If you’re trying to figure out how to pass FTMO challenge, you’re not alone. Like many traders, I once stood where you are, eager to get funded but unsure of the exact steps to take. I’ve since passed the FTMO Challenge myself, and in this guide, I’ll walk you through everything I learned the hard way. This isn’t theory. It’s a clear, detailed roadmap based on real experience.

By the end of this article, you’ll know exactly how to pass the FTMO challenge, from understanding the rules to building a winning trading system. This guidance matters because the FTMO Challenge isn’t just a test; it’s a door to professional trading with real capital, without risking your own money.

Key takeaways

- FTMO requires a 10% profit target within 30 days in phase 1 and 5% within 60 days in phase 2, while staying within daily and overall loss limits.

- Traders must meet the minimum trading days and avoid using martingale, copy trading, or any strategies that violate the rules.

- A clear trading strategy should include defined entry points, stop-loss levels, and an appropriate risk-to-reward ratio.

- Proper risk management includes limiting risk per trade, calculating lot sizes based on pip distance, and avoiding emotional decisions.

- Keeping a trading journal and reviewing each trade helps improve strategy and maintain consistency during the challenge.

1. What is the FTMO challenge?

The FTMO Challenge is the first phase of the evaluation process to become a funded trader for FTMO. It’s one of the top forex prop firms in the world. Traders must prove they can manage risk and stay consistent by following strict guidelines.

As someone who has personally passed this evaluation, I can tell you that it’s demanding, yet absolutely achievable with the right mindset and method.

The FTMO Challenge consists of two stages: The Challenge and The Verification.

- In The Challenge, you trade on a demo account with a fixed profit target and time frame.

- If successful, you move to the Verification stage, where you prove consistency under similar conditions, but with a lower profit target.

One of the most important lessons in how to pass the FTMO challenge is staying consistent through both phases. Succeed in both, and you’re rewarded with access to a funded FTMO account, allowing you to trade with real capital and receive profit shares.

Let’s break down the essential rules:

- Minimum Trading Days: 4. You must trade at least four separate days to complete either stage.

- Profit Target: 10% in Challenge, 5% in Verification.

- Maximum Daily Loss: 5% of initial balance (calculated from midnight Prague time, including open and closed positions).

- Maximum Loss (Overall): 10% of initial balance.

These objectives are non-negotiable. Failing to meet even one means restarting the challenge. Understanding how to succeed FTMO challenge means knowing that FTMO’s structure ensures you follow solid risk management. I think that is a crucial discipline for any professional trader.

2. Why do traders need to pass the FTMO challenge?

Passing the FTMO Challenge isn’t just about access to capital; it’s about validation. It proves that you can trade with discipline, control risk, and maintain consistency, the exact traits of a professional trader.

Once you’re funded, the benefits expand:

- Trade up to $200,000 in capital.

- Receive up to 90% of profits.

- No personal capital at risk.

- Scale your account with consistent performance.

For traders struggling to grow their account or break into the professional space, this is your opportunity. And if you follow the step-by-step process ahead, you’ll be equipped with everything you need to pass the FTMO Challenge the easy way, even if you’ve failed before. Let’s dive in.

3. How to pass the FTMO challenge? A basic guide for aspiring traders

I believe that passing the FTMO Challenge is not a matter of luck. It’s the result of a solid plan, consistent execution, and a mindset focused on long-term success. I’m here to share with you what actually worked for me, from the perspective of someone who’s already earned funding.

3.1. Use a trading system – Make decisions based on market analysis

One of the key reasons traders fail the FTMO Challenge is inconsistency. Without a structured trading system, every trade becomes a gamble. If you’re serious about learning how to complete the FTMO challenge, the first step is to eliminate guesswork by following a consistent system. I learned this the hard way during my first attempt.

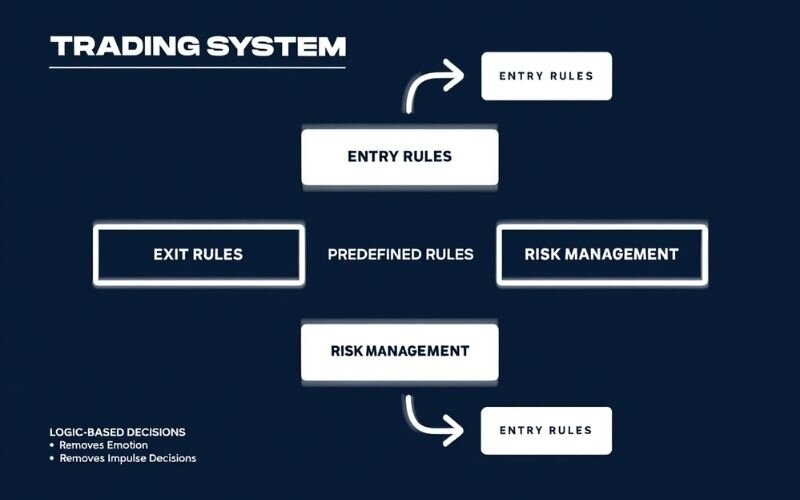

A trading system is a set of predefined rules for entries, exits, and risk management. It removes emotion and helps you stick to logic-based decisions.

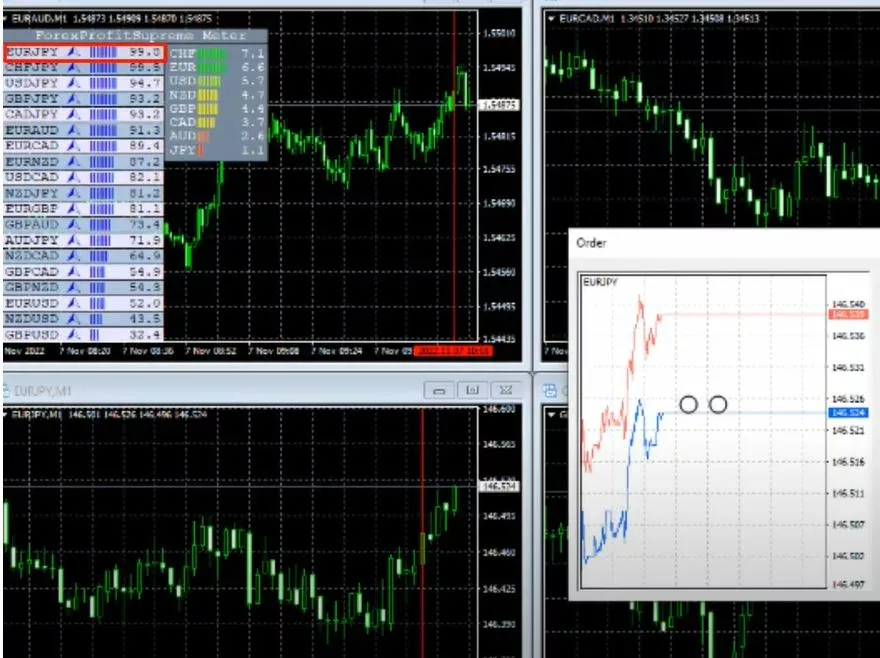

You can build your own or use reputable tools like the Forex Profit Supreme Meter to refine your decisions. You can download it here – it measures the relative strength of currency pairs.

Personally, I customized a moving average crossover strategy backed by confirmation from volume indicators. This consistency helped me meet my targets while avoiding impulsive trades.

3.2. Effective money management – Crucial to pass the FTMO challenge’s requirements

You can’t pass the FTMO Challenge without mastering money management. Here’s how I structured my risk:

First Step: Use a 1:3 Risk-Reward Ratio

- Risk 1% of your account per trade to aim for 3% profit.

- Example: $100 risk to earn $300 on a $10,000 account.

Second Step: Compound Gains

- Reinvest the profit from your first trade.

- Risk 4% of your account to aim for a 12% gain (i.e., $400 to make $1,200).

If the 1:3 setup feels too aggressive for your style, you can opt for a 1:2 ratio, which is still powerful. The point is to avoid risking more than 1% per trade unless you’re reinvesting winnings. These two rules are simple but powerful, and they played a major role in how to pass the FTMO challenge effectively while keeping risks under control.

3.3. Record your trades – Improve your trading skills

If you’re wondering how to pass the FTMO challenge, start by documenting every trade. You can’t improve what you don’t track. I kept a detailed trading journal during my FTMO preparation. Each entry included:

- Trade setup

- Entry/exit points

- Position size

- Reasoning and emotions

- Profit/loss outcome

Reviewing this weekly helped me spot patterns, especially in emotional trades, and refine my system. Over time, this practice alone boosted my win rate by 20%.

3.4. Follow a disciplined approach – Avoid letting emotions dictate your trades

Passing the FTMO Challenge requires not only skill but emotional control. The biggest mistakes I made were not technical; they were psychological. So, understanding how to complete the FTMO challenge is about staying calm, disciplined, and emotionally resilient when the pressure hits.

There were days I wanted to “make back losses” by overtrading or breaking my system. It never worked. You must build discipline and highlight patterns to become a funded trader.

To stay disciplined:

- Stick to your trading plan

- Accept losses as part of the game

- Take breaks if emotions rise

See more related articles:

4. Properly preparing your skills is key to answering how to pass the FTMO challenge

Passing the FTMO Challenge is about preparation. The most successful traders build strong foundations before risking a single dollar. Based on our own experience and working with dozens of aspiring funded traders, here’s how you can start on the right foot.

4.1. Prepare the necessary skills in advance

The table below outlines key steps and tools that will help you prepare effectively and trade with confidence:

| Step | Action | Purpose/Benefit |

|---|---|---|

| 1. Build Key Trading Skills | Develop core skills before taking your first FTMO Challenge trade | Establish a strong foundation to trade confidently |

| 2. Create a Risk Management Plan | Set specific limits: Maximum daily loss Overall loss Target profit | Aligns with FTMO rules and removes emotion from trading decisions |

| 3. Analyze Currency Strength | Use tools like Forex Profit Supreme Meter to identify strong and weak currencies | Avoid random trades and follow strong market trends |

| 4. Use Technical Indicators | According to TradingView experts, the following indicators are important to consider: Fibonacci retracements 20/100/200 EMAs Structure analysis You can view these indicators at tradingview.com. | Improve the timing and accuracy of entries and exits. Then, you can pass FTMO challenge with signals. |

| 5. Trade Selectively | Focus on pairs that match your strategy (e.g., a trending EURJPY) | Increases consistency and avoids overtrading |

4.2. Remember the consistency rule to build a sustainable trading system

FTMO rewards consistency, not occasional wins. That’s why it’s important to follow a steady system that can perform over time.

Trade like a professional by sticking to your daily routine, journaling trades, and measuring performance. Don’t change strategy mid-challenge. Instead, refine and repeat what works. If you lose one day, focus on recovery the next day. This disciplined routine is exactly how to pass the FTMO challenge successfully and sustainably.

4.3. My tips to pass the FTMO challenge with ease

Here are our proven tips. These tips are especially useful for beginners aiming to pass FTMO on their first attempt:

- Always trade with a clear strategy.

- Focus on high-probability setups confirmed by indicators and the daily chart.

- Cut losses quickly. Let winners run, but always secure profits.

- Check the 20, 100, and 200 EMAs; they reveal strong trend zones, as explained by expert Kridtapon P. from Medium.

- Don’t ignore free educational resources from FTMO, they’re packed with useful insights.

- Keep your mindset calm; psychology matters more than many realize.

5. Common mistakes and how to avoid them to pass the FTMO challenge

Even skilled traders fail the FTMO Challenge due to simple but costly errors. Below are the most common mistakes we’ve seen, and how to steer clear of them. Because understanding how to pass the FTMO challenge also means knowing what not to do.

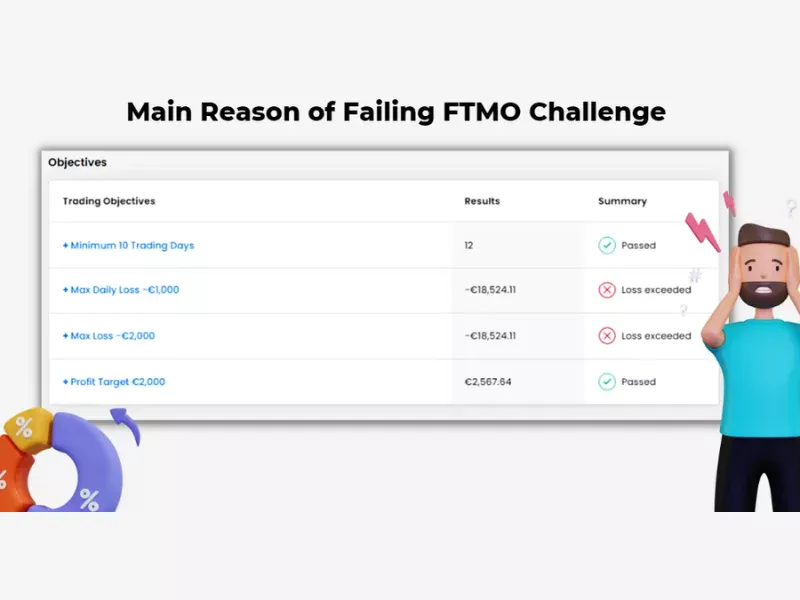

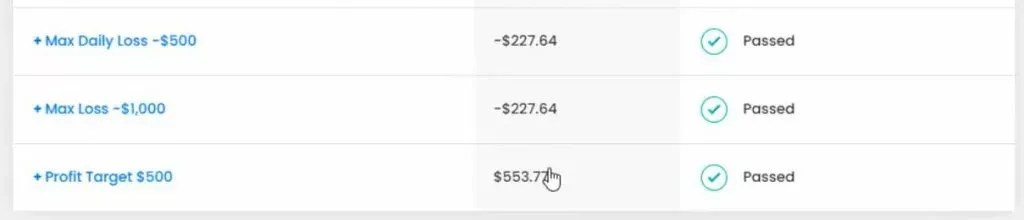

5.1. Exceeding the maximum FTMO daily loss limit

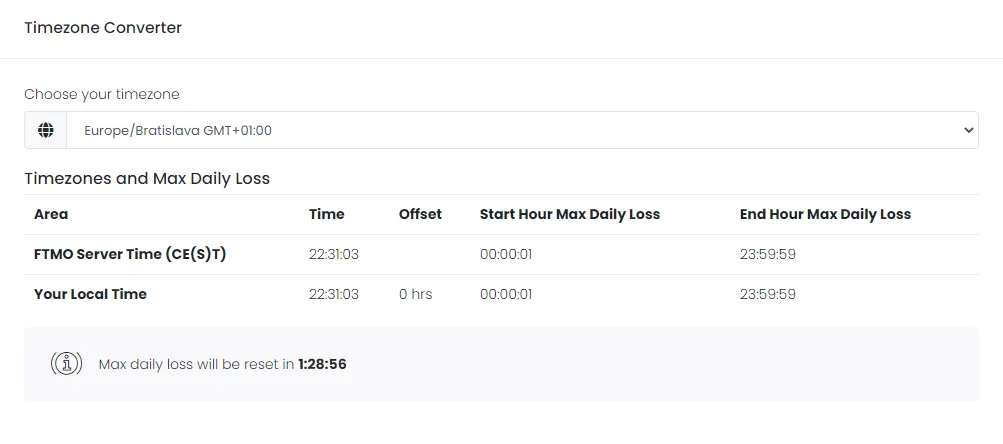

Many traders misunderstand how FTMO calculates the maximum daily loss. It’s based on the CE(S)T time zone, not your local time.

For example, losing $2,000 today and assuming midnight resets your limits. But FTMO’s day ends at 23:00 CE(S)T, not 00:00 on your clock. If you continue trading and lose another $600, you just violated the rule, even if your platform says it’s a new day.

Here is the official confirmation from FTMO

Avoiding this mistake is a key part of understanding how to succeed FTMO challenge without unnecessary rule violations.

Tip: Use FTMO’s time zone converter to stay aligned.

5.2. Breaking the loss limits

Loss limits apply to both closed and open trades. Suppose you’re down $2,000 and open a new trade, make sure your Stop Loss prevents you from losing more than $500 total that day. Always leave room for commission, swap, and slippage; they count toward your loss.

Tip: Use FTMO’s Metrix or Mentor apps to track your loss allowance in real time.

5.3. Ignoring major economic news releases

Economic news moves markets fast. During the Challenge phase, FTMO lets you trade around news, but you shouldn’t. Sudden volatility can ruin a good strategy.

Tip: Always check FTMO’s economic calendar before trading. Pause trading 2 minutes before and after big announcements to avoid unnecessary risk. Knowing when to stay out of the market is part of mastering how to pass FTMO challenge safely.

5.4. Operating too close to your risk limits

Placing your Stop Loss exactly at your loss limit is dangerous. Slippage or unexpected spread widening can push your loss beyond the threshold. Also, don’t forget about commissions; even a $15 fee can make you breach the rules.

Tip: A good practice is to stop trading at 4% daily loss, not wait for the full 5%. That small buffer protects your account.

6. A specific strategy on how to pass the FTMO challenge

If you’re actively searching for how to pass the FTMO Challenge, this section is your game-changer. You’re getting a real strategy that experienced traders have used to pass the Challenge, sometimes in just a few days. Whether you’re new or have tried and failed before, this guide will walk you through every step in a friendly, clear, and professional tone.

6.1. Specific strategy: Example

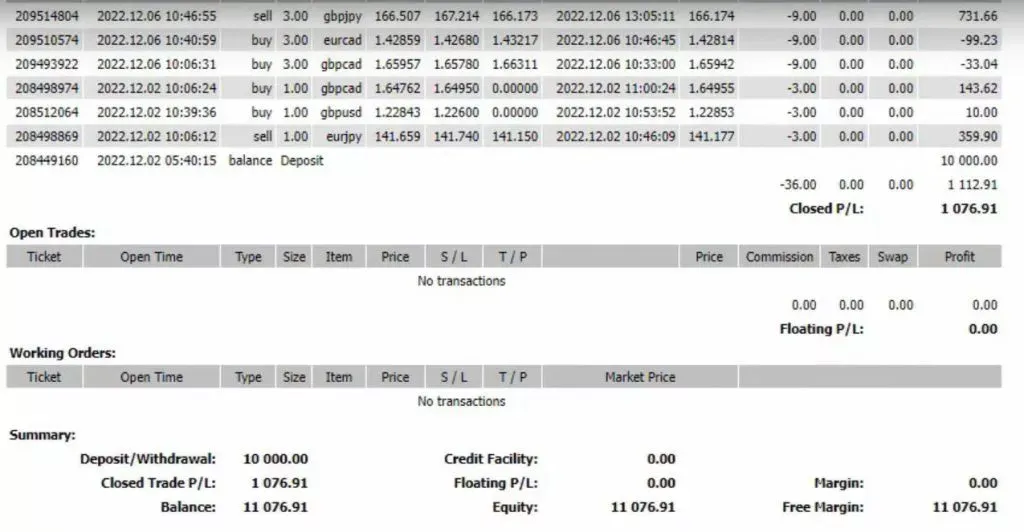

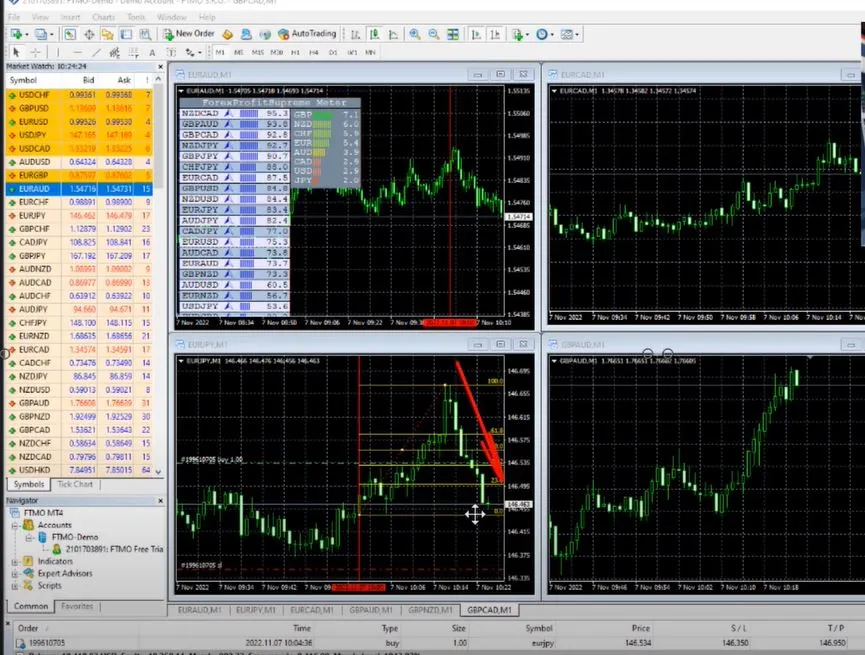

To demonstrate how to pass the FTMO challenge the easy way, let’s look at a live trade example:

- Day 1: The trader analyzed the GBP/USD pair. The setup looked strong based on key indicators.

- Day 2: A small loss occurred; that’s normal. The key was controlling the loss and sticking to the plan.

- Day 3: The trader noticed AUD was strong while EUR was weak. A short position was taken on EUR/AUD. A smart stop loss was placed above the tops, and a take profit was set near support.

Despite the market hitting SL, the trader minimized the loss to just $12.71. Eventually, the profit target of $500 was hit within 3 days. The result? An average reward-to-risk ratio of 3.01 and a profit factor of 4.01, strong signs of a solid trading system.

6.2. Specific strategy: Trade selection

Great trades begin with great pair selection. In this approach, we avoid unstable or highly manipulated pairs like CHF/JPY. Instead, we go for strong setups based on currency strength differentials, a critical step in how to pass the FTMO challenge successfully.

For instance, when the Euro and Swiss rank high and the Yen is weak, we choose EUR/JPY. Buying the strongest against the weakest increases the probability. We rely heavily on the Forex Profit Supreme Meter to spot these opportunities. When that alignment happens, we strike.

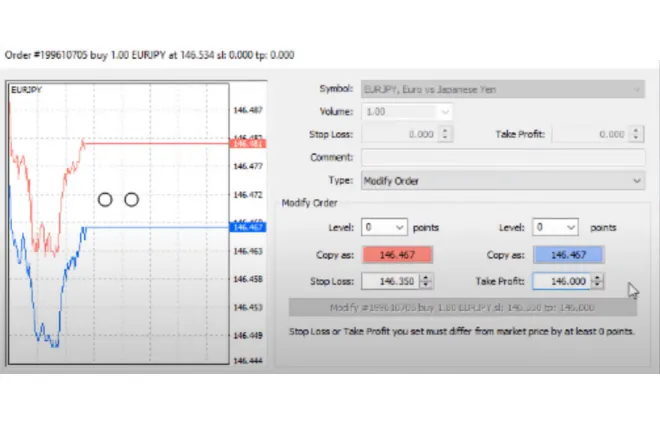

6.3. Specific strategy: Risk management

Next comes risk management, where many traders fail the FTMO Challenge. Our golden rule? Never risk more than 1.2% per trade.

In one case, we placed our Stop Loss just below a recent low, with Take Profit at 146.95. That TP was not random; it aligned with a daily counter-trendline, resistance zone, and sat just under the psychologically important 147 level.

We always place stops with breathing room. Risk was $124.77, just a fraction of the 5% daily loss limit. And although we trade entries on the M1 chart, we analyze on higher timeframes to stay aligned with the market’s bigger picture.

6.4. Specific strategy: Analysis on higher time frames

Never ignore the bigger picture. Before entering a trade, especially when aiming to master how to crack the FTMO challenge:

- We analyzed both the daily and M15 charts.

- The daily chart showed a pattern of higher highs and higher lows.

- On M15, we observed strong bullish momentum from Friday’s session.

Price was already above the 20 MA on daily, and the 100 & 200 MA on M15. This multi-timeframe confirmation gave us confidence to enter the trade.

6.5. Specific strategy: Improving the average price

Sometimes, the market gives us a second chance. After a strong reversal, we may add another position to improve our average price.

For example, after entering at 146.10, we opened a second trade at 145.85. The new Take Profit was set at 146.65, just below a recent London session high.

This is an advanced technique, but when used cautiously, with a well-placed Stop Loss, it allows us to recover faster while staying within risk parameters. It’s a smart move in mastering how to pass the FTMO challenge using calculated risk and flexibility.

6.6. Specific strategy: Closing trades

We don’t just “let it ride.”

- Several trades were closed manually when strong resistance was identified.

- Sellers were gaining control, so we exited to protect profits.

The mindset? Treat the challenge like a real funded account. Don’t rush. Even if it takes longer, finishing strong is what matters.

Treating the Challenge as if it were a live funded account makes all the difference. We stay focused on the 5% profit target. Once reached, we step back. No overtrading. No gambling.

View more:

7. FAQs

You can become an FTMO-funded trader in as few as 8 trading days, 4 days for the Challenge, and another 4 for the Verification phase. These days don’t need to be consecutive, and there’s no maximum time limit, so you can take it at your own pace.

To pass the $100k FTMO Challenge, you need to achieve a 10% profit within the 30-day trading period, without violating daily or overall loss limits. The key isn’t just strategy, it’s risk management. Limit each trade to no more than 1% risk, stick to your setup, and avoid overtrading.

One loss won’t disqualify you, but if you lose 10 trades in a row, that’s a 10% drawdown, and you’ll fail the FTMO Challenge. That’s why proper risk management is crucial. If you’re facing repeated losses, take a step back. Reassess your strategy, adjust your approach, and consider testing proven systems. Most importantly, keep your risk per trade low to avoid compounding losses. In trading, survival comes before success.

Stop trading immediately and review your trading journal. Continuous losses often signal deeper issues in strategy or mindset. Take a break, backtest your system, and consider switching to a demo account until consistency returns. Never try to “win it back”, reset with logic, not emotion.

You’ll trade with the same account balance as in your Challenge: $10k, $25k, $50k, $100k, or $200k. Keep in mind this is a demo account with virtual funds, but FTMO pays you up to 90% of the real profits you generate. Maximum capital allocation per trader is $400,000, split across multiple accounts. If you perform consistently, FTMO may scale your capital further over time. I always advise traders to focus on consistency; that’s what unlocks larger funding.

Once you meet all trading goals in the FTMO Challenge, you’ll receive a notification in your Account MetriX. FTMO will automatically review your performance. Within 1–2 business days, you’ll receive credentials for your Verification account. This is your final step before becoming an FTMO Trader. From my experience, this is where you should double down on discipline, one more solid phase, and you’re funded.

8. Conclusion

Passing the FTMO Challenge isn’t about being perfect. It’s about consistency, discipline, and understanding your edge. All are crucial elements when figuring out how to succeed FTMO challenge. We hope this guide gave you more than theory; it gave you a roadmap.

When I followed this exact process, I hit my 5% target in four days. But more importantly, I traded with confidence, not anxiety. That experience changed my career.

So, did you find this helpful? Are you ready to apply what you’ve learned and finally pass the FTMO Challenge?

If you are, keep practicing. Explore the resources we’ve shared across our Prop Firm & Trading Strategies and learn more about how to pass FTMO challenge. And remember, every expert at H2T Funding is here to walk with you on your journey, not just to help you pass the FTMO Challenge, but to thrive as a trader.