When comparing Funding Pips vs Blueberry Funded, you are essentially choosing between two distinct trading worlds. Funding Pips is built for speed and aggression, offering high leverage and low fees, while Blueberry Funded focuses on institutional stability and broker-backed security.

H2T Funding has rigorously analysed the trading conditions, payout speeds, and hidden rules of both firms to help you cut through the noise. Whether you are looking for instant rewards or a structured career path, this guide reveals the truth behind the marketing. Let’s dive in to find the perfect fit for your strategy!

Key takeaways:

- Funding Pips: Best known for its flexible trading rules, high profit split (up to 100%), low fees, and rapid account setup, making it ideal for fast-paced traders.

- Blueberry Funded: Stands out with its structured evaluation process, strong reliability, and clearly defined drawdown rules, suiting traders who prioritize consistency.

- Both firms provide excellent access to forex, commodities, crypto, and indices. They also support popular trading platforms and offer a scaling plan for successful traders.

- Choose Funding Pips if: You want the lowest entry fees, high leverage (1:100), and the ability to skip evaluations via the Zero Model (Direct Funding).

- Choose Blueberry Funded if: You value premium customer support and broker-backed stability and want to trade unique assets like single stocks with a trusted partner.

1. Overview of each firm: Funding Pips vs Blueberry Funded

Honestly, a Funding Pips vs Blueberry Funded review is a look at two completely different philosophies in trader evaluation. Funding Pips is all about speed, simplicity, and a high profit split. Think of it as the sprinter’s choice.

On the other hand, Blueberry Funded represents discipline and transparency, focusing heavily on a clear structure and tight risk management. Simply put, it’s designed for the marathon runner.

From our experience, your preference will boil down to what you value more: flexibility or stability.

Comparison at a Glance

| Criteria | Funding Pips | Blueberry Funded |

|---|---|---|

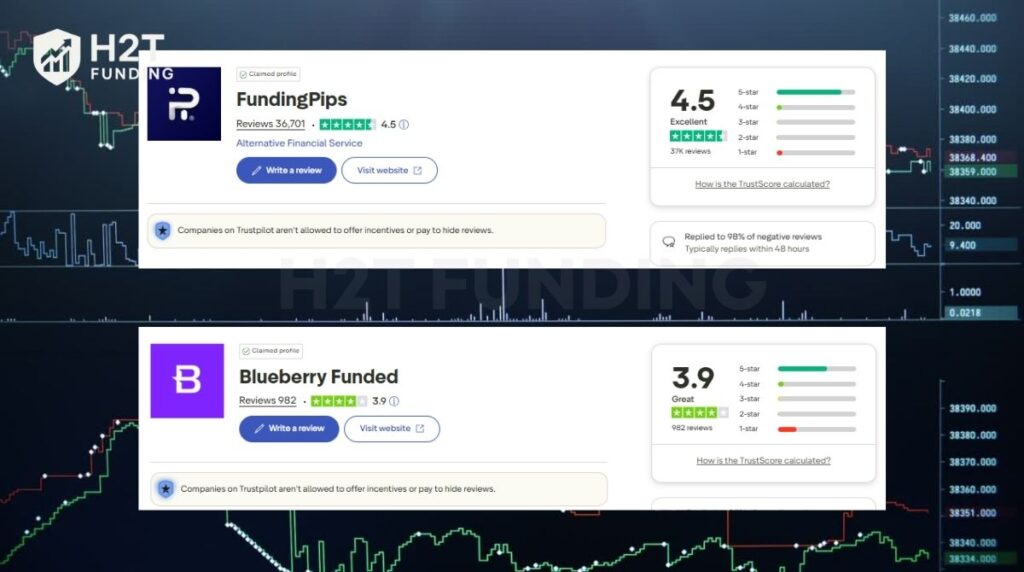

| Founded / Trust Level | 2022 / 4.5 on Trustpilot (36k+ reviews) | Recent / 3.9 on Trustpilot (920+ reviews) |

| Evaluation Models | 1-Phase, 2-Phase, Zero Model (Direct Funding) | Prime (2-Step), Step 1, Rapid, Synthetic, Instant Elite & Lite |

| Tradable Assets | Forex, Metals, Indices, Commodities, Cryptocurrencies | Forex, Indices, Commodities, Crypto, Stocks |

| Platforms | MT5, Match-Trader, cTrader | MT4, MT5, DXTrade, TradeLocker |

| Profit Split | Up to 100% | 80% – 90% |

| Minimum Trading Days | 3 days | 3–5 days (Note: A trading day only counts if you generate a minimum profit of 0.5% of the initial balance). |

| Scaling Plan | Yes, up to $2M | Yes |

| Payout Schedule | On-demand, weekly, bi-weekly | Every 14 days |

| Drawdown Rules | Static | Trailing or Static, model-dependent |

| Risk Notes | Strict rules on HFT, arbitrage | Conservative leverage (1:30 on FX, 1:10 on Indices/Commodities, 1:2 on Crypto) |

| Best For | Low Fees, High Leverage & Speed | Support, Stability & Stocks |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Funding Pips vs Blueberry Funded websites before purchasing any challenge.

Now that we have a high-level view of the specifications, it is time to dig deeper into the actual trading experience. The numbers tell one story, but the platform performance, support quality, and funding speed tell another. Let’s break down exactly what each firm brings to the table, starting with the high-speed contender.

Funding Pips

#1

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

I think Funding Pips is incredibly straightforward and built for speed. It is widely recognised for its extremely low entry fees and instant access; traders receive their account credentials immediately after purchase, accelerating the funding process.

Besides standard challenges, their unique “Zero Model” allows scalpers and day traders to skip the evaluation phase entirely and start working towards rewards from Day 1. With leverage up to 1:100 and a “Zero Payout Denial” policy, it removes the typical barriers found in other firms.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

Blueberry Funded

#2

Account Types

1-step, 2-step, rapid, and instant funding

Trading Platforms

MT4, MT5, DXTrade, TradeLocker

Profit Target

5% – 10%

Our take on Blueberry Funded

This firm feels more professional and buttoned-up. Blueberry Funded is consistently highlighted for its responsive customer support team and smooth instant funding experience (via the Instant Elite & Lite models).

Backed by Blueberry Markets, the firm provides a tech infrastructure optimised for stable execution with minimal slippage. While they follow a 14-day payout cycle, Blueberry Funded operates on a fixed 14-day payout cycle, with fast processing once the payout date is reached. It is the ideal choice for traders who value a reliable, broker-backed partner.

| 💳 Challenge Fee | $25 – $1,500 |

| 👥 Account Types | 1-step, 2-step, rapid, and instant funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $1,25K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, Stocks, Futures |

Read more:

2. Core models & key rules: Funding Pips vs Blueberry Funded

This is where things get really interesting. Both firms have a clear evaluation process, but honestly, how you experience it is night and day. It all comes down to their core philosophies on what makes a successful trader.

2.1. Profit targets & minimum trading days

With Funding Pips, the goal is simple: prove your skill, and do it fast. On the flip side, Blueberry Funded is more about proving consistency over time.

| Feature | Funding Pips | Blueberry Funded |

|---|---|---|

| Core Philosophy | Speed & Simplicity | Consistency & Structure |

| Challenge Models | 1-Phase & 2-Phase | 1-Step, 2-Step, Rapid, etc. |

| Profit Target | 5%–10% | 5%–10% |

| Min Trading Days | 3 Days, | 3–5 Days |

The bottom line? Funding Pips is built for speed and immediate results. Blueberry Funded rewards stability and patience.

2.2. Drawdown & daily loss limits

So, how do they handle risk? This is where your trading style really matters.

Funding Pips uses a static drawdown model, which I think is a huge plus for many traders. Blueberry Funded offers more variety, which appeals to traders who want to choose their risk model.

| Feature | Funding Pips | Blueberry Funded |

|---|---|---|

| Drawdown Model | Static Drawdown | Trailing or Static (Depends on model) |

| Maximum Loss | Fixed 8% – 10% | Fixed 10% |

| Daily Loss Limit | 4% – 5% | 4% – 5% |

| The Big Advantage | More Breathing Room: Since the drawdown is static, it does not trail your profits. This allows you to build a buffer as your account grows. | Strategic Choice: Offers variety, allowing you to choose between trailing or static rules to best align with your personal risk management strategy. |

I’d say Funding Pips is more forgiving for traders who have a big winning streak, while Blueberry Funded gives you more upfront control over how your risk is calculated.

2.3. News, overnight & automation policies

What about different trading strategies? Can you trade the news or run your Expert Advisor?

Funding Pips is incredibly flexible here. You pretty much have the green light for most styles. Blueberry Funded is a bit more conservative and asks you to pay attention to the fine print.

| Policy | Funding Pips | Blueberry Funded |

|---|---|---|

| News Trading | Allowed (Restricted Window) Mixed. Allowed in Evaluation & On-Demand. For other cycles, strictly prohibited 5 minutes before and after high-impact news. | Model-Dependent Rules vary based on the specific account type you choose; some models have tighter restrictions. |

| Overnight & Weekend | Fully Allowed You can hold trades overnight and over weekends as long as you need to. | Generally Permitted Holding trades is standard practice, though it’s always best to check the specific challenge terms. |

| EAs/Automation | Flexible Most EAs are allowed. However, HFT (high-frequency trading) and arbitrage strategies are strictly prohibited. | Conservative EAs are allowed. However, Signal trading and third-party copy trading are strictly prohibited. |

If you want maximum freedom, Funding Pips delivers. If you prefer a structured environment, Blueberry Funded provides clarity, but you need to confirm the rules for your chosen path.

3. Fees, refunds & cost efficiency of Funding Pips and Blueberry Funded

Let’s talk money. What’s it going to cost you to get started, and is it a good value? Honestly, both firms are competitive, but they approach pricing differently. Funding Pips seems to focus on being the low-cost leader, while Blueberry Funded aims for transparency and value.

| Criteria | Funding Pips | Blueberry Funded |

|---|---|---|

| Fee Type | One-time challenge fee | One-time challenge fee |

| Refund Policy | The fee is refunded with the 4th payout | The fee is refunded with the first payout |

| Challenge Cost | Starts at $29 (very low) | Starts at $25 (extremely accessible) |

| Transparency | Good, all costs are upfront | Excellent, very clear terms |

| Added Fees | None that we could find | No hidden fees reported |

| Payout Cycle | Faster (weekly, bi-weekly, on-demand) | Standard (every 14 days) |

When you look at the raw numbers, the overall trading fees at Funding Pips are often cheaper, especially for larger account sizes. A fee starting at just $29 is incredibly low and removes a huge barrier for new traders. I think this is one of their biggest selling points. They want you in the door, trading.

On the other hand, Blueberry Funded offers a different kind of value. While their fees might be slightly higher for some accounts, the clarity and consistency you get in return are, in my opinion, worth it. You know exactly what you’re paying for, and the refund policy is just as solid. A $25 entry point for their smaller accounts is also fantastic for beginners.

To put it simply: If your top priority is the lowest possible entry cost, Funding Pips is hard to beat. But if you value a highly transparent and stable fee structure, Blueberry Funded provides excellent peace of mind. Both firms give you your money back, so the real cost is zero if you’re successful. Not bad, right?

Read more: Does FundingPips Have a Risk Management Tool – Secure Your Funded Account

4. Profit split & scaling of Funding Pips and Blueberry Funded

Alright, this is the part everyone cares about: how much money do you actually get to keep, and how big can your account grow? To be honest, this is where Funding Pips really tries to stand out from the crowd.

| Criteria | Funding Pips | Blueberry Funded |

|---|---|---|

| Profit Split | 60% – 100% (Depending on payout cycle) | 80% up to 90% |

| Scaling Plan | Aggressive, up to $2M | Structured and consistent |

| Payout Frequency | On-demand, weekly, bi-weekly | Fixed at every 14 days |

| Conditions | Hit a 10% profit target to scale | Consistent profitability required |

Let’s be real, the profit split from Funding Pips is a huge draw. Starting at 80% is great, but the chance to scale up to a 100% split at their Master Stage is pretty incredible. It makes you feel like all the hard work is truly paying off. Their scaling plan is also super ambitious; if you hit a 20% growth target, they’ll increase your account size, with a ceiling of $2 million. That’s a massive opportunity.

Now, Blueberry Funded offers a very fair and competitive 80% to 90% profit split. It’s a great deal, no question about it. Their scaling plan is more traditional; you prove consistent profitability, and they’ll bump up your capital. It feels more like a steady career progression rather than a sprint to the top.

The biggest difference for me? The payout frequency.

- Funding Pips gives you control. Want your money every week? You got it. Hit a big trade and want to cash out? Their on-demand option is a game-changer.

- Blueberry Funded is more methodical with a fixed 14-day cycle. It’s reliable and predictable, which many traders actually prefer for managing their finances.

Our verdict: If your goal is to maximize your take-home pay and scale your account as fast as possible, Funding Pips offers one of the most aggressive packages out there. However, if you prefer a structured, reliable system for both your profits and account growth, Blueberry Funded delivers exactly that.

5. Platforms & tradable assets of Funding Pips and Blueberry Funded

A prop firm can have the best rules in the world, but it means nothing if the tech is clunky or you can’t trade the markets you know best. So, how do these two stack up?

To be frank, both firms give you excellent market access. You won’t feel limited.

| Criteria | Funding Pips | Blueberry Funded |

|---|---|---|

| Supported Platforms | Match-Trader, cTrader | MT4, MT5, DXTrade, TradeLocker |

| Instruments | Forex, Crypto, Indices, Commodities, Metals | Forex, Indices, Metals, Crypto, Stocks |

| Execution | Good, optimised for fast trading | Very stable, with low slippage reported |

| Leverage | Up to 1:100 (Forex). Note: Crypto 1:2, Indices 1:20. | Up to 1:30 |

| Dashboard | Modern and intuitive | Clean and functional |

For me, the choice of trading platforms is a big deal. Blueberry Funded wins on variety by offering the industry-standard MT4 and MT5. If you rely on legacy EAs built specifically for MT4, Blueberry is the safer choice.

Funding Pips, however, has significantly levelled up by adding MetaTrader 5 (MT5) alongside Match-Trader and cTrader. This is a massive improvement for traders who prefer the industry standard. While they don’t offer the older MT4, the inclusion of MT5, combined with the advanced features of cTrader, ensures that most modern traders will feel right at home.

When it comes to trading instruments, both firms cover all the major bases. Whether you trade EUR/USD, gold, NAS100, or Bitcoin, you’re set. Blueberry Funded does have the edge by offering stocks, which is a nice bonus for equity traders.

Finally, let’s touch on leverage. This is a major point of contrast. Funding Pips offers up to 1:100, which gives you significant buying power. Blueberry Funded is much more conservative at 1:30 for FX.

Our Take: If you live and breathe MT4/MT5 and prefer a stable, lower-leverage environment, Blueberry Funded is the obvious choice. However, if you crave higher leverage and prefer modern platforms like cTrader, Funding Pips is your best bet. It offers a powerful setup, ideal for day traders who thrive on tight spreads and fast execution.

6. Payout & trust: What are real traders saying?

Rules and platforms are one thing, but the ultimate question is: do they pay out? After all, that’s the whole point, right? Nothing tells the truth better than the experiences of other traders.

To get the real story, we dug through Trustpilot, Reddit, and trading forums. We wanted to see exactly what real traders are saying. Talk is cheap, but a payout receipt is proof.

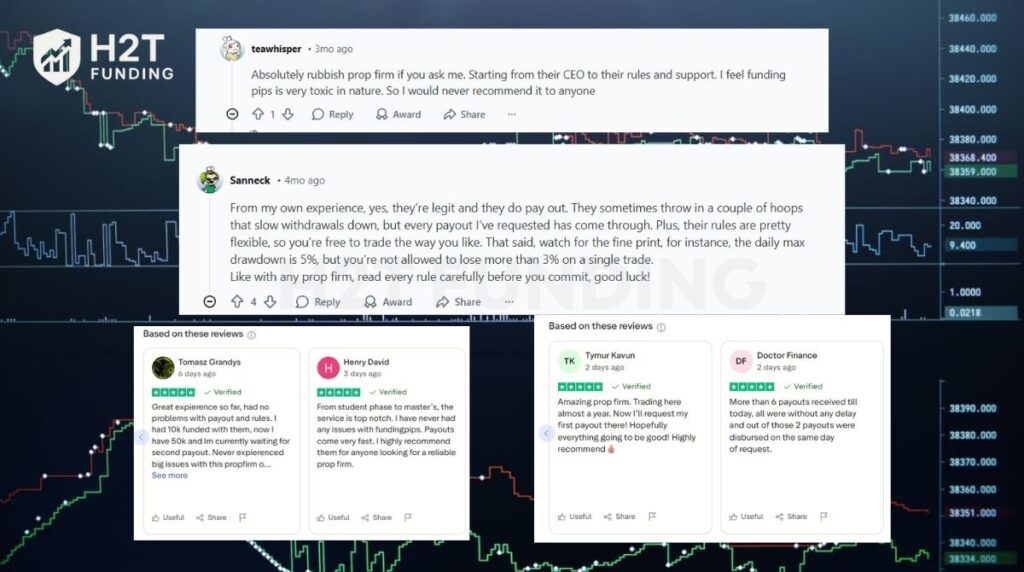

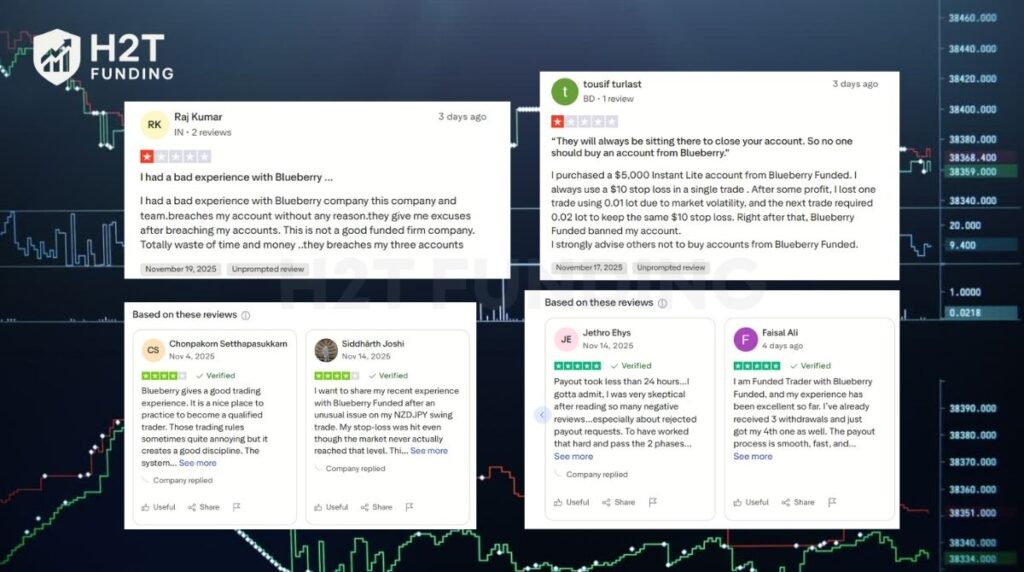

Below are a few snapshots of real conversations. I think they paint a pretty clear picture.

After reading through hundreds of reviews, a clear pattern emerges.

Funding Pips is consistently praised for its fast and reliable payouts. When traders follow the rules, they get their money, often quicker than expected. The main criticisms tend to revolve around their strict policies on certain trading strategies and occasional customer support delays. If you can navigate their rules, the trust level for payouts is very high.

Blueberry Funded, on the other hand, is seen as a highly structured and reliable partner. The positive reviews almost always mention fast withdrawals and a “smooth, fast, and transparent” process. The negative feedback? It nearly always comes from traders who admittedly or unknowingly broke a specific rule, like their anti-martingale policy. This tells me that Blueberry Funded is strict but fair; they lay out the rules, and they stick to them.

In a nutshell, both firms have a strong track record of paying their successful traders. Your experience will largely depend on whether you prefer the speed and flexibility of Funding Pips or the disciplined, rule-based environment of Blueberry Funded.

7. Which firm is easier to pass?

When it comes to passing the evaluation, Funding Pips generally offers the easier path for most traders due to its looser restrictions and higher leverage. However, Blueberry Funded offers a cheat code by allowing you to skip the challenge entirely.

Here is the breakdown of the difficulty factors:

| Difficulty Factor | Funding Pips | Blueberry Funded | Winner |

|---|---|---|---|

| Drawdown Type | Static (Fixed 10%) | Typically Relative / Trailing | Funding Pips |

| Leverage | 1:100 (More buying power) | 1:30 Forex / 1:10 Indices (Requires strict risk management) | Funding Pips |

| Daily Loss Limit | 5% | 4% – 5% | Funding Pips |

| Min Trading Days | 3 Days | 5 Days (Challenge) | Funding Pips |

| Instant Option | Zero Model (Available) | Instant Elite (Available) | Draw |

Why is Funding Pips easier for evaluation?

- Static Drawdown: This is the biggest advantage. Your maximum loss limit does not trail your profits. If you make a profit, your breathing room grows.

- High Leverage (1:100): It is mathematically easier to hit an 8% profit target with 1:100 leverage than with 1:30 leverage. You have more room to manoeuvre.

- Higher Daily Limit: Funding Pips offers a 5% daily loss limit, whereas Blueberry’s Prime challenge is often capped at 4%. That 1% difference can save your account during a bad day.

Why Blueberry Funded is harder (but safer):

- Lower Leverage: With Forex leverage at 1:30 and Indices/Commodities capped at 1:10, you cannot open massive positions to gamble your way to a win. You cannot luck your way to a win with high-risk gambling.

- The Instant Shortcut: While their evaluation is harder, Blueberry Funded allows you to buy an Instant Elite or Instant Lite account. If you want the easiest path, simply choosing the Instant model removes the risk of failing a challenge entirely.

Verdict: If you plan to take a standard 2-step challenge, Funding Pips is statistically easier to pass. If you want to bypass the stress of a challenge, both firms offer excellent Instant Funding models.

8. Who should choose which firm?

Alright, let’s cut to the chase. After this whole Blueberry Funded vs Funding Pips breakdown, which one is actually for you? Honestly, there’s no single best choice; it all boils down to your personality and trading style.

I’ve put together this quick guide to help you figure out where you fit. Think of it as a cheat sheet.

| If You Are a… | Your Best Choice Is… | And Here’s Why… |

|---|---|---|

| Complete Beginner | Blueberry Funded | Their rules are crystal clear, and the structured environment helps build good habits from day one. It’s less overwhelming. |

| Fast-Paced Day Trader / Scalper | Funding Pips | Speed, tight spreads, and high leverage. Their entire model is built for traders who get in and out of the market quickly. |

| Long-Term Swing Trader | Blueberry Funded | The stable trading conditions and clear drawdown rules are perfect for strategies that require holding positions overnight or over the weekend. |

| Aggressive Trader Chasing High Profits | Funding Pips | The potential for a 100% profit split and a massive scaling plan rewards high performance. The short 3-day minimum trading rule lets you fly. |

| Trader Who Values Consistency | Blueberry Funded | The firm’s entire philosophy is built around steady risk management and rewarding consistent performance milestones over explosive gains. |

| EA and Automation User | Funding Pips | They are generally more permissive with a wider range of automated trading strategies (as long as it’s not HFT or arbitrage). |

| Trader Who Hates Ambiguity | Blueberry Funded | What you see is what you get. The rules are strict but transparent, and their customer support is known for being responsive and helpful. |

| Trader on a Budget | Funding Pips | Their entry fees are among the lowest in the industry, and you get instant access to the challenge immediately after paying. |

| Trader Valuing Support | Blueberry Funded | If you want a partner that replies quickly and solves issues fast, their customer service is top-tier compared to the market average. |

Simply put:

- Choose Funding Pips if you value flexibility, speed, and maximizing your profit share. You are confident in your strategy and just want the capital and freedom to execute.

- Choose Blueberry Funded if you value structure, stability, and a clear path to getting funded. You want a reliable partner that rewards discipline over everything else.

9. FAQs

I’d say Blueberry Funded has the edge for beginners. Their rules are stricter, but that discipline is actually a good thing when you’re starting out. Funding Pips is great, but its flexibility might be overwhelming if you haven’t nailed down your risk management yet.

They both offer a fantastic range of account types, from small accounts to large ones, suitable for various capital levels and trading styles. Funding Pips is known for its fast-track, 1-step, and instant funding models. Blueberry Funded has a wider variety of specialized challenges (Rapid, Synthetic, etc.). It really depends on what kind of challenge you’re looking for.

Yes, absolutely. Funding Pips is famous for its on-demand and weekly payouts, which are incredibly fast. Blueberry Funded pays out reliably every 14 days, and traders report receiving their money within 24 hours of a request. You can trust the withdrawal process at both.

To put it simply, the evaluation process at Funding Pips is built for speed, hitting your profit target with no time limit. Blueberry Funded is more methodical, usually requiring a minimum number of trading days to prove consistency.

100%. Based on extensive user reviews, as long as you follow their rules to the letter, they are very consistent with payouts. Most negative feedback comes from rule violations, not a failure to pay.

Blueberry Funded, without a doubt. Their trading rules are stricter, with lower leverage and specific regulations against strategies like martingale, making them the more conservative choice. Funding Pips gives you more room to be aggressive, but their static drawdown still keeps risk in check.

Funding Pips requires a minimum of 3 trading days for its evaluation stages. Similarly, Blueberry Funded typically requires 3 to 5 days, depending on the specific challenge model you choose.

Both offer all the majors: forex trading, commodities (like gold), indices, and cryptocurrencies. Blueberry Funded also offers stocks, which is a nice plus. You’ll have no shortage of markets to trade.

There is no single “best” firm, but rather the best fit for your style. If you prioritize low fees, high leverage (1:100), and speed, Funding Pips is the top choice. If you prefer institutional stability, strict discipline, and broker-backed security, Blueberry Funded is the better option.

Funding Pips is generally preferred for its static drawdown and lower entry prices, which is a huge advantage for managing risk. FundedNext is a larger, older competitor known for its variety of models. However, for pure cost-efficiency and simple rules, Funding Pips currently holds the edge.

For the best value (highest capital for the lowest fee), the standard 2-step evaluation is the best choice at both firms. However, if you want to skip the stress of testing entirely, the Zero Model (Funding Pips) or Instant Elite (Blueberry Funded) are the best options for immediate earning potential.

Yes, absolutely. Being backed by Blueberry Markets (a reputable broker), they have a high trust score for financial reliability. Payouts are processed on a 14-day cycle, and traders confirm that funds are typically sent within 24–48 hours after the request is approved.

10. Conclusion

So, what’s the final verdict in the Funding Pips vs. Blueberry Funded showdown? It’s not about finding a clear winner but about matching a firm to your trading DNA. Choose Funding Pips if you crave speed, high profit splits, and aggressive flexibility. It’s built for confident, fast-paced traders. Opt for Blueberry Funded if you prioritize a structured, stable environment with crystal-clear rules that reward discipline and consistency above all else.

If you’re ready to take the next step with a partner that understands your trading style, explore the funding opportunities at H2T Funding today!