If you’re like me, someone who values flexibility over rigid trading schedules, then finding a no minimum trading days prop firm can make all the difference in your prop trading journey. These firms remove the pressure of meeting daily trade requirements, allowing you to focus on quality setups rather than quantity.

After researching and testing several options myself, I’ve compiled this updated list of prop firms that offer true freedom without compromising on funding potential. Whether you’re a part-time trader or a seasoned professional looking for fewer restrictions, these choices offer a more adaptive and trader-friendly experience.

Key takeaways

- No minimum trading days allow for faster funding: Traders can pass evaluations as soon as they meet profit targets and risk parameters, with no need to wait for arbitrary day counts.

- Top firms offering this flexibility include FX2, E8, FXIFY, FundedTradingPlus, and The Funded Trader. Each provides distinct advantages such as one-step evaluations, instant payouts, and high profit splits.

- “No minimum trading days” is not the same as “no time limit”: The former allows fast completion, while the latter removes deadline pressure; both offer different kinds of flexibility.

- Low MTDs don’t guarantee a better experience: Traders should still assess key factors like drawdown policies, trading conditions, payout reliability, and firm reputation.

- Choosing the right firm requires a balanced approach: While quick progression is attractive, long-term success depends on evaluating the firm’s credibility, rules, and support ecosystem.

1. What is a no minimum trading days prop firm?

A no minimum trading days prop firm is a proprietary trading firm that does not require traders to execute trades for a specific number of days before completing an evaluation phase or qualifying for a funded account.

In most traditional prop firm models, even if a trader hits the profit target and respects drawdown rules early on, say, in 2 or 3 days, they are still forced to continue trading for 5, 10, or even 30 days to meet the minimum trading day requirement. This rule is primarily in place to assess consistency over time. However, it often delays capable traders who achieve goals quickly.

2. What are the benefits of having no minimum trading days?

Prop firms that remove the minimum trading day requirement offer a significant edge for certain types of traders. This seemingly simple rule change has far-reaching advantages, particularly for those who trade with speed, precision, or during specific market conditions.

- Faster access to funded accounts: Traders who meet profit targets and adhere to risk parameters can complete evaluations immediately, without being delayed by mandatory waiting periods. This shortens the path to receiving capital and allows high-performing traders to scale their activity more efficiently.

- Reduced psychological pressure: Without the constraint of trading for a set number of days, traders are free to act only when optimal setups arise. This reduces the temptation to overtrade or take low-quality positions just to fulfill a quota, supporting better risk management and emotional discipline.

- Merit-based evaluations: The absence of a minimum day rule shifts the focus entirely to trading performance. Traders are assessed based on profitability and rule compliance, rather than arbitrary time spent in the market. This benefits individuals with precise, effective strategies.

- Increased flexibility for short-term strategies: Scalpers and day traders often capitalize on rapid market movements. A no-MTD policy allows them to complete evaluations within one or two sessions, aligning better with their trading style and market timing.

- Closer alignment with real trading conditions: In a professional trading environment, success is defined by consistency and profitability, not by ticking off a set number of trading days. Removing this requirement makes the evaluation process more realistic and trader-friendly.

Prop firms with no minimum trading day requirements offer a more efficient, performance-focused pathway to funding. By removing time-based restrictions, traders gain greater flexibility, reduce unnecessary pressure, and are evaluated purely on merit. This model supports disciplined, high-performing traders and aligns more closely with real-world trading expectations.

3. 7+ Best no minimum trading days prop firm – Newest updated

If you’re a trader who operates with speed and precision, waiting for a mandatory number of trading days can feel like an unnecessary delay. Prop firms that eliminate the “minimum trading days” rule cater directly to this mindset. Let’s explore some of the best prop firms that offer this liberating flexibility.

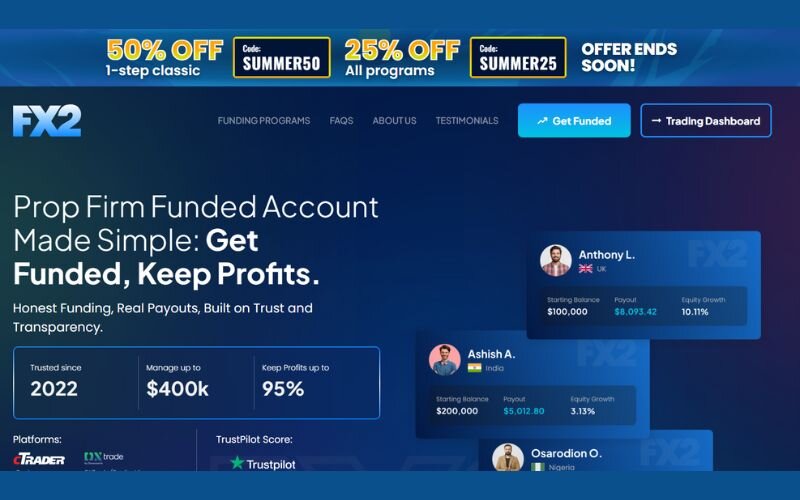

3.1. FX2 Funding

FX2 Funding positions itself as a straightforward and trader-centric firm, primarily known for its simple 1-step evaluation process. The absence of a minimum trading day requirement is central to their appeal, offering a direct path to a funded account for profitable traders.

Key features:

- Evaluation model: A single-phase evaluation where traders must achieve a 10% profit target.

- Drawdown rules: A 4% maximum daily loss limit and a 6% maximum total drawdown.

- Time limits: There are no minimum or maximum time limits to complete the evaluation.

- Profit split: Offers a high profit split, starting at 80% and scaling up to 95%.

- Payouts: Payouts can be requested on a weekly basis.

- Tradable instruments: They offer a range of instruments, including Forex pairs, indices, and cryptocurrencies.

| Pros | Cons |

|---|---|

| ✅ Simple 1-step evaluation is easier to pass. | ❌ The 6% maximum drawdown is quite tight and less forgiving. |

| ✅ No time pressure with unlimited trading days. | ❌ As a newer firm, it lacks the long-term track record of industry veterans. |

| ✅ Very high scaling profit split, up to 95%. | ❌ Fewer account size options compared to larger competitors. |

| ✅ No minimum trading days for fast progression. |

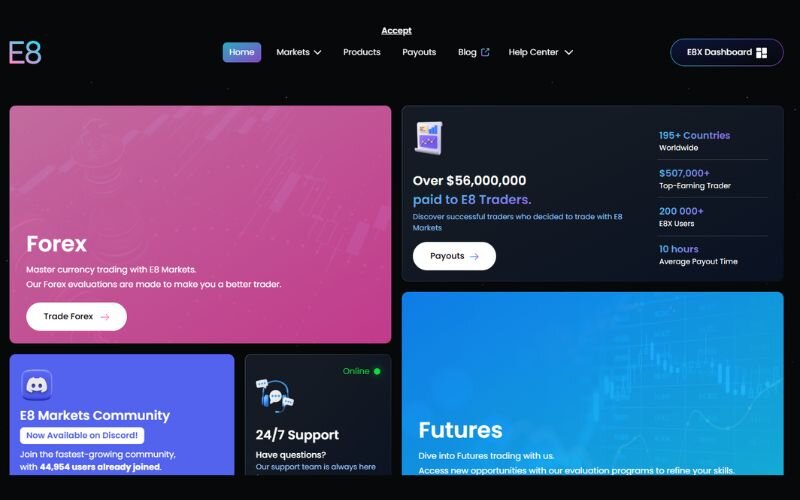

3.2. E8 Markets

E8 Markets is a well-regarded firm in the industry, recognized for its user-friendly platform and flexible trading conditions. Removing the minimum trading day rule from its core evaluation programs allows skilled traders to quickly demonstrate their abilities and get funded faster.

Key features:

- Multiple programs: E8 offers several account types, including the E8 Evaluation, ELEV8, and E8 Track programs, catering to different trading styles.

- Evaluation structure: The standard E8 evaluation is a two-phase process. Phase 1 requires an 8% profit target, and Phase 2 requires a 5% profit target. The E8 One program offers a single-phase evaluation.

- Risk parameters: Traders must adhere to a daily loss limit (typically 5%) and a maximum loss limit (usually 8%). These rules can sometimes be customized.

- Leverage: E8 Funding provides leverage up to 1:100.

- Payout system: The first payout can be requested 8 days after the first trade on a funded account. Subsequent payouts are typically on a bi-weekly basis, with an 80% profit split. The maximum loss rule can increase by 1% with each withdrawal, up to a maximum of 14%.

| Pros | Cons |

|---|---|

| ✅ No minimum trading days on evaluation accounts. | ❌ Two-phase evaluation can be time-consuming for some traders. |

| ✅ Reputable firm with a strong industry presence. | ❌ First payout requires an 8-day waiting period. |

| ✅ Scaling plan increases max drawdown with withdrawals. | ❌ Relative drawdown on some accounts can be tricky to manage. |

| ✅ High leverage of up to 1:100 is available. |

3.3. FXIFY

FXIFY offers traders access to significant capital with a high degree of flexibility, highlighted by their “no minimum trading days” policy on funded accounts. This allows for on-demand payouts from the very first day of trading a funded account.

Key Features:

- Flexible evaluations: FXIFY provides 1-phase, 2-phase, and 3-phase assessment options to suit different trader preferences. Account sizes range from $5,000 up to $400,000.

- Profit targets & drawdown: In the 2-phase evaluation, the profit target is 10% for phase 1 and 5% for phase 2. It has a 4% maximum daily drawdown and a 10% static maximum drawdown. The 1-phase evaluation has a 10% profit target with a 3% daily and 6% trailing maximum drawdown. While there are no maximum trading periods, some evaluation phases may require a minimum of five trading days to pass.

- Profit split: Traders can earn a profit share of up to 90%.

- Instant payouts: A standout feature is the ability to request a payout immediately after closing a successful trade on a live account, with no minimum targets or days required.

- Technology and spreads: As a partner of FXPIG, FXIFY offers tight spreads from 0.0 pips and access to over 20 liquidity providers on MT4 or MT5 platforms.

| Pros | Cons |

|---|---|

| ✅ On-demand payouts from day one on a funded account. | ❌ The 10% maximum drawdown is static, not trailing. |

| ✅ High profit split up to 90%. | ❌ Having 1, 2, and 3-phase options can be confusing for new traders. |

| ✅ Excellent trading conditions with low spreads. | |

| ✅ Wide variety of account sizes and models. |

3.4. The Funded Trader

The Funded Trader is a community-focused firm offering a diverse range of challenge types to suit different trading styles. Their Knight and Rapid challenges are specifically designed for speed, featuring no minimum trading day requirements.

Key features:

- Challenge variations:

- Rapid challenge: This challenge has no minimum trading days. It involves two phases with profit targets of 8% and 5%.

- Knight challenge: This is a one-step challenge with a 10% profit target and no minimum trading days requirement.

- Standard & Royal challenges: These challenges have minimum trading day requirements of 3 and 5 days, respectively.

- Drawdown rules: Drawdown limits vary by challenge. For example, the Rapid Challenge has a 5% daily and 8% max loss, while the Knight Challenge has a 3% daily and 6% relative drawdown.

- Profit split: The standard profit split is 80%, but it can be scaled up to 90%.

- Flexibility: The firm allows the use of EAs and trade copiers in certain challenges and has no restrictions on news trading for most programs.

| Pros | Cons |

|---|---|

| ✅ Specific challenges (Knight, Rapid) have no minimum days. | ❌ Not all challenges have this feature, which can cause confusion. |

| ✅ Strong reputation and a large, active trading community. | ❌ The Knight challenge has a tight 6% trailing drawdown. |

| ✅ High level of flexibility with news trading and EAs. | ❌ Has historically faced some user complaints about payout speed. |

| ✅ Offers one of the most popular 1-step challenges. |

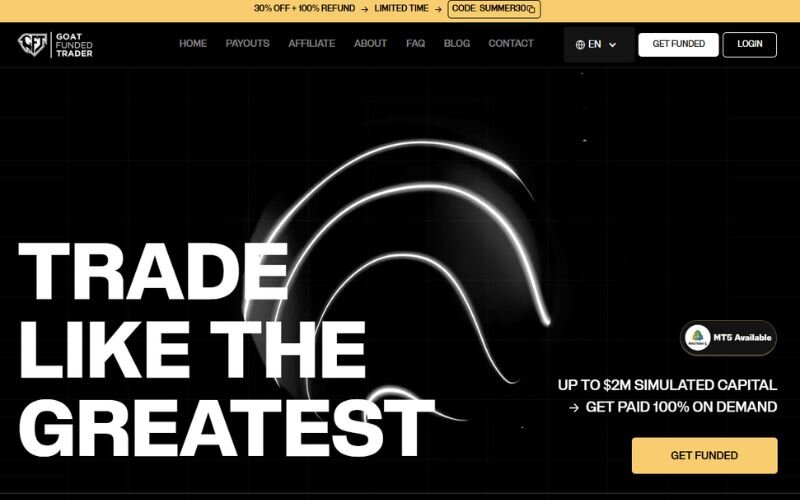

3.5. Goat Funded Trader

Launched in 2023, Goat Funded Trader has quickly carved out a significant space in the proprietary trading industry. The firm is recognized for its highly flexible approach, offering seven distinct funding programs tailored to different trading styles. With no minimum or maximum trading day requirements, a wide variety of tradable instruments, and leverage up to 1:100, it provides traders with the tools and freedom needed to succeed.

Key features:

- Diverse funding programs: Offers seven unique models, including one-step, two-step, and instant funding challenges, ensuring a fit for almost any trader.

- Complete time flexibility: There are no minimum trading day requirements to pass an evaluation and no maximum trading period, removing all time pressure.

- Profit split and scaling: Profit splits range from 65% to 95%. The firm also has a clear scaling plan that rewards consistent traders.

- Trading conditions: Allows overnight and weekend holding, as well as news trading. It provides a professional trader dashboard and various add-on features to enhance the trading experience.

- Instruments and drawdown: Traders can access Forex pairs, commodities, indices, stocks, and cryptocurrencies. The drawdown rules vary by program, with some using a daily equity-based drawdown and others featuring a maximum trailing drawdown on instant funding accounts.

| Pros | Cons |

|---|---|

| ✅ No minimum trading days or maximum time limits provide total flexibility. | ❌ The Standard Challenge’s 8% maximum drawdown can be tight. |

| ✅ Seven unique funding programs to cater to different trading styles. | ❌ Uses an equity-based daily drawdown, which can be more restrictive than balance-based. |

| ✅ Wide range of instruments including stocks and cryptocurrencies. | ❌ Instant funding programs come with a maximum trailing drawdown. |

| ✅ Excellent scaling plan with profit splits reaching up to 95%. | ❌ The starting profit split on some programs (65%) is lower than competitors’ offerings. |

| ✅ Strong community trust, reflected in a high Trustpilot rating. |

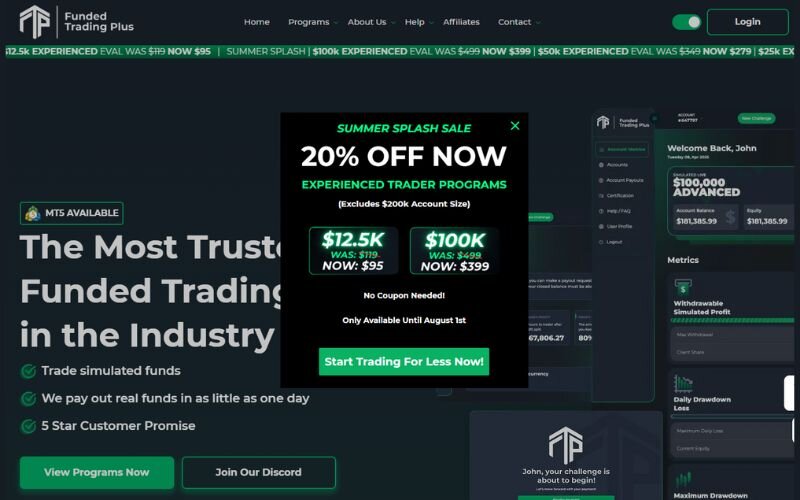

3.6. Funded Trading Plus

Funded Trading Plus (FTP) is highly respected for its extreme flexibility and for being one of the pioneers of the “no minimum trading days” rule. Their programs are designed to accommodate virtually any trading style, making them a top choice for experienced traders who don’t want to be constrained by restrictive rules.

Key features:

- Program variety: Offers several programs, including a 1-step evaluation (Experienced Trader), a 2-step evaluation (Advanced Trader), and an Instant Funding model.

- No minimum days: A core feature across their main evaluation programs, allowing for instant passing.

- Unrestricted trading: Famous for allowing all trading styles, including EAs, news trading, copy trading, and holding over weekends.

- Profit split: Starts at 80% and scales up to 100% for top-performing traders on certain programs.

- Payouts: Offers fast and reliable weekly payouts.

| Pros | Cons |

|---|---|

| ✅ True “no minimum days” policy on evaluation accounts. | ❌ The 6% trailing drawdown on the 1-step program can be challenging for some. |

| ✅ One of the most flexible firms for trading strategies (EAs, news, etc.). | ❌ Instant funding programs come with a higher initial cost. |

| ✅ Excellent reputation and highly positive user reviews. | ❌ The sheer number of programs can be slightly confusing for newcomers. |

| ✅ Simple one-step evaluation is available. |

3.7. The 5%ers

The 5%ers are one of the original and most reputable prop firms in the industry, known for their unique career growth model rather than simple challenges. They offer different programs, with their popular Hyper Growth and Bootcamp models featuring no minimum trading day requirements.

Key features:

- Unique programs:

- Hyper Growth: An instant funding program where your account doubles with every 10% profit milestone. No minimum days required.

- Bootcamp: A low-cost, three-stage challenge to prove consistency, leading to a funded account. No minimum days required.

- High Stakes: A more traditional 2-step challenge that does require 3 minimum profitable days.

- Aggressive scaling: Their main selling point is the aggressive account scaling plan, with the potential to manage up to $4 million.

- Profit split: Varies by program, from 50/50 on the Bootcamp to as high as 100% on scaled High Stakes accounts.

- Support: Provides a wealth of resources, including a trader dashboard, daily analysis, and performance statistics.

| Pros | Cons |

|---|---|

| ✅ Instant funding and challenge programs with no minimum days. | ❌ Their most popular “High Stakes” program does have a minimum day rule. |

| ✅ Industry-leading reputation and a long, trusted track record. | ❌ The Bootcamp program starts with a 50/50 profit split, which is low. |

| ✅ Excellent and aggressive scaling plan for long-term growth. | ❌ The models are more complex than a simple one- or two-step evaluation. |

| ✅ Low-cost entry option with the Bootcamp challenge. |

3.8. Rebels Funding

Rebels Funding is built upon a foundation of extensive market experience, with its core team actively trading since 2011 and providing education since 2015. While the firm offers a variety of modern funding programs, its unique approach replaces the “minimum days” rule with a “minimum number of trades” requirement, offering a different kind of flexibility.

Key features:

- Experienced team: The firm is backed by a team with over a decade of hands-on trading and educational experience.

- No minimum days, but minimum trades: Instead of waiting for days to pass, traders must complete a minimum number of trades (e.g., 4 or 5) per phase to progress.

- Program variety: Offers 1-phase, 2-phase, and 3-phase programs with diverse options.

- Profit split: Offers a profit split of up to 90%.

- Payouts: Payouts can be requested on a weekly or bi-weekly basis, depending on the program.

| Pros | Cons |

|---|---|

| ✅ Backed by a team with deep, long-term market experience. | ❌ The “minimum trades” rule can encourage rushing or overtrading for some. |

| ✅ Technically no minimum waiting period based on days. | ❌ This rule acts as a different kind of barrier to instant completion. |

| ✅ A vast selection of program types to choose from. | ❌ The large number of programs with slightly different rules can be confusing. |

| ✅ High profit splits and frequent payout options. |

4. Why are Minimum Trading Days important for Traders?

In the context of proprietary trading firm challenges, “Minimum Trading Days” (MTDs) refer to the fewest number of days a trader must actively place at least one trade to be eligible to pass an evaluation phase, even if profit targets and other criteria are met sooner. This rule is a common component of many prop firm evaluations.

Opting for a prop firm with low or no MTDs offers several distinct advantages for traders:

- Time Efficiency: The most significant benefit is the potential to save considerable time. If you achieve the profit target and adhere to drawdown rules quickly, low MTDs allow you to advance to the next stage or a funded account much faster.

- Reduced Psychological Pressure: A high MTD requirement can create psychological pressure to take unnecessary trades simply to meet the day count, potentially leading to suboptimal decisions. Lower MTDs alleviate this, allowing traders to stick to their strategy.

- Greater Flexibility: Traders employing short-term strategies or those capable of hitting targets rapidly benefit greatly. Low MTDs accommodate their ability to capitalize on market conditions without being artificially held back.

However, it’s worth noting a potential consideration: some firms with very low or no MTDs might occasionally have other specific rules or slightly different conditions in their programs, so a comprehensive review of all terms is always essential.

See more articles:

5. What’s the difference between No Time Limit and No Minimum Trading Days?

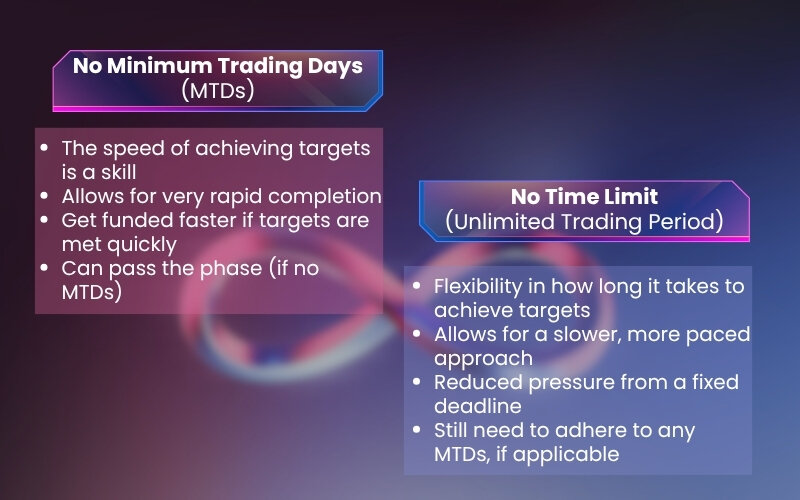

When evaluating prop firm challenges, traders often encounter terms like “no time limit” and “no minimum trading days.” While both sound appealingly flexible, they address different aspects of the evaluation process, and it’s crucial to understand their distinct meanings:

- No Minimum Trading Days (MTDs): As discussed previously, this means there’s no requirement to trade for a specific number of days. If you meet all other objectives (e.g., profit target, drawdown rules) on your first or second day of trading, you could theoretically pass that phase immediately. The focus is on performance efficiency over a short period, if achieved.

- No Time Limit (or Unlimited Trading Period): This refers to the overall duration you have to complete a challenge phase. If a challenge has “no time limit,” it means you are not restricted to, for example, 30 or 60 days to reach your profit target. You can take as many weeks or months as necessary, provided you don’t violate other rules like drawdown limits. The focus here is on reducing pressure related to a deadline.

Here’s a quick comparison:

| Feature | No Minimum Trading Days (MTDs) | No Time Limit (Unlimited Trading Period) |

|---|---|---|

| Primary Focus | The speed of achieving targets is a skill | Flexibility in how long it takes to achieve targets |

| Impact on Challenge Pace | Allows for very rapid completion | Allows for a slower, more paced approach |

| Key Benefit | Get funded faster if targets are met quickly | Reduced pressure from a fixed deadline |

| If You Hit Target Early | Can pass the phase (if no MTDs) | Still need to adhere to any MTDs, if applicable |

Essentially, “no minimum trading days” allows for rapid completion if targets are hit quickly. “No time limit” allows for a more paced approach without the stress of a ticking clock. A prop firm might offer one, both, or neither of these conditions. Understanding this difference is key to selecting a challenge that aligns with your trading style and timeline expectations.

6. Criteria for highlighting prop firms in this article

To provide you with a focused and useful comparison, the proprietary trading firms highlighted in this article were primarily selected and reviewed based on their minimum trading day (MTD) requirements. However, recognizing that MTDs are just one piece of the puzzle, we also consider and present information on several other key factors to offer a more holistic view.

Our evaluation and the information presented for each firm encompass:

- Minimum Trading Days: The central criterion for inclusion in this specific list.

- Profit Target: The percentage gain required to pass the evaluation phases.

- Maximum Drawdown: Both overall and daily drawdown limits.

- Leverage: The amount of leverage offered.

- Tradable Assets: The range of instruments available (e.g., Forex, indices, crypto).

- Challenge Fees: The cost of participating in the evaluation.

- Funding Process/Speed: General expectations for receiving a funded account post-challenge.

- Reputation & Community Feedback: Where objective information is available, this is considered.

H2T Funding is committed to objectivity. The aim is to provide comprehensive data points, allowing you, the trader, to conduct your own thorough due diligence and make informed decisions. This article focuses on firms with low MTDs but encourages a broader assessment before committing to any prop firm.

7. Important considerations when choosing based on minimum trading days

While the allure of no minimum trading days prop firm is understandable, it’s crucial to approach this specific criterion with a balanced perspective and caution. Simply chasing the no MTD count without considering other vital factors can lead to unfavorable outcomes.

Keep these key points in mind:

- Don’t sacrifice core quality for speed: A prop firm offering zero or very few MTDs might seem ideal for quick funding. However, if this comes at the cost of overly restrictive rules elsewhere, poor trading conditions, an unreliable reputation, or opaque payout processes, it’s unlikely to be a sustainable choice.

- Beware of “Too Good to Be True” offers: Exercise healthy skepticism. If a program’s promises, including exceptionally no MTDs combined with very easy targets, seem unrealistic compared to industry standards, investigate thoroughly.

- No MTDs aren’t universally optimal: While beneficial for some, a no MTD requirement may not suit every trading style. Traders employing longer-term strategies, or those who prefer a more methodical approach, might feel unnecessarily rushed or find that such programs don’t align with their natural trading rhythm.

- No guarantee of success: No MTDs don’t guarantee you’ll pass the challenge. Trading skill, robust risk management, and adherence to all other rules remain paramount.

8. Other critical factors to consider beyond minimum trading days

While a low minimum trading day (MTD) requirement can be highly attractive for traders aiming for swift funding, it’s vital to remember that this is just one component of a much larger picture. Selecting the right proprietary trading firm requires a comprehensive assessment of various elements to ensure it aligns with your trading style, risk tolerance, and long-term goals.

Beyond MTDs, diligently evaluate the following:

- Reputation and Track Record: This is paramount. Investigate the firm’s history, operational transparency, and overall standing in the trading community. Look for genuine, unbiased reviews to gauge reliability and avoid potential scams.

- Trading Conditions: Examine the specifics of their trading environment. This includes typical spreads, commissions, slippage during volatile periods, and the trading platforms offered (e.g., MT4, MT5, cTrader, or proprietary).

- Drawdown Rules: Understand the drawdown policies thoroughly. Differentiate between daily drawdown and maximum overall drawdown, and clarify whether they are calculated based on balance or equity. Strict or unclearly defined drawdown rules can easily lead to challenge failure.

- Specific Trading Rules: Check for restrictions on news trading, holding positions overnight or over weekends, and the use of Expert Advisors (EAs) if applicable to your strategy.

- Payout Process and Speed: Research the firm’s payout schedule, methods, and reported consistency. Vague or slow payout processes are a significant red flag.

- Customer Support: The quality and responsiveness of customer support can be crucial, especially when issues arise.

- Community Reviews and Feedback: Seek out discussions and reviews from other traders on independent forums and social media to get a broader sense of user experiences.

Crucial Advice: Always take the time to meticulously read and understand the full Terms & Conditions of any prop firm before committing to a challenge. What seems appealing on the surface might have critical details hidden in the fine print.

9. FAQ about Prop Firms and Minimum Trading days

Yes, some firms like FORFX (Peak Scalp account) and FunderPro claim to have zero minimum trading days. Others, such as FTMO (4 days) and FundedNext or AquaFunded (around 5 days), have low MTDs. Always check their official websites for the latest information.

It depends on the firm. Some require you to meet the full minimum trading days, while others may allow you to proceed once all objectives are met. Always confirm the specific rules with the firm.

No, a low minimum trading day requirement does not guarantee a firm’s reputation. Evaluate factors like their track record, payout consistency, trading conditions, and community feedback.

Focus on what matters most for your trading success. Weigh low MTDs against other important factors like drawdown rules and the firm’s credibility. Sometimes, a firm with higher MTDs but better overall conditions is the better choice. Adjusting your expectations may also be necessary.

Minimum trading days (MTDs) vary by firm, typically ranging from zero to several days, depending on the specific program and rules set by each prop firm.

Yes, FTMO requires a minimum of 4 trading days to complete their challenge. Always check their current guidelines for any updates.

10. Conclusion: Finding the Prop Firm That Aligns with Your Needs

Selecting a no minimum trading days prop firm may seem like an attractive shortcut to securing a funded account, but it should never be the sole criterion in your decision-making process. Choosing the right proprietary trading firm requires a comprehensive evaluation that goes beyond fast funding. Factors such as the firm’s reputation, risk management rules, trading conditions, and payout reliability must be carefully considered.

Ultimately, the best no minimum trading days prop firm is one that aligns with your trading strategy, risk tolerance, and long-term goals. We encourage you to take the time to assess your priorities and conduct in-depth research before making a commitment. A well-informed choice today can lead to a more stable and rewarding trading journey tomorrow.

Explore more in-depth reviews of top trading tools and platforms in our toplist section. To discuss prop trading experiences and share insights with fellow traders, join Prop Firm & Trading Strategies of H2T Funding Community now!

![7+ Best no minimum trading days prop firm [New updated]](https://cdn.h2tfunding.com/wp-content/uploads/7-Best-no-minimum-trading-days-prop-firm-New-updated.jpg)