You’ve seen them everywhere. The world of proprietary trading has exploded, and it seems like a new firm pops up every week. It’s an incredible business model, offering a scalable way to turn trading expertise into a serious revenue-generating company.

The growth isn’t just anecdotal. This niche market was valued at $6.7 billion in 2020 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% from 2021 to 2028. Even more impressively, online searches for “proprietary trading” surged by an astonishing 8,409% from 2020 to 2024, signaling massive public interest and demand.

But there’s a huge gap between having the idea and actually launching a successful firm. So, how do you cross it? H2T Funding is here to guide you every step of the way, breaking down exactly how to set up a prop trading firm. This isn’t just theory; it’s a practical roadmap covering everything from the business plan and legal headaches to the essential technology you can’t afford to get wrong.

Let’s get started!

Key Takeaways:

- Prop firm definition & advantages: It explains what a proprietary trading firm is and why this model is attractive due to its high profit potential, lower entry barriers, and global scalability.

- 10-step setup roadmap: The article provides a detailed guide, from market research and business planning to legal requirements, funding, and brand building.

- Technology is the backbone: It stresses the critical importance of investing in trading platforms, CRM, and risk management software, strongly recommending white-label solutions over building from scratch.

- Cost structure & revenue streams: It breaks down the essential expenses and diverse income sources, including evaluation fees, commissions, and spread markups.

- Common mistakes to avoid: The article warns against pitfalls like cutting technology costs, lacking a marketing plan, unbalanced evaluation rules, and poor customer support.

1. What is a prop trading firm & why is the model so attractive?

The rise of proprietary trading firms has transformed the financial landscape, offering a unique and highly appealing business model for both aspiring traders and entrepreneurs.

But what exactly are these firms, and why has this model gained such immense traction?

Let’s break down the core definitions, operational models, and undeniable benefits that make prop trading firms an increasingly attractive venture.

1.1. Definition of a prop trading firm

To understand the opportunity, we first need to be clear on what a proprietary trading firm actually is. It’s a business designed to leverage its own capital by funding skilled traders, and in return, both the firm and the trader share in any profits generated.

This means that, at its heart, it’s a business that believes in talent so much that it puts its own capital on the line for skilled traders, creating a true partnership where success is mutual.

This approach is fundamentally distinct from other financial players you might know:

- Unlike a brokerage, A brokerage is simply an intermediary. They connect you to the market, taking a cut through commissions or spreads. They don’t trade their own money with you. A prop firm, however, steps up to provide the actual trading capital. It’s their skin in the game, empowering you to trade bigger.

- Unlike a hedge fund, Hedge funds manage massive, often exclusive, pools of capital from outside investors, such as institutions or ultra-wealthy individuals. Modern prop firms don’t manage external client investments. Their risk capital is their own, reflecting a bold, entrepreneurial spirit focused on internal talent and controlled risk.

1.2. The core business models of a prop firm

Today’s prop firms typically operate on one of two primary models:

- The evaluation/challenge model: This is, by far, the most dominant model in the industry. The firm’s main revenue stream comes from selling trading challenges to aspiring traders. Those who pass the evaluation by meeting profit targets without breaking risk rules are granted a funded account.

- The direct funding & profit split model: This more traditional approach involves providing capital directly to traders who already have a long and verifiable track record of success. It’s less common and reserved for elite, proven talent.

1.3. The benefits of starting a prop firm

- High profit potential: You create two powerful revenue streams: the consistent income from evaluation fees and a percentage of the profits from your successful traders.

- Lower barrier to entry: Compared to the monumental cost and regulatory hurdles of launching a traditional financial institution, the barrier is substantially lower. This is especially true when using a white label solution, which removes most of the initial technological development costs.

- Globally scalable business: The entire model is built for the internet age. With a digital platform, you can attract, evaluate, and manage traders from almost anywhere in the world, offering incredible potential for scale.

2. The 10-step roadmap to set up a prop trading firm

Building a firm isn’t some kind of magic; it’s a journey, a dedicated process. It’s a serious project, requiring perseverance and clear vision. But don’t let that intimidate you!

By diligently following these steps we’ve laid out, you’ll feel far more confident and, crucially, avoid those costly missteps that so many newcomers unfortunately make. Remember, each step you take is a solid foundation for your aspirations!

- Step 1: Conduct market research & define your niche

- Step 2: Build a solid business plan

- Step 3: Navigating the legal and registration requirements

- Step 4: Secure funding & plan your finances

- Step 5: Choose your technology stack – the backbone of your prop firm

- Step 6: Select a liquidity provider (LP)

- Step 7: Design attractive evaluation programs

- Step 8: Build your brand & website

- Step 9: Hire a core team & set up operations

- Step 10: Plan your marketing & trader acquisition strategy

2.1. Step 1: Conduct market research & define your niche

This is a step many people rush, and I have to tell you, it’s a huge mistake! Before you do anything else, put aside the initial excitement and become a diligent student of the market. Do you know your competitors’ evaluation rules? What profit splits are they offering? Which prop trading platforms are they using?

Your biggest goal is to find your own unique selling proposition (USP). What will make your firm stand out, becoming the superior choice? Can you offer more flexible rules, a higher profit share, or perhaps a stronger, more supportive community? Remember, these are the very things that will capture the hearts of traders and make them choose you over everyone else out there.

2.2. Step 2: Build a solid business plan

Your prop trading business plan isn’t just a document; it’s your North Star, your guiding light through the exciting, yet often turbulent, waters of entrepreneurship. It certainly doesn’t need to be a daunting 100-page academic thesis, but it absolutely must be crystal clear and thoroughly comprehensive.

I’ve personally witnessed far too many brilliant ideas, bubbling with potential, simply fizzle out because their passionate founders skipped this absolutely critical step, relying purely on sheer enthusiasm instead of a solid roadmap. Don’t let that be you!

Think of it as your firm’s DNA; it defines who you are, what you offer, and how you’ll win. A well-thought-out plan forces you to confront challenges on paper before they become costly real-world problems.

Your plan absolutely must include:

- Company mission: This is your “why”, the core, deep-seated value you genuinely aim to provide. It’s not just a marketing slogan; it’s the soul of your operation, guiding every single decision you make.

- Business model: Here, you lay out exactly how your firm will thrive financially. Be crystal clear about your revenue streams (e.g., purely evaluation-based vs. direct funding) and how traders interact with your system. For inspiration, explore a comprehensive prop firms review.

- Financial projections: Now for the hard truth. You need to be brutally, unflinchingly honest here. Map out your startup costs, monthly “burn rate,” and when you can realistically expect to turn a profit. I always advise new founders: be conservative with revenue hopes and incredibly generous with expense estimates. Trust me, it’s a far better feeling to be pleasantly surprised than financially stranded and stressed.

2.3. Step 3: Navigating the legal and registration requirements

Getting this right from day one will save you immense headaches later.

- Company structure: Choose a legal structure like an LLC or a Corporation. This creates a legal shield between your personal assets and the business.

- Business registration: Officially register your company name and entity.

- Prop firm license: Now for the big question. Let me be clear on this: most evaluation-based prop firms are structured as educational or skills-assessment companies, not as brokerages. This often means they don’t fall under the same strict prop firm regulation as a company holding client funds. However, laws are constantly changing and vary by location. Do not skip this step: consult with a lawyer who specializes in fintech.

2.4. Step 4: Secure funding & plan your finances

Cash is king. You’ll need enough capital to cover all your initial setup costs plus at least 6-12 months of operational expenses. Your financial runway is critical, ensuring you have enough liquidity to navigate the early stages without pressure and to invest in growth.

From my experience, this isn’t just about having money; it’s about having peace of mind. Underfunding is a common, often heartbreaking pitfall I’ve personally witnessed countless ambitious firm owners stumble into. It relentlessly forces their hand into rushed decisions and, tragically, makes them miss out on so many truly valuable opportunities.

2.5. Step 5: Choose your technology stack – the backbone of your prop firm

Your prop firm technology is not the place to cut corners. It is the heart of your entire business. I’ve personally witnessed promising firms cripple themselves with a clunky, unreliable tech stack; it’s like trying to win a race with flat tires – utterly heartbreaking and entirely avoidable!. Trust me, this is an investment you don’t want to skimp on.

Your core components are:

- Trading platform: The software your traders interact with daily. MT4/MT5 and cTrader are the industry workhorses. Newer platforms like TradeLocker and DXtrade are also gaining serious traction.

- Prop firm CRM & trader dashboard: This is your mission control. It’s a non-negotiable tool for managing users, tracking challenges, processing payments, and providing analytics. In my experience, a robust CRM not only streamlines operations but also offers invaluable insights into trader behavior, which is incredibly useful.

- Risk management software: This is what protects your business. This software automates the monitoring of drawdown rules and other limits, which is essential for effective risk management in prop trading. This is the tool I consider your firm’s ultimate “shield”; never underestimate the importance of automated risk management.

- Can you trade options on a funded account? When considering the types of assets your firm will allow, it’s crucial to understand the limitations and tools for asset classes like options trading funded account.

2.6. Step 6: Select a liquidity provider (LP)

Your liquidity provider for prop firm operations is the one who actually executes the trades your funded traders make. A good LP means fair pricing and fast execution for your traders, which directly impacts their profitability and satisfaction.

Choosing the wrong partner, on the other hand, can be devastating. It can lead to frustrating execution slippage, a relentless wave of trader complaints, and a damaged reputation that’s incredibly tough, sometimes even impossible to repair.

From my perspective, this isn’t just a vendor choice; it’s a strategic partnership that underpins your entire operation’s integrity. Choose wisely. For various operational considerations, including general business efficiency, you might also find insights on managing expenses.

2.7. Step 7: Design attractive evaluation programs

Your prop firm evaluation model, or your “trading challenges,” is your core product. You’re walking a tightrope here, a delicate and nerve-wracking dance where every single move counts.. The rules must be tough enough to weed out unskilled traders but fair and attractive enough to get people to sign up.

2.8. Step 8: Build your brand & website

Your brand is more than a logo. It’s the collective impression and gut feeling people have every time they interact with your firm. Allocate resources to building a website that looks polished, loads quickly, and is incredibly intuitive for visitors. It’s your 24/7 salesperson.

2.9. Step 9: Hire a core team & set up operations

You can’t be a one-person army forever. As exhilarating as it is to build something from the ground up, the truth is, the sheer weight of tasks will eventually become overwhelming. To truly thrive, to scale, and to prevent burnout, you absolutely must build a solid team around you. At a minimum, you’ll desperately need:

- Customer support: These are the empathetic voices, the vital front line of your business, ensuring your traders feel heard, valued, and supported through every challenge.

- Risk management: This is your vigilant guardian, someone sharp and steady to oversee all trading activity, relentlessly protecting your precious capital.

- Marketing: This is your beacon, the person passionately responsible for bringing in that vital, continuous stream of new, eager traders who will power your firm’s growth.

2.10. Step 10: Plan your marketing & trader acquisition strategy

You can build the best firm in the world, but if no one knows about it, you’ll fail. You need a dedicated plan to start a prop firm and keep it growing. A mix of SEO, affiliate marketing, and building a strong social media community is a powerful combination.

Read more:

3. Compare 2 solutions to set up a prop trading firm

When it comes to establishing a prop trading firm, one of the most pivotal foundational decisions you’ll face is how to build your technological infrastructure: do you opt for a custom-built solution from the ground up, or do you choose a white-label (or turnkey) solution? This choice profoundly impacts your budget, timeline, and where your operational energy will be focused.

Let’s break down each approach:

3.1. Building from scratch

This means you’ll be hiring a dedicated team of developers, designers, and IT specialists to construct every single piece of your prop firm’s technology infrastructure from zero. This includes your custom website, the trader dashboard, integrated CRM, sophisticated risk management tools, and the backend systems for managing evaluations and payouts.

- Pros:

- Total customization: You get precisely what you envision, tailoring every feature to your unique business model and specific requirements.

- Full control: You own the intellectual property and have complete control over future development and scalability.

- Cons:

-

- Exorbitant cost: This is almost always a “money pit.” Building robust, secure, and scalable financial technology can easily cost upwards of $200,000 to millions of dollars. This isn’t just a number; it’s a drain that can exhaust your resources before you even begin.

- Protracted timeline: Development takes a significant amount of time, often a year or more, before you can even launch. Think of the lost revenue opportunities slipping away during that long wait.

- High complexity & risk: You’ll bear the entire burden of development, bug fixing, security, and ongoing maintenance. Technical challenges, frustrating delays, and unexpected cost overruns aren’t just possibilities; they’re common companions on this path.

- Resource-intensive: This demands deep expertise in software development, cybersecurity, and financial systems, which means building and managing a larger, highly specialized core team, a challenge in itself.

My Take: While building from scratch offers the ultimate sense of control, it’s rarely the pragmatic choice for new prop firms. The immense capital outlay, extended timeline, and inherent complexities can truly exhaust your resources long before you ever get to onboard your first excited trader.

It’s a path typically reserved for established financial institutions with vast budgets and very specific, niche needs that no off-the-shelf solution can possibly meet.

3.2. White-label or turnkey solution

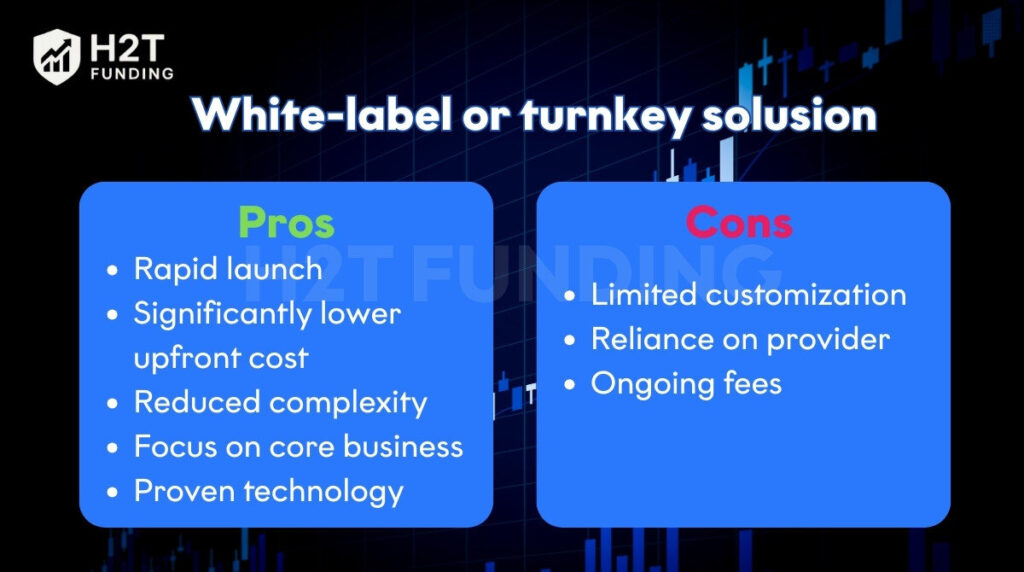

Think of a white-label prop firm solution as a “business in a box.” You partner with a specialized technology provider who offers a complete, ready-to-go, pre-built platform and system. This includes the trading platform integration, CRM, dashboard, and often critical risk management tools. You simply apply your own branding (logo, colors, domain) and launch.

- Pros:

- Rapid launch: You can go live in a matter of weeks or a few months, not years. This allows you to start generating revenue much faster.

- Significantly lower upfront cost: Instead of building, you’re essentially leasing the technology, which drastically reduces initial capital requirements.

- Reduced complexity: The technology provider handles development, maintenance, updates, and security, freeing you from technical headaches.

- Focus on core business: You can dedicate your energy, time, and resources to what truly drives your business: marketing, trader acquisition, customer service, and building your community.

- Proven technology: You benefit from a system that has likely been tested and refined by many other users.

- Cons:

- Limited customization: While you can proudly brand it as your own, deep functional customization is usually limited to what the provider offers. This can sometimes feel a little restrictive, like wearing an off-the-rack suit instead of one perfectly tailored just for you..

- Reliance on provider: Your operations are tied to your technology partner’s reliability and continued support.

- Ongoing fees: You’ll typically pay monthly or annual licensing fees to the provider.

My take: For 99% of entrepreneurs looking to set up a prop trading firm, a white-label solution is the obvious and smarter path. It democratizes access to this business model by lowering barriers to entry significantly.

It allows you to focus on strategic growth and trader acquisition, rather than getting bogged down in costly and time-consuming technical development. It’s about leveraging existing expertise to bring your vision to market efficiently and effectively.

4. How much does it truly cost to start a prop trading firm?

Financial management isn’t just a detail when setting up a White Label Prop Trading Firm; it’s the bedrock of your success. From my experience, having a crystal-clear picture of both what you’ll spend and how you’ll earn is what separates a thriving firm from one that struggles. It’s about more than just budgeting; it’s about building a robust financial strategy that can withstand market ups and downs.

4.1. Understanding your cost structure

The money you spend forms the financial skeleton of your company. Every dollar counts, influencing how smoothly you operate and how much you can grow. Let’s break down the typical expenses you’ll face, so you can plan wisely and avoid nasty surprises.

- Platform fees (leasing): This is usually a big chunk, both upfront and monthly. You’re paying to use a ready-made trading platform from a White Label provider. I always tell people this is where you should spend money wisely; a reliable platform means happy traders and fewer headaches for you.

- Marketing & trader acquisition: Getting traders to know about and join your firm costs money. Think ads, partnerships, and content. Don’t underestimate this; hoping for “organic” growth is a recipe for an empty firm, in my opinion.

- Team salaries & office costs: Even with automation, you’ll need talented people for support, risk management, and marketing. Good people cost money, but they’re absolutely worth it. This also includes any office space if you choose to have one.

- IT & security: Keeping your systems running smoothly and, crucially, keeping data safe. This covers things like server costs, cybersecurity measures, and general tech maintenance. This is another area where cutting corners can lead to catastrophic reputational damage.

- Partner payments: If you work with “Introducing Brokers” (IBs) or other partners who bring you traders, you’ll pay them commissions. It’s an investment in growing your client base.

- Legal, accounting & audits: Getting sound legal advice, managing your books, and performing regular audits are non-negotiable for staying compliant and transparent. This isn’t a “nice-to-have”; it’s a fundamental cost of doing legitimate business.

- Taxes: Like any successful business, you’ll owe taxes on your profits. Make sure this is factored into your financial planning from day one.

4.2. Unpacking your revenue streams

A prop trading firm doesn’t just make money from profitable traders. The smartest firms I’ve seen diversify their income sources, creating a steady financial flow even when markets are tricky. This multi-faceted approach builds resilience and paves the way for consistent profitability.

- Evaluation/Challenge fees: This is often the primary and most consistent income stream for modern prop firms. Traders pay a fee to attempt your evaluation or challenge to get a funded account. You can explore more about how much a funded account costs and the associated fees to best prepare yourself.

- Commission on trading volume: You earn a small commission every time your traders open or close a trade. It adds up, especially with active traders.

- Spread markups: You can add a small markup to the bid-ask spread provided by your liquidity provider. It’s a common practice, but you need to be competitive; too high, and traders will leave.

- Markup on deposits/withdrawals: You might add a small fee or markup when traders deposit or withdraw funds, especially if using various payment processors (PSPs) or crypto.

- Currency exchange (FX) spread & Commission markup: If traders fund accounts or trade in different currencies, you can earn from the exchange rates and any associated commission markups.

- SWAP markups: For trades held overnight, there’s a swap fee. You can add a small markup to this.

- Other services/fees: This can be diverse, think subscription fees for premium tools, performance fees, or revenue-sharing from other services you might offer your trading community. Innovative firms are always looking for new ways to add value and generate revenue here.

5. Common mistakes to avoid when starting out

Having been in this space for a while, I’ve personally witnessed the same painful mistakes surface again and again. It’s truly frustrating and heartbreaking to see promising ventures stumble over entirely avoidable pitfalls.

Based on everything I’ve learned (often the hard way), here are the crucial errors you absolutely must avoid at all costs:

- Being cheap on technology: Your platform is your business. Believe me, unreliable tech will kill your reputation faster than anything else. You pour your heart into building this firm, don’t let a shoddy system undermine it all.

- Hoping for “organic” growth: Don’t dream! You must have a clear marketing plan and a dedicated budget. Hope is simply not a strategy for long-term success. Your vision deserves to be seen.

- Bad math on your rules: This is a delicate balance. Make your challenge too hard, and no one will dare to sign up. Make it too easy, and you risk paying out more than you can possibly handle, putting your entire business in jeopardy. You can learn more about developing a strong trading plan to improve this problem.

- Treating support as an afterthought: Slow, unhelpful support is a recipe for disaster. Your traders need to feel heard and supported promptly; otherwise, they’ll leave without a second thought, taking their loyalty and your potential profits with them. Their trust is your most valuable asset.

6. Frequently asked questions (FAQ)

Honestly, no. It helps to understand trading, but your job as the founder is to be a CEO, not the head trader. Your attention must be on growing the business: the technology, the marketing, and the day-to-day operations. You can bring on specialists to handle risk management.

The nightmare scenario is a funded trader hitting a massive home run that your revenue can’t cover. This is precisely why having automated, robust risk management technology isn’t a luxury; it’s an absolute necessity.

The business model has two parts. The primary, consistent revenue comes from the fees traders pay for the evaluation. The other revenue source comes from the firm taking a percentage of the profits from its successful funded traders. That fee income is the lifeblood that covers operational costs and trader payouts.

Yes, provided it’s structured correctly. As mentioned, most firms today operate as evaluation companies, not regulated financial entities. This is the key distinction. But regulations can change. I’ll say it again: talk to a lawyer who knows this specific industry. That investment will pay for itself many times over.

For the vast majority of firms, even “funded” traders are operating in a simulated environment. The payouts they earn are paid directly from the firm’s operational revenue (i.e., the pool of money from all the evaluation fees). This closed-loop system is what makes the business model viable and manageable.

Don’t believe the hype – it’s absolutely never too late to start! The market is saturated with copycats, not innovation. If you bring a truly unique edge (like amazing support or fairer rules), you’ll absolutely find your niche and thrive.

7. Conclusion: Are you ready to build your prop trading empire?

Starting a proprietary trading firm is a challenging but incredibly rewarding journey. It demands careful planning, a solid strategy, and an obsession with providing value to your traders. By using this guide on how to set up a prop trading firm, you’re already ahead of the game and have a foundation for building a sustainable, profitable business.

Here’s a quick checklist to guide you in setting up your prop trading firm:

- Plan your business: Define your model, vision, and target traders.

- Handle legal & compliance: Set up your legal structure and meet all regulations.

- Secure your funding: Get enough capital for setup and at least 6-12 months of operations.

- Invest in technology: Choose solid trading platforms, CRM, and vital risk management software.

- Pick a great liquidity provider (LP): Ensure fair pricing and fast trade execution.

- Design clear rules: Create transparent challenge rules and payout structures for your traders.

- Build your brand & website: Establish a strong online presence and clear messaging.

- Assemble your core team: Get support for customer service, risk, and marketing.

- Launch your marketing: Implement a plan to attract and acquire traders.

If you’re a trader looking to navigate this exciting world and find the best proprietary trading partners, H2T Funding is your trusted resource. We provide in-depth reviews, proven strategies, and the latest updates on proprietary trading firms, helping traders from beginners to experts make informed choices when looking for the right trading partners.

For even more insights and detailed guides, be sure to explore our Blog. Dive deeper into specific topics within our Prop Firm & Trading Strategies sections.

Was this guide helpful in your journey to understand how to set up a prop trading firm? We’d love to hear your thoughts and questions in the comments below!