Starting your journey with a prop firm like FTMO opens up significant capital opportunities. But a common question quickly arises: how many FTMO accounts can I have? How to choose a prop firm? This isn’t just about quantity; it’s about optimizing your strategy within their established framework.

FTMO stands as a prominent prop firm, providing capital to consistent traders after a rigorous evaluation process. Understanding their account policies is crucial for any serious trader looking to scale.

This article breaks down FTMO’s account policies, clearing up the rules on the number of accounts allowed, capital limits, and how to merge them. This will give you a clear roadmap to scale your trading effectively and compliantly.

Key takeaways:

- Unlimited accounts in evaluation: During the FTMO Challenge and Verification stages, traders can have an unlimited number of accounts, allowing flexibility to experiment and refine strategies.

- Capital limits for funded traders: Once a funded FTMO Trader, you’re capped at $400,000 for default accounts or $200,000 for Aggressive accounts per trader or strategy to manage risk.

- Account merging for efficiency: FTMO allows merging accounts into a single master account if they meet specific conditions (e.g., same risk setup, no drawdown), simplifying capital management.

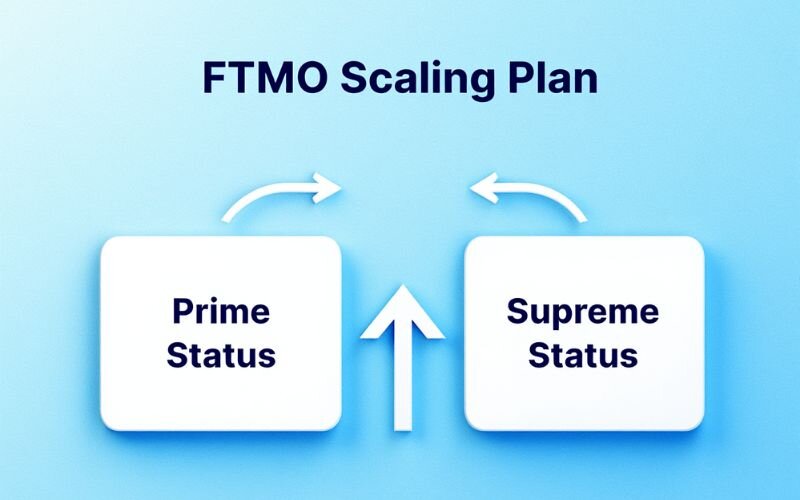

- Structured scaling plan: FTMO offers Prime and Supreme Status for scaling capital, with specific requirements like merging two $200,000 accounts for a $400,000 Supreme Status account.

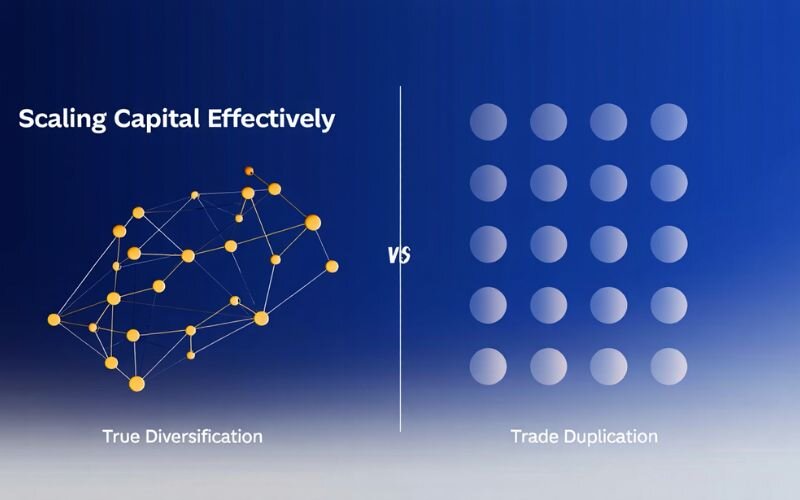

- Importance of diversification: Traders must avoid duplicating strategies across accounts to comply with FTMO’s risk management rules and ensure genuine diversification.

- Disciplined risk management: Adhering to FTMO’s rules, including a 5% daily loss limit and 10% maximum loss limit, is critical to avoid account breaches.

- Focus for success: Managing fewer accounts with focus can lead to better performance and faster progression compared to spreading efforts across multiple accounts.

1. How many FTMO accounts can I have?

Understanding the specifics of how many FTMO accounts you can have depends on which stage of their program you’re in. FTMO structures its evaluations and funded accounts with clear guidelines. It’s important to grasp these distinctions to navigate your trading journey effectively.

1.1. Understanding the FTMO Challenge and Verification Stages

During the initial FTMO Challenge and subsequent Verification stages, the flexibility is quite generous. You can have an unlimited number of accounts. This is actually a very smart policy from FTMO. It gives traders a safe sandbox to learn, adapt, and refine their strategies without arbitrary restrictions getting in the way.

This unlimited flexibility in the initial stages is a golden opportunity. It lets traders experiment with different approaches and retry without hitting a hard limit during the evaluation stage, providing a valuable learning curve to prove their consistency over time.

View more:

1.2. The FTMO Trader stage: Introducing capital limits

When you successfully complete the evaluation phase and become an FTMO Trader, the rules change. This is when clear capital allocation limits come into effect. You will be subject to a maximum capital allocation limit of $400,000 per trader or strategy for the default account type. However, for the Aggressive account type, this limit is $200,000.

This limit serves a clear purpose for FTMO: risk mitigation and diversification. It’s designed to manage their overall exposure while still providing significant capital to proficient traders. For you, this means careful planning is essential as you scale your trading.

It’s critical to understand that attempting to circumvent this rule through multiple registrations for identical strategies is a direct violation of their terms and conditions. Such actions can lead to serious repercussions, including immediate account suspension. Adherence to this rule is paramount for long-term success with FTMO.

2. Strategies for managing multiple FTMO accounts

Once you’ve successfully navigated the FTMO Challenge and Verification, understanding how to manage and potentially expand your capital becomes key.

FTMO offers specific pathways for this, primarily through account merging, which can streamline your operations and help you scale efficiently.

2.1. Understanding the “strategy” clause

FTMO’s rule states a maximum capital allocation of $400,000 “per trader or strategy.” This phrasing often prompts questions among traders. While the $400,000 limit is fundamentally tied to the individual trader, the “or strategy” aspect emphasizes the firm’s focus on preventing the aggregation of identical trading patterns across multiple accounts if it exceeds their risk thresholds.

Essentially, this “or strategy” element is FTMO’s statement on its commitment to risk management. The core principle is to prevent a single individual from controlling an excessively large pool of aggregated capital through identical trading patterns across multiple accounts. It’s about genuine diversification, not just spreading identical risk.

View more: Best trading strategy for beginners

2.2. The power of combining accounts (account merging)

FTMO provides an option to combine individual FTMO Accounts into a single master account. This feature is incredibly useful for traders who have successfully passed multiple challenges and wish to consolidate their capital for easier management and potentially higher payouts.

To qualify for account merging, specific conditions must be met. These criteria ensure that the process is fair and aligns with FTMO’s risk management framework.

Here are the conditions under which FTMO allows individual accounts to be combined:

- Initial balance: All accounts to be merged must be at their initial balance.

- No drawdown: The accounts must not be in drawdown at the time of the merge request.

- No pending profit withdrawal: There should be no simulated profit due for withdrawal on any of the accounts.

- Same risk setup: All accounts must have the same risk setup.

- Same base currency: The accounts must operate with the same base currency.

The benefits of merging accounts are significant. It simplifies the management of larger capital, as you’re dealing with one consolidated account rather than several smaller ones. This can also lead to streamlined reporting and potentially higher payouts from a single, larger pool of capital.

3. Advanced scaling: Beyond the initial FTMO account

Once you become an FTMO Trader, the journey doesn’t necessarily end with your initial funded account. FTMO offers a structured scaling plan that allows consistent, profitable traders to increase their capital allocation significantly. This progression is designed to reward sustained performance and responsible trading.

3.1. The scaling plan explained: Prime status and supreme status

FTMO’s scaling plan offers pathways to larger capital through two main statuses: Prime Status and Supreme Status. Achieving these statuses is a testament to a trader’s consistency and ability to manage risk effectively over extended periods.

For those aiming for even higher capital, the Supreme Status is the ultimate goal within FTMO’s scaling framework. However, the path to achieving it, especially through account merging, has specific requirements. This is where clarity is paramount, particularly concerning how many FTMO accounts I can have when considering the Supreme Status.

It’s important to understand that you cannot merge four $100,000 FTMO Accounts into a single $400,000 FTMO Account to apply for the Supreme Status. This is a common misconception, but FTMO has specific criteria for this advanced status.

To qualify for a $400,000 FTMO Account for Supreme Status, the capital must originate from at least two $200,000 FTMO Accounts that have been successfully merged, or directly from a single $400,000 FTMO Account.

Furthermore, any merged $400,000 FTMO Account must first progress through the Prime Status before it becomes eligible for Supreme Status. This sequential progression underscores FTMO’s commitment to evaluating performance at each higher tier of funding.

A crucial detail to remember is that if you attempt to merge one Prime FTMO Account with one Regular FTMO Account, the current progress of conditions for the Supreme Status will be reset.

This particular rule around Supreme Status merging clearly indicates FTMO’s structured progression path. It’s not just about accumulating capital, but about achieving consistency at higher tiers of funding before being granted the ultimate status.

View more: Easiest prop firms to pass

3.2. Diversification versus duplication

As you consider scaling your capital, it’s vital to distinguish between true diversification and mere duplication of trades. While having multiple accounts might seem like a way to spread risk, FTMO’s rules are designed to prevent excessive exposure through identical strategies.

Ethical trading and strict adherence to the firm’s rules regarding identical strategies are paramount. FTMO’s policies also serve as a form of risk management for the firm itself, ensuring that its capital is not overly concentrated or exposed through a single, undifferentiated trading approach across numerous accounts.

4. Important considerations and best practices for FTMO traders

Navigating the world of proprietary trading, especially with a firm like FTMO, requires more than just a profitable strategy. It demands a deep understanding of their operational framework and a commitment to best practices. This ensures not only your success but also a sustainable partnership with the firm.

4.1. Adhering to FTMO’s rules

Understanding and meticulously following all of FTMO’s rules, not just the account limits, is absolutely crucial for your long-term success. These rules are in place to define the boundaries of acceptable trading behavior and to protect both the trader and the firm. Ignoring them can lead to account breaches or, in severe cases, suspension.

Remember, the most successful traders with prop firms aren’t just masters of their strategy; they are also incredibly disciplined about following every single rule the firm sets. Think of it as building a sustainable, trustworthy partnership with FTMO.

4.2. Risk management across multiple accounts

Even if you’re allowed to manage multiple accounts, disciplined risk management remains paramount. It’s easy to feel a false sense of security with a larger combined capital. However, you must avoid overleveraging or exposing too much of your overall capital based solely on aggregated simulated profit and loss.

Each account should be managed with its specific parameters in mind, and your overarching risk should be carefully monitored across all active accounts.

View more: What is leverage in trading?

4.3. The benefit of focus

While FTMO allows for multiple accounts (especially during the challenge phase), sometimes, a focused approach yields better results. Spreading yourself too thin across many accounts can dilute your attention and reduce the effectiveness of your trading.

Often, concentrating your efforts on excelling with one or two accounts, rather than attempting to manage a large number simultaneously, can lead to more consistent performance and faster progression through the scaling plan. Quality often trumps quantity in this scenario.

I’d like to add a personal perspective here: many traders get excited by the idea of “unlimited” accounts and open several Challenges at once, thinking it’s a shortcut. However, they often forget about a capital that’s even more important than money: “mental capital” – your limited reserve of focus and emotional energy each day.

Instead of spreading this precious resource thin, a much wiser strategy is to treat your first successful FTMO account as your core business. Master it, protect it, and let FTMO’s own Scaling Plan grow your capital for you. This path may feel slower at the start, but it is far more sustainable in the long run.

4.4. Staying updated with FTMO policies

The landscape of prop trading, including the terms and conditions of firms like FTMO, can evolve. It’s a dynamic environment, and policies might be updated to reflect market conditions or operational adjustments.

Therefore, make it a crucial habit to regularly check the official FTMO FAQ pages and their comprehensive Terms of Service. Staying informed ensures you are always trading within their most current guidelines.

Explore more blog posts from this category:

5. FAQs – Related questions about FTMO accounts

Unlimited accounts during the Challenge and Verification stages. Funded traders are capped at $400,000 total capital per trader or strategy.

Yes, but rules vary by firm. Some allow multiple accounts with strict capital limits; always check the specific firm’s terms.

Maximum Daily Loss: 5% of initial balance. Maximum Loss: 10% of initial balance. Breaching either results in evaluation failure or account closure.

No, Supreme Status requires merging two $200,000 accounts or a single $400,000 account, with Prime Status achieved first.

Yes, you can buy multiple Challenges simultaneously, as there’s no limit during the evaluation stages.

Yes, two $200,000 accounts are allowed within the $400,000 capital limit, with the option to merge later for Supreme Status.

6. Conclusion

Understanding how many FTMO accounts can I have is crucial for any trader aiming for long-term success with this leading prop firm. While the FTMO Challenge and Verification stages offer unlimited flexibility, the transition to a funded FTMO Trader introduces a clear $400,000 capital limit per trader or strategy.

Navigating this framework successfully involves not only mastering your trading skills but also meticulously adhering to FTMO’s specific rules regarding account management and scaling.

The ability to merge accounts, particularly for progression to Prime and Supreme Status, highlights FTMO’s structured approach to growth. However, it’s vital to remember the precise requirements for such merges, especially that a $400,000 Supreme Status account cannot be built from four $100,000 accounts.

Success with FTMO is a rewarding journey that demands strategic planning, disciplined risk management, and a thorough understanding of its well-defined guidelines.

At H2T Funding, our goal is to empower traders like you with accurate, unbiased knowledge to navigate the complexities of the forex world. We believe that informed decisions are the foundation of consistent trading success.

Explore more in-depth analyses within our Prop Firm & Trading Strategies category to further refine your trading approach.