The prop firm industry recap 2025 reveals a market defined by strict consolidation and rigorous standards. Data from QuantVPS in 2025 shows that only 4% of forex traders secure funded accounts, while just 1% maintain them long-term. Notably, traders who risk under 2% per trade are 40% more likely to succeed than those taking higher risks.

If 2024 was the year of the Gold Rush, 2025 was the Reality Check. The era of cheap accounts and loose rules is over, replaced by a demand for sustainability. At H2T Funding, we analyze these critical shifts to help you navigate the changing landscape. This article reviews the key 2025 statistics and offers a data-driven roadmap for safe trading in 2026.

1. Prop firm statistics 2025: Pass rates and payouts

The Prop firm industry recap for 2025 depicts a market defined by explosive interest but ruthless standards. According to the Prop Firm App (2025), global search demand for prop firms surged by 5,625% since 2020.

This massive influx of retail participants has shifted the industry from a niche sector to a mainstream financial career path. The United States and India currently lead this expansion, each generating over 6,600 monthly searches.

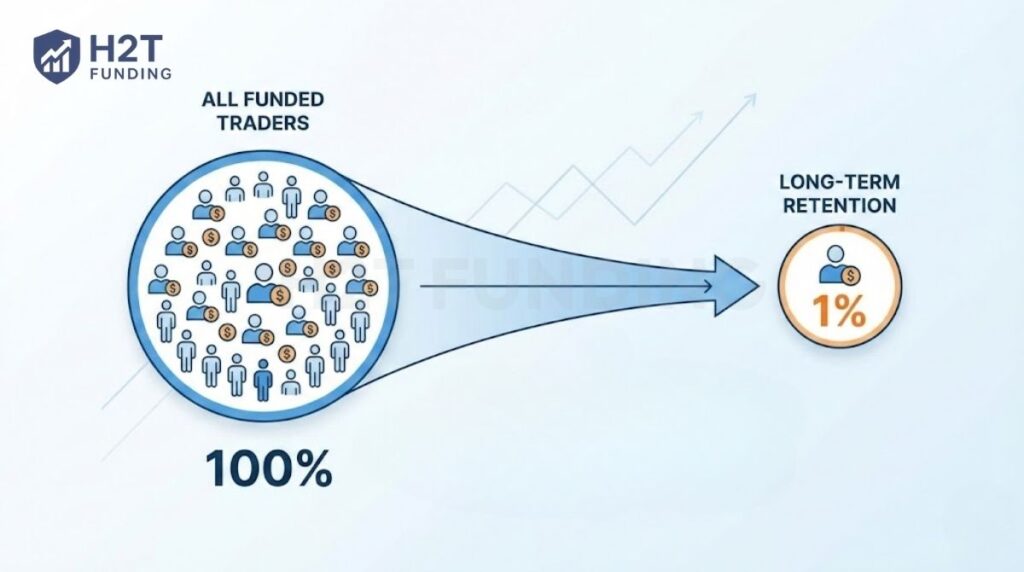

However, this popularity hides a harsh reality. Data from QuantVPS reveals that roughly 90% of traders fail the evaluation phase. Ultimately, only 4% of applicants secure a funded account.

1.1. The survival of the fittest (Pass rates & Risk)

The filter becomes even tighter post-funding. Statistics show that a mere 1% of funded traders manage to retain their accounts long-term, highlighting a critical gap in risk management skills.

Success, however, leaves clues. The data indicate that candidates who risk less than 2% per trade during evaluations are 40% more likely to pass than those using aggressive strategies.

This correlation proves that modern prop firms are designing challenges specifically to identify disciplined risk managers rather than lucky gamblers.

1.2. Evolution of payouts and profit splits

For the top 1% who succeed, the financial rewards in 2025 have become more competitive. While the 80/20 profit split remains the industry baseline, the market is aggressively shifting toward the trader’s favor.

Leading firms like Topstep and FundingTicks are now offering scaling plans that reach 90% or even 100% splits after specific milestones.

Furthermore, payout speed has replaced leverage as the primary selling point. Firms offering daily withdrawals are rapidly taking market share from those stuck on 14-day payment cycles.

1.3. Asset class preferences

The distribution of asset class interest in 2025 reveals an important imbalance between popularity and risk concentration. While stock trading remains dominant globally, it remains structurally underrepresented in the prop firm space due to regulatory constraints and higher capital requirements.

As a result, Forex continues to dominate the prop firm ecosystem, generating over 18,800 monthly searches for funded trading programs. Futures prop trading emerged as the fastest-growing alternative, with 13,300 monthly queries, driven by demand for regulated exchanges and transparent pricing.

However, 2025 introduced a new layer of risk within equities: extreme concentration. Nvidia became the defining stock of the year, repeatedly surpassing Apple and Microsoft to become the world’s most valuable listed company, with its market capitalization fluctuating between USD 4 trillion and USD 5 trillion.

By late 2025, Nvidia reported record quarterly revenue of USD 57 billion, up 62% year-over-year, fueled by relentless demand for AI infrastructure from hyperscalers. This dominance reshaped index behavior, increasing correlation risk across major equity benchmarks.

For prop traders, this meant fewer diversification benefits and higher exposure to single-name volatility, particularly for index-focused strategies. The lesson of 2025 was clear: asset popularity does not equal risk dispersion.

1.4. Gold price surge & its forex impact volatility

The 2025 gold market became one of the most influential macro drivers of Forex volatility, reshaping trader behavior and increasing risk across major prop firm evaluations. Gold prices surged from approximately US$2,600/oz in January 2025 to a historic record above US$4,300/oz, marking the metal’s largest annual gain in over 46 years (Investing News Network, 2025).

Throughout the year, gold rallied in nearly every month, supported by:

- Escalating geopolitical conflicts in Eastern Europe and the Middle East

- Turbulence from President Trump’s trade policies

- A reversal in Federal Reserve monetary policy

- Record ETF inflows and strong central bank accumulation (World Gold Council, 2025)

This powerful macro cocktail turned XAUUSD into one of the most volatile instruments across retail and institutional markets.

1.4.1. Quarterly performance highlights (verified from Investing News Network)

The metal finished the year with an annual gain of approximately 59.5%, placing it among the strongest-performing major assets globally. This scale of appreciation forced both institutional and retail participants to reassess gold’s role, no longer as a passive hedge, but as an active volatility engine across Forex and risk assets.

- Q1 2025: Gold gained 20%, breaking above US$3,000/oz for the first time.

- Q2 2025: Prices briefly exceeded US$3,500, driven by aggressive tariff actions and global equity stress.

- Q3 2025: Another record quarter, rising 15% to US$3,858/oz amid Fed rate cuts and declining bond yields.

- Q4 2025: Gold hit its all-time high of US$4,379.13 on October 17 before consolidating in the US$4,000–4,200 range.

Meanwhile, gold futures (GC) showed signs of compression near US$4,360, with price oscillating around the critical VC PMI pivot at ~4,363, indicating the market was coiling for another large move. Cycle maturity, harmonic Square of 9 resistance (4,375–4,410), and fading intraday momentum suggested a temporary consolidation phase rather than a breakdown.

1.4.2. How the 2025 gold rally impacted Forex traders in prop firms

Gold’s unprecedented rise had ripple effects that directly influenced Forex-focused prop traders:

1. Gold volatility spilled into USD pairs

Gold’s surge pressured the US dollar throughout much of 2025, amplifying volatility in:

- EUR/USD

- GBP/USD

- AUD/USD

- USD/JPY

Forex markets experienced wider spreads, faster intraday swings, and more stop-outs, especially during:

- Fed rate decisions

- Tariff announcements

- Geopolitical escalations

This higher volatility contributed to increased failure rates in prop firm evaluations, particularly for over-leveraged traders.

2. Prop firms tightened rules related to XAUUSD exposure

Due to extreme volatility and liquidity spikes:

- Many CFD prop firms reduced leverage on gold (some as low as 1:20).

- Others imposed news filters, position size caps, or restricted gold trading entirely during NFP and CPI events.

- Firms noticed that gold-related losses were the leading cause of account breaches.

This shift reinforced 2025’s movement toward risk-first evaluation frameworks, aligning with your article’s theme that the prop industry is prioritizing disciplined capital management over raw aggressiveness.

3. Trader behavior shifted toward safer intraday strategies

As gold’s volatility intensified with broad wicks, repeated liquidity grabs, and sudden macro shocks, traders were forced to evolve. Swing trading became less practical, prompting a move toward intraday strategies, tighter risk controls, and a stronger emphasis on hedging and inter-market correlation signals.

This aligns directly with the statistics showing traders who risk under 2% per trade have a 40% higher chance of passing (QuantVPS, 2025).

Gold’s 2025 rally was not just a commodities story; it was a macro shockwave that reshaped Forex volatility, influenced prop firm risk models, and altered trader performance outcomes. Understanding gold’s role in the broader financial ecosystem is now essential for any trader preparing to tackle prop firm challenges in 2026.

2. Major hot industry events of 2025

The prop firm industry recap for 2025 chronicles a brutal phase of survival of the fittest. Following the initial regulatory shocks of 2024, this year exposed the fatal flaws in unsustainable business models.

It wasn’t just small firms that vanished; industry giants and well-intentioned startups alike crumbled under the pressure of liquidity. The following events defined the market’s trajectory.

2.1. The failure of A-Book models: Funded Unicorn

In July 2025, the industry was shaken by the closure of Funded Unicorn, one of Germany’s prominent firms. Unlike competitors running B-Book (simulation) models, they reportedly operated a legitimate A-Book strategy.

By mirroring trades to the real market, they aimed for transparency. However, the firm cited massive losses and bureaucratic hurdles as the reasons for their sudden exit, proving that ethical models are not immune to failure without massive capital reserves.

2.2. Casualties of the price war: Propel Capital

By August 2025, the race to the bottom in pricing claimed Propel Capital. Just 14 months after launch, CEO Mitchell Ali announced the shutdown, admitting they could no longer compete with rivals offering aggressive discounts.

The financial reality was stark. Filings revealed the UK-based firm held just over £3,000 in assets against more than £150,000 in liabilities.

This collapse highlighted the mathematical impossibility of the deep-discount model. Firms selling accounts at a loss to acquire users eventually face a liquidity crunch they cannot escape.

2.3. CFD industry scale expands despite firm collapses

While dozens of prop firms collapsed throughout 2025, the broader CFD industry continued to expand in terms of user participation.

According to Finance Magnates Intelligence, the total number of active CFD accounts reached 5.92 million by Q3 2025, up from just over 5 million at the end of 2024. With only a narrow gap remaining and no signs of deceleration, the industry is widely expected to have crossed the 6 million active account threshold by year-end.

This made 2025 one of the most active growth years for CFD participation on record. The expansion was driven primarily by increased retail engagement across emerging markets, even as operational pressure forced many smaller firms to exit the market.

The contrast was striking: user growth accelerated while firm survivability declined. This divergence underscored a core problem of 2025, not a lack of demand, but a growing mismatch between participation growth and sustainable capital, liquidity, and infrastructure at the firm level.

2.4. Capital concentration intensifies as three brokers surpass $1T monthly volume

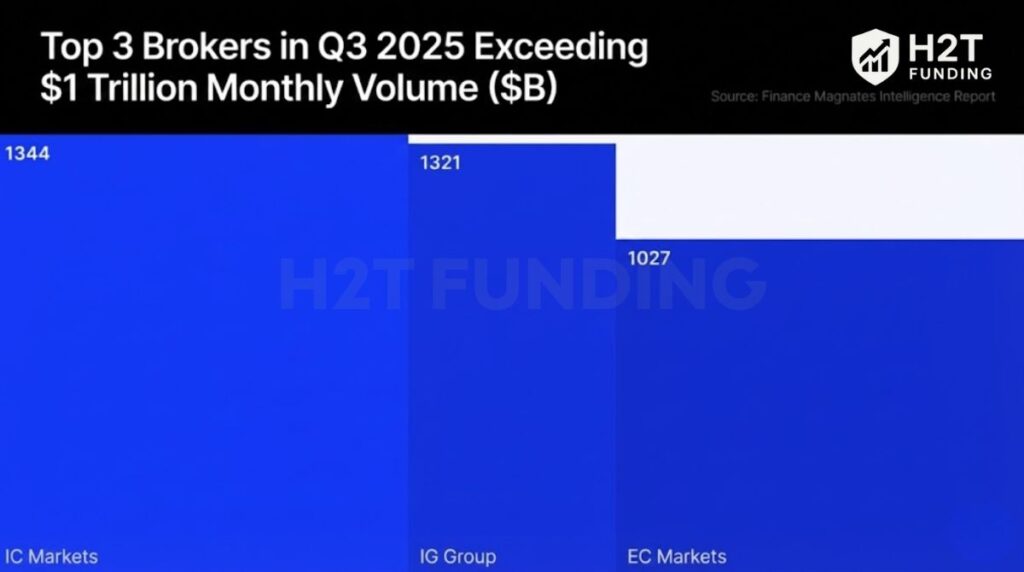

At the same time, trading volume became increasingly concentrated among the industry’s largest players.

In Q3 2025, Finance Magnates Intelligence reported that three brokers: IC Markets, IG Group, and EC Markets, each exceeded an average monthly trading volume of $1 trillion, marking the first time this milestone had been reached by multiple firms simultaneously.

Combined, these brokers accounted for nearly 15% of total reported global retail trading volume, excluding the Japanese market. This level of concentration highlighted a widening gap between dominant, well-capitalized brokers and smaller firms operating with thinner liquidity buffers.

For prop firms, this concentration had second-order effects. As liquidity, execution quality, and pricing advantages clustered around the largest brokers, smaller prop firms faced higher hedging costs and reduced margin for error. The industry was not shrinking; it was consolidating capital and flow into fewer, stronger entities.

2.5. The MetaQuotes crackdown aftershocks

The platform shakeout extended well beyond prop firms in 2025, driven by both technological transition and regulatory pressure.

According to Finance Magnates Intelligence, MT5 surpassed MT4 in total trading volume for the first time in Q1 2025, capturing 54.2% of combined MT4–MT5 volume, while MT4 declined to 45.8%. This marked a critical inflection point after nearly two decades of MT4 dominance, signaling an accelerated shift toward newer, multi-asset platforms rather than an abrupt or isolated replacement.

The trend continued throughout the year. By Q2 2025, MT5’s share expanded to 58.7%, and by Q3 2025, it reached approximately 62%, confirming that the transition was structural rather than temporary. This adoption curve was reinforced by MetaQuotes’ gradual reduction of MT4 support, broader instrument availability on MT5, and sustained broker incentives to migrate clients to the newer platform.

At the same time, regulatory pressure intensified with the full enforcement of the EU’s Digital Operational Resilience Act (DORA) in January 2025. Unlike earlier regulatory guidance, DORA imposed binding obligations related to system uptime, incident reporting, stress testing, and third-party technology oversight.

For smaller prop firms and brokers, the combination of platform migration costs and DORA compliance created a disproportionate financial burden. Licensing fees, infrastructure upgrades, and operational audits accelerated consolidation across the industry.

By year-end, the message was clear: firms unable to maintain resilient platforms, transparent execution, and regulatory-aligned infrastructure would not survive into 2026.

2.6. Payment rails under stress

In 2025, payout reliability became not only a liquidity issue but a payment infrastructure challenge. Major processors such as Deel, Rise, and Wise increased KYC and AML scrutiny, freezing or reviewing accounts when payout volumes spiked. In several cases, firms held sufficient funds but were unable to access them in real time.

This created a dangerous perception gap: firms appeared insolvent despite holding capital. In response, stronger firms adopted multi-rail payout systems, including on-chain stablecoin fallbacks. By year-end, crypto payouts had quietly shifted from a convenience feature to a structural necessity.

2.7. Infrastructure failures

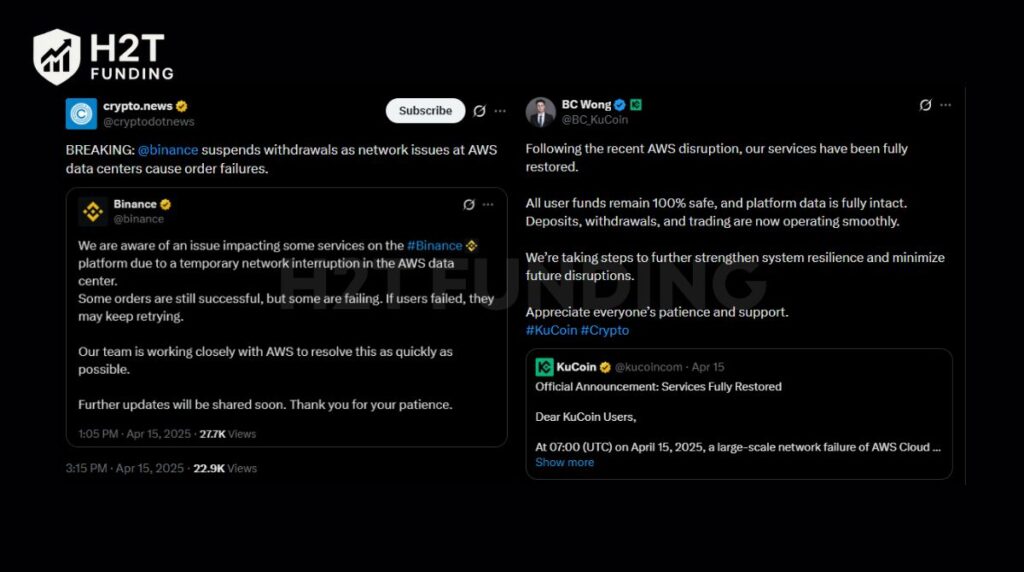

While regulatory pressure accelerated the collapse of weak prop firms, 2025 also exposed a deeper systemic vulnerability: infrastructure concentration.

Throughout the year, multiple cloud and data failures disrupted access to trading platforms worldwide. Early outages at Amazon Web Services temporarily halted withdrawals at major platforms such as Binance and KuCoin. Subsequent incidents affected Robinhood, Coinbase, and several consumer-facing financial services.

In the CFD and prop trading space, Cloudflare outages directly impacted brokers including XTB, Monaxa, Skilling, Xtrade, and FXPro, leading to execution delays and temporary trading suspensions. Finance Magnates Intelligence estimated that such disruptions cost an average CFD broker approximately USD 1.58 billion in lost trading volume, equivalent to nearly 1% of monthly revenue.

The most severe incident occurred when CME Group halted trading entirely following a cooling system failure at a CyrusOne data center, freezing prices across multiple futures markets. This event highlighted the fragility of centralized infrastructure supporting global trading.

For prop firms, these incidents accelerated a shift toward broker-backed execution, redundant systems, and platform diversification. In 2026, technological resilience is no longer optional; it is a prerequisite for survival.

3. Future outlook: Prop trading trends for 2026

The prop firm industry of 2025 signals a pivot from chaotic growth to technological maturity. With the market now valued at over $10 billion, the wild west era is ending.

In 2026, firms will evolve from simple funding sources into comprehensive Growth Partners. Success will no longer depend on high leverage, but on AI-driven performance optimization and democratized access to professional infrastructure.

3.1. The rise of AI-powered performance tools

The biggest evolution in 2026 will be the transition from static dashboards to intelligent, adaptive trading assistants.

- Predictive Risk Management: AI will not just flag breached rules; it will predict them. This transforms risk management from a penalty into a strategic advisory service.

- Behavioral Nudges: Algorithms will identify destructive patterns invisible to the trader, such as overtrading after a loss. The system may intervene with nudges, like temporarily locking position sizing to enforce discipline during emotional tilt.

3.2. Lowering the barrier to professional execution

Prop firms are democratizing technology previously reserved for hedge funds.

- Unified Trading OS: Traders will no longer juggle disjointed apps. Expect a single operating system where charting, execution, and journaling are deeply integrated. Your journals AI might suggest strategy tweaks that can be immediately back-tested within the same interface.

- Accessible Co-Location: High-frequency strategies will no longer require massive investment. Firms will offer one-click VPS solutions with guaranteed sub-millisecond latency to major exchanges, leveling the playing field for retail traders.

3.3. Dynamic, personalized rule sets

The one-size-fits-all model is becoming obsolete. In 2026, risk parameters will become adaptive based on trader data.

- Tailored Drawdowns: A trader with a proven, low-volatility statistical arbitrage strategy might automatically be granted a higher maximum drawdown than a high-risk scalper. Rules will be tailored to the proven risk profile of the specific strategy.

- Collective Intelligence: Beyond forums, firms will offer anonymous strategy benchmarking. You will see how your risk-adjusted return (Sharpe ratio) compares to the top 20% of traders using similar strategies, providing valuable market-relative feedback.

3.4. Global expansion and accessibility

The funded-trader model is exploding in emerging markets like Southeast Asia, Latin America, and Africa.

- Removing Capital Barriers: By eliminating minimum deposit requirements, firms are transforming trading from a wealth-based pursuit into a skill-based career.

- Skill-Over-Capital: This shift rewards process and consistency over bank balance, allowing talented traders in developing economies to access global liquidity without currency devaluation risks.

Summary for 2026: The future belongs to firms that offer Technology + Capital, not just Capital alone. Traders who embrace these AI tools and adaptive environments will have a distinct edge over those sticking to legacy models.

4. FAQs

The most significant shift was the Sustainability Shakeout. In 2025, the market moved away from aggressive growth at all costs models, leading to the collapse of several major firms that relied on low prices and high leverage. Simultaneously, the industry underwent a Great Platform Migration, forcing a mass transition from legacy MetaTrader servers to independent platforms like cTrader and DXtrade to ensure regulatory compliance.

You can verify a firm’s safety by applying the 48-Hour Rule. A legitimate firm should process payouts within 24 to 48 hours; any delay citing maintenance is a major red flag for liquidity issues. Additionally, always check for Radical Transparency: the firm must publicly disclose its broker partner and have a visible, verifiable CEO. If a firm operates anonymously or hides its execution source, it should be avoided.

Firms allowing HFT often use it as a bait-and-switch trap. They market HFT-passing services to collect easy challenge fees, knowing that HFT bots often breach toxic trading flow policies during the funded stage. This creates a conflict of interest where the firm accepts your money for the exam but legally refuses your payout, leaving you with a passed challenge but no withdrawable profits.

The difference lies in the business model’s sustainability. Futures firms (like Topstep or Apex) rely on recurring monthly data subscriptions, making discounts a normal part of their revenue stream. In contrast, CFD firms selling one-time fee accounts at massive discounts (e.g., 80% off) often operate on a Ponzi-like structure, needing an influx of new losers to pay existing winners. Therefore, deep discounts in CFD firms are a warning sign, whereas in Futures, they are standard practice.

5. Conclusion

Looking back at 2025, the message for traders is clear: consistency and transparency mattered far more than low prices or high leverage. The collapse of multiple prop firms exposed the weakness of models built on aggressive discounts, loose rules, and opaque operations.

If 2025 was about survival, 2026 will be about selection. The winners going forward will not be the firms offering the lowest entry fees, but those with proven liquidity, fast payouts, real broker backing, and resilient infrastructure.

For traders, this shift requires a more professional approach. Stop guessing and start trading safely. Visit H2T Funding today for the most up-to-date reviews and in-depth strategy guides to help you pass your next challenge.