Do you ever wonder where your paycheck goes before the month is over? Learning how to track expenses can be the game-changer your finances need.

Tracking expenses gives you more than numbers; it gives you control. Studies from the U.S. Bureau of Economic Analysis show that the average American spends nearly as much as they earn. Without a clear system, overspending becomes a habit.

This guide from H2T Funding is for working adults, students managing loans, freelancers with fluctuating incomes, and families juggling bills. I started budgeting out of necessity, using a spreadsheet and later switching to apps. That shift helped me save for emergencies, invest consistently, and cut back on wasteful spending. You can follow these steps to get the same results.

Key takeaways:

- Expense tracking means recording, organising, and reviewing how your money moves. It helps you understand spending patterns, stay accountable, and make informed financial decisions.

- Tracking expenses gives you control over your finances, helping you avoid overspending, align with your income cycle, and identify patterns that impact your budget.

- Starting with clear financial goals and a tracking method that fits your lifestyle is key, whether it’s a manual spreadsheet, a budgeting app, or bank summaries.

- Logging every expense, daily or weekly, builds strong money habits, and a monthly review helps you adjust your budget to stay on track and reach your goals faster.

- Expense categories like rent, food, transportation, and subscriptions should be monitored closely, especially for spotting leaks or reducing non-essential spending.

- Staying consistent is the secret to success. Build simple routines, track honestly, and adjust regularly; these small habits make expense tracking effortless and sustainable over time.

1. What is expense tracking?

Expense tracking means keeping a clear record of where your money goes, whether it’s daily coffee runs, monthly bills, or yearly subscriptions. It’s the practice of recording, organising, and reviewing your spending to understand how your income is used.

For individuals, expense tracking helps you stay aware of your financial habits, avoid overspending, and plan for future goals. For small businesses or freelancers, it also means keeping track of operational costs, software subscriptions, and reimbursements, all to ensure every dollar serves a purpose.

2. Why should you track your monthly expenses?

Tracking your monthly expenses isn’t just a good habit; it’s the foundation of smart money management.

Here’s why it matters:

- Most of your financial life runs on a monthly cycle: Rent or mortgage, utility bills, subscriptions, and credit card statements are due every month. When you track expenses every month, it’s easier to match spending with income and avoid late payments or surprises.

- It helps you spot spending patterns: Maybe you’re spending more on food delivery than you thought, or streaming subscriptions are quietly eating into your budget. A monthly view helps you see what’s going on and what needs to change.

- It makes saving for big goals more realistic: Want to save for a down payment, a vacation, or pay off debt? Monthly tracking shows where you can cut back and how much you can set aside without guessing.

- It aligns with how most people get paid: Whether your paycheck comes weekly, biweekly, or twice a month, monthly tracking provides a clear picture of what you can afford, and when.

- It builds better habits over time: The more consistently you track, the more aware and intentional you become with money. And that’s the first step toward financial confidence.

If monthly feels too frequent or overwhelming, you can always start small, even reviewing your spending every three months is better than none. But once you see the benefits, monthly tracking will likely become your go-to routine.

3. What you need to start tracking expenses

If you’re wondering how to track expenses effectively, it starts with building the right foundation. To succeed, you need both financial awareness and the right tools. Begin by laying the right financial foundation.

Expense tracking is about understanding how to track your money and making your spending reflect your priorities. The right setup helps you stay consistent and develop better financial habits that last for years.

3.1. Analyse your income, spending, and overall financial picture

Before you start tracking your expenses, take a moment to understand your financial reality. You can’t manage what you don’t measure. Knowing where your money comes from and where it goes lays the groundwork for smarter budgeting decisions.

If your goal is to make better use of your salary, check out this related guide: Best budget for single person earning $100k; it’s a practical example of how to align income and lifestyle spending efficiently.

3.1.1. Know your income sources

Start by calculating your net income, your earnings after taxes and deductions. Include:

- Salary or wages

- Freelance income

- Passive income (investments, rental income, etc.)

Knowing your real take-home pay is critical. Gross income gives a false sense of security, while net income shows what you can actually use. If you have multiple income streams, this becomes even more important when learning how to track finances or how to control monthly expenses efficiently.

You can also explore how to make extra income to diversify your earnings and boost savings.

3.1.2. Recognise where your money typically goes

Understanding your spending patterns is just as important as knowing your income. Break expenses into:

- Fixed expenses: Rent or mortgage, insurance, subscriptions

- Variable expenses: Groceries, transportation, dining, entertainment

Use a pie chart or visual tracker to see how your money flows each month. You can do this easily in Excel, Google Sheets, or even Canva. This visualisation makes tracking your expenses simple and helps identify areas where you can cut back or reallocate funds.

For a smart long-term balance between spending and investing, see the 3-fund portfolio by age.

3.2. Go with a tracking method you’ll actually use

When deciding how to track expenses, selecting a method that suits your lifestyle is key. It’s also crucial if you want to figure out how to keep track of expenses long-term without burnout.

Here are three common approaches:

3.2.1. Manual tracking (Notebook or spreadsheet)

Best for detail-oriented minimalists who like a hands-on approach. Create a simple log with:

- Date

- Category

- Amount

- Notes (optional)

Pros: Total customisation and no reliance on apps or internet access.

Cons: Time-consuming and prone to human error.

If you prefer a more personal approach, this simple way to track expenses is great for learning how to track expenses manually and staying mindful of every dollar you spend.

3.2.2. Digital budgeting apps

Tools like YNAB (You Need a Budget), PocketGuard, and Goodbudget make keeping track of expenses easier than ever. They often include:

- Automatic bank syncing

- Custom goals and category setup

- Real-time spending alerts and reports

Choose an app based on your comfort level and goals. Some prioritise automation, while others offer flexibility for those who want to stay hands-on.

3.2.3. Bank/Credit card expense summaries

Most banks (like Chase or Capital One) provide categorised spending summaries online.

Tip: Log in to your account monthly to review transactions or export them to Excel. Combining these summaries with your app or spreadsheet ensures complete accuracy, a crucial step when learning how to track spending consistently.

4. How to track expenses: A step-by-step guide to start tracking today

If you’re ready to take action, here’s a simple guide on how to track expenses starting right now. This is the exact method I used when I finally decided to take my finances seriously, and it worked. Now, I’m sharing it with you so you can start seeing results too.

Let’s break it down into a few simple steps so you can follow along easily:

- Step 1: Set clear, realistic financial goals.

- Step 2: Choose a tracking method that fits your lifestyle.

- Step 3: Log every expense consistently.

- Step 4: Review and adjust your budget each month.

Keep reading to see how each step works in practice and start building your own expense tracking routine today.

4.1. Step 1 – Set financial goals

Start with a specific, realistic target to guide your spending habits.

Examples:

- Save $500/month towards an emergency fund using a high-yield savings account.

- Pay off $3,000 in credit card debt over 6 months by setting aside $500 each month.

If you’re unsure what to prioritise, the 70-20-10 rule offers a simple framework for dividing your income between needs, savings, and personal goals.

Tip: Use the SMART framework, make your goal Specific, Measurable, Achievable, Relevant, and Time-bound.

Here’s how to apply it:

- Specific: Define exactly what you want to achieve (e.g., build a $1,000 emergency fund).

- Measurable: Make sure you can track your progress (e.g., save $100 each month).

- Achievable: Set a goal that fits your current income and expenses.

- Relevant: Focus on goals that support your bigger financial picture.

- Time-bound: Set a clear deadline (e.g., reach your savings goal in 10 months).

Using SMART helps turn vague ideas like “I want to save more” into clear, realistic goals you can actually stick to, and it helps when you’re thinking about how to keep track of expenses toward your goals.

Have you ever faced short-term financial pressure, learn how budgeting advances work. They can help cover essentials while keeping your plan on track.

4.2. Step 2 – Choose a tracking method

When learning how to track expenses, it’s important to pick a method that suits your lifestyle and comfort level with technology. Below is a quick comparison of the three most common options:

| Tracking Method | Best For | Pros | Cons |

|---|---|---|---|

| Manual (Notebook or Spreadsheet) | People who prefer a hands-on approach | Syncs with your bank Tracks and categorises spending automatically | Time-consuming Prone to human error |

| Budgeting Apps (YNAB, PocketGuard) | Tech-savvy users who want automation | Automatically tracks and categorises No setup required | May require a learning curve Some apps have fees |

| Bank/Credit Card Summaries | Those who want a simple, no-fuss method | Automatically tracks and categorizes No setup required | Limited customization May miss cash or peer-to-peer spending |

Explore the difference between active and passive income to better understand how each income type affects your tracking and long-term financial growth.

4.3. Step 3 – Log every expense (Daily or weekly)

Develop a consistent routine:

- Daily Tracking: Log every expense immediately using your app or a paper notebook. Great for those working toward tight goals.

- Weekly Review: Set aside 10–15 minutes every Sunday to record and reflect on expenses.

Example: If you spend $13.50 on lunch, log it under “Dining Out” as soon as you pay or batch-enter it later that night. Habits like this are essential when learning how to track expenses effectively.

4.4. Step 4 – Review & adjust monthly

When the month ends, review:

- Which categories did you overspend in (e.g., dining out, subscriptions)

- Unexpected expenses that weren’t budgeted (e.g., emergency dentist visit)

Action Steps:

- Shift funds between categories to balance your budget.

- Reduce discretionary spending or tweak savings contributions as needed.

- Set one improvement goal for the next month (e.g., cut coffee runs by 50%).

Example: In January, you overspent $70 on dining out. In February, set a $100 cap and try meal prepping more often.

See more related articles:

5. How to track expenses on Reddit

Reddit is one of the best places to explore how real people manage their money and track spending in everyday life. Across finance communities, users share personal systems, from structured budgeting to simple tracking routines that keep them accountable.

Many Reddit users highlight the difference between budgeting and expense tracking, and how both can complement each other. While some prefer to plan with detailed budgets, others focus on tracking real-time spending to stay flexible. This balance helps them stay in control without feeling restricted.

Several posts show how people use tools like YNAB, PocketGuard, or manual spreadsheets to track expenses as a couple or individually. Some even review their spending weekly or set small “budget meetings” to stay on the same page financially. It’s a practical, low-stress way to stay consistent.

Discussions in personal finance subreddits also reveal a mix of tracking habits; some users prefer Google Sheets or Excel for full control, while others rely on mobile apps for automation. The key insight is that there’s no universal method; what matters most is choosing a routine you can maintain long-term.

Many Redditors recommend keeping systems simple. Apps like Ivy Wallet or ExpenseEasy, for example, allow quick daily logging with minimal setup. These tools make it easier to stay aware of where your money goes and build steady financial habits over time.

Overall, Reddit offers a genuine view of how people approach expense tracking differently, proving that consistency and awareness matter far more than complexity. Whether through apps, spreadsheets, or simple notes, the shared experiences show that staying mindful of spending is what truly drives progress.

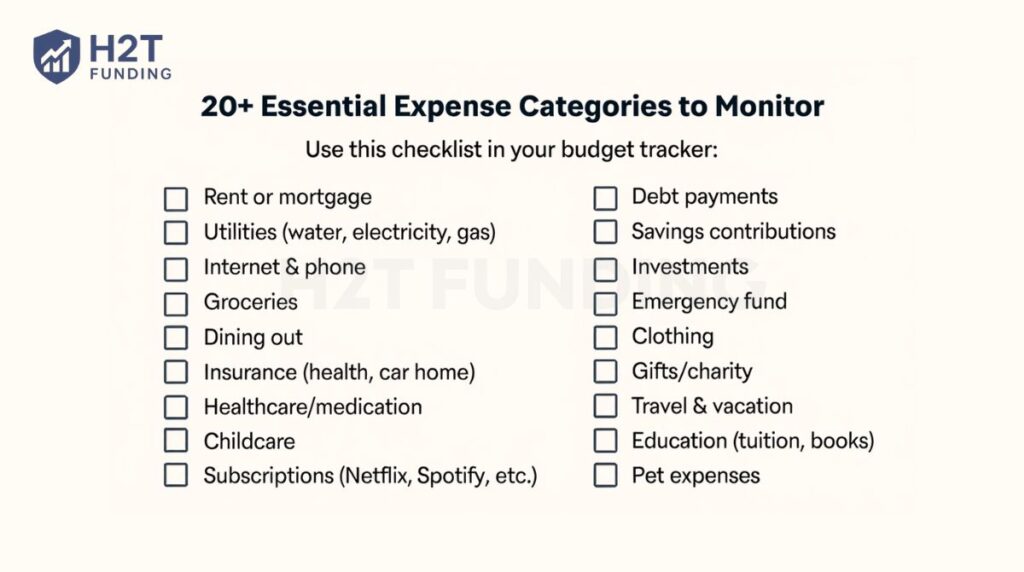

6. 20+ Essential expense categories to monitor

Use this checklist in your budget tracker below:

7. Tips to stay consistent with expense tracking

When I first started tracking my expenses, I thought it would be easy, note what I spend and call it a day. But two weeks in, I realised the hardest part wasn’t starting, it was sticking with it. Staying consistent felt like a chore at first, until I built a few small habits that made it part of my daily rhythm. Here’s what helped me stay on track:

- Build a daily or weekly routine: I started setting aside 5 minutes before bed to log my expenses. It’s now second nature, just like brushing my teeth. Pick a time that works for you and make it a small, non-negotiable part of your day.

- Be completely honest: At first, I skipped tiny expenses like snacks or parking fees. Big mistake. Once I started logging everything, I finally saw where my money was quietly disappearing.

- Automate when you can: I used to rely on memory and always forgot something. Connecting my bank to an app like YNAB or using expense summaries saved me hours and gave me a clearer picture of my spending.

- Review and adjust regularly: Every month, I’d look at my categories and notice patterns; groceries were fine, but “dining out” always crept higher. Instead of feeling guilty, I just adjusted my budget to reflect reality.

- Reward your consistency: After my first full month of tracking, I treated myself to a nice dinner, guilt-free this time. Celebrating progress kept me motivated to continue.

Over time, expense tracking stopped feeling like an obligation and started feeling like a tool for confidence. I no longer wonder “Where did my money go?”. I already know. Once you turn it into a habit, tracking your expenses becomes less about control and more about clarity, and that’s when real financial freedom starts.

8. FAQs

The quickest way is to download a free budgeting app like YNAB or PocketGuard. These apps connect to your bank accounts and automatically categorise your spending, saving you time while giving you a clear picture of your habits.

Yes, especially during your first few months. Logging every transaction, even small ones like a $3 coffee, builds awareness and helps identify patterns you may not notice otherwise.

Use either your lowest recent income month or a 3-month average to create a conservative baseline. This ensures you don’t overcommit during higher-earning months and prepares you for leaner periods.

Start with the 50/30/20 guideline: 50% needs, 30% wants, 20% savings/debt. Treat it as a baseline, adjust for your reality (e.g., high rent city → 60/20/20). Recheck the mix monthly and shift percentages as goals change.

Definitely, even if you’re saving, expense tracking helps optimise your finances, showing where you can save more, spend more intentionally, or spot leaks in your budget. It turns passive saving into active financial management.

It’s a simple budgeting split: 50% for needs (housing, utilities, groceries), 30% for wants (dining, travel, hobbies), 20% for savings or debt payoff. Use it to set guardrails, then tweak the percentages to fit your situation.

Pick a medium (app, spreadsheet, or notebook). Create categories (housing, food, transport, subscriptions, etc.). Add columns for date, description, amount, and payment method. Log transactions daily or weekly, then review totals at month-end.

Use one quick rule: log purchases the same day. Enable bank notifications, keep receipts in one spot, and set a 5-minute nightly check-in. For impulse control, set a 24-hour wait on non-essential buys over a set amount.

The easiest way to start tracking expenses is to download a budgeting app like YNAB or PocketGuard and connect it to your bank accounts. The app automatically imports and categorises transactions so you can see your spending instantly. If you prefer something simpler, start with a spreadsheet or a notes app before upgrading later.

Yes, especially when you’re just starting. Recording small expenses like snacks, coffee, or rideshares helps reveal where your money really goes. Once you understand your habits, you can group minor purchases into a single “miscellaneous” category to save time.

Manual (notebook/sheet) gives maximum control and awareness but takes time. Apps automate imports and categorisation, saving effort but needing occasional recategorization. Choose the option you’ll stick with; consistency beats method.

Do quick daily checks (or a weekly 10–15 minute session) and a full monthly review. In the monthly review, compare actual vs. plan, adjust category limits, and set one improvement target for the next month.

Tie tracking to clear goals (debt-free date, travel fund, emergency cushion). Keep the system lightweight, celebrate monthly wins, and automate as much as possible. If you miss a few days, restart, progress over perfection.

Agree on shared goals and category limits, use a joint app or shared sheet, and schedule a short weekly “money check-in.” Give each person a personal spending allowance to reduce friction while keeping the overall plan on track.

9. Conclusion

Learning how to track expenses is one of the most empowering things you can do for your financial health. By applying the steps above, you’ll not only know where your money goes but also make intentional decisions about your future.

I’ve lived this, so I get it.

A few years ago, I used to live paycheck to paycheck, not knowing where my money went. Everything changed when I started tracking my expenses – first with a simple spreadsheet, then with apps like YNAB. That simple habit helped me pay off debt, build an emergency fund, and take control of my finances.

Ready to take action?

- Try a free app like YNAB, or a simple spreadsheet

- Use our checklist to audit your last 30 days of spending

- Share this guide with someone who’s just getting started

As someone who once feared the word “budgeting,” I can confidently say: You can do this, and it starts today.

You can read more practical tips and personal finance guides like this in the Strategy Section and Budgeting Strategies of H2T Funding.