You’re stuck trying to decide between two of the industry’s leading prop trading firms: the giant FTMO and the flexible newcomer Funding Pips? The fear of choosing the wrong prop firm, one whose hidden rules clash with your strategy, is a real concern for many traders. This single choice can impact your challenge fee and, more importantly, your confidence.

This definitive FTMO vs Funding Pips comparison cuts through the marketing noise. H2T Funding’ll dissect the critical differences in their evaluation models, trading rules, and payout structures that aren’t immediately obvious.

After reading this guide, you will have the clarity needed to see which firm truly aligns with your personal trading style. This will empower you to make a confident decision and invest in the challenge that gives you the best chance of success.

Key takeaways

- FTMO represents a structured, discipline-driven prop trading firm with strict risk rules, while Funding Pips focuses on flexibility in its challenge model and trading conditions.

- Both FTMO and Funding Pips are legitimate firms with strong Trustpilot ratings, but each has unique rules, risks, and ideal trader profiles that must align with personal trading strategies.

- Traders who prefer FTMO typically value rule clarity, deeper risk management, and a proven model for steady capital growth.

- Traders who choose Funding Pips usually prioritize flexible trading rules, faster funding opportunities, and low-cost entry to funded accounts.

- FTMO is harder to pass due to its fixed risk limits and highly structured evaluation, while Funding Pips is easier thanks to flexible challenge models, lower entry fees, and faster access to funded accounts.

1. FTMO vs Funding Pips: Overview and quick comparison table

FTMO and Funding Pips are both well-known prop trading firms, but they are built on very different philosophies. Before comparing rules and numbers, it’s important to understand what each firm stands for and the type of trader it is designed to support.

1.1. FTMO

FTMO is one of the most established and trusted prop firms in the industry. It is best known for its strict rules, professional structure, and strong focus on risk management.

The firm uses a two-step evaluation model that tests both profitability and consistency, making it more demanding than many competitors. This disciplined approach is a key reason why FTMO has built long-term trust with serious traders.

Successful traders can manage large account sizes and benefit from a clear scaling plan designed for steady, long-term capital growth.

1.2. Funding Pips

Funding Pips is a newer prop firm that emphasizes flexibility and faster access to funded accounts. It offers multiple evaluation models, including 1-step and direct funding options.

Unlike FTMO, it removes the consistency rule during standard evaluations and allows more freedom with news and weekend trading. This makes it appealing to traders with dynamic or aggressive strategies.

Lower challenge fees and customizable payout cycles position Funding Pips as an accessible option for traders who want speed and fewer entry barriers.

The quick comparison table below highlights the key differences between FTMO and Funding Pips at a glance, setting the foundation for a deeper side-by-side analysis.

| Aspect | FTMO | Funding Pips |

|---|---|---|

| CEO | Otakar Suffner | Khaled Ayesh |

| Funding Models | 2-step | 1-step, 2-step, and Master account (direct funding) |

| Account Size | $10K – $200K | $5K – $100K |

| Profit Split | 80% – 90% | 60% – 100% |

| Profit Target | 10% (Step 1) 5% (Step 2) | Flexible options: Tuesday payday, bi-weekly, monthly, and on-demand |

| Payout Frequency | Bi-weekly (every 14 days) | Flexible options: Tuesday payday, bi-weekly, monthly, and on-demand |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 4 days | 1-7 days, varies depending on the different plans |

| Daily Loss Limit | 5% | 3% – 5% |

| Maximum Loss Limit | 10% | 5% – 10% |

| Instruments | Forex, Metals, Commodities, Indices, Stocks, Crypto, and Energies | Forex, Crypto, Indices, Metals & Energies |

| Platforms | MT4, MT5, cTrader, DXtrade | MT5, Match Trader, and cTrader |

| News/Weekend Trading | Weekend holding restricted (standard); News restricted on funded accounts | Master On-Demand: News allowed Evaluation and master other cycles: Weekend/news holding allowed |

| Starting Fees | €155 (~$178) | $29 |

Note: Data is subject to change based on current promotions and updates from the firms.

While the table offers a great summary, the numbers don’t tell the whole story. The real deciding factors are hidden in the details of their rules and processes. Let’s now move on to a deep-dive review of each prop firm to see how they impact your actual trading experience.

FTMO

#1

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO presents itself as the industry’s gold standard, and its entire operation reflects this. It’s not designed to be the easiest or cheapest path to funding. Instead, its focus is on identifying genuinely consistent traders through a demanding, but fair and transparent, evaluation process.

The firm’s demanding structure, especially the consistency rule, acts as a powerful filter. This isn’t necessarily a negative; it’s a tool that fosters immense discipline. For traders who thrive within a clear framework and value a long-term professional partnership, FTMO provides an unparalleled environment for growth.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Funding Pips

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

Funding Pips has strategically positioned itself as the flexible alternative to the industry’s more rigid players. Its core appeal is the freedom it offers during the evaluation stage, notably the absence of a consistency rule on its standard models.

However, this initial flexibility transitions into a more nuanced environment on a funded account. The firm introduces unique behavioral and consistency rules at the payout and scaling stages. This shows a clever business model: an easy entry to attract talent, followed by a structured system to ensure long-term, responsible trading.

It’s an ideal choice for traders who are confident in their strategy but have struggled with restrictive evaluation rules in the past. It offers a faster, more accessible door into the world of funded trading.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

Ultimately, the choice between these two firms hinges on what a trader values most at the start of their journey. FTMO offers a path defined by upfront discipline and established prestige, making it the choice for those who want a proven, steady career track.

Funding Pips, in contrast, provides a path of initial flexibility and accessibility, ideal for skilled traders who want to get funded quickly before adapting to rules on the live account.

Read more:

2. A deep dive comparison: Key factors for traders

The overview table gives us the what, but a trader’s success is determined by the how. How each firm structures its evaluation, manages risk, and provides its tools directly impacts your daily trading reality.

Let’s break down these critical factors one by one to see which firm truly supports your path to funding.

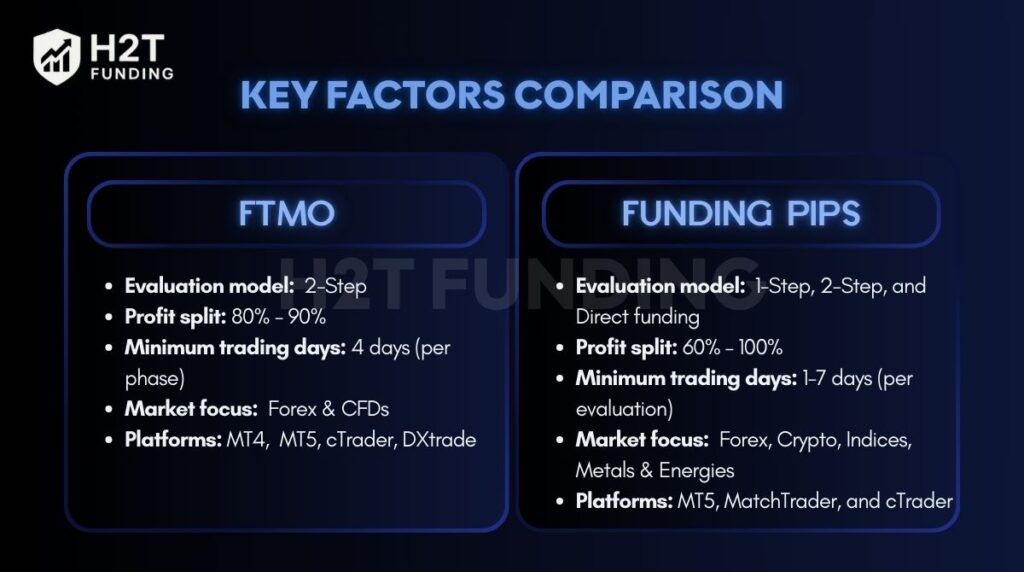

2.1. Evaluation process and funding models

The path to a funded account is the first major difference you’ll encounter. FTMO offers a single, well-defined 2-step evaluation that has become the industry benchmark for testing trader consistency. Conversely, Funding Pips provides multiple evaluation paths, including 1-step, 2-step, and even direct funding models, aiming to fit various trading styles and preferences.

| Feature | FTMO (Standard 2-Step) | Funding Pips (Varies by Model) |

|---|---|---|

| Funding Models | 2-Step Challenge & Verification | 1-Step, 2-Step, and Master (Direct) |

| Profit Target | 10% (Step 1), 5% (Step 2) | 5% – 10% (depending on the model) |

| Minimum Trading Days | 4 days per step | 1 – 7 days (depending on the model) |

| Time Limit | No time limits | No time limits |

From a trader’s perspective, FTMO’s single path is straightforward; you know exactly what to train for. It’s a standardized test of skill and discipline. This approach removes the guesswork entirely.

On the other hand, Funding Pips offers true customization. A confident trader might opt for the 1-step challenge, a faster path that resembles instant funding, while another might prefer the Master account’s unique rules. This flexibility is powerful but requires you to honestly assess your own trading style before choosing a path.

2.2. Supported trading platforms

Your trading platform is your command center, so compatibility is non-negotiable. Both firms provide access to the industry’s most respected software. However, a few key differences in their lineup could be a deciding factor for your specific strategy.

| Feature | FTMO | Funding Pips |

|---|---|---|

| Available Platforms | MetaTrader 4, MetaTrader 5, cTrader, DXtrade | MetaTrader 5, cTrader, Match-Trader |

For me, FTMO’s inclusion of MT4 is a significant advantage. Many experienced traders rely on custom EAs or indicators built exclusively for this classic platform. While both firms cover the modern essentials with MT5 and cTrader, FTMO’s broader selection provides a critical safety net for traders with legacy tools.

Funding Pips offers a clean, modern suite that will satisfy the vast majority of traders. If you don’t have a specific attachment to MT4, their platform offerings are excellent and more than sufficient for professional trading.

2.3. Tradable assets and leverage

The range of assets and the leverage offered can either empower or restrict your trading strategy. While both firms cover popular markets, the leverage you get can change dramatically depending on the funding model you choose, especially with Funding Pips.

| Asset Class | FTMO (2-Step) | Funding Pips (1-Step) | Funding Pips (2-Step) | Funding Pips (Master/Instant) |

|---|---|---|---|---|

| FX | 1:100 | 1:30 | 1:100 | 1:50 |

| Metals | 1:30 | 1:10 | 1:30 | 1:20 |

| Indices | 1:50 | 1:5 | 1:20 | 1:20 |

| Energy | 1:30 | 1:10 | 1:10 | 1:10 |

| Crypto | 1:3 | 1:1 | 1:2 | 1:2 |

| Stocks | 1:3 | Not Offered | Not Offered | Not Offered |

Note: Funding Pips leverage is model-specific and may vary by trading platform and server. During promotions, leverage conditions can be adjusted temporarily. Traders should always verify leverage directly in the dashboard before starting.

FTMO also offers a Swing account, which allows holding trades through news and weekends but uses lower leverage (typically capped at 1:30) compared to the standard FTMO account.

This detailed view reveals critical differences. For traders who focus on single-stock CFDs, FTMO is the only option between the two. Furthermore, its 1:50 leverage on indices is a standout feature, offering much better capital efficiency than any of Funding Pips’ models.

With Funding Pips, you must be extremely careful about which model you select. Notice the drastically lower leverage on their 1-step challenge (e.g., 1:5 on indices). This is a crucial detail that could invalidate many strategies. While their 2-step model is competitive for forex, FTMO provides more consistent and often more generous leverage across the board.

2.4. Risk management

A prop firm’s risk rules are the real test of a trader’s discipline. FTMO enforces this through strict, non-negotiable drawdown limits, including fixed daily and total loss caps that clearly define trading boundaries. Funding Pips also applies firm drawdown rules, but introduces more variation depending on the account model and funding stage.

| Feature | FTMO | Funding Pips |

|---|---|---|

| Maximum Daily Loss | 5% (fixed) | 3% – 5% (varies by model) |

| Maximum Overall Loss | 10% (fixed) | 5% – 10% (varies by model) |

| Hedging Allowed | Generally restricted | Prohibited on all accounts |

| Stop-Loss Required | No (but essential for rule compliance) | No (but essential for rule compliance) |

FTMO’s rigid framework functions like a built-in risk coach. The rules are uniform across accounts and leave little room for interpretation, forcing traders to manage exposure carefully on every position. This structure is ideal for those who perform best with clear, objective limits.

Funding Pips takes a more segmented approach to risk control. Drawdown limits, exposure rules, and behavioral conditions can change based on the chosen model or payout stage. Traders must pay closer attention to account-specific rules and manage risk through position sizing and execution rather than relying on a single standardized framework.

2.5. Scaling plans

A prop firm’s scaling program is its long-term promise to you. It’s the pathway from a funded trader to a serious capital manager. FTMO presents this as a clear, structured career ladder, while Funding Pips frames it as an elite goal with significant rewards for top performers.

| Feature | FTMO | Funding Pips |

|---|---|---|

| Scaling Trigger | 10% net profit over a 4-month cycle | Tiered: 4-16 payouts + cumulative profit goals (10%-40%) |

| Capital Growth | A fixed +25% per successful cycle | Progressive: +20%, +30%, +40%, then doubled |

| Drawdown Increase | No (drawdown % remains fixed) | Yes, max drawdown increases by +1% at each of the 4 stages |

| Max Account Size | Up to $2,000,000 | Up to $2,000,000 |

| Ultimate Reward | 90% profit split and large capital | Hot Seat: 100% split, monthly bonuses, custom conditions |

FTMO’s plan is the definition of professional consistency. Its goal is a single, clear set of performance benchmarks: 10% in 4 months. This straightforward, mathematical approach is perfect for traders who value predictability and a steady path to managing larger capital.

Funding Pips, however, has created a compelling, multi-stage journey that feels like leveling up. The most significant advantage here is the increase in drawdown limits as you progress. This is a massive benefit, giving a successful trader more breathing room and demonstrating the firm’s growing trust. The final Hot Seat level, with its 100% split and bonuses, offers one of the most attractive end-goals in the industry.

3. Important trading rules and restrictions of FTMO and Funding Pips

The rulebook is where a trader’s strategy either thrives or fails. FTMO manages this by offering a distinct choice upfront: a restricted Normal account or a flexible Swing account. In contrast, Funding Pips offers broader freedom by default but implements its own unique, behavior-focused restrictions on funded accounts.

| Rule / Restriction | FTMO | Funding Pips |

|---|---|---|

| Consistency Rule | Yes, a core rule of the evaluation process | No consistency rule for Evaluation accounts; Zero Accounts include a 15% consistency rule |

| Weekend Holding (Funded) | Allowed (Swing account only) | Allowed |

| News Trading (Funded) | Allowed (Swing account only) | Allowed (with a restricted 10-minute window on some payout plans) |

| Max Lot Exposure | No (risk managed by drawdown limits) | Yes, on certain 2-Step Master accounts |

| Gambling Behavior Rule | Broadly defined as exploiting the system | Specifically defined (e.g., max risk per trade idea capped at 3%) |

| Forbidden Strategies | Arbitrage, HFT, and prohibited third-party EAs | Arbitrage, HFT, and prohibited third-party EAs |

Note: Although Funding Pips does not impose a consistency rule on standard Evaluation models, their Zero Accounts require maintaining a 15% consistency score and limiting the biggest winning day to 15% of total profits.

FTMO’s approach requires a strategic choice from day one. A trader must decide if their style fits the Normal account with its news and weekend restrictions, or if they need the complete freedom of the Swing account. This is a clear, structured system that defines your trading boundaries before you even place a trade.

Funding Pips offers more dynamic flexibility, which is incredibly appealing for news traders and swing traders. However, this freedom is balanced by their unique behavioral rules on funded accounts, like the Max Lot Exposure limit. A trader must decide which they prefer: FTMO’s upfront structural rules or Funding Pips’ more fluid environment that monitors for specific risk-taking patterns.

4. Challenge fees and refund policies

Your initial investment in a prop firm challenge is the evaluation fee. It’s crucial to understand not just the upfront cost, but also the value you receive and the policy for getting your money back. FTMO positions itself as a premium service with a higher price point, while Funding Pips competes aggressively on cost across its various models.

| Feature | FTMO | Funding Pips |

|---|---|---|

| Evaluation Fees | €89 – €1,080 | $29 – $555 (highly model-dependent) |

| Refund Policy | Yes, 100% refund with the first profit split | Yes, 100% refund with the first profit split |

The pricing here reflects each firm’s brand identity perfectly. FTMO’s higher fee feels like an investment in a premium, all-inclusive package; you’re paying for their established reputation and comprehensive support tools. This price point demands a higher level of commitment from the start.

On the other hand, Funding Pips’ aggressive pricing significantly lowers the barrier to entry. This makes challenges less costly and more accessible, which is ideal for traders testing the waters or managing limited risk capital.

While both firms offer a full refund, Funding Pips refunds only funded evaluation models after the first payout, and does not apply to instant funded accounts.

5. Profit split and payout structure of FTMO vs Funding Pips

Getting paid is the ultimate goal, and a firm’s profit-sharing structure reveals its core philosophy. FTMO offers a reliable, predictable structure that fosters a consistent rhythm for traders. In contrast, Funding Pips provides a complex but powerful menu of options, allowing traders to customize their payout schedule based on their immediate needs and performance.

| Feature | FTMO | Funding Pips |

|---|---|---|

| Profit Split | 80% | 60% – 80% (depending on chosen cycle) |

| Maximum Profit Split | 90% (via Scaling Plan) | 100% (Monthly cycle or Hot Seat) |

| Payout Frequency | Bi-weekly (every 14 days) | Multiple options (Tuesday, Bi-weekly, Monthly) |

| Fastest Payout Option | Becomes On-Demand after the first 14-day payout | Tuesday Payday (can be as fast as the same day) |

| Withdrawal Conditions for Higher Payout | Consistent profit over 4 months (Scaling Plan) | 35% consistency score required for 90% On-Demand payout |

FTMO’s payout system is built on predictability. The bi-weekly schedule creates a consistent rhythm, which is excellent for financial planning and building disciplined habits. You know exactly when your review is and when you get paid. This straightforward approach removes complexity and lets a trader focus solely on trading.

Funding Pips, in contrast, hands the control over to the trader. This flexibility is a massive advantage; needing cash quickly means you can opt for a Tuesday Payday with a lower profit-sharing split of 60%. However, it comes with complexity.

Crucially, to access the 90% on-demand payout, a trader must meet a 35% consistency score. This is a critical detail, as it reintroduces a rule similar to FTMO’s famous challenge requirement, but at the payout stage.

6. Support customer & education materials

Beyond the trading rules, the quality of a firm’s support and educational resources can significantly impact a trader’s journey. FTMO invests heavily in a formal educational ecosystem. In contrast, Funding Pips focuses on building a powerful community and ensuring constant support and accessibility.

| Feature | FTMO | Funding Pips |

|---|---|---|

| Main Support Channels | Live Chat, Email, Phone | Email, Discord |

| Key Support Feature | Multi-channel, including direct phone support | 24/7 support via a large, active Discord community |

| Educational Resources | FTMO Academy: A comprehensive trading course | Blog articles and community-driven learning on Discord |

| Community | Established and professional | Very large, highly active, and rapidly growing Discord server |

FTMO’s approach is structured and institutional. The FTMO Academy is a genuinely valuable resource, offering a full curriculum that can guide a trader’s development. This commitment to formal education, combined with direct phone support, creates a very professional and supportive environment.

Funding Pips leverages the power of community and 24/7 availability. Their Discord server is more than just a support channel; it’s a dynamic hub for real-time information and peer-to-peer help. This approach is perfect for traders who prefer interactive learning and want immediate access to support, regardless of the time zone.

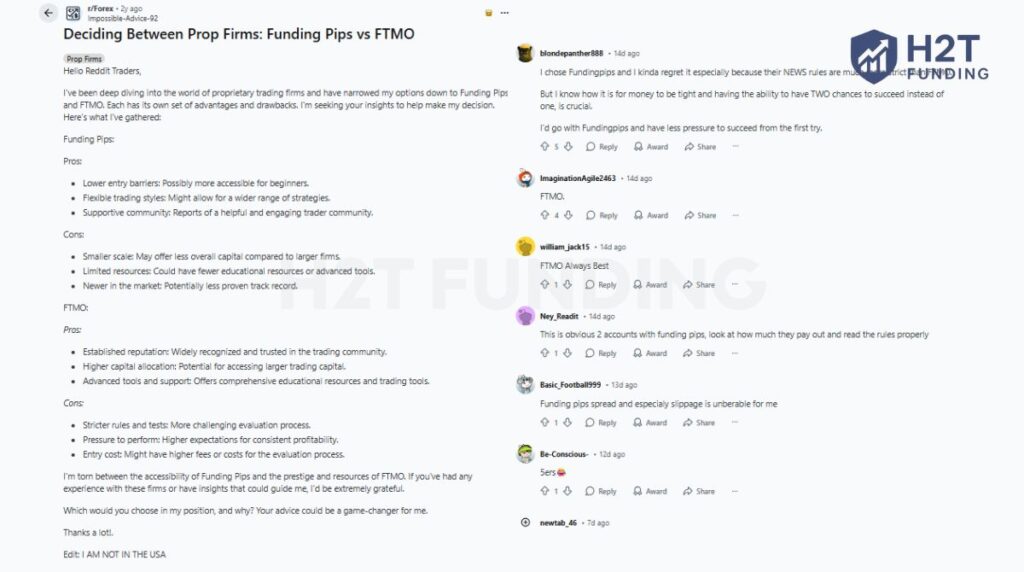

7. Community feedback: FTMO vs Funding Pips on Reddit and Trustpilot

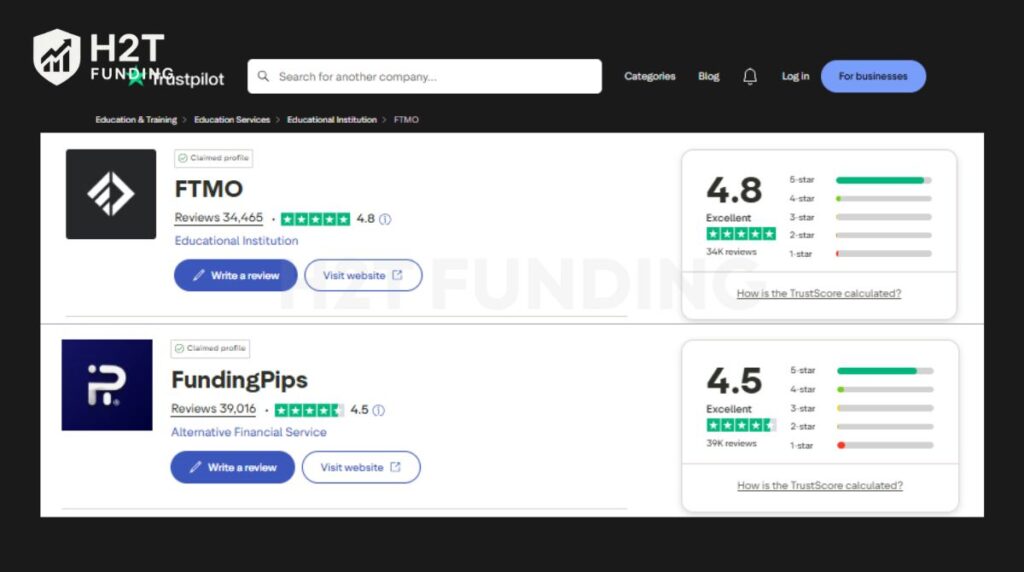

Official websites provide the rules, but community platforms like Trustpilot and Reddit reveal the real user experience. Diving into these reviews shows a fascinating split in trader sentiment, highlighting the distinct strengths and weaknesses of each firm.

On Trustpilot, both firms command impressive ratings from tens of thousands of users, cementing their status as major industry players. FTMO boasts a stellar 4.8-star rating, often praised for its professionalism and reliability, reflecting its long-standing reputation.

Close behind, Funding Pips holds a strong 4.5-star rating, with users frequently celebrating its simple rules and fast evaluation process.

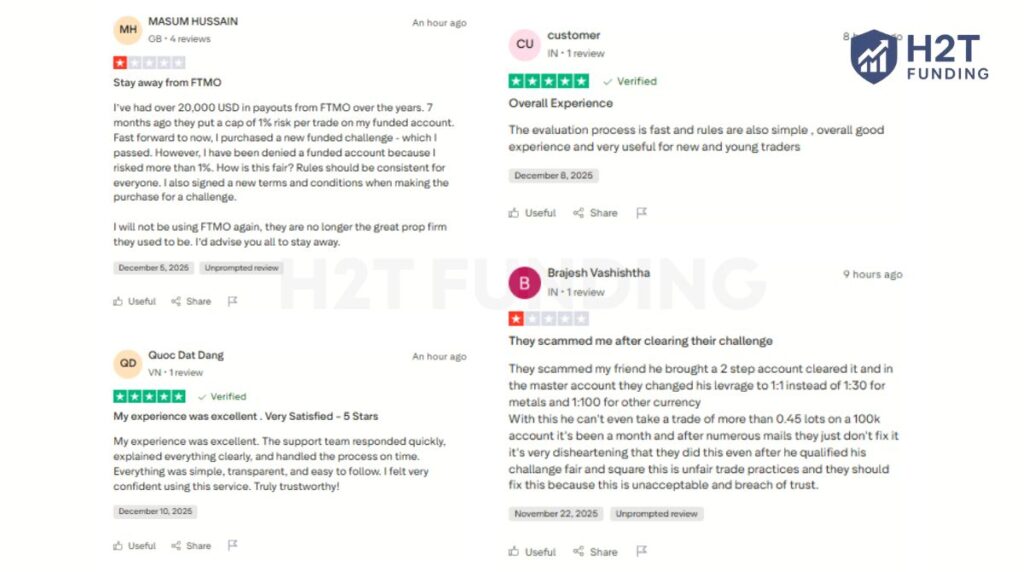

The detailed reviews tell a deeper story. Positive feedback for both firms often centers on successful payouts and good support experiences. However, negative reviews pinpoint specific pain points; some traders feel blindsided by rule changes or experience issues with leverage and slippage. That showcases that no firm is perfect, and traders must read the terms carefully.

When the conversation moves to Reddit, the debate becomes more nuanced and strategic. In threads comparing the two, a clear pattern emerges. Traders often recommend FTMO for its established trust and prestige, seeing it as the more serious or proven path. The stricter rules are seen by many as a fair trade-off for its unmatched reputation.

Conversely, Funding Pips is frequently championed for its flexibility and lower pressure. Traders appreciate the absence of the consistency rule and lower entry fees, making it a popular choice for a first attempt at a challenge. However, some Reddit users express concerns over issues like slippage or evolving rules, which reflect the growing pains of a newer, rapidly expanding firm.

8. Which firm should you choose? FTMO or Funding Pips

The final decision isn’t about which prop firm is universally better, but which one is the right partner for you. Your personal trading style, risk appetite, tolerance for specific rules, and long-term goals will point you to the correct choice.

Let’s break down the ideal trader profile for each firm.

| Prop Firm | Best For | Key Warnings |

|---|---|---|

| FTMO | Swing traders (via Swing account), long-term and career-focused traders who value structure, strict risk control, and predictable scaling | Strict drawdown rules, higher upfront fees, slower scaling, and restrictions on news/weekend trading on standard accounts |

| Funding Pips | Scalpers, news traders, beginners with low capital, and traders seeking fast or flexible funding options | Rules and leverage vary by model and platform, with lower leverage on some plans and behavioral limits on funded accounts |

This table highlights the core trade-off between the two firms. FTMO prioritizes structure and long-term consistency, which suits disciplined traders but leaves little room for error. Funding Pips prioritizes flexibility and speed, but requires traders to pay close attention to model-specific rules and risk conditions.

Before choosing, traders should carefully review both the rule breakdown and the warning section above, as overlooking these details is one of the most common reasons traders fail prop firm challenges.

To see a detailed walkthrough of their platform and a deeper analysis of the challenge rules, watch our complete FTMO review on YouTube.

9. FAQs

The main difference lies in their core philosophies. FTMO emphasizes a highly structured, disciplined approach with its famous consistency rule and restrictions on news/weekend trading on standard accounts. Funding Pips prioritizes flexibility, offering no consistency rule on standard Evaluation accounts, allowing news/ weekend trading, and providing multiple evaluation models.

Objectively, Funding Pips is often considered easier to pass because standard Evaluation accounts do not include a consistency rule. This is primarily because it does not have the famous consistency rule, which is a major hurdle in the FTMO challenge. Additionally, some of their models have lower profit targets, further reducing the pressure on the trader.

Both firms are widely regarded as legitimate and have paid out millions to traders. FTMO has a longer history and is considered the industry’s gold standard for reliability. Funding Pips is newer but has quickly built a strong reputation for consistent payouts and transparency, backed by a high Trustpilot score.

With Funding Pips, yes, you can. With FTMO, it depends entirely on your account type. Their Normal funded account restricts these activities, but their Swing account allows them, providing a clear choice for different trading styles.

Funding Pips is generally faster and more flexible, offering options like a Tuesday Payday that can process a payout in as little as one day. FTMO operates on a standard bi-weekly schedule, which is highly reliable but less flexible; their processing time after a request is typically very fast.

Funding Pips is often recommended for beginners due to its lower entry fees and the absence of the challenging consistency rule. This creates a lower-pressure environment for a first attempt. However, FTMO’s structured rules and extensive educational academy can provide a valuable framework for a new trader’s development.

Yes, both firms allow the use of EAs. However, they both have strict rules against using third-party EAs that are used by many other traders simultaneously (e.g., mass-marketed EAs). They also prohibit strategies like latency arbitrage or high-frequency trading.

If you violate a hard breach rule (like the daily or max loss limit) at either firm, your account is terminated. Neither firm offers a free retry for hard breaches. However, if you finish a challenge in profit without violating any rules but haven’t met the profit target, both firms often offer a free retry.

No, neither FTMO nor Funding Pips has a maximum time limit to complete their evaluation challenges. You can take as much time as you need to reach the profit target, as long as you do not violate any of the other rules.

Neither firm is universally better; they are suited for different traders. FTMO is better for traders who value a structured, disciplined path and a long-standing reputation. Funding Pips is better for traders who prioritize flexibility, fewer rules during evaluation, and lower entry costs.

Better is subjective and depends on a trader’s needs. Firms like Funding Pips are considered better for flexibility, while others may offer higher leverage or different scaling plans. FTMO remains the benchmark for its combination of reputation, support, and a clear, albeit strict, trading structure.

No, you cannot. FTMO requires a minimum of 4 trading days for both Step 1 (Challenge) and Step 2 (Verification). This rule is in place to ensure traders demonstrate consistency over a short period, not just a single lucky trading day.

10. Conclusion

After breaking down every detail, the FTMO vs Funding Pips decision becomes much clearer. It’s not about finding a winner, but about finding a partner that fits. Your choice will come down to a single, crucial question: Do you value a proven, structured path more than you value strategic freedom?

FTMO remains the undisputed benchmark for structure, reputation, and disciplined trader development. It’s a premium choice for those who thrive within a proven framework and value a predictable, long-term career path.

Funding Pips has masterfully captured the demand for flexibility and speed. By removing key restrictions and offering a dynamic, multi-stage growth plan, it empowers confident traders who want to operate with fewer constraints.

The prop firm landscape is always evolving. To see how other firms stack up and to deepen your understanding of the industry, be sure to check out more expert comparisons on the H2T Funding Blog.