Budgeting for irregular income can be a real struggle, especially when your paycheck changes month to month. Whether you’re a freelancer, a small business owner, or work on commission, the unpredictable cash flow can make it tough to cover bills, save money, or plan.

For example, my friend Hannah, a freelance graphic designer, used to dread the end of each month. Some months were overflowing with projects; others were painfully quiet. She often found herself dipping into savings or relying on credit cards just to get by.

But by adopting a few key strategies, like setting a baseline budget and separating her business and personal finances, Hannah finally gained control. Now, she knows the minimum she needs to cover her essentials and has even started building an emergency fund.

Hannah’s success wasn’t magic; it came from applying proven principles. In this guide, we’ll walk through 6 essential steps for budgeting for irregular income that will help you build the same financial stability.

Key takeaways

- Irregular income is earnings that fluctuate month to month, common among freelancers, gig workers, contractors, and commission-based professionals.

- Building a baseline from your lowest-earning month ensures you can always cover essential expenses.

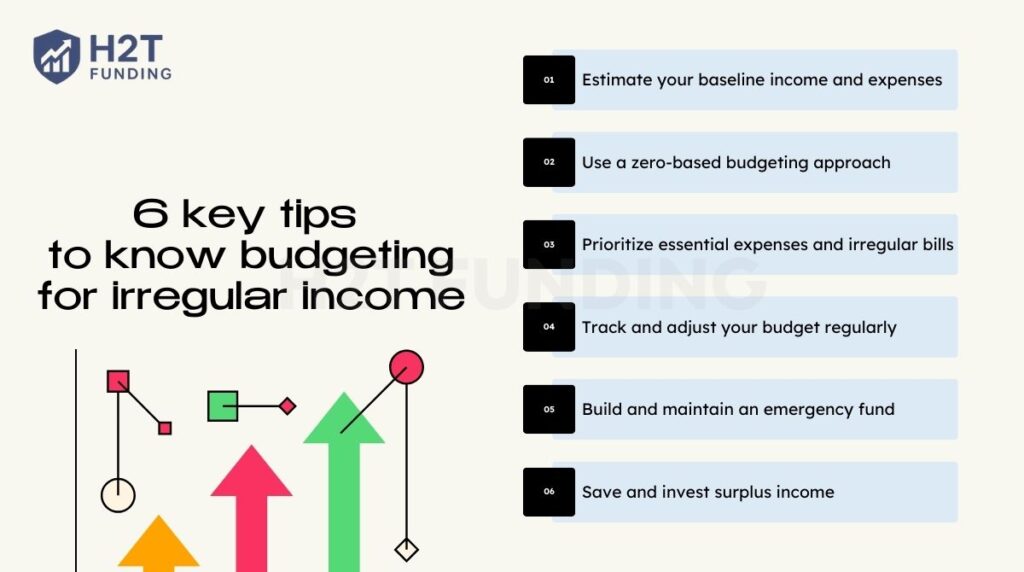

- The 6 key tips for managing irregular income are: estimate your baseline, use zero-based budgeting, prioritize essentials and irregular bills, track and adjust regularly, maintain an emergency fund, and save or invest surplus income.

- An emergency fund combined with disciplined use of surplus income creates long-term stability and reduces financial stress.

1. What is irregular income

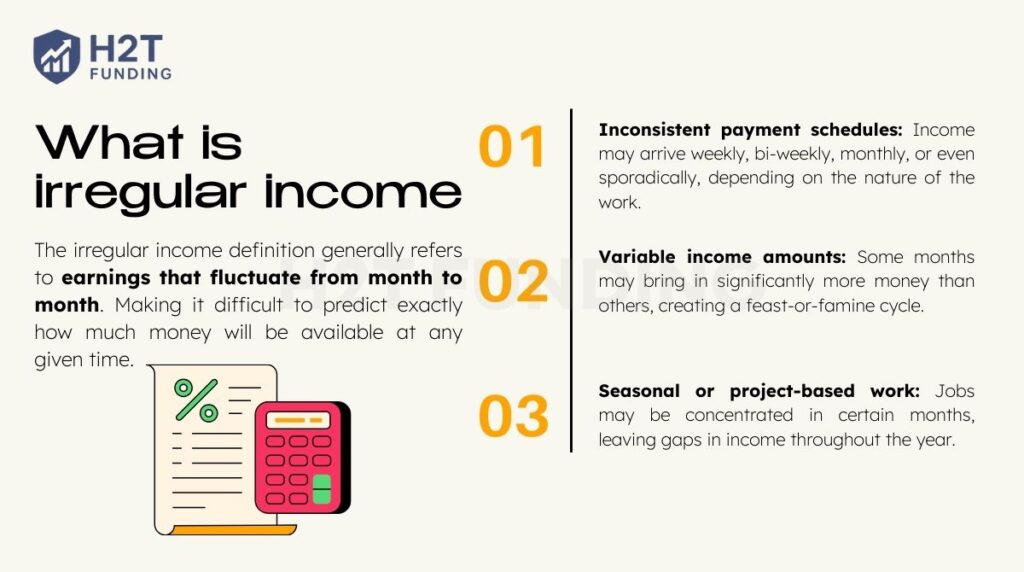

The irregular income definition generally refers to earnings that fluctuate from month to month. Making it difficult to predict exactly how much money will be available at any given time. Unlike a fixed salary, employees receive the same amount regularly. People with irregular income face uncertainty in both the amount and the timing of their earnings.

Typical irregular income examples include freelance design projects, seasonal tourism jobs, or commission-based real estate sales. This type of income is common among freelancers, gig workers, small business owners, seasonal employees, commission-based professionals, and contractors.

While the flexibility and potential for higher earnings are attractive, the lack of consistency makes financial planning harder. It also increases exposure to unexpected expenses. Using an emergency fund calculator can help you plan for these unexpected costs and build financial stability.

Key characteristics of irregular income:

- Inconsistent payment schedules: Income may arrive weekly, bi-weekly, monthly, or even sporadically, depending on the nature of the work.

- Variable income amounts: Some months may bring in significantly more money than others, creating a feast-or-famine cycle.

- Seasonal or project-based work: Jobs may be concentrated in certain months, leaving gaps in income throughout the year.

Because of these traits, managing finances on an irregular income requires a proactive mindset. It’s not just about budgeting when money comes in; it’s about preparing for when it doesn’t. Understanding your income patterns is the first step toward building a system that supports your financial stability.

2. 6 key tips to know budgeting for irregular income

Budgeting for irregular income can feel daunting, but with the right tools and mindset, it becomes manageable. One effective way is to learning how to budget your income step by step, you create a system that gives you more control and stability, even when earnings fluctuate.

You can make the process easier by using an irregular income budget template to organize your expenses and savings.

To make things easier, here are 6 proven tips you can follow:

- Estimate your baseline income and essential expenses

- Apply a zero-based budgeting approach

- Prioritize fixed costs and plan for irregular bills

- Track and adjust your budget regularly

- Build and maintain an emergency fund for lean months

- Save and invest surplus income wisely

Let’s break down each tip so you can put them into practice right away.

2.1. Estimate your baseline income and expenses

The foundation of how to budget with irregular income is knowing your baseline. Start by reviewing your earnings over the last 6–12 months and identify the lowest monthly income. This conservative estimate ensures you’ll always have enough to cover financial obligations even in slower months.

Then, outline your essential monthly expenses:

- Housing or rent

- Utilities (electricity, gas, water, internet)

- Groceries

- Transportation (fuel, car payments, public transit)

- Insurance premiums

- Debt or loan repayments

If your lowest monthly income does not cover these costs, look for ways to reduce spending or add income streams. For a step-by-step framework on organizing expenses, check out the guide on how to create a personal budget. This baseline becomes your safety net when budgeting irregular income.

2.2. Use a zero-based budgeting approach

A zero-based method assigns every dollar a job, so income minus expenses equals zero. This structure makes budgeting on irregular income more predictable and helps avoid overspending. If you’ve ever wondered what makes a budget a zero-based budget, the answer is simple: every dollar is accounted for, either spent, saved, or invested. Nothing is left without a purpose.

Steps to implement a zero-based budget for irregular income:

- Cover the “four walls” essentials first: housing, food, insurance, and utilities.

- Allocate funds for debt repayment and savings.

- Assign any extra income to investments or discretionary categories.

Tools like YNAB’s irregular income features or EveryDollar make this method easier by automating allocations and syncing with your bank accounts. With these apps, you can consistently track progress and gain clarity on exactly where your money goes.

2.3. Prioritize essential expenses and irregular bills

When budgeting for variable income, fixed costs must come first. Essentials like housing, utilities, groceries, and insurance should never be skipped. Next, prepare for irregular bills such as quarterly taxes, annual subscriptions, or car insurance.

A simple way to handle them is to spread the cost:

| Irregular Bill | Annual Cost | Monthly Savings Needed |

|---|---|---|

| Car insurance | $600 | $50 |

| Software fee | $240 | $20 |

| Taxes (quarterly) | $2,400 | $200 |

By setting aside small amounts monthly, you avoid financial stress when these bills arrive. Tools like Goodbudget or a dedicated savings account help you stay on top of these obligations.

2.4. Track and adjust your budget regularly

A budget isn’t static, especially with contract workers or freelancers. Tracking ensures your plan matches your real income and monthly expenses.

Options to track spending:

- Pen and paper: simple but manual.

- Manual budgeting app: record each expense as you go.

- Automated budgeting app for irregular income: syncs with bank accounts for effortless tracking.

Revisit your budget with every paycheck to adjust your allocations. You might be surprised by what you find. For example, many people discover that 15% of their income is spent on daily snacks or other small, non-essential purchases. Identifying these spending leaks is the first step to redirecting that money toward your savings or debt goals.

2.5. Build and maintain an emergency fund

An emergency fund is crucial when you live on a variable income. It covers essentials during lean months or unexpected events.

- Start small: $500–$1,000 as a starter cushion.

- Grow gradually: Aim for 3–6 months of expenses (some prefer up to 12 months).

- Keep it separate: Use a high-yield savings account to avoid dipping into it.

According to the Federal Reserve (2023), 40% of Americans would struggle with a $400 emergency. Building your own fund protects you from falling into debt during financial shocks. Tools like an irregular income budget template can help calculate how much you need.

2.6. Save and invest surplus income

In good months, avoid the temptation to overspend. Instead, use your extra earnings strategically to strengthen your finances.

A simple guideline is the 70-10-10-10 rule:

- 70% for essentials and monthly expenses

- 10% for savings

- 10% for investments

- 10% for discretionary or lifestyle spending

This structure balances immediate needs with long-term growth. Surplus funds can reduce debt, build your emergency fund, or go into investments like index funds or retirement accounts. For comparison, you can also explore the 50/30/20 budget rule, another popular method that helps people manage income effectively across needs, wants, and savings.

Managing irregular income is about building stability in the face of uncertainty. A structured budget creates clarity, while consistent tracking and mindful saving provide the cushion needed to handle both strong and weak months. With discipline and planning, financial control becomes less stressful and more sustainable over time.

See more related articles:

3. Overcoming the challenges of budgeting with irregular income

Budgeting for irregular income comes with unique hurdles, but they can be managed. Unpredictable earnings, irregular bills, and overspending temptations are common issues. With practical strategies and tools, you can stay on track. Here’s how to tackle these challenges effectively.

- Handle unpredictable income: Fluctuating pay makes stability difficult. Estimate your lowest monthly earnings to build a baseline, as 36% of U.S. workers rely on gig jobs (McKinsey, 2022). Adjust your plan each paycheck and use apps to stay flexible. If you’ve wondered, “How do you pay yourself a salary with an irregular income?”, treating surplus as profit is the answer.

- Manage irregular bills: Annual subscriptions, car insurance, or quarterly taxes can break your budget if unplanned. Spread the cost across months to avoid sudden shocks. Saving small amounts regularly ensures these financial obligations are always covered.

- Resist overspending in high-income months: High-earning months can tempt you to overspend, risking future shortfalls. Follow the 70-10-10-10 budget rule to allocate 10% to savings and 10% to discretionary spending. Surplus income can also be redirected toward debt repayment or future goals. See this guide on budgeting mistakes to avoid to strengthen discipline further.

- Build a financial buffer: Unstable income often creates financial stress, especially since 40% of Americans cannot cover a $400 emergency (Federal Reserve, 2023). Keep a buffer in your checking account, starting with $500, then grow it to cover several months of expenses. For targeted goals like equipment or a home down payment, explore this resource on how to save for a big purchase.

- Use technology to stay disciplined: Tracking expenses manually can be overwhelming with irregular income. Budget apps for irregular income automate expense tracking and budget adjustments. They help you stick to your plan. Regular reviews keep you focused and reduce financial anxiety.

Applying these strategies consistently is what allows freelancers and business owners to save for larger goals, from buying new equipment to building a retirement fund. The peace of mind that comes from knowing you have a financial buffer improves overall well-being and reduces stress associated with uncertain earnings.

By adopting these practical steps and leveraging technology to your advantage, budgeting for irregular income becomes a manageable, even empowering, part of your financial life.

Read more: What is leverage in futures trading

4. FAQs – Frequently Asked Questions

Irregular income varies monthly or seasonally, unlike a fixed salary. Irregular income 5 examples could include freelance photography, commission-based sales, seasonal farm work, event catering, and online content creation. Budgeting for irregular income helps manage these fluctuations. It ensures financial stability despite unpredictable earnings.

To budget for irregular income, calculate your average income using your lowest monthly earnings. Prioritize essential expenses like rent and utilities, adopt zero-based budgeting, and track spending regularly using apps for dynamic adjustments. This approach keeps your finances on track.

Flexibility is key when budgeting for irregular income. Track expenses consistently, adjust budgets with each paycheck, and build an emergency fund for lean months. These steps create a sustainable financial plan despite income variability.

Set aside a fixed monthly amount for irregular bills like quarterly taxes or annual subscriptions. Use budgeting apps for irregular income to track these expenses. This prevents financial surprises. A small reserve fund ensures you’re prepared for unexpected costs.

The 70-10-10-10 budget rule allocates 70% to essentials, 10% to savings, 10% to investments, and 10% to discretionary spending. For irregular income, adjust percentages based on monthly earnings. It’s a flexible framework for financial stability.

YNAB offers flexibility with real-time syncing for variable income. EveryDollar excels in zero-based budgeting, ideal for prioritizing essentials. Goodbudget’s envelope system curbs overspending. The best budget app for irregular income depends on your preference for automation or manual control.

Examples of irregular income include freelance graphic designers, real estate agents, or seasonal ski instructors. Their earnings fluctuate based on projects, sales, or seasons.

False. Budgeting for irregular income is effective with the right approach. Use zero-based budgeting, track expenses with apps, and prioritize essentials.

The key is to base your budget on your lowest expected monthly earnings. Start by covering essential expenses such as housing, utilities, groceries, and insurance. Then, use tools like an irregular income budget template to track cash flow and set aside savings in high-income months. This approach builds consistency and protects you during leaner periods.

The 70/20/10 rule suggests dividing income into three parts: 70% for essentials like rent, food, and bills; 20% for financial goals such as savings or debt repayment; and 10% for discretionary spending. It provides a simple guideline for balancing needs, long-term stability, and lifestyle choices.

Budgeting on a limited income requires strict prioritization. Focus on covering basic financial obligations first, such as rent, food, and transportation. Cut down on non-essential expenses and look for ways to reduce fixed costs. Even small savings matter, so start with a realistic plan and build gradually as income grows.

5. Conclusion

Ultimately, budgeting for irregular income isn’t just about tracking earnings; it’s a crucial strategy for achieving long-term financial stability when your paychecks are unpredictable. Without a plan, fluctuating income can easily lead to stress, missed payments, or unnecessary debt. But with the right approach, you can take control of your finances, even when your income varies from month to month.

If you’re just getting started, focus on one or two simple actions. Calculate your baseline income and explore budgeting apps that can help you manage your cash flow more effectively. These small steps create the foundation for lasting financial control.

Want to go further? Visit Strategies and Budgeting Strategies on H2T Funding to explore more articles on smart budgeting, saving strategies, and real-world tips for freelancers, gig workers, and anyone earning on a non-fixed schedule. Take the first step toward financial confidence today.