Let’s be honest, the world of trading can seem incredibly confusing from the outside. The jargon alone is enough to make anyone feel lost. When beginners ask How does trading work? What they’re really asking for is a straightforward guide that cuts through the noise and shows them a clear path to start.

This guide was created to be that path. H2T Funding will demystify the process by explaining exactly how you can participate in financial markets. I will provide a step-by-step roadmap, from understanding the core principles to executing your first trade and, most importantly, learning how to manage your risk effectively.

Key takeaways

- Trading works by profiting from price movements across different timeframes by buying low and selling high, or by short-selling to benefit from falling prices.

- Beginners should follow a clear 5-step process: choose a broker -> create a plan -> analyze the market -> understand order types, -> execute and close trades.

- Risk management is the foundation of long-term success. Many experienced traders recommend risking no more than 1–2% per trade

- Leverage amplifies both gains and losses, making it a powerful but dangerous tool if used without discipline.

- Most traders use a reliable charting platform (like TradingView), basic technical indicators (moving averages, RSI), stop-loss & take-profit orders, an economic calendar, and a trade journal to manage risk and performance consistently.

- Consistent trading results come from discipline, emotional control, and long-term practice, not from shortcuts or get-rich-quick expectations.

1. What is trading? A simple explanation

Trading is the active practice of buying and selling financial assets, such as stocks, currencies, commodities, or cryptocurrencies, to profit from price movements across various time horizons. Unlike passive investing, trading involves deliberate market analysis, risk management, and the strategic timing of entries and exits, whether positions are held for minutes, days, or extended periods.

Think of it this way: you buy an asset when you predict its value will rise, planning to sell it at a higher price. Crucially, trading also allows you to profit from falling prices by speculating that an asset’s value will go down, a concept known as short-selling.

This isn’t just about company stocks, either. The world of trading spans a huge variety of markets. You can trade everything from global currencies (forex) and assets like gold and oil to modern digital assets.

2. How does trading work? The step-by-step process

Now that you understand the core concepts, let’s get practical. A successful trade isn’t just a random click of a button; it’s the result of a deliberate process. Following a structured approach is what separates consistent traders from gamblers.

I’ll walk you through the exact five steps you need to take, from setting up your foundation to executing your very first trade.

- Step 1: Choose a regulated broker and open an account

- Step 2: Develop a trading plan and set a budget

- Step 3: Analyze the market (technical and/or fundamental)

- Step 4: Select the right order types to manage risk

- Step 5: Open, manage, and close the trade

Let’s break down each step in detail below.

2.1. Step 1: Choosing a broker and opening an account

Think of your broker as your essential business partner. They provide the software and access you need to interact with the markets, so choosing the right one is your first critical decision. A bad partner can cost you money through high fees or poor technology.

When you’re starting, cut through the noise and focus on what matters:

- Regulation: First, are they regulated by a major financial authority? For most traders, regulation is considered the most important safety check.

- Fees: How do they get paid? Look at their commissions and spreads (the gap between the buy and sell price). The lower the fees, the more of your profit you keep.

- Platform: Is their software clean and easy to use? A confusing platform is the last thing you want to deal with when you’re learning.

If you’re also exploring alternatives to traditional brokers, such as prop trading firms, it’s worth understanding whether they are legitimate before committing any capital.

2.2. Step 2: Developing a trading plan & budget

Based on my experience, many traders skip this step and pay for it later. Most beginners jump right past this step, and it’s the costliest mistake you can make. Trading without a plan isn’t freedom; it’s just guessing. Your plan provides the rules, and your budget provides the limits.

Your trading plan is your personal rulebook. It doesn’t have to be long, but it must answer these questions:

- What specific assets will I trade?

- What strategy will I use to decide when to enter or exit?

- What are my clear goals for a trade?

- What is my absolute maximum loss per trade?

For your budget, the only rule is this: only trade with money you are fully prepared to lose. This isn’t a savings account. By setting a tight budget, you take the pressure off and can make decisions based on your plan, not on fear.

2.3. Step 3: Analyzing the market (Technical vs. Fundamental)

With a plan in place, you need a way to spot potential trades. This is called market analysis, and there are two main schools of thought. Most traders end up using a blend of both.

- Technical analysis is the art of reading charts. The idea is that an asset’s price history tells you a story about its potential future. You’ll use patterns, trends, and indicators to forecast where the price might go next.

- Fundamental analysis is more like detective work. You dig into the underlying health of an asset. For a stock, that means looking at company earnings and industry news to figure out what it’s truly worth.

For those focusing on technical analysis, understanding core tools like trendlines can help identify price direction and potential trading opportunities more clearly.

2.4. Step 4: Understanding order types (Market, limit, stop-loss)

An order is simply the instruction you give your broker to buy or sell an asset. Knowing the basic order types is essential for executing your plan and managing risk effectively. As a beginner, you only need to master three.

- Market Order: Executes immediately at the best available price. It instructs your broker to buy or sell immediately at the best current price. A market order ensures your trade is executed quickly, though the final price may differ slightly from what was quoted.

- Limit Order: A command that gives you price control. You set a specific price, and the order will only activate if the market reaches that price or a more favorable one. It’s the ideal way to avoid paying more than you intend.

- Stop-Loss Order: Stop-loss orders are widely considered one of the most important risk management tools. It’s a preset order that automatically closes your trade if the price moves against you to a certain level. Using it is crucial for preventing a small loss from turning into a large one.

- Take-Profit Order: The opposite of a stop-loss, this pre-set order automatically closes a winning trade once it hits your target price. Using take-profit orders helps you lock in gains before the market has a chance to reverse.

It’s also helpful to understand when markets are most active, as different trading sessions can affect liquidity, spreads, and how efficiently your orders are filled.

2.5. Step 5: Executing the trade (Opening and closing positions)

This is where your planning and analysis come together. Executing a trade involves two key actions: opening the position and, eventually, closing it. This entire process is managed through your broker’s online trading platform.

First, opening positions is the act of entering the market. Based on your analysis, you decide whether to buy (go long) or sell (go short) and place your order. Once your broker fills the order, you have a live trade, and its value will fluctuate with the market.

Later, closing positions is how you exit the trade to realize your outcome. If you initially bought, you close the position by selling. If you initially sold, you close it by buying. The difference between your entry and exit price determines your final profit or loss on that trade.

Before executing trades with real capital, many traders refine their entries and exits by learning how to backtest a trading strategy to evaluate performance under historical market conditions.

In essence, every trade follows this same simple lifecycle from entry to exit. Mastering exactly how a trade works, through this simple sequence of opening, monitoring, and exiting a position based on your pre-defined plan, is the core mechanical skill of trading

3. What can you trade? An overview of financial markets

Okay, let’s move from theory to action. To see how trading works in practice, you need to understand the assets available. Here are the primary markets you can participate in:

- Stocks: This involves trading shares of publicly listed companies like Apple or Amazon. When you trade stocks, you are speculating on the company’s future performance and overall market sentiment.

- Forex (Foreign Exchange): This is the world’s largest financial market, where currencies are traded in pairs (like EUR/USD). Traders aim to profit from changes in exchange rates, driven by economic news and global events. Its massive volume provides high liquidity.

- Commodities: These are raw materials. Think of valuable metals like gold and silver, energy products like oil, or agricultural goods like coffee. Their prices are often influenced by global supply and demand.

- ETFs and Indices: Instead of trading a single stock, you can trade a basket of them. Indices (like the S&P 500) reflect the performance of a broader market segment, while ETFs are funds that track those indices and trade just like individual shares.

- Cryptocurrencies: A newer and more volatile market, this includes digital assets like Bitcoin and Ethereum. Trading here involves speculating on their price movements, which can be rapid.

- Futures: Standardized contracts that obligate buyers and sellers to trade an asset at a predetermined price on a specific future date. Futures are widely used for speculation and hedging in markets like commodities, indices, and interest rates.

- Options: Financial contracts that give traders the right, but not the obligation, to buy or sell an asset at a set price before a certain date. Options are commonly used for risk management, income strategies, and leveraged speculation.

- Bonds (Fixed Income): Debt instruments issued by governments or corporations. Bond trading involves speculating on interest rate changes, credit risk, and economic conditions rather than direct price growth alone.

- Derivatives: These are financial contracts, like CFDs (Contracts for Difference), whose value is derived from an underlying asset like a stock or commodity. They allow you to trade on price movements without owning the asset itself.

Each of these markets provides a unique environment with its own set of opportunities and risks. Understanding this variety is the first step in deciding where you want to focus your trading efforts.

4. When can you trade? Understanding market hours

Financial markets don’t all run on the same clock; each has its own schedule. Knowing these hours is crucial because it determines when you can open or close your trades. It’s a key piece of information for planning your trading activity.

Here’s a general breakdown of the hours for major markets:

- Stock markets: Most stock exchanges operate on a set schedule, like a regular business day. The New York Stock Exchange, for example, is open from 9:30 AM to 4:00 PM Eastern Time. These hours vary by country, so you’ll need to check the local time if you’re trading international stocks.

- Forex market: The forex market is unique, operating 24 hours a day, five days a week. It opens on Sunday evening and runs continuously until Friday afternoon (ET). This is possible because trading follows the sun around the globe, ensuring there is always market liquidity in financial centers like Tokyo, London, and New York.

- Commodities & indices: Many major commodities and global indices can be traded nearly 24 hours a day during the week. However, their most active hours are often tied to the primary exchanges where they are listed, so it’s always smart to check the specific session times.

In short, your trading schedule will depend entirely on which market you choose to trade. The 24-hour nature of forex offers flexibility, while stock trading requires you to operate within specific daily windows.

5. What tools do traders use?

Successful trading is about using the right ones. I have spent time on Reddit, and noticed a common theme: most profitable traders rely on a simple, well-tested toolkit rather than complex or magic systems.

Below are the core tools traders consistently mention and use in practice, across markets and strategies.

5.1. A reliable charting platform

This is the foundation of almost every trader’s workflow. A good charting platform allows you to:

- Analyze price action across multiple timeframes

- Draw trendlines, support/resistance, and key levels

- Apply technical indicators when needed

Popular choices include:

- TradingView (web-based, versatile, widely used)

- NinjaTrader (favored by futures traders)

- ThinkorSwim (powerful desktop platform, strong for options)

Across trader discussions and community feedback, clarity, stability, and speed are mentioned far more often than advanced features.

5.2. Technical indicators (used selectively)

Indicators are tools, not strategies. Experienced traders tend to:

- Use a small number of indicators, not many

- Prefer tools that help confirm structure, momentum, or volatility

- Avoid overloading charts with conflicting signals

Commonly used indicators include:

- Moving Averages

- RSI or Stochastic

- ATR (for volatility and risk sizing)

- Volume-based tools (Volume Profile, VWAP)

Many traders also customize or combine indicators to suit their own decision-making process.

5.3. Market structure & drawing tools

Some of the most important “tools” aren’t indicators at all:

- Trendlines

- Support and resistance zones

- Price channels

- Fibonacci retracements

These tools help traders interpret market behavior visually and often replace the need for multiple indicators, especially on higher timeframes.

5.4. Order execution & broker tools

Execution matters. Traders rely on their broker’s platform to:

- Place market, limit, and stop orders efficiently

- Manage risk with stop-loss and take-profit levels

- Monitor open positions without lag or slippage issues

A clean interface and reliable order fills are more important than flashy features.

5.5. News and economic calendars

Even technical traders keep an eye on:

- Major economic releases (interest rates, CPI, jobs data)

- Earnings announcements

- High-impact geopolitical events

Tools like economic calendars help traders avoid unnecessary risk during volatile periods.

5.6. Trade journaling & performance tracking

This is one of the most underrated tools in trading. A trade journal helps traders:

- Identify recurring mistakes

- Track strategy performance over time

- Improve discipline and emotional control

Journaling can be as simple as a spreadsheet or as advanced as dedicated trading journal software.

5.7. Education & community resources

While tools are important, learning how to use them correctly matters more. Many traders benefit from:

- Educational platforms

- Recorded trade reviews

- Community discussions and shared analysis

Learning from others’ experience often shortens the learning curve significantly.

Across markets and strategies, most traders eventually discover the same truth: Your tools should support your thinking, not replace it. A clean chart, a reliable platform, basic risk management tools, and consistent self-review will outperform any overloaded setup in the long run.

6. What makes prices move?

At the most basic level, market prices fluctuate based on the balance between buyers and sellers. This is the core principle of supply and demand. When demand exceeds supply, meaning more buyers are willing to transact than sellers, the price rises. When supply outweighs demand, prices fall. Every price move you see on a chart is the result of this ongoing imbalance.

But what causes these shifts in supply and demand? Several powerful forces are constantly at play, creating the market movements that traders analyze.

- Economic factors: Major economic news is a primary driver. Announcements about interest rates, inflation reports, and employment numbers can cause immediate and significant market reactions as traders adjust their expectations for the economy’s health.

- Geopolitical events: Political instability, elections, trade negotiations, and conflicts can create uncertainty. This uncertainty often leads to volatility as traders react to the news, trying to protect their capital or find new opportunities.

- Market sentiment: This is the collective mood of all market participants, a powerful force driven by widespread speculation and psychology. Is the general feeling optimistic (bullish) or pessimistic (bearish)? This sentiment, often driven by news and psychology, can become a self-fulfilling prophecy, pushing prices in a particular direction.

Ultimately, trading involves analyzing how these factors might influence supply and demand. Your goal is to anticipate the direction of the next price move before it happens.

7. Mastering risk and psychology

I’ve covered the mechanics of trading, how it works, but this next part is what truly separates successful traders from those who burn out. In my experience, long-term consistency isn’t about predicting the future; it’s about discipline.

Let’s focus on the two pillars that will define your career: how you manage risk and how you manage yourself.

7.1. Risk management: Your most important skill

Let me be direct: you are going to have losing trades. It’s a non-negotiable part of trading. The professionals are masters at controlling the size of their losses and understanding how drawdown affects long-term performance. Your primary job is not to be a market wizard, but to be an excellent manager of risk.

The cornerstone of this skill is position sizing. To help new traders stay consistent, many professionals recommend risking no more than 1–2% per trade. By doing this, you mathematically ensure that no single loss, or even a series of them, can wipe you out. This is how you give yourself the time and capital needed to learn and eventually find your edge.

7.2. Leverage: Understanding the double-edged sword

Leverage is a tool that allows you to control a large position with a small amount of your own capital. Think of it as borrowing power from your broker to amplify your market exposure. It is one of the most powerful and misunderstood tools in trading.

When used correctly, leverage can magnify a successful trade into a significant profit. A small, favorable price move can result in substantial gains relative to your initial investment. This potential for amplified returns is what attracts many traders to it.

However, leverage magnifies losses just as quickly. A small move against your position can quickly drain your account. This is why retail leverage is capped in many regions, such as 1:30 in the EU, 1:50 in the US, and 1:25 in Japan. I always advise treating leverage with extreme respect and caution.

7.3. Trading psychology: How to control fear and greed

The biggest obstacle you will face in trading isn’t the market; it’s the person in the mirror. Your mind is a powerful force that can derail even the best-laid plans. The two most destructive emotions you must learn to master are fear and greed.

Fear often causes you to close winning trades too early or avoid taking valid setups after a loss. Greed, on the other hand, tempts you to take oversized risks or hold onto a trade for far too long, hoping for an unrealistic profit, only to watch it reverse.

The only reliable antidote to these emotions is a solid trading plan. By committing to follow your pre-defined rules for entry, exit, and risk management, you replace emotional reactions with disciplined actions. This is the essence of professional trading.

7.4. The power of a demo account: Practice without risk

A demo account, also known as a paper trading account, is a market simulator. It gives you access to a real-time trading platform with virtual money, allowing you to experience the market without any financial risk whatsoever.

This is an essential part of a professional trader’s toolkit. Use it to test your trading plan, get comfortable with your broker’s platform, and experience the feeling of executing trades and managing positions.

Think of it as your training ground. Making mistakes on a demo account costs you nothing but teaches you valuable lessons. I strongly recommend spending a significant amount of time here until you can follow your plan and achieve consistent results before you even consider risking real money.

8. Common mistakes beginner traders should avoid

Look, everyone makes mistakes in this game, especially when starting out. I certainly did. The goal isn’t to be perfect, but to avoid the big, classic blunders that take most beginners out of the market. If you can sidestep these, you’re already ahead of the curve.

Here are some of the most frequent and costly mistakes to watch out for:

- Trading without a plan: This is the big one. It’s when you place trades based on gut feelings, tips, or market hype. This approach lacks consistency and is no different from gambling.

- Failing to manage risk: The fastest way to blow up your account is to forget about defense. This often looks like not using a stop-loss order on every trade or risking too much capital on a single idea. A single oversized loss can undo weeks of hard work.

- Emotional decision-making: Letting fear and greed drive your actions is a guaranteed way to lose money. This includes revenge trading (trying to win back a loss impulsively) or getting euphoric after a big profit and immediately taking on reckless risk.

- Over-leveraging: New traders are often tempted by the idea of big profits from small accounts. Using too much leverage is like driving a car too fast on a dangerous road; it dramatically increases the chance of a crash. Respect leverage, or it will hurt you.

Avoiding these common traps won’t guarantee profits, but it will significantly improve your chances of survival. By focusing on discipline, planning, and consistent risk management, you set yourself apart from the majority of beginners.

9. How to trade safely (without blowing your account)

If there’s one lesson I see repeated endlessly by experienced traders on Reddit, it’s this: accounts don’t blow up because of bad strategies. They blow up because of poor risk management. Most long-term traders who survive consistently follow a few simple rules, even if those rules initially seem boring or restrictive.

At its core, trading safely means:

- Limiting how much you can lose on any single trade

- Cutting losses quickly before they spiral

- Accounting for hidden costs that eat into profits

- Avoiding excessive leverage that magnifies mistakes

These principles show up again and again in real trader discussions, not as theory, but as lessons learned the hard way.

9.1. Only risk 1–2% per trade

This is one of the most common rules shared by traders who stopped blowing up their accounts. By risking only a small percentage of your capital on each trade, you ensure that no single loss, or even a string of losses, can knock you out. Small, controlled losses give you the time and psychological space needed to improve.

9.2. Always use a stop-loss

A stop-loss is not optional; it’s your safety net. Traders who avoid stops often describe the same pattern: small losses turning into large ones due to hope, hesitation, or revenge trading. A predefined stop-loss removes emotion from the exit decision and protects your account when the market moves against you.

9.3. Understand your trading costs

Even a solid strategy can fail if costs are ignored. Spreads, commissions, slippage, and overnight fees all add up over time, especially for active traders. Understanding these costs helps you avoid overtrading and ensures that your edge isn’t quietly eaten away.

9.4. Avoid over-leverage

From what I’ve seen, leverage causes more damage than bad analysis. Many traders admit their biggest losses came from using too much leverage during moments of confidence or frustration. Keeping leverage modest allows my risk rules to actually work.

So, you don’t need to trade aggressively to succeed. If you protect your capital and stay disciplined, you give yourself the most important edge in trading, the ability to keep showing up and improving.

10. How does trading work on Reddit

While guides like this provide a structured path, sometimes the most valuable lessons come from the unfiltered experiences of traders in the trenches. Platforms like Reddit offer a raw look into the daily realities, struggles, and triumphs of learning this skill.

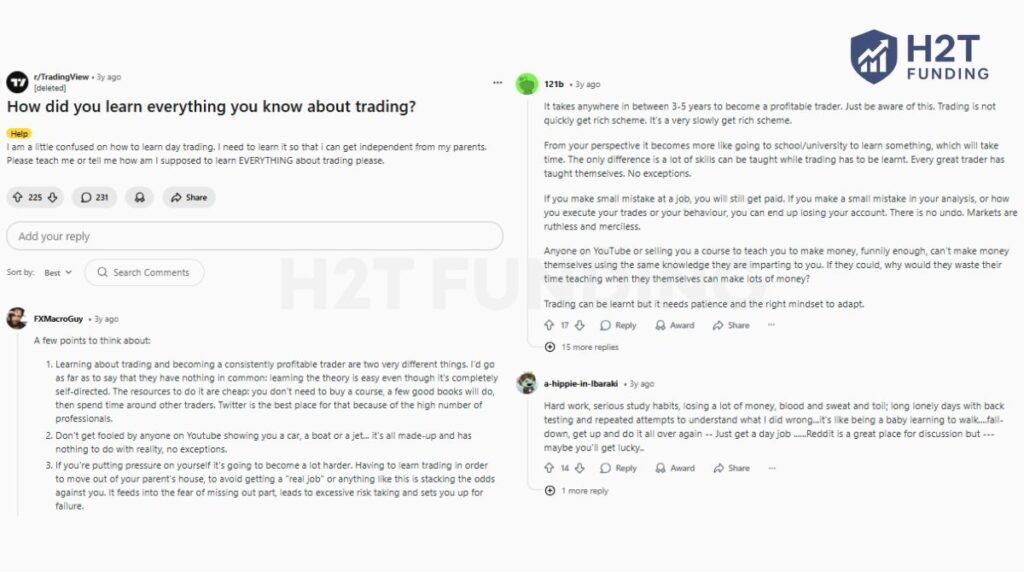

One of the most common posts answering the question of what trading on Reddit is is a request for a quick explanation. They are often eager to get started, believing they can pick it up fast. However, the response from experienced traders is almost always a dose of sobering reality.

The consensus is clear: trading is not a get-rich-quick scheme. Veterans emphasize that learning the terminology is just the first small step. The real journey involves mastering market dynamics, understanding economic drivers, and, most importantly, learning about your own psychology. They often point out that many smart people fail, not from lack of intelligence, but from a lack of emotional control.

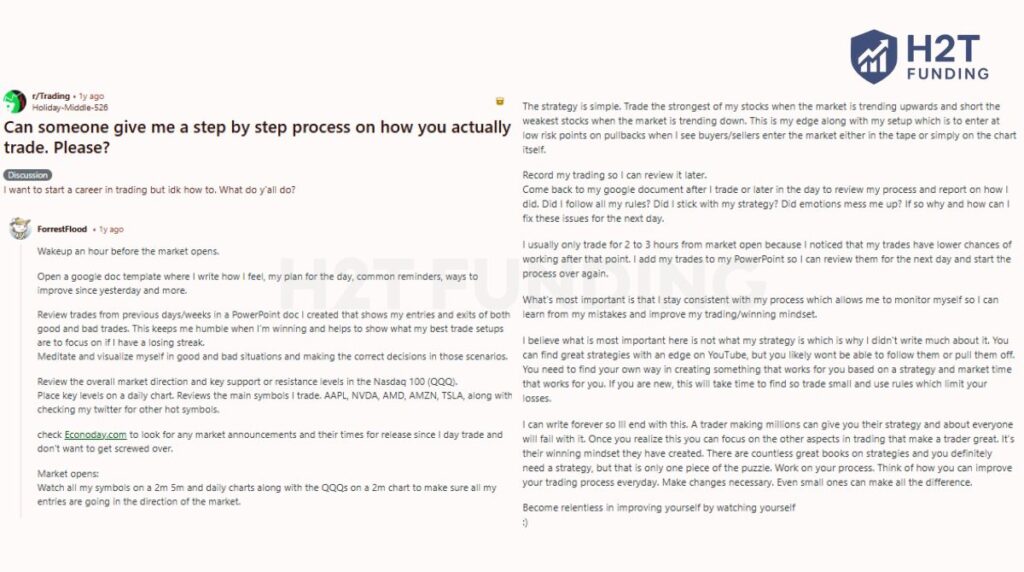

Another frequent question is for a concrete, step-by-step daily process. Aspiring traders want to know what the day-to-day work actually looks like. The answers reveal that successful trading is built on a foundation of discipline and a repeatable routine.

As you can see, a professional’s day doesn’t start with randomly looking for trades. It begins with preparation: reviewing a personal trading plan, checking the economic calendar for major news, and assessing one’s own mental state. The process ends with a review, analyzing what went right and what went wrong. This is the difference between treating trading as a serious business versus a casino hobby.

Finally, when asked how long it takes to learn, the answers are a crucial reality check. The community warns newcomers to be wary of online gurus who promise easy profits. The real path is often long, difficult, and requires immense patience.

The timelines shared by consistently profitable traders are often measured in years, not weeks or months. They describe it as a process that is ruthless and merciless, requiring hard work, study, and learning from inevitable losses. The key takeaway is that learning the theory is one thing, but becoming a profitable trader is a completely different, and much harder, challenge.

11. FAQs

You make money from trading by correctly speculating on an asset’s price movement. This works in two ways. First, you can buy an asset expecting its price to rise and then sell it for a profit (going long). Second, you can anticipate a price drop, sell it first, and later repurchase it at a lower level to keep the difference (going short).

Yes, you can. Many online brokers allow you to open an account with a small amount, like $100. An account this size is great for learning how trading works and practicing risk management with real emotions involved. However, it’s not a realistic way to generate meaningful income.

While theoretically possible for elite traders with very large capital accounts, it is an extremely unrealistic goal for a beginner. Generating that level of profit consistently requires a large amount of capital to risk, a highly refined strategy, and years of experience. A beginner’s focus should be on learning the process and achieving consistency, not on a specific dollar amount.

For beginners, how trading works is best understood as a structured process: 1. Learn the absolute basics of markets and risk. 2. Choose a regulated broker and open a demo account. 3. Develop a simple trading plan with clear rules. 4. Practice on the demo account until you can follow your plan. 5. Start with a very small amount of real money you can afford to lose.

The best site is subjective, but it should meet three key criteria. First, it must be regulated by a top-tier financial authority. Second, it should have low fees, such as tight spreads or low commissions. Third, its online trading platform must be stable and easy to use.

Trading is a skill-based profession with the potential for high returns, but it is not a get-rich-quick scheme. A very small percentage of people achieve great wealth through trading, but it is the result of years of dedicated work, discipline, and mastery over risk and psychology. For most, the realistic goal is to develop a consistent source of supplemental income.

The most common mistakes include trading without a plan and failing to use a stop-loss on every trade. Other errors are risking too much capital on a single idea and making emotional decisions driven by fear or greed, such as revenge trading.

The difference is the timeframe of the trades. Scalping involves holding trades for just a few seconds to minutes. Day trading means all positions are opened and closed within the same day. Swing trading is a slower approach where trades are held for several days or even weeks to capture a larger price movement.

There are three main approaches. Manual trading is where you make every decision and click every button yourself. Automated trading uses software or bots to trade based on preset rules. Social trading is a newer method where you can automatically copy the trades of other, more experienced traders.

12. Conclusion

Ultimately, understanding how trading works is about recognizing it as a skill-based business, not a guessing game. The path from beginner to consistent trader is built on a structured process: you create a plan, manage your risk on every single trade, and work relentlessly to master your own psychology. It’s a challenging journey, but it is a clear one.

You now have the foundational knowledge and a realistic roadmap to begin. The next step is to deepen your expertise.

To continue your education, I encourage you to explore our in-depth articles. Dive into specific methodologies in our Prop Firm & Trading Strategies section by visiting H2T Funding.