When you put money into a prop firm, the fear of being scammed is real. Many traders worry about fees, payouts, and strict rules. So, is Topstep legit? Yes, Topstep is a real, long-standing prop trading company, not a scam.

Founded in Chicago and operating since 2012, Topstep focuses on futures trading and has paid thousands of traders. Still, doubts remain because not everyone passes the Trading Combine, and some complain about costs. In this guide, H2T Funding gives you a clear, balanced review so you can see how Topstep works, whether it’s worth it, and how it compares with other prop firms.

Key takeaways

- Topstep is legit, not a scam, with more than 10 years of history and a base in Chicago.

- Traders receive real payouts, including 100% of the first $10k and 90% after.

- The program runs on the TopstepX platform with account sizes up to $150k.

- Strict rules and combined fees cause many traders to fail before getting funded.

- Topstep suits disciplined futures traders, while other prop firms may fit forex or broader markets.

1. What is Topstep, and how does it work?

Topstep is a prop trading company founded in 2012 in Chicago. It focuses on futures trading, giving traders a chance to prove consistency without risking personal funds. The journey starts with the Trading Combine, a simulated evaluation where you must hit profit targets and respect rules like the maximum loss limit and daily drawdown.

Currently, all new accounts must be traded on the TopstepX platform, the firm’s in-house software designed for evaluation and funded stages. If you succeed, you can qualify for funded accounts ranging from $50,000 to $150,000, depending on your chosen starting size.

One of Topstep’s most attractive features is its profit split structure. Traders keep 100% of their first $10,000 in cumulative payouts. After reaching that threshold, the split moves to 90% for the trader and 10% for Topstep. This rule applies across all funded accounts and is based on lifetime cumulative payouts, offering fair upside for consistent performers.

Continue reading:

2. Is Topstep legit? Is Topstep a scam?

The short answer: Topstep is legit, not a scam. The company has operated since 2012, is based in Chicago, and has built a strong reputation in prop trading for futures. It is regularly mentioned in trusted media like Forbes and Investopedia, which strengthens its credibility.

Topstep has a clear withdrawal process that many traders have confirmed receiving. The firm is transparent about its rules, such as the maximum loss limit and profit targets, so there are no hidden traps if you read the guidelines carefully. Reliable customer support also helps traders resolve issues during the Trading Combine or funded stages.

But let’s be real: just because it’s legit doesn’t mean it’s easy money. The hard truth is, most traders wash out. They either can’t handle the strict rules or their strategy just isn’t cut out for it. That isn’t Topstep being fake; that’s just the reality of the prop trading game. It demands serious discipline and a reality check on your expectations.

3. Is Topstep regulated?

No, Topstep is not regulated by any government body or the NFA. Unlike a traditional broker, Topstep is a financial technology company that provides simulated accounts for evaluation. Because it does not hold client deposits or act as a counterparty, it falls outside the typical regulatory framework.

The firm is not a member of the National Futures Association (NFA), which is the main self-regulatory body for futures in the U.S. Instead, its role is to offer a platform where traders can prove their skills in a real-time simulated trading environment before accessing firm-funded accounts.

This distinction often confuses. Lack of direct regulation does not make Topstep a scam; it simply means traders must understand that they are joining a prop trading evaluation program, not a licensed brokerage service.

4. Proof Topstep is a legit company

Topstep has been in business since 2012, headquartered in Chicago. Over more than a decade, it has built a strong reputation in futures prop trading, surviving while many newer firms have shut down.

The company has been recognized by major media and business outlets. It appeared in Forbes, MarketWatch, FOX Business, and Crain’s Chicago Business. It was also listed in Inc. 5000 and received the FIA Innovator Award. These mentions confirm Topstep’s visibility beyond just the trading community.

Topstep also ensures transparency in its payout model. Traders keep 100% of their first $10,000 in lifetime cumulative payouts, and then shift to a 90/10 split. The rules are published openly on their Help Center, showing clarity in how earnings are shared. The platform also enforces trading guidelines like the consistency rule, which promotes disciplined and sustainable performance among funded traders.

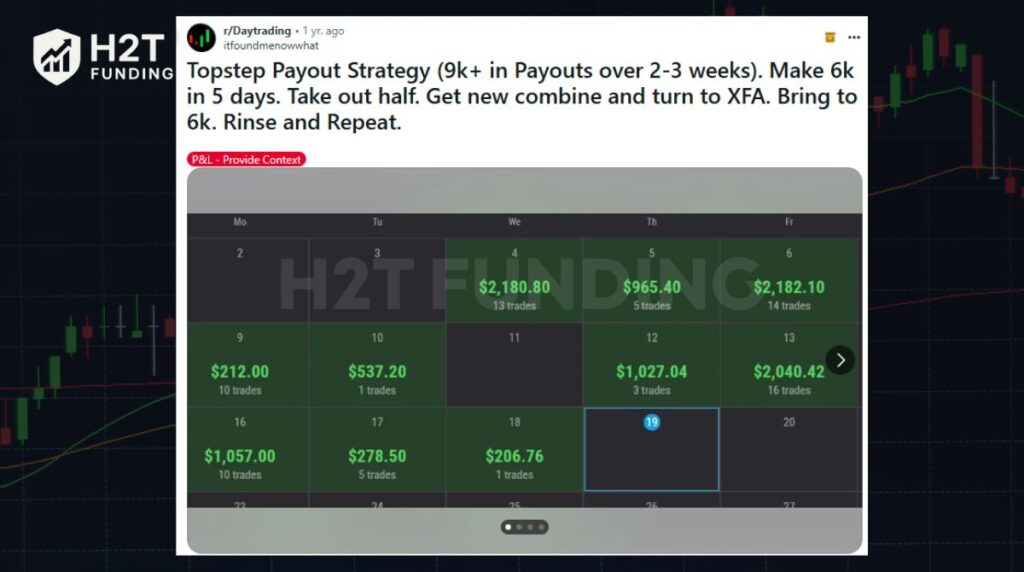

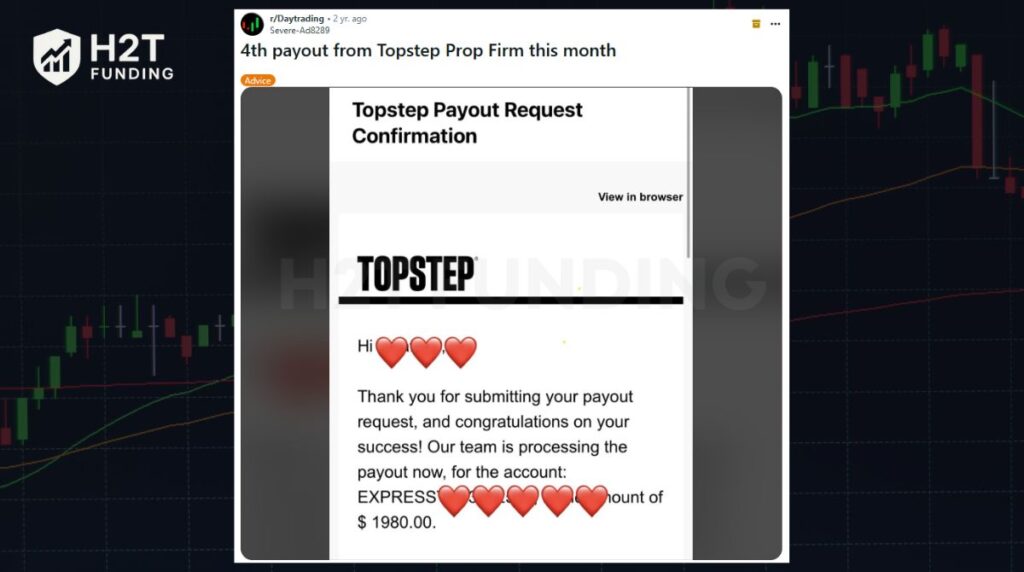

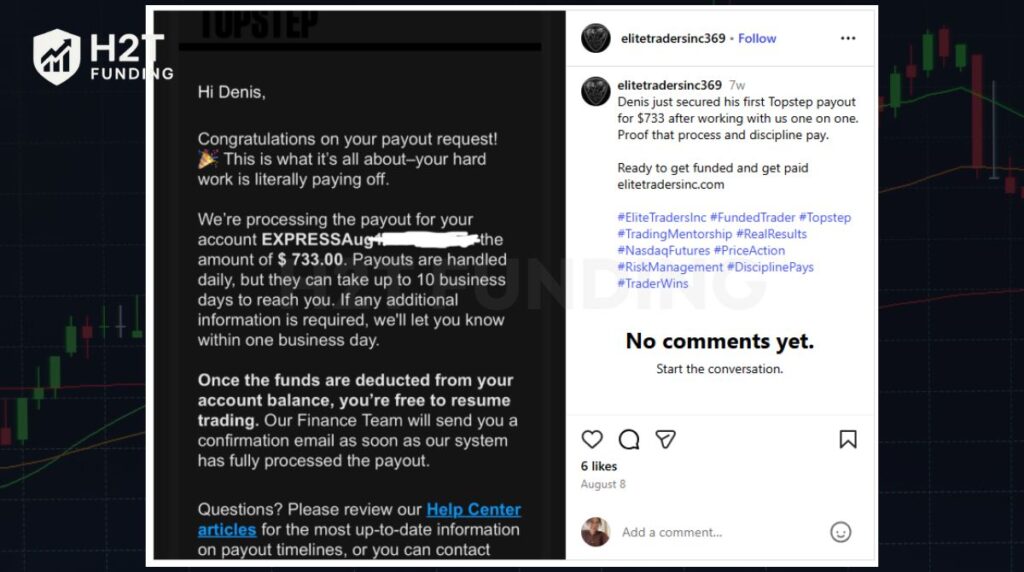

But you don’t just have to take my word for it. I’ve spent time digging through forums and social media, and the proof is out there if you look. For example, you’ll find:

- Traders on Reddit are posting screenshots of their P&L calendars showing $9,000+ payouts.

- Others are sharing the actual confirmation emails they got from Topstep for amounts like $1,980.

- Even on Instagram, I saw a trader showing off his first $733 payout.

These real cases confirm that Topstep does pay out when traders meet the rules. While not every trader will succeed, the company itself has demonstrated legitimacy through years of operation, media recognition, and transparent payouts.

5. Advantages and disadvantages of Topstep

Like any prop trading firm, Topstep has clear strengths but also challenges that traders should consider. Understanding both sides helps you decide if this futures-focused program matches your goals.

| Pros | Cons |

|---|---|

| Long history since 2012, based in Chicago, well recognized in futures trading. | Not regulated by NFA or other government agencies. |

| Transparent profit share: 100% of first $10k, then 90/10 thereafter. | Combined fees can add up if you fail multiple times. |

| Dedicated TopstepX trading platform built for evaluation and funded trading. | Limited platform choice, new accounts must use TopstepX only. |

| Clear rules: maximum loss limit, daily drawdown, and profit targets published openly. | Strict rules mean many traders fail before reaching the funded stage. |

| Proven payouts confirmed by community reviews and official case studies. | Mainly supports futures trading, no forex or stock trading. |

| Strong customer support and educational resources for traders. | Some traders feel rules are restrictive compared to other prop firms. |

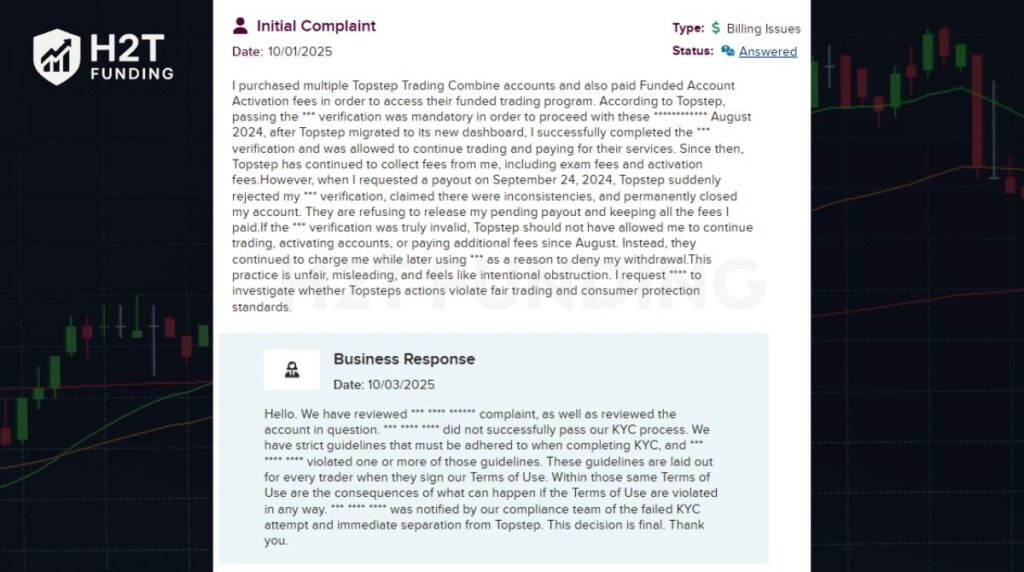

While Topstep is not considered a scam, there have been isolated user complaints that raise concerns. On Reddit, some traders reported delays or denials in payout requests, usually due to rule violations or incomplete verification steps.

The Better Business Bureau (BBB) has also recorded several complaints involving account closures or payout disputes, where users claimed their accounts were deactivated before they could withdraw profits.

Although many of these cases were resolved, they highlight the importance of fully understanding the firm’s trading and payout rules before committing.

In summary, Topstep offers transparency, proven payouts, and a strong track record, which makes it attractive for serious futures traders. However, its strict rules, evaluation costs, and lack of NFA regulation can be deal-breakers for some.

6. Compare Topstep with other Prop Firms

Look, no prop firm is perfect, and Topstep is no exception. Before you jump in, it’s smart to weigh the good against the bad. Knowing what you’re getting into will help you decide if their futures program is actually the right fit for you.

| Feature | Topstep | FTMO | The Funded Trader | Apex Trader Funding |

|---|---|---|---|---|

| Challenge Fee | $49 – $375 (Trading Combine) | €89 – €1,080 | $49 – $1,265 | $147 – $687 (often discounted) |

| Account Sizes | $50K – $150K | $10K – $200K | $5K – $200K | $25K – $300K |

| Profit Split | 100% first $10K, then 90/10 | 80% – 90% | 75% – 95% | 90% – 100% |

| Trading Platforms | TopstepX (proprietary) | MT4, MT5, cTrader, DXTrade | MT4, MT5, cTrader, Match-Trader | NinjaTrader 8, Tradovate, WealthCharts |

| Markets Offered | Futures only | Forex, commodities, indices, stocks, crypto | Forex, commodities, indices, crypto | Futures (equity indices, currencies, commodities, interest rates, crypto) |

| Profit Target | 6% | 5% – 20% | 8% – 10% | 6% |

| Time Limit | No hard limit, must stay active | No time limit | No time limit | No time limit |

| Special Notes | Pioneer in futures prop trading, strict rules & transparency | Most popular for forex traders worldwide | Flexible (1-step, 2-step, 3-step auditions) | Large futures-focused firm with aggressive discounts |

Each prop firm serves a different type of trader. Knowing which one fits your style can save you time and money before starting an evaluation.

- Topstep is most suitable for futures traders who value structure, strict rules, and a proven firm with a decade-long history.

- FTMO is ideal for forex and multi-asset traders seeking platform flexibility and global recognition.

- The Funded Trader fits risk-takers and flexible learners who want different audition options and higher profit splits.

- Apex Trader Funding is best for high-volume futures traders looking for larger account sizes, discounted fees, and generous profit splits.

In short, there is no one best firm for everyone. Topstep shines in futures, FTMO leads in forex, TFT gives flexibility, and Apex offers scale. The right choice depends on your market focus, risk tolerance, and trading strategy.

7. Real experience from a Trader (community review)

When you dig into what other traders are saying, you’ll see two very different stories playing out. On one hand, you have a ton of traders posting proof of their payouts and praising the platform. But it’s not all positive. For every success story, you’ll find someone who feels burned by the strict rules or costs.

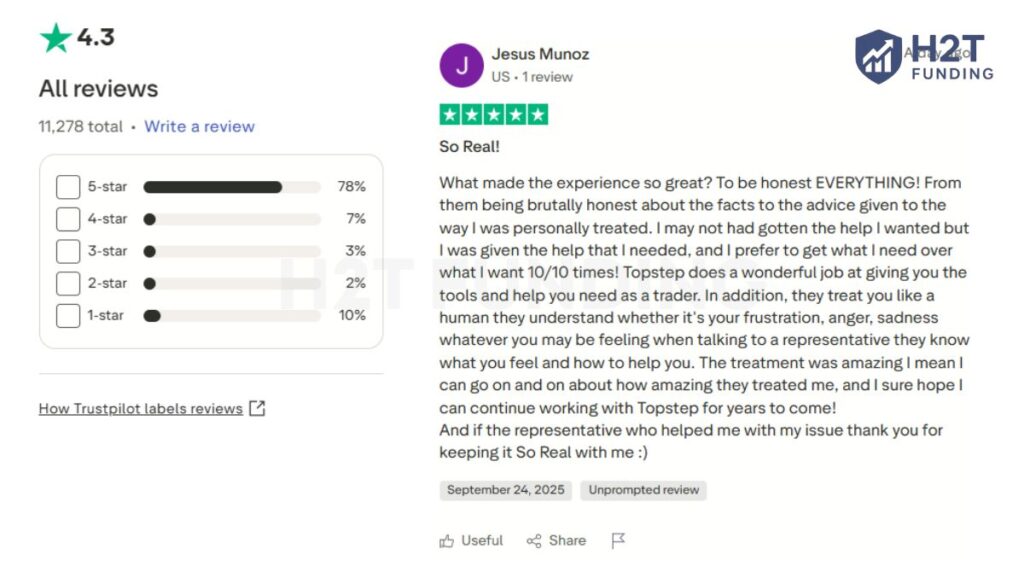

On Trustpilot, Topstep holds a 4.3-star rating across 11,000+ reviews, with 78% being 5-star, a strong endorsement compared to many other prop firms.

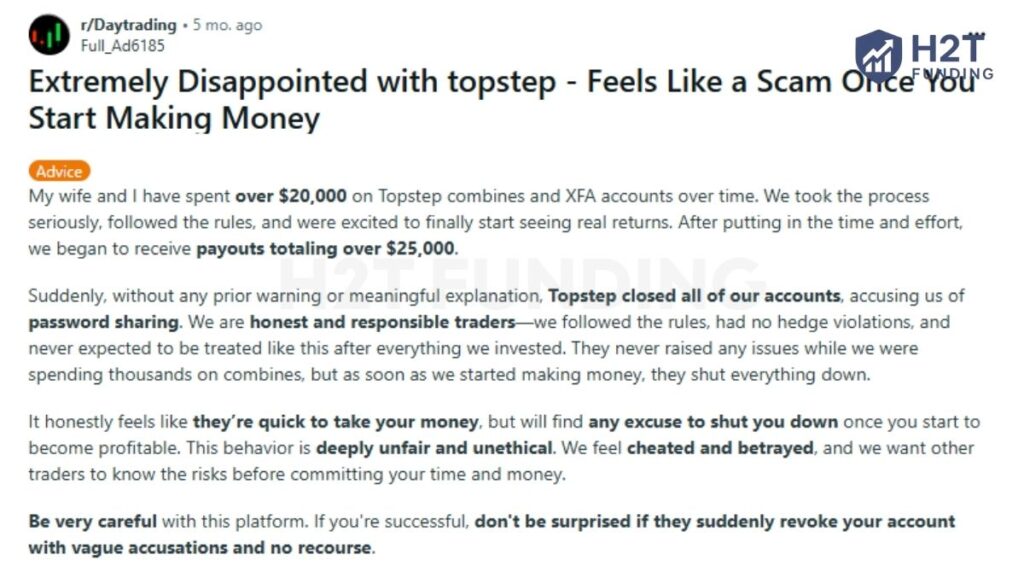

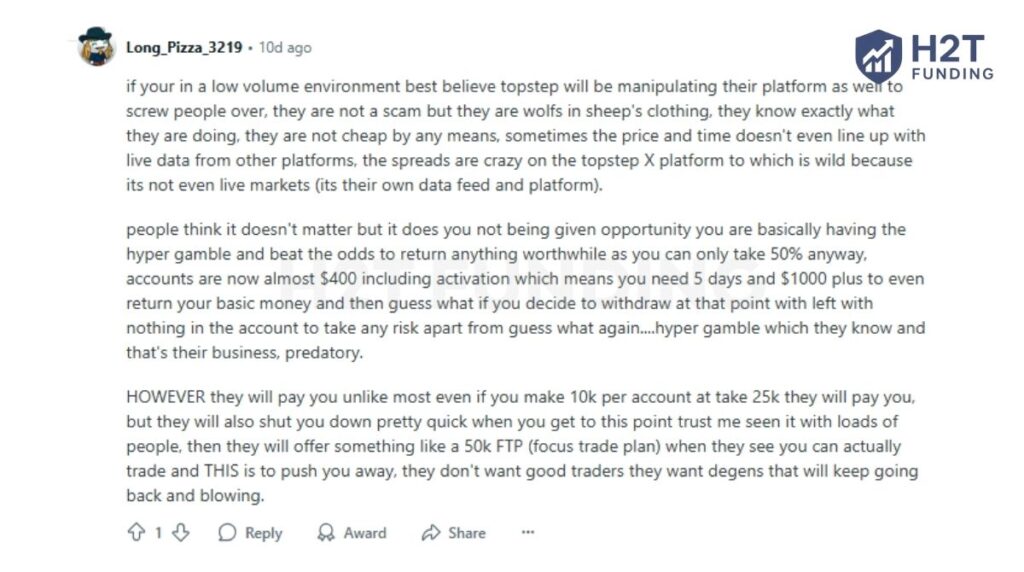

However, not all feedback is glowing. Some traders complain about fees and the strict enforcement of rules. For example, one Reddit user claimed that after earning over $25,000 in payouts, their accounts were suddenly closed due to alleged violations, leaving them frustrated and betrayed.

Other customer feedback concerns about the TopstepX platform spreads and payout conditions, describing the firm as tough on traders who reach consistent profits. Still, even these critics admit Topstep does pay out, though they feel the rules are designed to filter aggressively.

In short, Topstep is praised for real payouts and support, but criticized for strict rules and costs. Traders who approach it with discipline and realistic expectations often succeed, while those who underestimate the evaluation challenges may see it as unfair.

8. Topstep FAQs

No. Topstep is not a scam. The firm has been active since 2012, is based in Chicago, and has been featured in outlets like Forbes and MarketWatch. While some traders complain about rules, there is no evidence of Topstep being fraudulent.

Yes. Many traders confirm receiving real payouts. The company’s structure gives 100% of your first $10,000, then shifts to a 90/10 split. Payout confirmations are widely shared on Reddit, Trustpilot, and social media.

Yes, for disciplined futures traders. Topstep is worth it if you want structure, transparency, and a chance to grow with firm capital. It may not be worth it if you prefer forex or dislike strict trading rules.

Not directly. Topstep is better for futures traders, while FTMO offers broader markets like forex, stocks, and crypto with MT4/MT5 platforms. The best choice depends on your market focus.

Yes. Beginners can join, but success is not easy. Passing the Trading Combine requires consistency, respect for the maximum loss limit, and patience. Many first-time traders fail without preparation.

Yes. Once you’re funded, payouts are made in real USD to your account. The company processes requests within a few business days, with confirmed cases ranging from hundreds to thousands of dollars.

Topstep charges monthly fees for the Trading Combine, starting around $49 and up to $149 depending on account options. If you fail, you must pay again to restart. These fees are how Topstep runs its evaluation model.

Most failures are due to breaking risk rules, like daily loss or trailing drawdown. Others fail because of a poor trading strategy or treating the combination like gambling. Success requires discipline and risk management.

You request payouts directly from your funded account dashboard. To protect your account, trade consistently, avoid rule violations, and never ignore the maximum loss limit. Following guidelines strictly is key to keeping access.

Yes. Proof of payouts is abundant online. Traders report multiple successful withdrawals, with some earning over $25,000 before account closure disputes. The majority confirm that payouts are real.

Cons include recurring commission fees, strict rules that reset your progress, futures-only markets, and the fact that Topstep is not NFA-regulated. Some also dislike being limited to the TopstepX platform.

Topstep does not publish exact data, but community estimates suggest that only a small percentage of traders pass. This aligns with prop firm industry averages, where most fail due to poor discipline or unrealistic expectations.

No. Topstep is not a broker. It is a financial technology prop firm offering simulated accounts. Because it doesn’t hold client deposits, it is not regulated by the NFA or government financial bodies.

No. Even if you hit the profit target quickly, the rules require trading across multiple days to prove consistency. Passing in one day is not possible under the current guidelines.

If you fail, your account closes. You can restart by paying for a new Trading Combine. Many traders go through multiple combinations before passing. There is no permanent ban.

Yes. Reddit shows both sides. Some traders share real payout screenshots, while others complain about strict rules or account closures. The general consensus: Topstep is legit, but success requires discipline.

9. Conclusion

So, is Topstep legit? Yes. The firm has more than a decade of history, pays traders through a clear profit split, and is widely recognized in the futures trading space.

If you are asking Is TopstepTrader legitimate, Is Topstep legit, or Is Topstep trader legit, the answer remains the same: Topstep is a real prop firm, though its strict rules and fees mean not everyone succeeds. For those still wondering how legit Topstep is, the best way to decide is by matching its model with your own trading discipline.

To dive deeper, explore our Prop Firm & Trading Strategies section on H2T Funding for more reviews and guides that compare firms and share practical trading methods.

You’ve distilled a complex topic into something very manageable.

Thank you for reading my article