How much money do you need to trade futures? The quick answer is: you can start trading micro contracts with just $500–$1,000, but a realistic account balance for proper risk management is usually $2,000–$5,000.

For E-mini contracts, the capital requirements typically range from $5,000–$10,000+, depending on volatility, margin requirements, and your broker’s minimum. Since futures trading has no $25k PDT rule, retail traders can enter these markets more easily.

So, how much capital is required for futures trading? H2T Funding sees traders start small and grow steadily with the right plan. This guide breaks down what really matters: margin requirements, realistic capital levels, and what other traders are doing in the real world.

Key takeaways:

- Most brokers let you open a futures account with as little as $500 to $2,500, but that amount is only the technical minimum.

- In practice, many traders recommend starting with around $2,000 to $5,000 for micro contracts to handle margin changes and market swings comfortably.

- Larger contracts, such as E-mini or full-size futures, often require at least $20,000 to trade with proper risk control.

- Futures trading does not have the $25,000 day-trading rule that applies to stocks, but you still need enough balance to stay above the margin level.

- Remember, the real goal isn’t how much you start with. It’s how well you manage your capital and stay consistent over time.

1. What is futures trading, and why should you care

To put it simply, futures trading is about buying or selling a contract that represents the future price of something. It could be oil, gold, the S&P 500, or even bitcoin. When you trade futures, you’re not buying the asset itself. You’re trading an agreement on where you think the price will go.

I remember when I first heard about futures, it sounded complicated. Honestly, it scared me a little. But once I opened a demo account and placed a few small trades, things started to click. The idea that you can profit whether prices go up or down felt both powerful and risky at the same time.

Why should you care? Because futures give you access to markets that most retail traders never touch. They’re highly liquid, often open almost 24 hours, and allow you to use leverage to control large positions with smaller capital. That’s exciting, right? But here’s the catch: leverage is a double-edged sword. It can multiply your profits, but it can also drain your account faster than you expect if you’re careless.

So, if you’ve ever wanted to trade global markets or test strategies that go beyond simple stock buying, futures trading is worth your attention. Just make sure you understand what you’re getting into, manage your risk carefully, and don’t rush, especially if you’re still learning the best trading strategy for beginners. Every experienced trader I know started small, learned from mistakes, and built up slowly. There’s no shame in that, just growth.

2. Key cost drivers and capital requirements in futures trading

Let’s be honest, the amount of capital you need for futures trading isn’t the same for everyone. It depends on what you trade, how often you trade, and how much risk you can handle. Contract size and market volatility are major factors influencing how much money you need to trade futures.

For example, Micro E-mini S&P contracts have smaller tick values and lower volatility, making them ideal for small accounts. In contrast, contracts like crude oil (CL) or the E-mini Nasdaq (NQ) move much more aggressively and require higher capital requirements and stricter risk management. Both work, but they demand different levels of funding and discipline.

To make things clearer, think of it this way: every futures contract has a margin requirement set by the exchange and your broker. This is the minimum amount of money you must have in your trading account to open a position.

A more accurate example of margin requirements today would be Micro E-mini S&P 500 (/MES) at around $80 intraday margin, while Micro Nasdaq 100 (/MNQ) is typically $120. However, overnight maintenance margins can be several times higher, so traders must account for larger capital requirements to avoid margin calls.

From my own experience, margin is both a blessing and a trap. It gives you leverage, meaning you can control a large position with a small deposit. But if the market moves against you, losses are amplified just as quickly. I once watched a $2,000 account drop below $1,000 in a single morning because I didn’t respect margin limits. Trust me, it’s a lesson you only need to learn once.

Another factor that affects your capital requirements is your broker. Each broker has its own minimum, and these requirements vary by region and local regulatory rules. If you ever plan to trade through a funding program, understanding prop firms with the lowest minimum trading days can also help you plan your path.

Some U.S. brokers have no minimum deposit at all, while many brokers in Europe or Asia require higher minimums. This directly affects how much capital is required for futures trading for retail traders.

But don’t get fooled by that number. Just because you can start small doesn’t mean you should. Most seasoned retail traders recommend having extra funds as a cushion against market volatility.

If you ask me how much capital is required for futures trading, I’d say start with enough to stay comfortable even when things go wrong. Maybe $2,000 if you’re trading micro contracts, or $10,000 if you want to day trade futures more actively. The goal isn’t just to survive the margin calls, but to have enough flexibility to manage risk properly and refine your trading strategy over time.

In short, your capital is like fuel. The more you have, the farther you can go, but driving recklessly burns it fast. So, before you decide how much money to trade futures with, understand the costs, learn your broker’s rules, and plan for both the wins and the setbacks.

3. How much money do you need to start trading futures (realistic figures)

The truth is: how much you need to trade futures depends on the contract size, volatility, and your risk tolerance. Broker minimums are often low, but realistic capital requirements are higher if you want to trade sustainably.

Futures capital requirements by contract type

| Contract Type | Typical Minimum Capital | Intraday Margin (Example) | Good For | Example of What You Can Trade |

|---|---|---|---|---|

| Micro Futures (MES, MNQ, M2K) | $500–$1,000 (minimum)$2,000–$5,000 (realistic) | $50–$150 | Small accounts, beginners | Trade Micro E-mini S&P 500 with controlled risk |

| E-mini Futures (ES, NQ) | $5,000–$10,000+ | $500–$1,500 | Intermediate traders | Day trade E-mini Nasdaq with moderate volatility |

| Standard / Full-Size Futures (CL, GC, ZB) | $20,000+ | $2,000–$7,000 | Experienced traders | Crude Oil (CL), Gold (GC), high volatility |

| Prop Firm Evaluations | $50–$150 entry fee | Depends on prop rules | Low-cost funded trading | H2T Funding challenges starting ~$100 |

| Demo / Paper Trading | Free | None | Learning without risk | Simulate MES/MNQ trades to build a strategy |

Why these numbers matter

Broker ads often say you can start with $500–$1,000, but that’s only the technical minimum.

In reality:

- Micro futures require a practical buffer for volatility.

- E-mini contracts move aggressively; you need more capital to survive normal drawdowns.

- Overnight trading increases the maintenance margin by 2–3 times, so undercapitalized accounts are margin-called quickly.

Reddit traders love to show “$500 to $10,000” success stories, but for each one, many accounts blow up due to leverage and volatility.

Realistic trading scenarios (Examples)

- $1,000 account → You can trade one micro contract (MES) with tight risk.

- $3,000 account → Comfortable micro futures trading; room for volatility.

- $10,000 account → You can day trade E-minis or small swing positions.

- $20,000+ account → You can handle full-size futures or higher volatility markets like Crude Oil.

You don’t need a huge balance to begin; you just need the right path:

- Start with a FREE demo to learn risk management.

- Use a prop firm challenge (~$100) if you want leverage without risking personal capital.

- Go live with $2,000+ if you want sustainable micro futures trading with real risk control.

Trading futures isn’t about how fast you can grow your account; it’s about consistent risk management, understanding margin requirements, and staying in the game long enough to learn.

4. Which futures contracts are more accessible for smaller accounts

How much money do u need to trade futures? If you’re starting with a smaller trading account, choosing the right type of futures contracts can make all the difference. Not all contracts require the same margin or offer the same volatility. Some are more forgiving for beginners, while others can drain your account faster than you expect.

Micro vs. E-mini vs. Standard contracts

Let’s break it down simply:

| Contract type | Typical margin requirement | Contract size | Best for |

|---|---|---|---|

| Micro contracts | $80 – $150 | 1/10th the size of E-mini | Beginners or small accounts |

| E-mini contracts | $500 – $2,000 | 1/5th the size of standard futures | Intermediate traders |

| Standard futures | $5,000+ | Full contract | Experienced traders with larger capital |

From my own experience, micro contracts are a great way to learn futures trading without too much pressure, especially if you’re also looking into the best prop firms for beginners as another way to practice with lower risk.

They move more slowly, the losses are smaller, and you can still apply a serious trading strategy. If you’re testing your system or adjusting position sizing, micro contracts give you time to think clearly instead of panicking over every tick.

E-mini contracts, on the other hand, are where most retail traders eventually end up. They balance liquidity and leverage well, and they follow the same market conditions as their bigger counterparts. But keep in mind, you’ll need more capital to manage volatility and maintain proper margin levels.

A quick tip: always check your broker’s margin minimum and maintenance margin before you start. Some trading platforms adjust these based on market volatility, especially around news events. You don’t want to wake up to a margin call just because the market spiked overnight.

So, which one should you pick? If you’re still learning, start small. Micro contracts let you focus on building trading experience and good risk management habits. As your skills and confidence grow, you can scale up to E-mini or even standard contracts later. Remember, every professional trader started small before handling larger positions.

5. Risk management and trading strategy: why money alone isn’t enough

Let’s be real for a moment. Having capital is important, but it’s not what keeps you in the futures trading game for long. What really matters is how you use it. I’ve seen traders start with $500 and last for months, while others with $10,000 blow up their accounts in a week. The difference? Risk management and discipline.

Here are some key things that I’ve learned over the years:

- Always manage your risk first. When deciding how much money to trade futures, limit risk to 1–2% per trade. With a $1,000 account, that’s a $10–$20 max loss, pushing small traders toward micro contracts and disciplined position sizing based on volatility and margin requirements. For example, if your trading account is $5,000, try to keep your maximum loss per trade under $100. It sounds small, but it gives you room to survive market volatility and learn from mistakes without losing confidence.

- Keep your position sizing consistent. It’s tempting to double your lot size after a win, but that’s how many retail traders get wiped out. Use a fixed position size or calculate it based on your stop loss distance. That small habit builds long-term survival.

- Leverage is not your friend unless you respect it. Futures contracts offer big leverage, but that doesn’t mean you should use all of it. Start small, maybe with micro contracts. The goal isn’t to win big today; it’s to still have capital to trade tomorrow.

- Focus on your trading strategy, not luck. A good plan beats emotion every time. Write down your entry and exit rules. Note how different market conditions affect your trades. I often keep a trading journal to see where I messed up and what worked best.

- Adapt to volatility. When market volatility spikes, widen your stop losses or reduce position sizes. Futures trading moves fast, and reacting too slowly can turn small drawdowns into large losses.

Truth is, most beginners underestimate the mental side of trading. Staying calm when your trade turns red takes practice. So, instead of thinking only about how much money you need to trade futures, focus on how well you can control yourself when the market gets tough. Because in the end, the best investment strategy starts with you.

Day trading vs swing or overnight futures

If you’ve ever wondered how much money you need to day trade futures compared to swing trading, you’re asking the right question. The truth is, both styles can work well. It really depends on your capital, personality, and risk tolerance.

Day trading vs swing or overnight futures

When people ask, How much money do you need to day trade futures the answer depends on your approach. Day trading and swing trading are two very different beasts. I’ve tried both, and honestly, they feel like two separate worlds.

6. How much money do you need to trade futures Reddit

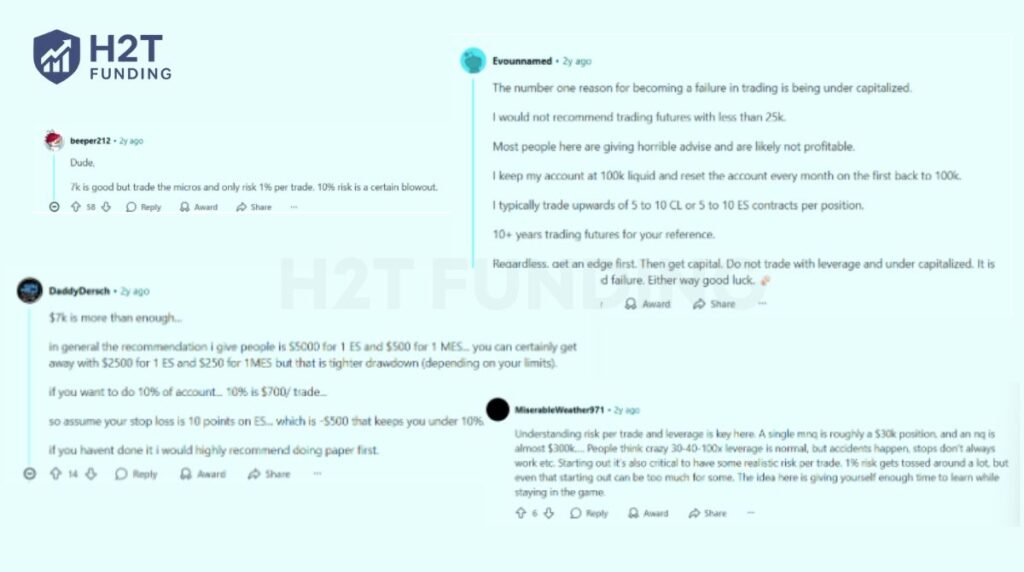

If you’ve ever wondered how much you need to trade futures, Reddit’s r/FuturesTrading community offers some of the most genuine insights. In one popular thread titled “How much to trade futures realistically?”, traders shared honest experiences about starting capital, risk, and lessons learned from both wins and blowups.

After reading through dozens of posts, here’s the general consensus:

- Most traders agree that undercapitalization is the biggest reason for failure. Even if brokers let you start with low deposits, you’ll struggle with margin requirements and market volatility without extra capital.

- Some traders argue that $500 to $1,000 is enough for micro contracts, but others believe $5,000 to $10,000 gives more breathing room and flexibility.

- Everyone emphasizes risk management. Controlling position sizing and leverage matters far more than the amount you start with.

- Several traders suggest using demo or prop firm accounts first. It’s a good way to build experience without risking your own funds.

If you want to understand how much money you need to trade futures, Reddit discussions give you a raw, unfiltered view. From small retail traders to experienced pros, the message is clear: there’s no single magic number. Your success depends on your capital discipline, your emotional control, and how well you manage risk under pressure.

7. Key differences between day trading and swing trading

| Feature | Day trading futures | Swing or overnight futures |

|---|---|---|

| Holding period | Positions open and close within the same day | Positions held for several days or weeks |

| Margin requirements | Lower intraday margin, often 50% of the standard | Higher maintenance margin, especially overnight |

| Capital needs | A smaller initial balance can work for micro contracts | Larger balance required to handle volatility and margin swings |

| Market exposure | Avoids overnight market volatility | Exposed to market gaps and global news events |

| Trading style | Fast-paced, multiple small trades | Fewer trades, larger price targets |

If you ask me, day trading suits people who love action and can focus for hours. You might only need $2,000 to $5,000 to get started if you stick to micro contracts and follow strict risk management rules. But remember, brokers can change their margin minimums anytime, especially during volatile market conditions.

Swing trading, on the other hand, demands patience. You’ll need more capital, maybe $10,000 or more, because positions stay open longer and require a higher maintenance margin. I remember holding an E-mini contract overnight once; it felt like babysitting a live grenade. The next morning, the market moved 1% against me before I even had coffee.

Here’s what I’ve learned: your choice depends on personality, schedule, and capital. If you can handle fast decisions and thrive on short-term moves, day trading might fit you. But if you prefer analyzing trends, planning entries, and letting trades breathe, swing trading could be better.

In the end, both styles can work in futures trading. What matters is knowing your limits, understanding your capital requirements, and choosing a style that matches your trading goals and risk tolerance. Because at the end of the day, trading isn’t about copying others; it’s about building a system that fits you.

8. How to start trading futures with small capital

Starting futures trading with a small account can feel a bit intimidating, but it’s absolutely doable if you approach it the right way. Let me walk you through what actually matters, not the glossy promises you see online, but the practical steps traders use in real life.

8.1. Start with the right contracts (Micro Futures first)

If your account is small, micro futures are your best friend. Honestly, they were designed for this exact situation.

- MES (Micro E-mini S&P 500)

- MNQ (Micro Nasdaq 100)

- MGC (Micro Gold)

They’re 1/10th the size of the regular E-mini contracts, so the margin requirements are much lighter and the swings don’t hit your account as hard. I still remember the relief I felt the first time I switched from E-mini to MES. Suddenly, the market didn’t feel like a roller coaster, trying to throw me off every minute.

8.2. Pick a broker that works for small accounts

You don’t need a big minimum deposit to open a futures account. Many brokers allow $100–$500 to get started, although I’d say $500–$1,000 feels more realistic, so you’re not trading on a shoestring.

What actually matters is:

- Fair commissions

- Clear margin rules

- A simple platform you understand

If a broker advertises extremely low intraday margin, just remember: that doesn’t mean you should max out your leverage. That’s a fast path to blowing up.

8.3. Understand margin before you risk a dollar

Margin is often misunderstood. It’s not a fee; it’s the amount you need in your account to control a contract. Micro futures can have intraday margins as low as $50–$150, but overnight margins are several times higher.

That’s why small accounts get into trouble. The market jumps overnight, the maintenance margin kicks in, and suddenly a trader wakes up to a margin call. So before you open any position, make sure you know the margin requirement for both intraday and overnight.

8.4. Use strict risk management (yes, even with tiny accounts)

I know this part sounds boring, but it’s the only reason small accounts survive long enough to grow. A simple rule I stick to is: risk only 1–2% per trade.

If you have $1,000, that’s a $10–$20 loss limit. Sounds tiny, right? But that’s the whole point. Small accounts don’t survive large swings. Good traders control losses like they guard their homes.

8.5. Practice first, seriously, it helps

Paper trading isn’t glamorous, but it gives you room to breathe. When I first tested futures strategies on a demo, I realized how fast things move compared to stocks. It helped me avoid mistakes that would’ve cost hundreds of dollars.

And if you want a middle ground, prop firms let you start for roughly $100 and trade simulated capital under rules that protect you from catastrophic mistakes. It’s not mandatory, but it’s helpful.

8.6. Start small, then build slowly

You can absolutely begin live trading with $2,000+ if your goal is to trade micro contracts comfortably. Anything below that is possible, just tighter, more fragile, and less forgiving.

Once you’ve built consistency, add funds gradually or scale position size slowly. Futures trading rewards patience, not speed. In fact, the slower traders usually last longer.

If you manage your expectations, stick with micro contracts, respect margin, and keep your risk tiny, starting futures trading with small capital is not only possible, it’s a smart way to learn without putting yourself under unnecessary pressure. The goal isn’t to get rich right away. It’s to stay in the game long enough to become good.

9. Hidden costs when trading futures

When I first started trading futures, I thought commissions were the only thing I’d pay. Honestly, that was naïve. There are a handful of small charges that slip in quietly, and if you don’t watch them, they eat into your profit faster than you expect.

- Exchange & clearing fees: Every contract you trade goes through an exchange and a clearinghouse. These fees look tiny, often under a couple of dollars, but they show up on every order. If you’re active, the total adds up quickly.

- Routing & regulatory fees: This part is easy to miss. Some brokers pass routing fees straight to you. And the NFA fee? It’s only a few cents per side, yet it’s always there. Think of it as the “hidden sales tax” of futures trading.

- Platform & data costs: Some brokers charge for real-time market data or platform access. It’s annoying, but it’s part of the game. A friend of mine ignored this once and wondered why his balance dipped even on days he didn’t trade.

- Overnight carrying costs: If you hold a position past the day session, your broker may charge a carrying fee. It doesn’t sound like much, but over a month, it becomes a real expense, especially for traders who swing or hold positions longer.

- Margin-related risks (the invisible cost): This isn’t a fee on paper, but it’s a cost in practice. If you drop below the maintenance margin, your broker can liquidate your position. I’ve seen traders lose more to a forced exit than to actual trading mistakes. That surprise hit to your account feels like a fee, even when it isn’t labeled as one.

- Slippage in fast markets: When volatility spikes, you often get filled at a worse price than you hoped. It’s not written as a fee, but it behaves like one. It’s the market charging you for moving too slowly.

Futures trading isn’t just about calling the right direction. It’s also about understanding the quiet costs that sit in the background. Once you know they’re there, it becomes much easier to manage them and to keep more of what you earn.

10. FAQs – Common questions about futures trading

You cannot realistically trade futures with $100 because most brokers require a minimum deposit of $500–$1,000 for micro contracts. A $100 balance may work for demo trading, but it cannot meet initial margin or maintenance margin requirements in real market volatility.

You can, especially with micro contracts like the Micro E-mini S&P 500 (MES). But even then, you’re working with tight limits. One losing trade could wipe out a large portion of your balance. A more realistic approach is to treat $500 as training capital, not investment capital. Paper trade first, then increase your minimum deposit once you find a consistent strategy.

No, futures trading doesn’t have the same $25k rule that stock day trading does. You can open a trading account with far less. However, if you ask me how much capital is required for futures trading sustainably, I’d say around $2,000–$5,000 for micros and $10,000+ for E-minis. That gives you enough cushion to survive margin calls and market swings.

This concept describes market behavior. If the market opens outside the previous day’s value area and re-enters it, there’s about an 80% chance it will move through the entire area. It’s part of some traders’ investment strategies, but it’s not a universal rule. Use it with caution and always confirm with your own trading experience.

Popular trading platforms include NinjaTrader, TradeStation, and Interactive Brokers. Each has different trading commissions and margin policies, so compare carefully. For beginners, NinjaTrader is often recommended because of its user-friendly interface and low intraday margins.

For micro futures contracts, most brokers require around $400–$1,000 to open an account. Intraday margins can be as low as $50 per contract, but overnight positions require more because of the maintenance margin. Always check your broker’s official margin schedule before placing trades.

A common rule of thumb is to risk no more than 1–2% of your total balance on a single trade. For example, if your trading account has $5,000, your max loss per trade should stay under $100. This keeps your risk tolerance manageable and helps protect against unexpected market volatility.

Yes, but you’ll need realistic expectations. Futures markets move fast, and holding trades requires discipline. If you work full-time, focus on evening sessions or swing setups that don’t need constant monitoring. Many part-time traders start small, use solid educational resources, and gradually scale as their skills improve.

It depends on the contract, but to put it simply, you need enough to survive the swings. Most brokers let you open an account with a few hundred dollars, yet in reality, you need more than the minimum margin to trade safely. For micro futures, many traders begin with $2,000–$5,000 so they have room for volatility and proper risk control. E-mini contracts usually require $10,000+ if you want to trade without feeling constantly pressured.

The 80% rule suggests that if the price opens outside the previous day’s value area and then moves back inside it, there’s roughly an 80% chance it will travel across the entire value area. It’s not a guarantee, just a market tendency some traders pay attention to. I see it as a reminder to stay alert, not a signal to jump into a trade without a plan.

11. Conclusion

So, how much money do you need to trade futures? The truth is, there’s no one-size-fits-all answer. Your starting capital depends on your goals, your trading style, and how well you manage your account balance over time. Whether you begin with $500 for micro contracts or build up to E-minis, the key is staying consistent and managing your risk carefully.

At H2T Funding, we help traders grow responsibly by combining prop firm opportunities with practical trading strategies. Before you start, make sure you understand all trading fees, margin rules, and platform requirements.

Then, focus on what really matters: discipline, patience, and a plan that fits your lifestyle. If you’re ready to take your next step, explore our Prop Firm & Trading Strategies category for more guides and funding options.