Are you wondering how does forex currency trading works and why so many people are drawn to it? Forex trading is the exchange of currencies to profit from market volatility and rate changes. Unlike the stock market, the forex market runs 24 hours a day, five days a week, offering traders endless opportunities to buy, sell, and speculate on global currencies.

For beginners, forex trading may seem complex, but once you grasp currency pairs, leverage, spreads, and risk management, it turns into a structured process instead of guesswork. This guide, H2T Funding, will break it down step by step so you can see clearly how the forex market operates.

Key takeaways:

- Forex trading is the act of exchanging one currency for another to profit from price changes.

- Market volatility, technical analysis, and geopolitical events drive forex price movements.

- Major types of forex markets include spot, forwards, futures, options, and swaps.

- Beginners must learn core terms like currency pairs, pips, spreads, leverage, and lot size.

- Forex trading, how it works is simple: buy when you expect a currency to rise, sell when you expect it to fall.

- The forex market operates 24/5, with peak activity during the London–New York trading hours.

- Key players include central banks, commercial banks, brokers, corporations, and retail traders.

- Trading signals, candlestick charts, bar charts, and line charts help analyse price movements.

- Risk management is essential because leverage can magnify both profits and losses.

- Success requires discipline, a trading plan, and ongoing education rather than gambling on luck.

1. What is forex trading?

Forex trading, or foreign exchange trading, is simply the act of buying one currency while selling another.

Imagine you are at the airport, exchanging your dollars for euros before a trip. The rate shows how much one currency is worth in exchange for another, like traders analysing support and resistance in forex. That everyday experience is basically how currency trading works – only on a much larger and faster scale.

I first understood the size of the foreign exchange market when I saw the Japanese Yen react instantly to a Bank of Japan policy statement, not from a statistic. While the stock market was asleep, trillions were moving because of a few sentences.

It was then that I realised the 24 hours a day, five days a week market wasn’t just a feature, it was a living, breathing entity. That’s what hooked me, and it’s core to understanding what forex trading is and how it works on a deeper level.

The difference between the forex and the stock market is not just about size. Stocks mean owning part of a company, while forex means speculating on one currency’s value against another via a broker’s platform.

It’s like betting on whether the euro will gain strength against the dollar, or whether the yen will fall compared to the pound. This constant push and pull is what keeps the market alive.

To put it simply, forex is the world’s largest financial marketplace, where money itself is the asset being traded. If you’ve ever wondered what forex trading is and how it works, this is the foundation: Buying and selling money itself on a global scale. That’s why traders from every corner of the globe, from central banks to beginners like me once are drawn to it.

2. Types of forex markets

When people talk about forex, they often imagine only one type of trading. In reality, the foreign exchange world has several different markets, each with its own purpose and style. The main ones are spot, forwards, futures, options, and swaps.

Spot forex market:

This is the simplest and most direct form of currency trading. In the spot market, currencies are exchanged instantly at the current rate. When I first tried trading, I chose the spot market because it felt closest to exchanging currencies at a bank or airport.

- Accessibility: Great for beginners since everything happens in real time.

- Immediate settlement: Deals are usually settled within a day.

- Real-time prices: Rates reflect the true supply and demand right now.

Forward forex market:

Forwards are agreements between two parties to exchange currencies at a future date for a fixed price. I remember a friend who worked in an importing company telling me how they used forward contracts to lock in rates and avoid nasty surprises from sudden currency swings.

- Hedging tool: Used heavily by businesses to protect against volatility.

- Customised contracts: Tailored to the exact needs of the deal.

- Counterparty risk: Since these are private, trust matters a lot.

Futures forex market:

Futures work much like forwards, but with one major difference: they are traded on exchanges, and beginners often wonder about the smallest account size to trade futures.

- Exchange-traded: Provides more security against default.

- Margin requirements: Traders must keep enough funds as collateral.

- Highly liquid: Easy to enter and exit positions.

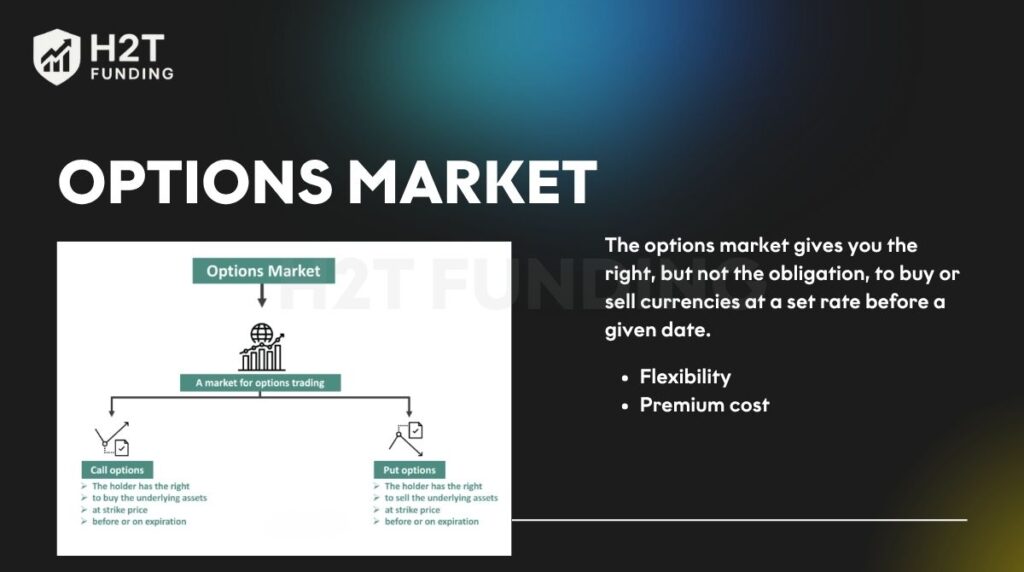

Options market:

The options market gives you the right, but not the obligation, to buy or sell currencies at a set rate before a given date. I once bought a small option contract on EUR/USD just to test it, and while the premium felt like a “ticket fee,” the flexibility it gave was eye-opening.

- Flexibility: Perfect for hedging or speculation.

- Premium cost: You pay upfront, even if you don’t use it.

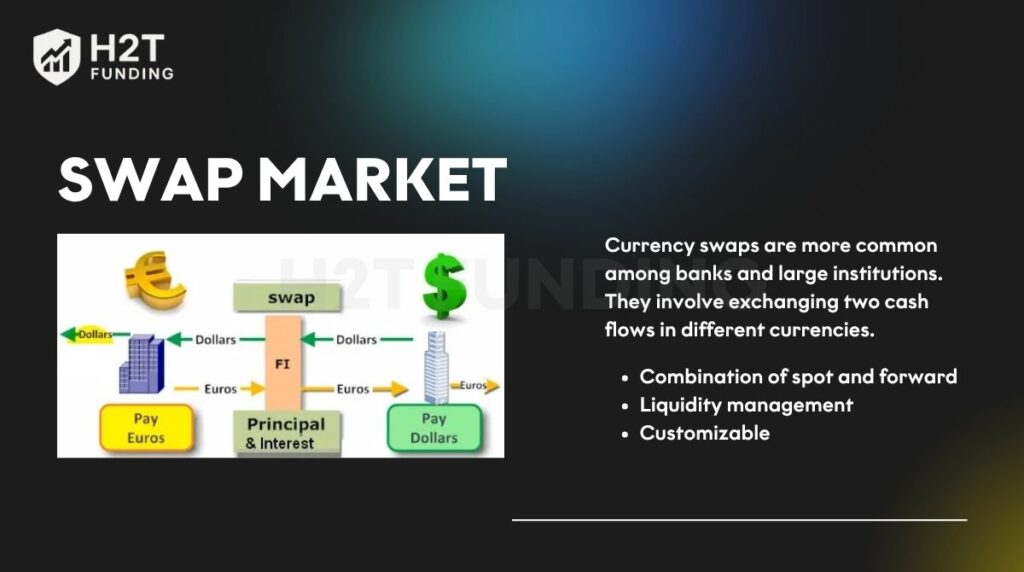

Swap market:

Currency swaps are more common among banks and large institutions. They involve exchanging two cash flows in different currencies. While I don’t trade swaps myself, I’ve learned they are critical for managing liquidity and balancing risks for big players.

- Combination of spot and forward: A two-step process.

- Liquidity management: Helps institutions keep their balance sheets stable.

- Customizable: Terms are tailored to specific needs.

Forex is not just one market but a collection of several spots for immediate trades, forwards, and futures for contracts, options for flexibility, and swaps for institutions. Each serves a unique role, and understanding them helps traders see the bigger picture of how forex trading actually works and how it works across different markets.

3. Basic terms for beginners learning about forex

If you’ve just stepped into forex, I know exactly how confusing it can feel. That’s why I’m going to break down the basic forex terms you must understand before you even place your first trade. Keep these in mind; they’re your foundation.

- Currency pairs: In forex, you trade one currency against another, such as EUR/USD or GBP/JPY. I still remember my first EUR/USD trade. I didn’t realise USD was the quote and almost misread the price. The first in the pair is the base, while the second is the quote.

- Buy order (Long position): This is when you expect the base currency to rise in value against the quote. I like to think of it as “betting on growth.” My first long on GBP/USD during Brexit chaos taught me how quickly a good guess can turn profitable or risky.

- Sell order (Short position): When you expect the base currency to fall, you sell. Shorting felt scary at first. I mean, making money when the price drops? But it’s one of forex’s most powerful tools.

- Pip (Point in price): This is the smallest unit of price change in forex, usually the 4th decimal place (0.0001). Don’t underestimate it; a few pips can make or break a trade. I once celebrated a 30-pip win that felt like a million.

- Spread: The tiny difference between the buy and sell price. It looks small, but spreads are how brokers make money, and they eat into your profits. I’ve learned to always check spreads before jumping into volatile sessions.

- Leverage: This is borrowing power from your broker to control bigger positions. Sounds exciting, right? But be careful. High leverage made me money fast, but it also blew up one of my early accounts. Respect leverage, or it’ll teach you a harsh lesson.

- Lot size: This is how much currency you’re actually trading. 1 standard lot = 100,000 units. Luckily, most beginners (including me when I started) stick to micro or mini lots to reduce risk.

Once you understand these terms, forex makes more sense, especially if you’ve searched for trading forex explained or forex how does it work in simple words. You’ll read charts differently, place trades with more confidence, and avoid the rookie mistakes I once made.

4. How does forex currency trading work

The challenge (and the thrill) lies in predicting which one will gain strength. To understand how forex currency trading truly works, let’s break it down into four key parts: Buying a currency pair, selling a currency pair, common order types in forex, forex market hours, and liquidity.

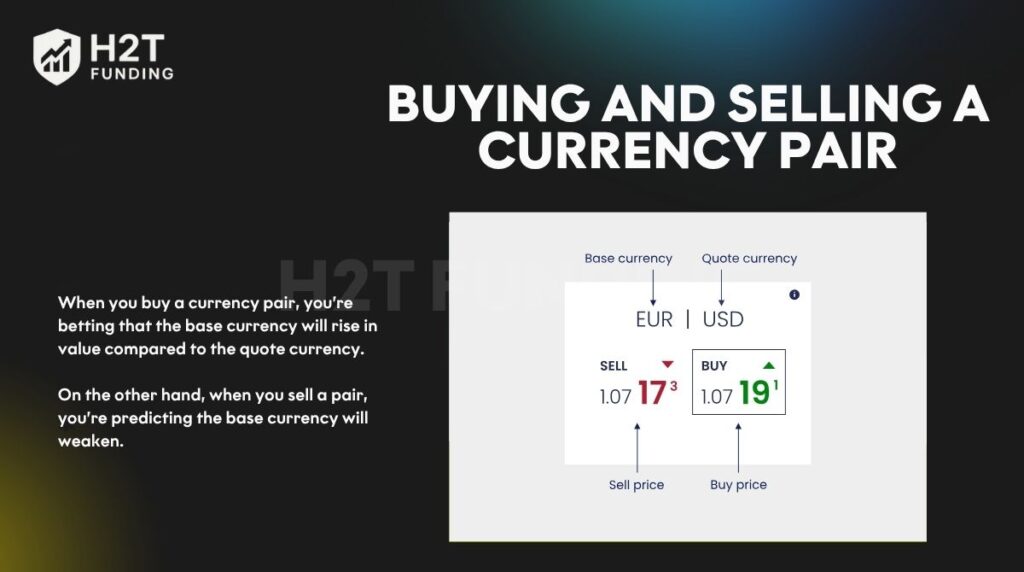

4.1. Buying a currency pair

When you buy a currency pair, you’re betting that the base currency will rise in value compared to the quote currency. For example, if I buy EUR/USD, I’m expecting the euro to strengthen against the dollar.

I still remember my first EUR/USD long position. The price moved just 50 pips in my favour, and I felt like I’d cracked the code to financial freedom. (Spoiler: I hadn’t… yet.)

4.2. Selling a currency pair

On the other hand, when you sell a pair, you’re predicting the base currency will weaken. If I sell GBP/USD, I’m saying the pound will fall, and the dollar will rise. Beginners often fear short-selling, but in forex, it is normal and often smart.

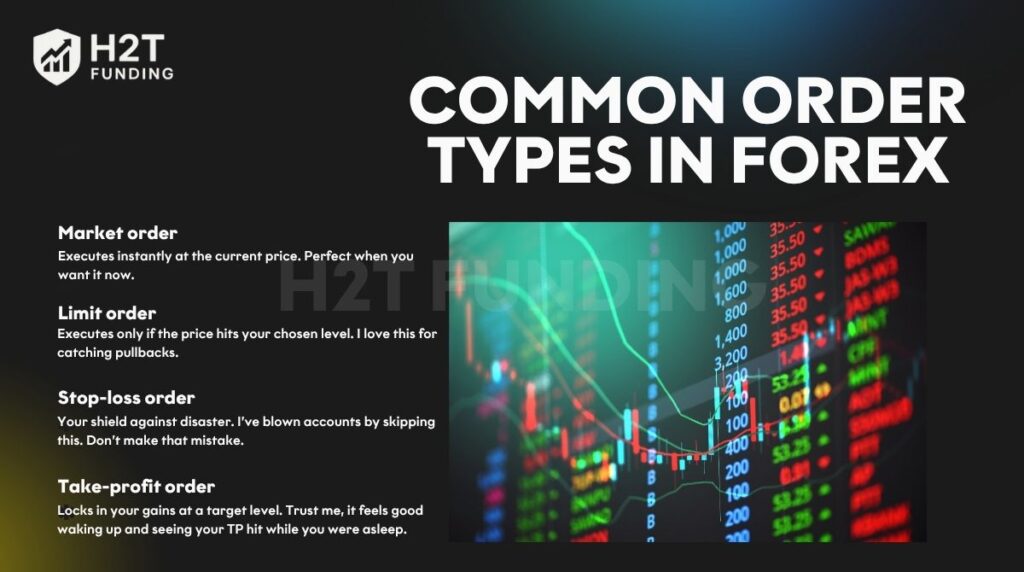

4.3. Common order types in forex

Here’s where things get practical. It’s not just about clicking buy or sell; it’s about how you place those trades:

- Market order: Executes instantly at the current price. Perfect when you want it now.

- Limit order: Executes only if the price hits your chosen level. I love this for catching pullbacks.

- Stop-loss order: Your shield against disaster. I’ve blown accounts by skipping this. Don’t make that mistake.

- Take-profit order: Locks in your gains at a target level. Trust me, it feels good waking up and seeing your TP hit while you were asleep.

4.4. Forex market hours and liquidity

One of the reasons I fell in love with forex is the 24/5 trading schedule. From Monday morning in Asia to Friday night in New York, there’s always action somewhere.

The most exciting times? The London–New York overlap. That’s when liquidity is at its peak, spreads are tight, and price movements can be explosive, especially when combined with tools like a trendline to confirm entries. I’ve made some of my best trades during those golden hours and also taken painful losses when I got greedy.

4.5. Why liquidity matters

Forex is the most liquid market in the world, with trillions traded daily. This liquidity fills your orders fast, but big players like banks and funds move the market in ways retail traders must ride, not fight.

So, when it all comes down to it, how does forex trading actually work? The practical answer is this: you are managing risk through smart orders, risk management, and an understanding of a liquid market while trying to capitalise on the movement of currency pairs.

This core mechanic is the essence of forex trading and how it works. Mastering key elements and keeping a journal shows how forex trading truly works beyond theory. Sounds simple, right? But like I learned the hard way, execution and discipline are everything.

If you’re just starting, keep it basic: Practice with small lot sizes, respect stop-losses, and study how the market breathes in different sessions. The mechanics are easy; the mastery is what takes time.

5. Who participates in the forex market?

The forex market is the largest financial market in the world, and it brings together a wide range of players from powerful institutions to everyday traders. Each group has its own purpose, influence, and strategy. Here are the main participants:

- Central banks and governments: They manage national currencies, stabilise economies, and sometimes intervene directly to influence exchange rates. For example, the Federal Reserve or the European Central Bank can cause huge market swings with a single policy decision.

- Commercial banks and financial institutions: These are the backbone of forex trading. Large banks handle massive currency transactions for businesses, investors, and even other banks. They also trade currencies to profit from fluctuations, adding significant liquidity to the market.

- Brokers: Brokers act as the bridge between major market participants and retail traders. A broker provides access to trading platforms, facilitates currency pair execution, and offers leverage, spreads, and trading signals. Without brokers, individuals could not participate directly in the foreign exchange market. Choosing a reliable broker is critical because it directly affects your execution and trading costs.

- Retail traders: Individual traders like beginners, hobbyists, and professionals are also part of the forex world. While their trading volumes are smaller compared to banks, the growth of online platforms has made retail participation more visible than ever. Many start with demo accounts before moving into live trading.

- Corporations and multinational companies: Businesses that operate across borders often need to convert currencies for payments, investments, or hedging. For example, an airline might use forex to lock in fuel costs priced in another currency.

Read more:

6. Example: How a forex trade works

Every forex transaction follows the same principle: you are speculating on how one currency will move against another. If your call is correct, you make a profit; if not, you take a loss. Let’s look at a detailed EUR/USD example.

6.1. Trade setup: Buying EUR/USD

Assume EUR/USD is quoted at 1.11280, with an ask price of 1.11284 and a bid price of 1.11276. The difference between the two is the spread of 0.8 pips. Believing the euro will rise against the dollar, you decide to buy at 1.11284.

Forex positions are measured in lots. One standard lot equals 100,000 units of the base currency. In this case, buying one lot of EUR/USD means trading €100,000 for $111,284. You choose to open three lots, or €300,000, for a total notional value of about $333,852. That gives you a pip value of $30 per pip.

Because forex uses leverage, you don’t need to provide the full value upfront. With a margin requirement of 2%, your initial margin is just $6,677 (around €6,000).

6.2. If your prediction is correct

The dollar weakens, and EUR/USD rises to 1.11530. At that point, the bid price is 1.11526, and you close your three-lot position there:

- New value: 1.11526 × (100,000 × 3) = $334,578

- Initial value: $333,852

- Profit: $726

Alternatively: (1.11526 – 1.11284) = 24.2 pips × $30 per pip = $726.

Note: Holding overnight would also incur swap/funding fees, which are standard in forex trading.

6.3. If your prediction is wrong

The dollar strengthens, and EUR/USD falls to 1.11030, with a bid of 1.11026. Closing the position here leaves you with:

- New value: 1.11026 × (100,000 × 3) = $333,078

- Initial value: $333,852

- Loss: $774

Or, in pips: (1.11284 – 1.11026) = 25.8 pips × $30 per pip = $774.

This example shows the double-edged nature of leverage: a small move of just a few dozen pips can translate into hundreds of dollars gained or lost. That’s why risk management is the most critical skill for anyone entering the forex market.

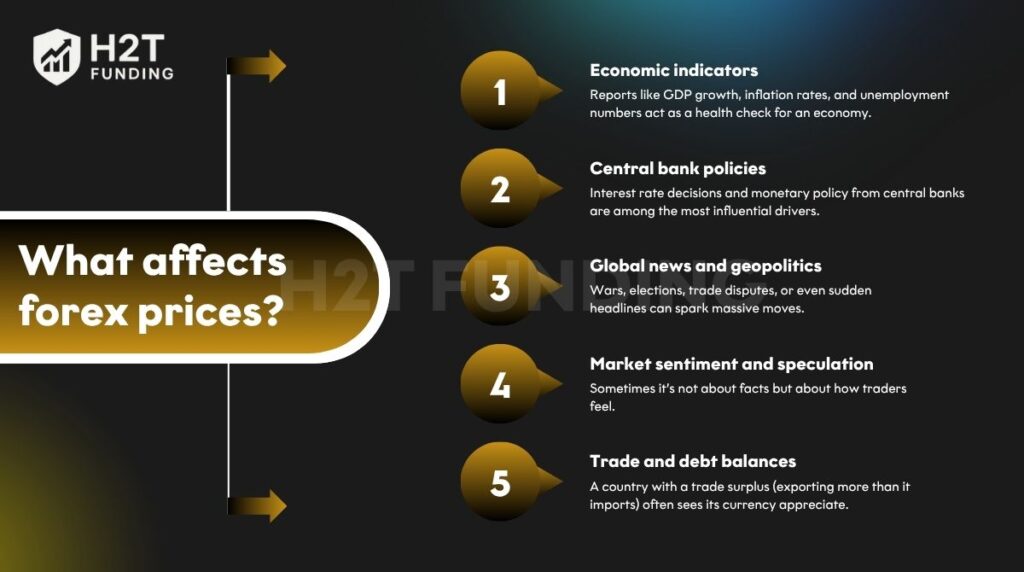

7. What affects forex prices?

Currency prices in the forex market never move randomly, and anyone exploring how does currency trading works should understand the main drivers: Economic indicators, central banks’ policies, geopolitical events, and overall market sentiment.

These factors, combined with speculation and technical analysis, shape every movement on the chart. Behind every rise or fall, there are powerful forces shaping the value of one currency against another. Here are the main factors:

- Economic indicators: Reports like GDP growth, inflation rates, and unemployment numbers act as a health check for an economy. Strong economic data usually pushes a currency higher, while weak numbers can drag it down. Traders often wait for these releases with intense anticipation, as a single report can cause sharp volatility.

- Central bank policies: Interest rate decisions and monetary policy from central banks (like the Federal Reserve or ECB) are among the most influential drivers. Higher rates tend to attract global investors, strengthening a currency. On the flip side, rate cuts often weaken it. Many traders have learned the hard way that ignoring central bank meetings is a recipe for surprise losses.

- Global news and geopolitics: Wars, elections, trade disputes, or even sudden headlines can spark massive moves. For example, geopolitical tension often drives traders into safe-haven currencies like the U.S. dollar or Swiss franc. It’s a reminder that in forex, politics, and markets are deeply connected.

- Market sentiment and speculation: Sometimes it’s not about facts but about how traders feel. If the market believes a currency is strong, demand rises even before economic data confirms it. Speculators amplify these swings, which is why sudden rallies or sell-offs can appear “irrational” at first glance.

- Trade and debt balances: A country with a trade surplus (exporting more than it imports) often sees its currency appreciate. Meanwhile, nations with heavy public debt or persistent deficits may struggle to keep investor confidence, pushing their currencies lower.

In short, forex prices reflect a blend of hard data, central bank actions, global events, and human psychology. Knowing these drivers helps traders avoid guessing and start understanding why the market moves the way it does.

8. How to start forex trading as a beginner

Getting started in the forex market can feel overwhelming, but breaking it into simple steps makes the process manageable. Below are the key actions every beginner should take:

- Learn the basics: Understand what forex trading is, how currency pairs work, and the role of leverage, margin, and spreads. Free training resources and online guides can help.

- Choose a reliable broker: Research and compare forex brokers that are licensed, transparent with fees, and provide user-friendly trading platforms.

- Practice with a demo account: A forex demo account lets you trade with virtual money, test strategies, and build confidence without financial risk.

- Move to live trading gradually: Once you gain consistency in demo trading, start with a small real account to experience real market conditions.

- Apply risk management: Protect your capital by setting stop-loss orders, limiting leverage, and never risking more than a small percentage of your account on one trade.

- Develop a trading plan: A structured plan covering entry/exit rules, money management, and emotional discipline is essential for long-term success.

Starting forex trading the right way helps beginners avoid costly mistakes and build a strong foundation for growth in the world’s largest financial market. If you’ve ever wondered how forex trading actually works at the beginner level, this step-by-step plan is your roadmap.

9. Risks of forex trading

Forex trading can be exciting, but it also carries significant risks that every trader should be aware of. From my own experience starting out, I realised that focusing only on profits without managing risks often leads to costly mistakes.

- High volatility: Currency markets can change direction within seconds, leading to sudden losses if you’re unprepared.

- Leverage risk: While leverage can amplify profits, it also magnifies losses, making risk management essential in forex trading. Without a solid plan to control position size and protect capital, even small shifts in market volatility can wipe out an account.

- Emotional pressure: Fear, greed, and impatience often push beginners to overtrade or abandon their strategy.

- Broker risk: Choosing an unreliable or unregulated forex broker can expose you to hidden fees or even fraud, which is why traders should also learn how to choose a prop firm carefully before committing capital.

- Knowledge gap: Lack of proper forex education often results in poor decision-making and unrealistic expectations.

Trading forex is not gambling; it requires discipline, strategy, and risk management. By acknowledging these risks early, beginners can approach the market with a more realistic mindset and better long-term results.

10. Forex trading tips for beginners

Starting out in forex can feel overwhelming, but a few simple tips can make the journey smoother. I still remember my early trades, some wins, some painful losses, and these lessons helped me stay in the game.

- Keep it simple: Don’t overload your chart with too many indicators. Stick to one or two strategies you truly understand, and beginners can start with the best trading strategy for beginners to build confidence.

- Use a demo account first: Practising in a demo saved me from blowing real money while I was still learning.

- Risk only what you can afford to lose: Never trade with rent or savings; emotional pressure will ruin your judgment, and measuring performance with a good Sharpe ratio helps keep expectations realistic.

- Follow a trading plan: Enter and exit trades based on clear rules, not gut feelings.

- Focus on major currency pairs: They’re less volatile for beginners and have lower spreads.

- Don’t chase every move: Sometimes the best trade is no trade at all.

Every beginner makes mistakes, too. The difference is whether you treat them as lessons or repeat them until your account is gone.

11. FAQs

Yes, forex trading is legal in most countries, but regulations vary by region.

It’s possible, but very rare. Most traders focus on steady growth, not overnight wealth.

Some brokers allow you to start with as little as $10, though $100–$500 is more practical.

No, but trading without a strategy or risk management can quickly feel like gambling.

Major pairs like EUR/USD, GBP/USD, and USD/JPY are due to lower spreads and higher liquidity.

At least $100–$500 is recommended for meaningful practice with proper risk management.

Profits vary; a realistic range is 1–5% monthly, not guaranteed daily income.

Highly unlikely without extreme risk, which usually ends in losses.

Yes, but it limits position size and growth potential.

Mainly spreads, commissions (if any), and swap/overnight fees.

Yes, in most countries, forex profits are subject to tax.

By financial authorities like FCA (UK), CFTC (US), ASIC (Australia), and others, depending on the region.

A sudden price jump on the chart, usually after weekends or major news events.

12. Conclusion

Now, you don’t just know the theory; you grasp the practical reality of how does forex currency trading works. You’ve seen that behind the candlestick charts is a story told by economic indicators and market sentiment.

Based on my own journey, the key isn’t a sprint for quick profits. It’s about building a sustainable skill through discipline, patience, and a solid risk management plan, turning speculation into a calculated strategy.

If you want more than theory, resources like H2T Funding and its Prop Firm & Trading Strategies can give insights into trading approaches and guide you on the right path.

At the end of the day, forex trading is less about predicting the future and more about managing risk while taking calculated opportunities. With patience, practice, and the right knowledge, you can turn forex into a long-term skill that supports your financial goals.