Warning: On February 17, 2025, Spain’s National Securities Market Commission (CNMV) issued an investor warning including FXRK, indicating it may be offering financial services without proper authorization, a potential red flag for EU-based traders.

The FXRK reviews then turn to its headline features: a $3M scaling plan, a 90% profit share, and no minimum trading days. These benefits can be appealing for traders looking to accelerate their growth, but regulatory warnings like this make it essential to assess whether the rewards outweigh the risks.

That’s why H2T Funding looked deeper into its funding programs, trading rules, and real trader feedback before drawing any conclusions.

If you’re researching FXRK and feel intrigued by its offer, keep reading to see whether its aggressive growth potential truly outweighs the payout and trust concerns.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FXRK websites before purchasing any challenge.

1. Our take on FXRK

FXRK presents itself as an ambitious prop firm with bold promises: a $3M scaling plan, profit splits up to 90%, and no minimum trading days. On paper, these features are beautiful for traders aiming to accelerate their capital growth. From my perspective, these conditions can feel liberating, especially for scalpers and high-frequency traders who usually get stuck with restrictions elsewhere.

FXRK operates under a proprietary trading firm model and is not regulated as a licensed financial broker. Unlike regulated brokers, proprietary trading firms typically operate without direct oversight from financial authorities such as the CNMV, FCA, or SEC.

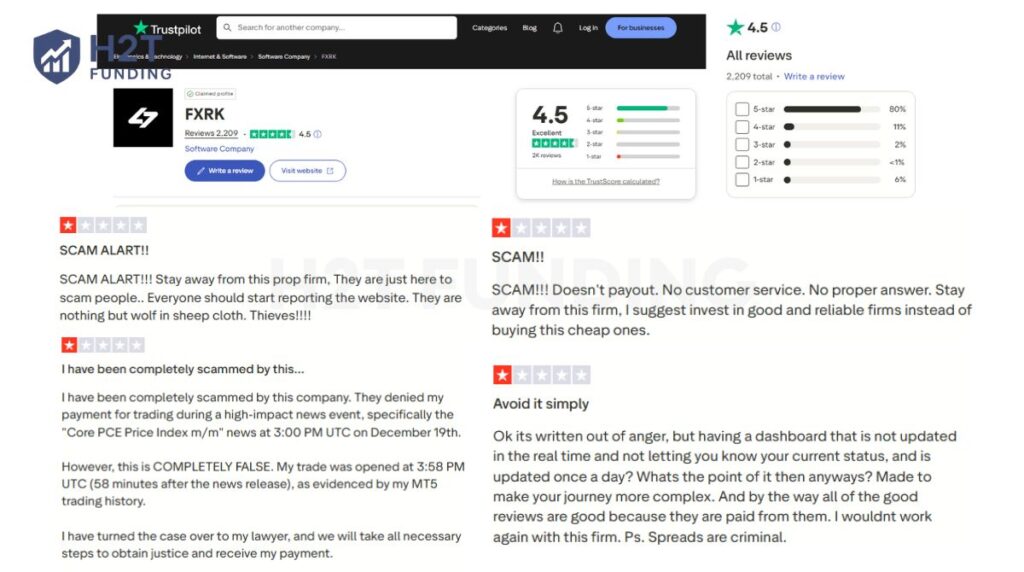

Looking at external feedback, some of the feedback above on Trustpilot praises its fast withdrawals and wide product range. However, some users also gave it a 1-star rating, and many of those negative reviews accuse the firm of being a scam or manipulating rules. Interestingly, FXRK appears proactive in damage control; FXRK responds to a large portion of negative reviews.

From my standpoint, this responsiveness shows that FXRK actively manages its online reputation. But replying to criticism is not the same as resolving structural concerns like regulatory oversight or transparency. It creates a mixed picture: strong customer engagement, but underlying trust issues that cannot be ignored.

Key features of FXRK

- Funding models: 1-Step, 2-Step challenges with no minimum trading days

- Scaling plan up to $3M for successful traders

- Profit split: 80% standard, up to 90% with Scale Plan

- FXRK advertises a broad range of tradable instruments across Forex, commodities, indices, stocks, and cryptocurrencies

- Zero commissions on all trades

Who FXRK is best for:

- Traders seeking fast-track funding with no minimum trading days

- High-frequency or scalping traders who benefit from tight spreads & zero commissions

- Those who are comfortable with higher risk in exchange for aggressive growth potential

Who FXRK is not ideal for:

- Traders who prioritize regulated prop firms for capital protection

- Beginners needing structured training or educational resources

- Those unwilling to pay Scale Plan fees for higher account tiers

Pros and cons of FXRK

| Pros | Cons |

|---|---|

| FXRK advertises zero commissions, though actual trading costs depend on spreads. | Unregulated status increases capital risk |

| Up to 90% profit split with Scale Plan | Warning issued by CNMV in Feb 2025 |

| Some traders claim delays (even months in certain cases), though experiences vary widely. | Minimal educational resources for beginners |

| 2,200+ tradable assets | Limited transparency on company operations |

| No minimum trading days | Address and contact details not disclosed |

| Scaling plan up to $3M |

FXRK promotes itself as a proprietary trading firm offering funded accounts with profit splits and scaling, but there is currently no verifiable evidence of regulatory oversight or industry recognition equivalent to established prop firms.

Watch my video review of FXRK to learn more about this proposition.

2. FXRK funding process & account types

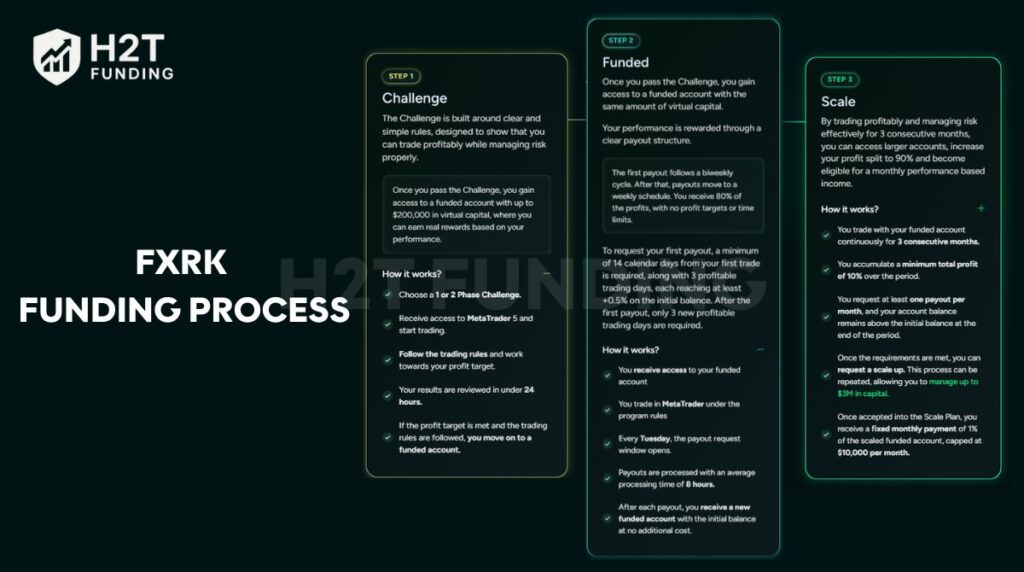

FXRK’s funding journey is broken into three main stages: Challenge, Funded, and Scale, designed to test trader skill, reward consistent performance, and progressively increase capital allocation. While the entry path varies between One-step and Two-step challenges, the progression structure remains the same.

Funding Process Overview

| Stage | Description | Key Points |

|---|---|---|

| Challenge | Prove your profitability with sound risk management to qualify for a funded account. | Pass a 1-step or 2-step evaluation Trade on MT5 Evaluation within 24 hours Up to $200k virtual capital |

| Funded | Successful traders receive a funded account with real profit-sharing payouts. | 80% profit split (90% via Scale Plan) Weekly payouts 5 positive trading days (+0.25%) to withdraw No profit target or time limit |

| Scale | For consistent traders, accounts can be scaled up to $3M with higher profit splits and monthly income. | 4 consecutive profitable months At least 10% total profit Monthly withdrawals required Fixed monthly payout up to $10,000 |

Overall, FXRK’s funding structure offers both opportunity and pressure, giving traders a clear path to scale while demanding strict consistency. Keep reading to explore more details on how these programs actually work in practice.

2.1. One-step challenge

The One-step Challenge offers a streamlined path to funding for experienced traders. By removing the second evaluation phase, you can access a funded account faster, provided you can meet a single profit target while adhering to strict risk management rules.

All One-step accounts share the same favorable trading conditions to support your strategy. You will trade with 1:100 leverage and have unlimited time to reach your goal, meaning there is no pressure to rush trades.

The evaluation operates on a Static Drawdown model, which is generally considered safer for traders compared to trailing drawdowns. Additionally, FXRK does not impose any consistency rules, giving you the flexibility to trade news or hold positions overnight without restrictions.

| Account Size | Price (One-time Fee) | Profit Target (9%) | Max Daily Loss (3%) | Max Total Loss (6%) | Min Profitable Days |

|---|---|---|---|---|---|

| $5,000 | $49 | $450 | $150 | $300 | 3 Days |

| $15,000 | $99 | $1,350 | $450 | $900 | 3 Days |

| $25,000 | $179 | $2,250 | $750 | $1,500 | 3 Days |

| $50,000 | $279 | $4,500 | $1,500 | $3,000 | 3 Days |

| $100,000 | $499 | $9,000 | $3,000 | $6,000 | 3 Days |

| $200,000 | $999 | $18,000 | $6,000 | $12,000 | 3 Days |

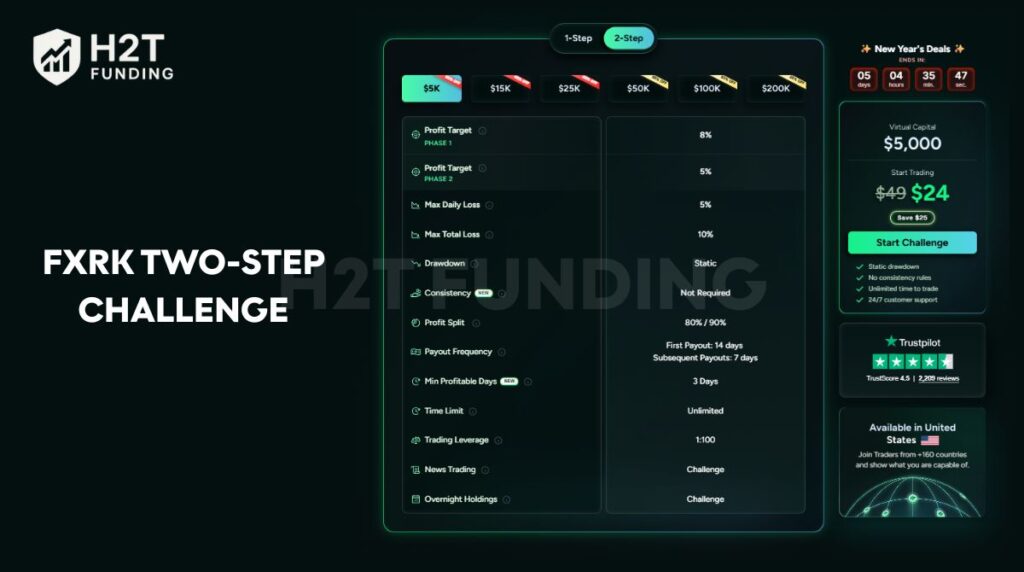

2.2. Two-step challenge

If you prefer a more balanced approach with extra room for error, the Two-step Challenge is likely the better fit. While it involves an additional evaluation phase, it offers significantly more generous loss limits compared to the One-step option. This structure is ideal for traders who prioritize capital preservation and want “breathing room” to navigate market volatility without breaching drawdown rules.

Just like the One-step program, you enjoy 1:100 leverage, unlimited trading time, and no consistency rules. The key difference lies in the objectives: you must pass Phase 1 (8% target) and Phase 2 (5% target). In exchange for this extra step, your Max Total Loss is increased to 10%, giving you a substantial safety net.

| Account Size | Price (One-time Fee) | Phase 1 Target (8%) | Phase 2 Target (5%) | Max Daily Loss (5%) | Max Total Loss (10%) | Min Profitable Days |

|---|---|---|---|---|---|---|

| $5,000 | $49 | $400 | $250 | $250 | $500 | 3 Days |

| $15,000 | $109 | $1,200 | $750 | $750 | $1,500 | 3 Days |

| $25,000 | $199 | $2,000 | $1,250 | $1,250 | $2,500 | 3 Days |

| $50,000 | $299 | $4,000 | $2,500 | $2,500 | $5,000 | 3 Days |

| $100,000 | $519 | $8,000 | $5,000 | $5,000 | $10,000 | 3 Days |

| $200,000 | $999 | $16,000 | $10,000 | $10,000 | $20,000 | 3 Days |

Verdict on FXRK’s funding program

FXRK offers an appealing structure with no time limits and high profit splits up to 90%, facilitating rapid scaling. The ability to trade news and hold positions over weekends gives it a clear advantage over many competitors in the market.

However, potential risks exist due to its unregulated status and occasional reports regarding delayed payouts or sudden compliance checks. These factors suggest a need for caution regarding the firm’s long-term reliability for a professional trader.

Consequently, FXRK is best suited for those willing to trade stability for speed and high profit potential. It is not a “safe haven” for every trader; weigh these risks carefully before seeking an account funded status.

3. FXRK trading rules

FXRK sets out a blend of permissive and restrictive trading rules that aim to give traders operational flexibility while protecting the firm’s capital. On one hand, they allow strategies that many prop firms restrict, which can be a significant advantage for skilled traders. On the other hand, several strict compliance measures can quickly lead to disqualification if overlooked.

3.1. Allowed trading practices

FXRK offers more flexibility than many competitors by permitting strategies and trading behaviors often restricted elsewhere. These allowances can benefit both short-term and long-term traders, particularly those who rely on news-driven or swing trading setups:

- Expert Advisors (EAs): You can use EAs and automated bots, provided they are not designed to exploit technical glitches or execute prohibited strategies like tick scalping.

- Copy trading: You are permitted to copy trades only if you are the master of your own accounts. Copying signals from third parties or other traders is strictly prohibited.

- VPN/VPS Usage: Allowed for ensuring stable connectivity. It is strongly recommended to use a paid VPS with a dedicated IP to prevent “Multiple Accounts” flagging or IP conflicts.

- News trading (Conditional): Permitted freely during the Challenge phase. However, on an account funded status, trading high-impact news is restricted (must close 2 minutes before and after release).

- Overnight & Weekend holding: You can hold positions overnight or over weekends during the evaluation. Once funded, all trades must be closed before the market closes to avoid a hard breach.

- Inactivity policy: To keep your account active, you must execute at least one trade every 30 consecutive days. There are no time limits to pass the challenge.

3.2. Prohibited trading practices

Despite the generous allowances above, FXRK maintains a strict framework to prevent exploitation and safeguard capital. Traders who breach these rules can face immediate account termination, forfeiture of profits, or even blacklisting:

- Martingale & grid strategies: Strictly banned. Increasing position sizes after losses to recover (Martingale) or stacking orders without market direction (Grid) is considered gambling, not trading skills.

- Tick scalping & latency: Strategies executing trades in under 30 seconds (targeting 1-3 pips) or exploiting data delays (arbitrage) are prohibited and will lead to termination.

- Account manipulation: Practices like Account Rolling (gambling across multiple accounts), Account Sharing, or Hedging between two different accounts are forbidden.

- Hyperactive trading: Spamming excessive orders or modifications to clog servers is considered toxic behavior and is not allowed.

- No account sharing, use of emulators, hacking, exploiting server errors, or platform vulnerabilities allowed

Verdict on FXRK trading rules

FXRK presents a “bait and switch” dynamic where the trading challenge is permissive, but the account-funding stage demands strict discipline. While the Challenge allows news trading and weekend holding, these are abruptly revoked upon funding, catching many off guard.

The prohibition of Martingale and Grid strategies is a positive standard to prevent gambling, ensuring only legitimate strategies survive. However, the strict news trading ban makes this firm unsuitable for fundamental traders who rely on volatility spikes.

Ultimately, FXRK is a fair environment for disciplined technical scalpers and day traders who can adapt to professional constraints. If you rely on holding trades through major events, this prop firm may not be the right fit for your style.

4. FXRK payout structure

FXRK enforces a strict schedule, processing all withdrawals exclusively on Tuesdays to maintain a predictable rhythm for traders. You become eligible for your first payout 14 calendar days after activation, provided you meet specific performance benchmarks.

To qualify, you must accumulate a minimum of 3 Profitable Trading Days, a requirement that applies to both the initial and subsequent cycles. Once your first request is approved, your account automatically upgrades to a faster weekly withdrawal frequency for future payouts.

Crucially, a “Profitable Day” is strictly defined as achieving a net gain of at least +0.5% of the Initial Balance. For example, on a $100k account, you need a daily profit of at least $500; smaller wins will not count toward this quota.

When these conditions are met, you can request a minimum of $100 USD via Bank Transfer or Crypto (ETH, BSC, MATIC, TRX). Note that partial payouts are prohibited; you must withdraw 100% of profits, after which your balance resets to the initial capital.

Requests are typically processed within 24 to 48 hours, ensuring a relatively quick turnover. This structured approach aims to reward consistent performers while preventing withdrawals based on “lucky” volatility spikes.

Key payout details summary

| Feature | Details |

|---|---|

| Request Window | Tuesdays Only |

| First Payout Timing | 14 days after activation |

| Subsequent Frequency | Weekly (every Tuesday) |

| Qualification Rule | 3 Profitable Days (>0.5% of Initial Balance each) |

| Processing Time | 24 – 48 hours |

| Profit Split | 80% (Standard) up to 90% (Scale Plan) |

Verdict on payout structure

FXRK’s payout system offers a structured path to weekly income, but the +0.5% profit requirement acts as a rigorous filter. By demanding significant daily gains to unlock funds, the firm effectively separates consistent traders from those relying on luck.

However, despite these clear rules, community feedback on Trustpilot raises validity concerns regarding execution. Frequent reports of payment delays and unexpected compliance checks contrast sharply with the promised efficiency. (I read that information on Trustpilot.)

Consequently, traders should view FXRK as a high-reward but high-risk vehicle. While the weekly potential is attractive, reliability remains a variable that risk-averse professionals must carefully consider.

5. Scaling plan

FXRK’s Scale Program is a structured pathway designed to reward consistent performance with massive capital growth. It allows traders to progressively increase their managed funds up to $3,000,000 while unlocking superior financial conditions.

To qualify for an upgrade, you must demonstrate profitability over a 3-month consecutive cycle. The primary target is achieving a cumulative growth of 10% (averaging roughly 3.3% per month) while strictly adhering to all risk management rules.

Consistency is further validated through mandatory payouts to ensure you are not just holding floating profits. You are required to complete at least one approved withdrawal per month, totaling a minimum of three withdrawals throughout the full evaluation cycle.

Successful scaling grants access to an enhanced 90% profit split, rewarding your long-term discipline. Additionally, higher tiers unlock a unique fixed monthly income of 1% of the managed balance (capped at $10,000), paid regardless of that month’s trading results.

Key requirements for scaling

| Criteria | Details |

|---|---|

| Evaluation Period | 3 consecutive months |

| Profit Target | Minimum 10% cumulative (approx. 3.3% monthly) |

| Withdrawal Rule | Mandatory 1 withdrawal/month (3 total per cycle) |

| Account Condition | Balance must be positive relative to start |

| Scaling Limit | Up to $3,000,000 |

| Key Benefits | Balance must be positive relative to the start |

Verdict on scaling plan

FXRK’s scaling model stands out as one of the most aggressive in the industry, particularly due to the fixed monthly salary and $3M cap. The 10% target over three months is realistic for skilled traders, though the mandatory monthly withdrawal adds strategic pressure.

However, given the firm’s track record of payout disputes, scaling may hold little real value if withdrawals are unreliable. In practice, the ability to grow an account is only as good as the certainty of receiving profits, making this plan attractive in theory but questionable in execution.

6. Spreads, commissions & refund policy

FXRK Markets offers a highly competitive trading environment on MetaTrader 5, specifically designed to minimize execution costs. The firm operates on a 0 Commission structure, meaning you pay $0 fees per lot traded, allowing you to keep more of your gross profits.

In terms of pricing accuracy, FXRK boasts industry-leading liquidity with spreads as low as 0.06 pips on major pairs like EUR/USD. This ultra-tight pricing model is particularly advantageous for scalpers and high-frequency traders who rely on precision entries.

However, financially, the firm maintains a strict No-Refund Policy. Unlike many competitors, the challenge fee is never reimbursed, even after you reach the funded stage and withdraw profits, making it a permanent initial investment.

- Commissions: $0 Fees (0 Commission per lot).

- Typical spreads: From 0.06 pips on EUR/USD.

- Refund policy: No Refunds. The challenge fee is not reimbursed upon payout.

Verdict on spreads, commissions & refund policy

The combination of 0.06 pips spreads and zero commissions creates one of the most cost-efficient trading environments available. For high-volume traders, the savings on trading costs can rapidly exceed the value of the initial signup fee.

However, the No Refund Policy is a major financial disadvantage compared to competitors who reimburse fees. Because the entry cost is unrecoverable, your break-even point is higher, as you must earn back the fee through profits alone.

Ultimately, while the trading conditions may be professional, the financial structure is less trader-friendly. You must calculate this “sunk cost” into your risk model, as the fee is gone the moment you pay it.

7. FXRK trading platform

FXRK exclusively utilizes MetaTrader 5 (MT5), the advanced successor to the industry standard. This platform is designed for professional execution, offering superior speed and depth of market analysis compared to older versions.

The platform is fully cross-compatible, available on both PC and Mobile devices. This ensures you can monitor markets and manage positions seamlessly, whether you are at your desk or on the move.

- Fast execution: Optimized for high-speed order processing and low latency.

- Advanced analysis: Equipped with enhanced charting tools and technical indicators.

- Automation-ready: Fully supports Expert Advisors (EAs) and algorithmic trading.

- Accessibility: Native apps for iOS and Android ensure 24/7 market access.

Verdict on the trading platform

Adopting MT5 is a strategic move by FXRK. For traders who rely on modern custom EAs and sophisticated indicators, MT5 offers superior backtesting and execution capabilities compared to the older MT4.

But the lack of variety is a limitation. Traders who prefer the modern interface of cTrader or the flexibility of MatchTrader will find the platform options restrictive, as FXRK is currently locked into the MetaQuotes ecosystem.

8. FXRK trading instruments & leverage

FXRK grants access to a broad spectrum of global financial markets, covering Forex, Commodities, Indices, Stocks, and Digital Assets. This diversity allows you to execute cross-market strategies within a unified trading environment.

However, leverage is not uniform; it is tiered based on the asset’s inherent volatility to ensure responsible risk management. While Forex pairs enjoy high leverage, riskier assets have tighter caps applicable to both Challenge and Funded accounts.

- Crypto: Up to 1:2

- Forex: Up to 1:100

- Indices: Up to 1:25

- Commodities (Metals & energies): Up to 1:20

- Stocks: Up to 1:5

Verdict on trading instruments & leverage

For me, the breadth of FXRK’s market access is a major strength, enabling true portfolio diversification. It enables traders to diversify strategies across multiple markets, from Forex to Commodities, Stocks, Indices, and Digital Assets.

While 1:100 for Forex meets industry standards, the caps on other assets, specifically 1:2 for Crypto and 1:5 for Stocks, are quite conservative. This setup effectively protects capital but may feel restrictive for aggressive day traders used to higher leverage on digital assets.

Ultimately, FXRK is optimized for Forex traders. If your primary strategy involves high-leverage scalping on Crypto or Stocks, you may find these safety rails limiting compared to other multi-asset prop firms.

9. Education & resources of FXRK

FXRK provides very limited educational support for traders. While there is a trading blog and performance evaluation tools to track your trades, the firm does not offer webinars, trading courses, or video tutorials. This lack of structured learning resources makes it challenging for new traders to develop skills solely within FXRK’s ecosystem.

Verdict on education & resources

The absence of formal educational materials is a significant drawback, particularly for beginners who rely on structured guidance. Experienced traders can still utilize the performance tracking tools, but anyone seeking comprehensive learning support will need to look elsewhere.

10. Customer support

FXRK offers two support channels: live chat and email. There is no phone support, which limits immediate assistance. Both the website and support are available in English and Spanish, but this is not sufficient to classify FXRK as a truly multilingual prop firm.

Verdict on customer support

The lack of phone support and limited language options is a major drawback. Some users report: when I had a simple query about a payout confirmation, my emails went unanswered for over 72 hours, and the live chat could only provide canned, unhelpful responses. This lack of accessible support is a major concern when your capital is on the line.

11. What did other traders say about FXRK Trustpilot and FXRK Reddit review ratings

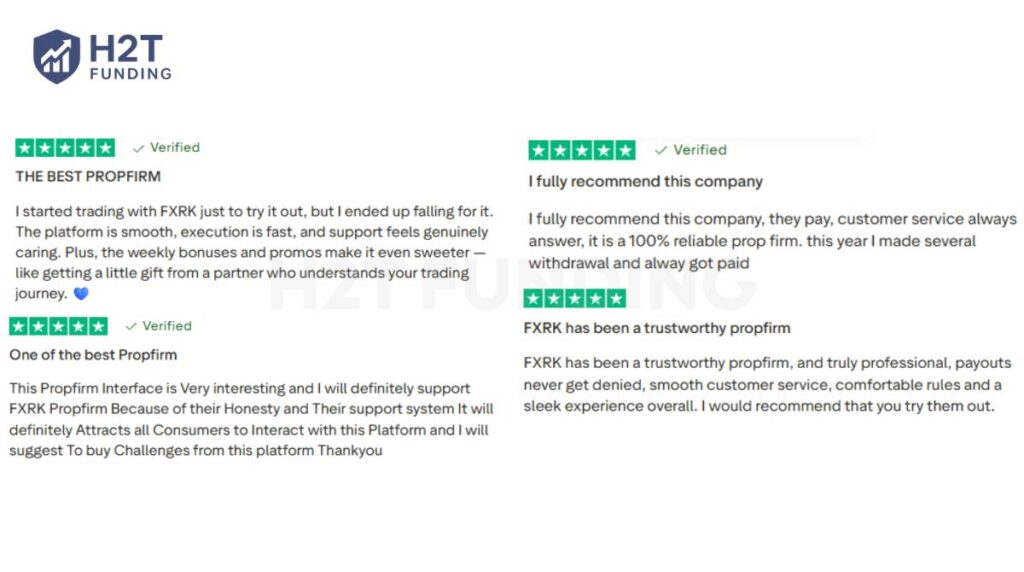

As of January 12, 2026, FXRK holds a strong 4.5-star rating on Trustpilot. Despite a high numerical rating, reviews remain polarized. While 80% of feedback is positive, highlighting the “sleek” interface and reliable support, a vocal 9% minority reports severe friction, creating a polarized community.

Satisfied verified users frequently cite fast execution and attractive weekly bonuses as key strengths. However, negative reviews often center on disputed rule breaches, specifically regarding news trading denials and dashboard lags, leading to heated “scam” accusations.

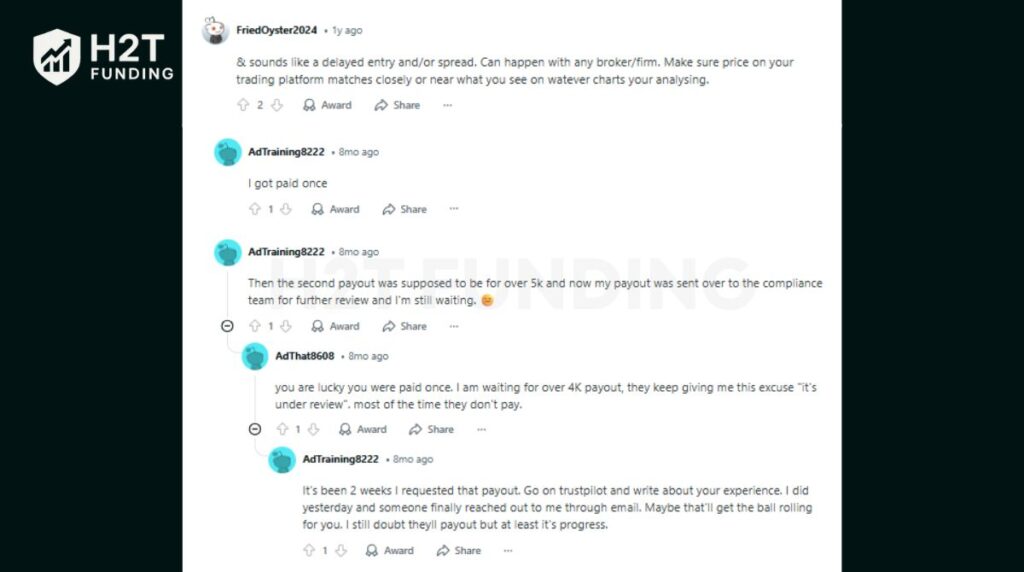

On FXRK Reddit, technical discussions are more granular. User FriedOyster2024 highlighted potential “delayed entries” and spread discrepancies, advising traders to strictly cross-reference prices with external charts to ensure accuracy during volatile moves.

More concerning are reports from users like AdTraining8222 and AdThat8608 regarding the “Compliance Team.” A recurring pattern emerges where small initial payouts are approved, but subsequent larger requests (over $4,000 – $5,000) get stuck in indefinite “under review” statuses.

Crucially, AdTraining8222 noted that support only re-engaged after they posted a negative Trustpilot review. This suggests that public pressure is sometimes necessary to unblock stalled payments, a significant red flag for traders expecting a stress-free withdrawal process.

12. How to sign up with FXRK

Getting started with FXRK involves participating in one of their funded account challenges, which can be either a one-step or two-step evaluation. Challenge sizes range from $5K up to $200K, offering flexibility depending on your experience and risk appetite.

Here’s a step-by-step overview of the registration and onboarding process:

- Step 1: Create your free account on the FXRK website.

- Step 2: Access the Dashboard and start a new challenge.

- Step 3: Configure your challenge (Type, Size, Platform).

- Step 4: Select optional Add-ons (e.g., 90% Split, Weekly Payout).

- Step 5: Apply coupons and review the order.

- Step 6: Enter billing details and complete payment.

- Step 7: Receive credentials and start trading.

- Step 8: Pass the evaluation and get funded.

Follow the detailed steps below to secure your funded account today.

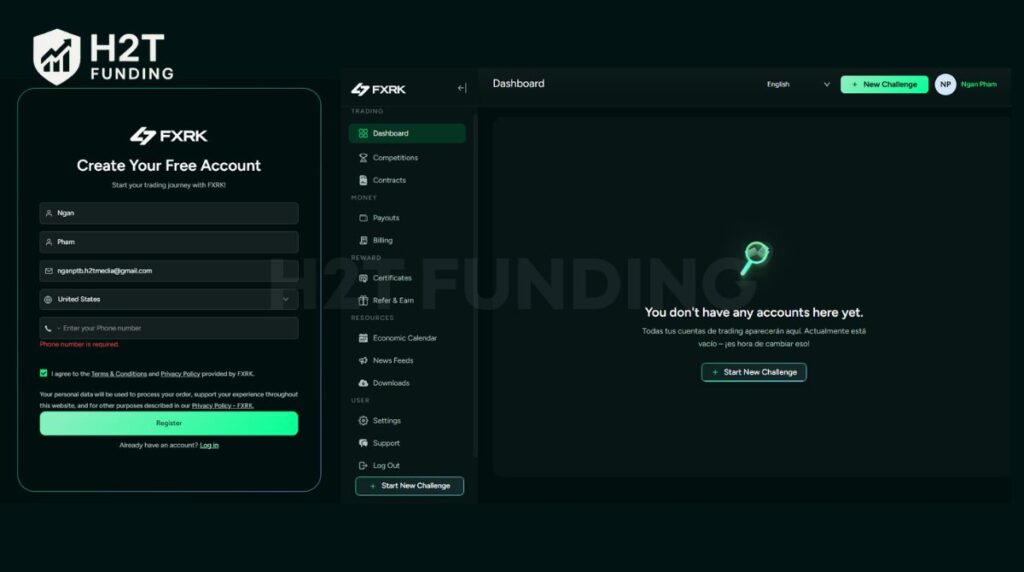

12.1. Step 1: Create your free account

Visit the official FXRK website via H2T Funding and click Get Funded. You will be prompted to create a free account by entering your First Name, Last Name, Email, Country, and Phone Number. Agree to the terms and click Register to proceed.

12.2. Step 2: Access the dashboard

Once registered, you will be directed to the main FXRK Dashboard. If you have no active accounts, the screen will show an empty state. Click the Start New Challenge button in the center of the screen or the top right corner to begin the purchase process.

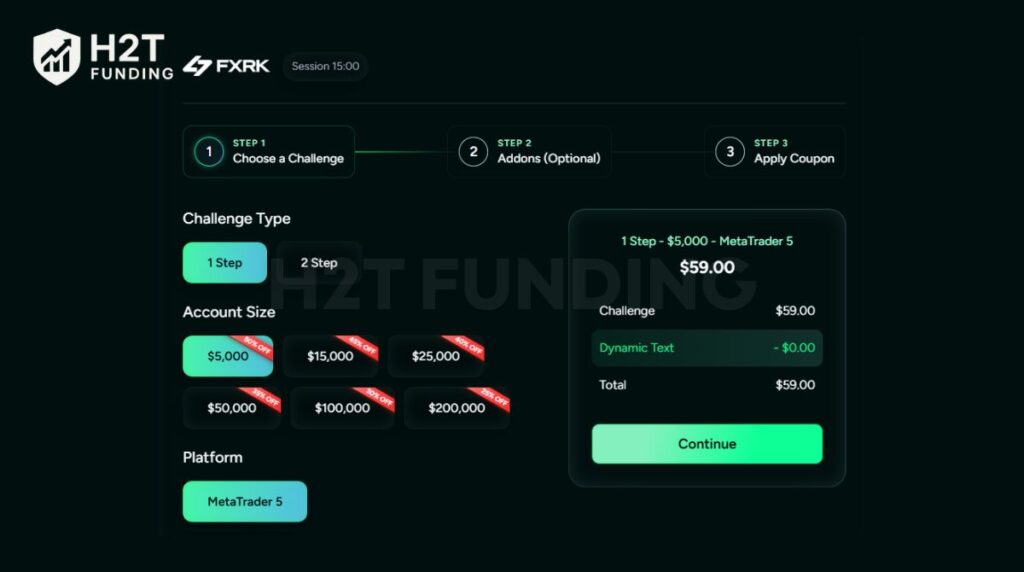

12.3. Step 3: Configure your challenge

You will enter a 3-step configuration wizard. First, select your Challenge Type (1 Step or 2 Step) and your Account Size ($5,000 to $200,000). Confirm MetaTrader 5 as your platform. The summary on the right will update the price dynamically.

12.4. Step 4: Select optional Add-ons

FXRK allows you to customize your account with paid Add-ons. You can choose to boost your Profit Split to 90%, unlock Weekly Payouts, remove the Minimum Trading Days rule, or buy a Second Chance. Select any that fit your strategy before clicking “Continue”.

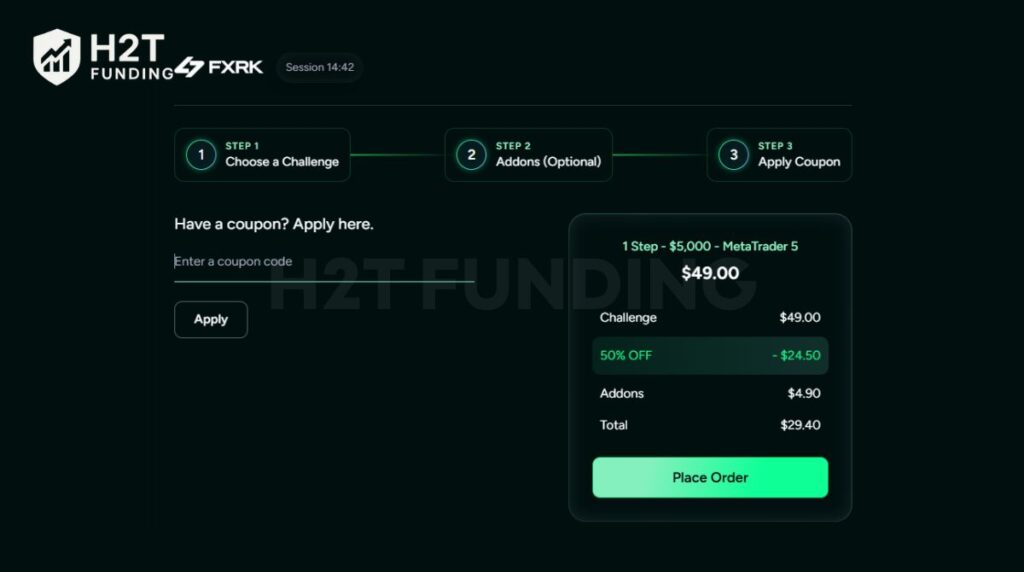

12.5. Step 5: Apply coupon & review

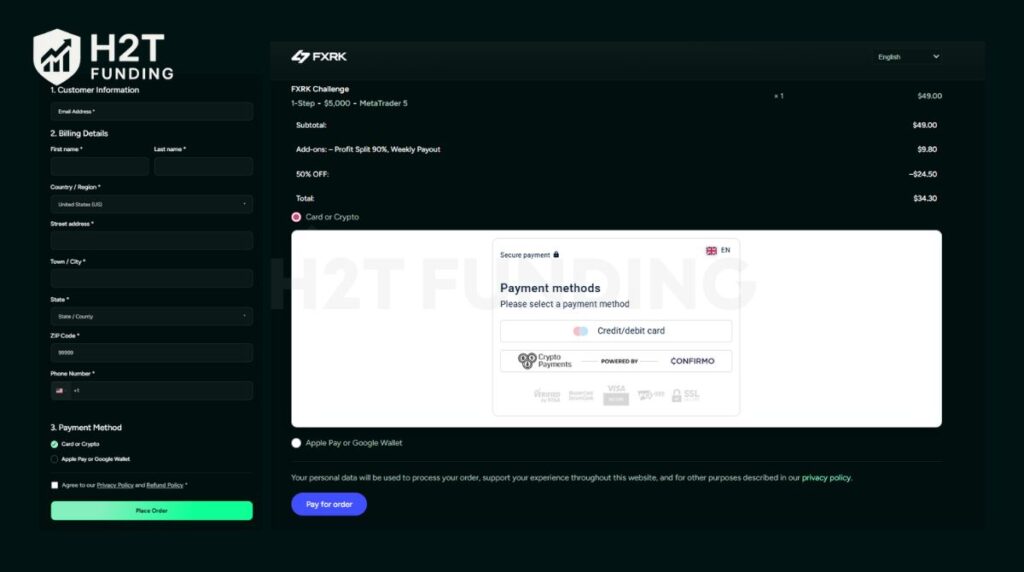

If you have a promo code, enter it in the Apply Coupon field to receive discounts (e.g., 50% OFF). Review your order summary, ensuring the challenge type, account size, and total price (including any discounts) are correct before proceeding.

12.6. Step 6: Complete billing & payment

Fill in your billing details, including your address, city, and zip code. Select your preferred payment method: Credit/Debit Card or Crypto (powered by Confirmo). You can also use Apple Pay or Google Wallet. Click Place Order to finalize the transaction.

12.7. Step 7: Receive credentials & trade

Upon successful payment, your FXRK login credentials for MetaTrader 5 will be emailed to you instantly. Download the MT5 platform, log in to your new simulation account, and begin trading according to the rules of your chosen challenge.

12.8. Step 8: Get funded

Focus on hitting your profit target while strictly respecting the static drawdown limits. Once you meet the trading objectives, your account will be reviewed, and you will transition to a funded status, eligible for payouts up to 90%.

The FXRK onboarding is straightforward and fast, which can be attractive if you want to start trading quickly. For those prepared to monitor their accounts closely and accept operational risks, FXRK provides a clear path to funded trading and account scaling.

13. FXRK vs other prop firm

Choosing the right prop firm goes beyond profit splits; you need to weigh challenge costs, account scaling potential, payout frequency, and overall credibility.

FXRK stands out with over 2,200 tradable assets and a profit split of up to 90%, but recurring payout complaints make it a high-risk option. Below is a vertical comparison with two other well-known firms: FTMO and Blueberry Funded, both offering 1-Step and/or 2-Step challenges with 80%–90% profit splits.

| Feature | FXRK | FTMO | Blueberry Funded |

|---|---|---|---|

| Profit Split | Up to 90% | Up to 90% | 80% – 90% |

| Account types | 1-Step & 2-Step | 2-Step | 1-Step, 2-Step, rapid, and instant |

| Challenge Fee (200K) | $999 | €1,080 | $1,000 (2-step) |

| Payout Frequency | Weekly | On-demand (after 14 days) | Weekly |

| Scaling Plan | Up to $3M | Up to $2M | Up to $2M |

| Strengths | 2,200+ assets, news trading allowed, no time limit | Strong brand, reliable support | Transparent rules, multiple choice of challenge |

| Weaknesses | Many payout complaints, no phone support | Higher relative cost, stricter EA rules | Fewer assets than FXRK, newer brand reputation |

Which prop firm might suit you best?

- FXRK: Ideal for experienced traders focused on rapid scaling, broad market access, and high profit potential. But be prepared for operational risk, including reported payout issues and limited educational support.

- Blueberry Funded: A solid middle-ground option with broker backing, low challenge fees, wide asset coverage, and bi-weekly payouts. Great for cost-conscious traders seeking a balance between growth and reliability.

- FTMO: Recommended for traders who value a strong brand reputation, comprehensive education, and consistency. While challenges have no time limits, FTMO’s rules are built for consistent traders, and its reputation for fairness makes it a reliable long-term choice.

14. FXRK restricted countries

FXRK maintains a broad international reach but enforces strict geographic limitations to comply with global legal and regulatory standards. Consequently, the firm does not offer services or solicit clients from specific regions deemed high-risk.

Currently, residents of the following countries are prohibited from opening accounts:

- Afghanistan

- Central African Republic

- China

- Cuba

- Democratic Republic of the Congo

- Guinea-Bissau

- Iran

- Iraq

- Libya

- Mali

- North Korea

- Republic of the Congo

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- United Arab Emirates (UAE)

- Venezuela

- Yemen

Additionally, services are strictly denied to any individuals or entities listed under international sanction regimes, including ISIL (Da’esh), Al-Qaida, and the Taliban (1988). Ultimately, it is the trader’s responsibility to ensure that trading with FXRK complies with their local jurisdiction’s laws.

15. FAQs

FXRK operates as an unregulated prop firm and has received a CNMV warning. While some traders report successful payouts, the risk profile is significantly higher than established firms.

FXRK is a prop firm that funds traders who pass its 1-Step or 2-Step evaluation challenges, sharing profits from live account trading.

80%, and you can scale up to 90% profit split for funded traders.

MetaTrader 5 (MT5).

FXRK gives access to more than 2,200 tradable instruments, covering Forex currency pairs, major and minor commodities, global stock indices, individual stocks, government and corporate bonds, futures contracts, and a range of digital assets like cryptocurrencies.

No. FXRK operates as an unregulated proprietary trading firm, meaning it is not overseen by any government financial authority. Traders should weigh this factor carefully, as it affects investor protection and dispute resolution.

Yes, FXRK allows the use of Expert Advisors (EAs) and algorithmic bots on MetaTrader 5. However, your EAs must not execute prohibited strategies such as tick scalping, latency arbitrage, martingale, or grid trading. The automated strategy must reflect legitimate market analysis and not exploit technical flaws.

Yes. Traders who maintain consistent profitability and meet specific performance requirements over four months can scale their accounts up to a maximum of $3 million and receive up to 90% profit split, along with fixed monthly income bonuses at higher tiers.

Yes, but it depends on your account status. During the Challenge phase, you are free to trade all news events without restriction. However, on a Funded Account, trading High-Impact news is strictly prohibited. You must close all positions 2 minutes before the release and wait 2 minutes after before opening new trades.

FXRK allows traders to hold and trade multiple funded accounts simultaneously. However, account limits, merging options, and scaling rules depend on the chosen challenge type and internal policy.

Yes, but only during the Challenge phase, you are permitted to hold trades overnight and over the weekend. Once you are Funded, holding positions over the weekend is prohibited. You must close all active trades before the market closes on Friday (or the daily break for specific assets) to avoid disqualification.

16. Final thoughts on FXRK

This FXRK H2T Funding review stands out with its unlimited time to complete challenges, profit split of up to 90%, flexible trading rules that allow news trading and weekend holds, and FXRK claims to offer over 2,000 assets. FXRK reports a scaling plan up to $3M, though details depend on internal policies..

However, the absence of regulation, multiple trader complaints about delayed or missing payouts, and limited customer support seriously impact its long-term credibility.

Based on the FXRK reviews, it is best suited for traders who prioritize speed, high earning potential, and rule flexibility, and are willing to accept higher risks in exchange. It’s not an ideal choice for those seeking a fully reliable, low-risk prop firm experience.

What about you? Have you traded with FXRK or considered taking their challenge? Share your experience or opinion in the comments; your insights can help other traders make informed decisions.

For more in-depth evaluations, visit our Prop Firm Review section at H2T Funding. Compare FXRK with other top proprietary trading firms, explore the best profit split opportunities, and find the prop firm that matches your trading style and goals.