How do funded trading accounts work? Ever wondered how traders access massive amounts of capital without personally funding it?

A funded trading account is the key to an agreement where a professional trading firm provides the funds, empowering skilled individuals to trade large positions and earn a share of their successes.

In this beginner’s guide, I will explain what a funded trading account is, how it makes money for traders, how to create one, and how to choose a funded trading program based on your references. Let’s get started!

1. What exactly is a funded trading account?

A funded trading account is a setup where a proprietary trading firm supplies the money needed for a trader to operate in the markets. In return, the trader agrees to split a portion of any profits earned with the firm.

The unique arrangement of trading accounts allows talented individuals to bypass the barrier of insufficient capital, leveraging the firm’s resources to achieve larger trading volumes and potentially greater returns.

Unlike traditional personal trading accounts, where you risk 100% of your own money, a prop firm bears the majority of the financial risk (up to specific drawdown limits).

This arrangement thrives on a win-win dynamic: the firm earns from the profits of your effective trades, while you, as the funded trader, receive significant trading capital and the opportunity to take a portion of the profits.

This all sounds great, but how do funded trading accounts work? And more importantly, how do you earn money from it? The process typically involves a few key stages

2. How do funded trading accounts work?

Traders earn money by generating consistent profits in the markets and receiving a percentage of those profits as a payout.

For aspiring traders with skills but limited capital, funded trading accounts offer a popular pathway to accessing significant market exposure.

Prop trading companies provide this arrangement, which enables people to trade the company’s funds after demonstrating their skills through a rigorous evaluation process. Traders give the company a share of their profits in exchange for this opportunity.

Here’s a comprehensive explanation of the typical trading process for a funded trading account:

2.1. Step 1: The application and choosing a program

The first step in your trading journey is choosing a prop firm and funded trader program that suits your trading approach, appetite for risk, and long-term financial objectives.

Firms offer a variety of account sizes, typically ranging from $10,000 to over $1,000,000 in virtual capital, each with a corresponding one-time evaluation fee. This fee is often refundable upon successfully passing the evaluation and receiving your first profit split.

4 key factors to consider when choosing a program include:

- Evaluation model: Firms typically offer one-step or two-step evaluation challenges. One-step challenges require traders to meet a single set of objectives, while two-step challenges have a verification stage with a second set of, often easier, targets.

- Trading rules and objectives: Carefully examine the profit targets, drawdown limits, and any other trading restrictions.

- Profit sharing: This refers to the portion of trading gains allocated to you. It typically starts around 75-80% for the trader and can often scale up to 90% or higher with consistent profitability.

- Allowed instruments and strategies: Ensure the firm permits trading the assets you specialize in (e.g., forex, indices, crypto) and doesn’t prohibit your trading style (e.g., news trading, holding positions overnight).

2.2. Step 2: The evaluation phase

The evaluation phase, or “challenge,” is the most critical stage of the process. You will trade on a demo account to prove your skills under strict rules. Your goal is to demonstrate consistent profitability while managing risk effectively.

You must meet a specific profit target, usually between 8% to 10% of the account balance. Trading is also bound by drawdown limits, which restrict your maximum daily and overall losses. These rules test your risk management abilities under pressure.

Other rules include minimum trading days to ensure consistent activity. Some firms also enforce consistency rules to prevent one large win from meeting the target. Adherence to all regulations is mandatory to pass this crucial stage.

Any rule violation, particularly one involving drawdown limits, results in the account being terminated immediately. To try again, you’ll usually have to pay for a new evaluation. Some firms may offer a discounted “reset” option for another attempt.

2.3. Step 3: The funded account

Once you pass the test, you are given a funded account for your use. Although it is a demo account, it is linked to the firm’s live capital. This means you are now eligible to earn real money from your trading performance.

You will continue trading while following rules similar to the evaluation phase. After a particular period, you can request your first profit payout. Payouts are based on a certain profit split percentage between you and the firm.

Many reputable firms also offer scaling plans to reward consistent traders. If you accomplish certain profit targets over time, the firm will expand your account size. This allows you to trade with greater capital and make higher profits.

After a specified period (often your first 30 days of trading), you can request your first profit payout. The profit split is calculated based on the net profit you’ve generated in your funded account.

For example, on a $100,000 account with an 80/20 profit split, if you make a $5,000 profit, you would receive $4,000, and the firm would retain $1,000.

2.4. Step 4: Maintaining funded status

Consistent trading discipline is essential for a successful long-term partnership with a prop business. The same drawdown rules as in your evaluation will apply to your funded account.

In essence, the funded trader process is a performance-based system for mutual benefit. Allowing skilled traders to leverage a firm’s capital for ideal opportunities. Success demands high discipline and excellent risk management to navigate the markets consistently.

So, to recap, how funded trading accounts work is straightforward: you choose a firm, prove your skills in their challenge by following the rules, get verified, and then you’re ready to trade with their capital.

Maybe you need:

3. Funded Accounts vs. Regulated Trading Accounts

In contrast, regulated trading accounts are completely independent trading accounts. Understanding the difference between those with a funded account is important for anyone looking to enter the trading world.

3.1. What is a regulated trading account?

A regulated trading account can also be known as a standard brokerage account, where you trade with your own money.

These types of accounts provide direct access to live financial markets, and when trading, you retain 100% of the profits generated.

For frequent traders, regulated accounts often come with particular rules, such as the Pattern Day Trader rule in the US, which requires a minimum equity of $25,000 for margin accounts if you open four or more day trades within five business days.

3.2. The differences between funded accounts and regulated trading accounts

Now that we have explored what a funded account is, let’s compare to see what the differences are between a funded trading account and a regulated trading account.

| Feature | Funded trading account | Regulated trading account |

|---|---|---|

| Capital source | Provided by a trading firm | 100% your own money |

| Ownership of funds | Belongs to the funding firm | Belongs to you |

| You are responsible for all losses | Risk to the trader | Strict rules set by the funding firm (e.g, drawdown limits, daily loss limit) |

| Profit sharing | Shared between you and the funding firm | You keep 100% of the profits |

| Regulatory oversight | Can be less regulated than traditional brokers | Operated by brokers supervised by recognized financial authorities |

| Account access | Requires passing an evaluation process | Requires identity verification and meeting account minimums |

| Trading rules | Rules set by the broker and regulatory bodies (e.g, Pattern Day Trader rule in the US) | Rules set by the broker and regulatory bodies (e.g Pattern Day Trader rule in the US) |

| Withdrawals | Subject to the funding firm’s withdrawal policies and profit splits | Withdrawals are made according to the broker’s policies |

Understanding the differences between funded trading accounts and regulated trading accounts is important, especially for beginners, because it directly impacts the risks they take, the capital they trade with, the rules they must follow, and the overall environment in which they learn and operate.

Beginners often have limited capital and experience, making the chance of trading big via funded accounts appealing. However, funded accounts come with specific evaluation processes and strict trading parameters that might be challenging for those still developing their discipline and strategy.

Conversely, regulated accounts, while requiring personal capital and subjecting traders to market risk and potentially rules, offer a more traditional and often more transparent pathway through brokers supervised by financial authorities.

Knowing these distinctions helps traders choose an account type that aligns with their references.

4. How to create a funded trading account?

Securing a funded trading account, where you trade with a firm’s capital, involves a structured process to prove your skills.

- Choose a reputable prop firm: Select a firm that aligns with your trading style and offers clear rules and suitable programs.

- Understand their rules: Thoroughly read and commit to their specific guidelines for trading objectives and risk management.

- Complete a trading challenge: You’ll typically undergo at least one virtual challenge (e.g., Phase 1, Phase 2). This is your chance to demonstrate consistent profitability and disciplined risk management, proving your trading ability isn’t just luck.

- Await account verification: After successfully passing the challenge, the firm will verify your identity. This usually takes 24-72 hours.

- Receive your funded account: Once verified, you’ll be notified that your live funded account is ready, allowing you to begin trading with the firm’s capital and earn profit splits.

5. The upsides and downsides of funded trading accounts

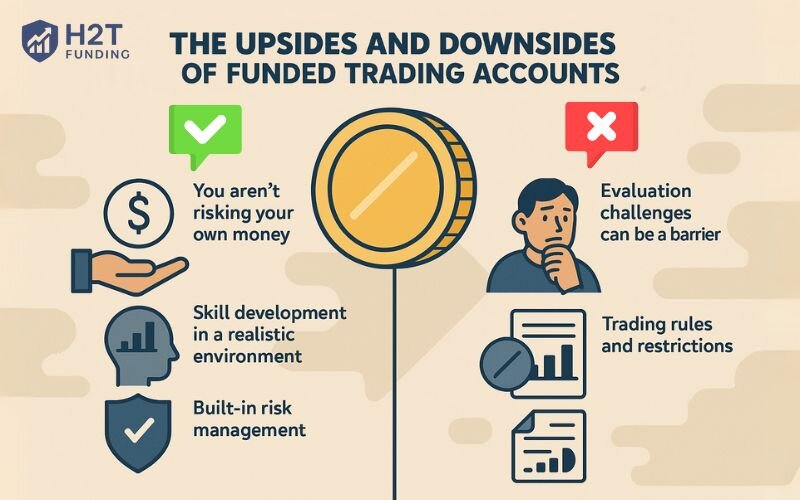

Funded trading accounts open significant doors for traders, yet like any investment opportunity, they come with both advantages and disadvantages. To make an informed decision, it’s crucial to understand both sides of the coin.

5.1. Advantages of funded trading accounts

Funded trading accounts offer a compelling path for traders to scale their careers and access significant capital. While the initial evaluation might be simulated, the benefits of qualifying for a real funded account are substantial. These are key advantages of choosing a funded trading platform:

- You aren’t risking your own money: This is the biggest advantage. When a trade goes against you, and it will, the loss comes out of the firm’s capital, not your personal savings. For many traders, being free from that financial fear is a massive psychological edge that allows them to execute their strategy properly

- Skill development in a realistic environment: Though technically simulated, many accounts closely mirror the dynamics of real market conditions. This immersive experience supports the cultivation of strategic thinking, disciplined execution, and adaptability, all essential traits for long-term success in trading.

- Built-in risk management: Proprietary firms often enforce predefined risk management protocols, such as drawdown thresholds and position limits. These measures train traders to make sound decisions, helping them develop a strong instinct for identifying and managing risk effectively

One of the biggest hurdles I see traders face is the psychological pressure of the evaluation. It’s not just about hitting a profit target; it’s about doing it while knowing one mistake can end your attempt. This pressure is often underestimated.

5.2. Drawbacks of funded trading accounts

While funded trading accounts offer unique opportunities for traders to grow without committing personal capital, they also come with limitations that may not suit every individual.

- Evaluation challenges can be a barrier: This process can be demanding and time-consuming, especially for beginners. Unless an instant funding option is available, this prerequisite may delay entry into live trading and lead to frustration.

- Trading rules and restrictions: Funded trading comes with a set of operational rules, such as daily drawdown limits, time restrictions, and trading style constraints. Breaking these guidelines may lead to the closure of your trading account.

It is important for aspiring traders to thoroughly understand these constraints before entering a partnership with a proprietary trading firm

5.3. Benefits of funded trading accounts

Funded trading, when used effectively, can open many doors in the trading market. As a funded trader, there are some appealing benefits that you should know:

- Flexible trading lifestyle: The idea is to think of funded traders as freelancers; you can see that both groups have many similarities. There are no fixed schedules or mandatory hours. You can choose to trade anywhere and anytime.

- Education & support: Many firms equip traders with a toolkit for growth. This offers training materials and webinars. With ongoing support to develop strategies, a beginner trader can sharpen their skills with aid.

- Capital without personal risk: This is the biggest advantage of a funded trading account, as you have access to a large amount of capital, starting from $2,000 to $200,000, depending on your performance and the firm’s rules.

6. How to choose the best funded trader program for you

Selecting the right funded trader program hinges on your personal trading approach, financial objectives, and psychological tendencies. To help narrow your options, ask yourself:

- Do you prefer a manual trading style or rely on algorithms?

- Are you comfortable operating within strict time constraints, or do you need more trading flexibility?

- Which category best fits you (scalper, swing trader, or algorithmic trader)?

If you’re still exploring your style, consider starting with firms that offer trial accounts or affordable entry points, such as FTUK. For a comprehensive comparison, check out our guide that evaluates prop firms side by side.

For a deeper look, explore this article featuring the Top 12 easiest prop firms to pass in 2026.

7. How do funded trading accounts pay out?

After actively trading and meeting the required performance criteria, you should be able to request a withdrawal from your funded trading account. Here is an example of a payout process for a funded trading account.

- To begin, complete the KYC/AML verification by submitting your ID and proof of address, ensuring that you avoid using any VPN or VPS during this process.

- Once verified, proceed to submit a payout request through the firm’s dashboard, such as Trade Hub, and select your preferred payout method.

- After the firm reviews the request for any rule violations or gains from prohibited strategies, the funds are transferred to you.

- The processing period generally takes about 3 to 5 business days.

8. FAQs

Many think it’s a shortcut to quick riches or that it eliminates risk. In reality, it’s an intensive job interview with constant scrutiny. You’re risking the opportunity of accessing capital, and strict rules protect the firm’s funds, not guarantee your success.

From my experience, it’s overwhelmingly poor risk management. Traders overleveraged, chasing quick profits and hitting drawdown limits. Data I’ve seen suggests 90-95% fail the initial challenge due to this. Other key reasons are a lack of a robust trading plan, emotional decision-making, and simply ignoring the firm’s specific rules.

Relentlessly focus on risk management before profit. Your primary goal in a challenge is not to lose money according to the rules. Prop firms filter out risky traders. Instead of taking on the actual challenge, begin with the smallest account and spend months practicing rigorous risk management on a demo. It’s a marathon where survival is the first, most important victory.

You will get a funded account to manage after passing the challenge. While it’s often a demo account, it’s linked to the firm’s live capital, meaning you become eligible to earn real money from your trading performance.

One of the most concerning red flags is a firm’s lack of transparency. Especially when paired with a pattern of delayed or disputed payouts. If you notice recurring complaints in independent reviews about payment issues, you should consider the credibility of the firm. A firm’s track record of honoring payouts should always be a top priority in your selection criteria.

Yes, you can make money with funded trading accounts. But keep one thing in mind that you need to prove you have the skills by applying consistent discipline and being able to manage risk effectively. Lastly, you must have a strategy that aligns with the prop firm’s rules.

9. Conclusion: Trading with discipline

We have explored how do funded trading accounts work through this article. To sum up, getting a funded account isn’t about the money. It’s about discipline. Prop firms are not searching for lottery winners who get lucky on one big trade; they are searching for consistent professionals who manage risk obsessively.

If you can prove you are that trader, the capital will follow. The real challenge, and the true reward, is in mastering your own discipline, not just mastering the market. The journey to becoming funded is a testament to consistent performance and strategic partnership, creating a path toward professional trading.

Ready to explore its full potential? Dive into our Prop Firm & Trading Strategies section. And remember, every expert at H2T Funding is here to accompany you on your journey to becoming a trader.