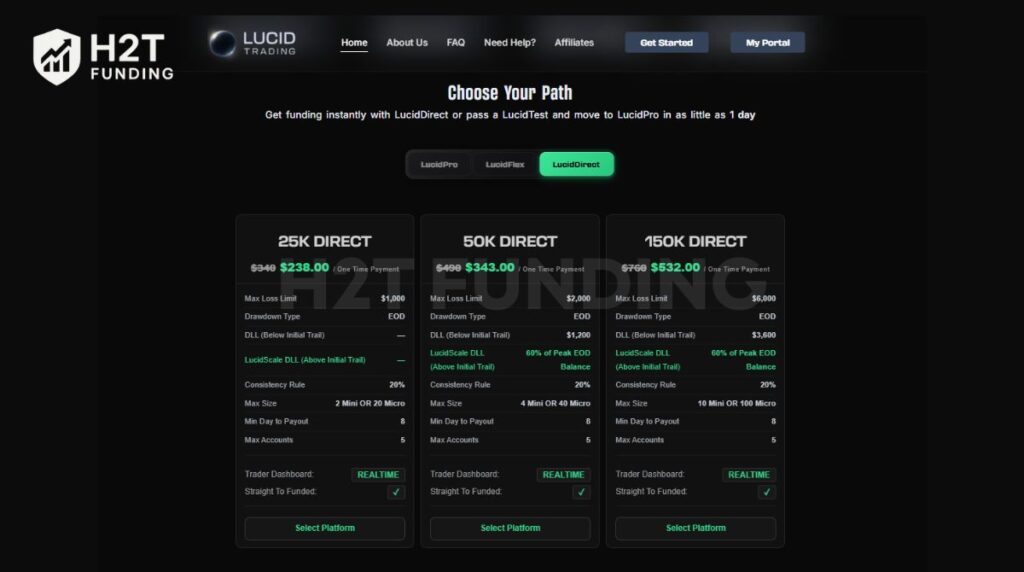

3.3. Lucid Direct account

Lucid Direct is the premier straight-to-funding pathway that allows you to skip the evaluation phase entirely. While it requires a higher upfront cost, you begin trading for real payouts from the very first day.

This program utilizes the End of Day (EOD) drawdown and introduces a 20% consistency rule to ensure long-term stability. You can manage up to 5 accounts simultaneously, making it an excellent option for scaling your capital quickly.

A unique feature here is the LucidScale DLL, which dynamically adjusts your daily loss limit based on your peak EOD balance once you are above the initial trail. The minimum days to payout is set at 8, ensuring you build a short track record before your first withdrawal.

| Plan Type | Max Loss Limit (EOD) | Daily Loss Limit (Below Trail) | Consistency Rule | Min Day to Payout | One-Time Fee |

|---|---|---|---|---|---|

| 25K | $1,000 | NONE | 20% | 8 | $238.00 |

| 50K | $2,000 | $1,200 | 20% | 8 | $343.00 |

| 150K | $6,000 | $3,600 | 20% | 8 | $532.00 |

Verdict on Lucid Trading funding programs

Choosing the right account type is the most critical decision for your journey with this proprietary trading firm. Each path serves a different psychological profile and level of market experience.

- Choose Lucid Pro if: You are budget-conscious and want a FREE activation fee after passing. It is the best all-rounder for those who don’t mind a standard 1-step evaluation.

- Choose Lucid Flex if: You find Daily Loss Limits restrictive and want the cheapest possible entry into evaluation accounts. It offers the most freedom during the testing phase.

- Choose Lucid Direct if: You are a seasoned professional with a proven strategy and want to bypass demo trading. The higher cost is offset by the ability to earn real profits from Day 1.

The lack of activation fees across the board makes Lucid Trading one of the most transparent firms in the industry. However, the 20% consistency rule on Direct accounts is quite strict, so ensure your strategy doesn’t rely on single home run trades.

4. Lucid Trading rules

The foundation of Lucid Trading rules is designed to mirror a professional environment rather than a restrictive fail-fast game. Success here depends on demonstrating a genuine market edge and maintaining a high level of risk management throughout the evaluation.

The firm operates on a partnership of trust, where they provide the capital and technology while you bring the discipline. Whether you are using evaluation accounts or a LucidDirect path, understanding the operational boundaries is vital for a smooth payout process.

4.1. Core trading rules

These are the operational standards that apply to almost every account type within the Lucid Trading prop firm ecosystem.

- Daily Closing Times: All positions must be closed by 4:45 PM EST (Monday-Friday). The system will auto-liquidate open trades, but this is not a hard breach of the account.

- Market Reopen: Trading resumes at 6:00 PM EST (Sunday-Thursday). Traders must be aware of holiday hours, which may alter these cutoffs.

- Consistency Percentage: To qualify for a Lucid Trading payout, your largest single day cannot exceed a certain percentage of total profit (40% for Pro, 50% for Flex, and 20% for Direct).

- Inactivity Policy: Accounts with no activity for 20 days are flagged. If no response is received by Day 30, the account is deactivated to maintain system integrity.

- Breached Accounts: If you hit the drawdown limits, the account is marked as breached. You have 30 days to purchase a reset before the account is permanently deleted.

4.2. Allowed trading rules

Lucid Trading offers significant freedom for various strategies, making it a favorite for those who find other firms too restrictive.

- News Trading: You are free to trade during major news events without restriction. However, you must manage the risks of slippage and high volatility on your own.

- Automation & Copiers: The use of automated strategies and trade copiers is permitted, provided they comply with the firm’s broader trading rules.

- Scaling and DCA: Traders are allowed to scale into positions or use Dollar Cost Averaging (DCA). While Martingale is strongly discouraged, it is not strictly prohibited.

- Genuine Scalping: Short-term entries are welcome as long as they reflect realistic market behavior and do not attempt to manipulate fill logic.

- Flipping: Quick in-and-out trades to meet minimum trading day requirements are allowed, though meaningful activity is encouraged.

- Swing Trading: This is exclusively allowed in LucidLive accounts, where traders can hold positions through the overnight maintenance window.

4.3. Prohibited trading rules

To ensure the long-term sustainability of the firm, certain behaviors that exploit the simulated environment are strictly forbidden.

- Hedging: Taking opposing positions on the same contract across multiple accounts, users, or different firms is a major violation and leads to account closure.

- High-Frequency Trading (HFT): Using algorithms to execute a massive volume of trades within milliseconds is prohibited due to the load it places on the infrastructure.

- Microscalping: If more than 50% of your profits come from trades held for 5 seconds or less, your account will be flagged and reviewed for bad faith activity.

- System Exploitation: Any attempt to take advantage of system errors, price discrepancies, or data delays is considered a breach of integrity.

Verdict on Lucid Trading rules

The most impressive part of the Lucid Trading rules is the No Hard Breach policy on closing times. Most firms will fail your account instantly if you forget to close a trade by 4:00 PM, but Lucid simply flattens it for you, which is a massive stress reliever.

However, the consistency percentages are the real gatekeepers here. If you have one lucky day that makes up 60% of your profit, you will have to continue trading until that day fits within the allowed ratio. It effectively filters out lucky gamblers and rewards those with a repeatable, steady process.

In summary, the rules are fair, transparent, and logical. As long as you aren’t trying to game the simulated fill logic via microscalping, you will find the environment very supportive of professional growth.

5. Lucid Trading payout structure

The Lucid Trading payout system is the firm’s primary differentiator, focusing on providing traders with rapid access to liquidity. While most competitors enforce rigid 30-day windows, this platform offers a path to daily payouts once specific eligibility criteria are met.

Standard-funded accounts operate on a 90/10 profit split, allowing you to keep the vast majority of your gains. For those who reach the LucidLive stage, the split adjusts to 80/20, but provides much higher autonomy. Approved withdrawals are typically disbursed via Plaid or WorkMarket within two business days.

5.1. LucidPro Payout requirements

To secure a payout in the LucidPro track, you must navigate a balance between profit and safety. The system uses a buffer balance (Initial Max Loss + $100) to ensure you don’t liquidate your account immediately after a withdrawal.

| Account Size | Min Daily Profit (5 Days) | Buffer Balance | Max Payout (Cycles 1-2) |

|---|---|---|---|

| $25,000 | $50 | $26,100 | $1,000 |

| $50,000 | $100 | $52,100 | $1,500 |

| $100,000 | $150 | $103,100 | $2,000 |

| $150,000 | $200 | $154,600 | $3,000 |

Traders must also adhere to a 40% consistency percentage, meaning your largest single-day gain cannot account for nearly half of your total withdrawal request. This ensures that your success is built on a repeatable strategy rather than a single lucky event.

5.2. LucidFlex Payout requirements

The LucidFlex model is unique because it removes the buffer balance requirement entirely. As long as you have a positive net profit and meet the 5-day profit minimum, you are eligible to request funds.

| Account Size | Min Daily Profit (5 Days) | Max Payout Limit | Move to Live Cap |

|---|---|---|---|

| $25,000 | $100 | 50% of Profit (Max $1,000) | $5,000 |

| $50,000 | $150 | 50% of Profit (Max $2,000) | $5,000 |

| $100,000 | $200 | 50% of Profit (Max $2,500) | $5,000 |

| $150,000 | $250 | 50% of Profit (Max $3,000) | $5,000 |

Note that Flex payouts do not scale up over time. You are limited to 6 total payouts per account before being transitioned to a LucidLive environment. This track is ideal for those who prefer smaller, more frequent withdrawals.

5.3. LucidDirect Payout requirements

Because LucidDirect bypasses the evaluation, it carries the strictest consistency rules at 20%. You must trade for at least 8 separate days and reach a specific profit goal before your first request.

- Profit Split: 90/10 standard.

- Consistency: 20% (Largest day / Total profit).

- Payout Minimum: $500 across all account sizes.

- Max Payouts: Scale from $1,000 (25K account) up to $3,500 (150K account) as you complete more cycles.

5.4. LucidLive: The professional stage

Once you transition to LucidLive, the rules become significantly more flexible. You can request payouts daily from Day 1, with no minimum trading day or profit requirements.

Traders at this level can withdraw directly from their current account balance, even on days when a loss occurred. This provides full autonomy over capital management, though withdrawing the entire balance requires a brief consultation with the risk management team to discuss account implications.

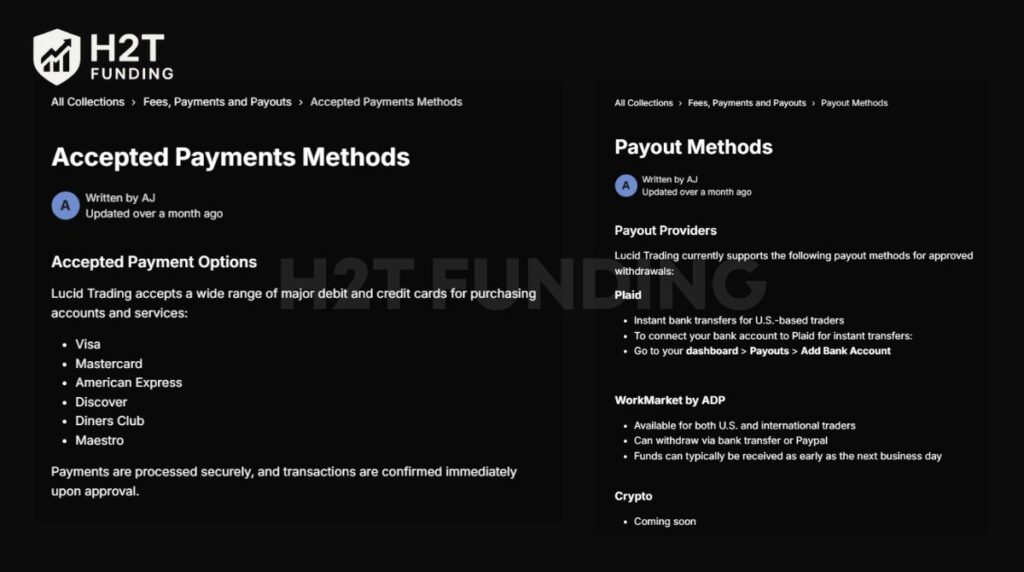

5.5. Accepted payment & payout methods

Managing your funds is streamlined through several secure providers. Lucid Trading ensures that transactions are confirmed immediately upon approval.

- Plaid: Offers instant bank transfers specifically for U.S.-based traders.

- WorkMarket by ADP: Available for both U.S. and international traders, supporting bank transfers and PayPal.

- Accepted Purchases: Major debit and credit cards, including Visa, Mastercard, and American Express.

Verdict on Lucid Trading payout structure

The payout framework here is clearly designed to filter for professional behavior. The buffer balance in Pro accounts might feel restrictive initially, but it actually protects the trader from hitting the Max Loss Limit during a drawdown.

The daily payout availability in the Live stage is the gold standard of the industry. However, you must be prepared to handle the consistency rules in the earlier stages. If your strategy produces lumpy returns with one massive day followed by many small ones, you may find yourself trading longer to meet the percentage requirements.

This firm is perfect for the steady grinder who makes consistent daily profits. The 90% profit split and two-day processing time make it a highly competitive choice for anyone prioritizing cash flow and liquidity.

6. Scaling plan of Lucid Trading

The scaling plan at Lucid Trading is a core component of their risk management strategy for funded futures accounts. It ensures that traders do not take on excessive leverage before proving they can maintain a stable, profitable balance.

This plan only applies to the funded phase; there is no scaling during the evaluation accounts stage. It is designed to grow with your success, allowing for larger position sizes as your simulated profits increase.

A critical detail for any Lucid Trading review is that these limits update at the end of each session. This means your tradable contract size will not shift in real-time during the trading day, providing a more stable execution environment.

| Simulated Profits | 25K Plan Limits | 50K Plan Limits | 100K Plan Limits | 150K Plan Limits |

|---|---|---|---|---|

| $0 – $999 | 1 Mini (10 Micros) | 2 Minis (20 Micros) | 3 Minis (30 Micros) | 4 Minis (40 Micros) |

| $1,000 – $1,999 | 2 Minis (20 Micros) | 3 Minis (30 Micros) | 4 Minis (40 Micros) | 5 Minis (50 Micros) |

| $2,000 – $2,999 | – | 4 Minis (40 Micros) | 5 Minis (50 Micros) | 6 Minis (60 Micros) |

| $3,000 – $4,499 | – | – | 6 Minis (60 Micros) | 8 Minis (80 Micros) |

| $4,500+ | – | – | – | 10 Minis (100 Micros) |

Attempting to circumvent these limits is a violation of the trading rules. The back-end systems track account balances closely, and repeated attempts to bypass the scaling plan may result in a formal account review.

Verdict on Lucid Trading scaling plan

Scaling plans are often viewed as a hurdle, but they act as a safety net for the trader. By tying contract size to profit, the firm prevents the one-trade blowup that often happens when a trader over-leverages a small account.

The decision to update limits at the end of the session rather than intraday is a major benefit. It prevents the confusing situation where your buying power suddenly drops while you are in the middle of a winning or losing trade.

The LucidFlex scaling plan is fair and rewards patience. However, if you are a power trader who wants full 10-minute contract capability on a $150K account immediately, you must first earn at least $4,500 in simulated profits to unlock the maximum position size.

7. Spreads & commission fees

Understanding the cost of doing business is vital for any professional trader. At Lucid Trading, the fee structure is transparent, with commissions applied to every trade on a per-side basis to reflect real-market conditions on CME futures contracts.

Because you are trading on centralized exchanges like CME, CBOT, NYMEX, and COMEX, the spreads are raw and market-driven. The firm does not add an artificial markup to the spreads, ensuring that you get the most accurate execution possible during your evaluation accounts phase.

Below is a detailed breakdown of the commission fees for the most popular assets:

| Symbol Category | Representative Symbols | Commission (Per Side) | Exchange |

|---|---|---|---|

| Equity Minis | ES, NQ, RTY, YM | $1.75 | CME/CBOT |

| Equity Micros | MES, MNQ, M2K, MYM | $0.50 | CME/CBOT |

| Currencies | 6A, 6B, 6E, 6J, 6S | $2.40 | CME |

| Energies | CL (Crude), QG (Gas) | $2.00 / $1.30 | NYMEX |

| Metals | GC (Gold), SI (Silver) | $2.30 | COMEX |

| Agriculturals | ZS, ZC, ZW | $2.80 | CBOT |

Verdict on Lucid Trading spreads & commission fees

The $1.75 commission for E-mini contracts is fairly standard across the prop trading industry. Where Lucid Trading truly stands out is its $0.50 commission rate for Micro contracts, making it especially cost-effective for traders who use a micro-scaling approach to manage risk with greater precision.

It is important to remember that these fees are deducted from your account balance in real time. For high-frequency scalpers, these costs can add up quickly and impact your ability to reach the profit target.

The fee structure is competitive and favors those who trade liquid indices and micros. However, currency and agricultural futures carry slightly higher costs ($2.40 – $2.80), so traders specializing in those niches should factor these overheads into their trading rules and overall strategy.

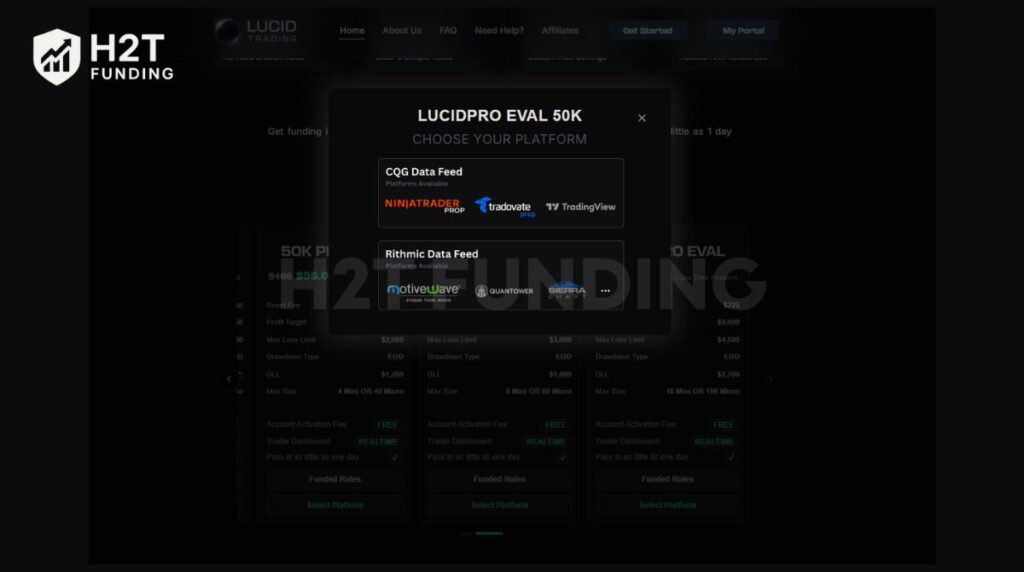

8. Lucid Trading platform

Lucid Trading provides exceptional flexibility by supporting multiple data feeds. This allows you to integrate your preferred trading platforms directly with your evaluation accounts for a seamless professional experience.

The firm currently offers three primary pathways: CQG, Rithmic, and the legacy Project X. However, users should note that Project X (LucidX) is being phased out. New purchases for LucidX end on December 31, 2025, with full termination scheduled for February 28, 2026.

- CQG Data Feed: Supports NinjaTrader, Tradovate, and TradingView.

- Rithmic Data Feed: Supports Quantower, MotiveWave, Sierra Chart, Jigsaw, Bookmap, ATAS, and MultiCharts.

- R|Trader Pro: Available as the official Rithmic management tool for all Rithmic-based accounts.

Verdict on Lucid Trading platforms

The inclusion of TradingView via CQG is a massive win for modern traders. We recommend avoiding LucidX at this stage to prevent migration issues in 2026. For those needing deep market analysis, the Rithmic integration with Quantower offers the most robust professional environment.

9. Trading instruments & leverage

Lucid Trading specializes exclusively in CME futures contracts, providing a transparent and regulated environment. This focus ensures that all funded futures accounts benefit from high liquidity and centralized exchange execution across all account types.

Traders have access to five major categories: Equities (S&P 500, Nasdaq), Metals (Gold, Silver), Energies (Crude Oil, Natural Gas), Interest Rates, and Agriculturals. This variety allows for diverse strategies across different market sectors during the evaluation accounts phase.

Leverage in futures is managed through max position size rather than fixed ratios like 1:100. Depending on your LucidPro or LucidFlex plan, you can trade multiple Minis or dozens of Micros, allowing for precise risk management based on your account’s drawdown limits.

Verdict on Lucid Trading instruments

The asset selection is excellent for dedicated futures specialists who value centralized transparency. While the lack of spot Forex or Crypto might deter some, the ability to trade Micro contracts with low commissions makes this firm an ideal place to master the CME markets with professional capital.

10. Lucid Trading customer support & education

The support ecosystem at Lucid Trading is designed for high-speed efficiency, offering 24-hour support, 5 days a week. Traders can access assistance from Monday through Friday, with a dedicated team of real humans ready to help via the live chat feature.

Most technical inquiries receive a quick response within 10-15 minutes, which is a significant advantage during active market hours. Additionally, the Lucid Trading Discord community provides a vital space for peer-to-peer interaction and real-time updates among fellow futures traders.

A notable weakness of this prop firm, however, is the lack of structured educational resources. Unlike many competitors that offer mentorship or courses, Lucid Trading provides very little guidance. They clearly expect you to have already mastered your strategy before opening any evaluation accounts.

Verdict on Lucid Trading support & education

The firm is exceptionally responsive to technical issues, ensuring that your trading infrastructure remains stable. However, the total absence of formal educational content makes it a difficult environment for total beginners to navigate without external help.

If you are looking for deep dives into risk management or market theory, you will likely need to rely on the H2T Funding blog or other third-party resources. Lucid Trading is a platform for the self-sufficient professional rather than the student.

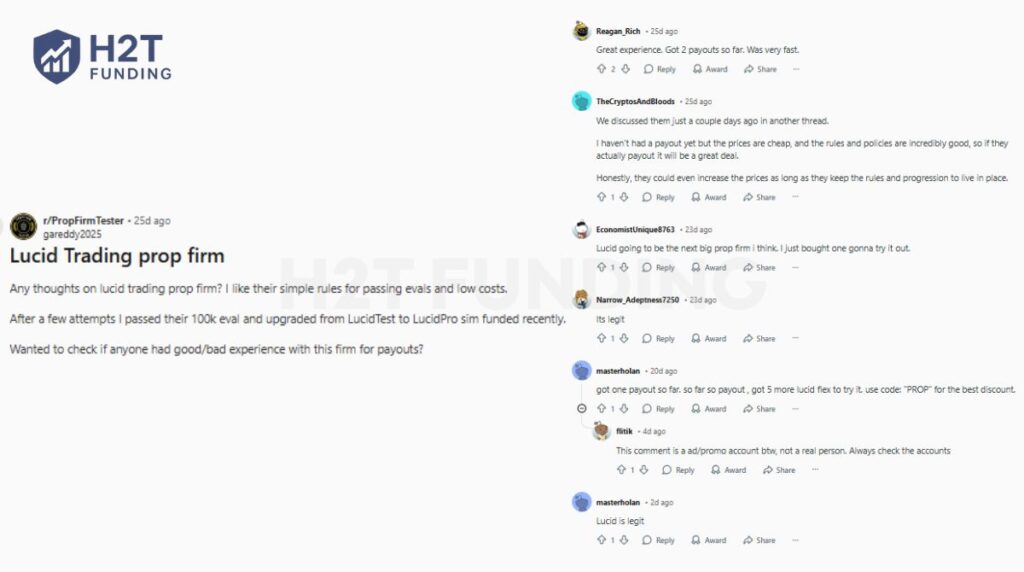

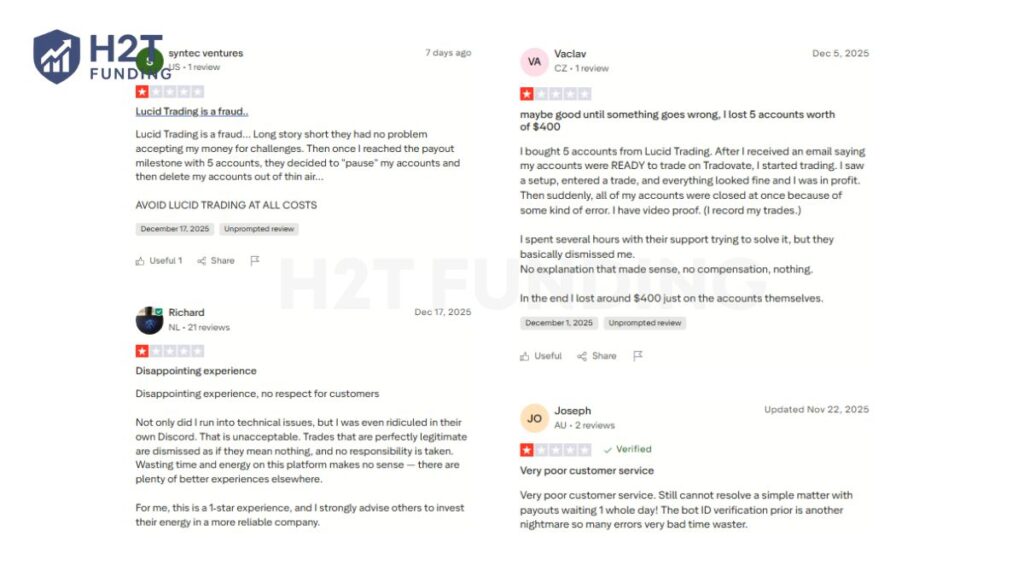

11. Real trader feedback: Lucid Trading Trustpilot and Lucid Trading reviews Reddit

Public sentiment regarding this firm is overwhelmingly positive, with Lucid Trading currently holding an impressive 4.8 Excellent rating on Trustpilot. With over 800 reviews submitted, the consensus highlights a high level of trust and transparency within the community.

Analysis of recent feedback shows that most participants are satisfied with the price stability and the firm’s ability to provide a fun yet professional environment. The majority of traders appreciate the simple rules for passing evaluation accounts without hidden traps.

On platforms like Reddit, the speed of the Lucid Trading payout process is a recurring highlight. Many users report that requests are approved almost immediately, with funds arriving via Plaid or bank transfer in as little as one to two business days.

This level of efficiency is rare in the proprietary trading space and significantly boosts the firm’s credibility. Traders often note that while the trader dashboard might feel basic, the backend execution and payout processing are world-class.

However, the experience is not perfect for everyone, as approximately 2% of users have reported 1-star reviews. These complaints often center on technical errors where accounts were closed unexpectedly or paused after reaching significant profit milestones.

Some traders have voiced frustration with the ID verification bot, describing it as a nightmare that causes unnecessary delays. In these rare cases, the response from customer support was perceived as dismissive, leaving users feeling frustrated despite having video proof of their trades.

Another honest critique involves the payout buffer requirements and the dashboard’s user interface. Some find the dashboard not that great visually, and others warn that the buffer rule means you must earn significantly more than the minimum payout to actually see cash.

For example, on certain account sizes, you might need to reach a much higher profit level just to secure a $1,500 withdrawal due to the safety buffer. While this protects the firm, it can be a frustrating realization for those who didn’t read the trading rules carefully.

12. How to sign up for Lucid Trading

Getting started with a funded futures account path is designed to be a frictionless process. By following a few simple steps, you can move from a retail environment to a professional proprietary trading setup in under 30 minutes.

The registration process follows these key milestones:

- Step 1: Visit the official Lucid Trading website.

- Step 2: Select your preferred account types (Pro, Flex, or Direct).

- Step 3: Choose your data feed and trading platforms.

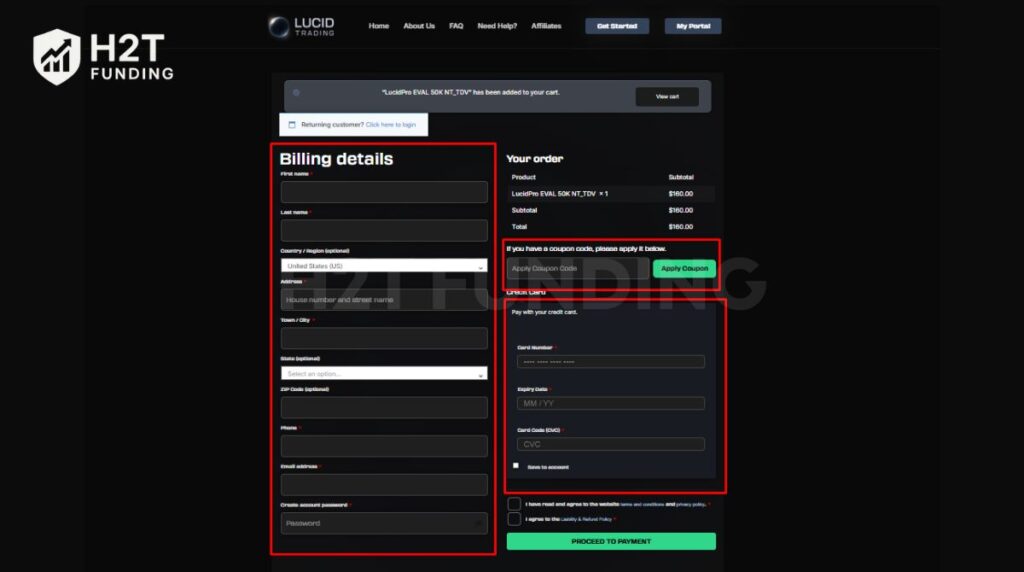

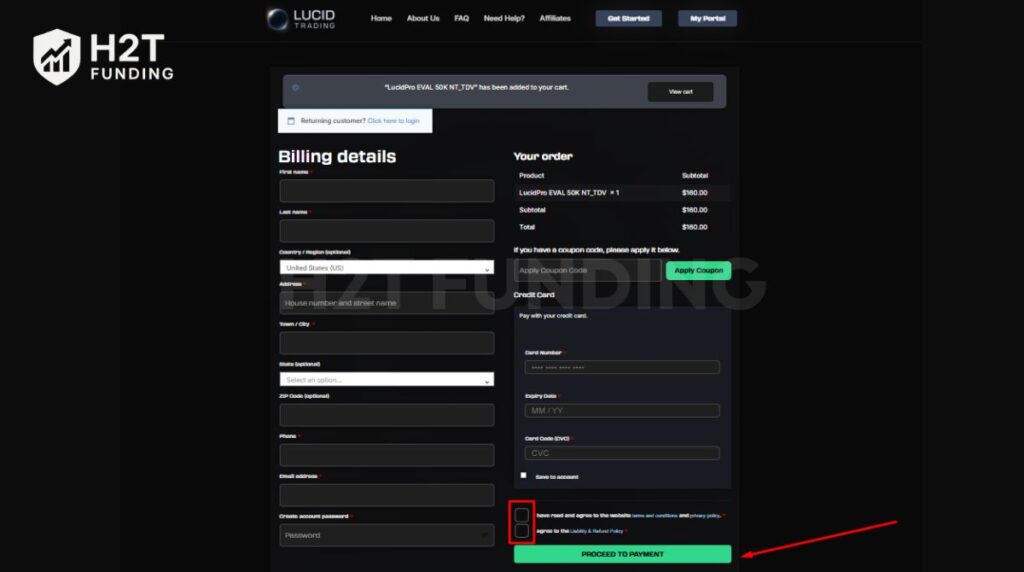

- Step 4: Enter billing details and apply any active discount codes.

- Step 5: Complete payment and wait for real-time activation.

Follow the detailed breakdown below to ensure your account is set up correctly for your first profit target attempt.

12.1. Step 1: Access the home page

The first step is to visit the official portal and locate the Get Started button in the top right corner of the navigation bar. This will take you directly to the available evaluation accounts and instant funding options.

12.2. Step 2: Choose your funding path

Review the various account sizes and rules we discussed in the previous sections. Whether you prefer the LucidPro evaluation or the LucidDirect instant funding route, ensure the parameters align with your risk management style.

12.3. Step 3: Select your trading platform

Once you pick an account size, you must choose between the CQG or Rithmic data feeds. This decision is crucial as it determines if you will use Tradovate, NinjaTrader, or specialized tools like Quantower and Bookmap.

12.4. Step 4: Enter billing details

Fill in your personal information, including your name, address, and email, in the Billing Details section. Ensure your email is accurate, as this is where your trading platforms’ login credentials and activation notices will be sent.

Important: Before clicking Proceed to Payment, double-check the Coupon Code field. Ensure your discount has been successfully applied to the total price to avoid overpaying for your evaluation accounts.

12.5. Step 5: Complete payment and activation

Finalize the transaction using a major credit or debit card. Thanks to their real-time dashboard and activation system, you should receive your login details and be ready to trade in 5 to 30 minutes after the transaction is approved.

The Lucid Trading signup process is engineered for speed, allowing you to move from initial registration to market execution in under half an hour. By following this structured five-step guide, you ensure that your account is correctly configured for your specific technical and regional needs.

13. Lucid Trading restricted countries

Before purchasing an account, you must verify your eligibility based on your residency and citizenship. Lucid Trading adheres to strict international financial regulations, which means individuals from certain jurisdictions are prohibited from using its services.

If you reside in any of the Lucid Trading restricted countries listed below, you will not be able to pass the mandatory identity verification required for a Lucid Trading payout. Attempting to bypass these geo-restrictions is a violation of the firm’s trading rules.

| A – C | D – J | K – N | P – S | T – Z |

|---|---|---|---|---|

| Afghanistan | Donetsk | Kenya | Pakistan | Tanzania |

| Albania | Ecuador | Kherson | Panama | Turkey |

| Algeria | Ethiopia | Kosovo | Papua New Guinea | Trinidad and Tobago |

| Angola | Ghana | Laos | Philippines | Tunisia |

| Bahamas | Guinea | Lebanon | Russia | Uganda |

| Barbados | Haiti | Liberia | Senegal | Ukraine |

| Belarus | Iceland | Libya | Serbia | Vietnam |

| Bosnia & Herz. | Indonesia | Lithuania | Sevastopol | Venezuela |

| Bulgaria | Iran | Luhansk | Slovenia | Yemen |

| Burkina Faso | Iraq | Mali | Somalia | Zimbabwe |

| Burma/Myanmar | Jamaica | Mauritius | South Africa | |

| Botswana | Mongolia | South Sudan | ||

| Burundi | Montenegro | Sri Lanka | ||

| Cambodia | Morocco | Sudan | ||

| Central African Rep. | Mozambique | Syria | ||

| Côte d’Ivoire | Namibia | |||

| Crimea | Nicaragua | |||

| Cuba | Nigeria | |||

| Congo (Brazzaville) | North Korea | |||

| Congo (Kinshasa) | North Macedonia |

We highly recommend checking the official Lucid Trading website periodically, as this list can change based on evolving global financial laws and proprietary trading regulations.

14. Compare Lucid Trading vs other prop firms

Evaluating Lucid Trading alongside established peers reveals its positioning in the competitive futures landscape. Each firm offers a different balance of challenge fees and rules to attract diverse types of professional traders.

The following data highlights how these firms structure their funded futures accounts. Focus on these specific metrics to determine which environment best supports your risk management goals and trading style.

| Criteria | Lucid Trading | Take Profit Trader | My Funded Futures | Topstep |

|---|---|---|---|---|

| Challenge Fee | $60 – $532 | $150 – $360 | $77 – $477 | $49 – $149 |

| Account Types | 1-step, and instant funding | 1-step | 1-step | 2-step |

| Profit Split | 90% | 80% – 90% | 80% | 90% – 100% |

| Account Size | $25K – $150K | $25K – $150K | $50K – $150K | $50K – $150K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Profit Target | 5% – 6% | 6% | 6% | 6% |

Choosing between these firms depends on whether you value historical reputation or modern payout flexibility. Each platform caters to a slightly different segment of the futures market.

- Lucid Trading: Best for traders seeking the highest profit split with the flexibility of daily payouts. It is the most cost-effective path for those who want to avoid activation fees.

- Take Profit Trader: Ideal for those who value a long-standing reputation and a straightforward 1-step evaluation. It is a solid, reliable choice for consistent performers.

- My Funded Futures: The top choice for high-volume traders who need low commissions and a transparent, one-phase model with no daily loss limits.

- Topstep: Recommended for traders who prefer a highly structured environment and the stability of the oldest firm in the industry, using a specialized proprietary platform.

While Topstep offers the most history, Lucid Trading provides a more modern and flexible payout structure. For traders who have already mastered their trading rules, the 90% split and lack of activation fees at Lucid make it a superior choice for maximizing net take-home pay.

15. FAQs

Lucid Trading is a legitimate prop firm with a high 4.8/5 rating on Trustpilot. They are a registered entity (Lucid Prop Ltd) that has a proven track record of processing daily payouts to successful traders globally.

No, Lucid Trading is not a broker. They provide access to capital and technology through partners. Your trades are executed on a simulated or live-funded feed provided by CQG or Rithmic.

The firm is officially registered as Lucid Prop Ltd, operating under the leadership of Lucid Trading CEO AJ. The company launched in late 2024 and focuses exclusively on the futures market.

Lucid Trading is known for its rapid activation times, significantly outpacing industry standards. Once you pass your evaluation objectives, your account is typically upgraded within 5 to 30 minutes. For those choosing the LucidDirect route, you can begin executing trades in just 5 to 15 minutes after your purchase is finalized.

Traders have access to all CME futures contracts. This includes Equity indices (S&P 500, Nasdaq), Metals (Gold, Silver), Energies (Crude Oil), Interest Rates, and Agricultural futures.

Depending on your chosen data feed, you can use Tradovate, NinjaTrader, TradingView, Quantower, Sierra Chart, and several other professional tools. The CQG feed is best for TradingView users.

Leverage is defined by max contract sizes. For example, a 50K account allows up to 4 Minis or 40 Micro contracts. This ensures proper risk management across all funded futures accounts.

Individual account sizes range from $25,000 to $150,000. Traders can manage multiple accounts simultaneously, though there is a total live funding cap of $150,000 across all active accounts.

You can request a Lucid Trading payout through your dashboard. Funds are disbursed via Plaid (U.S. bank transfers) or WorkMarket (International bank/PayPal). A crypto payout option is coming soon.

No, all purchases are one-time fees and are non-refundable. Since there are no monthly subscriptions, the fee covers the administrative and data costs of setting up your evaluation accounts.

If you hit the drawdown limits, your account is breached. You can manually purchase a reset through your dashboard to return the account to its original starting balance and trading rules.

There is no deadline. You can take as much time as you need to reach the profit target, provided the account remains active. Accounts with 20 days of inactivity will be flagged for deactivation.

Yes, you can choose the LucidDirect path. This allows you to skip the evaluation entirely and trade for real payouts from Day 1, though it carries a higher upfront cost and a 20% consistency rule.

To maintain system performance and fair access, the firm allows you to run up to 10 evaluation accounts at any given time. Regarding funded status, there is a strict limit of 5 funded accounts per household. This allows traders to diversify their strategies or use copy-trading tools across multiple balances effectively.

16. Conclusion

This Lucid Trading review highlights a firm that offers a modern approach to futures funding with competitive profit splits up to 90%. To answer the main question: yes, daily payouts are real, but are primarily accessible once traders reach specific stages, like LucidLive. Success depends on understanding the unique requirements tied to each funding pathway.

For more insights into the latest funding opportunities, visit the Prop Firm Review section at H2T Funding. Our team provides unbiased analysis to help you find the perfect partner for the futures contracts market. Choosing the right firm is the first step toward building a sustainable trading career.