If you just broke a rule and saw your Trading Combine shut down, don’t panic. Topstep gives you the option to reset your account instead of starting from zero. But do you know how to reset Topstep account yet?

In this guide by H2T Funding, we explain everything you need to know about Topstep account resets. You’ll learn what a reset means, how to do it, what fees apply, and how to avoid repeating the process unnecessarily.

Key takeaways

- A reset restores your account to the original starting balance, resets the Maximum Loss Limit, Consistency Target, and clears days traded.

- Reset applies only to Trading Combine accounts. Live Funded Accounts cannot be reset, and Express Funded Accounts must use Back2Funded reactivation (new dashboard) instead.

- Reset fees vary by account size and path (Standard vs No Activation Fee).

- On the new Dashboard, each reset extends your subscription billing date by 30 days; the legacy Dashboard does not.

- Avoid frequent resets by managing risk (1–2% per trade), journaling trades, and practising with demo accounts before evaluation.

1. What does resetting a Topstep account mean?

A reset in Topstep means your account is restored to its original starting conditions. The Account Balance, Maximum Loss Limit, Consistency Target, and days traded all return to zero. This gives traders a fresh start without needing to open a brand-new subscription.

You usually need a reset when your Trading Combine becomes ineligible after breaking the Maximum Loss Limit. By resetting, the account regains eligibility for funding.

Resets can be applied up to 2 times per combine per day on active subscriptions; combine purchase limits apply separately. This limit helps traders stay disciplined and avoid relying too heavily on resets.

It’s important to distinguish between rule breaches. Hitting the Daily Loss Limit only blocks trading for the rest of the day, and funding eligibility resumes the next session, without requiring a reset. But if you break the Maximum Loss Limit, your account stays ineligible until you complete a reset.

When you buy a reset, Topstep also extends your subscription rebill date by 30 days from the reset date. This means you’re not only restarting your account but also gaining more time in your Trading Combine.

Before resetting, make sure you’re fully familiar with which trading platforms Topstep supports. Using the right platform setup can help you avoid future rule violations and trade more efficiently after your reset.

2. When do you need to reset your Topstep account?

You need to reset your Topstep account when your Trading Combine becomes ineligible for funding, most often after breaking the Maximum Loss Limit. In this case, only a reset can make the account eligible again. This is why many traders call it a Topstep challenge account, or a Topstep evaluation reset.

Another common reason is when you want to start fresh, even without a violation. Some traders choose to reset midway through the challenge if their trade history is messy or they feel they cannot reach the Consistency Target. Resetting gives a clean slate to reapply a better strategy.

For tech issues, contact support; resets are not automatic because of tech/platform issues. If your login fails or the trading platform, like TopstepX, encounters errors, the Support Team may guide you to reset your account or platform access to restore normal use.

You can avoid many of these issues by first reviewing the Topstep trading rules to understand exactly which actions might lead to ineligibility or a reset requirement.

3. How to reset TopStep account (Step-by-step guide)

Resetting your Topstep account is refreshingly simple once you know where to look. However, the process isn’t one-size-fits-all; the steps change depending on whether you’re resetting a Trading Combine, a funded account, or just fixing a technical glitch.

On the new Topstep Dashboard, the Reset Bank gives traders more control by storing Bankable Resets that can be used at any time.

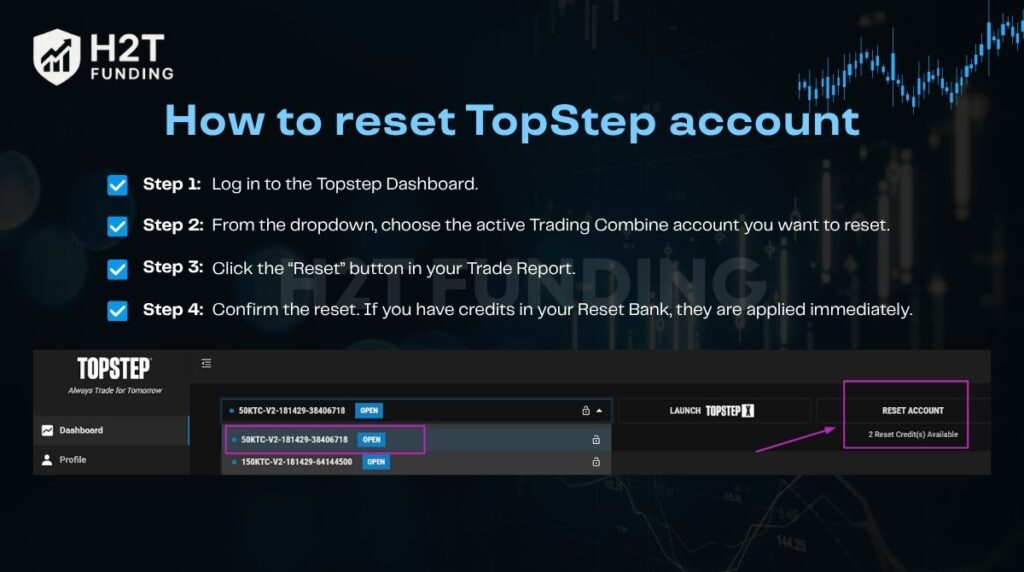

3.1. Reset Topstep Evaluation Account

- Step 1: Log in to the Topstep Dashboard.

- Step 2: From the dropdown, choose the active Trading Combine account you want to reset.

- Step 3: Click the “Reset” button in your Trade Report. The system will also show whether you have Bankable Reset credits available.

- Step 4: Confirm the reset. If you have credits in your Reset Bank, they are applied immediately. Otherwise, payment is required.

Every monthly renewal, one Bankable Reset is added to your Reset Bank. These credits never expire, can be accumulated, and replace the older Reset-at-Rebill option. Traders often call this the most flexible way to perform a Topstep evaluation reset.

If you’re also running automated strategies, it’s worth noting that Topstep applies strict rules on bots and algorithms. You can learn more in our guide on whether Topstep allows automated trading.

3.2. Reset funded account

For a Live Funded Account or Express Funded Account, resets are not automated. You must open a chat or ticket with the Trader Support Team. They will check your payout policy, account balance, and confirm whether a reset is possible. This process protects the integrity of funded capital.

Funded traders should also keep in mind the Topstep trailing drawdown rule; breaking it may require a manual reset or even account review by support.

Read more:

3.3. Troubleshooting login or platform access issues

Some issues are not about evaluation rules but about platform access. These can often be fixed without resetting your Trading Combine account.

A reset may be needed if your login credentials fail or if your trading platform is not working. Start by updating your password or reinstalling the platform. When these steps don’t solve the issue, support staff can manually reset your platform access. This is different from a reset account Topstep option, which clears trading history and restores rules.

With the new Reset Bank system, you’re not limited to emergency resets only. You can build up multiple credits, apply them at will, and control exactly when to restart your Trading Combine.

4. Reset fees and rules you should know

Understanding the cost and conditions of a reset is important before you decide to use one. Fees vary by account size, and the rules are different depending on whether you are in the Trading Combine, Express Funded stage, or using the new dashboard.

4.1. Reset cost by account size

The reset fee depends on the size of your Trading Combine. Larger accounts cost more to reset, and all payments are non-refundable, so accuracy matters.

| Account size | Standard path | No activation fee path | Notes |

|---|---|---|---|

| 50K | $49 | $89 | Non-refundable |

| 100K | $99 | $139 | Non-refundable |

| 150K | $149 | $189 | Non-refundable |

Always confirm the account number before you click reset to avoid unnecessary loss.

4.2. Reset rules for funded accounts

Not all funded accounts can be reset. The rules are stricter for accounts already in the payout stage, with only limited options to recover.

- Live Funded Accounts: never eligible for resets. Breaking a rule here means going back to the Trading Combine.

- Express Funded Accounts on the new dashboard: can use Back2Funded, which allows up to two reactivations. Each reactivation keeps the payout policy and account size.

- Legacy Express Accounts: not eligible for Back2Funded, so failing the rules requires starting from scratch.

- Reset-at-Rebill / Automatic Reset: As of August 2025, Topstep does not offer Reset-at-Rebill. It means Trading Combine accounts no longer reset automatically when a subscription renews. Instead, each monthly rebill adds one Reset Credit to your Reset Bank, which you can use at any time.

If you manage multiple funded accounts, it’s important to understand how resets interact with your overall portfolio. Learn more in our detailed guide on how many funded accounts you can have with Topstep. Knowing your limits can help you plan smarter reset strategies.

Note: The Back2Funded program allows traders with Express Funded Accounts to reactivate their accounts up to two times if they break a rule before their first payout. You’ll retain your account size, payout structure, and platform setup, but a reactivation fee applies.

4.3. Subscription rebill policy

A reset may also affect your subscription billing date. This depends on which version of the Topstep dashboard you are using.

- New dashboard: every reset automatically moves your rebill date forward by 30 days.

- Legacy dashboard: resets do not change the rebill date; billing continues on schedule.

4.4. Free reset opportunities

Topstep occasionally provides free resets through promotions. These are not guaranteed and should be seen as bonuses, not a core strategy.

- TopstepTV giveaways: free resets may be offered during Fire Drills or quiz sessions.

- Newsletter promotions: seasonal offers or reset codes are sometimes included.

- Limited availability: free resets are tied to events and expire quickly.

Resets are a useful tool to keep you in the game without buying a brand-new account. However, they are always final and non-refundable, so use them wisely and focus on trading discipline to reduce how often you need them.

5. Tips to avoid resetting too often

Resetting too many times can drain your budget and confidence. The best way to limit resets is by building stronger habits around trading discipline. Below are practical steps I’ve used and seen work for other traders in the Topstep evaluation.

- Risk management first: Keep your risk per trade small, around 1–2% of account size. This is a classic trap. It only takes one undisciplined day to hit the Maximum Loss Limit, forcing a costly reset. Learning to stick with smaller, manageable risk sizes is what has kept me, and many other successful traders, in the game.

- Keep a trade journal: Recording every entry, exit, and thought process helps you spot patterns that lead to losses. When I started journaling, I realised I was breaking the Consistency Target simply by switching strategies too often. The journal gave me the clarity to adjust.

- Practice on demo accounts: Before trying another evaluation, spend time trading in a free demo environment. This step gave me confidence and cut down my reset costs dramatically. Treat the demo as seriously as the real challenge.

A reset is not a failure, but preventing unnecessary resets will save you money and improve your journey toward a funded account.

See more rules about the Topstep account:

6. Important notes about the reset policy

Resets are simple in concept but come with conditions you should not ignore. Here are the most important points every trader needs to keep in mind:

- Legacy vs new dashboard: On the old dashboard, buying a reset does not move your billing date. On the new dashboard, each reset automatically pushes your next payment 30 days later. This gives you extra time to finish the Trading Combine.

- Funded accounts: A Live Funded Account can never be reset. If you break a rule there, you must go back to the evaluation stage. For Express Funded Accounts on the new dashboard, the Back2Funded option lets you reactivate up to two times without starting over.

- Bankable Resets: Each time your subscription renews, one reset is added to your Reset Bank. These credits never expire, and you can use them whenever you want, on any active Trading Combine account.

- Refund policy: Once you reset, it’s final. Topstep does not refund mistakes like choosing the wrong account number or clicking reset twice.

- Free resets: Sometimes Topstep gives away resets on TopstepTV or through newsletters. These are limited promotions but worth watching out for.

- Dashboard requirement: Starting November 18, 2025, resets are only available through the new Topstep Dashboard. Accounts still on the legacy dashboard can no longer be reset and must be migrated to the new dashboard.

Keep in mind that resets are just one part of your overall trading expenses. Fees like Topstep’s market data charges also affect your total cost of participation, so it’s smart to plan your resets and data usage together for better cost efficiency.

The reset policy is designed to give traders another chance, but using it wisely, rather than often, is what protects both your progress and your budget.

7. Real trader feedback: Reset vs. creating a new Topstep account

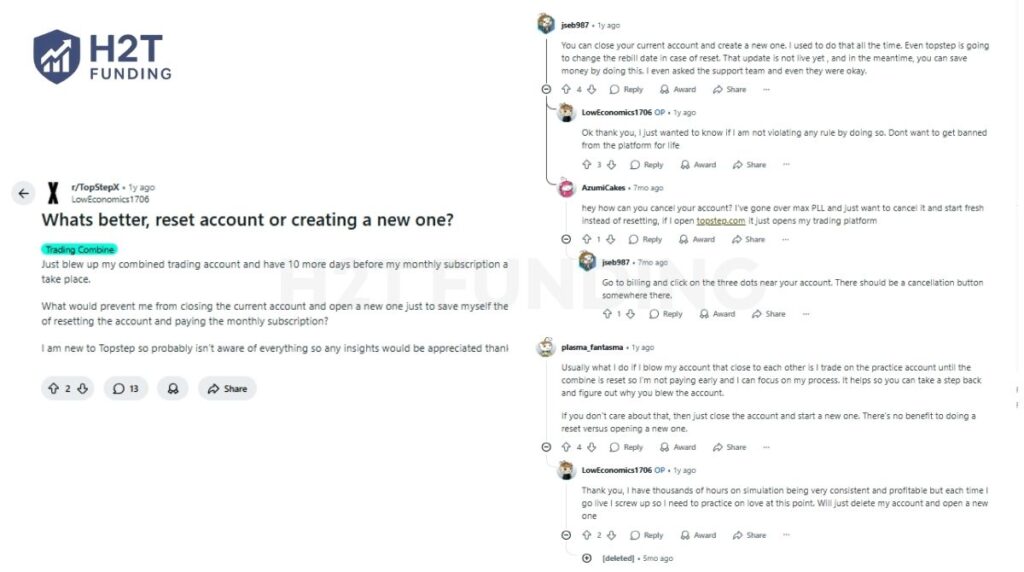

Many traders have debated whether it’s better to reset an existing Topstep account or simply start a new one after breaking a rule. The discussion often centres around two key factors: cost efficiency and timing before the next rebill date.

From community insights, traders who are close to their next billing date sometimes prefer to open a new account instead of paying both the reset fee and the upcoming subscription.

Others note that using a reset can be more convenient, especially when you still have plenty of days left in your billing cycle or want to preserve your trading history on the same dashboard.

Overall, the feedback shows that there’s no universal answer. The smarter choice depends on how close you are to your rebill, your trading performance, and whether you value continuity or a clean slate. For most traders, it’s a balance between saving costs and maintaining consistency in their evaluation process.

8. FAQs about resetting Topstep accounts

The price depends on account size. A 50K account reset is $49, a 100K account is $99, and a 150K account is $149. Payments are final and non-refundable.

Live Funded Accounts cannot be reset. Express Funded Accounts on the new dashboard may qualify for Back2Funded, which allows up to two reactivations without starting a new Trading Combine.

Resets on the dashboard apply almost instantly. Once payment or a Reset credit is confirmed, your account balance and rules return to the starting level right away.

Yes. A reset clears past trades, account balance, and progress toward the Consistency Target. You start again as if it were a brand-new account.

Yes, but Topstep limits how many resets you can purchase per day. With the Reset Bank, you can also accumulate credits and use them when you need. This is often called a Topstep account reset credit, and it gives traders more control.

Practice accounts can be reset through support if needed, though most traders simply open a new practice account since it is free and unlimited. Still, if you want to know how to reset your Topstep practice account directly, support can guide you through the process.

No. Resets are manual. However, on the new dashboard, every subscription renewal gives you one Bankable Reset that you can use anytime.

Yes. You can open a brand-new Trading Combine at any time by purchasing a new subscription, separate from your current account.

You cannot fully delete an account on your own. To close or cancel, you must contact the Trader Support Team and request removal or subscription cancellation.

On the legacy dashboard, resets do not change your billing cycle. On the new dashboard, buying a reset automatically pushes your rebill date 30 days forward.

Yes. Free resets are sometimes offered during TopstepTV events or through email newsletters. Sometimes you may also receive a Topstep reset code through seasonal promotions or special events.

Hitting the Daily Loss Limit blocks you for the rest of that trading day. Once markets reopen, you can continue, and your account remains eligible; no reset needed.

9. Conclusion

Knowing how to reset Topstep account gives you control when things don’t go as planned. Instead of quitting after breaking a rule, a reset lets you restart with the same account size and conditions. It’s your opportunity to learn from a mistake without having to start over completely.

But remember, the ultimate goal is to build habits so strong that you rarely need them. Treat the reset as a valuable safety net, but focus your energy on the discipline and solid risk management that will truly carry you to a funded account.

For deeper guidance, explore H2T Funding’s Prop Firm & Trading Strategies section. There, you’ll find practical tips on risk control, funded account rules, and trading methods tested by real traders. These insights will help you save money, avoid resets, and grow with confidence.