Traders often ask: How many Topstep accounts can I have without breaking the rules? Some believe you can run as many as you want, while others warn that opening too many could block payouts. This mix of opinions makes traders nervous and unsure how to scale safely.

The rules at Topstep are actually more straightforward than you might think. While you can have unlimited Trading Combines, the real strategy comes into play at the funded stages: you can scale up to 5 Express Funded Accounts, but only 1 Live Funded Account.

This guide, H2T Funding, will break down exactly what Topstep multiple accounts really mean and show you how to use this structure to your advantage in 2026.

Key takeaways

- You can have unlimited Trading Combines, up to 5 Express Funded Accounts, and only 1 Live Funded Account on the Topstep account.

- Trading Combines have no hard cap, but Topstep how many of accounts you can run, depending on purchase caps: 10 new Combines per month and 2 resets per day.

- Express Funded Accounts allow real payouts with a max of 5 accounts, but hedging or copy-trading between accounts is prohibited.

- Live Funded Accounts are limited to one per trader, and all Express accounts close once you move to Live.

- Managing multiple accounts effectively requires separating strategies, strict risk control, and using tools like trade copiers wisely.

1. What is Topstep and the account model?

Topstep was founded in 2012 in Chicago with the mission of giving traders access to real capital without putting their personal savings at risk. The firm specializes in futures trading, offering a structured evaluation process that rewards discipline and consistency over luck.

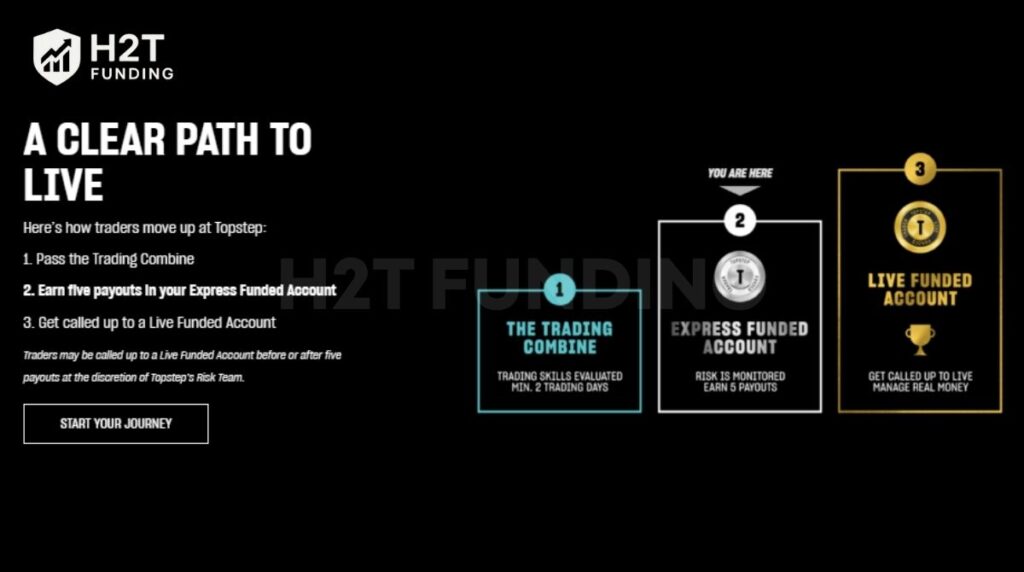

The journey with Topstep begins in the Trading Combine, where your skills are tested across at least two trading days. If you meet profit targets while staying within rules, you move forward.

The next step is the Express Funded Account, where you trade with real risk monitoring and must complete five successful payouts. After demonstrating consistent performance in the Express Funded Account, Topstep’s risk team may invite you to a Live Funded Account. While five successful payouts are a common benchmark, the final decision depends on overall performance and risk evaluation

To start, traders choose a Trading Combine account size: $50K, $100K, or $150K. Each option has a monthly fee, a set profit target, and limits on contracts and maximum loss.

For example, the $50K plan costs $49/month, comes with a $3,000 target, and a $2,000 loss limit. This structure ensures every trader is tested fairly before accessing funded capital.

Before starting your own evaluation, it’s worth learning about the basics. From how a demo trading account works to how to choose a prop firm that fits your trading style and goals.

2. Topstep’s official rules on the number of accounts

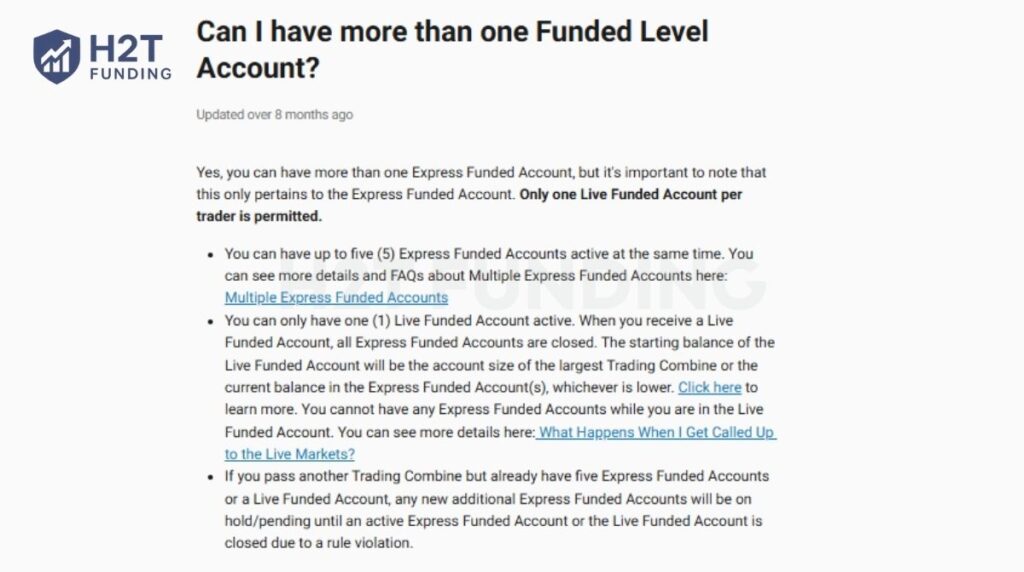

Topstep sets clear rules on how many accounts I can have with Topstep. You may run up to five active Express Funded Accounts at once. If you earn another account while already managing five, the new one will remain pending until you close an existing account.

When it comes to Live Funded Account, the limit is strict: only one account per trader. The moment you are called up to live trading, all your Express Funded Accounts are closed. A Live Funded Account will start with the balance of your largest passed Combine or your Express Funded Account balance, whichever is lower, and subject to the maximum account size cap. Balances from multiple Express accounts are not combined.

This answers the common question: How many live accounts can I have with Topstep?

For the Trading Combine, Topstep does not cap how many accounts you can open. However, they warn against excessive activity, such as buying more than 10 Combines per month or resetting more than twice per day. These limits are designed to encourage healthy trading habits and avoid reckless behavior.

Maintaining a clear trading plan helps traders stay disciplined, manage risk effectively, and avoid emotional decisions when running multiple accounts.

All accounts must also follow the payout policy and risk rules. Each Express Funded Account can request payouts independently; however, trading behavior across all accounts is shown under the same trader profile and subject to Topstep’s overall risk and conduct review.

For those exploring the industry standards, check out our breakdown of prop firm rules to see how Topstep compares with other major firms.

3. How many Topstep accounts can I have?

The exact number of accounts you can hold with Topstep depends on the stage you are in. Some traders run multiple accounts to increase their chances, while others focus on funded accounts to scale capital. To avoid confusion, here’s a quick breakdown of how many accounts I can have on Topstep at each stage:

| Account Type | Limit | Key Requirement |

|---|---|---|

| Trading Combine | Unlimited | Must be tied to one Topstep profile |

| Express Funded Account | Up to 5 active accounts | Independent payouts, monitored risk |

| Live Funded Account | Only 1 account | All Express accounts closed once live begins |

3.1. Trading Combine

This is the evaluation stage, where you prove your skills in a simulated environment. There is no strict limit on how many Combines you can open. Still, Topstep applies purchase policies, 10 new Combines per month, and 2 resets per account per day.

Your main goal is to hit the profit target without breaching the Max Loss Limit. A Consistency Target also applies, meaning your best day cannot make up more than 50% of total profits. This consistency rule helps ensure you trade steadily, build sustainable habits, and avoid relying on a single lucky win.

3.2. Express Funded Account (XFA)

After passing the Combine, you activate an Express Funded Account by paying a one-time $149 activation fee. The Express Funded Account operates in a simulated environment with real payout eligibility, subject to Topstep’s risk and payout rules. You must complete five profitable trading days, with each day showing at least $150 (new dashboard) or $200 (old dashboard) in profit, before requesting a withdrawal.

You can hold up to five active XFAs at the same time, even of different sizes. Profit sharing starts with 100% of your first $10,000, then shifts to a 90/10 split in your favor. However, certain practices like hedging (opening opposing positions on the same instrument across your accounts) or mirroring trades with other traders are strictly prohibited.

For traders comparing different funding models, it’s worth exploring how other firms operate. For instance, looking at how Apex Trader Funding works provides useful context on payout rules and scaling structures, which contrast with Topstep’s XFA system.

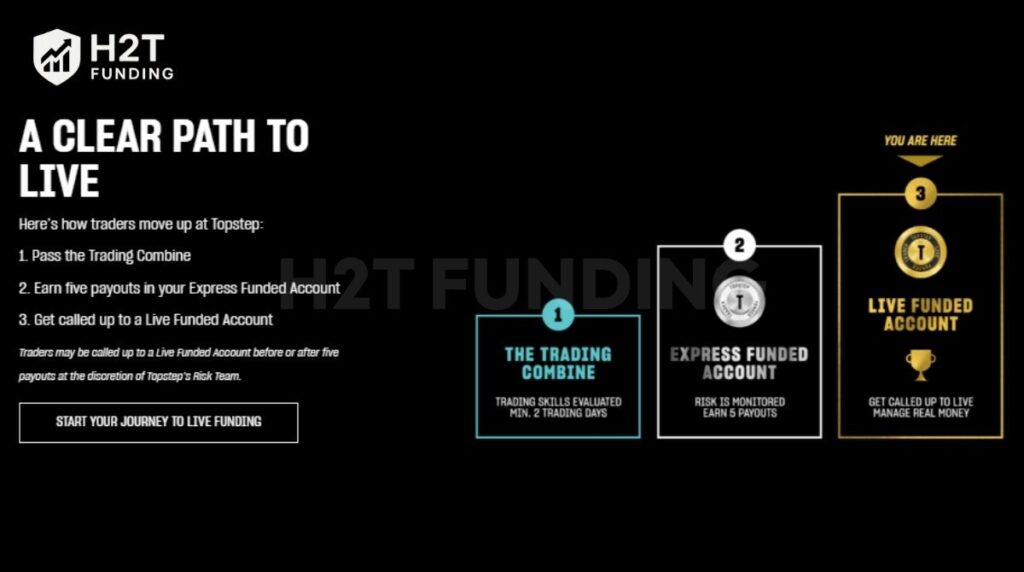

3.3. Live Funded Account

Once you show consistency in the XFA, Topstep may invite you to the Live Funded Account, where you trade real company capital. At this point, all Express accounts are closed automatically, and you can only manage one Live Funded Account under your name.

Your starting balance is based on the largest Combine you passed or your current XFA balance, whichever is lower. Here, payouts continue under Topstep’s revenue-sharing model, but you trade with real money at the brokerage level.

For example, say you have three Express Funded Accounts with balances of $10,000 each. Topstep will base your Live Funded Account’s starting balance on the largest active account or its Express equivalent, whichever is lower.

Note: Topstep allows traders who lost their Live status to return to Express through the Back2Funded program. You can reactivate your last Express account, keeping part of your progress and payout eligibility. However, reactivation does not reset your five-account limit; pending accounts still count toward your total Express cap.

Ultimately, how many Topstep accounts can you have? The rules are straightforward: unlimited Trading Combines, up to 5 Express Funded Accounts at once, and only 1 Live Funded Account per trader. Understanding these limits helps you scale capital safely while staying fully compliant with Topstep’s policies.

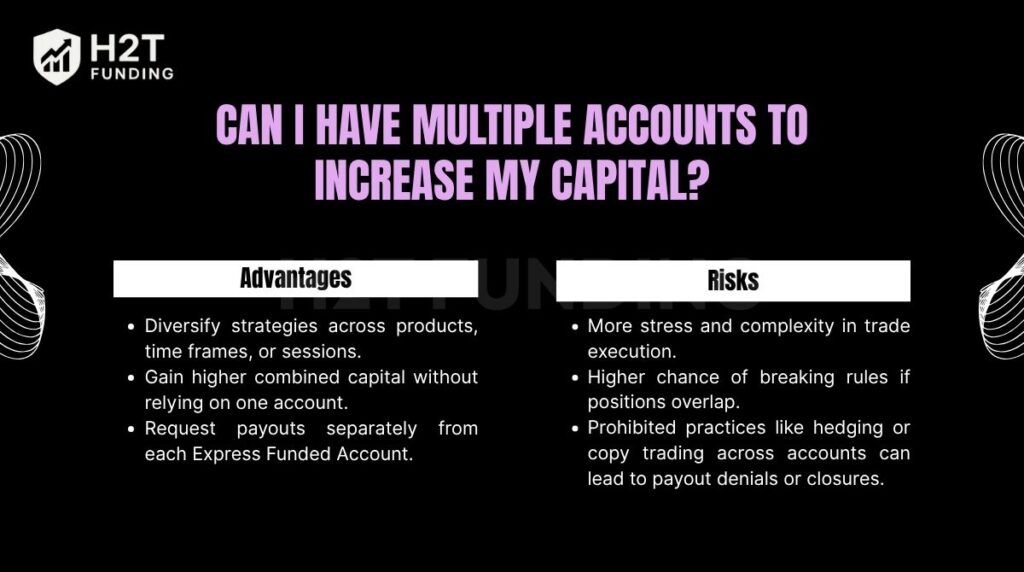

4. Can I have multiple accounts to increase my capital?

Many traders look at multiple accounts as a way to boost total buying power. By holding several accounts, you can spread strategies, trade different markets, and scale profits faster. But the benefits only come if you manage them with discipline.

Advantages of multiple accounts:

- Diversify strategies across products, time frames, or sessions.

- Gain higher combined capital without relying on one account.

- Request payouts separately from each Express Funded Account.

Risks of multiple accounts:

- More stress and complexity in trade execution.

- Higher chance of breaking rules if positions overlap.

- Prohibited practices like hedging or copy trading across accounts can lead to payout denials or closures.

The bottom line: yes, you can run up to five Express Funded Accounts to increase capital, but poor risk management could turn that advantage into a liability. Success depends on balance, not just more accounts.

I have some direct experience with this. Back in 2023, I activated two Express Funded Accounts, assuming more accounts automatically meant more profit. The flaw in that thinking became obvious during a volatile CPI release.

By placing nearly identical trades on both, I hadn’t diversified my strategy at all; I had simply doubled my risk on a single idea. It was a close call and a stark reminder that managing multiple accounts requires smart diversification, not just more leverage.

Read next: 7 Best Trading Strategies for Beginners

5. Manage multiple Topstep accounts efficiently

Managing multiple accounts is possible, but you need structure to avoid mistakes. Instead of trading more, think of each account as part of a system that requires planning, tracking, and discipline.

To manage multiple Topstep accounts effectively, you should:

- Use a trade copier for self-management: A trade copier allows you to execute a trade on one account and have it automatically replicated across your other personal accounts. While some platforms offer trade copier tools for personal convenience, traders must be extremely cautious. Topstep strictly prohibits hedging, mirrored trading behavior, or coordinated strategies across multiple accounts. Any form of copying that violates these conduct rules may result in account closures or denied payouts.

- Separate strategies per account: Don’t mirror the same trades everywhere. For example, keep one account for morning scalps and another for swing trades. This diversification reduces the chance of hitting the same loss limits at once.

- Automate tracking and alerts: Tools like TradersPost can sync signals, track drawdowns, and adjust position sizes across accounts. This automation prevents small mistakes from snowballing.

- Stick to strict risk rules: Experts recommend keeping per-trade risk under 0.5% and setting daily loss caps. LiquidityFinder stresses using equity protection features if you copy trades across accounts to avoid wiping out multiple accounts on one bad day.

In short, handling multiple accounts is less about chasing higher numbers and more about building a framework. When you treat each account as a separate strategy with defined risk, multiple accounts become a powerful way to scale safely.

Continue reading: Topstepx Why Are My 2 Charts Mirroring Together? An Easy Fix

6. What happens if you exceed Topstep account limits?

Account limits at Topstep aren’t simply a matter of violating the rules or getting blocked immediately. The consequences are significant enough to directly impact a trader’s ability to make money.

Here’s what actually happens when you exceed your Topstep account limit.

6.1. No payout

The most obvious and serious consequence: you will not receive a payout for that period.

- Even if your account is still profitable.

- Even if your account hasn’t been reset or failed.

Topstep reserves the right to refuse profit payments if it detects that you have exceeded your risk limits, position size, or that your trading behavior is inconsistent with the account rules.

Many traders are most frustrated by the fact that they have traded well and made profits, but cannot withdraw their money.

6.2. Account frozen (temporarily locked)

In many cases, the account will not fail immediately, but will enter the following state:

- No further trading allowed

- No new positions opened

- Waiting for internal review results

This is the state of a frozen account.

Topstep needs time to determine:

- Did you accidentally exceed the limit?

- Or did you intentionally circumvent the rules/take excessive risks?

6.3. Review trading behavior

This is a step many traders overlook, but it’s extremely important.

Topstep will examine:

- Trading frequency

- Position size

- Entry timing (news, spike)

- Are there signs of gambling, overtrading, or revenge trading?

Don’t just look at the numbers, look at the behavior.

Therefore, some traders:

- Do not violate the “hard” rules

- But still have payouts withheld or account limits imposed.

6.4. Unable to merge balances

If you have multiple Topstep accounts, exceeding the limit in one account can lead to:

- Unable to merge balances

- Unable to combine profits between accounts

- Loss of capital scaling advantage

This is especially disadvantageous for traders following a multi-account scaling strategy.

6.5. Why do many traders think they’ve been “blocked” even without a strict rule?

This is the most common misunderstanding.

In reality:

- Topstep doesn’t always have rules explicitly stating “permanent ban.”

- However, they have the right to assess the overall risk of a trader.

Traders often think they’ve been “blocked” because:

- Their account has been frozen for a long time.

- They haven’t received payouts even though there’s no clear violation.

- Support gives vague responses.

- They are not allowed to open new accounts.

The reality isn’t a “strict block,” but rather that Topstep no longer trusts your trading behavior.

7. Compare Topstep’s account policy with other prop firms

Every prop firm has its own rules for how many accounts you can hold. Understanding these differences helps traders plan scaling and avoid hitting hidden limits.

| Prop Firm | Account Limit Policy | Key Notes |

|---|---|---|

| Topstep | Unlimited Trading Combines, up to 5 Express Funded Accounts, 1 Live Funded Account | Express accounts close when moving to Live; strict on hedging/copy trading |

| FTMO | Up to 3 funded accounts merged into one master account; combined equity cap of $400,000 | Allows account merging for easier management |

| The 5%ers | High Stakes: 3 accounts (one per size tier) Hyper Growth: 4 accounts Bootcamp: 3 accounts | Different programs have separate limits, and they can be combined as long as caps are respected |

| FundedNext | Multiple funded accounts allowed, combined ceiling of $300,000 | Applies only to live funded accounts; challenges don’t count until passed |

Looking at the policies, each firm takes a slightly different approach.

- Topstep is the most restrictive at the live stage, allowing only one account once you transition from Express.

- FTMO prefers consolidation, letting you merge accounts into a single master account for easier tracking.

- The 5%ers offers flexibility across its different programs: High Stakes, Hyper Growth, and Bootcamp, each with its own limits, which you can combine strategically.

- Meanwhile, FundedNext puts the emphasis on capital ceilings, allowing multiple accounts as long as they don’t exceed $300K in live funding.

This comparison shows that while Topstep prioritizes tighter control, firms like The 5%ers and FundedNext provide broader room for traders who want to run multiple strategies at once.

8. FAQs

Yes, you can have up to five Express Funded Accounts. However, once you are promoted to the Live Funded Account, you can only have one. At that point, all of your Express Funded Accounts will be closed.

No. Topstep does not allow merging accounts. Each Express Funded Account is treated separately, with its own balance, payouts, and risk limits.

No. You can open unlimited Trading Combines, but there are purchase caps, 10 new Combines per month, and 2 resets per account per day. This policy is meant to prevent unhealthy trading behavior.

Opening too many Combines or resets will trigger a warning and temporary restrictions. For Express Funded Accounts, any account beyond the 5 allowed will remain pending until you close an active one.

Yes. All accounts, Combine, Express, or Live, must be under the same trader profile. Sharing or splitting accounts with others is not permitted.

The 50% Consistency Rule applies during the Trading Combine. Your best trading day cannot represent more than half of your total profits. This ensures consistent performance, not just one lucky trade.

There is no fixed payout cap. You keep 100% of your first $10,000 profit, and then 90% of profits afterward. However, each payout request must follow the minimum trading day requirements.

You can hold up to five active Express Funded Accounts at the same time. They may be of different sizes, but hedging or copy trading between them is prohibited.

Yes, but with an important distinction. You are allowed to use a trade copier to place identical trades across your own multiple Topstep accounts for management purposes. What is prohibited is coordinated trading with, or copying trades from, other individuals. You are also not allowed to use copy trading to hedge positions across your accounts.

No. Once you pass a Combine, your Express Funded Account must stay on the same platform. If you want a different platform, you need to start a new Combine and pass it again.

9. Conclusion

So, the answer to how many Topstep accounts can I have is straightforward: unlimited Trading Combines, up to five Express Funded Accounts, and only one Live Funded Account. Knowing these limits helps you scale capital without risking payout issues or violating firm rules.

If you plan to grow with Topstep, remember that success comes not just from having more accounts, but from managing them with discipline, strategy, and strict risk control. Many traders have learned the hard way that chasing numbers leads to stress, while structured scaling leads to long-term gains.

For deeper insights, explore more articles in our Prop Firm & Trading Strategies section. You’ll find guides on how to manage risk, prop firm reviews, and comparisons with other leading prop firms. These resources will give you the clarity you need to trade smarter, scale faster, and protect your capital every step of the way.