Even though most people understand the value of saving, many still struggle to hit their goals. According to Bankrate’s 2024 Emergency Savings Report, only 41% of U.S. adults feel comfortable with their savings, showing how urgent better spending habits and financial planning are.

If you’re looking for a realistic challenge, learning how to save 10000 in a year is achievable, even without a high income. With clear steps, discipline, and smart money strategies, this guide from H2T Funding will show you exactly how to save 10k in 1 year.

Key takeaways

- To save $10,000 in one year, break it down into smaller milestones, around $833 monthly, $192 weekly, or $27 daily, so the target feels achievable.

- Build a savings plan that combines budgeting, expense cuts, income boosts, and automatic transfers. Tracking progress keeps you accountable and motivated.

- Use smart tools like high-yield savings accounts, separate goal accounts, or simple investment options to make your money work harder while staying safe.

- Avoid common pitfalls such as lifestyle inflation, impulse spending, or neglecting variable expenses. Review and adjust your plan regularly to stay on course.

1. Why saving $10,000 in a year is a great goal

Reaching $10,000 in savings within a year is more than just a number; it’s a powerful financial milestone. With that amount, you can create a safety net for emergencies, build an investment fund, or prepare for major life goals like a down payment or travel.

Setting this target also gives you a stronger sense of control over your money. Instead of reacting to unexpected expenses, you start planning, making conscious financial decisions that reduce stress and increase confidence. For many, it’s also the first step to stop living paycheck to paycheck.

It’s an ambitious goal, for sure, but it’s definitely within reach for many people. Saving $10k in 12 months requires discipline and consistency, which are the same habits that build long-term wealth and help reach bigger financial goals.

Once you’ve done it, you’ll have the confidence to tackle even bigger goals down the road. Try using a simple tool like a savings calculator or a how to save 10k in a year calculator to visualize your path.

2. Break down the goal: $10,000/ year into monthly/ weekly savings

The best way to tackle a big savings goal is to divide it into smaller, manageable pieces. Instead of stressing over the full $10,000, think of it in terms of monthly, weekly, or even daily amounts. This makes the target feel realistic and easier to stick to.

Here’s the breakdown:

- Per month: about $833

- Per week: about $192

- Per day: about $27

Once you see the numbers clearly, the next step is to match them with your current income and spending. Ask yourself: how much can you comfortably save right now, and where is the gap compared to these targets?

For a more strategic approach, check out this guide on how to track expenses to identify exactly where your money is going.

Tools like Excel, Notion, or budgeting apps, or even a simple save 10,000 in a year chart, can give you visibility. And using smart budgeting methods to reveal money leaks, such as frequent dining out, unused subscriptions, or impulse shopping. Fixing these habits helps you reach savings milestones.

See more:

3. How to save 10000 in a year

Saving $10,000 in one year requires a mix of smart budgeting, strict expense control, and creative ways to earn more. The following steps show you how to design a practical strategy that fits your lifestyle and helps you stay consistent for 12 months.

3.1. Assess income and expenses

Let’s start with the basics: you need a clear picture of what’s coming in and what’s going out. It’s nearly impossible to find extra money for savings if you’re flying blind. Track every source of income and compare it against fixed and variable expenses.

- Income to track: salary after tax, side gigs, bonuses, commissions, rental income, dividends.

- Expenses to track: rent or mortgage, utilities, groceries, transport, insurance, debt payments, subscriptions, leisure, and personal care.

- Use budgeting tools like YNAB or simple spreadsheets to keep everything organized.

This analysis highlights the gap between what you earn and what you spend, and where you can start cutting back.

3.2. Build a realistic savings plan

Once you know your baseline, create a plan that matches your financial situation. The key is to set regular contributions that move you toward the $10,000 goal without leaving you short on essentials.

- Decide how much to save per paycheck: for example, $400 every two weeks.

- Choose where to store the money, ideally a high-yield savings account that earns interest.

- Set up regular savings contributions to remove temptation and keep your savings consistent.

By turning saving into a scheduled commitment, you reduce the mental effort and increase your chances of success. Some people even follow a how to save $10000 in a year challenge where they commit fixed contributions each week until they hit the target.

3.3. Cut expenses to free up money

If your current budget doesn’t leave enough space, trimming costs is the fastest way to bridge the gap. Start with wants before adjusting your needs.

- Create a detailed budget using the 50/30/20 budget rule: 50% needs, 30% wants, 20% savings, and debt payments.

- Reduce nonessential spending: cook at home instead of eating out, cancel unused subscriptions, and delay impulse purchases with the 30-day rule.

- Optimize essential costs: share housing, use public transport, shop with a list, compare insurance providers, and cut utility waste.

Each cut may seem small, but together they free up hundreds of dollars every month. That’s exactly how to save 10000 in one year without feeling overwhelmed.

3.4. Boost your income

Sometimes cutting isn’t enough, especially if your expenses are already lean. In that case, look for ways to increase your earnings.

- From your main job: negotiate a raise, aim for promotions, or switch to a higher-paying role.

- Side hustles: freelancing, tutoring, design, online sales, delivery apps, or renting out unused items.

- Smart investing: If you have extra capital, consider ETFs, index funds, or high-yield savings accounts.

The more you can grow your income streams, the faster you’ll hit your $10,000 goal.

3.5. Avoid new debt

Debt is one of the biggest obstacles to saving. High-interest loans or credit card balances can erase progress quickly.

- Avoid financing nonessential purchases or taking on “buy now, pay later” options.

- Focus on paying down existing high-interest debt before it grows larger.

- Use automatic payments to avoid fees and penalties.

Staying debt-free ensures your savings accumulate instead of being redirected to cover interest.

3.6. Invest wisely

If you manage to set money aside faster than expected, you can make it work harder. But every investment should align with your risk tolerance and timeline.

- Safe options: high-yield savings accounts, money market accounts, or certificates of deposit (CDs).

- Moderate-risk options: ETFs or index funds for steady long-term growth.

Remember, investing is optional. The priority is reaching $10,000 in cash savings first, then exploring growth opportunities.

4. Practical steps and support tools

Reaching $10,000 in savings requires more than good intentions. What really makes the difference is applying systems that remove friction, add structure, and keep you motivated for a full year. Here are some practical ways to make it work in real life.

4.1. Automate your savings (Pay Yourself First)

A common mistake is saving whatever is left after spending. The problem is, most months, nothing is left. By paying yourself first, you flip the process.

For example, if you earn $3,500 per month after tax, set an automatic transfer of $400 into your savings account on payday. After 12 months, that alone gets you close to $5,000.

4.2. Create separate savings accounts

When your emergency money and goal money sit in the same account, it’s tempting to dip into it. Creating separate accounts helps you stay focused.

- Keep one account for emergencies, say, three months’ worth of rent and bills.

- Open another account labeled “$10,000 goal” so you can track progress clearly.

I learned this one the hard way. I actually named my savings account “Future House Fund.” It sounds a bit cheesy. But every time I logged into my bank app, seeing that label genuinely stopped me from splurging on a new gadget or taking a weekend trip. It was a simple mental trick that really worked for me.

4.3. Try savings challenges

Challenges make saving less abstract and more engaging. They also help you start small and scale up.

- 52-week challenge: If you save $1 in week one, $2 in week two, and so on, you’ll end up with $1,378 by year’s end. Some people double it (start with $2, then $4, etc.) and finish with nearly $2,756. That’s more than a quarter of the $10k target.

- No-spend challenge: I remember a friend from my old job tried a “no-spend January.” She still bought groceries, but she cut out all online shopping. By the end of the month, she was shocked to find she’d saved $600. That money ended up paying for a flight she’d been wanting to book for ages.

Explore more saving challenges at:

4.4. Track your progress

Progress tracking builds motivation because you can see how small steps add up.

- Apps like YNAB link to your bank accounts, showing in real time how close you are to your $10k goal.

- You can also use a spreadsheet to project: “At $833/month, I’ll cross $5,000 by June.” This projection creates accountability.

This might sound old-school, but I use a savings thermometer chart taped to my fridge. There’s something really satisfying about coloring in a new section. When I crossed the $2,500 mark, I allowed myself a small celebration, a nice dinner out that cost about $30. It felt like a well-earned reward that didn’t undo all my hard work.

4.5. Seek accountability and support

Money goals are easier to abandon when no one else knows about them. Accountability adds social pressure and encouragement.

- Tell a trusted friend or family member you’re saving $10k and ask them to check in quarterly.

- Join online finance groups (like Reddit’s r/personalfinance) where members share their savings progress. I even posted my goal in a personal finance forum online, and got some incredibly practical tips.

- Even forming a “savings club” with friends, where everyone reports progress each month, can make the journey less isolating.

In short, saving $10,000 becomes realistic when you combine the right tools with discipline. Automating transfers, splitting accounts, and using challenges reduce effort, while progress tracking and accountability keep motivation high. These simple systems turn a tough goal into a step-by-step process you can stick to.

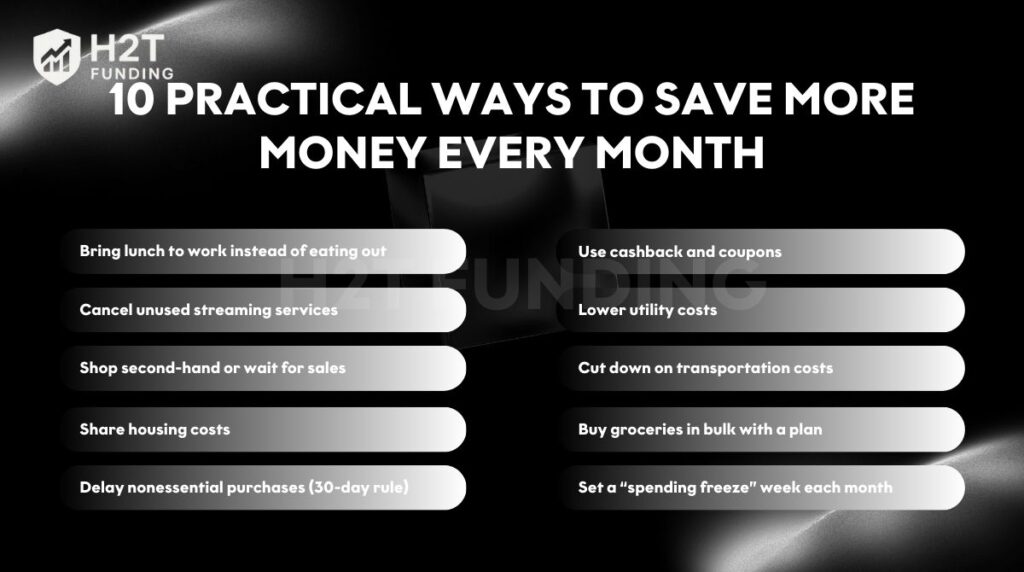

5. 10 practical ways to save more money every month

Even small adjustments in your daily routine can free up hundreds of dollars each month. Here are ten practical tips that can help you get closer to the $10,000 goal:

- Bring lunch to work instead of eating out: A $12 lunch each workday adds up to nearly $250 a month. Cooking at home can cut that to under $80, saving you $170 monthly, or more than $2,000 a year.

- Cancel unused streaming services: Many households forget about subscriptions they no longer use. Dropping two $12 services can save $288 annually, money that grows quickly when redirected into savings.

- Shop second-hand or wait for sales: Buying a $60 item second-hand for $15 saves $45 each time. Over several purchases, these small wins can free up hundreds of dollars yearly without reducing quality.

- Share housing costs: Splitting rent and utilities with a roommate can cut expenses by $400 a month. That single move alone covers almost half of your monthly $833 savings target.

- Delay nonessential purchases (30-day rule): By waiting a month before buying, you reduce impulse spending. Many find that half the items on their list no longer feel necessary, often saving $500 or more in a year.

- Use cashback and coupons: Cashback cards and coupon apps typically save 2-5% on regular spending. If you spend $1,500 monthly on essentials, you could save up to $900 annually.

- Lower utility costs: Simple changes like switching to LED bulbs, unplugging electronics, or adjusting your thermostat can save $20-$40 per month. Over a year, that’s nearly $500 in extra savings.

- Cut down on transportation costs: Using public transport or carpooling just twice a week might save $30 weekly. That’s over $1,500 in annual savings compared to driving alone.

- Buy groceries in bulk with a plan: Planning meals and shopping in bulk can lower grocery bills by 10-15%. On a $400 monthly bill, that’s $40-$60 saved, adding up to over $700 per year.

- Set a “spending freeze” week each month: Choose one week with no discretionary spending, no dining out, no shopping. If you normally spend $100-$150 weekly on extras, this challenge can save up to $1,800 annually.

These ten tips may seem small on their own, but together they can free up far more than $10,000 in a single year. From splitting rent to skipping one week of spending each month, the savings add up quickly.

The key is staying consistent. Stick with these habits, and your chances of hitting the $10k target get much, much better.

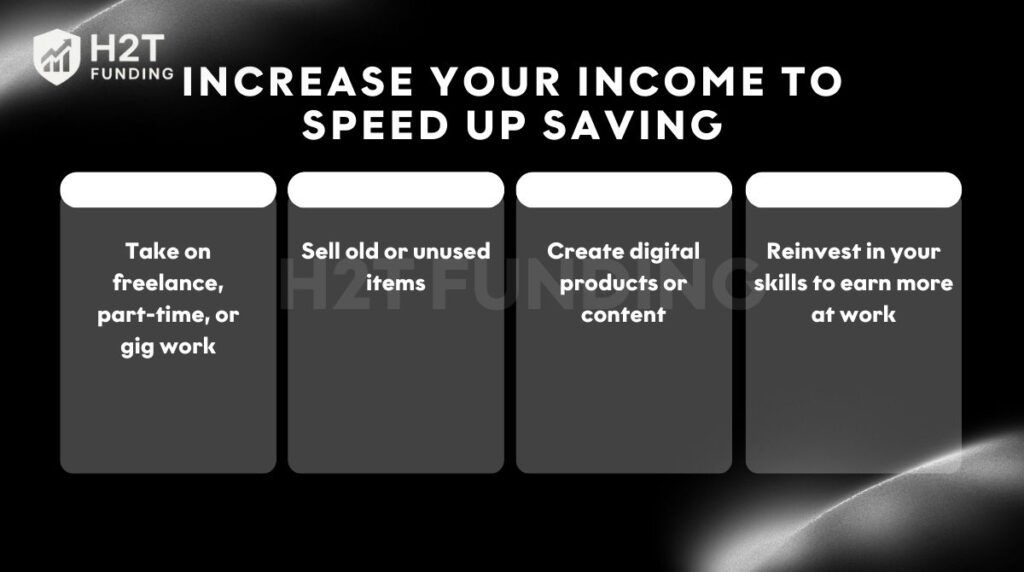

6. Increase your income to speed up saving

For me, just cutting expenses wasn’t enough. I remember feeling stuck and frustrated because there was only so much I could trim from my budget. The real game-changer was when I started seriously looking for ways to earn more on the side.

Even an extra $100 or $200 each month created momentum, and that’s where strategies like freelancing, selling unused items, or negotiating a raise proved effective.

- Take on freelance, part-time, or gig work: Writing, tutoring, or gig economy jobs like Uber and DoorDash can add $200-$500 each month. Even a few extra hours a week can cover a big portion of your savings target.

- Sell old or unused items: Many households have electronics, clothes, or furniture sitting idle. Clearing them out through online marketplaces often brings in hundreds of dollars that can go straight into savings.

- Create digital products or content: Starting a blog, a YouTube channel, or even offering online lessons requires effort, but even small monthly earnings build momentum. With consistency, this income can grow into a reliable stream of passive income.

- Reinvest in your skills to earn more at work: Upskilling pays long-term dividends. A raise of just $300 a month adds $3,600 a year, more than a third of your goal, without changing your lifestyle.

Growing your income makes saving $10,000 less about sacrifice and more about opportunity. By pairing these strategies with disciplined budgeting, you not only hit the target faster but also build a stronger foundation for future goals.

7. What to do after saving $10,000

Reaching $10,000 is a milestone, but what you do next determines whether that money simply sits idle or works to improve your financial security. Here are smart ways to put your savings to use.

- Invest for growth: If your $10,000 is more than you need for short-term expenses, consider placing part of it in index funds, ETFs, or a Roth IRA. Even a modest 7% annual return can grow the money into $20,000 in about 10 years.

- Build an emergency fund: Experts recommend keeping three to six months of living expenses easily accessible. Parking this in a high-yield savings account gives you both liquidity and interest income while protecting against unexpected costs.

- Pay down high-interest debt: If you carry credit card balances at 18-20% APR, using $5,000 to clear that debt is often smarter than investing. Eliminating high-interest payments frees up future cash flow and lowers financial stress.

- Set your next goal: Don’t stop at $10,000. You might aim for $20,000, start investing regularly, or fund a specific purpose like a home down payment or education. Asking how much to save 10k in 12 months is only the first step; the real win is maintaining good habits and breaking free from the cycle of living paycheck to paycheck.

The point is to make sure that $10,000 isn’t just a number sitting in an account. It should be a tool that gives you more options, reduces stress, and actively works toward your next big goal.

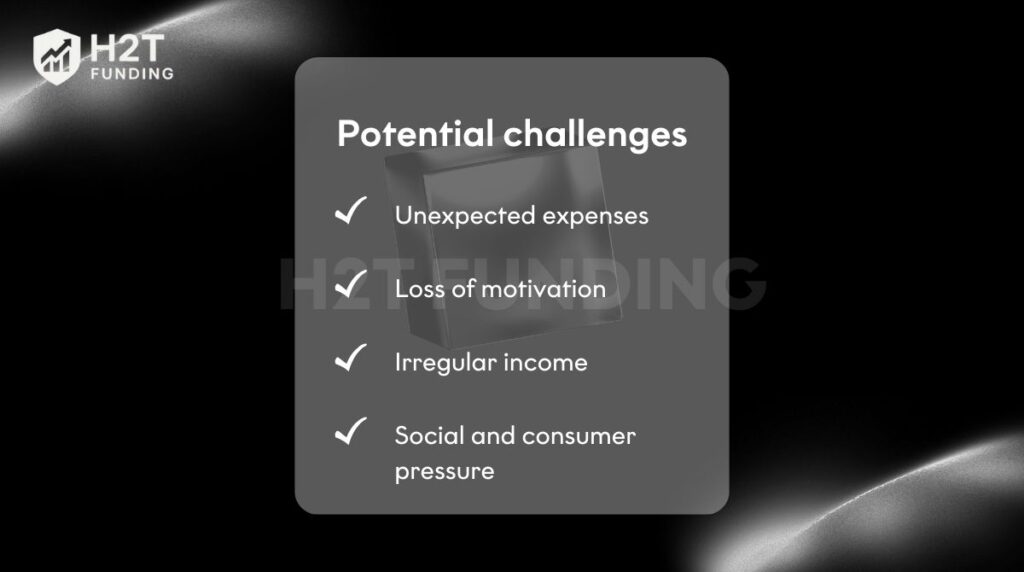

8. Potential challenges and how to overcome them

Even with a clear plan, saving $10,000 in a year comes with obstacles. Recognizing these challenges early and having strategies to tackle them makes the journey smoother. A solid savings strategy keeps your finances on track and helps you recover faster from setbacks.

- Unexpected expenses: Emergencies like medical bills or car repairs can derail savings. The solution is to keep a separate emergency fund so you don’t touch your $10,000 goal. Even $1,000 in a side account provides a cushion.

- Loss of motivation: Saving is a long-term process, and enthusiasm fades. To stay motivated, remind yourself why you started, track progress visually, and celebrate milestones like $2,500 or $5,000. Small rewards keep energy high.

- Irregular income: Freelancers or gig workers often face ups and downs in earnings. In high-income months, save more than the target to balance out the leaner periods. Automating transfers during good months also helps.

- Social and consumer pressure: Friends, ads, and social media can tempt you into spending. The key is defining your personal values and remembering that comparison won’t help. Focus on your own goal and remind yourself that $10,000 is worth the short-term sacrifice.

When you’re prepared for these hurdles, a setback is just that, a temporary problem, not an excuse to give up. With discipline and the right systems, you can keep moving steadily toward your goal.

9. FAQ: How to save $10,000 in a year

Yes, but it requires strict discipline and a side income. On a $35,000 salary, you’d need to save about 28% of your income. Cutting expenses aggressively and adding freelance work can make it possible.

The 50/30/20 rule allocates 50% of income to needs, 30% to wants, and 20% to savings. If you earn $4,200 monthly, that means $840 goes to savings, almost exactly what you need to hit $10k in 12 months.

A high-yield savings account is the safest option, offering both easy access and interest growth. Money market accounts or CDs are also good choices if you don’t need immediate liquidity.

Yes. Breaking it down to $833 per month, $192 per week, or $27 per day makes it manageable. Combining cost-cutting with side hustles increases the likelihood of success.

It’s possible only with high income or large one-off cash inflows, like bonuses or asset sales. For most people, this requires extreme budgeting and side income beyond normal levels.

It’s the daily breakdown of the $10,000 goal. Saving $27.40 every day for a year adds up to about $10k. Thinking of it in daily terms makes the goal less intimidating.

At $500 a month, you’ll reach $10,000 in exactly 20 months. Increasing savings to $833 a month shortens the timeline to one year.

10. Conclusion

If you’re wondering how to save 10000 in a year or asking yourself this question, you’re not alone. Many people also ask, How can I save 10000 in a year on my current income? The key is to start today with what you have. The sooner you begin, the more momentum you build.

Saving $10,000 in a year is not just a dream; it’s a realistic financial milestone if you follow a smart plan and stay committed. By breaking the goal into daily or monthly amounts, cutting unnecessary costs, and boosting income, anyone can make steady progress toward this target.

For more strategies on building stronger money habits, explore the Cash Flow & Saving Strategies section at H2T Funding. You’ll find practical guides, tools, and insights to help you stay disciplined, track progress, and reach your next financial milestone.