Choosing between the industry benchmark, FTMO, and the modern challenger, FXIFY, is a critical decision. You aren’t just selecting an evaluation; you’re trusting a partner with your trading career, and a wrong move can be frustrating and costly.

This in-depth FTMO vs FXIFY comparison breaks down the details that truly matter. We analyze their evaluation processes, drawdown rules, trading flexibility, and crucially, their payout reliability and overall safety.

After reading this guide, you will be able to confidently determine which firm offers the right challenge and conditions for your specific trading style.

Key takeaways

- FTMO and FXIFY operate as proprietary trading firms that offer forex funding through different evaluation models, rule sets, and payout structures.

- FTMO provides safer long-term stability with strict risk management rules, while FXIFY offers flexible pathways, faster payouts, and lower entry costs.

- FXIFY supports a wider maximum account size and more trading platforms, while FTMO delivers a cleaner experience with a polished analytics dashboard and reliable customer service.

- Both firms allow automated trading with restrictions, use transparent commission structures, and provide essential educational resources and tools for trader development.

- FTMO is ideal for disciplined traders who prefer structured evaluations, stable risk parameters, and a long-proven payout history.

- Funding Pips’s style firms are suitable for traders who want modern features, flexible challenges, trading competitions, and more freedom to adapt their strategies.

1. Overview and quick comparison: FTMO vs FXIFY

To see which firm is the safer choice, let’s start with a high-level overview. This table directly compares the core features of FTMO and FXIFY, cutting through the marketing noise to show you the facts.

Pay close attention to the differences in funding models, maximum loss limits, and platform options. These are often the key factors that determine a trader’s success with a prop firm.

| Aspect | FTMO | FXIFY |

|---|---|---|

| CEO | Otakar Suffner | David Bhidey, Peter Brown, and Bobby Winters (all of them are co-founders) |

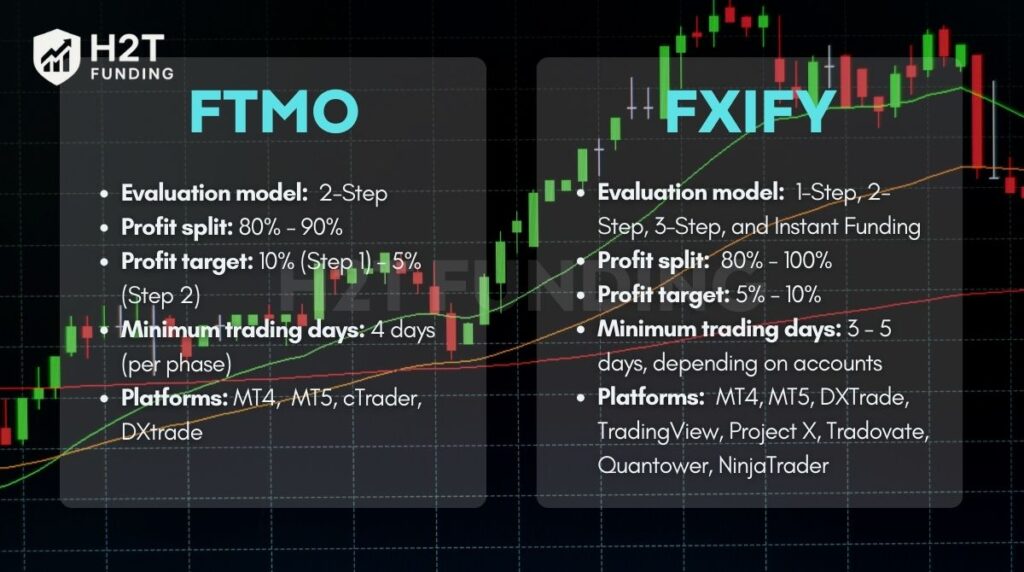

| Funding Models | 2-step | 1-step, 2-step, 3-step, and instant funding |

| Account Size | $10K – $200K | $5K – $400K |

| Profit Split | 80% – 90% | 80% – 100% |

| Profit Target | 10% (Step 1) 5% (Step 2) | 5% – 10% |

| Payout Frequency | Bi-weekly (every 14 days) | Bi-weekly (every 14 days) or 30 Days |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 4 days | 3 – 5 days, depending on accounts |

| Daily Loss Limit | 5% | 3% – 8% |

| Maximum Loss Limit | 10% | 4% – 10% |

| Instruments | Forex, Metals, Commodities, Indices, Stocks, Crypto, and Energies | Forex, Crypto, Indices, Commodities, Stocks, and Futures |

| Platforms | MT4, MT5, cTrader, DXtrade | MT4, MT5, DXTrade, TradingView, Project X, Tradovate, Quantower, NinjaTrader |

| News/Weekend Trading | Weekend holding restricted (standard); News restricted on funded accounts (Allowed on swing account) | Allowed holding over the weekend and news trading, but depends on the account plan |

| Starting Fees | €155 (~$178) | $39 |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FTMO vs FXIFY websites before purchasing any challenge.

While this table provides a quick overview, the real story is in the details. A firm’s reputation and suitability for you depend on how its specific model works in practice. Let’s break down each firm individually to see its strengths and weaknesses before we dive into a direct feature-by-feature comparison.

FTMO

#1

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO operates as the gold standard in the prop firm industry for a reason. Their entire model, from the 2-step challenge to the scaling plan, is built around fostering professional, consistent, and risk-averse trading habits. It’s less about finding traders who can get lucky and more about identifying individuals who can manage capital responsibly over the long term.

The platform feels incredibly polished and secure. Tools like the Performance Coaches and the ability to take a Free Trial show a genuine commitment to trader success beyond just collecting fees. For any serious trader who values reputation and a proven, structured path above all else, FTMO presents an incredibly compelling and safe choice.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

FXIFY

#2

Account Types

1-step, 2-step, 3-step, and Instant Funding

Trading Platforms

MT4, MT5, DXTrade, TradingView

Profit Target

5% – 10%

Our take on FXIFY

FXIFY feels like a direct response to the modern trader’s needs: flexibility, speed, and choice. Their entire platform is built around providing options, from 1-step challenges and instant funding to a massive array of trading platforms. This approach removes many of the rigid barriers that can frustrate traders at more traditional firms.

The On-Demand Payouts and aggressive scaling plan are powerful incentives that show confidence in their model. While they are a newer player, their strong Trustpilot score and clear, detailed rulebook provide a strong sense of safety and transparency. For the trader who wants to tailor their funding experience and get rewarded quickly, FXIFY is a top-tier and secure contender.

| 💳 Challenge Fee | $39 – $4,249 |

| 👥 Account Types | 1-step, 2-step, 3-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $1K – $400K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradingView |

| 🛍️ Asset Types | Forex, Metals, Equities, Crypto, Commodities, Stocks, Indies |

Ultimately, the choice between these two elite firms is a reflection of your own trading philosophy.

FTMO represents the pinnacle of reliability and structured professionalism, offering a proven path for traders who value security in a time-tested reputation. In contrast, FXIFY champions flexibility and modern convenience, providing a tailored experience for traders who need choice and adaptability.

The safer choice, therefore, isn’t about the firm itself but about which environment you are more likely to thrive in. Consider whether you value a veteran’s proven security over a modern challenger’s dynamic adaptability. Your honest answer will point you to the right partner for your trading career.

You can also read this in-depth comparison between FTMO and 5ers to gain a broader perspective before making your final decision.

Read more:

2. A deep dive comparison: Key factors for FTMO vs FXIFY

Now, we will dissect the critical rules that directly impact your trading performance and account security, from the structure of the challenge to the fine print of the drawdown rules. Let’s begin with the very first step: the evaluation process itself.

2.1. Evaluation process

Your path to a funded account begins here, and the two firms offer vastly different journeys. FTMO challenge rules provide a single, structured two-step path that has become the industry standard. FXIFY, on the other hand, prioritizes choice, offering multiple models to fit different trading styles.

| Feature | FTMO | FXIFY |

|---|---|---|

| Model Structure | Strict 2-Step Process (Challenge & Verification) | Highly Flexible: 1-Step, 2-Step, 3-Step, and Instant Funding models |

| Profit Target | 10% in Step 1, 5% in Step 2 | Varies by model (e.g., 10% for 1-step, 5-10% for 2-step) |

| Minimum Trading Days | 4 days per step (8 total minimum) | Varies (typically 3-5 days depending on the program) |

| Time Limit | Unlimited | Unlimited |

| Special Options | Offers a Free Trial to practice the challenge conditions | Instant Funding option available to bypass the evaluation process entirely |

FTMOs’ approach feels safer for methodical traders who value a proven, predictable structure. For me, the ability to test their exact conditions with a free trial is a huge confidence booster before committing real money.

Conversely, FXIFY offers safety through flexibility. If you’re a consistently profitable trader, a 1-step evaluation presents fewer hurdles and a faster path to funding, reducing the time your capital is tied up in the testing phase.

2.2. Trading rules and restrictions

A firm’s rules can either empower your strategy or constantly work against it. This is where safety is truly tested. FTMO is known for its clear but strict guidelines, while FXIFY offers more freedom, particularly around news and weekend trading, depending on your chosen account.

| Rule / Restriction | FTMO | FXIFY |

|---|---|---|

| News Trading | Restricted on standard funded accounts (2 mins before/after). A Swing account is required for full freedom. | Varies by plan: Allowed on standard evaluations. Restricted to Instant Funding & Lightning accounts. |

| Weekend Holding | Not allowed on standard funded accounts. Requires a Swing account. | Varies by plan: Allowed on standard evaluations. Prohibited on Instant Funding accounts. |

| EAs / Automation | Prohibited for third-party EAs. You can only use your own EAs and cannot copy other traders. | Varies by plan: Prohibited on Instant Funding & Lightning. Allowed on other evaluations. |

| Copy Trading | Allowed only from your own accounts. Copying other traders is strictly forbidden. | Varies by plan: Prohibited on Instant Funding & Lightning. Allowed on others (with conditions). |

| Consistency Rule | A guiding principle, not a hard-coded rule. They monitor for inconsistent position sizing to prevent gambling. | A hard-coded mathematical rule. Examples: 25% for 2-Step Classic (Funded), 30% for Lightning. |

| Key Prohibited Strategies | Focuses on broad Forbidden Trading Practices like exploiting price feeds and behavior not replicable in live markets. | Very specific list, including: HFT, Reverse/Group Hedging, Account Management, and Statistical Arbitrage. |

FTMO’s rules create a predictable and professional trading environment. For me, their principle-based consistency rule feels safer, as it focuses on overall behavior rather than a strict mathematical limit. The main takeaway is clear: if you need to trade news or hold over weekends on a funded account, you must choose the Swing account from the start.

If your main goal is to pass the FTMO Challenge, understanding the evaluation structure and common mistakes in advance can make a significant difference in your pass rate.

FXIFY, on the other hand, makes you responsible for choosing the right ruleset. Their standard evaluation accounts offer immense freedom, but their Instant Funding and Lightning plans are highly restrictive, even banning EAs and weekend holding. Their safety lies in the detailed transparency of their prohibited strategies, leaving no room for interpretation. You must study their plans carefully.

2.3. Trading conditions: Supported platforms, instruments, and leverage

A firm is only as good as its technology. Your trading conditions, the platforms, assets, and leverage directly impact your performance and safety. Here, FTMO offers a streamlined, proven setup, while FXIFY focuses on providing an extensive and highly specialized range of choices.

| Feature | FTMO | FXIFY |

|---|---|---|

| Platforms | MT4, MT5, and DXtrade. (A solid, industry-standard offering). | MT4, MT5, DXtrade, TradingView, plus a specialized suite for futures: NinjaTrader, Tradovate, ProjectX, Quantower. |

| Tradable Instruments | Forex, Indices, Metals, Energy, Crypto, Stocks. | Forex, Indices, Metals, Commodities, Crypto, Stocks, and dedicated Futures markets. |

| Leverage Model | Standardized based on the 2-step challenge model. | Variable by account type (Instant, 1-Step, etc.) and customizable at checkout. |

| Max Forex Leverage | 1:100 on the standard challenge. | Up to 1:50 (customizable). Standard plans are often 1:30. |

| Max Indices Leverage | 1:50 on the standard challenge. | Up to 1:15, depending on the account type. |

| Stocks Leverage | 1:3 | 1:2 |

For traders like me who value a plug-and-play experience, FTMO feels incredibly safe and straightforward. Their conditions are standardized, the 1:100 leverage on forex is generous, and the platforms are industry-proven. You know exactly what you are getting without navigating complex options.

FXIFY offers safety through specialization. Their platform variety is simply unmatched, making them the clear winner for futures traders or those who live on TradingView. While their default leverage is lower, the ability to customize it is a powerful feature. This is the safer choice for traders who need specific tools that FTMO doesn’t offer.

2.4. Profit split and scaling plan

This is where your long-term profitability is decided. A safe firm not only pays reliably but also offers a clear path to grow your capital. FTMO offers a performance-based path to a higher split, while FXIFY allows you to secure a top-tier split from day one for a fee.

| Feature | FTMO | FXIFY |

|---|---|---|

| Default Profit Split | 80% | 80% |

| Upgraded Split | 90%, achieved after successfully scaling the account. | Up to 100% for futures; 90% available as a paid add-on during checkout for other accounts. |

| Scaling Eligibility | Requires 10% net profit over a 4-month cycle (with at least 2 payouts). | Requires 10% profit over a 3-month cycle (with 2 profitable months). |

| Scaling Bonus | 25% capital increase per successful cycle. | Capital doubles with each successful scaling cycle. |

| Plans w/o Scaling | All standard plans are eligible for scaling. | No scaling available for Instant Funding or Lightning Challenge accounts. |

From a safety perspective, FTMOs model rewards consistency over time. Their scaling plan is a slow, steady climb, which feels secure and encourages sustainable trading habits. Earning the 90% split is a milestone that reflects proven, long-term performance.

For traders planning long-term growth, it’s also important to know how many FTMO accounts you can manage simultaneously within the firm’s scaling and risk framework.

FXIFY’s approach offers a faster, more aggressive growth path. The ability to double your maximum account size is a massive advantage for traders who can meet the criteria. However, you must remember that their most restrictive plans (Instant/ Lightning) offer no scaling at all, making them less suitable for long-term career growth.

2.5. Challenge fees and pricing structure

Your financial commitment is the first real trade you make with a prop firm. A safe pricing model is transparent, reasonable, and refundable. FTMO has a clear, standardized pricing list, while FXIFY offers a wider range of price points, including some of the most affordable entry options on the market.

| Feature | FTMO | FXIFY |

|---|---|---|

| Pricing Model | One-time fee for the 2-step challenge, tiered by account size. | Varies significantly by model (1-Step, 2-Step, Instant Funding, etc.). |

| $100k Account Fee | €540 for the standard 2-step challenge. | $299 for the Lightning 1-step plan. Other plans have different fees. |

| Lowest Entry Fee | €155 (approx. $165) for a $10k account. | As low as $39 for some smaller account challenges. |

| Fee Refund Policy | Yes, 100% refundable with the first profit split after passing the evaluation. | Yes, 100% refundable on all evaluation programs (not applicable to Instant Funding). |

From my perspective, FTMO offers the safety of simplicity. Their pricing is straightforward; you pay one fee for a specific account size, and you know it’s coming back if you pass. It’s a premium, all-inclusive investment in their ecosystem.

FXIFY is the safer choice for traders wanting to minimize initial risk or explore futures. The ability to start a CFD challenge for as little as $39 is a massive advantage. Their monthly fee model for futures also provides a different, potentially more manageable, cost structure compared to a large one-time payment.

3. Payout process and reliability

Getting paid is the ultimate goal, but a confusing withdrawal process is where many traders get caught off guard. FTMO provides a rock-solid, predictable reward system, while FXIFY offers enticing on-demand payouts but includes a critical drawdown rule that you must understand to stay safe.

| Feature | FTMO | FXIFY |

|---|---|---|

| Profit Split | 80% standard; 90% via scaling. | 80% standard; 90% via add-on; 100% on specific monthly plans. |

| 1st Payout | After 14 days of trading. | On Demand for most plans; 7 days for Lightning. |

| Frequency | Bi-weekly (every 14 days). | On Demand (1st), then every 14 or 30 days (depends on add-ons). |

| Processing Time | 1-2 business days. | Within 3 business days. |

| Min. Withdrawal | $20 (Bank), $50 (Crypto). | $50 for all account types. |

| Drawdown Rule | Static (Standard) or Trailing (Swing). | Drawdown Locks at the starting balance upon withdrawal request. |

The FTMO process is incredibly smooth and professional. In my experience, the on-request system after the initial 14 days is very reliable, with funds typically arriving within 48 hours. They don’t charge extra commissions on payouts, making it a very clean and safe experience for long-term earners.

FXIFY wins on speed with its Payout on Demand feature, which is a massive psychological boost for new traders. However, there is a major safety warning: on trailing drawdown accounts, FXIFY locks your maximum drawdown at the starting balance the moment you withdraw.

This means if you withdraw your entire profit, your current balance will equal your maximum drawdown limit. One single losing trade after that will immediately fail your account. To stay safe at FXIFY, you must always leave a buffer of profit in the account to avoid an instant breach after a payout.

4. Customer support and educational resources

When you have an issue, fast and effective support is a safety net you can’t trade without. Both firms provide solid support, but they invest their resources differently. FTMO offers a comprehensive suite of professional tools and true 24/7 support, while FXIFY focuses on foundational education with a unique incentive.

| Feature | FTMO | FXIFY |

|---|---|---|

| Support Channels | True 24/7 Support via Live Chat, WhatsApp, and Email. Phone support is available during business hours. | Email (Mon-Fri, 9 am-4 pm EST), 24-hour Live Chat (Mon-Fri), detailed FAQs. |

| Language Support | Extensive support available in 20 languages. | Primarily English-based support. |

| Educational Offering | FTMO Academy: A structured course for clients, plus unique performance analysis tools. | Free Trading Course: A 5-module course covering basics to strategy, open to everyone. |

| Key Tools | Performance Coaches, Account MetriX, Statistical App, Trading Journal, Equity Simulator. | Offers an incentive: complete the free course to unlock a $1k Instant Funding account for only $10. |

From a global trader’s perspective, FTMO’s support system is unequivocally safer and more accessible. Their true 24/7 availability across multiple channels and support in 20 languages is unmatched. Their advanced tools, like Performance Coaches, are designed to refine the skills of serious traders, making it a professional’s choice.

FXIFY provides a safer entry point for newcomers. Their free course is one of the better educational resources available, and the incentive to get a cheap funded account is a brilliant way to lower the barrier to entry. While their support is more limited in hours and languages, their educational focus is a clear strength for beginners.

5. Community feedback: FTMO vs FXIFY on Reddit and Trustpilot

A prop firm’s marketing promises mean nothing without real trader verification. By looking at honest feedback on platforms like Trustpilot and Reddit, we can see a clear picture of each firm’s reputation and where they excel from a user’s perspective.

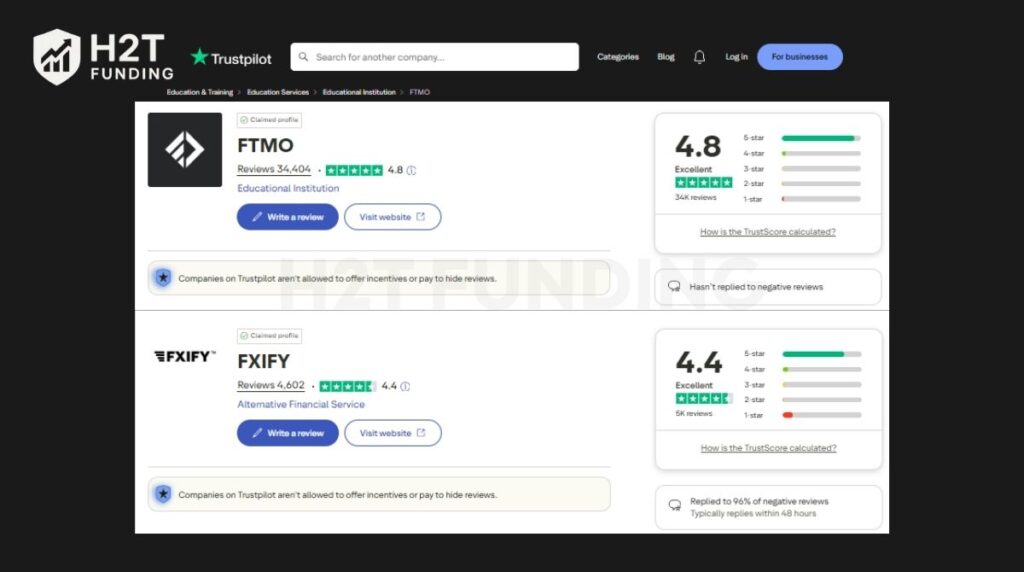

The numbers on Trustpilot tell a compelling story of reliability. FTMO boasts a stellar 4.8-star rating from over 34,000 reviews, confirming their status as a trusted industry leader. FXIFY holds a strong 4.4-star rating from over 4,600 reviews and stands out by actively responding to 96% of negative feedback, showing a commitment to customer satisfaction.

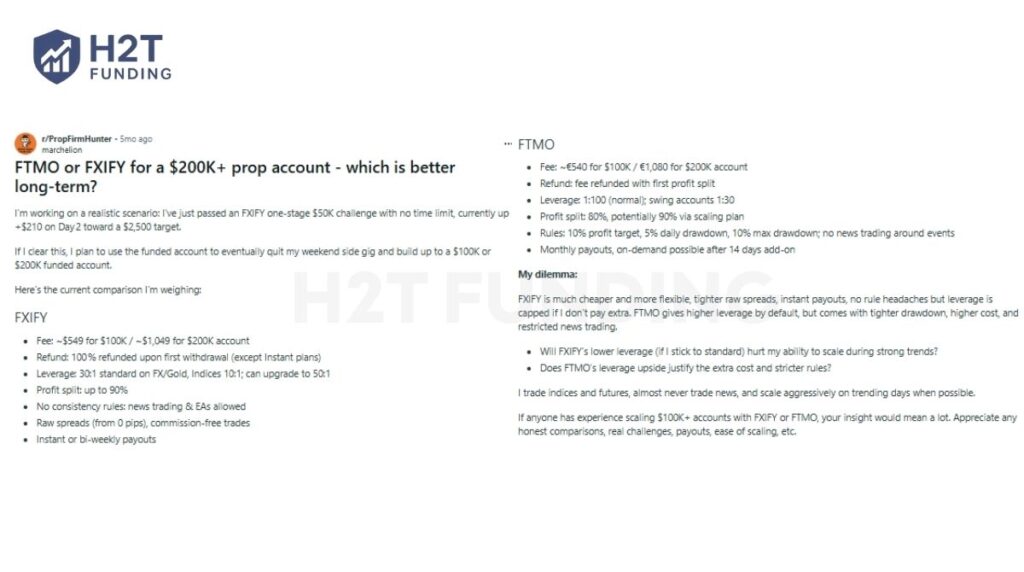

This Reddit post perfectly captures the core dilemma many traders face. The user highlights FXIFY’s cheaper fees, flexible rules (news trading, no consistency rule), and instant payouts. In contrast, they note FTMO’s higher default leverage but also its stricter rules, higher cost, and more rigid payout schedule.

In-depth reviews on Reddit often praise FXIFY for its affordable challenge fees and modern perks like withdrawal on demand. However, as this user points out, its newness in the market can be a concern for some, and customer support can sometimes be slow. The final verdict is often positive, but with a note of caution about its short history.

When traders review FTMO, the themes are remarkably consistent: payout proof and brand trustworthiness are rated a perfect 10/10. Users repeatedly confirm that FTMO pays out reliably and professionally. While they may score lower on challenge difficulty due to stricter rules, their reputation for safety and reliability is second to none.

In short, community feedback confirms that both firms are highly legitimate. FTMO is the undisputed veteran, seen as the gold standard for payout safety. FXIFY is the trusted newcomer, winning traders over with flexibility and a modern, feature-rich approach.

6. Is FTMO or FXIFY more legit and safer for traders?

After analyzing all the data, the answer is clear: both firms are highly legitimate and safe, but they offer different kinds of safety. The safer choice depends entirely on what you, as a trader, fear most.

If your biggest fear is unreliability and not getting paid, then FTMO is arguably the safer choice. Their decade-long track record, massive volume of positive reviews, and flawless payout reputation provide an unparalleled sense of security. They are the industry’s blue-chip standard for a reason.

If your biggest fear is failing due to restrictive rules or high initial costs, then FXIFY is the safer choice. Their flexibility in evaluation models, lower entry fees, and more lenient rules on news trading give you more room to breathe. Their detailed rulebook also removes ambiguity, which in itself is a form of safety.

Ultimately, I see it this way: FTMO offers safety through proven reputation, while FXIFY offers safety through flexibility and clarity. Neither is a risky bet; the right choice is the one whose safety net best matches your trading style and psychological needs.

7. Which prop firm is best for you?

The best prop firm is the one that aligns perfectly with your trading style, experience level, and personal goals. Let’s break down which type of trader is best suited for each firm.

You should choose FTMO if:

- You are a disciplined and consistent trader who values a proven, structured environment and can thrive under clear, professional rules.

- Reputation and payout security are your absolute top priorities, and you are willing to pay a premium for that peace of mind.

- Your strategy does not depend on news trading or holding trades over the weekend on your funded account (or you are willing to use their Swing account).

You should choose FXIFY if:

- You are a swing trader or news trader who needs the flexibility to hold positions over the weekend and during high-impact events.

- You are a trader on a budget who wants to minimize initial risk with lower entry fees.

- You are a specialized trader who needs access to a wider range of platforms like TradingView or specific futures markets.

For me, the choice comes down to this: I would choose FTMO for its rock-solid reputation and generous leverage for long-term account growth. However, if my strategy heavily involved news or I wanted the fastest possible path to a first payout, I would confidently choose FXIFY.

8. Mistakes traders make when choosing prop firms

Traders often fail not because of their strategy, but because they choose a prop firm with rules that conflict with their trading style. Choosing the wrong partner can lead to account termination even when you are in profit. To succeed, you must look beyond the marketing profit splits and analyze the hidden operational constraints.

8.1. Choosing based on price instead of rules

A low entry fee may look attractive, but it can hide restrictive conditions that hurt long-term performance.

Some traders choose the cheapest challenge available without reviewing:

- Drawdown mechanics

- Trading restrictions

- Scaling limitations

For example, FXIFY offers very cheap entry plans, but some of them restrict scaling and EAs. FTMO costs more upfront, but fees are refundable, and all standard accounts support long-term growth. A lower price does not always mean lower risk. Always evaluate rules first, cost second.

8.2. Ignoring drawdown rules and payout mechanics

Many traders assume drawdown only applies during evaluations, which is incorrect.

Typical mistakes include:

- Not knowing whether the drawdown is static or trailing

- Withdrawing profits without leaving a buffer

- Ignoring how drawdown behaves after payouts

Fully understand how maximum loss is calculated at all times, including after withdrawals. Maintain a safety margin to protect your account from normal losing trades.

8.3. Picking a firm that conflicts with your trading strategy

Not all prop firms support every trading style equally.

Traders often fail because they select firms that restrict:

- News trading

- Weekend holding

- Automated strategies

Before choosing a firm, you first ask yourself these questions:

- Do you trade during the news?

- Do you hold positions overnight or on weekends?

- Do you use automated systems?

Then select a prop firm whose rules align with those behaviors.

8.4. Ignoring long-term scaling and account growth

Many traders focus only on passing the challenge and forget about capital growth afterward. This often leads to choosing plans that:

- Have no scaling options

- Cap maximum account size

- Prioritize fast payouts over sustainability

Evaluate scaling rules before starting. A sustainable prop firm should reward consistent profitability with increasing capital over time.

8.5. Overlooking firm reputation and payout reliability

A prop firm’s reliability directly impacts your trading income.

Common oversights:

- Not checking how long the firm has operated

- Ignoring community feedback

- Assuming all firms pay equally

Research trader reviews, payout proof, and the firm’s operational history. Reputation is a key part of risk management.

8.6. Skipping the prohibited trading practices section

Many traders read only the headline rules and miss critical restrictions. Read the full list of prohibited strategies carefully. Make sure your trading behavior is compatible before starting a challenge.

Traders who succeed long-term focus on rules, risk management, and compatibility, not speed or marketing claims. Choosing the right prop firm and avoiding these mistakes dramatically improves both pass rates and long-term performance.

9. FAQs

The main difference is their core philosophy. FTMO offers a standardized, highly reputable 2-step challenge focused on professional consistency. FXIFY prioritizes flexibility, offering multiple evaluation types (1-step, instant), more trading rule freedom, and a wider range of platforms.

Easier depends on your trading style. FXIFY’s 1-step evaluation can be faster and has fewer hurdles, which some traders find easier. However, FTMO’s clear, consistent rules and lack of a hard-coded consistency rule might be easier for methodical traders to navigate.

Yes, both firms are considered highly reliable and legitimate. FTMO has a longer, proven track record and a massive volume of positive reviews, making it the industry benchmark for trust. FXIFY is a newer but well-regarded firm with a strong Trustpilot rating and a reputation for paying its traders.

FXIFY is often considered better for beginners. Their lower entry fees reduce risk, the free course helps beginners get started, and the flexible rules support traders still refining their strategy.

FTMO processes payouts within 1-2 business days after a 14-day cycle. FXIFY can process the first payout on demand and subsequent ones bi-weekly, typically within 3 business days.

Yes, but at FTMO, you need a specific Swing account to trade news on a funded account, and third-party EAs are prohibited. At FXIFY, news trading and EAs are allowed on most evaluation plans, but are restricted on their Instant Funding and Lightning programs.

They are very competitive. Both start at an 80% profit split. FTMO scales to 90% based on performance. FXIFY allows you to purchase a 90% split from the start and offers up to 100% on some specific monthly plans.

No, neither firm is known for hidden fees. You pay a one-time, refundable challenge fee (FTMO, FXIFY evaluations) or a clear upfront/monthly fee (FXIFY Instant/Futures). The costs are transparent.

This depends on your strategy. FTMO’s higher default leverage (1:100) can lead to larger position sizes. However, FXIFY’s aggressive scaling plan (doubling account size) and higher top-end profit splits (up to 100%) offer a faster path to very large accounts for successful traders.

FXIFY is generally more beginner-friendly due to its lower starting costs, free educational course, and more flexible 1-step evaluation option, which lowers the barrier to entry.

Yes, but with significant restrictions. Both firms ban strategies like HFT and latency arbitrage. FTMO prohibits common third-party EAs to prevent herd trading. FXIFY prohibits EAs entirely on its Instant Funding and Lightning plans, so you must choose a standard evaluation if you use automation.

10. Conclusion

In the end, the FTMO vs FXIFY debate doesn’t have a single winner, only a choice that is right for you. Both prop firms have proven to be legitimate, reliable partners that pay their traders and offer incredible opportunities. The question is not which one is better, but which one is better for your specific needs.

FTMO remains the undisputed king of reputation, offering a secure, professional, and predictable path for disciplined traders. FXIFY is the powerful and flexible challenger, providing more options, lower entry costs, and modern features for traders who need a less restrictive environment.

Making the right choice is the first step in your funding journey. To continue your research, explore more in-depth comparisons from H2T Funding, where we break down how these firms stack up against other industry leaders.