Blue Guardian is a prop firm providing capital from $5,000 to $200,000 with a profit split reaching up to 95%. It offers one-step, two-step, three-step, and instant funding options with no time limits, supporting popular platforms such as MT5 and Match-Trader across Forex, Indices, Commodities, and Cryptocurrencies.

However, every trader knows that attractive terms alone do not guarantee a reliable funding partner. Many prop firms advertise high profit splits and flexible rules, only for traders to later encounter hidden restrictions, unexpected rule violations, or payout delays. Finding a trustworthy firm is still a challenge for retail traders.

In this Blue Guardian review, H2T Funding looks beyond the promotional claims to assess how the firm operates in real trading conditions. We focus on funding accessibility, payout reliability, and whether traders can avoid unexpected restrictions or unfair practices.

Let’s see if this prop firm deserves a place in your long-term strategy.

1. Our take on Blue Guardian

Blue Guardian is a prop firm led by CEO Sean Bainton. It provides capital to retail traders through various evaluation steps, like one-step, two-step, three-step, and immediate funding programs designed for different trading styles.

One positive aspect is the 24-hour payout guarantee. If the firm fails to process a reward request within this window, the trader is upgraded to a 100% profit split, showing a strong commitment to transparency.

However, there are significant hurdles to consider. The firm enforces strict news trading rules on funded accounts and requires a steep 7% profit target before the first withdrawal is permitted on several models.

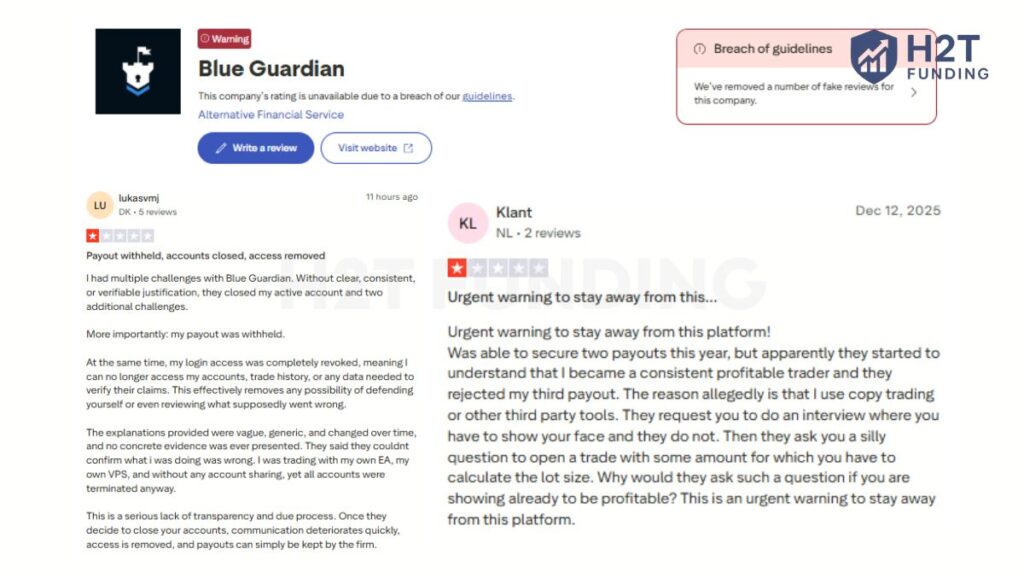

The recent Trustpilot warning about review guidelines is also a point of concern. We suggest looking for unbiased community feedback on external forums as part of your Blue Guardian prop firm review before making a financial commitment.

| Pros | Cons |

|---|---|

| 24-Hour Payout Guarantee (or 100% split) | Tighter trailing drawdown on many accounts |

| No time limits on any evaluation account | Strict inactivity rules (30-day limit) |

| Scaling up to $400,000 max capital | News restrictions on funded accounts |

| Supports Hedging and Martingale strategies | High initial payout hurdle (up to 7%) |

| Response time for support under 1 minute |

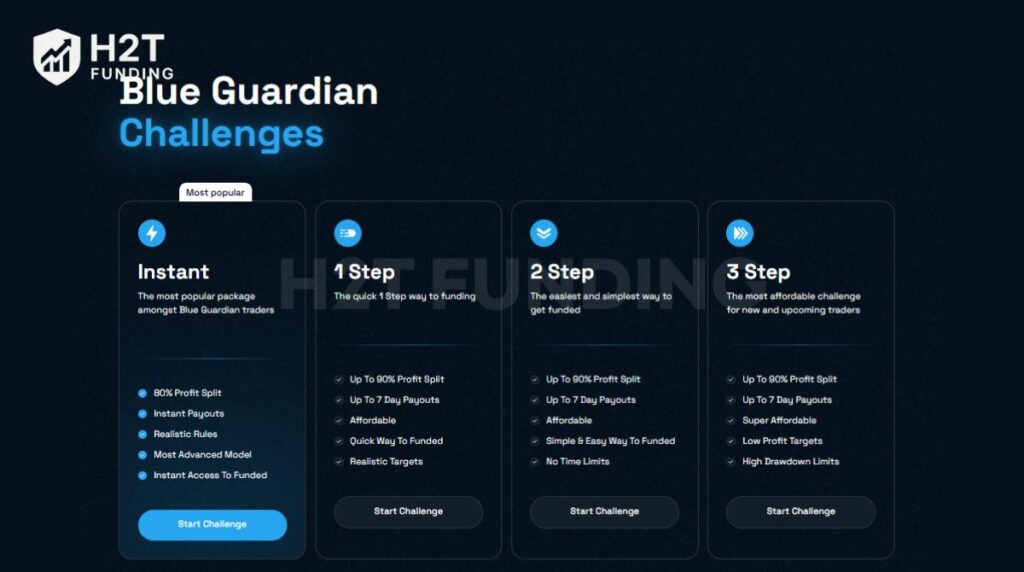

2. Funding program Blue Guardian

Blue Guardian offers a comprehensive suite of funding program options designed to cater to various trading styles. This blue guardian funding review breakdown explores how their structured accounts provide the flexibility needed to match your risk appetite.

Unlike firms that force a single model, their structured accounts provide the flexibility needed to match your specific risk appetite. From rapid evaluations to immediate capital access, these challenges are built to identify consistent talent. Each program offers a unique path to professional scale, ensuring a rewarding experience for disciplined traders seeking high profit splits and reliable capital.

2.1. One-step challenge

The one-step challenge is designed for traders who want to fast-track their journey to a funded account. By merging the evaluation into a single phase, Blue Guardian allows you to prove your skills and access capital much faster than traditional models. This program is ideal for those who have a proven strategy and want to bypass lengthy multi-step challenges.

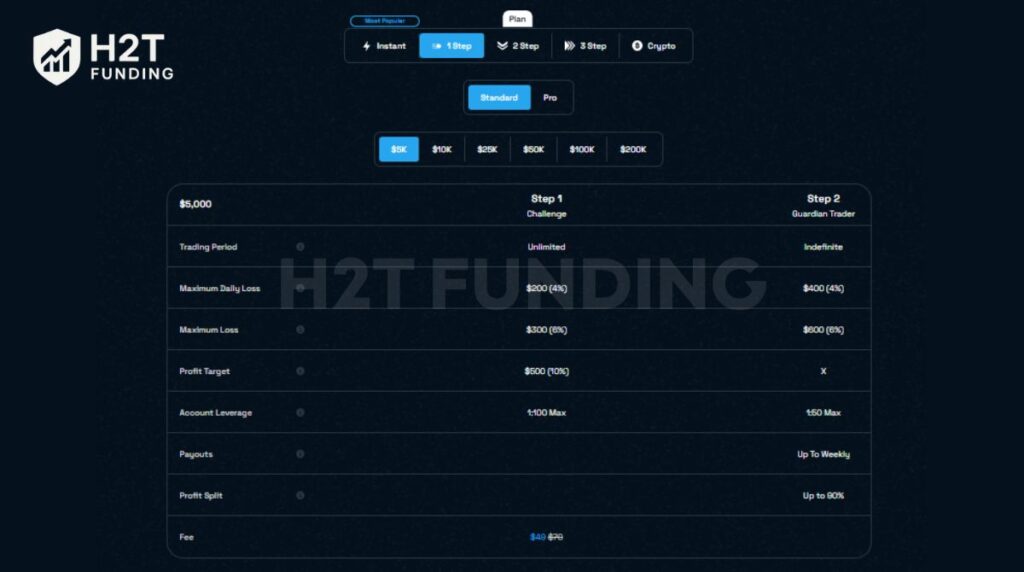

2.1.1. Standard account

The standard one-step is the go-to choice for traders who utilize higher leverage to capture market moves. It offers a balance between a competitive profit target and generous leverage limits.

The Standard account’s 1:100 leverage is a massive advantage for day traders. However, be careful, while high leverage can boost returns, it also makes hitting that 4% daily drawdown limit much easier if your risk management slips.

| Account Size | Audition Fee | Profit Target (10%) | Max Daily Loss (4%) | Max Total Loss (6%) | Max Leverage |

|---|---|---|---|---|---|

| $5,000 | $70 | $500 | $200 | $300 | 1:100 |

| $10,000 | $97 | $1,000 | $400 | $600 | 1:100 |

| $25,000 | $197 | $2,500 | $1,000 | $1,500 | 1:100 |

| $50,000 | $297 | $5,000 | $2,000 | $3,000 | 1:100 |

| $100,000 | $497 | $10,000 | $4,000 | $6,000 | 1:100 |

| $200,000 | $997 | $20,000 | $8,000 | $12,000 | 1:100 |

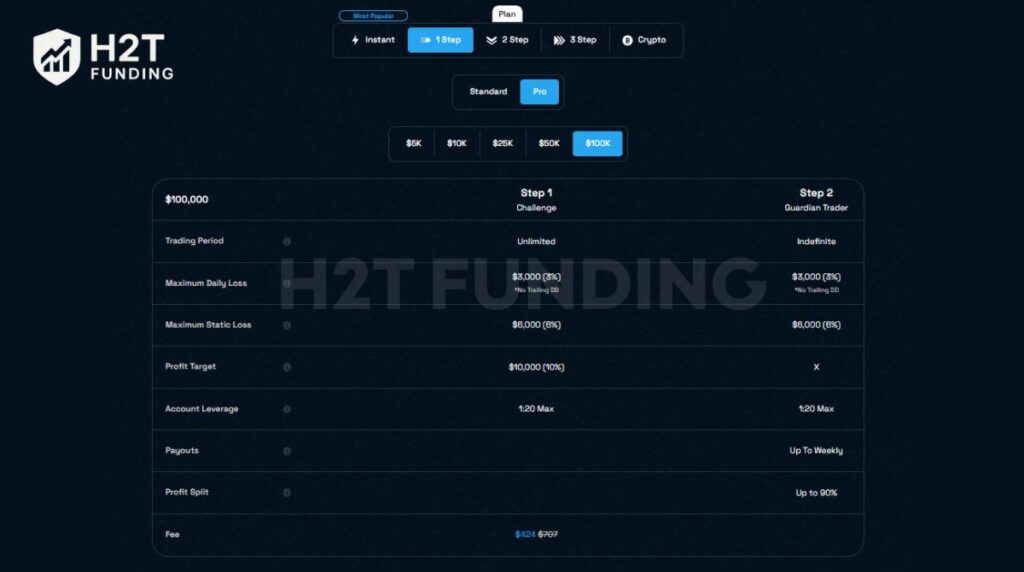

2.1.2. Pro account

The Pro One-Step is specifically engineered for traders who prioritize account safety and static rules. The standout feature here is the No Trailing Drawdown policy, providing a more stable environment for those who dislike moving loss limits.

The lower leverage (1:20) on the Pro account is a double-edged sword. It forces discipline, but it might feel restrictive for those used to aggressive scaling. The static loss limit, however, is a piece of mind feature that significantly improves the overall trading experience.

| Account Size | Audition Fee | Profit Target (10%) | Max Daily Loss(3%) | Max Static Loss (6%) | Max Leverage |

|---|---|---|---|---|---|

| $5,000 | $43 | $500 | $150 | $300 | 1:20 |

| $10,000 | $60 | $1,000 | $300 | $600 | 1:20 |

| $25,000 | $122 | $2,500 | $750 | $1,500 | 1:20 |

| $50,000 | $184 | $5,000 | $1,500 | $3,000 | 1:20 |

| $100,000 | $353 | $10,000 | $3,000 | $6,000 | 1:20 |

2.2. 2-step challenge

The two-step challenge remains the industry gold standard for identifying consistent, long-term talent. By splitting the evaluation into two distinct phases, Blue Guardian ensures that your trading success isn’t just a result of a lucky week.

But for me, the biggest draw here is the unlimited trading period. Removing the 30-day clock changes the psychological game entirely, allowing you to wait for high-probability setups without the fear of an expiring account.

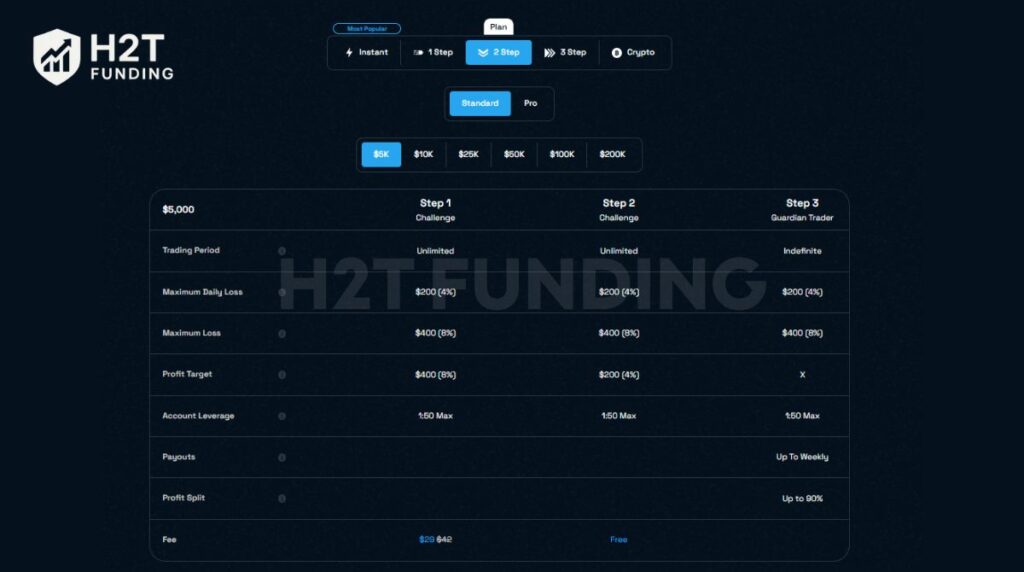

2.2.1. Standard account

The standard two-step is tailored for traders who want a balanced risk-to-reward ratio. It features a lower profit target in Phase 1 (8%) compared to the 1-step models, making the initial hurdle slightly more manageable for conservative strategies.

With a 1:50 leverage, this account type is very forgiving. The 8% target in Phase 1 is well within the reach of swing traders. However, keep an eye on the 8% total drawdown; it’s a bit tighter than some competitors, requiring precise risk management to protect your returns.

| Account Size | Audition Fee | Phase 1 Target (8%) | Phase 2 Target (4%) | Max Daily Loss (4%) | Max Total Loss (8%) |

|---|---|---|---|---|---|

| $5,000 | $42 | $400 | $200 | $200 | $400 |

| $10,000 | $97 | $800 | $400 | $400 | $800 |

| $25,000 | $197 | $2,000 | $1,000 | $1,000 | $2,000 |

| $50,000 | $297 | $4,000 | $2,000 | $2,000 | $4,000 |

| $100,000 | $497 | $8,000 | $4,000 | $4,000 | $8,000 |

| $200,000 | $997 | $16,000 | $8,000 | $8,000 | $16,000 |

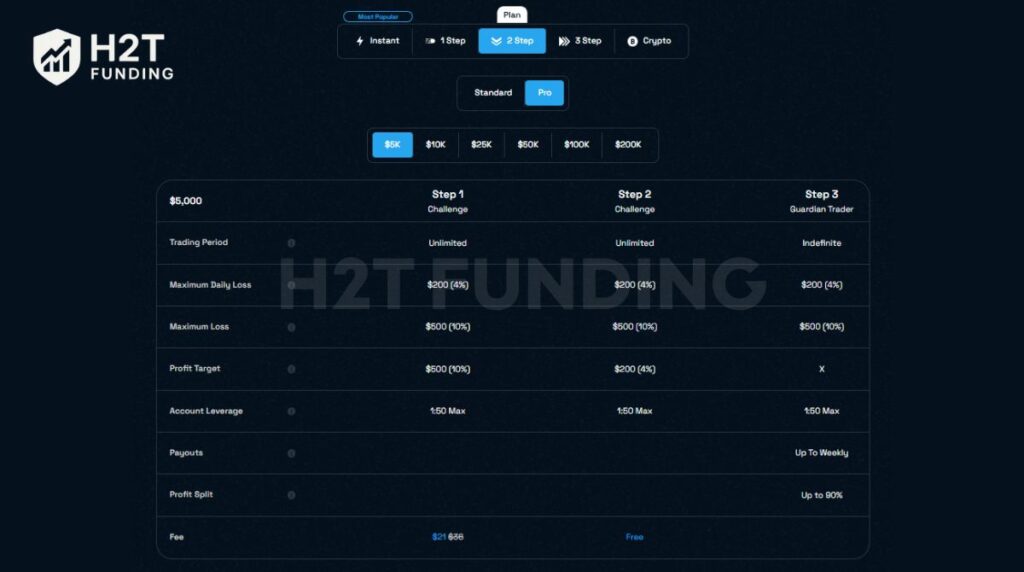

2.2.2. Pro account

The pro two-step is a premium tier for those who want a larger breathing room for their total balance. While the profit target in Phase 1 is higher (10%), the firm compensates by offering a massive 10% maximum loss limit, providing superior protection against market anomalies.

The Pro account is essentially the safety net version of the 2-step. That extra 2% in total drawdown (10% vs 8%) can be the difference between a blown account and a successful recovery. If you are a trader who experiences deeper occasional pullbacks, the Pro model offers much higher credibility for your long-term survival.

| Account Size | Audition Fee | Phase 1 Target (10%) | Phase 2 Target (4%) | Max Daily Loss (4%) | Max Total Loss (10%) |

|---|---|---|---|---|---|

| $5,000 | $36 | $500 | $200 | $200 | $500 |

| $10,000 | $79 | $1,000 | $400 | $400 | $1,000 |

| $25,000 | $141 | $2,500 | $1,000 | $1,000 | $2,500 |

| $50,000 | $250 | $5,000 | $2,000 | $2,000 | $5,000 |

| $100,000 | $464 | $10,000 | $4,000 | $4,000 | $10,000 |

| $200,000 | $921 | $20,000 | $8,000 | $8,000 | $20,000 |

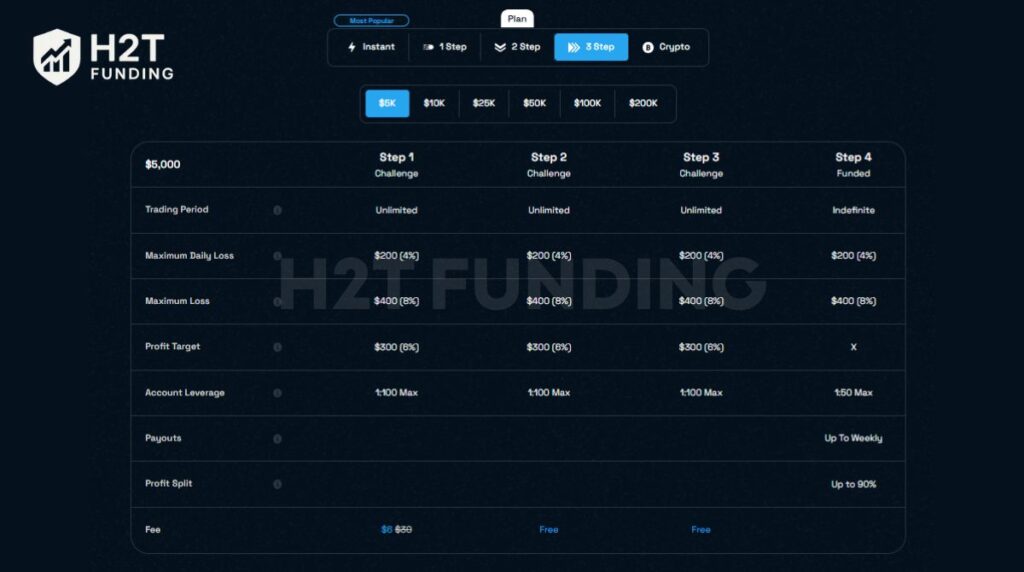

2.3. 3-step challenge

The three-step challenge is Blue Guardian’s answer for traders who prefer a marathon over a sprint. By spreading the evaluation across three phases, the firm significantly lowers the profit target for each stage to just 6%. This approach reduces the pressure to over-leverage and allows for a more relaxed trading experience.

This program serves as an excellent entry-level path for those who want to test their strategies with minimal financial risk. The unlimited trading period remains active here, ensuring you can take as much time as needed to clear each hurdle.

The shift in leverage is a key detail to watch. You enjoy high 1:100 leverage during the evaluation to help hit targets, but this drops to 1:50 once you reach the funded account (Step 4). This change requires an adjustment in position sizing to maintain consistent risk management.

| Account Size | Audition Fee | Profit Target (6% Per Phase) | Max Daily Loss (4%) | Max Total Loss (8%) | Max Leverage |

|---|---|---|---|---|---|

| $5,000 | $30 | $300 | $200 | $400 | 1:100 |

| $10,000 | $67 | $600 | $400 | $800 | 1:100 |

| $25,000 | $147 | $1,500 | $1,000 | $2,000 | 1:100 |

| $50,000 | $227 | $3,000 | $2,000 | $4,000 | 1:100 |

| $100,000 | $367 | $6,000 | $4,000 | $8,000 | 1:100 |

| $200,000 | $667 | $12,000 | $8,000 | $16,000 | 1:100 |

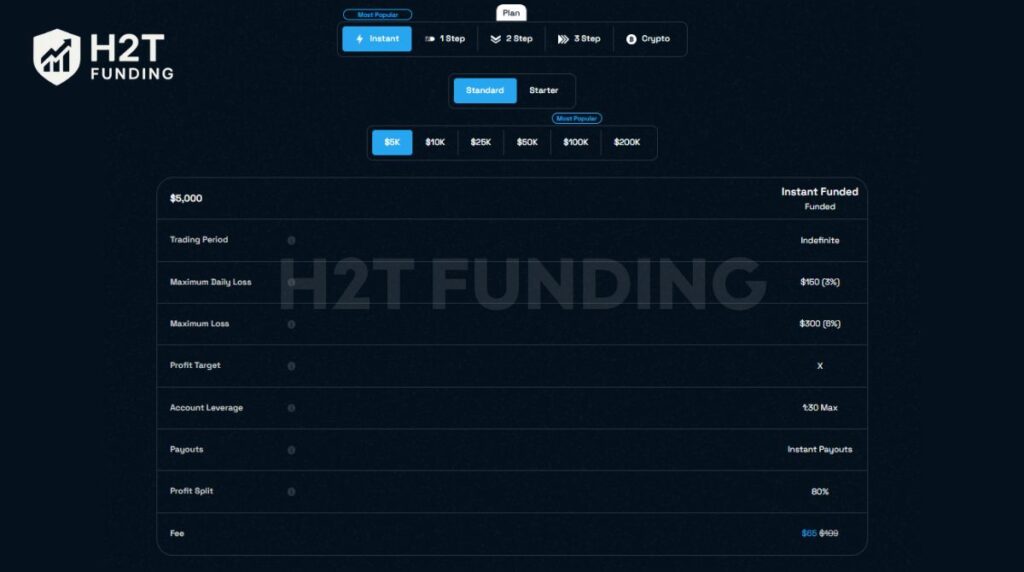

2.4. Instant funding

For traders who have already mastered their strategy and want to skip the evaluation process entirely, Blue Guardian’s instant funding model is a game-changer.

This program allows you to access live capital immediately after paying the entry fee, removing the weeks or months typically spent on challenges. It is a high-speed path to professional trading. Many Blue Guardian instant funding reviews highlight that it comes with stricter risk parameters to protect the firm’s capital.

2.4.1. Standard account

The standard instant option caters to traders seeking a high profit share without waiting weeks for a challenge resolution. It features an 80% profit split and flexible withdrawal options that suit full-time professionals.

| Account Size | Audition Fee | Daily Loss (3%) | Max Loss (6%) | Profit Split | Payout Frequency |

|---|---|---|---|---|---|

| $5,000 | $109 | $150 | $300 | 80% | Instant |

| $10,000 | $149 | $300 | $600 | 80% | Instant |

| $25,000 | $309 | $750 | $1,500 | 80% | Instant |

| $50,000 | $479 | $1,500 | $3,000 | 80% | Instant |

| $100,000 | $779 | $3,000 | $6,000 | 80% | Instant |

| $200,000 | $1,045 | $6,000 | $12,000 | 80% | Instant |

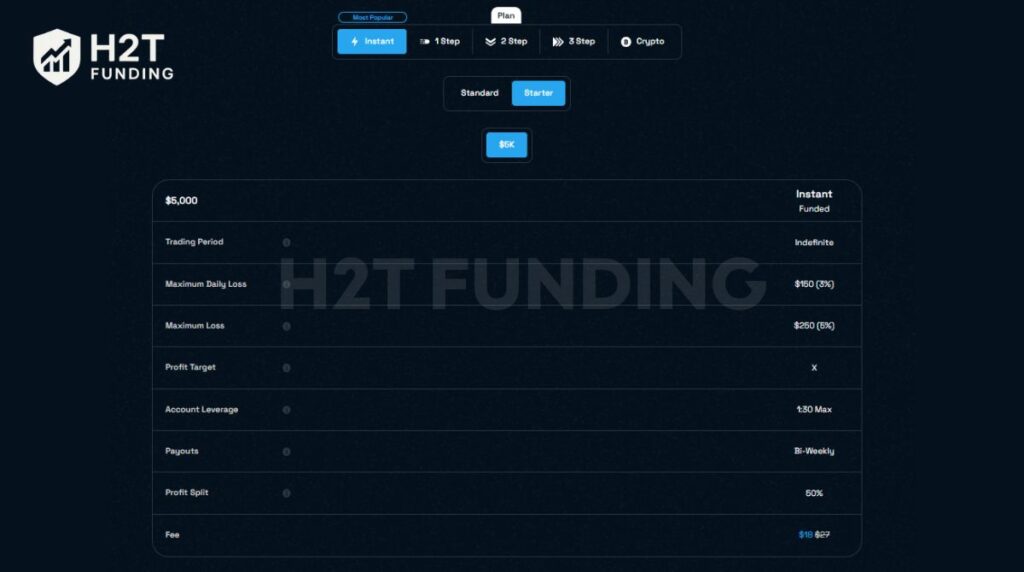

2.4.2. Starter account

The starter instant model functions as an accessible entry point into the funded space. With a fee of $27 for a $5,000 account, it allows traders to experience live market conditions with minimal financial commitment.

This account is primarily a learning tool. The 50% profit split is significantly lower than their other programs. It works well for those wanting to test their experience in a live prop firm environment before committing to larger evaluation fees.

| Account Size | Audition Fee | Daily Loss (3%) | Max Loss (5%) | Profit Split | Payout Frequency |

|---|---|---|---|---|---|

| $5,000 | $27 | $150 | $250 | 50% | Bi-Weekly |

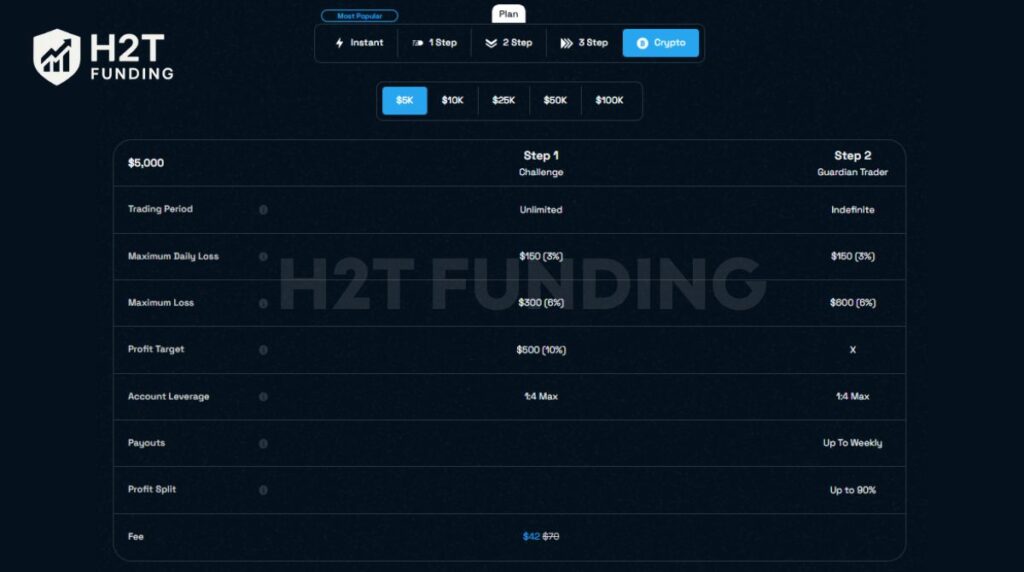

2.5. Crypto challenge

The crypto challenge is a specialized one-step evaluation tailored specifically for the digital asset market. Recognizing that cryptocurrencies behave differently from traditional Forex pairs, Blue Guardian has adjusted the account parameters to match this volatility.

Traders who specialize in Bitcoin, Ethereum, and other altcoins can utilize this program to secure funding up to $100,000. Like their other evaluation models, this challenge features an unlimited trading period, providing the flexibility to navigate crypto market cycles without time-based stress.

| Account Size | Audition Fee | Profit Target (10%) | Daily Loss (3%) | Max Loss (6%) | Leverage |

|---|---|---|---|---|---|

| $5,000 | $35 | $500 | $150 | $300 | 1:4 |

| $10,000 | $78 | $1,000 | $300 | $600 | 1:4 |

| $25,000 | $160 | $2,500 | $750 | $1,500 | 1:4 |

| $50,000 | $289 | $5,000 | $1,500 | $3,000 | 1:4 |

| $100,000 | $535 | $10,000 | $3,000 | $6,000 | 1:4 |

The 1:4 leverage is significantly lower than their Forex-focused programs. This reflects the inherent risk and high percentage moves common in crypto. While some may find this restrictive, it acts as a built-in risk management tool to prevent rapid account liquidation during flash crashes.

The 3% daily drawdown is quite tight for the crypto space. Precision in entry and a deep understanding of market volatility are required to stay within these conditions. For specialists who can maintain discipline under these rules, the potential for a 90% profit split is a strong incentive.

Verdict on Blue Guardian funding programs

Blue Guardian has built one of the most diverse product lineups in the current prop firm industry. Their range of challenges ensures that whether you are a high-volume day trader or a patient swing trader, there is likely an account type that fits your risk profile.

- 1-Step & 2-Step: Best for experienced traders who want a balance of high leverage (up to 1:100) and standard drawdown limits.

- 3-Step: Ideal for beginners or those with limited capital due to the $15 entry fee and lower 6% profit targets.

- Instant Funding: A professional-grade tool for those who have a finished strategy and require immediate capital without the evaluation delay.

- Crypto Challenge: A niche but necessary option for digital asset specialists who are comfortable with lower leverage and tight daily limits.

Our assessment shows that while the drawdown rules are firm across all programs, the lack of time limits provides a significant advantage for trader longevity. The ability to scale up to $400,000 in max capital across these programs makes Blue Guardian a viable long-term partner for serious professionals.

3. Blue Guardian rules

Blue Guardian provides a transparent ruleset, but the complexity lies in how these rules shift between its diverse account models. A rule that applies to a Classic account might be completely different for a Pro or Instant version.

Understanding these mechanics is the difference between a successful transaction and a failed challenge. Let’s break down the universal framework and the critical nuances you must watch out for across all 11 program variations.

3.1. Universal trading rules (Core policies)

Regardless of your chosen program, Blue Guardian maintains a baseline of professional trading standards. These are the non-negotiables designed to ensure market accuracy and firm stability.

- EAs and Trade Copiers: These are fully permitted for personal use. However, using them for group trading or signal services is strictly prohibited and leads to termination.

- Hold overnight & weekend trading: This is a significant advantage as Blue Guardian allows you to hold positions overnight and over the weekend on all account types. You don’t need to worry about closing trades before the market closes, optimizing the experience for swing traders.

- Minimum Holding Time: A 2-minute holding rule is in place to prevent tick scalping. Closing trades faster than this is a violation of the terms and conditions.

- News Trading: This is allowed during all evaluation phases. However, on funded accounts, you must not open or close trades 5 minutes before/after high-impact news.

- Account Inactivity: You must place at least one trade every 30 days. Failure to do so results in account termination, which is a frequent source of trader complaints regarding inactivity.

- Gambling/All-or-Nothing: High R:R trades are fine, but risking 3-4% on a single trade with a high margin and no stop loss is flagged as gambling and is prohibited.

3.2. The Guardian shield: Soft breach protection

The Guardian Shield is a signature safety feature that automatically closes trades if a loss threshold is hit. It aims to prevent hard breaches, but it carries a penalty that impacts your payout potential.

This tool is great for beginners, but expensive for professionals. For most models, a breach drops your profit split to 50%. However, the 2-Step Classic is unique; it offers three strikes. The first breach has no penalty, the second drops your split, and only the third causes a fail. This makes the Classic model one of the most forgiving in the prop firm market.

3.3. Account-specific differences

The most frequent issues traders face come from confusing the drawdown and consistency rules across different models. Here is how they compare based on the latest Blue Guardian data:

| Account Type | Minimum Days | Profit Target (P1/P2/P3) | Drawdown Type | Consistency Rule |

|---|---|---|---|---|

| Instant Standard | 5 Days | N/A | Trailing (6%) | 20% |

| Instant Starter | 5 Days | N/A | Trailing (5%) | 15% |

| 1-Step (Standard/Pro) | 3 Days | 10% | Trailing (6%) | None |

| 2-Step Standard | 5 Days | 8% / 4% | Static (8%) | None |

| 2-Step Classic | 3 Days | 8% / 5% | Static (8%) | None |

| 2-Step Pro | 4 Days | 10% / 4% | Trailing (10%) | 25% (Funded Only) |

| 3-Step | 3 Days | 6% / 6% / 6% | Static (8%) | None |

| Crypto Account | 3 Days | 10% | Trailing (6%) | None |

The 2-Step Pro offers a massive 10% drawdown, but it is trailing. Meanwhile, the Standard and Classic 2-Step models use static drawdown, which is far more beneficial for traders who hold positions through pullbacks. Always check your Blue Guardian dashboard to verify which specific logic is active for your account.

Verdict on Blue Guardian rules

The ruleset at Blue Guardian is highly versatile but requires a high degree of clarification before you start. Allowing Hedging and Martingale is a massive advantage that is rarely found in other firms, providing a superior algorithmic experience.

However, the news restriction on funded accounts and the trailing nature of the Pro/Instant models can be challenging. If you value a safety net, the 2-Step Classic is the clear winner due to its three-strike Guardian Shield.

For those seeking high capital with the least traps, we recommend the 2-Step Standard due to its static drawdown and lack of a consistency rule. Avoid the Starter account if you want more than one payout or a higher profit share.

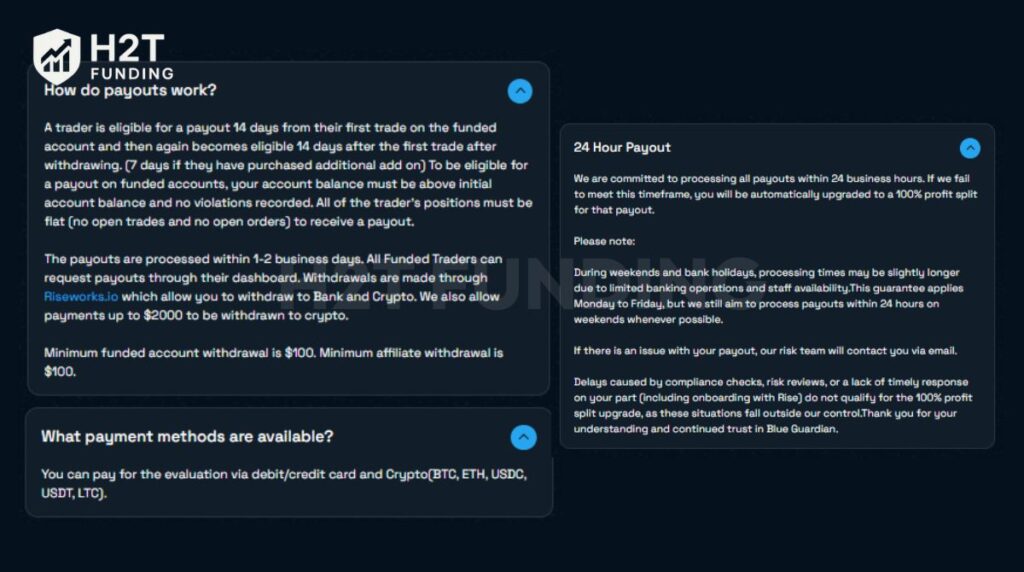

4. Blue Guardian payout structure

For most traders, receiving a payout is the ultimate validation of their strategy. Blue Guardian has positioned itself as one of the most transparent and reliable reward systems in the prop firm industry.

They have moved away from the hope they pay model to a guaranteed pay structure. This shift has significantly boosted the credibility of their operations among the global trading community.

4.1. The 24-Hour payout guarantee

The standout feature of their structure is the 24-hour payout guarantee. Blue Guardian commits to processing all requests within 24 business hours (Monday to Friday).

- The 100% split bonus: If the firm fails to meet the 24-hour window, your profit split is automatically upgraded to 100% for that specific transaction.

- Weekend policy: While they aim for 24 hours on weekends, banking holidays, and limited staff may extend the time slightly.

- Compliance note: Delays caused by your failure to complete onboarding with Riseworks or risk reviews do not trigger the 100% bonus.

This guarantee is a bold statement. It forces the firm to maintain high-efficiency support and risk teams. For a trader, knowing that a delay results in a larger profit share creates a win-win scenario that is rare in this industry.

4.2. Payout frequency and eligibility

Blue Guardian utilizes a bi-weekly cycle as their standard, but it offers flexibility for those who want their returns faster.

- Standard frequency: You are eligible for a payout every 14 days after your first trade on a funded account.

- 7-Day Add-on: Traders can purchase an add-on during checkout to reduce this wait time to just 7 days.

- Eligibility criteria: Your account balance must be above the initial starting capital, all positions must be closed (flat), and no violations can be recorded.

4.3. Methods and minimum limits

The firm uses professional-grade infrastructure to ensure that every transaction is secure and reaches the trader promptly.

- Withdrawal methods: They primarily use Riseworks.io, which supports both international bank transfers and crypto.

- Direct crypto: Payouts up to $2,000 can be withdrawn directly to crypto wallets (USDC and other stablecoins).

- Minimum withdrawal: The minimum amount to request a payout is $100 for both funded traders and affiliates.

- Profit splits: Instant Funding starts at 80%, while other evaluation programs can reach up to 90%.

Verdict on Blue Guardian payouts

The payout system at Blue Guardian is arguably its strongest selling point. The 24-hour guarantee effectively eliminates the anxiety associated with waiting weeks for returns. By using Riseworks, they provide a legitimate and tax-compliant way to receive funds globally.

However, traders must be diligent with the flat position rule. If you have a single tiny limit order open, your request will be delayed. Our advice is to triple-check your Blue Guardian dashboard before clicking the withdraw button to ensure a smooth, sub-24-hour experience. Overall, this is a top-tier system for any professional trader.

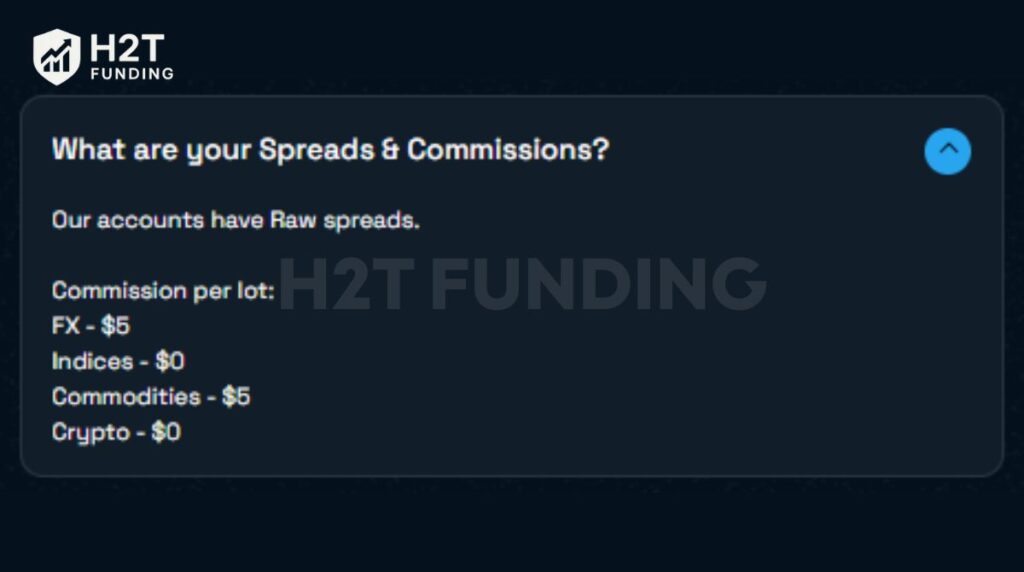

5. Spreads & commission fees

A professional Blue Guardian spreads review shows that the use of raw spreads starting at 0.0 pips means your dashboard displays prices very close to the live market. Traders pay $0 commission on Indices and Crypto, while Forex and Commodities carry a competitive fee of $5 per lot.

The use of raw spreads means your Blue Guardian dashboard displays prices very close to the live market. This tight pricing is essential for scalpers and day traders who need to minimize the cost of every transaction.

| Asset Class | Commission Per Lot |

|---|---|

| Forex (FX) | $5 |

| Commodities | $5 |

| Indices | $0 |

| Crypto | $0 |

The $0 commission on Indices and Crypto is a major advantage for those seeking higher returns. These low costs increase the credibility of your strategy by reducing the total drag on your funded account. This transparent fee structure is a key part of their professional operations.

Verdict on Blue Guardian Fees

The pricing at Blue Guardian is very favorable, especially for index and crypto traders. Raw spreads provide a sharp edge for high-frequency strategies. We find the experience here more cost-effective than firms that hide fees within wide spreads.

6. Blue Guardian trading platform

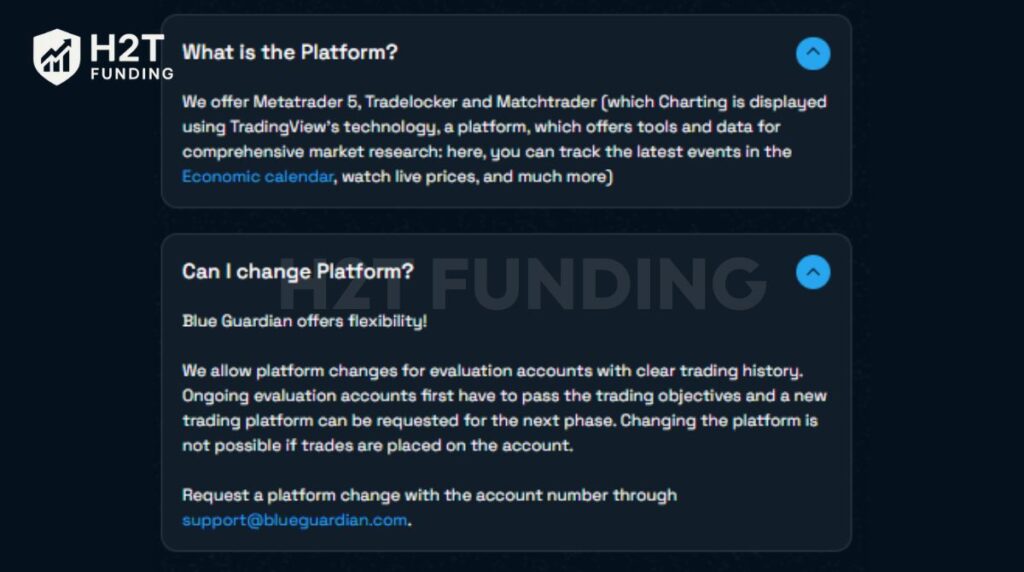

Blue Guardian offers MetaTrader 5, MatchTrader, and TradeLocker. This variety supports different trading styles and technical needs for every user.

The firm stands out by allowing you to switch platforms during your evaluation journey. However, you must submit a request to support@blueguardian.com before placing any trades on the account. If you are already in an evaluation phase, you must pass the current objectives before requesting a platform change for the next stage.

| Platform | Best For | Key Feature |

|---|---|---|

| MetaTrader 5 | EA & Algo Trading | Industry-standard stability & tools |

| MatchTrader | Modern Web Trading | TradingView integrated tech |

| TradeLocker | Mobile-First Traders | Lightweight UI & fast execution |

Each platform provides real-time market data directly to your Blue Guardian dashboard with low latency. Whether you prefer the classic MT5 interface or the modern TradingView charting tools found in MatchTrader and TradeLocker, the execution remains professional. This variety helps reduce technical issues and ensures a positive trading experience for both retail and institutional-style traders.

Verdict on Blue Guardian Platforms

Blue Guardian offers more choice than most competitors, who are currently restricted to a single platform. The integration of TradingView technology is a major win for technical analysts. We recommend choosing MT5 if you use EAs, but MatchTrader is the superior choice for those who prioritize clean, modern charting.

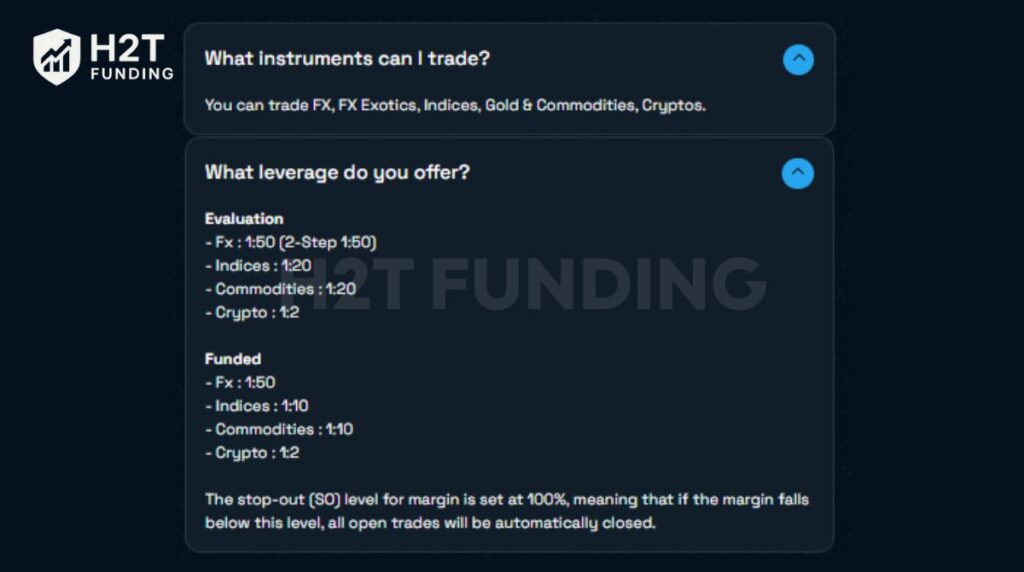

7. Trading instruments & leverage

Blue Guardian provides a diverse selection of assets, including FX, FX Exotics, Indices, Gold, Commodities, and Cryptos. This variety allows traders to diversify their strategies across multiple global markets.

Leverage levels differ between the evaluation and funded stages for specific asset classes. The firm maintains a 100% stop-out level, meaning all open positions close automatically if your margin falls below this threshold.

| Asset Class | Evaluation Leverage | Funded Leverage |

|---|---|---|

| Forex (FX) | 1:50 | 1:50 |

| Indices | 1:20 | 1:10 |

| Commodities | 1:20 | 1:10 |

| Crypto | 1:2 | 1:2 |

Traders must prepare for the leverage drop in indices and commodities when moving to a funded account. Managing this change in purchasing power is crucial for maintaining your long-term trading consistency.

The availability of FX Exotics and Cryptos provides additional opportunities for specialists seeking higher volatility. These parameters are designed to protect the firm’s capital while rewarding professional experience.

Verdict on Blue Guardian Instruments

The range of instruments is excellent, covering everything a modern trader needs to generate returns. While the lower leverage on funded indices might feel restrictive, it promotes better risk management and capital longevity.

8. Education & resource

Blue Guardian provides a variety of educational materials through their official blog and social media channels. These resources focus primarily on market psychology and the habits of successful traders.

Their video content features detailed interviews with traders who have achieved substantial payout results. These insights help others understand how to manage large accounts and maintain long-term consistency.

However, a clear weakness of Blue Guardian is that it does not provide a structured trading academy or comprehensive educational courses. They lack a step-by-step training system for beginners.

Most of their resources are geared toward psychological refinement rather than teaching technical analysis from scratch. Traders are expected to already possess the necessary experience to pass the challenges.

Verdict on Blue Guardian Education

The educational content is valuable for established traders looking to sharpen their mindset. But the lack of a structured curriculum means the firm is not a primary source for learning how to trade from zero.

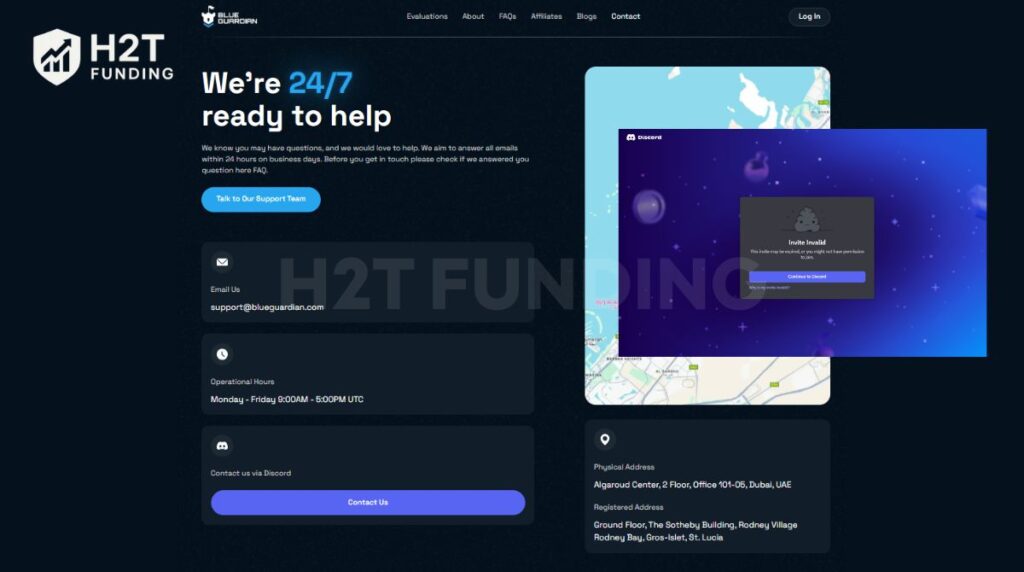

9. Blue Guardian customer support

Blue Guardian provides multiple channels for customer service, including email, Discord, and a 24/7 live chat via Intercom. This ensures that traders across different time zones can seek support whenever they encounter technical issues.

The firm maintains a physical presence with an office in Dubai and a registered address in St. Lucia. This transparency in their operations helps build credibility and trust within the global trading community.

- Email support: You can reach them at support@blueguardian.com to answer all queries within 24 hours.

- Live chat: Available 24/7 for immediate assistance with general questions.

- Operational hours: Dedicated technical teams operate Monday – Friday, 9:00 AM – 5:00 PM UTC.

However, we noticed a recurring issue with the Discord Blue Guardian invite link often appearing as invalid. This can be frustrating for new traders trying to join the community for real-time communication.

Traders should check the FAQ section on the Blue Guardian dashboard before contacting the team. Most common questions regarding drawdown or payout rules are already answered there in detail.

Verdict on Blue Guardian Support

The customer service is generally responsive, especially through the live chat feature. The physical office in Dubai adds a strong layer of credibility compared to digital-only firms. However, the broken Discord link is a minor flaw that needs better maintenance to improve the user experience.

10. Real trader feedback: Blue Guardian Trustpilot and Blue Guardian Reddit

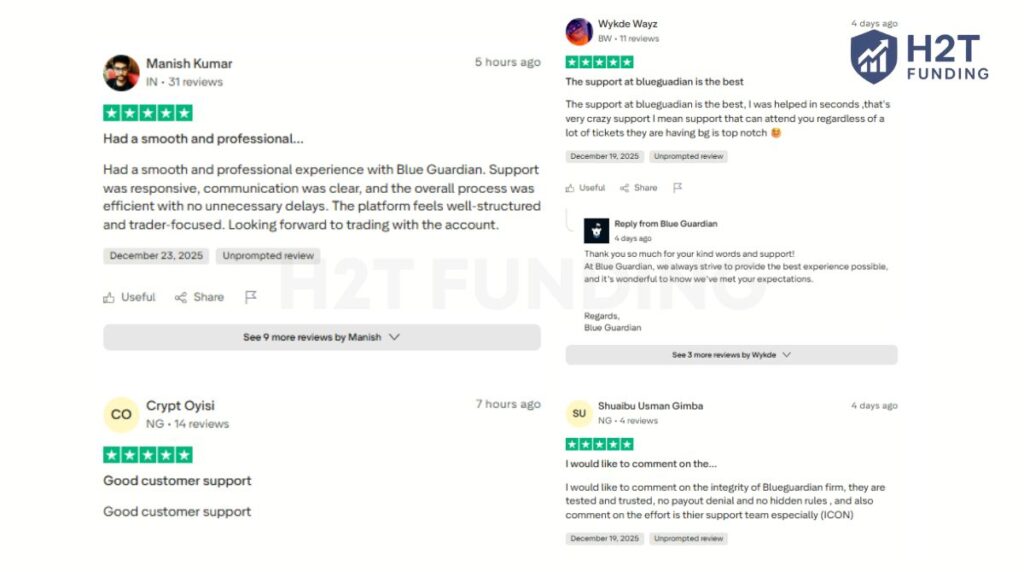

The feedback for Blue Guardian is a massive mixed bag, and you need to look past the surface to see the real experience. Currently, their Trustpilot page carries a serious warning. The platform has flagged the company for manipulating ratings by offering incentives or paying to hide negative reviews.

This is a major red flag for the firm’s credibility. A common complaint from traders involves accounts being closed and payouts withheld without verifiable proof of wrongdoing. Once an account is terminated, login access is often revoked immediately. This makes it impossible for the trader to defend their case or review their data.

On the flip side, many users still praise the customer service. Traders describe the support as top-notch and responsive. It seems that when things are running smoothly, the communication is clear and the process is efficient. The Dubai office adds a layer of physical legitimacy that many digital-only firms lack.

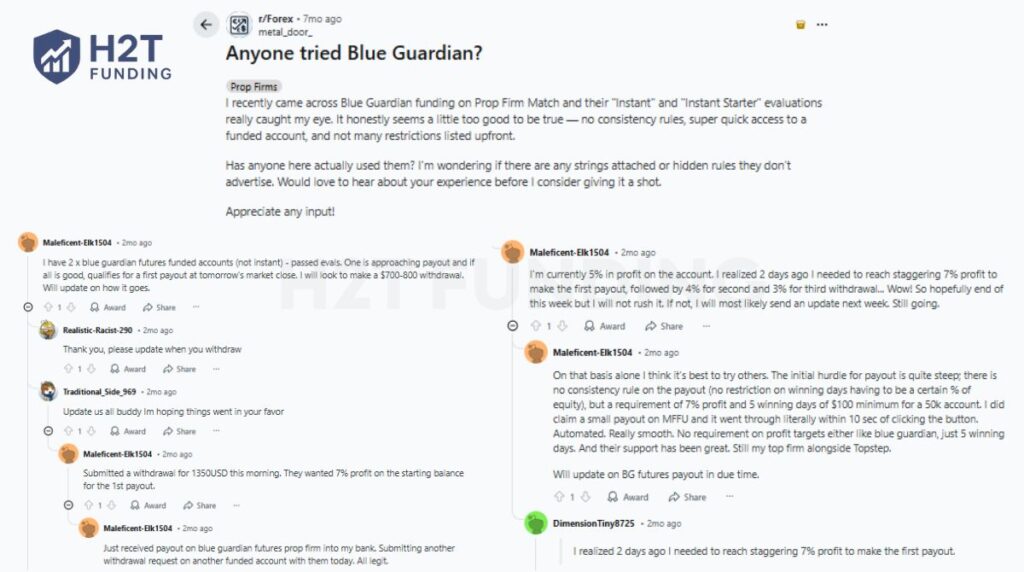

Reddit provides a more skeptical reality check for anyone considering this prop firm. A common Blue Guardian review Reddit sentiment is that the no consistency rule and instant access seem too good to be true. While some have successfully received Blue Guardian futures payouts into their bank accounts, they warn about steep hurdles.

One of the biggest hidden frustrations is the first payout requirement. Some traders on Reddit realized they needed to reach a 7% profit on their starting balance before they could even request a withdrawal. This initial barrier is much higher than that of many competitors, often forcing traders to take more risk just to get their first check.

The feedback is genuinely polarized. You have excellent support and verified payouts, but these are shadowed by Trustpilot’s warnings about fake reviews. The interviews for profitable traders and the steep 7% first payout hurdle are signs that the firm is very aggressive in protecting its capital. If you choose Blue Guardian, keep your trading squeaky clean to avoid these issues.

11. How to start with Blue Guardian

Starting your journey with Blue Guardian is a streamlined process designed for quick market access. By following a few simple steps, you can set up your professional profile and begin your chosen challenge in minutes.

The onboarding involves four main stages to ensure your account is secure and ready for live operations:

- Step 1: Create your official profile.

- Step 2: Verify your identity via email.

- Step 3: Select your funding program and platform.

- Step 4: Complete the transaction and start trading.

Follow our detailed step-by-step guide below to ensure you set up your account correctly for long-term success.

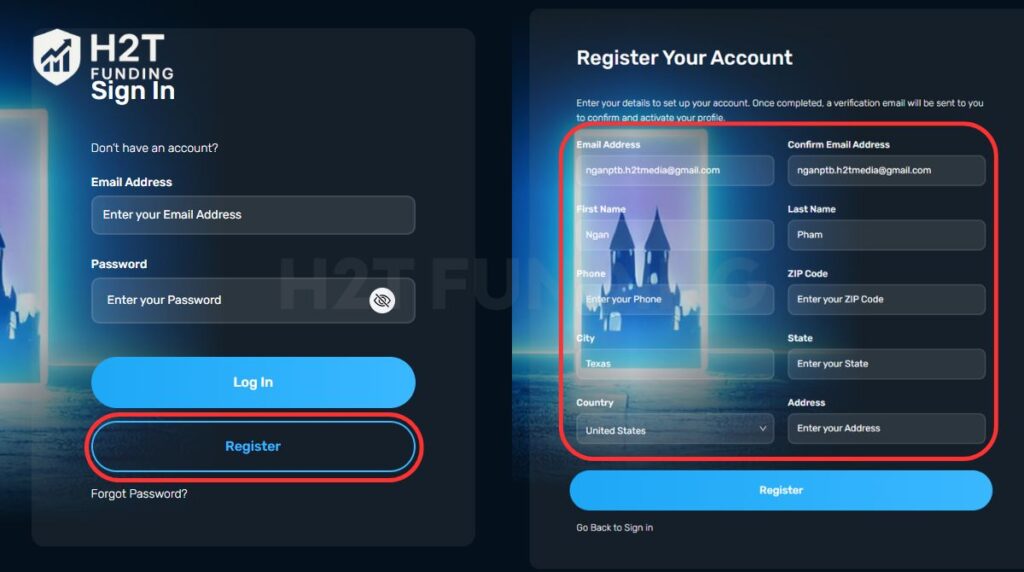

11.1. Step 1: Account registration

Begin by navigating to the official website. Click the Log In button in the top right corner, which will take you to the sign-in portal. If you are a new user, select Register to open the registration form.

You will need to enter your full name, phone number, and physical address. Providing accurate information is vital for the credibility of your profile and future payout approvals.

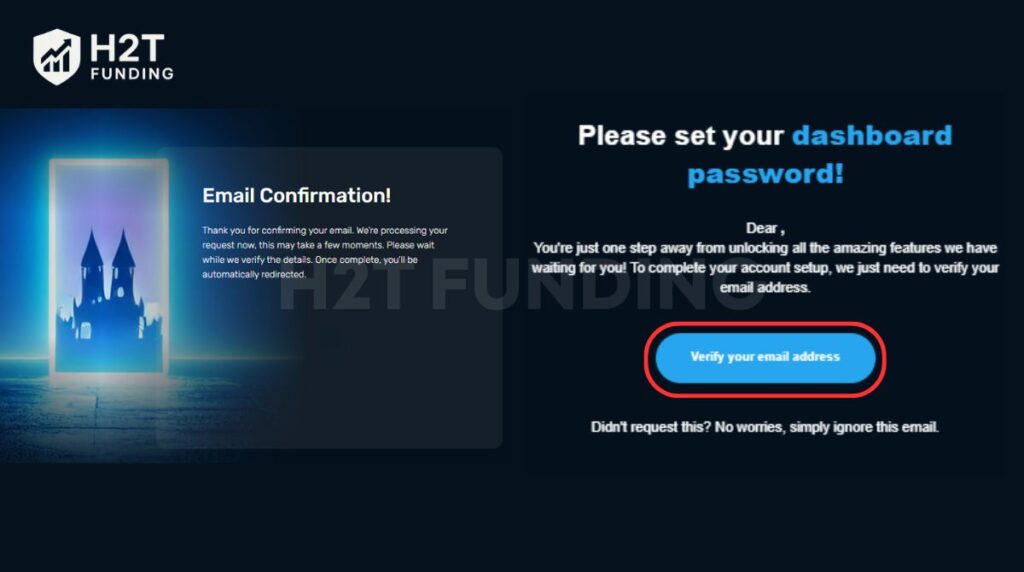

11.2. Step 2: Email verification

After submitting your registration, the system will send a verification link to your inbox. This step is a mandatory security measure to protect your Blue Guardian dashboard data.

Click the Verify your email address button in the message. Once confirmed, you will be automatically redirected to the client area to finalize your setup.

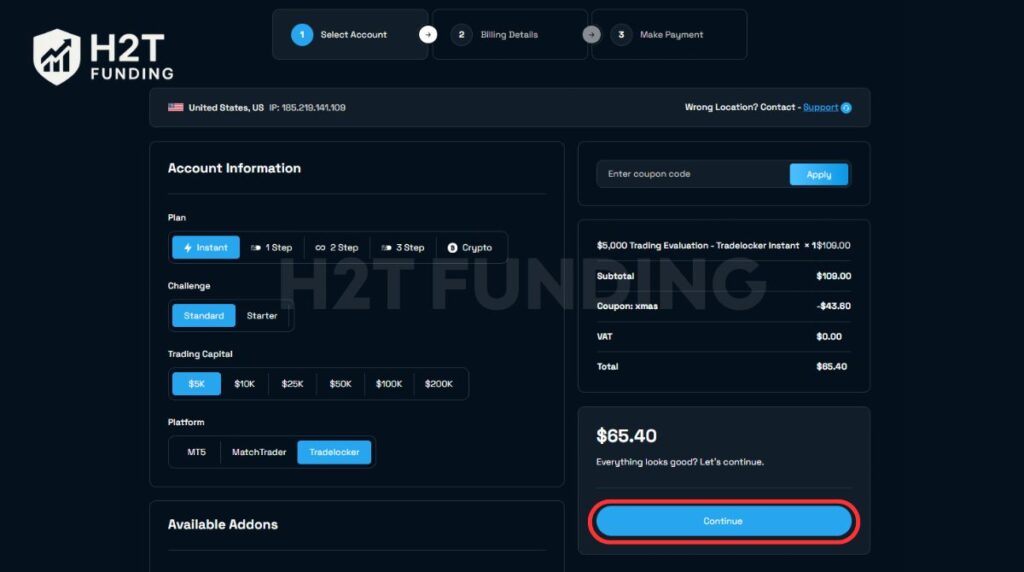

11.3. Step 3: Selecting your challenge

Once inside the client area, click on Purchase Challenge. You can now choose from the 11 different account types we analyzed earlier, such as the 2-Step Standard or Instant Funding options.

At this stage, you must also select your trading capital size and your preferred platform (MT5, MatchTrader, or TradeLocker). Choosing the right setup here is crucial for your overall experience.

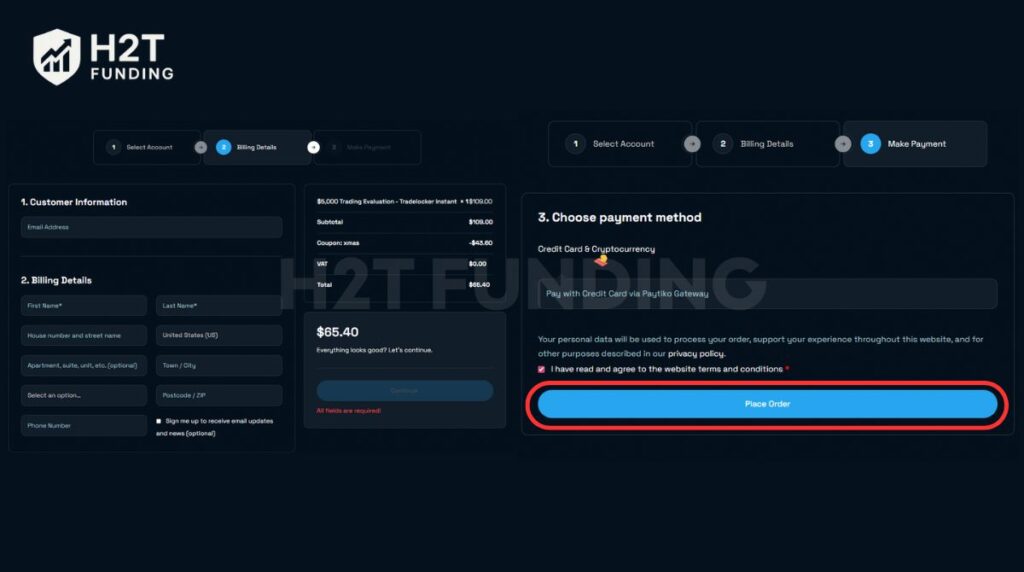

11.4. Step 4: Billing and payment

The final step is to enter your billing details and choose a payment method. Blue Guardian is flexible, allowing for payments via Credit Card or Cryptocurrency through secure gateways like Paytiko.

If you have a coupon code, be sure to apply it now to reduce your audition fee. Once you click Place Order, your credentials will be generated immediately.

Always double-check your billing information before paying. Errors in your address or name can cause delays during the payout phase when the compliance team reviews your documents. For a smooth start, we recommend using a stable credit card to ensure instant account activation.

12. Restricted countries by Blue Guardian

Blue Guardian maintains high standards of compliance with international financial laws and local regulations. Consequently, they do not offer funding services in every region. Traders must verify their residency before paying any fees, as opening an account from a prohibited area is a direct violation of their terms of service.

The following countries are currently restricted from using Blue Guardian’s operations:

- Afghanistan

- Albania

- Algeria

- Brazil

- Bulgaria

- Cuba

- Iran

- Japan, Jordan

- Kenya

- Libya

- Maldives, Myanmar

- North Korea

- Pakistan, Philippines

- Senegal

- Singapore

- Syria

- Vietnam

If your country is on this list, your credibility will be questioned during the KYC process, and you will be unable to receive a payout. We suggest reaching out to customer service for support or clarification if you believe your region’s status has changed recently. Avoiding these conditions through a VPN is strictly prohibited and will result in the immediate termination of your trading profile.

13. Compare Blue Guardian vs other prop firms

Choosing the right prop firm depends on your specific trading style and risk tolerance. While Blue Guardian offers excellent flexibility, it is important to see how it stacks up against other industry leaders like FundedNext, Alpha Capital Group, and FXRK.

The following table compares the core features of these firms to help you make an informed decision for your professional experience.

| Criteria | Blue Guardian | FundedNext | Alpha Capital Group | FXRK |

|---|---|---|---|---|

| Min Fee | $27 | $32 | $40 | $49 |

| Account Size | $5K – $200K | $2K – $200K | $5K – $200K | $5K – $200K |

| Profit Split | 80% – 95% | 80% – 95% | 80% | 80% – 90% |

| Platforms | MT5, MatchTrader, TradeLocker | MT4, MT5, cTrader, MatchTrader | MT5, cTrader, TradeLocker | MT5 |

| Asset Types | FX, Indices, Commodities, Crypto, Futures | FX, Indices, Commodities, Crypto, Futures | FX, Indices, Commodities, Metals | FX, Stocks, Bonds, Futures |

Each of these firms offers unique advantages depending on the challenges you prefer to take on. Choosing the right partner is the first step toward a successful payout journey.

- Blue Guardian: Best for traders seeking the most affordable entry point ($27) and specialized risk tools like the Guardian Shield.

- FundedNext: Ideal for those who want a 95% profit split and access to a wider variety of platforms, including MT4 and cTrader.

- Alpha Capital Group: A solid choice for UK-based traders who prefer a structured environment with high credibility in the British market.

- FXRK: Suited for aggressive traders looking for exotic assets like bonds and stocks, though you must be aware of their recent regulatory warnings.

Blue Guardian remains a top contender for those prioritizing instant funding and flexible strategy rules. However, if you need MT4 or want to trade futures and bonds, FundedNext or FXRK might offer a more complete asset list for your long-term strategy.

14. Should I choose Blue Guardian?

Deciding whether to partner with this firm depends on your specific trading goals and risk tolerance. To accurately review Blue Guardian, we must look at how they prioritize rapid returns and a guaranteed payout schedule for their partners.

You should choose Blue Guardian if you prioritize rapid returns and a guaranteed payout schedule. Their 24-hour processing guarantee is one of the best in the industry, and the $400,000 scaling limit provides enough capital for a professional career.

This firm is also ideal for algorithmic traders. Because they allow Hedging and Martingale, you have more freedom to run diverse strategies that other firms often ban. The Guardian Shield also offers an extra layer of protection for your funded account.

However, you should be cautious if you are sensitive to credibility issues. The recent Trustpilot warning regarding manipulated reviews is a concern that cannot be ignored. If you prefer a firm with a 100% clean public record, you might feel more comfortable elsewhere.

Additionally, the trailing drawdown on many of their models can be a significant hurdle. If your strategy involves frequent pullbacks, you may find the Classic or Standard 2-Step models with static drawdown more suitable for your professional experience.

15. FAQs

Blue Guardian is a legitimate prop firm with a physical presence in Dubai and a track record of paying over $17 million to traders. While Trustpilot has flagged them for review manipulation, many traders successfully receive their payout rewards regularly.

No, Blue Guardian is not a broker. They are a proprietary trading firm that provides capital for trading. They use external liquidity providers to simulate live market conditions on their supported trading platforms.

The company is legally registered in Saint Lucia. However, their primary physical operations and executive offices are located in the Almarood Center in Dubai, UAE.

Traders choose a 1, 2, or 3-step challenge. You must reach a specific profit target (e.g., 8-10%) without hitting the daily or maximum drawdown limits. Once you pass, you receive a funded account.

Traders can access a wide range of instruments, including Forex pairs, FX exotics, stock indices, gold, commodities, and various cryptocurrencies. This allows for a highly diversified professional experience.

Blue Guardian offers MetaTrader 5, MatchTrader, and TradeLocker. Both MatchTrader and TradeLocker feature TradingView technology, which provides superior charting tools and real-time market data.

The maximum leverage is 1:100 during the evaluation phase for Forex. On funded accounts, leverage is typically set at 1:50 for Forex and lower for indices and crypto to ensure better risk management.

You can start with an account as small as $5,000. Through their scaling plan, you can merge multiple funded accounts to reach a maximum aggregated capital limit of $400,000.

You can request a payout through your Blue Guardian dashboard every 14 days (or 7 days with an add-on). Withdrawals are processed via Riseworks.io, which supports both international bank transfers and crypto.

Audition fees are generally non-refundable once you begin trading. However, for evaluation models, the initial fee is usually refunded to you along with your first successful profit transaction.

If you violate a drawdown or consistency rule, the account is terminated immediately. You will lose access to the account and must purchase a new challenge if you wish to try again.

No, Blue Guardian does not have time limits. You can take as much time as you need to reach the profit targets, which reduces the pressure to over-leverage your account.

Yes, they offer an instant funding program. This allows you to skip the evaluation phases and start trading live capital immediately, though it comes with higher fees and stricter risk terms.

16. Conclusion

This Blue Guardian review highlights a firm that offers great speed and capital flexibility. With a guaranteed 24-hour payout system and capital scaling up to $400,000, it provides a strong foundation for professional traders. Their support for Hedging and Martingale sets them apart from more restrictive competitors.

However, success depends on your ability to navigate the trailing drawdown and specific funded account rules. While recent Trustpilot warnings are a concern, their physical Dubai office and transparent operations maintain their status as a major player. Professional discipline is essential to secure consistent returns here.

Choosing the right funding partner is the most important step in your career. We invite you to explore our other detailed prop firm reviews to find the perfect fit for your strategy. At H2T Funding, we provide the accuracy and insights you need to grow your capital safely.