10% OFF Sale

All Accounts (Standard & Advanced) and ZERO activation fees on Advanced Accounts

Alpha Futures is a legitimate London-based proprietary trading firm backed by Alpha Capital Group. They offer a one-step evaluation with up to $450K in simulated funding and a generous 90% profit split.

Unlike many prop firms that restrict traders with strict intraday trailing drawdowns, Alpha Futures focuses on long-term partnerships by removing common industry pitfalls. This trader-friendly structure allows skilled analysts to prove consistency and potentially earn professional exposure, including the opportunity to trade on a physical trading floor.

In this in-depth Alpha Futures review, H2T Funding breaks down everything you need to know, from their unique Max Loss Limit rules to the pros and cons of each plan. Is Alpha Futures a genuine career opportunity, or are there risks you should consider before joining? Let’s find out.

1. What is Alpha Futures?

Alpha Futures is a proprietary trading firm headquartered in London, operating under the established Alpha Capital Group. They provide a streamlined pathway for retail traders to access significant trading capital.

While many competitors enforce tedious multi-phase challenges, Alpha Futures utilizes a direct one-step evaluation. This structure allows you to prove your skills efficiently in a simulated environment.

Successful candidates become Qualified Analysts, managing virtual accounts with allocations up to $450K. Instead of trading live funds directly, you earn performance fees based on your hypothetical performance.

The firm distinguishes itself with a trader-friendly drawdown rule. On specific accounts, the maximum loss limit is calculated based on your EOD balance rather than high-water marks. This offers greater flexibility for trading futures contracts like E-mini S&P 500, Gold, and Crypto.

2. Our take on Alpha Futures

Alpha Futures is a fresh face, launched in July 2024, but it carries the established weight of Alpha Capital Group. They operate from a physical office in London, offering a level of legitimacy rarely seen in new firms.

Our experts value the “Static Max Loss Limit” highly. Unlike firms that trail your drawdown indefinitely, Alpha allows you to build a permanent safety cushion once you profit.

The End-of-Day (EOD) drawdown on Standard accounts is a massive advantage. It prevents intraday volatility from unfairly breaching your account, a common trap in the futures industry.

However, this firm is not for gamblers. The strict consistency rules demand a repeatable strategy, preventing you from passing with a single lucky “all-in” trade.

Overall, Alpha Futures focuses on longevity and career progression. If you are disciplined and seek a path to a monthly salary, this is a top-tier choice despite being a newcomer.

3. Alpha Futures programs

Alpha Futures offers three distinct pathways to suit different trading styles and budgets: Zero, Standard, and Advanced. Here is a comparison of the Alpha Futures pricing and features for each account:

| Feature | Zero Plan | Standard Plan | Advanced Plan |

|---|---|---|---|

| Monthly price | $99 – $199 | $79 – $239 | $139 – $419 |

| Activation fee | None | $149 | $149 |

| Profit target | 6% | 6% | 8% |

| Max drawdown | 4% | 4% | 3.5% |

| Scaling plan | Yes (to 3-6 contracts) | Yes (to 5-15 contracts) | No (Full 5-15 contracts) |

| Consistency rule | 40% (Qualified) | 40% (Qualified) | None |

Scroll down to analyze the specific pros and cons of each plan.

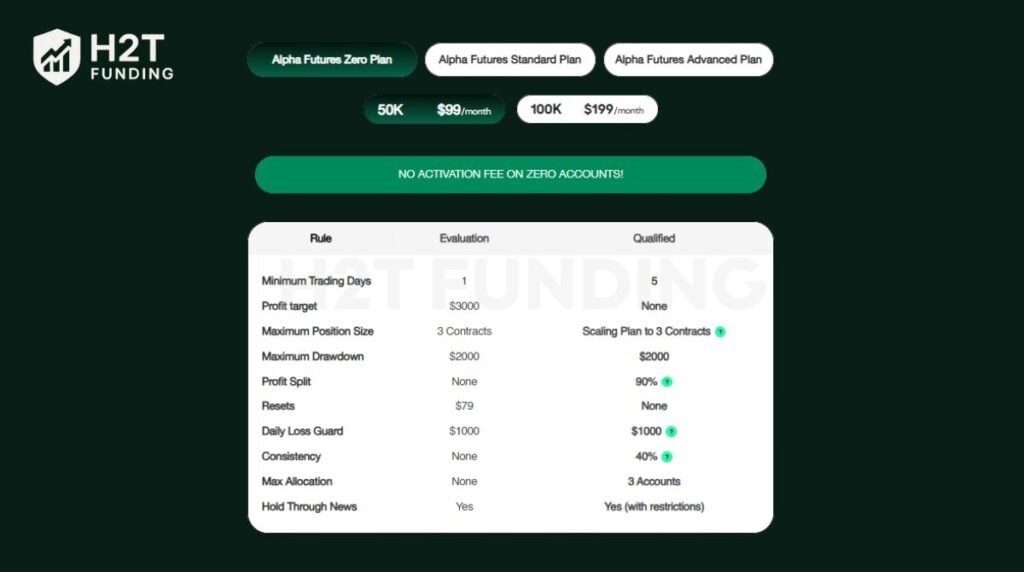

3.1. Alpha Futures Zero plan

The Alpha Futures Zero Plan operates on a monthly subscription model. It minimizes upfront costs by completely waiving the activation fee upon qualification. Traders can choose between two account sizes based on their capital needs.

| Feature | 50K Account | 100K Account |

|---|---|---|

| Monthly price | $99/month | $199/month |

| Profit target | $3,000 | $6,000 |

| Maximum drawdown | $2,000 | $4,000 |

| Daily loss guard | $1,000 | $2,000 |

| Max position (Scaling) | 3 Contracts | 6 Contracts |

| Min trading days | 1 Day | 1 Day |

Financially, this plan is superior for traders who are confident in their execution speed. Since the minimum trading requirement is only one day, you can pass immediately. This allows you to avoid recurring monthly fees and the standard activation costs.

However, traders must accept specific operational limits to enjoy these savings. The scaling plan restricts your maximum contract size even after you qualify. For instance, the 50K account initially limits you to just 3 contracts.

Furthermore, the qualified stage enforces a 40% consistency rule. You cannot rely on one lucky trade to withdraw profits. This requires a disciplined approach rather than aggressive, high-leverage gambling.

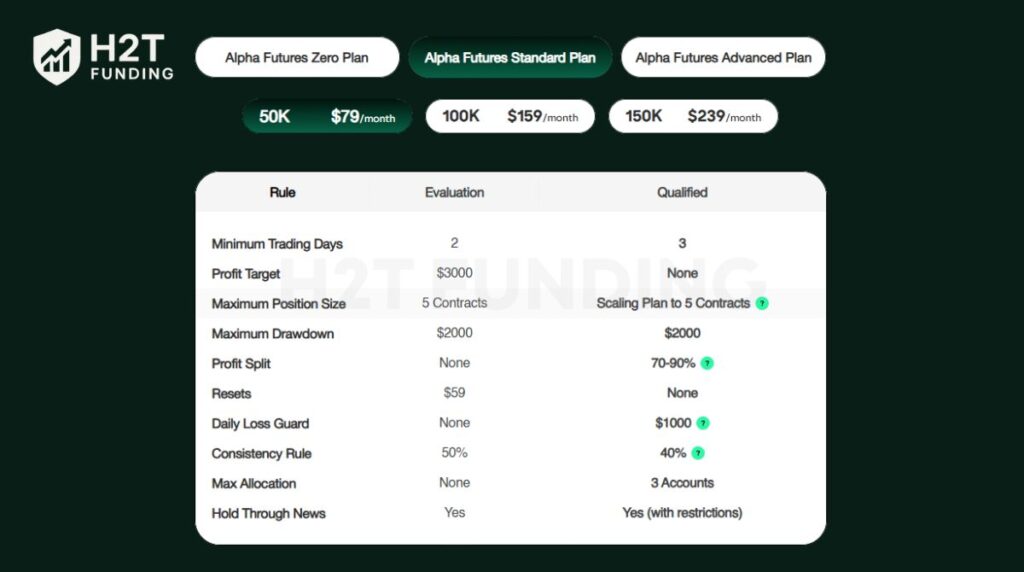

3.2. Alpha Futures Standard plan

The Standard Plan is the firm’s core offering, designed for traders who prefer a traditional evaluation structure. It balances competitive monthly fees with a robust set of rules aimed at building long-term discipline. Unlike the Zero plan, successful candidates must pay a one-time activation fee of $149 upon qualification.

| Feature | 50K Account | 100K Account | 150K Account |

|---|---|---|---|

| Monthly price | $79/month | $159/month | $239/month |

| Profit target | $3,000 | $6,000 | $9,000 |

| Max drawdown | $2,000 | $4,000 | $6,000 |

| Max position | 5 Contracts | 10 Contracts | 15 Contracts |

| Daily loss guard | $1,000 (Qualified) | $2,000 (Qualified) | $3,000 (Qualified) |

| Min trading days | 2 days | 2 days | 2 days |

From a risk management perspective, the Standard Plan is often safer for swing traders. The key advantage is the Maximum Drawdown, which typically trails the EOD balance rather than high-water marks. This prevents a winning trade that pulls back from accidentally breaching your account limits during the day.

However, growth on this plan is controlled by a strict Scaling Plan. You are not permitted to trade the maximum position size immediately after funding. You must build your profit buffer to unlock more contracts (e.g., scaling up to 10 contracts on the 100K account).

Additionally, traders must adhere to a 50% consistency rule during the evaluation. This ensures that your success is not the result of a single lucky trade. While this requires more patience, it aligns well with the firm’s goal of finding consistent partners.

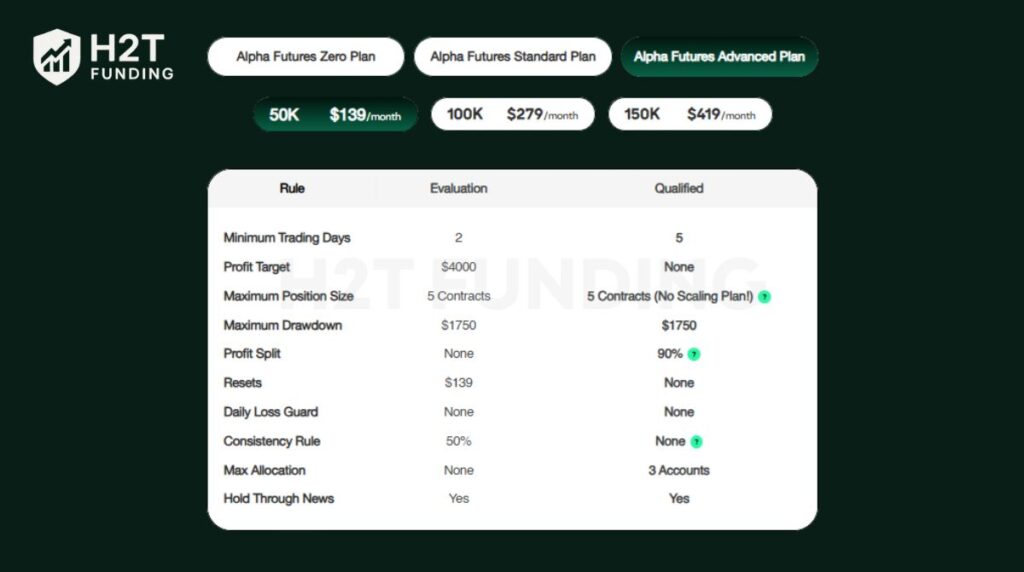

3.3. Alpha Futures Advanced plan

The Alpha Futures Advanced Plan targets experienced professionals seeking maximum freedom. It removes the “training wheels” found in the Standard option, allowing traders to utilize full leverage immediately. Like the Standard plan, a $149 activation fee applies once you qualify.

| Feature | 50K Account | 100K Account | 150K Account |

|---|---|---|---|

| Monthly price | $139/month | $279/month | $419/month |

| Profit target | $4,000 | $8,000 | $12,000 |

| Max drawdown | $1,750 | $3,500 | $5,250 |

| Max position | 5 Contracts | 10 Contracts | 15 Contracts |

| Scaling plan | NO | NO | NO |

| Consistency (Qualified) | None | None | None |

| Min trading days | 2 days | 2 days | 2 days |

The most significant benefit here is the complete removal of the scaling plan. Qualified analysts can trade the full contract size from day one. For example, the 100K account grants access to 10 contracts immediately, rather than forcing you to earn your way up.

Another major advantage is the absence of a consistency rule in the funded stage. You are not penalized for having a “windfall” day where you make the bulk of your profits. This flexibility is perfect for news traders or those capitalizing on high-volatility events.

These benefits come with higher performance expectations and costs. The profit targets are approximately 33% higher than the Standard plan options. Furthermore, the maximum drawdown limits are tighter (e.g., $3,500 on the 100K account), requiring precise risk management to avoid breaching the account.

Verdict on Alpha Futures programs

For most traders, the Standard Plan is the clear winner. Its EOD Drawdown is a massive advantage in volatile futures markets, preventing premature stop-outs during intraday swings, unlike the tighter trailing stops at competitors.

The Zero Plan is tempting due to its low entry cost, but be cautious. If you fail to pass quickly, the monthly recurring fees will eventually exceed the one-time fee of a standard account.

Only choose the Advanced Plan if your strategy relies on massive single-day wins (like news trading). The no consistency rule is powerful, but the tighter drawdown leaves zero room for error.

4. Alpha Futures rules

Success at Alpha Futures relies on a clear understanding of its risk framework. The firm implements specific guidelines to maintain the integrity of its simulated market and ensure traders operate with professional discipline.

4.1. General guidelines & allowed practices

The firm generally encourages strategies that can be scaled to a professional level.

- Maximum loss limit (MLL): This is the most critical rule. It trails your EOD balance (End of Day), not your intraday equity. For example, on a $50k account, the MLL is $48,000. If you profit $500, your MLL moves up to $48,500. Crucially, once the MLL reaches your starting balance, it stops trailing, allowing you to build a true safety buffer.

- Daily loss guard: A “soft breach” rule designed to protect you from tilting. If you hit this limit (e.g., $1,000 on a 50K Qualified account), your account is simply locked until the next trading day (6 PM ET) rather than being terminated. Note: Evaluation accounts on Standard/Advanced plans do not have this rule.

- News trading: You are allowed to trade during news events during the Evaluation. However, for Standard and Zero Qualified accounts, you cannot execute new orders 2 minutes before or after high-impact news (red folder on ForexFactory).

- Copy trading: Permitted, provided you are the sole individual executing trades across your own accounts.

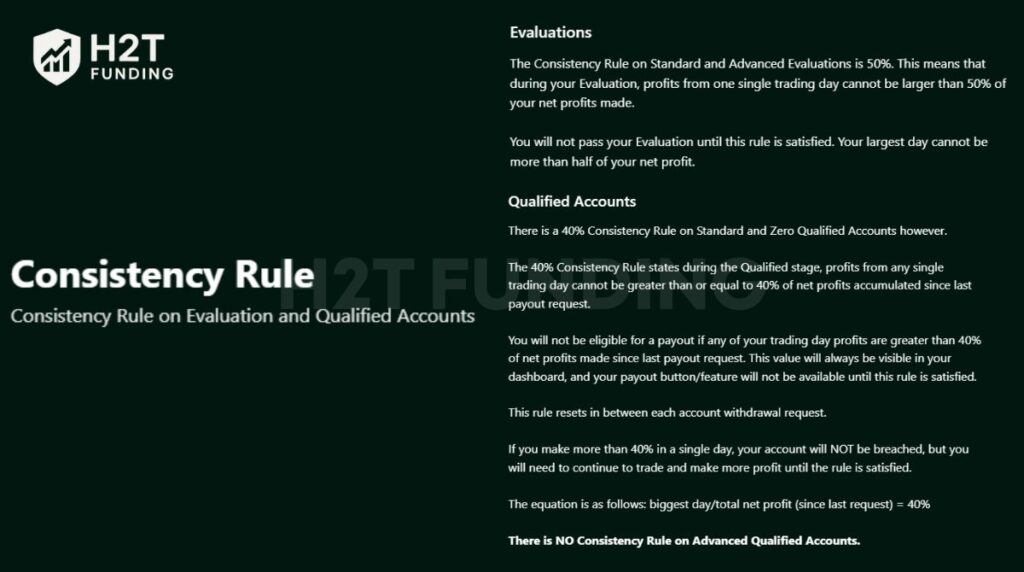

- Consistency rule:

- Evaluations: Standard/Advanced plans have a 50% consistency rule (one day cannot exceed 50% of total profit).

- Qualified: Standard/Zero plans have a 40% consistency rule (one day cannot exceed 40% of net profit since the last payout).

4.2. Prohibited trading practices

To maintain a fair simulated environment, Alpha Futures strictly forbids strategies that exploit the system rather than the market.

- Automation: fully automated bots, AI, and HFT (High-Frequency Trading) with 100+ trades/day are banned. Semi-automation (manual entry with automated management) is allowed.

- Price limit trading: You cannot trade when a product is within 2% of the CME price limit. This protects you from getting trapped in halted markets.

- Tick scalping: Opening and closing trades in under 2 minutes with no clear plan or taking max leverage for a few ticks is prohibited.

- Reverse trading: Hedging between accounts (long on one, short on another) is strictly forbidden.

- Group trading: Collaborating with others to take opposite sides of a trade is not allowed.

Verdict on Alpha Futures rules

In my professional view, the EOD Drawdown calculation is the defining feature that makes this evaluation approachable. It provides swing traders the necessary room to endure intraday volatility without an immediate breach, a flexibility often missing in the industry.

However, the primary challenge lies in the consistency rule. The 50% limit during evaluation and 40% during the qualified stage demands a genuine strategy. You cannot rely on a single “gambler’s luck” day to pass or secure a payout.

Ultimately, the static MLL is a massive advantage. Once you build your profit buffer past the starting balance, the drawdown stops trailing. This effectively creates a risk-free zone for your initial capital, allowing for sustainable long-term trading.

5. Alpha Futures payout rules

The Alpha Futures payout policy is designed to be transparent: follow the trading rules (especially News and Prohibited Practices), and you will be paid. There are no hidden “hoops” to jump through.

All payout requests are processed swiftly, typically within 48 business hours. However, the specific schedules and split percentages vary depending on the plan you choose.

5.1. Standard accounts payout policy

Standard accounts operate under a structured, tiered payout system designed to reward long-term consistency.

- Payout schedule: Traders may request a payout every 14 days, starting from the date the first trade is placed on the Qualified Account.

- Profit split (Tiered):

- Payouts 1 & 2: 70% profit share to the trader

- Payouts 3 & 4: 80% profit share to the trader

- Payouts 5 and above: 90% profit share to the trader

- Payout limits:

- Minimum payout request: $200

- Maximum payout per request: $15,000

- Condition: The trader must meet the 40% consistency rule at the time of submitting the payout request.

5.2. Advanced accounts payout policy

Advanced accounts offer greater flexibility and a higher immediate profit split, but they come with strict “winning day” requirements.

- Payout schedule: There are no fixed payout dates. Traders may request a payout after accumulating 5 winning trading days, defined as a trading day with $200 or more in profit. These winning days do not need to be consecutive.

- Profit split: A flat 90% profit share applies from the very first payout.

- Withdrawal buffer:

- Traders may initially withdraw 50% of their profits.

- After accumulating 30 winning trading days, traders unlock the ability to withdraw 100% of profits.

- Payout limits:

- Minimum payout request: $1,000

- Maximum payout per request: $15,000

5.3. Zero accounts payout policy

The Zero plan blends flexibility with tighter withdrawal caps suitable for smaller accounts.

- Schedule: Similar to Advanced, you can request after 5 winning trading days ($200+ profit).

- Profit split: A flat 90% immediately.

- Limits:

- 50K Account: Max $1,500 per request.

- 100K Account: Max $3,000 per request.

- Condition: Unlike Advanced, the 40% consistency rule applies here.

5.4. Supported payout methods

Alpha Futures offers a variety of payment options to ensure convenience for global traders. All payments are issued in USD.

- Bank/Wire: ACH (US), Wire Transfer, SWIFT.

- Digital/Crypto Friendly: Wise, Rise (requires signing an agreement).

Verdict on Alpha Futures payouts (important note)

While the $15,000 withdrawal cap on Standard/Advanced accounts is significantly higher than the industry average, traders must be careful with Account Liquidation.

Withdrawals are deducted directly from your account balance. If you withdraw 100% of your profits, your account balance drops back to the starting level. Since the Maximum Loss Limit (MLL) stops trailing at the starting balance, withdrawing everything effectively hits your MLL and closes the account.

Pro tip: Always leave a buffer in your account to keep it active and tradeable after a payout.

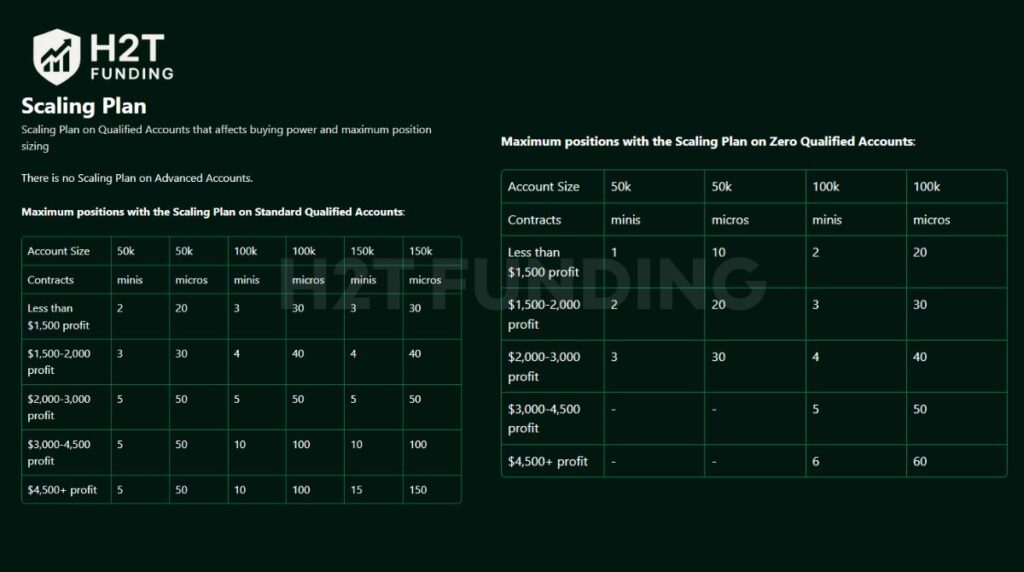

6. Alpha Futures scaling plan

The scaling plan is a mandatory risk management protocol for Standard and Zero Qualified Accounts. Alpha Futures operates on the philosophy that traders must “earn their large positions.”

Instead of granting maximum leverage immediately, the firm restricts your position size until you build a profit cushion. This ensures you do not over-leverage a fresh account and hit the drawdown limit on day one.

Important note: There is NO Scaling Plan for Advanced Accounts. Traders on the Advanced plan have access to maximum lots immediately.

6.1. Standard qualified accounts scaling

Standard accounts start with reasonable leverage (e.g., 2 minis on a 50k account) and scale up in tiers.

| Accumulated profit | 50K Max Contracts | 100K Max Contracts | 150K Max Contracts |

|---|---|---|---|

| Less than $1,500 | 2 Minis / 20 Micros | 3 Minis / 30 Micros | 3 Minis / 30 Micros |

| $1,500 – $2,000 | 3 Minis / 30 Micros | 4 Minis / 40 Micros | 4 Minis / 40 Micros |

| $2,000 – $3,000 | 5 Minis / 50 Micros | 5 Minis / 50 Micros | 5 Minis / 50 Micros |

| $3,000 – $4,500 | 5 Minis / 50 Micros | 10 Minis / 100 Micros | 10 Minis / 100 Micros |

| $4,500+ | 5 Minis / 50 Micros | 10 Minis / 100 Micros | 15 Minis / 150 Micros |

6.2. Zero qualified accounts scaling

The Zero plan has a tighter starting restriction to offset the lower entry cost and lack of activation fees.

| Accumulated profit | 50K Max Contracts | 100K Max Contracts |

|---|---|---|

| Less than $1,500 | 1 Mini / 10 Micros | 2 Minis / 20 Micros |

| $1,500 – $2,000 | 2 Minis / 20 Micros | 3 Minis / 30 Micros |

| $2,000 – $3,000 | 3 Minis / 30 Micros | 4 Minis / 40 Micros |

| $3,000 – $4,500 | Full Allocation (3) | 5 Minis / 50 Micros |

| $4,500+ | Full Allocation (3) | 6 Minis / 60 Micros |

Verdict on the scaling plan

This scaling structure is a “double-edged sword.” For disciplined traders, it acts as a necessary safety belt. By forcing you to trade small initially (e.g., 2 minis), it prevents a single bad trade from wiping out your fresh account. It forces you to build a buffer before swinging heavy.

On the other hand, aggressive scalpers may find the Zero Plan starting limit (1 mini) too restrictive. If your strategy requires scaling into positions with multiple lots immediately, you will feel handcuffed.

Recommendation: If you despise scaling restrictions and trust your risk management, pay the extra premium for the Advanced Plan. If you are building a long-term career, the Standard Plan scaling is reasonable and protects your capital.

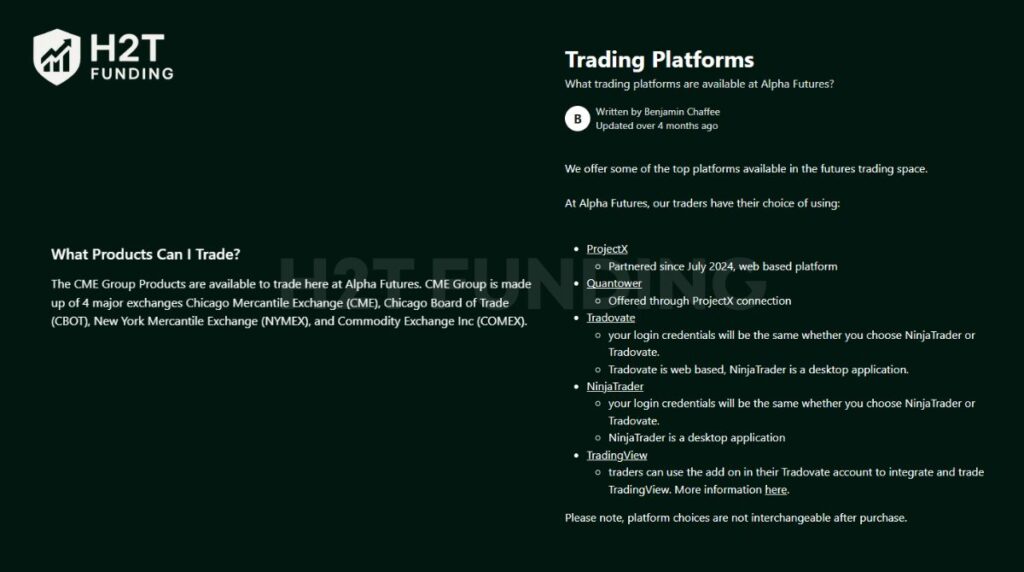

7. Alpha Futures instruments and trading platform

Alpha Futures provides access to professional-grade technology and a wide range of assets. However, your choice of platform at checkout is critical, as platform choices are not interchangeable after purchase.

7.1. Supported instruments

Traders can access the full suite of CME Group products. This encompasses the four major exchanges: CME, CBOT, NYMEX, and COMEX. You can trade popular futures trading contracts, including Equity Indices (ES, NQ), Energies (Crude Oil), Metals (Gold), and Interest Rates.

Crypto futures policy: You can trade Crypto futures like MBT (Micro Bitcoin) and MET (Micro Ether).

Important risk note: Due to high volatility, Alpha Futures treats these as full mini contracts regarding position sizing. For example, holding 5 MBT contracts counts as 5 full contracts against your maximum limit, not 5 micros.

7.2. Available trading platforms

Alpha Futures offers top-tier platforms to suit different trading styles.

- ProjectX: A robust web-based platform partnered with the firm since July 2024. Its biggest advantage is commission-free trading (users only pay regulatory fees), making it the most cost-effective option.

- Quantower: Available specifically through the ProjectX connection. This is ideal for order flow traders requiring advanced DOM and charting capabilities.

- Tradovate: A popular web-based platform known for its modern interface.

- NinjaTrader: An industry-standard desktop application. Note that Tradovate and NinjaTrader share login credentials, allowing for some flexibility between the two.

- TradingView: If you prefer charting on TradingView, you can integrate it via the Tradovate add-on to execute trades directly from your charts.

Verdict on instruments and trading platform

The choice boils down to Cost vs. Convenience. If you want to save money, ProjectX is the superior choice because of the commission free trading structure. This adds up significantly for high-volume scalpers.

However, if you require mobile trading or specific indicators found on TradingView, the Tradovate/NinjaTrader option is the industry standard, though standard commission fees will apply.

8. Alpha Futures customer service and education

A prop firm is only as good as its support system. Alpha Futures distinguishes itself by offering accessible, human support rather than relying solely on automated chatbots.

8.1. Customer support channels

The firm is headquartered in London, and its support hours reflect this. You can reach their experienced team through the following channels:

- Email Support: You can submit queries via the contact form or directly to support@alpha-futures.com.

- Operating Hours: The team is available Monday – Friday from 8 AM – 8 PM (GMT). This covers the entire European session and the morning to mid-US session.

8.2. Education and resources

Alpha Futures invests heavily in trader development, aiming to build long-term partnerships. Their “Learn” hub is divided into practical categories:

- Analyst interviews: This is a standout feature. You can watch “Meet the Analysts” videos where successful traders share their strategies and review their payout journeys (e.g., “$3,000 Single Payout” case studies).

- Introduction to futures: A dedicated section for beginners, including guides like “How To Trade Futures For Beginners 2025” and “From Zero to Funded.”

- Forex to futures: Specialized content designed to help retail Forex traders transition to the centralized futures market.

- Q&A sessions: Regular videos featuring the COO and market experts answering common questions about signing up and managing trades.

Verdict on support & education

The educational library is superior to most competitors, who offer only a basic PDF rulebook. The Analyst Interviews provide excellent social proof and practical insights into what is working right now on their platform.

Regarding support, the inclusion of phone support during UK/US overlap hours is a massive trust signal. It confirms they are a legitimate operation with a physical presence, not just a faceless website.

9. Real trader feedback: Alpha Futures review Trustpilot, and Alpha Futures Reddit

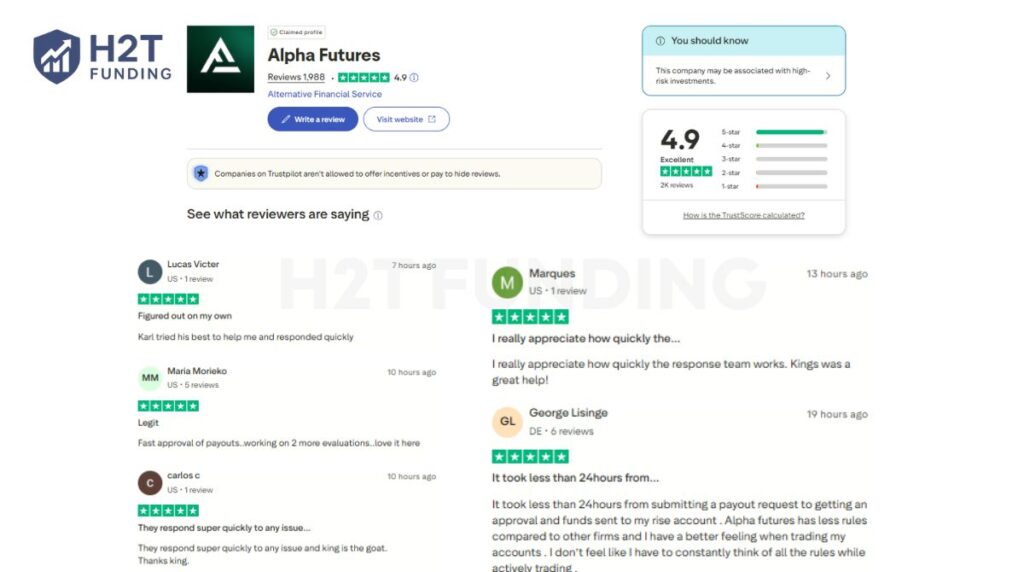

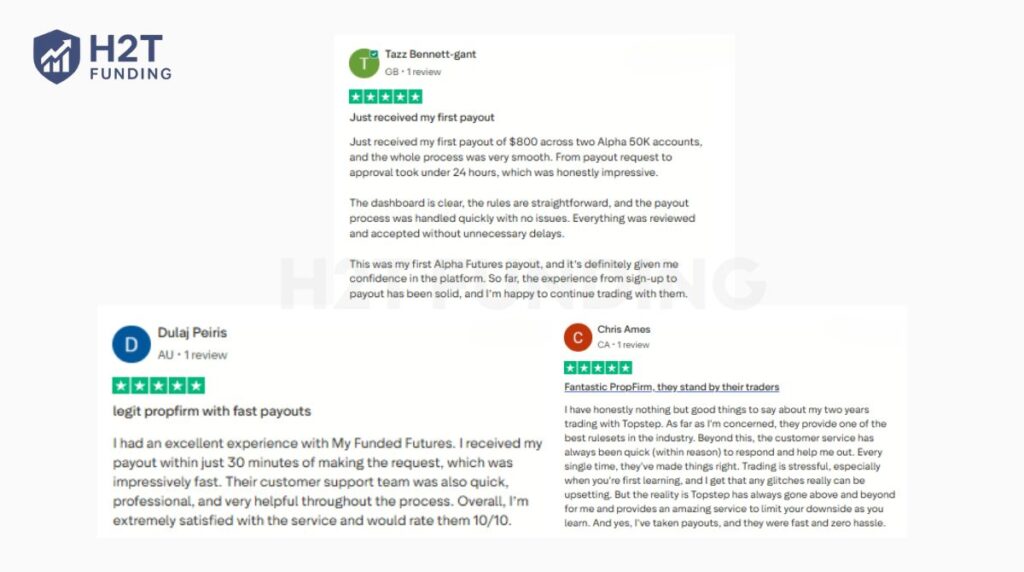

To get the truth about a prop firm, you must look beyond the marketing. We analyzed the Alpha Futures review Trustpilot page, which currently January 19, 2026, boasts an impressive 4.9/5 stars from nearly 2,000 reviews. The vast majority of verified users praise the firm for its legitimacy and speed.

Specifically, traders like Maria Morieko and George Lisinge highlighted that payout approvals are incredibly fast, often landing in accounts (like Rise) in less than 24 hours. The support team also receives high marks, with specific team members like “King” and “Karl” being frequently thanked for resolving issues quickly.

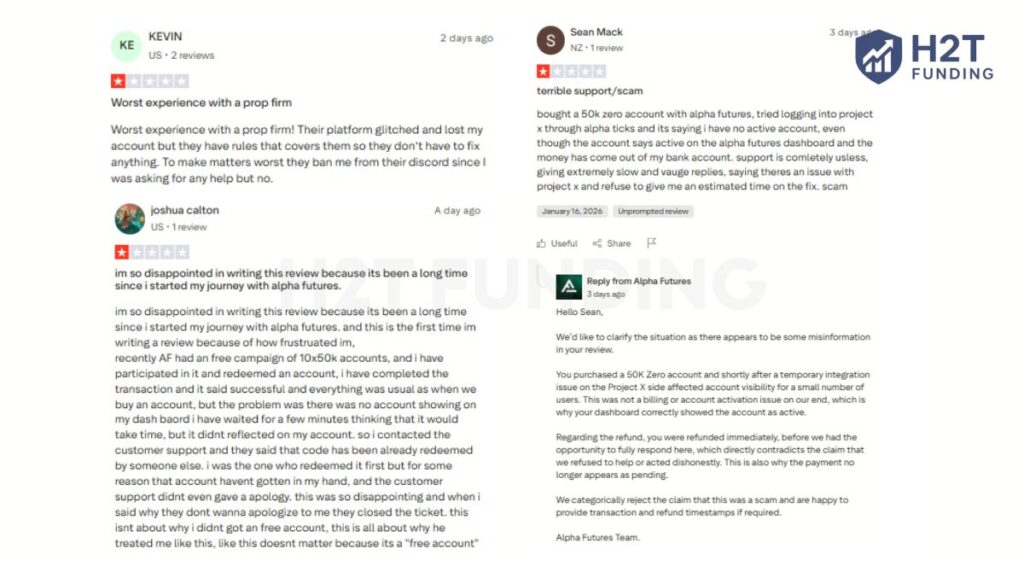

However, no firm is without flaws. A segment of users has reported frustration with technical glitches, particularly regarding the Project X platform integration. Users like Kevin and Sean Mack reported instances where accounts didn’t appear on the dashboard immediately after purchase or where platform glitches affected their standing.

It is worth noting that in cases like Sean’s, Alpha Futures was proactive in replying, clarifying that it was a temporary integration issue and issuing an immediate refund, which helps debunk claims of it being a “scam.”

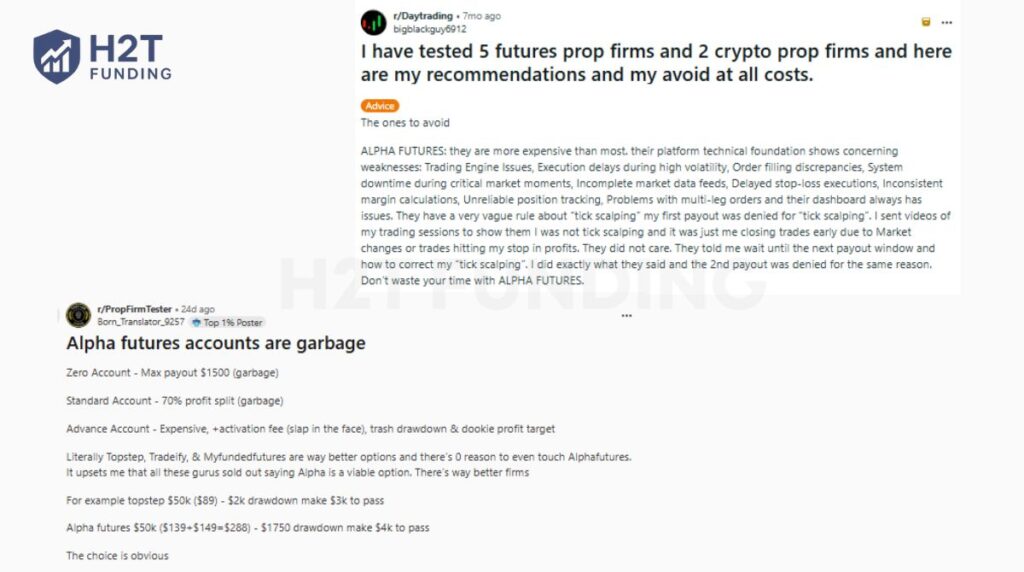

Digging into Alpha Futures Reddit threads reveals strong criticism regarding value. User Born_Translator_9257 argues that the pricing model is inferior compared to established competitors such as Topstep.

They point out that a $50K Advanced account is significantly more expensive ($139/month + $149 (activation) = $288 total) while also having a harder profit target ($4,000) than industry norms. This mathematical disadvantage is highlighted as a major pain point for experienced traders.

Additionally, user bigblackguy6912 warns about technical instability and the strict “tick scalping” rule. They report payout denials for closing trades too quickly, suggesting that the firm is hostile toward high-frequency scalpers.

10. How to sign up for Alpha Futures

Getting started with Alpha Futures is a streamlined process that takes less than 5 minutes. The dashboard is modern and user-friendly, allowing you to manage everything from plan selection to billing in one place.

- Step 1: Create your account credentials.

- Step 2: Verify your email address.

- Step 3: Select your specific evaluation plan.

- Step 4: Configure platform settings and finalize payment.

Follow the detailed instructions below to ensure you set up your account correctly.

10.1. Create your account

Navigate to the official Alpha Futures website and click the “SIGN UP” button in the top right corner.

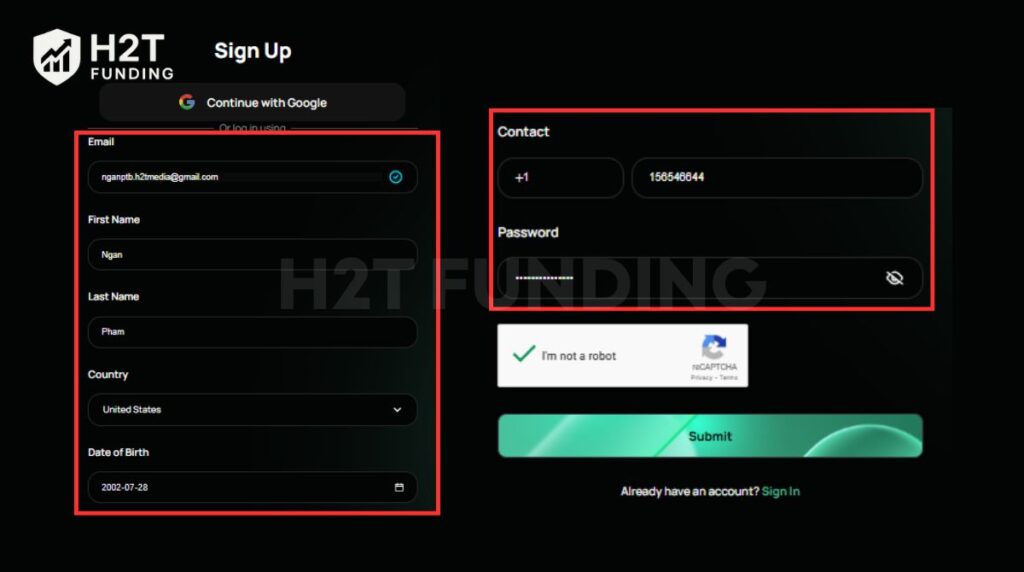

You will be directed to a registration form.

- Enter your Email, First Name, and Last Name.

- Select your Country and enter your Date of Birth.

- Create a secure password.

- Alternatively, you can use the “Continue with Google” option for a faster login.

10.2. Verify your email address

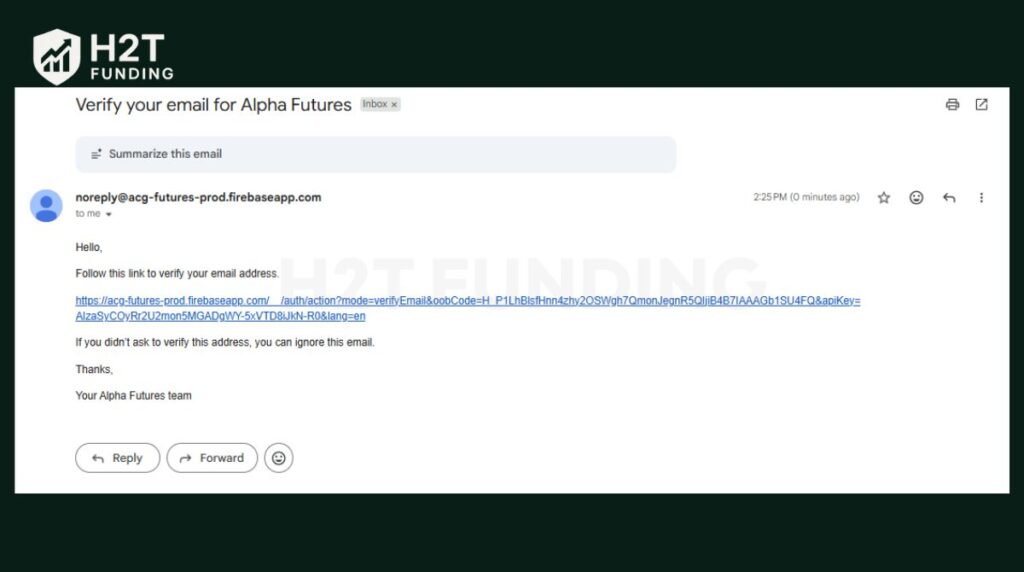

Once you submit the form, check your inbox immediately. You will receive an email from the Alpha Futures team (often sent via their Firebase system).

- Open the email with the subject line: “Verify your email for Alpha Futures”.

- Click the long verification link provided in the body text.

- This action activates your dashboard and logs you in automatically.

10.3. Select your evaluation plan

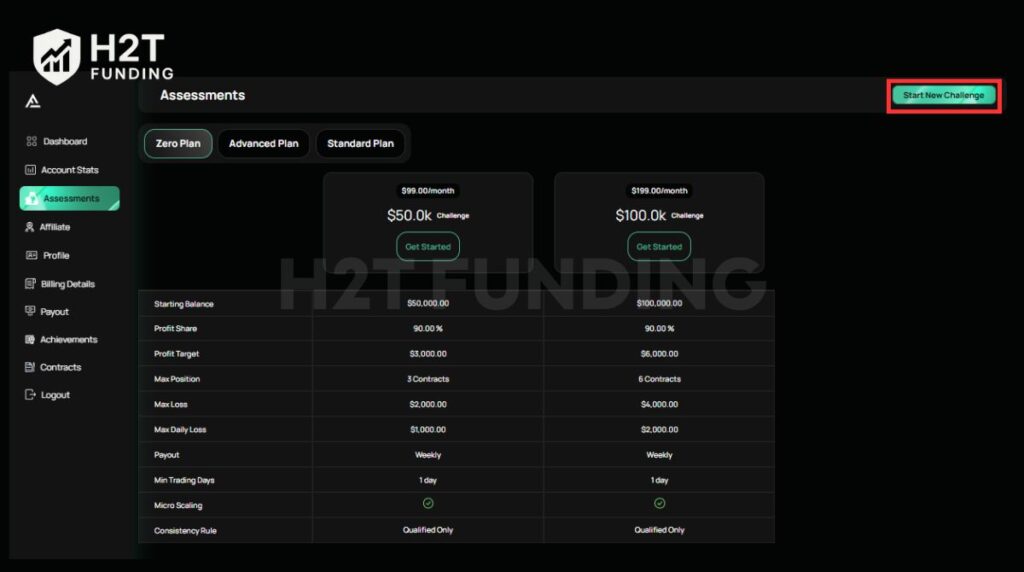

Inside the dashboard, navigate to the “Assessments” tab on the left-hand sidebar. Here you will see the three main program categories: Zero Plan, Advanced Plan, and Standard Plan.

- Toggle between the tabs to view the pricing and rules for each.

- Select your desired account size (e.g., $50.0k or $100.0k).

- Click the “Get Started” button under your chosen package.

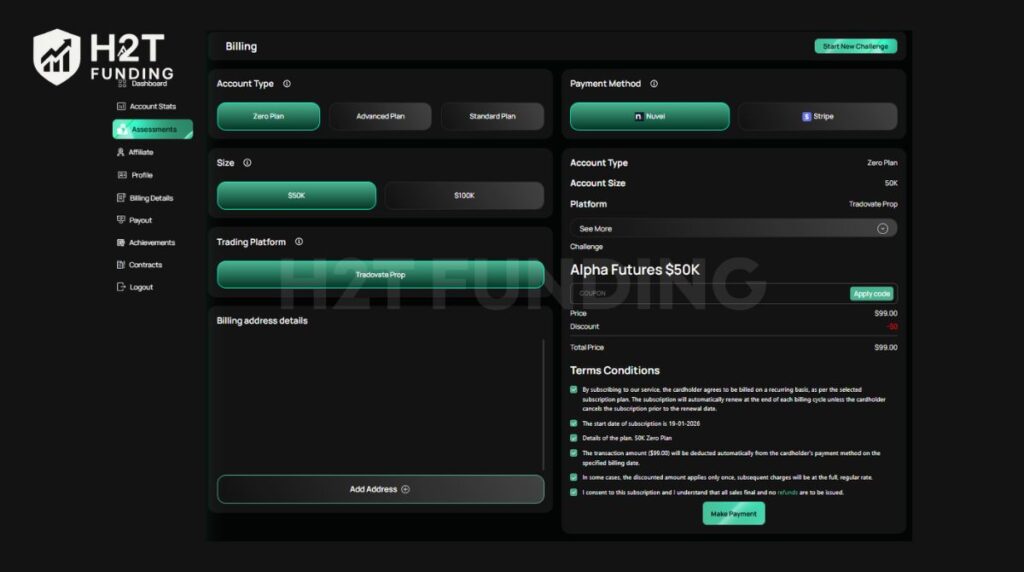

10.4. Configure and pay

You will be taken to the Billing page. This is the most critical step.

- Confirm account: Double-check the “Account Type” and “Account Size”.

- Select platform: Choose your Trading Platform (e.g., Tradovate Prop). Note: Ensure this is correct as it cannot be changed later.

- Billing details: Enter your full address.

- Payment: Choose your processor (Nuvei or Stripe) and enter a coupon code if you have one.

- Finalize: Check the “Terms and Conditions” boxes to agree to the subscription rules and click “Make Payment”.

Once your payment is processed, the system will instantly generate your trading credentials. Check your email for your username and password, which will also be visible in your Dashboard under the active account section.

We recommend downloading your chosen platform (ProjectX or Tradovate) immediately. You are now ready to execute your first trade and begin the path to becoming a Qualified Analyst.

11. Alpha Futures restricted countries

Alpha Futures offers its services to traders in over 150 countries. However, due to regulatory compliance and internal risk policies, there is a specific list of prohibited jurisdictions.

To qualify for an account, you must hold BOTH residency and citizenship from a non-restricted country.

- It is not enough to simply live in an approved country (e.g., the UK) if your citizenship belongs to a banned nation.

- Both your passport/ID and your proof of address must be from accepted regions.

Traders from the following nations are strictly prohibited from joining:

| Afghanistan | Albania | Belarus |

|---|---|---|

| Bosnia and Herzegovina | Bulgaria | Burkina Faso |

| Burma/Myanmar | Chad | Côte d’Ivoire |

| Croatia | Cuba | Democratic Republic of Congo |

| Djibouti | East Timor | Ethiopia |

| Guinea-Bissau | Haiti | Iran |

| Iraq | Jamaica | Jordan |

| Kenya | Kosovo | Laos |

| Lebanon | Lesotho | Libya |

| Malawi | Malaysia | Mali |

| Montenegro | Mozambique | Namibia |

| Nigeria | North Korea | North Macedonia |

| Pakistan | Palestinian Territory | Philippines |

| Romania | Russia | Rwanda |

| Senegal | Serbia | Sierra Leone |

| Slovenia | Somalia | South Africa |

| South Sudan | Sudan and Darfur | Syria |

| Tajikistan | Tanzania | Turkey |

| Ukraine | Venezuela | Vietnam |

| Yemen | Zimbabwe |

Traders should note that this list is more extensive than many competitors. Do not attempt to bypass these geo-blocks using a VPN. Alpha Futures enforces strict KYC (Know Your Customer) verification before the first payout, and any document mismatch will lead to an immediate ban and forfeiture of funds.

12. Compare Alpha Futures vs other prop firms

When comparing prop firms, payout speed is a key factor alongside rules and pricing. Instead of relying on marketing claims, trader reviews provide clearer insight into real-world performance.

User feedback shows that Alpha Futures processes payouts reliably, though not always instantly. One verified review reports receiving an $800 payout across two Alpha 50K accounts in under 24 hours, with the approval process described as smooth and transparent.

My Funded Futures is consistently highlighted for very fast payouts. In one documented case, a trader received funds within 30 minutes of submitting a request, reinforcing its reputation for speed and responsive support.

Topstep is viewed as the most established and reliable firm. While payouts are not the fastest, long-term users report consistent payments and strong trader support, prioritizing trust over speed.

| Feature | Alpha Futures | My Funded Futures | Topstep |

|---|---|---|---|

| Price range | $79 – $419 | $77 – $477 | $49 – $149 |

| Evaluation | 1-Step | 1-Step | 2-Step |

| Account size | $50K – $150K | $50K – $150K | $50K – $150K |

| Profit split | Up to 90% | 80% | 90% – 100% |

| Profit target | 6% – 8% | 6% | 6% |

| Drawdown | EOD Balance (Standard) | Trailing (No Daily Limit) | Intraday Trailing |

| Platforms | ProjectX, Quantower, Tradovate, NinjaTrader, TradingView | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading | TopstepX |

| Key benefit | Static Max Loss Limit | Instant Payouts | 100% Split on first $10k |

Choose Alpha Futures if: You are a swing trader who needs the EOD (End of Day) Drawdown. This gives you the most breathing room during volatile sessions compared to intraday trails. It is also the best choice if you want a 90% profit split without a tiered structure on the Advanced/Zero plans.

Choose My Funded Futures if: You prioritize speed. Their “Instant Payouts” mechanism is a major selling point for traders who want immediate access to their cash. Additionally, having No Daily Loss Limit provides flexibility for aggressive intraday strategies that might hit a daily cap elsewhere.

Choose Topstep if: You are a beginner looking for stability and education. With 14 years in operation, they are the safest “brand name” in the industry. Their 2-step evaluation is harder to pass but ensures you are truly ready. Plus, keeping 100% of the first $10,000 profit is an unmatched financial incentive for new traders.

13. Should I choose Alpha Futures?

Yes, especially if you are a swing trader who despises intraday trailing drawdowns. The biggest stress in prop trading is the intraday trail stopping you out during valid trades. Alpha Futures eliminates this anxiety with their EOD (End of Day) Drawdown on Standard accounts.

You should choose Alpha Futures if:

- You want a safety net: The Static Max Loss Limit is a game-changer. Once you build a profit buffer, the drawdown stops following you, creating a true safety net.

- You trade normally: If your strategy involves holding trades for longer periods rather than seconds, you will fit right in.

- You value reputation: Being backed by the established Alpha Capital Group provides peace of mind. They possess the liquidity that smaller firms lack.

You should skip Alpha Futures if:

- You are a “Tick Scalper”: If you aim to snatch 1-2 ticks in seconds using max leverage, their anti-scalping rules will flag you immediately.

- You rely on luck: The 40% consistency rule prevents “one-hit wonders.” You cannot pass by gambling on a single news event.

- You are restricted: Check the list carefully. If you are from countries like Vietnam or the Philippines, you strictly cannot join.

Alpha Futures is not a casino. It is a serious firm seeking partners. If you have discipline, the 90% profit split and EOD drawdown offer one of the best deals available.

14. Is Alpha Futures legit?

Yes, Alpha Futures is a legitimate proprietary trading firm. It operates as a subsidiary of the established Alpha Capital Group, ensuring the financial stability required to honor payouts reliably. They maintain a physical trading floor in London and actively recruit top performers for in-house roles, demonstrating a commitment to long-term partnerships.

Their credibility is further backed by a 4.9/5 Trustpilot score and thousands of verified reviews confirming swift withdrawals via Rise and Wise. By utilizing industry-standard platforms like NinjaTrader and Tradovate, they provide a transparent environment based on real CME market data, effectively dispelling concerns about manipulation.

15. FAQs

Yes, Alpha Futures is a legitimate firm that pays out verified traders. They process withdrawals within 48 business hours via methods like Rise, Wise, and Wire Transfer. Thousands of positive Trustpilot reviews confirm their reliability in honoring performance fees.

Yes, they offer a transparent “Path to Live” through the Alpha Prime program. Once a trader reaches a $40,000 profit or receives 5 payouts, they are reviewed for a live account. Alpha Futures converts your remaining simulated profits into a 12-month monthly salary and matches your risk contribution to fund a live account. Live traders enjoy daily payouts, a 60% profit split (plus salary), and zero consistency rules.

Traders purchase an evaluation to prove their skills. It is a one-step challenge where you must hit a profit target without breaching the drawdown. Once passed, you receive a Qualified Account to trade virtual funds and earn up to 90% of the profits you generate.

Traders can earn up to a 90% profit split. On Advanced and Zero accounts, this 90% rate applies immediately. On Standard accounts, it is tiered: starting at 70% for the first two payouts, 80% for the next two, and capping at 90% from the fifth payout onwards.

Yes, news trading is permitted during the Evaluation phase. However, on Standard and Zero Qualified accounts, you cannot execute trades 2 minutes before or after high-impact (Red Folder) news events. Advanced and Live Alpha Prime accounts do not have this restriction.

For Standard and Zero accounts, you must “earn your size.” You start with limited contracts (e.g., 2 minis) and unlock more leverage as you reach specific profit milestones. Advanced accounts have no scaling plan, allowing full leverage usage immediately.

No, High-Frequency Trading (HFT) and fully automated AI bots are strictly prohibited. Copy trading is allowed only if you are copying trades between your own personal accounts. Copying signals from third parties or group trading is banned.

Standard accounts allow withdrawals every 14 days. Advanced and Zero accounts offer a flexible schedule; you can request a payout after accumulating 5 winning trading days (days with $200+ profit), regardless of the calendar date.

16. Conclusion

This Alpha Futures review reveals a firm designed for longevity rather than quick failures. By replacing intraday trails with a static EOD Drawdown, they offer a massive advantage for swing traders. This structure makes them a top contender for those seeking a stable career.

While not ideal for scalpers due to consistency rules, the value for career-focused traders is undeniable. The “Path to Live” program, featuring a potential monthly salary, creates a legitimate professional pathway. For disciplined traders, the 90% profit split offers an optimal environment to grow.

Success ultimately depends on matching the firm’s rules to your specific trading style. If you are still weighing your options, explore our in-depth comparisons in the Prop Firm Reviews section at H2T Funding. We are here to help you find the perfect funding partner.