Lark Funding is best for disciplined traders seeking fast payouts and salary-style rewards, but it is not ideal for long-term capital scaling. This structure attracts traders who prioritize short-term cash flow, which also explains why concerns about rule changes and delayed payouts are frequently raised in trading communities.

While Lark Funding has gained attention for its funding models and attractive profit split, real trader feedback shows mixed experiences before and after evaluation. These differences often come from how traders interpret the firm’s rules and payout conditions.

In this Lark Funding review, H2T Funding will break down how the firm operates, what its funding programs actually offer, and how its rules can affect your trading journey. By the end, you’ll clearly understand Lark Funding’s structure, policies, and payouts.

1. What is Lark Funding?

Lark Funding is a Canada-based proprietary trading firm that officially entered the market on June 1, 2022. Since its launch, the company has positioned itself as a highly experienced and forward-thinking player in the prop space. They take great pride in their track record, stating that payouts are processed reliably for traders who meet all conditions.

The firm is led by CEO Matthew Letourneau (commonly known as Matt L.), who focuses heavily on platform development and client engagement. Under his leadership, Lark Funding has successfully navigated industry shifts by adopting modern trading platforms like DX Trade.

Beyond just providing capital, the firm aims to offer innovative features for all experience levels. Whether you are a beginner or a professional, their structure is built to support long-term career growth. This is achieved by offering stable trading conditions within a professional simulated trading environment that mirrors real market movements.

2. Our take on Lark Funding

At H2T Funding, we’ve reviewed dozens of prop firms, and Lark Funding stands out as a stable and transparent partner for traders who prioritize consistency over high-risk gambles. Since the 3.0 update, the firm has clearly shifted toward a more career-focused environment, where trading data quality is rewarded as much as raw profit targets.

The platform provides a professional and efficient experience, particularly regarding its rapid liquidity and honest rule enforcement. Unlike firms that rely on hidden traps, Lark Funding feels like a genuine capital provider that values long-term trader development through innovative features like the Monthly Base Reward.

From our perspective, this firm is an ideal match for the disciplined professional who wants to avoid the psychological stress of all-or-nothing trading. The simulated trading environment is stable, and the inclusion of a Smart Restart Guarantee provides a much-needed safety net for serious individuals.

While the lack of a scaling plan is a drawback for some, the reliability of their payout system and the transparency of their trading rules make them a top contender. If you seek a firm that treats you like a business partner and delivers rewards without delay, Lark Funding is a highly dependable choice in the current prop space.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Lark Funding websites before purchasing any challenge.

| Pros | Cons |

|---|---|

| Payouts are exceptionally fast, often processed in under 2 hours. | The firm does not currently offer a scaling plan for accounts. |

| The Monthly Base Reward provides a stable, salary-like income stream. | Educational resources and training materials are very limited. |

| There are no hidden consistency rules or complex profit traps. | The $10,000 daily gain limit can restrict aggressive strategies. |

| Traders can earn a high-performance reward of up to 90%. |

3. Lark Funding programs

This prop firm offers 1-Step, 3-Step, and instant funding programs to help you scale your professional trading career. That also makes it a popular option among traders searching for the easiest prop firms to pass.

To further support your growth, the Career Bundle includes exclusive AI coaching and a Smart Restart Guarantee for added security. Explore the detailed breakdown of each program below to identify the best capital allocation model for your specific needs.

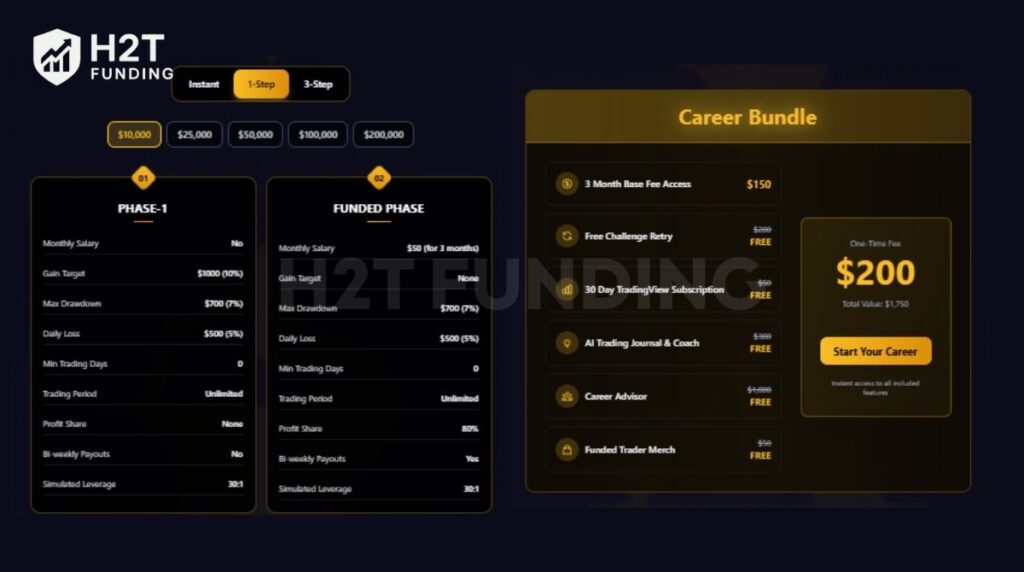

3.1. 1-step challenge

The 1-Step Career Evaluation is a groundbreaking addition launched with Lark Funding 3.0, tailored for traders who want to reach a funded status through a single phase. This model focuses on speed and professional development, offering a unique Monthly Base Reward that functions as a contractor fee for consistent data providers.

To succeed, you must reach a profit target of 10% on your demo accounts while adhering to a static drawdown model. A structure that closely aligns with common principles found in guides on how to pass a prop firm challenge. Professionals often prefer this approach as it provides a fixed safety net that does not trail your peak balance.

| Account Size | Profit Target (10%) | Daily Loss Limit (5%) | Max Static Drawdown (7%) | Monthly Base Reward |

|---|---|---|---|---|

| $10,000 | $1,000 | $500 | $700 | $50 |

| $25,000 | $2,500 | $1,250 | $1,750 | $125 |

| $50,000 | $5,000 | $2,500 | $3,500 | $250 |

| $100,000 | $10,000 | $5,000 | $7,000 | $500 |

| $200,000 | $20,000 | $10,000 | $14,000 | $1,000 |

A unique advantage of this 3.0 update is the integration of a salary-like income stream for consistent performers. This system incentivizes traders to treat their capital allocation with a professional mindset, rewarding data quality over high-risk gambling.

- Monthly base reward eligibility: Traders who demonstrate professional consistency on Master Accounts can qualify for a data consistency fee every 30 days. To be eligible, you must maintain an overall drawdown better than -3.5% and record at least 3 profitable trading days of 0.5% or more.

- The career bundle and smart restart: Every Career Evaluation includes a Smart Restart Guarantee, which provides a free second attempt if your first attempt fails while staying within specific risk parameters. This bundle also features a 30-day TradingView subscription and access to TrackAlpha.AI, an advanced trading journal and coach.

- Trading conditions and leverage: The simulated trading environment offers competitive leverage options, including 30:1 for Forex and 20:1 for Metals. While there is a $7 round-trip commission per standard lot on FX and Metals, other instruments like Indices and Oil remain commission-free.

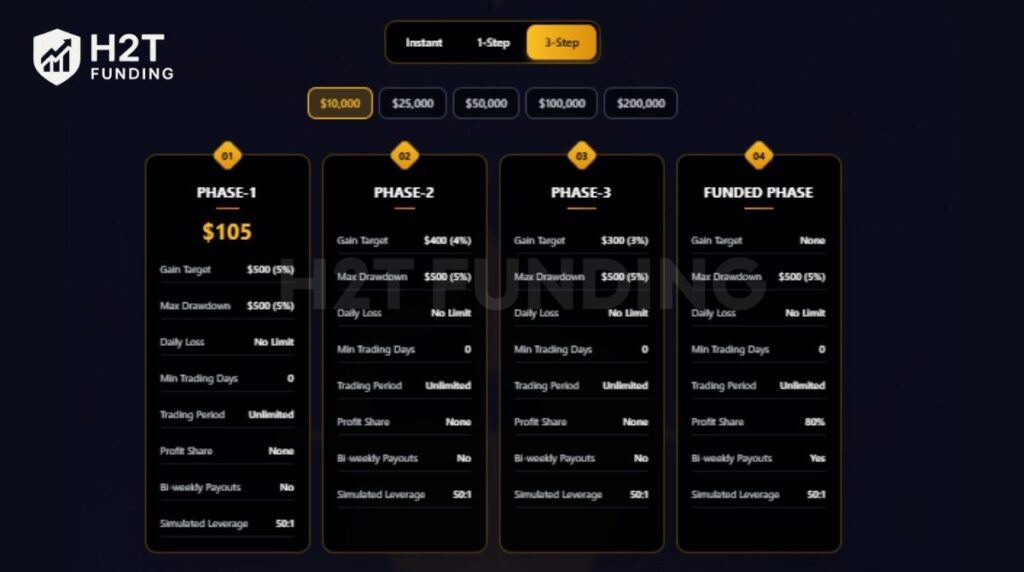

3.2. 3-step challenge

The 3-Step evaluation is the most affordable and low-pressure pathway offered by Lark Funding. It is specifically structured for traders who prefer a gradual progression toward professional funding with a minimal financial barrier.

This program stands out by offering the highest leverage available on the platform across all phases. By spreading the profit targets across three stages, the firm ensures you can build consistency without the stress of meeting a high-profit requirement in a single evaluation phase.

| Account Size | Entry Fee | Phase 1 Target (5%) | Phase 2 Target (4%) | Phase 3 Target (3%) | Max Drawdown (5%) |

|---|---|---|---|---|---|

| $10,000 | $105 | $500 | $400 | $300 | $500 |

| $25,000 | $175 | $1,250 | $1,000 | $750 | $1,250 |

| $50,000 | $280 | $2,500 | $2,000 | $1,500 | $2,500 |

| $100,000 | $370 | $5,000 | $4,000 | $3,000 | $5,000 |

| $200,000 | $750 | $10,000 | $8,000 | $6,000 | $10,000 |

This model is particularly favored for its flexible trading conditions, allowing you to navigate the markets with more breathing room. Below are the core features that define the 3-Step experience:

- No daily loss limit: A rare and highly valuable feature that provides maximum flexibility during high volatility sessions.

- 50:1 Simulated leverage: Offers significantly higher purchasing power compared to the 1-Step model for Forex pairs.

- Unlimited trading period: There is no countdown, meaning you can meet your objectives at your own pace without time-related stress.

- Static max drawdown: Your loss limit is fixed at 5% of the initial balance, ensuring transparency and ease of risk tracking.

3.3. Instant funding

For traders who prefer to bypass profit targets but remain subject to strict risk and gain rules and start earning rewards immediately, Lark Funding instant funding is the ultimate solution. This model allows you to bypass the typical profit targets and move straight to a funded account after a simple registration process.

The instant model is unique because it offers a high-performance reward from day one and high leverage. It is designed for experienced traders who have a proven strategy and want to monetize their skills without delay.

| Account Size | Entry Fee | Max Trailing Drawdown (8%) | Daily Loss Limit (5%) | Performance Reward |

|---|---|---|---|---|

| $5,000 | $200 | $400 | $250 | 90% |

| $10,000 | $400 | $800 | $500 | 90% |

| $25,000 | $1,125 | $2,000 | $1,250 | 90% |

| $50,000 | $2,750 | $4,000 | $2,500 | 90% |

| $100,000 | $4,500 | $8,000 | $5,000 | 90% |

This program is highly regarded for its flexible trading rules and lack of typical industry restrictions. Below are the key benefits of choosing the instant funding route:

- 90% profit split: One of the most competitive rates in the market, allowing you to keep the vast majority of your gains.

- On-demand first payout: You can request your first payout whenever you are in profit, followed by a stable monthly payout system.

- No consistency rules: You are not forced to follow rigid volume or frequency patterns, providing full freedom over your strategy.

- News & weekend trading: There are no restrictions on news trading or holding positions over the weekend, which is ideal for swing traders.

Verdict on Lark Funding programs

Lark Funding has created a well-balanced ecosystem that caters to every type of trader. Unlike many firms that force a one-size-fits-all model, their 3.0 update offers genuine variety and specialized benefits for different career stages.

- The 1-step challenge: Our top recommendation for serious professionals. The Monthly Base Reward (salary) adds a layer of financial stability that is rare in this industry. It is perfect if you want a career-style path with extra coaching tools.

- The 2-step challenge: Best fit for beginners or traders on a budget. The lack of a daily loss limit and the 50:1 leverage provide the breathing room needed to learn and grow without the fear of a sudden hard breach.

- Instant Funding: This is for the high-conviction trader with a proven edge. If you already have a profitable system and want to avoid the psychological stress of an evaluation, the 90% split and on-demand payouts are worth the higher entry cost.

If you are looking for the best overall value, start with the 1-Step Career Evaluation. The combination of the Smart Restart Guarantee and the AI coach makes it the most robust package for long-term success. However, if you are a speed-to-market trader, the Instant Funding model is hard to beat for its immediate reward potential.

4. Lark Funding rules

To maintain a professional and sustainable environment, Lark Funding has established clear trading rules that all participants must follow. These guidelines ensure that the firm identifies truly skilled traders while protecting their capital allocation from high-risk or gambling-focused behaviors.

Understanding these rules is essential for anyone entering the evaluation process. The firm uses a combination of automated detection and manual reviews to ensure compliance and maintain the integrity of its demo accounts.

4.1. General guidelines & allowed practices

Lark Funding is known for its flexibility regarding trading styles, allowing professionals to execute their strategies with minimal interference. As long as you maintain sound risk management, most standard trading activities are fully supported on their trading platforms.

- Scalping & intraday trading: Traders are permitted to scalp and day trade across all evaluation and funded account types.

- Expert advisors (EAs): The use of expert advisors is allowed, provided they do not engage in prohibited practices like HFT or arbitrage.

- News trading: You are free to trade during news events, though you must avoid all-or-nothing gambling behavior during these volatile periods.

- Copy trading: You may use a trade copier between two or more Simulated Funded Accounts to manage your portfolio efficiently.

- Weekend holding: This is allowed if you purchase the weekend-holding upgrade (10% extra fee); otherwise, trades must close by 3:45 pm EST on Friday.

- Multiple evaluations: You can run multiple challenges simultaneously, but they must be traded independently without copying trades between them.

- Margin rules: The firm operates with a 110% margin call level and a 100% stop-out level to protect account equity.

- VPN & VPS Usage: While allowed, the firm strongly discourages them to avoid security flags. You cannot use a VPN during KYC procedures.

4.2. Prohibited trading practices

To protect the firm’s capital, certain behaviors are classified as hard breaches, which may result in account termination or long-term restrictions, according to reported cases. These rules are designed to filter out gamblers and predatory strategies that exploit the simulated trading environment.

- All-or-nothing gambling: Placing trades that could reach drawdown limits in a single position is strictly prohibited.

- Gain limits: To prevent gambling, there is a $10,000 per-trade/daily gain limit. Exceeding this in a funded account leads to exclusion of profits.

- High-frequency trading (HFT): Algorithms designed to execute massive volumes in split seconds are banned as they destabilize the platform.

- Hedging & arbitrage: Hedging between different Lark Funding accounts or with third-party firms will result in a permanent restriction.

- Earnings releases: You must not hold Single Share Equity CFD positions into an earnings release; these must be closed 10 minutes before the market event.

- Account inactivity: Accounts must show at least one trade every 30 days. Failure to do so results in a breach for inactivity.

- Evaluation copying: Using a trade copier to pass multiple evaluations with identical trades is forbidden; each challenge must be passed individually.

- Hard breaches: Violating maximum daily loss or max drawdown limits typically result in the account being restricted and may lead to evaluation failure.

Verdict on Lark Funding rules

In our professional assessment, the Lark Funding rule set is highly fair but strictly enforced. The absence of a consistency rule is a massive advantage, but the $10,000 gain limit is a unique hurdle that aggressive traders must account for. This rule effectively forces you to trade with longevity rather than seeking a one-hit-wonder payout.

We believe these rules are relatively easy to follow for disciplined traders who use a stop loss and manage their margin utilization. The Soft Breach system for missing stop losses (if required) is a very trader-friendly touch, acting as a warning rather than a penalty. However, the 30-day inactivity rule means you cannot simply set and forget an account; you must stay engaged with the market.

5. Lark Funding payout structure

The withdrawal process at Lark Funding is designed for efficiency, ensuring that successful traders can access their earned rewards with minimal friction. Most requests are processed in under 6 hours, reflecting a high level of payout system reliability compared to industry averages.

Traders manage all financial requests through a streamlined dashboard, which provides full transparency over available balances. This automated approach helps maintain a professional simulated trading environment where performance is rewarded promptly and accurately.

- Evaluation payout schedule: For both 1-Step and 3-Step programs, the first payout is available 14 days after the first trade, with subsequent withdrawals every 14 days.

- Instant account access: These accounts provide an on-demand first payout for immediate liquidity, followed by a standard 30-day cycle for following requests.

- Minimum withdrawal limit: You must reach a minimum threshold of $100 in simulated gains before submitting a request to the firm.

- Payment processing: All transactions are handled via Riseworks, requiring a flat $40 processing fee per withdrawal to cover administrative costs.

- Flexible payout add-ons: During the initial registration process, you have the option to purchase a Weekly Payouts feature to increase the frequency of your rewards.

Verdict on Lark Funding payout structure

Lark Funding offers a highly dependable and fast withdrawal framework. The ability to receive funds in under six hours is a significant advantage for professional capital management. While the $40 fee is standard, the on-demand payout for instant accounts makes this firm a strong choice for traders focused on immediate cash flow.

6. Scaling plan of Lark Funding

Unlike many prominent competitors in the proprietary trading industry, Lark Funding does not currently offer a scaling plan. This means that once you pass your evaluation, the account balance you receive remains fixed at its initial level, regardless of how consistent or profitable your performance becomes over time.

This lack of a growth mechanism represents a significant limitation for professional traders looking to build a long-term career. Without the ability to scale, your capital allocation is permanently capped, preventing you from compounding your success and increasing your position sizes as you prove your expertise.

Verdict on Lark Funding scaling

The lack of a scaling plan is the primary weakness of the Lark Funding ecosystem. Most modern prop firms reward loyalty and risk management by increasing capital every few months, but here, your earning potential is strictly limited by your initial purchase.

This structure is not ideal for career-path traders who want to move from a small account to managing millions. If you choose to trade here, it’s best to select the largest account size you can comfortably manage from the start. This is because the account balance cannot be increased later through performance milestones.

7. Spreads & commission fees

Lark Funding works with various third-party liquidity providers, including Tier 1 banks and prime brokers, to derive their pricing. This aggregated approach allows them to offer competitive trading conditions while reducing the risk of relying on a single liquidity source.

For traders using the Instant Master Account, the firm provides RAW spreads to mimic live market environments. While they don’t have direct control over the underlying bank feeds, they provide public credentials for DXTrade so you can check their spreads in real-time before committing to a challenge.

The trading fees include a standard $7 round-trip commission per lot on Forex and Metals. However, it is important to note that Indices, Oil, and Crypto are commission-free, which can significantly reduce the overhead for traders specializing in those specific trading instruments.

Verdict on Lark Funding spreads

The transparency of providing real-time spread check credentials is a major win for trust. However, the $7 commission is fairly average for the prop industry, neither the cheapest nor the most expensive. While RAW spreads are excellent for scalpers, the commission-free status of Indices and Oil makes those assets the most cost-effective choice for high-volume traders on this platform.

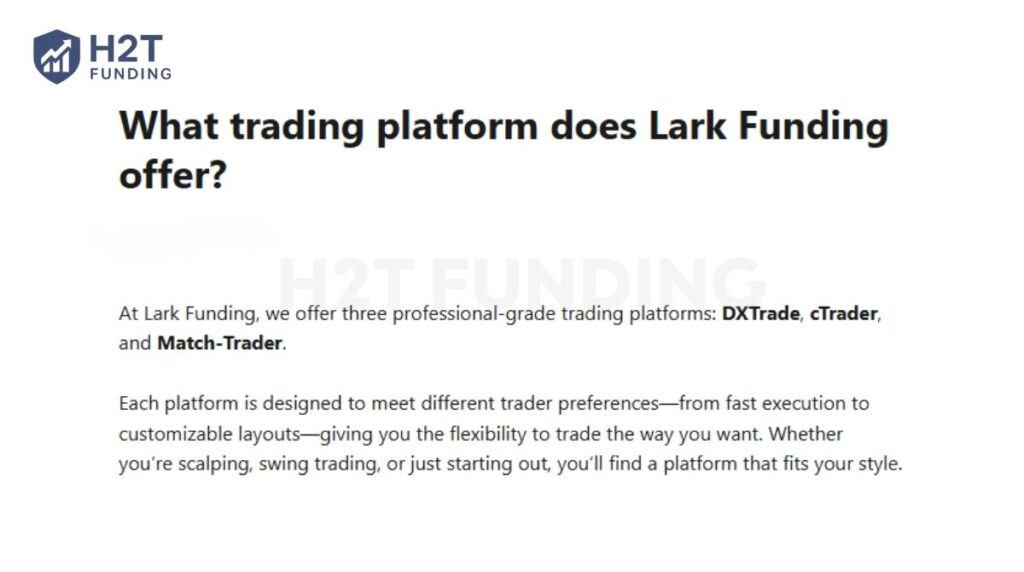

8. Lark Funding trading platform

Following recent industry shifts, Lark Funding has moved away from MetaTrader to offer three professional-grade trading platforms: DXTrade, cTrader, and Match-Trader. This diversity ensures that whether you are scalping or swing trading, you have access to a user experience that fits your technical needs.

Each platform is available across Desktop, iOS, and Android, allowing you to manage your demo accounts from anywhere. The Lark Funding dashboard integrates seamlessly with these platforms, providing a centralized hub to track your objectives and risk management metrics in real-time.

- cTrader: Preferred by professionals for its advanced charting and fast execution.

- DXTrade: A versatile platform that has become the new industry standard for many prop firms.

- Match-Trader: Known for its customizable layouts and intuitive interface for beginners.

Verdict on Lark Funding platforms

We believe the transition to cTrader is the strongest move Lark Funding has made. While DXTrade is reliable, cTrader offers a level of technical depth that professional traders crave. Although the absence of MetaTrader may not suit everyone, the firm appears to favor a more stable platform infrastructure, which can be beneficial from a risk management perspective.

9. Trading instruments & leverage

The variety of trading instruments available at Lark Funding is impressive, covering all major markets including Forex, Stocks, Indices, and Cryptocurrencies. However, the leverage options vary significantly depending on which of the challenge programs you choose to purchase.

Traders should carefully review these limits, as they directly impact their capital allocation and buying power during the evaluation process. Below is the breakdown of the simulated leverage across their three main models:

| Market | 1-Step Leverage | 3-Step Leverage | Instant Leverage |

|---|---|---|---|

| Forex | 30:1 | 50:1 | 50:1 |

| Metals | 20:1 | 20:1 | 50:1 |

| Indices | 10:1 | 20:1 | 10:1 |

| Stocks | 5:1 | 5:1 | N/A |

| Crypto | 2:1 | 2:1 | 2:1 |

Verdict on Lark Funding trading instruments & leverage

The leverage on the 1-Step Career Evaluation is somewhat restrictive, especially the 30:1 cap on Forex. If you are a high-leverage scalper, you might find the 3-Step or Instant models more suitable due to their 50:1 Forex limits.

On a positive note, the inclusion of Single Share Equity CFDs (stocks) offers a clear niche for equity traders. Just be sure to close positions before earnings releases, in line with the firm’s trading rules.

10. Education & customer support

Providing reliable assistance is a core part of the user experience at Lark Funding. Their team is available 24/7 to help traders navigate the evaluation process or resolve technical issues within the Lark Funding dashboard.

The firm utilizes multiple communication channels to ensure that support is always within reach. Whether you prefer direct messaging or community-based help, they have structured their service to be highly accessible:

- Email support: You can reach their specialist team at support@larkfunding.com for detailed account inquiries.

- Help center: A searchable database featuring dozens of articles on trading rules, billing, and platform setups.

- Live chat: A Chat with us feature is available on the website for instant answers to common questions.

- Lark Funding Discord: A large community server with over 15,000 members where you can interact with other traders and staff.

However, when it comes to learning resources, Lark Funding is quite limited. The firm does not offer a formal educational blog or trading academy to help beginners sharpen their skills. While they maintain an official YouTube channel, the content frequency is very low, focusing mostly on platform updates rather than deep-dive market education.

Verdict on Lark Funding support & education

The customer support is excellent and highly responsive, especially through the Lark Funding Discord. However, the complete lack of educational materials is a downside for developing traders.

If you already have a working strategy, the support team will serve you well. But if you are looking for a firm that will teach you how to master risk management or technical analysis, you will need to find those resources elsewhere, as Lark Funding focuses strictly on being a capital provider rather than an educator.

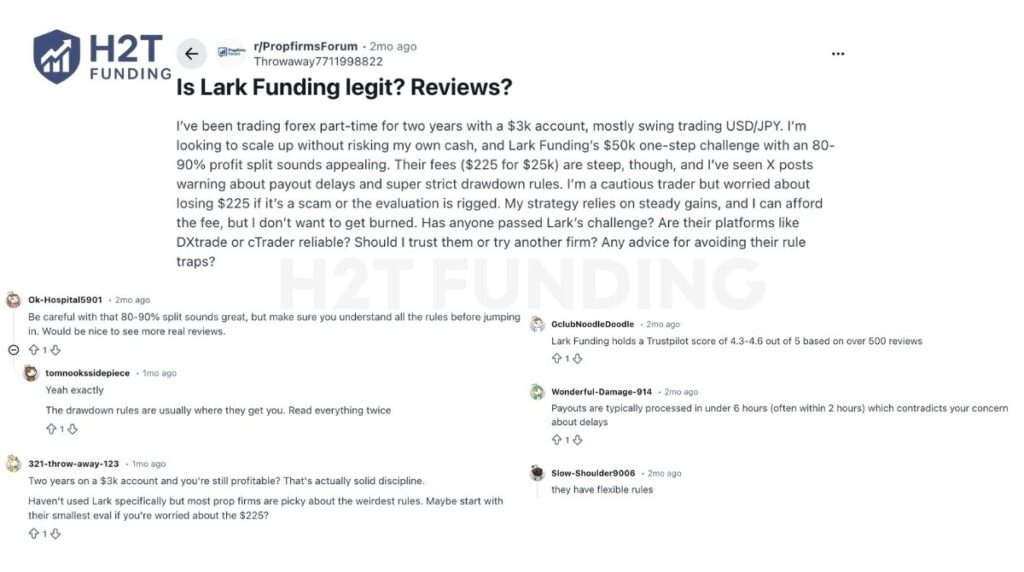

11. Real trader feedback: Lark Funding Trustpilot and Lark Funding Reddit

As of December 19, 2025, Lark Funding maintains an impressive reputation within the trading community, currently holding an Excellent 4.5-star rating on Trustpilot from over 570 reviews (updated on Jan 07, 2025). Most traders highlight that the user experience has significantly improved since the 3.0 update, especially praising the unique salary-style rewards and free retry options as industry-leading features.

Users have noted that the firm feels like it is building careers rather than just selling challenges. The Lark funding review highlights tangible support tools, including an AI trade journal and a relatively generous 7% max drawdown under the 1-Step program.

On Lark Funding Reddit, the discussion is often more analytical, with many users asking Is Lark Funding legit? before purchasing a challenge. While entry fees raise concerns for some traders, user feedback highlights a dependable payout process, with reported withdrawal times of around 2 to 6 hours. The general advice from successful Lark traders is to strictly follow the risk parameters to take full advantage of the 80-90% profit split without facing a hard breach.

What truly sets this firm apart is its 100% response rate to negative reviews on Trustpilot. Unlike many firms that provide generic template answers, the CEO (Matt) often provides detailed, data-driven explanations for why an account was breached or a payout was denied.

In summary, the feedback from both Lark Funding Trustpilot and Reddit is generally positive, though some traders raise concerns about gain limits and manual reviews. Their rules against gambling-style trading are strict, and the firm’s commitment to public accountability and rapid payouts makes it a trusted partner for disciplined professionals.

For traders who are still evaluating the industry as a whole, this are prop firms legit guide that offers a broader perspective before choosing any firm.

12. How to sign up for Lark Funding

Joining this platform is a quick and straightforward process designed to get you into the markets without unnecessary delays. By following a few simple steps, you can set up your profile and access your chosen evaluation model immediately.

To complete your registration, you will need to follow these specific phases:

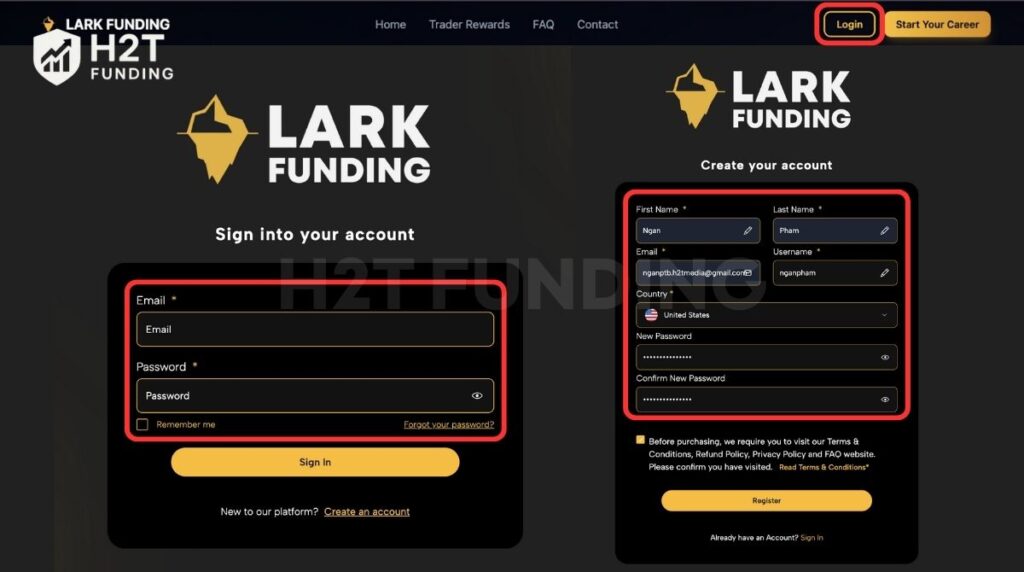

- Step 1: Access the member portal via the login gateway.

- Step 2: Provide your personal details to create a unique trader profile.

- Step 3: Use the Start Your Career navigation to view and select your path.

- Step 4: Configure your account preferences and finalize the billing information.

Please follow the detailed breakdown below to ensure your account is configured correctly from the very first click.

12.1. Step 1: Access the registration gateway

To begin, navigate to the top right corner of the homepage and click on the Login button. While this is typically for existing users, it also serves as the entry point for new registrations. This ensures you are entering the secure member area where all account activities are managed.

12.2. Step 2: Create your personal account

Look for the link at the bottom labeled Create an account. You will be directed to a form where you must enter your legal name, email, and country of residence. It is vital to confirm you have read the terms and conditions before clicking the register button to avoid any future compliance issues.

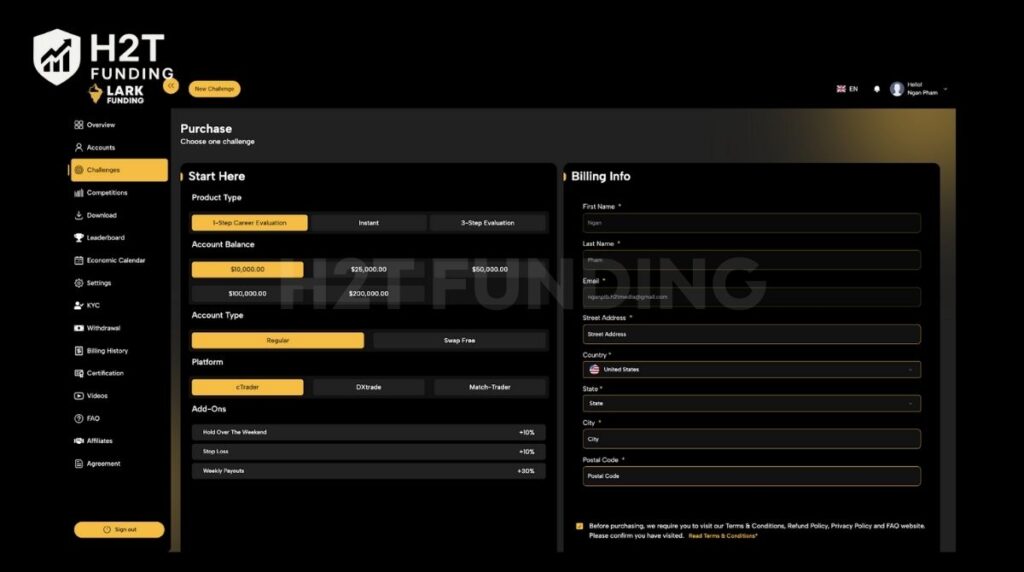

12.3. Step 3: Select your funding path

Once logged into the dashboard, navigate to the Challenges tab on the left sidebar. Here, you must Choose Your Path by selecting between the 1-Step Career Evaluation, the 3-Step Evaluation, or instant funding. Each path is clearly labeled with its specific profit targets and drawdown limits to help you make an informed choice.

12.4. Step 4: Finalize account setup and billing

Finally, pick your path, and then you will move to the final purchase screen. Here, you must select your account balance, preferred platform, and any desired add-ons. Complete the process by entering your billing address and contact information to receive your login credentials and start your journey.

The signup process is highly efficient and user-friendly, taking you from registration to challenge selection in just a few clicks. By utilizing the Start Your Career portal, you gain a clear overview of every option available, ensuring you can choose the right capital size and platform for your professional goals.

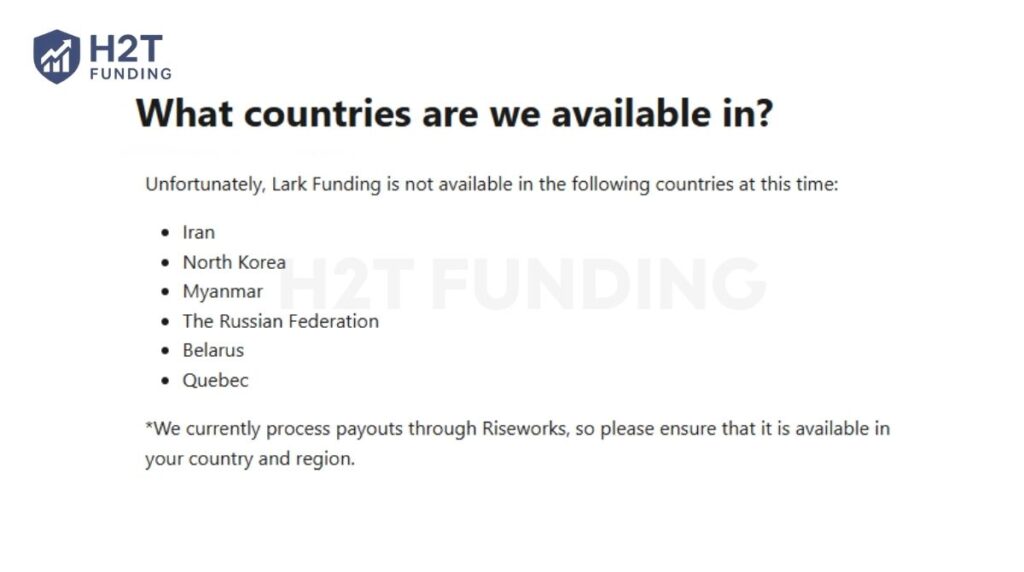

13. Lark Funding restricted countries

Before purchasing an evaluation, it is essential to verify your residency status to ensure you are eligible for payouts. Due to strict regulatory and compliance requirements, Lark Funding and its payout partner, Riseworks, do not provide services in specific jurisdictions affected by international sanctions or local laws.

If you are located in a restricted area, you will be unable to complete the KYC process, which is a mandatory step before receiving any rewards. The following countries are currently unsupported by the platform:

- Lark Funding Direct Restrictions: Iran, North Korea, Myanmar, the Russian Federation, Belarus, and the province of Quebec (Canada).

- Riseworks/Sanctioned Regions: Afghanistan, Central African Republic, Congo (Brazzaville), Cuba, Guinea, Haiti, Iraq, Libya, Mali, Somalia, South Sudan, Sudan, Syria, Venezuela, and Yemen.

- Restricted US Territories: Guam and Puerto Rico are temporarily unsupported at this time.

- Special Note on Ukraine: Onboarding for new users from Ukraine is currently suspended, though existing users may continue to trade and withdraw via cryptocurrency.

It is important to note that if you are a citizen of a restricted country but legally reside in a supported region, you can still participate. You must be able to provide valid residency documentation from your current country of residence during the verification phase to remain compliant.

Remind: Always check the latest list of unsupported regions before starting your journey to avoid any issues with the payout system.

14. Compare Lark Funding vs other prop firms

Choosing the right proprietary firm requires a careful analysis of costs, rules, and potential rewards. While many platforms appear similar, the fine details of their evaluation models and payout structures can significantly impact your long-term profitability.

The following table compares Lark Funding against three major industry competitors: Top One Trader, FTMO, and The5ers, to help you identify which environment best suits your strategy:

| Criteria | Lark Funding | Top One Trader | FTMO | The5ers |

|---|---|---|---|---|

| Challenge Fee | $105 – $4,500 | $64 – $2,537 | €89 – €1,080 | $39 – $850 |

| Account Types | 1-step, 3-step, Instant | 1-step, 2-step, Instant | 2-step | 1-step, 2-step, 3-step |

| Profit Split | 80% – 90% | 80% – 100% | 80% – 90% | 50% – 100% |

| Account Size | $10K – $200K | $5K – $200K | $10K – $200K | $5K – $250K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Profit Target | 5% – 10% | 0% – 10% | 5% – 10% | 5% – 10% |

| Trading Platforms | DXTrade, cTrader, Match-Trader | MT5, cTrader, Match, TradeLocker, TradingView | MT4, MT5, cTrader, DXTrade | MT5, cTrader |

| Asset Types | Forex, Metals, Indices, Crypto, Stocks | Forex, Metals, Indices, Crypto | Forex, Commodities, Indices, Stocks, Crypto | Forex, Indices, Commodities, Crypto |

Deciding between these firms depends on your specific trading goals and financial situation. Each platform excels in different areas, making them ideal for different types of market participants:

- Lark Funding: Best for traders who prioritize consistent monthly contractor fees (salary) and want to avoid complex multi-step evaluations.

- Top One Trader: A great choice for those seeking maximum profit splits of 100% and access to a wide variety of modern trading interfaces.

- FTMO: The go-to option for professionals who value institutional prestige and a decade-long track record of reliable bi-weekly payouts.

- The5ers: Ideal for budget-conscious traders looking for entry fees starting at $39 and a pathway to significant capital scaling.

In conclusion, while Lark Funding is a leader in the salary-style reward niche, competitors like FTMO and The5ers offer different levels of industry longevity and budget flexibility. You should select the firm that aligns with your need for either immediate income stability or long-term capital growth.

15. Who should choose Lark Funding (and who should not)?

Deciding whether to partner with this firm comes down to your personal career goals and risk appetite. It isn’t just about the funding; it’s about whether their specific rules and reward systems align with your daily routine and trading psychology.

Lark Funding is a strong fit if you value transparency and immediate rewards over complex growth milestones. To help you decide, we have identified the specific profiles that will benefit most from their current ecosystem:

- The consistency seeker: You prefer stability and regular income streams. The 1-Step Career Evaluation is perfect if you want a monthly base reward to act as a stable fee for your data quality.

- The simplicity advocate: You are tired of complex consistency traps. This platform is ideal if you want transparent, static drawdown rules that don’t change or move against you as your balance grows.

- The risk-conscious professional: You want a safety net for your investment. With the Smart Restart Guarantee, you get a second chance to pass at no cost if you follow responsible management protocols.

- The no-hurdle trader: You have a proven edge and want to earn from day one. Their instant model is excellent for those who wish to skip the psychological stress of a multi-phase evaluation process.

However, if your primary objective is to scale a single account into the millions organically, you may find the lack of a scaling plan restrictive. Lark Funding is best suited for traders who want to extract consistent profits and receive them within hours, rather than those focused on long-term capital compounding.

We recommend this firm for traders who seek a stable, professional partnership with high-quality execution and rapid liquidity. If you prioritize a firm that treats you like a business partner and simplifies the path to a high profit split, Lark Funding is a top-tier contender.

16. Is Lark Funding legit?

Yes, Lark Funding is generally considered legitimate by many traders, though, as with all prop firms, success depends on strict rule compliance. Their high rating on Trustpilot and active, public leadership under CEO Matt L. provide a level of professional accountability and trust that is essential for serious traders.

17. FAQs

Lark Funding is not a broker; it is a proprietary trading firm that provides access to demo accounts for simulated trading. Because they do not provide financial advisory services or manage real client deposits, they operate as a professional evaluation platform rather than a regulated brokerage.

The firm was officially launched on June 1, 2022. Based in Canada, it has quickly established a reputation for transparency and has successfully navigated the industry transition to modern trading platforms like DXTrade and cTrader.

Traders can begin their journey for as little as $105 for a $10,000 3-Step Evaluation account. This makes it one of the most affordable entry points in the prop firm industry for those on a limited budget.

Most payouts are handled in under 6 hours, though the firm officially allows up to 3 business days.

For evaluation accounts, the payout system allows requests every 14 days. For Instant Funding accounts, the first payout is available on demand, while subsequent withdrawals follow a 30-day cycle.

The limits vary by program: the 1-Step Career Evaluation has a 5% daily loss and 7% max static drawdown. The 3-Step and Instant models utilize a 5% or 8% max drawdown but do not always enforce a daily limit.

Lark Funding supports three professional-grade interfaces: DXTrade, cTrader, and Match-Trader. These platforms offer high-speed execution and advanced charting, ensuring a seamless user experience across desktop and mobile devices.

Yes, news trading is permitted on all account types. However, you must avoid all-or-nothing gambling behavior, as the firm requires all traders to maintain sound risk management even during periods of high volatility.

By default, trades must be closed by Friday at 3:45 pm EST. However, you can choose to hold positions over the weekend by paying a 10% add-on fee during the initial registration process.

The use of expert advisors is fully supported, provided they are not used for HFT or arbitrage. Copy trading is permitted between your own Simulated Funded Accounts, but it is strictly prohibited during the evaluation phase.

Currently, Lark Funding does not have a scaling plan. Your account balance remains fixed at the size you initially purchased, which is a key consideration for traders looking for long-term capital growth.

You can take multiple evaluations simultaneously, but the Lark Funding max allocation is capped at $500,000 per trader. Every evaluation must be passed individually without the use of trade copiers.

You are allowed to use a VPN or VPS, but the firm strongly discourages it to avoid security flags. Using a VPN during the KYC procedures is strictly forbidden and may lead to a breach of your account.

A violation of the daily loss or max drawdown results in a hard breach and account closure. However, the firm typically offers a 20% discount code to help you restart the evaluation and try again.

Yes, you must execute at least one trade every 30 days. If an account remains inactive beyond this period, it will be flagged and breached, resulting in the loss of your trading privileges.

18. Conclusion

Lark Funding has established itself as a stable and transparent partner for the global trading community since 2022. This Lark Funding review highlights their innovative 1-Step Career model and exceptional payout reliability as their strongest competitive advantages. While the lack of a scaling plan remains a drawback, their trader-centric rules and high profit shares offer a professional environment for disciplined growth.

Success in the prop industry depends on choosing a firm that aligns with your strategy. If you are still exploring your options, we invite you to read our other detailed prop firm reviews on the H2T Funding blog. Our team provides the deep-dive analysis you need to compare different capital allocation models and find your perfect trading partner.