For skilled traders, speed to funding is the ultimate goal. The FTMO vs Funded Trader debate often boils down to one key question. Which prop firm can get you trading with significant capital, faster?

This guide from H2T Funding delivers the clarity you need. We compare the challenge process, payout systems, and what real traders say. By the end, you will know exactly which firm best aligns with your personal trading goals and accelerates your journey to becoming a funded trader.

Key takeaways

- FTMO has a proven track record with consistent payouts, while The Funded Trader faced operational halts and payout issues.

- FTMO’s structured 2-step challenge and clear rules make it safer and easier for new traders to succeed.

- Choose FTMO if you value stability, predictable payouts, and a beginner-friendly process.

- Choose The Funded Trader if you are an experienced trader seeking faster funding and higher profit split potential, and can handle higher risk.

1. Overview of FTMO vs Funded Trader

FTMO and The Funded Trader are two leading names in the prop firm industry. Both offer a solution for skilled but undercapitalised traders. However, they have distinct philosophies on trader evaluation, risk, and growth. Below is a side-by-side look at their core features.

| Aspect | FTMO | The Funded Trader |

|---|---|---|

| CEO | Otakar Suffner | Angelo Ciaramello |

| Funding Models | 2-step | 1-step, 2-step, 3-step |

| Account Size | $10K – $200K | $5K – $200K |

| Profit Split | 80% – 90% | 80% – 99% |

| Profit Target | 10% (Step 1) 5% (Step 2) | 8% – 10% |

| Payout Frequency | On-demand after 14 days | Any time, 7 days or 14 days, depending on the program |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 4 days | 0 – 5 days, depending on the program |

| Daily Loss Limit | 5% | 3% – 5% |

| Maximum Loss Limit | 10% | 8% – 10% |

| Instruments | Forex, Commodities, Indices, Stocks, Crypto | Forex, Commodities, Indices, Crypto |

| Platforms | MT4, MT5, cTrader, DXtrade | MT5, cTrader, Match Trader |

| News/Weekend Trading | Restrictions on some accounts | Allowed |

| Starting Fees | €155 (~$178) | $42 |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FTMO and Funded Trader websites before purchasing any challenge.

For a complete breakdown, read our in-depth reviews of each prop firm to see which one truly fits your strategy.

FTMO

#1

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO stands as the gold standard in the proprietary trading firm industry for a reason. Its reputation is built on years of professionalism, transparency, and, most importantly, consistently paying its traders. For anyone serious about building a sustainable career, this level of trust is non-negotiable.

The firm’s structured 2-step challenge is its defining feature. While some may see it as rigid, we view it as a powerful training ground that forces traders to develop strong risk management and discipline. It is an ideal environment for beginners and experienced traders who value a clear, proven path to funding.

Ultimately, FTMO is a partner for the long term. Their focus isn’t just on finding profitable traders but on cultivating them through a stable and predictable system. The combination of fair trading conditions and a reliable payout schedule makes it our top recommendation.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

The Funded Trader

#2

Account Types

1-step, 2-step, and 3-step

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on The Funded Trader

The Funded Trader initially captured the market by offering unparalleled flexibility. Its variety of challenge formats, aggressive capital scaling, and the promise of high profit splits appealed to traders seeking a fast track to significant funding. On paper, it was designed to be a modern trader’s dream prop firm.

However, this attractive model was built on an unstable foundation. The firm’s subsequent operational collapse and the overwhelming evidence of unpaid traders reveal a critical failure in its core business. A prop firm’s primary promise is to pay for performance, a promise that TFT ultimately failed to keep for many.

While the firm is attempting a relaunch, it remains in a high-risk category. The slow progress on clearing outstanding payouts means trust has not been restored. For any trader, engaging with this prop firm at its current stage is an exceptionally high-stakes gamble.

| 💳 Challenge Fee | $42 – $1,100 |

| 👥 Account Types | 1-step, 2-step, and 3-step |

| 💰 Profit Split | 80% – 99% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto |

See more:

2. A detailed comparison of FTMO vs Funded Trader

The real difference between these prop firms lies in their program details. We will now dissect everything from their initial evaluation phases to the final profit splits. This comparison clarifies how each firm’s approach to risk management and trading conditions impacts your journey to securing funding.

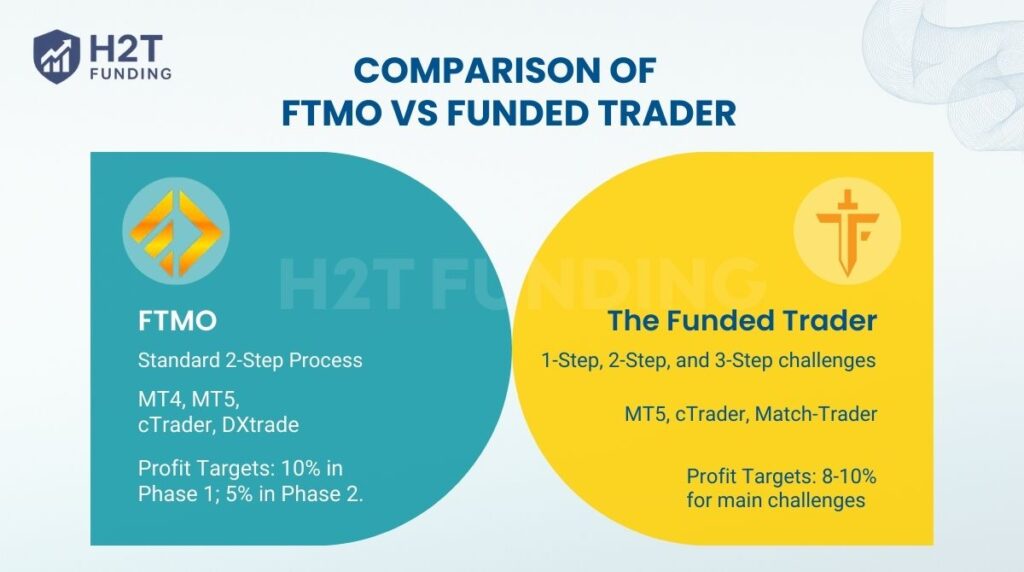

2.1. Evaluation program

The evaluation program is the gateway to securing funding. It is how a prop firm assesses your ability to trade profitably while managing risk. FTMO offers a standardised, time-tested process, whereas The Funded Trader provides a high degree of flexibility with multiple challenge formats.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Evaluation Structure | Standard 2-Step Process (Challenge & Verification) | Flexible 1-Step, 2-Step, and 3-Step challenges |

| Program Goal | Verify consistency and discipline over two phases. | Offer multiple paths to funding to suit different trading styles. |

| Account Variety | A single, streamlined challenge path for all traders. | Multiple account types (e.g., Knight, Royal, Dragon, Classic). |

FTMO’s 2-step evaluation is the industry benchmark. It is a clear, structured path that has proven effective for thousands of traders. This approach is perfect for those who value consistency and a straightforward process with clear challenge objectives.

The Funded Trader’s main advantage is choice. By offering 1-step, 2-step, and 3-step evaluation phases, it caters to a broader range of traders. A confident trader might prefer the 1-step challenge for faster funding, while a more conservative trader might opt for the 3-step process. This flexibility makes TFT’s platform highly adaptable to individual needs.

2.2. Challenge rules

Challenge rules define the specific targets and limits a trader must adhere to throughout the entire evaluation period. Success in a prop firm evaluation depends heavily on understanding and respecting these parameters. Both FTMO and The Funded Trader set clear objectives for profit targets and drawdown limits, but their approaches to time and trading days differ.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Profit Targets | 10% in Phase 1; 5% in Phase 2. | Varies by challenge (e.g., 8-10% for main challenges). |

| Maximum Daily Loss | Fixed at 5% of the initial account balance. | Typically 3-5%, depending on the selected challenge type. |

| Maximum Overall Loss | Fixed at 10% of the initial account balance. | Varies from 6-10%, depending on the challenge. |

| Trading Period | Unlimited. | Unlimited for all challenge phases. |

| Minimum Trading Days | 4 days (does not have to be consecutive). | None for the most popular challenges (e.g., Knight, Royal). |

FTMO challenge rules are simple and industry-standard: hit the profit targets without breaching the 5% daily or 10% overall loss limits. The 4-day minimum trading requirement encourages consistency rather than quick, high-risk wins. This structure promotes sound risk management.

The Funded Trader offers more tailored trading conditions. Traders can choose account types with lower profit targets or higher drawdown limits, matching the rules to their strategy. Removing the minimum trading day requirement on many accounts allows experienced traders to secure funding faster if they meet the profit goal quickly.

2.3. Trading restrictions

Both prop firms enforce rules against strategies that exploit the simulated trading environment. These restrictions are in place to ensure traders demonstrate genuine skill that can be replicated in live markets. While both prohibit cheating, their specific definitions and enforcement mechanisms vary.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| News Trading | Not allowed on funded accounts (non-swing) within a 2-minute window of high-impact news. | Prohibited on most challenges (e.g., Royal, Standard, Knight). A 3-warning system is used before an account breach. |

| Copy Trading | Allowed only from a trader’s own accounts. Copying others is forbidden. | Prohibited if copying from another trader. Copying between a trader’s own accounts is allowed. |

| Prohibited Strategies | The vague Forbidden Trading Practices clause focuses on gambling-like behaviour. Third-party EAs are banned. | Explicitly lists and defines forbidden strategies like grid trading, latency arbitrage, and order layering. |

| Enforcement | Discretionary review can lead to account suspension. | A clear warning and violation system, often with profit deductions before an account breach. |

FTMO’s rules are simpler and less restrictive on paper. They focus on preventing obvious gambling and unauthorised account management. This gives traders more freedom but also creates ambiguity, as the firm reserves broad discretion to decide what constitutes a forbidden practice.

The Funded Trader provides a highly detailed list of prohibited strategies. While its rules appear stricter, the clear warning system offers traders a chance to correct their behaviour before facing an account breach. That is one of the significant trader-friendly features.

2.4. Account fees and refund policy

Think of the evaluation fee not as a cost, but as your initial investment in a funded trading career. Both prop firms operate on a model where this investment is returned upon success. However, the way each prop firm handles this refund is a critical difference that reflects their overall philosophy.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Fee Structure | One-time, standardised fee based on account size. | One-time fee that varies by challenge type and account size. |

| Refund Mechanism | The full fee is refunded with the first profit split from the funded account. | No refunds. Instead, a bonus equivalent to your fee is paid out with the third withdrawal. |

| Refund Condition | Pass the evaluation and request your first payout. | Complete all challenge phases, reach the funded stage, and generate enough profit for three approved payouts. |

| Accessibility | Premium, fixed pricing with very rare discounts. | Much lower barrier to entry due to frequent discount promotions. |

FTMO’s policy is the industry gold standard for a reason. Getting your fee back with your very first payout feels like a true reward for your hard work. It’s a straightforward, powerful incentive that reinforces trust and shows the firm is confident in its successful traders. For many, this immediate return of capital is a top priority.

The Funded Trader uses a very different model. Once login details are sent, no refunds are allowed. Instead, traders receive a bonus equal to their fee with their third withdrawal after reaching the Funded phase. This setup keeps costs low upfront but requires traders to generate enough virtual profit before recovering their initial fee.

Continue reading:

2.5. Trading platforms and tradable assets

The right platform and a diverse range of assets are crucial for executing your strategy. Your comfort with a trading platform can directly impact performance. Both prop firms offer excellent tools, but with key differences in platform availability and asset classes.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Trading Platforms | MT4, MT5, cTrader, DXtrade | MT5, cTrader, Match-Trader |

| Tradable Assets | Forex, Indices, Commodities, Stocks, Crypto | Forex, Indices, Commodities, Crypto |

If you are a trader who built their edge on MT4, FTMO is a natural fit. Their inclusion of the classic platform alongside modern alternatives like cTrader shows a commitment to accommodating all traders. Furthermore, having access to stock CFDs opens up a whole new world of opportunities that are simply unavailable at many other firms.

The Funded Trader, on the other hand, embraces a newer generation of software with Match-Trader. For traders who value advanced charting or have already transitioned away from MT4, their platform lineup feels modern and efficient. Their asset list covers the most popular markets, ensuring you have ample opportunities in Forex, indices, and crypto without the distraction of stocks.

2.6. Profit split & Scaling plans

Your journey doesn’t end once you secure funding; it’s just the beginning. The profit splits and the opportunity for capital scaling are what determine your long-term earning potential. Here, FTMO offers a path of steady, predictable growth, while The Funded Trader presents a more complex but potentially faster and more rewarding system.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Default Profit Split | 80%, which can increase to 90% via the Scaling Plan. | 80%, with a tiered system that can reach a 99% split. |

| Scaling Condition | Achieve a 10% net profit over 4 months. | Tier-based: depends on the number of approved payouts + accumulated profit. |

| Scaling Increase | Account balance is increased by 25% of the initial balance. | Account balance is increased by 25% of the initial balance. |

FTMO’s plan is the definition of reliability. The 80/20 split is a fair industry standard, and the scaling requirement of 10% in 4 months rewards consistent, long-term profitability. It’s a straightforward path designed for traders who value steady growth and a clear, well-defined career trajectory with a trusted prop firm.

The Funded Trader takes a very different approach. Their scaling is based on four tiers, each requiring a specific number of approved payouts and a minimum accumulated profit after split. Payout caps and profit splits increase as you climb tiers:

- Tier 0: No payout history required. You start with a 90% split, but a small payout cap of 0.5% of the account.

- Tier 1: After 1 approved payout, the split temporarily drops to 30%, but the payout cap increases to 5%, then 10% on the next payout.

- Tier 2: After 3 approved payouts and 2.25% accumulated profit, the split rises to 70%, with a 10% payout cap. Example: On a $100K account, you must have withdrawn $2,250 after the split to qualify.

- Tier 3 (maximum): After 6 approved payouts and 20% accumulated profit, you unlock a 99% profit split with a 10% payout cap, one of the highest payout structures in the industry.

Both FTMO and TFT increase your account by 25% of the original balance once you meet their scaling requirements. The key difference lies in their philosophies: FTMO rewards consistent, disciplined growth. In contrast, TFT incentivises speed, high performance, and larger payout potential, though with greater operational risk and far more moving parts.

3. Trading conditions: Leverage and commission

The trading conditions a prop firm offers are the bedrock of your daily execution. Low costs and appropriate leverage can significantly impact your bottom line. We will now break down these crucial elements for both FTMO and The Funded Trader.

3.1. Leverage

Leverage is a powerful tool; it amplifies your buying power but also your risk. Choosing a prop firm with leverage that matches your risk management strategy is essential. Too little, and you can’t capitalise on opportunities; too much, and one mistake can be fatal.

| Feature | FTMO (Standard Challenge) | The Funded Trader (Varies by Challenge) |

|---|---|---|

| Forex Leverage | 1:100 | Up to 1:100 (e.g., Dragon Challenge) |

| Indices Leverage | 1:50 | Up to 1:20 (varies greatly) |

| Crypto Leverage | 1:3 | 1:1 or 1:2 |

FTMO provides a standardised, industry-accepted leverage of 1:100 on Forex. This is a balanced level that offers significant buying power without being excessive. Their conservative leverage on volatile assets like crypto encourages disciplined risk management, which is a hallmark of their brand.

The Funded Trader’s strength is customisation. If you are a conservative trader, you can choose a challenge like the Royal with 1:50 leverage. If your strategy requires more firepower, the Dragon challenge offers 1:100. This flexibility allows you to align the firm’s trading conditions perfectly with your personal trading plan.

3.2. Commission

Commissions are the direct cost of doing business and can eat into your profits, especially if you are a scalper or high-frequency trader. For many, finding a prop firm with the lowest possible costs is a top priority. Both firms offer competitive, but different, commission structures.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Forex Commission | $5 per lot | $4 per lot |

| Indices Commission | $0 | $0 |

| Metals Commission | Percentage-based (approx. $3 – $4) | $1 per lot |

If you are purely an index trader, FTMO is incredibly attractive. The zero commission on indices is a massive financial advantage that cannot be overstated. While their Forex commission is standard, the savings on indices can make them the clear winner for specialists in that area.

The Funded Trader, on the other hand, offers a more universally low-cost structure. At $4 per lot for Forex and an exceptionally low $1 per lot for metals, their commissions are highly competitive across the board. The zero commission on indices and crypto makes their trading conditions appealing for virtually any type of trader looking to minimise costs.

4. FTMO vs Funded Trader payout process

A successful strategy is only half the battle; getting paid quickly and reliably is what truly matters. The payout process reflects a prop firm’s operational efficiency and trust in its traders. FTMO offers a system built on a predictable, professional schedule, while The Funded Trader champions unparalleled speed and flexibility.

| Feature | FTMO | The Funded Trader |

|---|---|---|

| Payout Frequency | Predictable 14-day cycle after the first month. | Highly flexible; “Anytime” withdrawals are available on Knight accounts. |

| First Payout | Eligible 14 days after your first trade on the funded account. | Varies by challenge, from 2 days (Royal Pro) to 30 days (Royal). |

| Processing Time | Standard processing is aligned with the bi-weekly schedule. | Fast, typically within 3-5 business days after a request. |

| Payout Methods | Bank Wire and Cryptocurrency. | Rise, multiple Cryptocurrencies (USDC, ETH, BTC). |

If you value consistency above all, FTMO’s process is designed for you. Their bi-weekly payout schedule operates like a professional salary, providing a reliable and steady income stream. It is a time-tested system from a highly reputable prop firm that you can absolutely depend on.

The Funded Trader is the clear winner for traders who want control and faster access to their earnings. The ability to request a payout anytime on their Knight accounts is a game-changing feature, offering true fast payouts. Their wider range of modern payout options also adds a layer of convenience.

Read our related articles: How To Pass FTMO Challenge In 2026 And Get Funded Fast

5. Which prop firm is easier to pass?

When comparing difficulty, the core question is simple: Which firm gives you more room for mistakes? FTMO is fair and structured, while The Funded Trader (TFT) was more flexible on paper. But the experience of passing them feels very different for most traders.

FTMO is harder on targets, easier on consistency. You must hit 10% then 5%, which demands patience and clean risk management. But FTMO’s rules are predictable, the drawdowns don’t change, and there’s no time limit. If you trade steadily and value stability, FTMO feels more achievable because nothing unexpected gets in your way.

The Funded Trader was easier on rules, harder on trust. The 1-step challenge, zero minimum trading days, and flexible drawdowns made hitting targets quicker, great if you have a high-risk, high-confidence style. But during its past operational collapse, many traders who passed found themselves unable to withdraw profits. Passing was easy on paper, but actually getting paid was not.

The real difference comes down to your trading personality.

- If you prefer discipline, steady pacing, and a system that rewards clean risk control, FTMO aligns better and feels easier long term.

- If you thrive on fast targets, aggressive setups, and minimal restrictions, TFT’s structure suited that style, though the reliability issues turned the experience into a gamble.

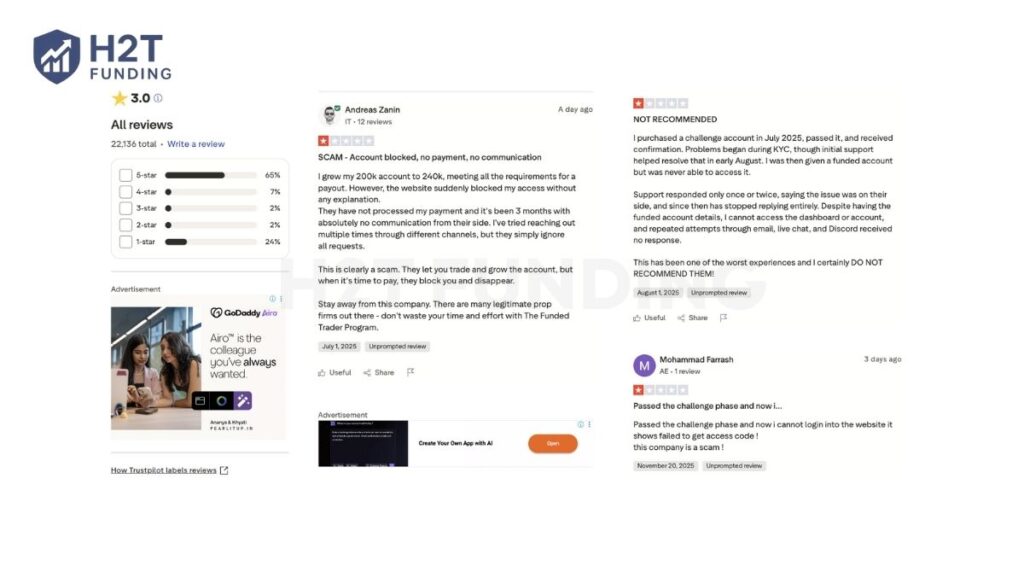

6. Community feedback: What Reddit & Trustpilot say

A prop firm’s marketing is one thing; the unfiltered experience of its traders is another. We analyzed Trustpilot and Reddit to see what real users are saying, and the feedback reveals a dramatic difference in reputation between FTMO and The Funded Trader.

FTMO consistently receives overwhelmingly positive feedback, boasting a stellar 4.8-star rating on Trustpilot. Traders frequently praise the firm for its professionalism, transparent process, and, most importantly, reliable and timely payouts. The community regards FTMO as a pillar of the industry, a safe and trustworthy partner for securing funding.

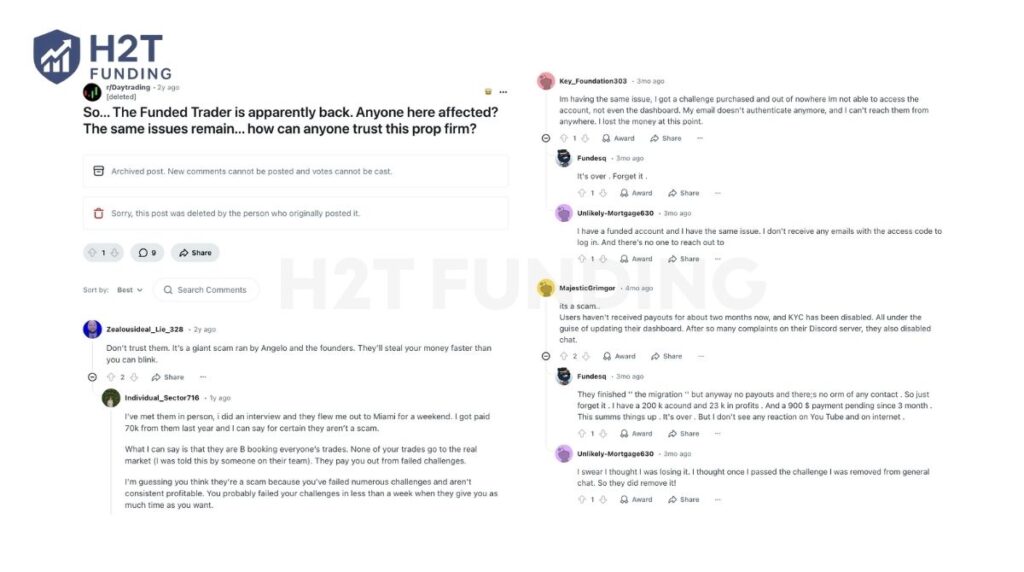

In stark contrast, The Funded Trader’s community feedback tells a story of severe operational issues. The firm’s Trustpilot score has fallen to a concerning 3.0 stars, driven by a large volume of 1-star reviews. These reviews, along with numerous Reddit threads, describe a consistent pattern of serious problems.

Common complaints include traders being unable to access their accounts after passing challenges, being denied payouts without clear reasons, and a complete lack of community support. Many users have directly labelled the company a scam after failing to receive their earned profits for months on end.

According to a report by OFP Funding, The Funded Trader abruptly ceased all operations in March 2024 amid accusations of fraud and significant payout delays. This operational halt validates the flood of negative feedback and represents a critical failure of the prop firm.

Don’t miss out: How to Pass a Prop Firm Challenge: Step-by-Step

7. FAQs

FTMO is often considered better for beginners due to its clear, structured 2-step challenge. This straightforward process teaches discipline and strong risk management from the start. The Funded Trader’s multiple options could be overwhelming, and its recent operational issues make it an unsuitable choice for new traders.

Theoretically, The Funded Trader’s 1-step challenges were designed for faster funding. However, due to widespread payout problems and its operational halt, FTMO is the only reliable option for actually receiving funds. Their process is proven and trustworthy, ensuring you get funded if you pass.

Based on its long track record, positive community feedback, and reliable payout history, FTMO is a significantly safer choice. It is a stable and reputable partner for building a long-term trading career. The collapse of The Funded Trader underscores the crucial importance of selecting a proven and dependable prop firm.

As of late 2026, The Funded Trader is not fully operational in a reliable sense. After ceasing operations in early 2024, the prop firm has announced it is attempting a relaunch. However, the firm is in a highly unstable and high-risk category for anyone seeking dependable funding.

A funded account means you trade with a firm’s capital. FTMO is simply one of the firms that provides funded accounts. Funded is the status, FTMO is the company offering it.

FTMO does not have an official 3% rule. The only official limits are 5% maximum daily loss and 10% maximum overall loss.

Yes, there is no time limit on FTMO challenges. If you hit the profit target and obey all rules, you can pass in a single day. However, you must still complete the minimum 4 trading days, which means you cannot receive the funded account immediately.

As of 2026, FTMO is objectively the safer and more reliable option due to consistent payouts, clean operations, and strong trader support. TFT’s history of unpaid traders and operational collapse places it in a high-risk category.

TFT is attempting a relaunch, but the firm is still viewed as high risk. Thousands of traders remain unpaid, and operations have not returned to pre-2024 reliability. Most traders and reviewers do not consider TFT fully legitimate in 2026.

The Funded Trader was easier to pass on paper thanks to lower profit targets, flexible rules, and 1-step challenges. FTMO is harder, with a structured 2-step evaluation and stricter drawdowns. However, FTMO is the only reliable option, because the Funded Trader’s past operational collapse meant many traders who passed couldn’t receive payouts.

FTMO offers clear, stable, and consistent rules. TFT previously had more flexible options, but their strict forbidden strategies list and operational instability make FTMO the superior choice for rule clarity and fairness.

FTMO has better payouts because they are consistent and reliable. The Funded Trader failed to honour its payout promises for many traders. A dependable 80-90% split from FTMO is infinitely better than a theoretical higher split you never receive.

The 100% payout claim existed in their promotions but was rarely fulfilled, with hundreds of reports of delayed or denied withdrawals. Treat this marketing claim with extreme caution.

FTMO’s 5% daily drawdown is standard in the industry and manageable with proper risk management. It encourages disciplined trading and aligns with long-term consistency.

Yes, because TFT allowed aggressive strategies, but due to operational collapse and unpaid traders, scalpers should avoid it until the firm fully regains transparency and trust.

Yes. FTMO rewards consistency through its scaling plan, reliable payouts, and clean rulebook, making it ideal for traders focused on long-term growth.

TFT historically offered cheaper entry fees due to constant discounts. FTMO is more expensive but provides greater stability and safer long-term returns. Cheap fees don’t matter if payouts never arrive.

FTMO is the clear winner. Its long track record, strong regulation-like structure, and dependable payouts make it the safest large prop firm in 2026.

FTMO offers dedicated Swing accounts with no news restrictions, making it an excellent choice for swing traders. TFT also allowed swing trading, but current instability makes FTMO the only reliable option.

8. Conclusion

The choice in the FTMO vs Funded Trader debate once represented a classic dilemma: stability versus flexibility. Our detailed comparison shows that The Funded Trader offered attractive features such as aggressive scaling and varied account types. However, its unstable operations ultimately resulted in a complete loss of trust.

Conversely, FTMO has consistently demonstrated why it leads the industry. With a proven evaluation process, fair trading conditions, and a stellar reputation for paying its traders on time, it stands as the undisputed and reliable choice. For any trader seeking a dependable path to funding, your focus should be on partnering with a prop firm that has proven its longevity and commitment to trader success.

This analysis is just one step on your journey. To master the markets and stay ahead, explore our other in-depth guides on the H2T Funding blog. You’ll find detailed trading strategies, tips for effective risk management, and more reviews designed to help you succeed.