The dream of becoming a day trader often looks like a golden ticket to financial freedom, working from home, and being your own boss. But behind the charts and potential profits lies a challenging reality.

Many new traders enter the financial markets with hopes of quick gains, only to face unexpected risks and heavy emotional pressure. This guide of H2T Funding doesn’t promise shortcuts, but it will show you step-by-step how to be a day trader and make money with practical strategies and realistic expectations.

Key takeaways:

- Day trading means opening and closing positions within the same trading day.

- Profit is possible, but risk management and discipline decide long-term success.

- You can start small, even with $100, but building trading skills first is critical.

- Common tools include demo accounts, stop-loss orders, and clear trading plans.

- Consistency requires continuous learning, mental control, and realistic goals.

1. What is day trading, and why do people choose it?

A day trader buys and sells financial instruments such as stocks, forex pairs, or crypto within a single session. To better understand how funded trading accounts support new traders, check out how funded trading accounts work.

The goal is to profit from short-term price fluctuations without holding positions overnight. Traders rely on trading platforms, fast execution, and a clear trading plan to react quickly to changing market conditions.

Why do people choose day trading?

- Profit potential: With leverage and volatility, traders can capture small price moves that add up. Understanding how leverage and margin work in funded trading accounts can help beginners control risk more effectively; see how funded trading accounts work for details.

- Flexibility: Many see day trading as a way to work from home and set personal trading hours.

- Control: Unlike long-term investment strategies, day trading gives immediate feedback and results.

The downsides:

Day trading is stressful and carries high risk. Without proper safeguards and emotional discipline, losses can exceed initial trading capital. The reality is that most beginners lose money because of overtrading, lack of strategy, or ignoring trading rules.

2. Can you really make money with day trading?

Most beginners wonder if day trading can truly generate consistent profit. The short answer: Yes, it is possible, but the odds are not in everyone’s favor. Over 80% of traders lose money due to poor risk management and limited understanding of drawdown, according to the U.S. SEC and academic studies. Only a small fraction of traders achieve sustainable income.

Case studies: Success vs. failure:

Success story: Imagine a trader, let’s call her Alex, starting with $5,000 in the market for forex pairs. Alex stuck to one strict rule: never risk more than 1% of her trading capital on a single trade.

She focused on mastering only one trading strategy and logged everything in a journal. This ironclad discipline is what allowed her to slowly turn trading into a career, essentially becoming a day trader for a living.

Failure story: In stark contrast, consider Jamie, who started with $1,000 and was constantly trying to answer “How do I become a day trader with $100,” hoping for huge returns on a small stake. Jamie used excessive leverage and ignored stop-loss orders.

After several pattern day trading violations, he didn’t realize that brokers can temporarily restrict trading activity. Can I reset day trade violations to understand brokerage rules before risking capital? Within a few weeks, his account was completely wiped out, a sadly common scenario when proper risk management is absent.

You can make money day trading, but it requires education, emotional discipline, and a well-tested trading strategy. The real challenge is setting realistic financial goals and avoiding the mistakes that trap 90% of new traders.

Profitable day traders exist, but they are the exception, not the rule. If you want to stand out from the majority, you need a structured trading plan, continuous learning, and strict control of risk.

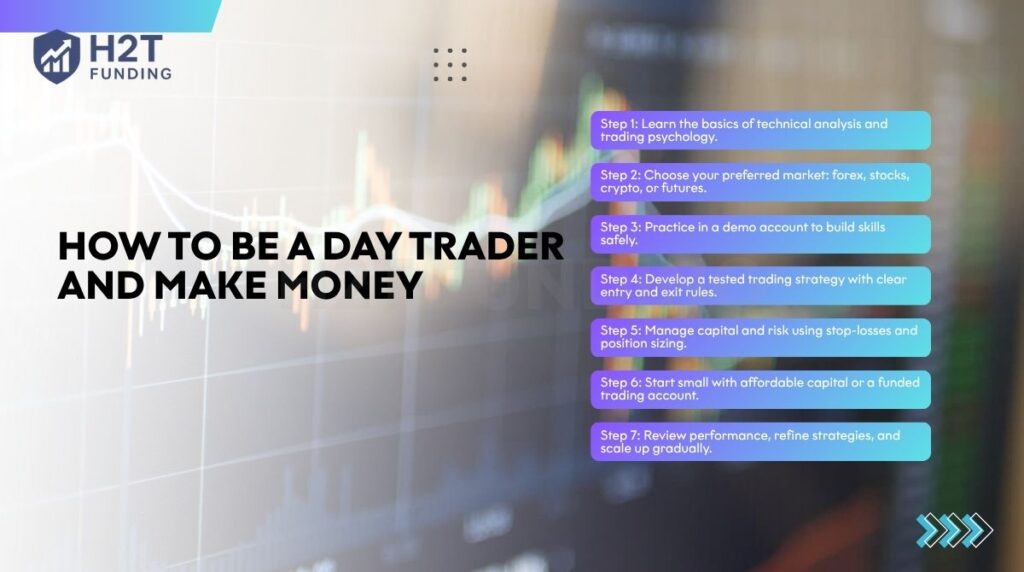

3. Step-by-step: How to be a day trader and make money

To succeed in day trading, you need more than enthusiasm. Every trader must combine education, practice, and discipline. Below is a clear roadmap showing how to be a day trader for beginners while avoiding the traps that cause most new accounts to fail.

7 steps to get started:

- Step 1: Learn the basics of technical analysis and trading psychology.

- Step 2: Choose your preferred market: forex, stocks, crypto, or futures.

- Step 3: Practice in a demo account to build skills safely.

- Step 4: Develop a tested trading strategy with clear entry and exit rules.

- Step 5: Manage capital and risk using stop-losses and position sizing.

- Step 6: Start small with affordable capital or a funded trading account.

- Step 7: Review performance, refine strategies, and scale up gradually.

3.1. Step 1: Learn the basics

Start with the fundamentals of technical analysis: candlestick charts, indicators, and price action. To deepen your understanding, study how moving averages work; see simple moving average vs exponential moving average for a clear comparison. Understanding trading psychology and how emotions affect decisions is just as important as reading the charts.

3.2. Step 2: Choose your market

Select the market that matches your interests and resources. Forex pairs offer high liquidity and 24-hour trading, while stocks, options, and crypto each come with their own volatility and trading hours.

To explore how professionals analyze option block trades to detect unusual market activity, read how to use option block trades to spot unusual options.

3.3. Step 3: Practice with a demo account

Before risking capital, open a demo account. This lets you test trading platforms, explore different investment strategies, and build confidence without financial risk.

3.4. Step 4: Build a strategy

Decide on one or two approaches, such as scalping, breakout trading, or pullback setups. When developing your trading strategy, you can also test moving average crossovers and volume-based setups using historical data.

For futures traders, it’s important to understand overnight exposure and check that you can hold futures overnight before building your plan. Write down clear entry and exit rules, supported by risk limits.

3.5. Step 5: Manage capital and risk

Always define your position size, protective stop, and profit-loss ratio before entering a trade. Protective rules help preserve your trading capital when markets become unstable.

3.6. Step 6: Start with a small capital

Begin with money you can afford to lose. Some try to learn how to become a day trader with no money, but in reality, even a small funded account teaches discipline better than theory alone.

3.7. Step 7: Review and scale gradually

Track results in a trading journal, refine your strategy, and only increase your account size once you achieve consistent performance.

Becoming a profitable day trader is a gradual process. Start small, stay disciplined, and let continuous learning guide your growth. If you follow these steps, the path to making money becomes clearer and more sustainable.

4. Markets to trade as a day trader

Day traders can choose from different financial markets, each with its own opportunities and risks. The choice depends on trading capital, risk tolerance, and preferred trading hours.

| Market | Advantages | Challenges |

|---|---|---|

| Forex | 24-hour access, high liquidity, low entry cost with margin and leverage | Volatility can trigger quick losses without strict risk management |

| Stocks | Regulated market, clear company data, strong intraday moves during earnings or news | U.S. pattern day trading rules require $25,000 minimum capital |

| Crypto | Open 24/7, large swings create profit potential, easy access from home | Extreme volatility and unregulated exchanges raise security concerns |

| Futures | Standardized contracts, low commission at reputable brokerage, broad asset exposure (commodities, indices) | High leverage amplifies risk and demands advanced trading skills |

Each market has its pros and cons. Successful day traders usually focus on one market at first, master its trading rules, and only expand once they build consistent trading experience.

For many beginners, forex and crypto seem attractive due to low barriers to entry. However, stocks and futures often provide more structure and regulatory protection.

5. 10-day trading tips for beginners

Getting started in day trading can feel overwhelming. To improve your chances of success, beginners need to balance trading skills with mental control and clear rules. Here are ten practical tips every new trader should know.

- Educate yourself: Stay informed about economic news, central bank announcements, and company events. A strong foundation in financial markets is essential.

- Protect your capital: Decide how much trading capital you can risk. Many day traders limit exposure to 1–2% of their account per trade.

- Commitment time: Day trading requires full attention during active trading hours. Without time to watch markets, it’s difficult to react to price swings.

- Start small: Begin with one or two assets. Narrow focus helps you understand price fluctuations and build confidence.

- Avoid penny stocks: cheap securities often lack liquidity and transparency. They can trap beginners with false hope of quick gains.

- Time your entries: Markets are most volatile near the open and close. Beginners should wait for support and resistance patterns to form before jumping into trades. See what support and resistance are to understand how key price levels influence market behavior and improve your trading strategy.

- Use stop-loss and limit orders: Always define exit levels. Using protective stops prevents heavy losses, while a limit order helps manage entries with precision.

- Set realistic goals: Even winning 50% of trades can be profitable if your profit-loss ratio is favorable. Focus on consistency, not jackpot trades.

- Review your behavior: Keep a trading journal. Analyze mistakes, track progress, and build a stronger mindset over time.

- Stick to your plan: Follow your strategy and avoid impulsive decisions. Discipline separates consistent traders from those who fail.

Day trading is demanding, but these tips help beginners reduce risk and build a disciplined approach. Success comes from planning your trades, controlling emotions, and adapting to changing market conditions.

6. Skills every day trader must have

Day trading is not only about chasing quick profits. To survive and grow, traders need a set of core skills that support consistent decision-making and protect their capital.

Chart reading and price action:

- Understanding charts and candlestick patterns is the foundation of day trading. Price action reveals market sentiment and helps traders recognize entry and exit points without relying solely on indicators.

- Learning to identify support and resistance levels and setting proper target prices can improve trade timing; see how the target price matching works for practical guidance.

Risk management:

- A trader’s longevity depends on controlling losses. Using a clear risk/reward ratio, proper position sizing, and stop-loss orders ensures no single trade can damage overall trading capital.

- For better protection, consider using trailing stop orders to lock in profits as prices move; learn the difference between the two at trailing stop loss versus trailing stop limit.

Discipline and trading psychology: Markets are driven by volatility and emotion. Successful traders maintain mental control, avoid revenge trading, and follow their predefined trading plan even under pressure.

Mastering trading tools: Modern trading platforms like MT4, MT5, or TradingView provide advanced charting, order execution, and backtesting. Knowing how to use these tools efficiently saves time and improves decision-making.

Every day, traders must combine technical skills, strict risk management, and emotional control. Without these abilities, even the best trading strategy cannot deliver consistent results in unpredictable market conditions.

7. How much money do you need to start day trading?

The capital required to begin day trading varies by market. Unlike long-term investing, day trading needs enough funds to manage risk and cover brokerage requirements.

- Forex: With margin and leverage, you can technically start with as little as $100–$500. However, small accounts limit position sizing and increase pressure.

- Stocks: U.S. regulations enforce the pattern day trading rule, which requires at least $25,000 in equity to day trade actively. Outside the U.S., brokers may allow smaller accounts, but execution costs can still be high.

- Crypto: Many exchanges let you start with $100 or less, but extreme volatility can wipe out a small balance quickly without proper risk management.

Some beginners ask about how to become a day trader with $100. While it is possible to learn with that amount, especially in forex or crypto, the goal should be education and practice, not making a living from such a small account.

The right amount of trading capital depends on your market choice and goals. Start with money you can afford to lose, build experience, and scale only after proving your strategy works under real market conditions.

8. Day trading strategies that work for beginners

Not all strategies are suitable for new traders. Beginners should focus on clear setups that balance opportunity with manageable risk. Below are four popular approaches that can help build experience and discipline.

- Scalping: Scalping aims to profit from very small price fluctuations by executing multiple trades within minutes. It requires fast decision-making, reliable trading platforms, and strict stop-loss rules. Best suited for liquid markets like major forex pairs.

- Breakout trading: This strategy involves entering trades when the price breaks through a defined support or resistance level. Breakouts often occur with high volatility, giving opportunities for strong intraday moves. Traders must confirm volume before committing.

- Reversal trading: Reversal setups look for signs that a price trend is about to change direction. Using candlestick patterns and momentum indicators, traders anticipate turning points. Reversals demand careful risk management as false signals are common.

- Momentum trading: Momentum traders follow assets that show strong directional movement. They buy when demand accelerates or sell when selling pressure increases. Momentum works best in trending environments but requires discipline to exit before the move fades.

- Timeframes and tools:

- Timeframes: Beginners often use 1-minute to 15-minute charts for scalping, and 15-minute to 1-hour charts for breakout or momentum setups.

- Tools: TradingView, MT4/MT5, and moving average indicators are common. Combine them with stop-loss orders for better control.

Each strategy has strengths and weaknesses. Beginners should test them first in a demo account, then pick one or two approaches to master. Consistency and adaptation matter more than chasing every possible setup.

9. Common mistakes that stop traders from making money

Sometimes, your biggest enemy isn’t the volatile financial markets, but the bad habits that silently sabotage your account. Even the best trading strategy will fail if you fall into these common traps:

- Overtrading: Taking too many trades in one session increases costs and emotional stress. More trades rarely mean more profit.

- No risk management: Skipping stop-loss orders or ignoring position sizing puts the entire trading capital at risk.

- Trading on emotions: Fear and greed push traders into impulsive decisions, especially during periods of high volatility.

- Believing in “holy grail” systems: Trusting so-called guaranteed strategies or signals often leads to disappointment and losses.

- Ignoring structured strategies: Entering markets without clear entry and exit rules makes it impossible to measure or improve performance.

- Mistaking convenience for an edge: Many beginners who look up “how to be a day trader from home” believe that comfort is an advantage. However, without self-discipline, that convenience quickly turns into a distraction and costly mistakes. A professional trading environment isn’t about the location; it’s about your mindset.

Avoiding these mistakes is just as important as finding the right trading strategy. Success comes from discipline, consistent risk management, and refusing to chase shortcuts.

10. Tips to make money consistently as a day trader

Consistency is the real challenge in day trading. To build steady results, traders need discipline, structure, and the ability to adapt. Here are practical ways to maintain profits over time:

- Focus on one or two strategies: Mastering a few setups, like breakout or momentum trading, prevents confusion and builds confidence under different market conditions.

- Keep a trading journal: Recording entries, exits, and emotional reactions helps refine your trading psychology and improve decision-making.

- Set realistic financial goals: Aim for modest returns such as 2–5% per month. Expecting 100% growth in weeks leads to overtrading and poor risk control.

- Review your profit-loss ratio: Ensure your winners are larger than your losers. A balanced ratio keeps your account growing even with only 50% win rates.

- Commit to continuous learning: Markets evolve, and successful traders adjust by studying new tools, strategies, and improving their mental control.

Making money consistently requires patience, structured planning, and constant self-improvement. When traders combine discipline with realistic goals, they build a foundation for long-term success instead of chasing short-term gains.

Do vs don’t for consistent day trading:

| Do | Don’t |

|---|---|

| Use stop-loss and limit orders on every trade | Trade without a defined exit plan |

| Risk only 1–2% of your capital per trade | Increase lot size impulsively after losses |

| Keep a detailed trading journal | Ignore emotional triggers or bad habits |

| Stick to one tested strategy | Jump between strategies after every loss |

| Focus on risk/reward ratio (at least 1:2) | Chase unrealistic daily profit goals |

| Take breaks and review weekly performance | Overtrade to “make back” losses |

Read more:

11. FAQs

Yes, but only for a small percentage of traders. Profitability depends on strong risk management, discipline, and consistent strategies.

It is possible, especially with adequate trading capital and experience. Beginners should focus on learning before chasing daily profit targets.

Earnings vary widely. Some consistent traders may reach 2–5% growth per month, while many others struggle to break even.

Studies show that over 80% of day traders lose money, and only a minority sustain long-term profits.

Yes, particularly in forex or crypto markets where leverage allows small accounts to participate. Still, managing risk is critical with limited funds.

Yes, but most traders fail without a tested trading plan and mental control. Consistency matters more than big wins.

There is no fixed number. Some may average $50–$200 a day, but income depends on account size, strategies, and market conditions.

It’s possible for professionals with large accounts and advanced trading skills, but unrealistic for beginners.

Day trading can be rewarding for those who enjoy markets, discipline, and learning. For many, though, the stress and risk outweigh potential gains.

12. Conclusion

How to be a day trader and make money is not about secrets; it’s about skills, discipline, and a repeatable process. Most failures come from weak risk control and emotions, not the strategy itself. Build competence first, scale later, and let data, not impulses, guide decisions.

Start small, test one or two setups, and track every trade in your journal. Aim for steady growth, protect downside with clear exits, and review results weekly. Consistency beats occasional big wins.

At H2T Funding, we cut through the noise with practical playbooks and real-world examples. Explore our Prop Firm & Trading Strategies resources to practice with funded programs, and dive into our Trading Strategies library to refine entries, exits, and risk rules.