Getting a raise or a higher-paying job feels great. It’s a clear sign you’re moving forward. But more money can bring a subtle problem: lifestyle inflation, also commonly known as lifestyle creep.

Learning how to avoid lifestyle inflation is one of the most important steps toward building real wealth and financial freedom for anyone committed to building sustainable wealth and achieving long-term financial independence.

This guide, H2T Funding, will explain what lifestyle inflation is, reveal its hidden downsides, and provide simple strategies to avoid it. By doing so, you can build a stronger savings account, maintain financial flexibility, and choose experiences over things.

Key takeaways

- Lifestyle inflation happens when rising income is matched by rising expenses, leaving little room for savings or investments.

- Common triggers include raises, peer pressure, targeted marketing, and the urge for instant gratification.

- Unchecked lifestyle inflation delays financial independence, increases stress, and weakens long-term security.

- Practical strategies, like setting goals, budgeting, automating savings, and mindful spending, help you stay in control.

1. Understanding lifestyle inflation

Before learning how to avoid lifestyle inflation, you need to understand what it means, why it spreads so easily, and the risks it brings to your financial well-being. So, recognizing the problem is the first step to overcoming it.

1.1. What is lifestyle inflation?

Lifestyle inflation, or “lifestyle creep”, is the common tendency for spending to increase as income rises. When comparing lifestyle creep vs lifestyle inflation, the terms are often used interchangeably, but both describe the same pattern of rising expenses alongside rising income.

For example, as income grows, spending often rises on non-essentials. You might move to a larger apartment, buy a nicer car, enjoy luxury vacations, or dine out more often.

Some lifestyle upgrades can be a healthy sign of career success. The problem begins when expenses expand at the same pace as income, leaving little room for savings or investments.

Imagine earning an extra $1,000 per month but using it all for a luxury car lease and frequent fine dining. Without adding to your financial buffer, the higher income brings no real progress in wealth management.

A clear example: Imagine receiving a $250 monthly raise. Instead of saving or investing, you spend $50 on a premium streaming plan, $150 on a newer car lease, and $50 on extra takeout. The entire raise disappears into new recurring costs, leaving no financial buffer for the future. This is one of many common lifestyle creep examples that show how small upgrades quickly accumulate.

Understanding lifestyle inflation gives you control over your income. When small upgrades don’t take over, savings grow, your buffer strengthens, and the path to financial freedom becomes clearer.

1.2. Why does lifestyle inflation happen?

Lifestyle inflation is not random; it grows from a mix of habits, psychology, and outside influences. Understanding the triggers makes it easier for you to spot the problem early.

- The reward mindset: After working hard for a raise, it’s natural to feel you deserve a reward. The danger is when a one-time treat becomes a recurring expense.

- Social comparison: Seeing friends or colleagues upgrade their cars, homes, or vacations creates pressure to do the same.

- Slow creep: Small, harmless choices, like dining out more often or upgrading subscriptions, pile up until expenses quietly match income.

- Marketing influence: We’re constantly told that buying more will make us happier and more successful.

- No financial plan: Without a budget or clear direction, new income slips away instead of strengthening a savings account or financial buffer.

Recognizing these triggers is key. Once you know why lifestyle inflation happens, you can stay mindful, protect your savings, and focus on real financial growth.

1.3. The dangers of uncontrolled lifestyle inflation

Allowing lifestyle inflation to go unchecked can have severe and lasting consequences for your financial health:

- A stagnant savings rate: Despite earning significantly more, your ability to save and invest remains flat, defeating the primary wealth-building advantage of a higher income.

- Difficulty reaching financial goals: Major life objectives like making a down payment on a home, becoming debt-free, or retiring early are significantly delayed or become unattainable.

- Increased financial stress: Living paycheck to paycheck on a high income is a uniquely stressful position, leaving you financially fragile and vulnerable to unexpected events like a job loss or medical emergency.

- The “Golden handcuffs”: You become trapped by a high-cost lifestyle that depends on your high salary, making it difficult to pursue a passion project, change careers, or take entrepreneurial risks.

- Delayed financial independence: Ultimately, it dramatically lengthens the time it takes to reach the point where work becomes a choice rather than a necessity.

Uncontrolled lifestyle inflation is more than just spending too much; it quietly erodes freedom and peace of mind. Staying aware of these dangers allows you to protect your savings, maintain a healthy financial buffer, and move closer to true financial independence.

Continue reading: How to stop living paycheck to paycheck in 9 easy steps

2. 10 key strategies for avoiding lifestyle inflation effectively

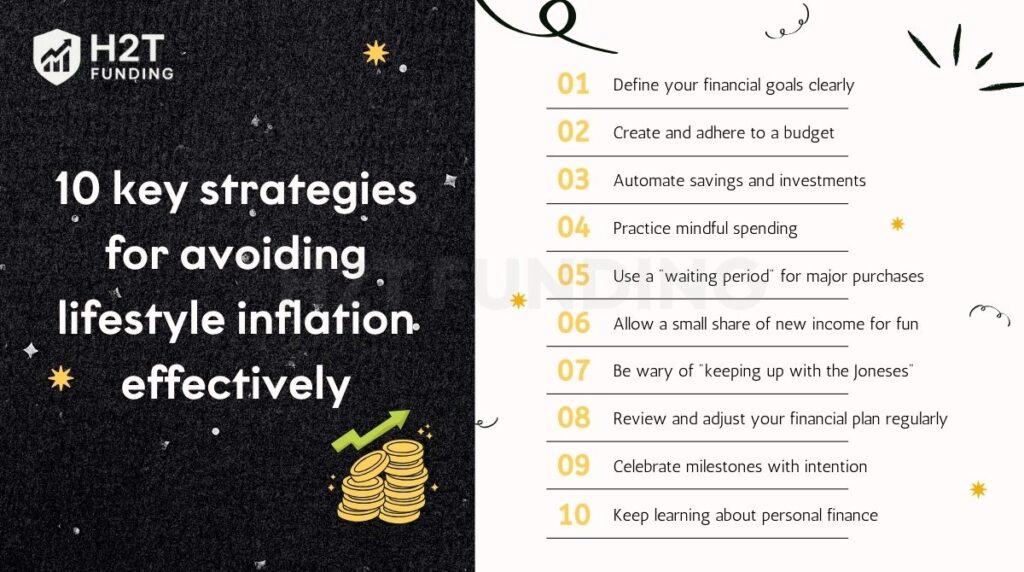

Understanding the pitfalls of lifestyle inflation is one thing; preventing it in practice is another. With focus and intention, you can use simple habits or the well-known 5 ways to avoid lifestyle creep to turn income growth into lasting wealth. Here are 10 strategies we’ll cover:

- Define your financial goals clearly

- Create and stick to a budget (before and after a raise)

- Automate savings and investments

- Practice mindful spending and separate needs from wants

- Use a “waiting period” for major purchases

- Allow a small share of new income for fun, but keep priorities first

- Be wary of “keeping up with the Joneses.”

- Review and adjust your financial plan regularly

- Celebrate milestones with intention

- Keep learning about personal finance

Continue reading these strategies below to see how each one can help you stay on track.

2.1. Define your financial goals clearly

The best defense against lifestyle inflation is knowing exactly what you’re working towards. Before your income increases, or as soon as it does, set clear, S.M.A.R.T. goals (Specific, Measurable, Achievable, Relevant, Time-bound).

Whether it’s a down payment, eliminating debt, or building a substantial retirement fund, having these targets provides a powerful incentive to prioritize saving and investing over discretionary spending.

When I picture how saving an extra $100 each month brings me closer to my goal, that new gadget or premium subscription loses its appeal. This intentional saving strategy is part of how to stop lifestyle inflation and redirect income toward your true financial priorities.

2.2. Create and adhere to a budget (before and after a raise)

A budget is simply a plan for your money, showing you where it needs to go. Tracking income and expenses gives you a clear view of where your money goes. When a raise comes in, plan and decide how that extra income will be used, rather than letting lifestyle creep take control.

I recommend the 50/30/20 rule (50% Needs, 30% Wants, 20% Savings/Debt Repayment) as a solid starting point for you, and adjusting it to direct more funds into savings can accelerate your progress. To build a practical plan that works in real life, explore these essential budgeting tips for freelancers.

2.3. Automate your savings and investments

The pay yourself first principle is a golden rule in personal finance for a reason. Set up automatic transfers from your checking account to your savings, investment, or retirement accounts, timed to coincide with your payday. Critically, make it a non-negotiable habit to increase these automatic contributions whenever your income rises.

If the money is moved to your savings or investment accounts before you even “see” it in your primary account, the temptation to spend it significantly diminishes.

Don’t miss out: Automate savings easily with these proven steps

2.4. Practice mindful spending and differentiate needs from wants

Get into the habit of spending with intention. Before making any purchase, especially a significant one, pause and ask yourself: “Is this a genuine need, or is it a want?” and “Does this purchase align with my long-term goals and personal values?” This reflective practice helps you enjoy your money on things that truly matter while sidestepping frivolous expenses that fuel lifestyle inflation.

Thinking critically before you “add to cart” or tap your card is a simple yet profound way to curb impulsive buying and focus your spending on true value. Lifestyle inflation examples, like upgrading gadgets or subscription plans without considering your priorities, can quickly spiral out of control.

2.5. Implement the waiting period rule for major purchases

For non-essential, big-ticket items that catch your eye, consider introducing a mandatory waiting period, such as 30 days. If, after this cooling-off period, you still genuinely desire the item, and it realistically fits within your budget and aligns with your goals, then you can consider purchasing it. More often than not, the initial strong urge to buy will have faded.

This simple delay tactic effectively prevents emotional or impulsive upgrades that are classic symptoms of lifestyle inflation.

2.6. Allocate a portion of new income to “fun,” but prioritize goals

It’s healthy to enjoy part of your increased income. The key is finding a balance so you can grow wealth without feeling deprived.

One sustainable approach is to split a raise into clear portions. For example:

- 50% for savings or investments

- 30% for aggressive debt reduction (if needed)

- 20% for guilt-free spending or a modest lifestyle upgrade

What matters most is deciding in advance, not after the money arrives. For more practical ideas to strengthen your saving habits, explore this save money challenge guide.

Finding a healthy balance between enjoying your present hard-earned money and securing your financial future is key to long-term adherence to your plan.

See more useful additional articles:

2.7. Be wary of keeping up with the Joneses

Resist the powerful urge to compare your lifestyle, possessions, or spending habits with those of your friends, colleagues, or, especially, the curated portrayals on social media. This constant comparison is a major driver of lifestyle inflation. Instead, focus on your own unique financial journey, your personal values, and what genuinely brings you happiness and security.

The mindset is fundamental if you want to truly master how to avoid lifestyle inflation. And it’s also a critical step if you’re searching for practical advice on how to avoid lifestyle creep in real life.

Remember, what you see on social media is often a “highlight reel,” not the full picture of someone’s financial reality or struggles.

2.8. Regularly review and adjust your financial plan

Your financial plan should be a living document, not something you set once and forget. Make it a habit to review your budget, savings progress, and investment performance at least annually, or whenever a significant life event occurs (such as a major pay raise, marriage, or new child).

This regular check-in ensures your spending, saving, and investment strategies remain aligned with your evolving goals and current circumstances. A financial plan isn’t set in stone; regular reviews keep your goals top-of-mind and allow for necessary course corrections.

2.9. Celebrate milestones wisely

Acknowledge and celebrate your achievements, including promotions and pay raises – you’ve earned it! However, these celebrations don’t always need to be extravagant or involve expensive purchases that could derail your progress. Consider prioritizing experiences over material goods, or set a specific, modest budget for any celebratory spending.

Joyful celebrations don’t have to be costly; mindful acknowledgment can be just as satisfying without compromising your long-term financial plans.

2.10. Continuously educate yourself on personal finance

Understanding core personal finance topics makes a big difference. Investing basics, compound interest, debt management, and ways to avoid lifestyle inflation all prepare you to make smarter financial choices.

Seek out reliable resources to consistently expand your knowledge. Continuous learning empowers you to make informed financial choices and stay ahead of common pitfalls like lifestyle creep.

3. The tangible benefits of avoiding lifestyle inflation

For me, getting a handle on this wasn’t just about the numbers; it was about changing my mindset. Instead of formal goals, it looked more like this:

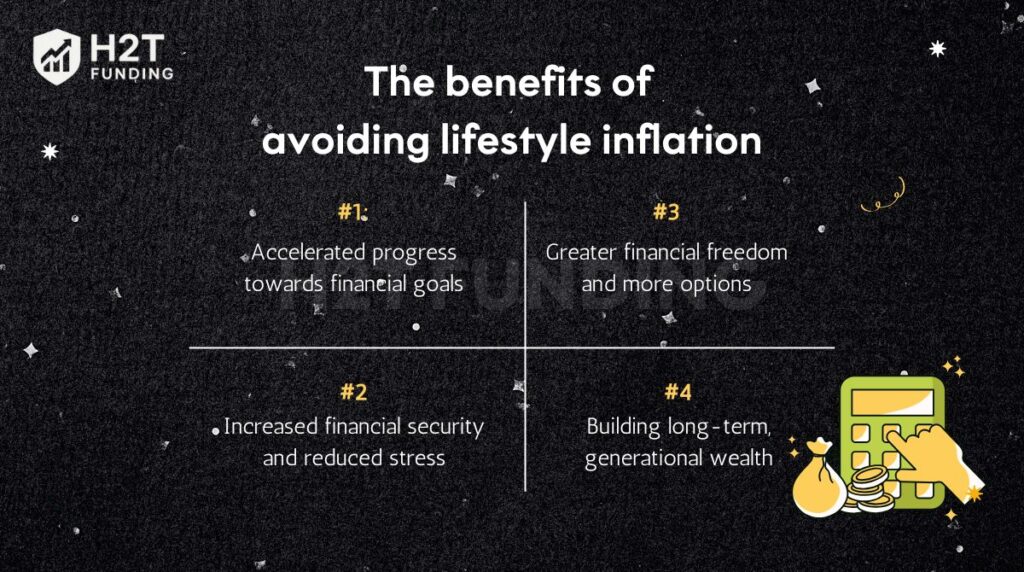

3.1. Accelerated progress towards financial goals

I’ve set clear milestones, like saving for a home and paying off my student loans. By avoiding lifestyle inflation, I’ve been able to reach these goals much faster than I initially expected. Each achievement has boosted my confidence and motivated me to continue on this path.

3.2. Increased financial security and reduced stress

Building a healthy emergency fund has been a game-changer. Knowing I have a financial cushion for unexpected expenses, like medical bills or job loss, has significantly reduced my stress levels. I feel more secure in my day-to-day life, which has improved my overall well-being.

3.3. Greater financial freedom and more options

Without the burden of a high-cost lifestyle, I’ve gained immense flexibility. I’ve been able to pursue passion projects that truly matter to me and even consider switching to a more fulfilling, albeit lower-paying, career. Understanding how to stop lifestyle inflation gave me the freedom to align my financial goals with my personal values.

3.4. Building long-term, generational wealth

By consistently saving and investing, I’m not just securing my future; I’m laying the groundwork for generational wealth. It feels empowering to know that my disciplined approach to finances can provide a legacy for my family. Understanding how to avoid lifestyle inflation has been key to this transformative process.

Overall, applying these strategies has not only enhanced my financial stability but also enriched my life in countless ways.

For traders, here’s a guide to prop firms with the lowest minimum trading days that shows how structure and discipline can accelerate success.

4. What if lifestyle inflation has already set in?

Recognizing that lifestyle inflation has taken hold of your finances is a crucial first step, and it’s nothing to be ashamed of; it’s an incredibly common challenge. Many people even share personal stories on forums like how to avoid lifestyle creep on Reddit, showing that you’re not alone in facing this issue.

The good news is that it’s entirely reversible with awareness and deliberate action. Please don’t feel discouraged; instead, view it as an opportunity to realign your spending with your true priorities. Here’s how to course-correct:

- Track your spending meticulously: For at least one full month, commit to recording every single expense, no matter how small. Use a budgeting app, a spreadsheet, or even a notebook. The goal is to get an honest, detailed picture of where your money is actually going.

- Identify areas for reduction: Compare your current spending habits to your spending before your last significant income increase. Pinpoint the non-essential upgrades or new recurring costs you’ve added. Be honest with yourself about which of these truly add value versus those that were impulse buys or status-driven.

- Create a “recovery” budget: Develop a new, realistic budget that prioritizes reallocating funds away from the identified inflated expenses and towards your savings, investments, or debt-reduction goals. This is where you actively practice how to avoid lifestyle inflation going forward.

- Start small and be consistent: Making drastic cuts overnight can be difficult to sustain and may lead to burnout. Begin by reducing or eliminating one or two inflated expense categories. Once you’re comfortable, tackle another. Small, consistent changes are more effective long-term.

- Focus on your “why”: Constantly remind yourself of your long-term goals, the ones that lifestyle inflation was hindering. Visualizing what you’re working towards (e.g., early retirement, a debt-free life, travel) will provide the motivation needed to stick to your new plan.

Overcoming lifestyle inflation starts with small, intentional steps. Tracking expenses, adjusting habits, and sticking to a recovery budget gradually shift your money toward what truly matters. Each change strengthens your finances and moves you closer to lasting freedom.

5. FAQs about lifestyle inflation

Not necessarily. Some improvement in your standard of living as your income grows is natural and can be a positive outcome of your hard work (e.g., moving to a safer neighborhood, affording better healthcare for your family). The problem arises when spending increases disproportionately to income, systematically neglecting savings and long-term goals. The key is intentional and controlled lifestyle enhancement, not mindless or reactive creep.

There’s no single magic number that fits everyone, as individual circumstances and goals vary. However, a common and sound recommendation is to aim to save or invest at least 50% of any net pay raise. The more you can allocate towards your financial objectives, the quicker you’ll achieve them. It’s crucial to revisit your budget and financial goals to determine an allocation that makes sense for your specific situation and helps you to avoid lifestyle inflation effectively.

The most common triggers include promotions, salary raises, or bonuses that make you feel wealthier overnight. Peer pressure is another factor; seeing friends or colleagues upgrade their homes, cars, or vacations often creates the urge to match them.

Yes. Avoiding lifestyle inflation doesn’t mean giving up enjoyment. You can set aside a portion of your income for guilt-free spending while directing the rest toward savings and long-term goals. This balance allows you to enjoy the present without sacrificing future security.

Start by tracking every expense for at least one month. Identify recent upgrades that don’t add real value, then scale them back. Create a recovery budget that reallocates money toward savings, investments, or debt repayment. Focus on small, consistent changes; these are easier to sustain than drastic cuts.

Build resilience through financial planning. Strengthen your emergency fund, diversify income streams, and invest regularly. Keep fixed expenses low, avoid unnecessary debt, and prioritize spending on needs over wants. These steps protect you from rising costs and keep your finances stable.

Key strategies include setting clear financial goals, sticking to a budget, automating savings, practicing mindful spending, and avoiding comparison with others. Use tools like the 50/30/20 rule to guide allocations. Regularly review your progress and adjust when needed to stay on track.

The most effective way is to decide in advance where each raise or bonus will go. Direct most of it toward savings or investments before lifestyle creep takes hold. Combine this with consistent tracking and conscious spending choices, and you’ll keep inflation in check.

6. Conclusion: Taking control of your financial destiny by avoiding lifestyle inflation

Mastering how to avoid lifestyle inflation is about making intentional financial choices that align with your long-term goals and values. Here are key takeaways to remember:

- Conscious spending: Focus on spending that supports your true aspirations rather than succumbing to lifestyle creep.

- Set clear goals: Define what you want to achieve financially, such as buying a home or building an emergency fund.

- Create a budget: Track your expenses and income to ensure you prioritize saving and investing.

- Build financial security: Establish a solid emergency fund to reduce stress and increase resilience.

- Invest wisely: Direct your increased income towards investments that will grow your wealth over time.

It’s the conscious choice to prioritize your future freedom over a temporary upgrade today. By deciding where your money will go before it even hits your account, you’re not just building wealth, you’re building a life with more options and less stress.

Want to dive deeper into smart money management and build a stronger financial foundation? Explore more insightful articles on Personal Finance at Budgeting Strategies of H2T Funding.