Managing your bills might seem like a tedious chore, but it’s one of the most powerful habits you can develop for long-term financial wellness. It’s the core of learning how to manage your money wisely and build healthy financial habits.

I used to dread missed due dates and felt overwhelmed every single month until I finally built a managing bills that worked for me. Now, how to manage your bills feels almost effortless.

In this guide, H2T Funding will show you exactly how to manage bills effectively with simple, actionable steps that anyone can follow. Let’s dive into how to manage bills every month better!

Key takeaways

- Managing bills effectively helps you stay in control of your money, avoid late fees, and protect your credit score.

- Building a clear system: listing bills, automating payments, and setting reminders, makes money management easier and less stressful.

- Using financial apps and digital tools like YNAB, Prism, or Rocket Money makes tracking, automation, and payment reminders effortless.

- Regularly reviewing records and integrating bill management into your budgeting routine strengthens financial health and supports long-term goals.

1. The real cost of poor bill management

Managing your bills effectively means more than avoiding overdue notices. It helps you take control of your money before your money starts controlling you. Let’s explore why that matters.

1.1. Late fees, credit score damage, and stress

Failing to manage your bills properly doesn’t just lead to late fees, which can cost you $25 to $50 or more per missed payment. That’s just the start.

Beyond the money, poor financial literacy also hurts your credit score. This makes it much harder to qualify for loans, open a new savings account, or even rent an apartment.

According to the Consumer Financial Protection Bureau (CFPB), consistent late payments can severely damage your credit score, making it tougher to qualify for loans or secure a solid investment profile.

The emotional toll is just as concerning. The stress of juggling due dates, account balances, and unexpected expenses can disrupt your focus and sleep, ultimately affecting your financial health and long-term well-being.

1.2. Why managing bills is foundational to financial wellness

Bill management is the foundation of financial control. When you know what’s due, when, and how much, you can plan better, avoid overdrafts, and start building toward bigger financial goals, like building retirement savings or investing.

Budgeting, saving, and financial growth all stem from mastering core habits. Managing your finances properly ensures you stay on track, make the most of tax advantages, and use compound interest to your benefit.

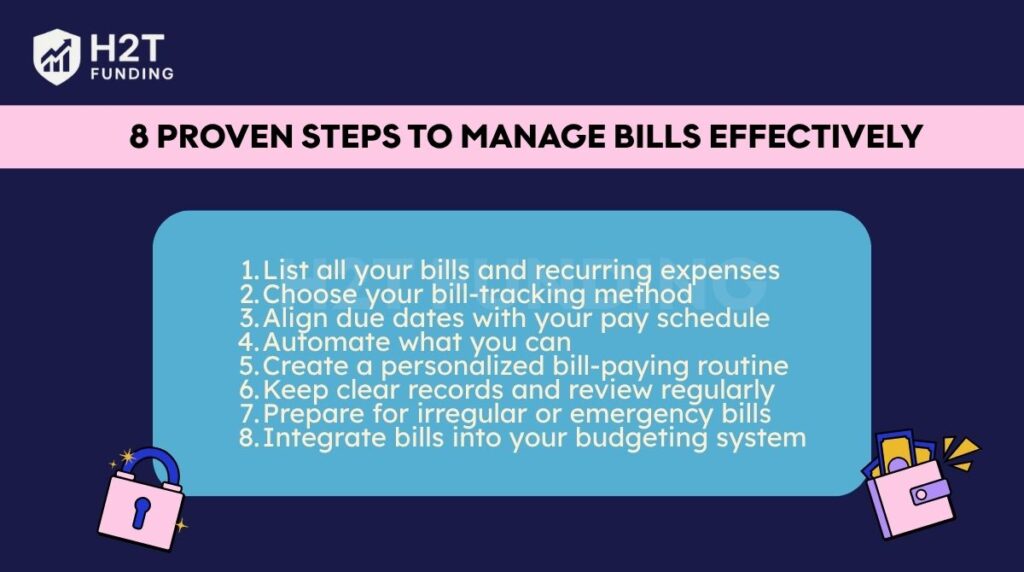

2. 8 Proven steps to manage bills effectively

Managing your bills truly doesn’t have to be a source of stress. In fact, with a solid system in place, it can become the simplest part of your personal finance routine. I know the anxiety well: that sinking feeling when a new month starts, complete with forgotten subscriptions, sudden charges, and a bank balance that disappears too quickly.

After testing different methods, I finally found a simple and effective process.

These next 8 proven steps are the exact ones I used to regain control over my financial health and stop feeling overwhelmed by due dates. Follow them to build a system that fits your lifestyle and helps you know clearly how to manage bills better:

- Step 1: List all your bills and recurring expenses

- Step 2: Choose your bill-tracking method

- Step 3: Align due dates with your pay schedule

- Step 4: Automate what you can

- Step 5: Create a personalized bill-paying routine

- Step 6: Keep clear records and review regularly

- Step 7: Prepare for irregular or emergency bills

- Step 8: Integrate bills into your budgeting system

If you’re ready to stop worrying about missed payments and start managing your bills efficiently, this is where to begin.

2.1. Step 1: List all your bills and recurring expenses

One of the first lessons I learned when figuring out how to manage bills effectively was the importance of knowing exactly what I owe and when.

So, begin by listing every bill you pay. Include fixed expenses like rent, car payments, and insurance, as well as variable ones like utilities, subscriptions, and groceries. Don’t forget annual or semi-annual bills such as auto registration or Amazon Prime.

Break them into two categories:

- Fixed: Same amount each month (e.g., mortgage, Netflix)

- Variable: Fluctuates monthly (e.g., electricity, groceries)

Tracking expenses gives you full visibility and ensures no bill slips through the cracks. This approach is also practical when learning how to manage money for students who often face tight budgets.

Pro tip: Use a free Google Sheet or budgeting app to keep an up-to-date log. Alternatively, you can use a personal financial management PDF to organize your bills offline.

2.2. Step 2: Choose your bill-tracking method

You have two main options:

- Manual tracking: Use a spreadsheet, paper planner, or printable bill calendar.

- Digital tracking: Apps like You Need A Budget (YNAB) and Prism sync with your bank accounts to track spending and send reminders.

If you prefer visibility and control, manual may be your style. If you want automation savings and alerts, digital tools are your best friend.

2.3. Step 3: Align due dates with your pay schedule

If your rent is due on the 1st but you’re paid on the 15th, cash flow becomes a problem. Many service providers allow you to change your bill due dates; call and ask.

Try to align fixed payments right after you get paid. This prevents spending money needed for bills and creates a logical flow.

Example: If you’re paid biweekly, schedule half your bills after each paycheck to balance your obligations.

2.4. Step 4: Automate what you can

Automation can be a lifesaver if used wisely. Set up auto-pay for bills that are the same each month, like your car loan or internet. This prevents late fees and saves time.

However, be cautious with fluctuating bills like utilities. Always ensure your account has enough funds to cover these charges.

According to Experian, using auto-pay on at least three accounts can help improve your payment history on your credit report.

2.5. Step 5: Create a personalized bill-paying routine

Set aside a specific time each week to check in with your bills. This could be your designated bill-paying day. You could do this every Sunday afternoon or every payday. Use:

- Payment reminders: Calendar alerts or notifications from financial apps

- Bill hub: A central place (physical or digital) where you store digital statements, receipts, and passwords

Building a routine turns bill payment into a habit, not a hassle.

2.6. Step 6: Keep clear records and review regularly

Another tip I found useful in learning how to manage bills effectively was building the habit of reviewing my records monthly. It helped me avoid duplicate charges and understand my spending patterns better.

Don’t just pay and forget. Keep a digital or physical folder of:

- Payment confirmations

- Receipts

- Disputed charges or billing errors

Set a monthly review to see how much you’ve paid, spot any unusual charges, and track recurring increases (like a creeping Netflix bill).

Real-world example: One user caught a duplicate gym membership charge that had gone unnoticed for 4 months, saving $200.

2.7. Step 7: Prepare for irregular or emergency bills

Life happens: your car breaks down, or your pet needs surgery. Plan for it:

- Build an emergency fund (aim for $500 to start)

- Keep a buffer in your checking account

- Know your options to negotiate, defer, or split payments if needed

According to Bankrate, only 44% of Americans could cover a $1,000 emergency. Be part of the prepared minority. Strong money management also helps children to learn how to invest later and develop financial awareness early.

2.8. Step 8: Integrate bills into your budgeting system

Managing bills isn’t separate from budgeting; it’s a part of it. Use a system like:

- 50/30/20 rule: 50% needs (bills), 30% wants, 20% savings/debt

- Zero-based budgeting: Every dollar is assigned a job, including to each bill

Apps like YNAB specialize in this integration, helping you plan ahead instead of reacting.

Use budgeting to spot where bills can be reduced or canceled, such as unused subscriptions or switching providers.

See more related articles:

3. Tools and apps to simplify bill management

Technology takes the stress right out of managing bills, making the whole process consistent and even boring, in a good way! Honestly, whether you love being a hands-on planner or you’d rather automate absolutely everything, there’s a perfect tool waiting for you.

Let’s see how finding the right app or system can totally simplify your entire financial routine.

3.1. Top apps for reminders, payment tracking, and automation

Here are some of the most popular and effective apps to help you manage bills:

- YNAB (You Need A Budget): Ideal for zero-based budgeting, it helps you assign every dollar to a purpose, including bill payments. Perfect for those who want to plan proactively.

- Truebill (now Rocket Money): Best for subscription tracking. It helps cancel unwanted subscriptions and negotiates bills on your behalf.

- PocketGuard: Good for keeping track of how much money you have left after bills, goals, and necessities.

According to a 2023 NerdWallet report, users who consistently used budgeting apps reduced missed payments by 60% within six months.

3.2. How to choose tools that work for your lifestyle

The best bill management tool is the one you’ll actually use. Ask yourself:

- Do you prefer full automation or manual control? If you want reminders and alerts, try Prism. If you love budgeting down to every cent, YNAB is your match.

- Do you use multiple bank accounts or credit cards? Go for apps that support syncing all your financial accounts securely.

- Are you mainly tracking subscriptions? Then, Rocket Money (Truebill) might be the most helpful.

- Do you need help organizing spending categories? PocketGuard or YNAB can show how bills fit into your overall spending.

Be sure to check user reviews, data security practices, and pricing. Some apps offer free basic plans with paid upgrades for advanced features.

4. FAQs

The easiest method is to automate fixed payments (like rent and subscriptions), use a bill tracker or budgeting app for variable bills, and set a weekly reminder to review upcoming due dates. Consistency is more important than complexity.

Not necessarily. Automate fixed bills with stable amounts and reliable due dates. For variable bills (like utilities), it’s safer to review the amount before paying to avoid overdrafts or surprise charges.

Use calendar alerts, bill tracker apps like Prism, or even sticky notes near your workspace. Some banks also offer bill alert notifications via SMS or email.

Start by organizing your bills around your pay schedule, building a buffer in your account, and using a budgeting system like the 50/30/20 rule to stop living paycheck to paycheck. Even a $100 emergency fund can make a big difference.

It depends on your income and lifestyle, but the general guideline is that essential bills (housing, utilities, transportation, etc.) should not exceed 50% of your income under the 50/30/20 rule.

The best way to organize your bills is to use a budget planner or app, set up automatic payments, and track due dates on a calendar or reminder system.

The best way to manage bill payments is to automate them whenever possible. Setting up auto-pay or scheduling reminders ensures bills are paid on time, avoiding late fees and credit score damage. You can also organize payments by due date in a calendar or budgeting app to track your spending efficiently.

Start by listing all your monthly income and expenses to see where your money goes. Allocate funds first for essentials like rent, utilities, and food, then set aside money for savings and debt payments. Use budgeting tools or spreadsheets to track bills and adjust your spending as needed.

To manage your money effectively, create a realistic monthly budget and stick to it. Prioritize saving at least 10–20% of your income, pay debts on time, and monitor your cash flow. Apps like YNAB can help you visualize spending and maintain financial discipline.

The most effective method is to automate payments through your bank or biller’s website. If automation isn’t possible, set digital reminders a few days before each due date. Keeping a small buffer in your checking account can also prevent missed payments from unexpected timing issues.

5. Conclusion

Learning how to manage bills effectively is one of the most empowering financial habits you can develop.

With a clear system, the right tools, and consistent routines, you can reduce stress, avoid costly mistakes, and build a stronger foundation for financial success. That’s why managing your finances properly is essential for long-term security.

Want to take your financial planning to the next level? Explore our Cash Flow & Saving Strategies at H2T Funding and discover how to optimize your income, save with purpose, and build lasting financial security.

If you found this guide helpful, don’t forget to like, share it with someone who might need it, and drop a comment below. We’d love to hear how you manage your bills or what tools you swear by!