How much can you make day trading with $1000 is one of the first questions new traders ask themselves when they start out. The idea of turning a small account into fast profits is tempting, yet the reality is often more complicated than the glossy ads suggest. Many people get excited, jump in too quickly, and then feel the sting of sudden losses when markets move against them.

H2T Funding believes clarity is more valuable than hype. Instead of promising overnight riches, we will walk you through what really matters when you trade with a $1,000 account: The risks, the realistic gains, and the habits that build long-term success. By the end, you will see that growth is possible, but only if you respect money management, risk control, and your own emotions.

Key takeaways:

- How much you can make day trading with $1 000 depends on risk control, trading style, and discipline.

- Realistic daily gains are usually $10–30 with 1–2% risk per trade, not $1,000 a day.

- Factors like win rate, reward-to-risk ratio, and number of trades shape your results.

- Common mistakes include overtrading, chasing losses, and expecting a full-time income too soon.

- Simple strategies such as scalping, swing trading, and momentum can work if paired with money management.

- A $1,000 account is best seen as a learning tool to build habits, track progress, and prepare for scaling up.

1. What is day trading?

Day trading means buying and selling financial instruments within a single day, hoping to catch small price swings. While the concept sounds straightforward, living through those fast market moves is far from easy.

Day trading focuses on short-term price changes in stocks, forex trading, futures, or other markets. To trade effectively, you first need to understand the 4 main trading sessions that shape market activity.

The aim is to turn small fluctuations into consistent profits. Unlike long-term investing, the focus is on short-term results rather than holding positions for months or years. This makes protective exits, position size, and risk control absolutely critical.

Many beginners ask, Can you make money day trading with 1000? The honest answer is yes, but only if expectations are realistic. Believing you can transform $1,000 into $10,000 in a few weeks usually ends with blown accounts.

Strong emotions hit hardest with small capital. I vividly remember my first attempts with a small account; one bad trade left me stunned, and chasing losses in a panic only made things worse.

Learning how to understand trading charts earlier would have helped me avoid some of those mistakes. This is why setting realistic goals and focusing on day trading realistic profit matters more than chasing fantasy returns.

Most promotions highlight compounding returns and long-term success, but they rarely mention the truth: Price swings can wipe out your gains just as fast. In short, day trading is a real opportunity, but without grounded expectations and discipline, the dream of fast money quickly turns into disappointment.

2. Factors that determine how much you can earn

The amount you can make with a $1,000 account does not come from luck alone. Real outcomes depend on a few simple but powerful factors that shape every trade you take.

- Risk per trade: Most experienced traders keep risk between 1–2% of their account. On $1,000, that means risking $10–20 per position. Early on, driven by impatience, I ignored this and risked far more, only to watch my balance evaporate after a short string of losses. Respecting risk management limits and understanding concepts like drawdown in trading is what kept me in the game.

- Win rate: Your percentage of winning trades matters, but it doesn’t need to be 70% or higher. A trader with a 50% win rate can still grow steadily if losses are small and wins are larger. I have seen beginners obsess over win rate, but they forget that following the consistency rule in trading and applying strong money management often matters more.

- Risk-to-reward ratio: A healthy R: R, like 1:2, means you aim to make $20 for every $10 you risk. I learned that chasing tiny profits with big risks is the fastest road to frustration. A good ratio, combined with principles like the margin of safety formula, protects you even when you lose more trades than you win.

- Number of trades per day: Some traders take two solid setups and log off, while others scalp dozens of times. From my own experience, fewer strong setups bring steadier outcomes and less stress. Overtrading just drains your focus and piles on fees.

Together, these factors decide whether you walk away with steady returns or an empty account. They are the building blocks of realistic goals and the first step toward trading success.

3. How much can you make day trading with $1000

With a $1,000 trading account, a realistic expectation for daily profits is usually between $10 and $30, which equals about 1–3% per day for a disciplined and skilled trader. Still, actual returns can swing widely due to market fluctuations and the risks involved in day trading. Because of this, it’s difficult to generate a stable full-time income when starting with such a small balance.

Can you make $1000 a day trading with only $1000? No, unless you gamble recklessly with extreme leverage, and even then, the odds are stacked against you. Most traders who chase that dream end up with an empty account.

Prop firms highlight the same reality in different ways. FTMO shows that 90% of traders lose money in their equity simulator. FX2 Funding runs scenario-based examples to illustrate how growth depends on win rate and risk management. FundYourFX leans on rules of thumb like “1–3% per day,” but admits that growth over time requires patience.

From my own journey, the lesson is clear: day trading realistic profit is not about flashy numbers, but about consistent progress. Small daily gains build confidence, and with time, they compound into something meaningful, especially when guided by a solid trading plan.

If you are still unsure which method fits your small account, take a look at our guide on the best trading strategy for beginners to choose an approach that matches your goals and risk tolerance. Before committing real money, you can also backtest a trading strategy to see how it performs under different market conditions.

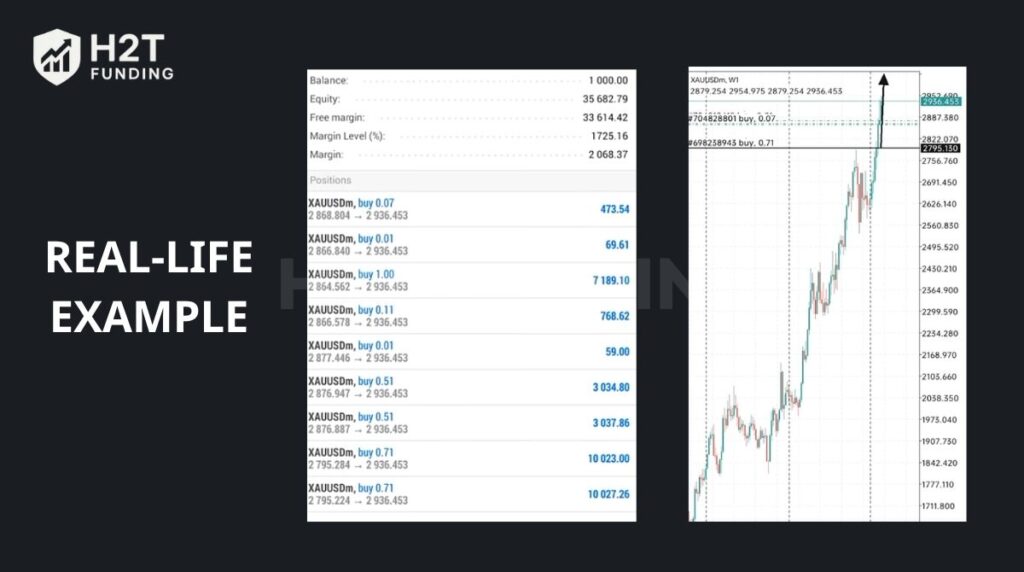

4. Real-life example: How much can you earn with a $1,000 account

A $1,000 trading account may seem small, but with careful money management and the right market trend, it can still generate significant profits. The key is not about making a fortune in a single day, but about building habits of risk control and disciplined trading.

For example, in the screenshot below, an account that started with just $1,000 opened multiple XAUUSD (gold) positions of varying lot sizes. By catching a strong bullish wave, the Equity quickly surged to over $35,000 in a short period of time.

This result illustrates the power of the market when you’re aligned with the trend, but it also highlights an important warning: with high leverage, big profits always come with big risks. A single reversal could wipe out the account just as quickly.

To understand this better, take a look at the longer-term trend of gold on the weekly (W1) chart. During a steep uptrend, holding buy positions can deliver returns far beyond what you might expect from a small account.

The lesson here is not that everyone will turn $1,000 into tens of thousands of dollars, but that a small account is best used as a training tool. It helps you learn how to manage emotions, test strategies, and most importantly, protect your capital so you’re prepared for bigger opportunities in the future.

5. Common mistakes when expecting profits from $1,000

Traders who start with $1,000 often carry heavy expectations, but the pressure usually leads to poor decisions. The gap between realistic profit and dream results is what drives many accounts to zero.

- Overtrading: Taking too many positions in one day drains focus and piles on trading fees. I once thought more trades meant more chances to win, but it only magnified my losses. Quality setups matter far more than quantity.

- Using too much leverage: High leverage feels powerful, but it cuts both ways. A small market fluctuation against you can wipe out weeks of consistent profits in minutes. I still can’t forget that heart-pounding feeling of watching my account balance collapse, all because I tried to “scale up too fast” without proper money management.

- Ignoring risk management: Skipping stop-loss orders or risking 10% on a single trade is gambling, not trading. Risking small amounts may seem slow, but it keeps you in the game long enough to actually learn.

- Expecting full-time income from a small account: Believing that a $1,000 account can pay bills every month is dangerous. That pressure creates emotional swings, FOMO, and revenge trades. The truth is that compounding returns takes patience, not desperation.

From my experience, the traders who survive are not the ones chasing daily gains but the ones who protect their capital. A $1,000 account is not about getting rich fast; it’s about building the habits that will carry you when the account grows larger.

Read more:

6. Day trading strategies suitable for $1,000 capital

A small account requires more precision than power. The strategy you choose shapes not only your daily gains but also your emotions and long-term consistency.

- Scalping: This style involves opening and closing trades within minutes, aiming to capture tiny moves. With a $1,000 account, the attraction is quick results, but the challenge is trading fees and emotional swings. I tried scalping early on and realized that without high-quality setups, the stress outweighed the profits.

- Swing trading: Holding trades for several days allows more breathing room and fewer decisions each day. It suits people who cannot sit in front of screens for hours. The downside is that overnight market fluctuations can hit harder. I found swing trades more manageable when I had work during the day, but they required trust in stop-loss orders and patience.

- Momentum trading: Following strong market moves can be exciting, especially in FX. A small account can benefit because one well-timed trade may cover the entire week’s goal. The risk is jumping in too late and paying for the reversal. Momentum taught me that discipline and money management matter more than the thrill of chasing trends.

Each approach has pros and cons, but with $1,000, you cannot afford reckless risks. The strategy should match your approach, your tolerance for stress, and also prepare you for bigger opportunities, such as passing a prop firm challenge.

Over time, keeping a trading journal to review results helps refine which path actually brings consistent profits instead of short-lived wins. Understanding how prop firms make money can also give you a perspective on why discipline and risk control matter so much.

7. Practical guide for beginners

Starting day trading with just $1,000 can feel intimidating. The key is not to rush, but to follow a clear path that keeps you disciplined and avoids costly mistakes. Instead of diving in blindly, it helps to see the journey as a simple roadmap with a few essential steps.

Here’s a quick checklist before we break it down in detail:

- Step 1: Learn and build knowledge: Study charts, technical analysis, and trading psychology.

- Step 2: Practice with a demo account: Test your strategies risk-free before trading real money.

- Step 3: Choose the right broker: Pick a reliable, low-cost, and well-regulated platform.

By keeping these steps in mind, you’ll set a solid foundation for growth. Now, let’s look at each one more closely.

7.1. Step 1: Learn and build knowledge

Before asking how much you can make day trading with $1,000, the real question is whether you understand what you are risking.

- Study technical analysis to read charts and spot high-quality setups.

- Learn about trading psychology because emotional swings often hurt more than market conditions themselves.

- Read books, take affordable courses, and use free resources. I found that even free webinars gave me insights that saved me from costly mistakes later.

7.2. Step 2: Practice with a demo account

Jumping straight into live forex trading with small capital often ends badly. Practicing in a demo environment helps you see if your approach and strategy actually work.

- Open demo trades to test stop-loss orders, trade size, and money management without risking real dollars.

- Use the demo to track day-to-day P&L in a trading log, which helps reveal bad habits before they become expensive.

- I spent months on a demo, and it taught me that chasing every move was useless. Patience was the real skill.

7.3. Step 3: Choose the right broker

A broker can either support or sabotage your growth, especially with small accounts. The wrong choice adds unnecessary trading fees and stress.

- Look for platforms with low costs and flexible leverage so a $1,000 account doesn’t get eaten by commissions.

- Make sure the broker has reliable execution and trustworthy regulation.

- I once stayed with a broker who delayed orders, and it cost me profitable trades. Switching to a better one immediately improved my consistency.

Taken together, these steps shape realistic goals and build habits that lead to trading success. Small accounts can grow, but only if you treat them with the same respect as larger ones.

8. What does the community say about how much you can make day trading with $1,000?

Hearing from real traders often paints a more honest picture than polished ads. Community discussions reveal the struggles, doubts, and realistic expectations behind small accounts.

On Reddit, the thread How much can you make day trading with $1 000 reddit shows mixed feelings. Traders admit that even with 100% returns in a year, the money is still small unless you keep a job on the side.

Some argue that making 20% a year is not enough to live on, while others say small accounts are better for learning discipline before moving on to proprietary trading firms. One comment struck me: “With $1,000, most people, maybe it’s not even worth it.” I could relate, because I once felt the same frustration after months of small, slow growth.

On Quora, the answers to Can you make $1000 a day day trading? They are equally sobering. Contributors explain that to earn $1,000 daily, you would likely need at least $20k–50k in capital. With only $1,000, the math simply doesn’t add up unless you take reckless risks.

Several users suggest focusing on swing trading and compounding returns instead of chasing unrealistic daily gains. One writer even shared screenshots of stocks they used to illustrate potential, but admitted that beginners should not expect quick wins.

From reading these communities, I realized the pattern: small accounts are best seen as training tools. They help you practice risk management, test your approach, and build confidence. The dream of turning $1,000 into a daily full-time income is tempting, but steady growth and lasting progress come from patience, not shortcuts.

Read more:

9. FAQs

With $100k, even a modest 1% daily gain means $1,000, but market conditions and risk management decide whether that’s sustainable. Most professionals target steady monthly growth, not daily riches.

A $10,000 account can realistically earn $100–300 a day if you respect stop-loss orders and use proper position sizing. Emotional swings can ruin that progress quickly.

With only $500, daily gains are tiny, often $5–10. It’s a way to learn discipline, but trading fees and overtrading can wipe it out fast.

At $30k, some traders pull $200–600 daily if they focus on high-quality setups. Consistent profits come from realistic goals and avoiding over-leverage.

No, not realistically. Small accounts are for building skills, not replacing income. To live from trading, larger capital or proprietary trading firms are usually required.

It could take years with compounding returns and careful money management. Trying to rush this goal often leads to blown accounts.

Yes, but only as a learning tool. You won’t make big money, but you will gain experience in forex trading, risk management, and trading style.

Between 0.5% and 2% per day is already strong. Anything higher usually means you are over-risking and relying on luck, not skill.

At least $5,000–10,000 with steady strategies. With only $1,000, trying to make $100 daily is gambling.

The 3-5-7 rule is a risk management approach. It suggests risking no more than 3% of trading capital on a single trade. Traders should also keep overall exposure across all open positions below 5%. Finally, the goal is to aim for a profit target of at least 7% to cover potential losses. Traders use this framework to limit drawdowns and stay disciplined over time.

Most traders aim for 10–20% a month with small accounts. The focus should be on consistent profits, not hitting jackpot returns.

Yes, if your goal is learning. No, if your goal is to replace income. A $1,000 account is best used to build habits before scaling up with more capital.

10. Conclusion

So, how much can you make day trading with $1000? The answer is clear: Not enough to replace a full-time income, but enough to practice risk management, refine your trading style, and build habits that lead to long-term success. Small accounts bring valuable lessons about money management, emotional swings, and the discipline needed for consistent profits.

Instead of chasing the dream of $1,000 a day, focus on realistic goals and compounding returns. Even daily gains of $10–30 can teach you how to manage stop-loss orders, size positions properly, and survive tough tape conditions. With time, you’ll see that trading success is not about starting capital alone; it’s about patience and persistence.

At H2T Funding, we help traders move beyond illusions and focus on what really works. If you’re serious about growing as a trader, explore our Prop Firm & Trading Strategies category. Here, you can compare the best firms and learn proven approaches. You’ll also join a community that turns discipline into opportunity.