Let’s be honest, the FTMO 10k challenge rules can look confusing at first glance. Profit targets, daily loss limits, verification… It’s a lot to digest. But once you understand how it works, everything starts to make sense.

At H2T Funding, we’ve helped many traders break down these rules and prepare for the FTMO evaluation the right way. We also stay updated with the latest FTMO challenge explained, ensuring every insight in this guide reflects FTMO’s most recent updates. This guide will walk you through the key stages, limits, and smart ways to pass based entirely on FTMO’s official information.

Ready to learn how to trade like a funded pro? Let’s get into it.

Key takeaways:

- FTMO’s program is a two-step evaluation process designed to test your structured trading approach, not luck.

- To pass, traders must hit a 10% profit target, stay within 5% daily loss and 10% total loss, and trade at least 4 days.

- FTMO does not impose a fixed time limit for the challenge phase; you may complete it at your own pace. However, if you leave the account inactive for a prolonged period, the challenge may be terminated.

- In the FTMO Challenge stage, you can choose the ‘Swing Account’ type. This account allows news trading, a key point in the FTMO challenge rules news (FTMO rules news), and positions to be held over the weekend, unlike the standard account.

- Fees are refunded once you pass and become an FTMO Trader.

- Success depends on consistency, emotional control, and capital protection discipline, not high-risk trades.

- Avoid common mistakes like overtrading, ignoring the time zone reset, or chasing quick profits.

1. What is the FTMO challenge, and why should you care?

The FTMO challenge is the first step in proving that you can trade like a professional. In short, it’s part of FTMO’s trader assessment program – a two-stage test where you trade in a simulated account that mirrors real market conditions. The goal? Show that you can manage risk, stay consistent, and meet the trading objectives set by FTMO.

Think of it this way: FTMO doesn’t look for lucky traders; they look for those who demonstrate strong trading skills, composure, and a sound approach to risk.

During both the Challenge and Verification stages, you are not required to close your positions by the end of the trading day. You can hold trades overnight or over the weekend. However, this does not apply once you move to a funded FTMO Account under the standard account type.

Once you meet those objectives, you move to the second stage called verification, and after that, you can get a funded account with real profits shared back to you.

Honestly, a lot of traders get nervous before starting. I get it; the word “challenge” can sound intimidating. But if you understand the structure, it’s actually fair and transparent.

FTMO provides everything upfront: account types, capital sizes, and all trading conditions, including specific details for the FTMO demo challenge rules. And that’s what makes it one of the most trusted prop firms in the industry.

2. FTMO Account Types (2026 Update)

FTMO offers two main account types in 2026: Normal (Classic) and Swing, each designed to fit different trading styles and risk tolerances, including options like the FTMO 100k challenge rules and the FTMO 200k challenge rules.

Both share identical evaluation rules (profit targets, drawdowns, and trading days), but differ in leverage, news restrictions, and overnight holding permissions.

2.1. Normal (Classic) Account

The Normal Account is FTMO’s standard setup and remains the most popular choice among intraday traders.

Key specifications (2026):

- Leverage: Up to 1:100

- Profit target: 10% in Challenge / 5% in Verification

- Max daily loss: 5%

- Max total loss: 10%

- Trading restrictions:

- Cannot hold trades over the weekend

- Cannot open/close positions during major high-impact news (NFP, CPI, FOMC, etc.)

- Best for: Day traders, scalpers, and algorithmic traders who prefer short-term setups with tighter execution and higher leverage.

Verdict: A balanced choice for those who value high leverage and trade actively during liquid market hours. However, it requires careful timing around scheduled news events.

2.2. Swing Account

The Swing Account was designed to give long-term traders and swing specialists more flexibility. In 2026, FTMO expanded this account to fully support news trading and weekend exposure, making it one of the most trader-friendly setups available.

Key specifications (2026):

- Leverage: Up to 1:30 on forex pairs

- Profit target: 10% in Challenge / 5% in Verification

- Max daily loss: 5%

- Max total loss: 10%

- Trading restrictions:

- No restrictions on holding trades over the weekend or through major news events

- No limit on holding duration, suitable for positional strategies

- Best for: Swing traders, fundamental traders, and long-term investors who rely on broader market moves or multi-day setups.

Verdict: Perfect for traders who dislike time pressure or want to hold through macro events. The lower leverage reflects its focus on sustainability rather than speed.

Quick Comparison: Normal vs Swing Account

| Feature | Normal (Classic) | Swing |

|---|---|---|

| Leverage | 1:100 | 1:30 |

| News Trading | ❌ Restricted | ✅ Allowed |

| Weekend Holding | ❌ Not allowed | ✅ Allowed |

| Suitable for | Day traders/scalpers | Swing/position traders |

| Time Limit | ❌ None (removed in 2026) | ❌ None |

| Evaluation Rules | Same for both | Same for both |

The 2026 update made both FTMO account types more flexible than ever. Removing the time limit from challenges and expanding Swing account permissions marked a major step toward trader freedom. Whether you trade 5-minute charts or weekly trends, FTMO’s structure now accommodates both styles without compromising discipline or rule clarity.

3. FTMO Challenge Rules (Full Breakdown)

The FTMO Evaluation Process, often considered a benchmark among the best prop firms for beginners, is divided into two simple stages: the FTMO challenge and the verification. Each step is designed to test how well you manage risk and follow trading discipline under real market conditions, but with virtual capital.

3.1. Stage 1: FTMO challenge

This is where it all begins. You trade on a demo account that simulates live market conditions. Your task is to meet specific trading objectives, such as:

- Achieving a 10% profit target

- Staying within the 5% daily loss and 10% maximum loss limits

- Trading for at least 4 minimum trading days

The idea isn’t to push for quick profits but to demonstrate steady performance. FTMO evaluates traders based on strict metrics such as risk-to-reward ratio and control over capital drawdown to measure long-term stability, especially when trades don’t go your way.

3.2. Stage 2: Verification

Once you pass the initial phase, you move to the final confirmation step. Here, the required profit is lowered to 5% of the starting balance, while the risk limits remain the same as in the first stage. This process confirms that your performance is repeatable and not just a result of luck.

Upon success, you become eligible to share profits from the simulated capital (up to 90%) under FTMO’s terms. This profit-sharing model is central to how prop firms make money. They benefit from successful traders without risking their own capital during the evaluation stages. The exact percentage may vary depending on your chosen trading profile and agreement.

4. Key trading objectives & limits in the FTMO challenge rules

These are the official FTMO challenge rules: achieve a 10% profit target, trade at least 4 days, and stay within the 5% daily loss and 10% overall loss limits.

4.1. Minimum trading days

This rule sounds simple, but it’s really about patience and consistency, two core components of how to be more disciplined in your trading. FTMO wants to see steady trading activity, not quick, one-day wins.

- For both the Challenge and Verification stages, you must complete at least 4 mandatory active days of trading (they don’t need to be consecutive).

- A ‘trading day’ is counted when you open at least one new position on that day in the Prague Time zone (CE(S)T). At midnight Prague Time (CE(S)T), the system records the account’s balance value, and from that point, you are not allowed to exceed the daily loss limit.

- Why it matters: “To be honest, I thought 4 days sounded easy, but when I started, just sitting out and waiting cost me mental energy.”

4.2. Profit target

This is the ultimate goal of the FTMO Challenge: showing that you can grow an account while managing risk consistently. Developing a clear trading plan is crucial to achieving this, as it defines your strategy for hitting profit goals without breaking the rules.

- During the Challenge stage, you must achieve 10% profit of your initial account balance.

- During the verification stage, you must achieve 5% profit, with all other risk rules unchanged.

- Example: If your account size is $100,000, you’ll need $10,000 profit in the challenge.

4.3. Maximum daily loss

You must avoid losing more than 5% of your initial balance in one trading day, including both closed and floating P&L.

- The rule: You cannot lose more than 5% of your initial balance in a single trading day (closed + floating P&L) during the Challenge and Verification.

- Real-life note: I once opened a trade late in the day, went to sleep, and woke to a floating deficit that pushed me over the daily limit scary.

4.4. Maximum loss (Drawdown)

Your equity must stay above 90% of the initial balance, allowing for an overall loss of 10%. This includes both closed and open positions, swaps, and commissions.

- Over the entire evaluation period, your equity must never fall below 90% of the initial balance (i.e., you’re allowed up to 10% total loss).

- Includes both closed and open position losses, swaps, and commissions. Equity matters, not just balance.

- This rule is non-negotiable. Breaching the limit leads to the termination of your evaluation, meaning your attempt will immediately end without a refund.

5. What are the FTMO challenge rules? Do’s and don’ts

Rules for ftmo challenge are designed so that you trade responsibly with real-market conditions in a simulated account. In this section, you’ll find the FTMO rules explained clearly, covering both risk management and trading behaviour. Meet the objectives, avoid the risk limits, and you move to the next stage.

| Do’s | Don’ts |

|---|---|

| Use a replicable strategy: FTMO emphasizes that your trading method must be “replicable in the real market.” | Don’t ignore the time zone rule: The day resets at midnight Prague Time (CE(S)T). If you think your loss happened tomorrow, but it’s still counted as the same day, you might violate the rule. |

| Respect the risk limits from day one: The rules clearly state that you must stay within the Maximum Daily Loss (5%) and the overall loss limit (10%) of the initial balance. | Don’t assume you can exceed the drawdown: At no point may your equity fall below 90% of the original account in Challenge or Verification. |

| Trade at least on 4 different days: It doesn’t mean four days in a row, but four distinct trading days during the Challenge. | Don’t trade without a plan just to hit the profit target: If you push too hard, you might hit limits or breach rules. It’s better to trade smart than trade fast. |

| Focus on performance metrics, not big wins: As FTMO says, the Evaluation Process is about showing you can trade long-term and responsibly with a clear strategy. | Don’t assume you’re trading live funds: Though you trade real-market data, the funds during Challenge and Verification are simulated. FTMO emphasizes this. |

| Use their free trial if you’re not ready: FTMO offers a free trial (demo) account so you can get a feel for the rules without pressure. |

When I took the FTMO challenge, I opened a position late in the day. I woke up to a floating loss that pushed me past the daily limit. And just like that, the challenge ended. Lesson? Always check your time zone, day reset, and open positions before midnight CE(S)T.

Tip: Set a personal limit for the day, say -3% instead of the full -5%. That way, you cushion yourself against unexpected swings or slippage.

6. How to pass the FTMO challenge

Many traders want to know how to pass FTMO challenge, and the answer lies beyond just hitting profit goals. To succeed, you must trade smart, manage risk strictly, and show consistent performance rather than just chasing quick gains.

6.1. Understand the framework

First things first, understand the rules of the game. FTMO’s evaluation process requires:

- A 10% profit target in the Challenge stage.

- A 5% maximum daily loss of your starting balance.

- With a 10% overall loss limit, you can’t let your equity fall below 90% of the start.

- At least 4 trading days in the phase.

- There is no time limit to complete the phase; you can take your time (phew!).

So yes, the rules are clear. If you skip one, you fail. And trust me, that’s a real worry.

6.2. Prepare your trading plan

Before you click “Start,” I’d honestly recommend you sit down and map out this:

- Decide your trading style (day trading, swing …) and which instruments you’ll trade.

- Set daily goals & risk limits (e.g., risk ≤ 2% per trade).

- Pick a few setups you know well; don’t trade random pairs just because “something moves.”

- Use a demo account to test your plan so that when you go live (or demo under live conditions), you’re ready.

FTMO emphasizes the part about “replicable in the real market” and “responsible money management.”

6.3. Trade with discipline & consistency

Here’s where most fail because the rules are met, but consistency isn’t. So:

- Focus on quality trades, not many trades.

- If you hit your daily loss cap (5%), stop trading that day. Yes, actually stop.

- Keep at least 4 trading days, but they don’t need to be consecutive. So don’t force trades if the setups aren’t there.

- Be aware that midnight CET/CEST is the cutoff each day for the floating losses count, so don’t leave open risky trades unattended.

6.4. Avoid high-risk behaviours & mistakes

Let’s be honest: We all have that “let’s go big” moment. But under FTMO rules, that’s dangerous. Some things to avoid:

- Chasing profits by taking huge risks.

- Ignoring the max drawdown or daily loss. One breach and it’s over.

- Trading during highly unpredictable news unless you have a plan. FTMO itself notes that market fluctuations and liquidity play a crucial role.

6.5. Use the advantage of time

Here’s a “secret” many overlook: FTMO doesn’t hurry you. No time limit means you can progress at your own pace if you trade correctly. So take your time. Think of it as building a habit. The goal isn’t just to pass. It’s to show you can trade under these rules and build something sustainable. That mindset shift? It makes a big difference.

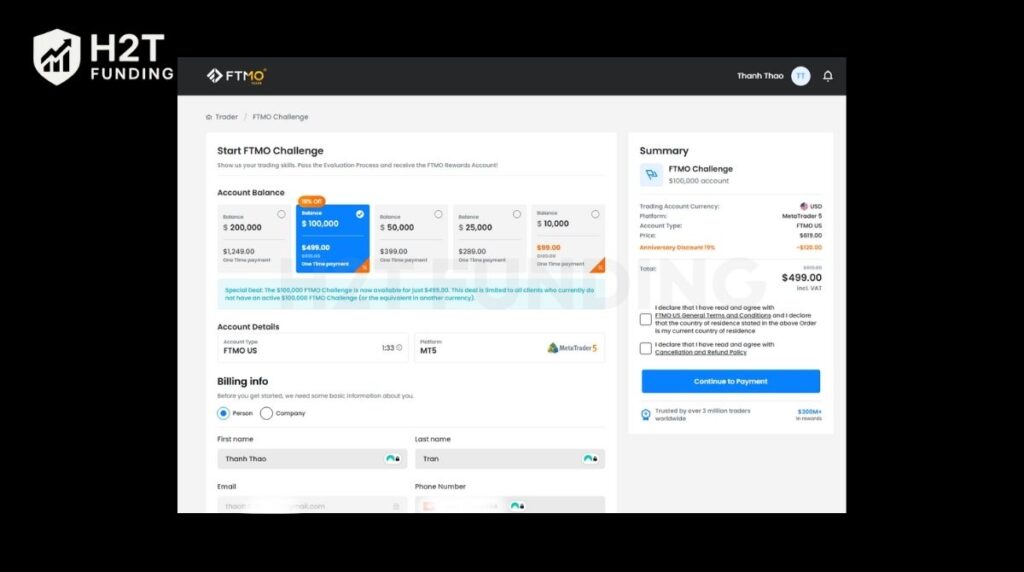

7. FTMO refund policy & payment methods

When you pay for the FTMO Challenge, it’s not just a fee; it’s an investment in your trading potential. One of the main rewards is that once you pass both the Challenge and Verification stages, you’ll receive your initial Challenge fee back with your first profit withdrawal.

So, basically, if you succeed, the cost of entering the Challenge is covered by your own earnings.

What’s important to note? The fee is a one-time payment before you start, and it’s required to access the FTMO trading platform and its evaluation process. FTMO explains that this fee covers the development and operation of the entire system. You’ll pay it upfront, but if you make it to the payout stage, you’ll get it refunded, which is a win-win!

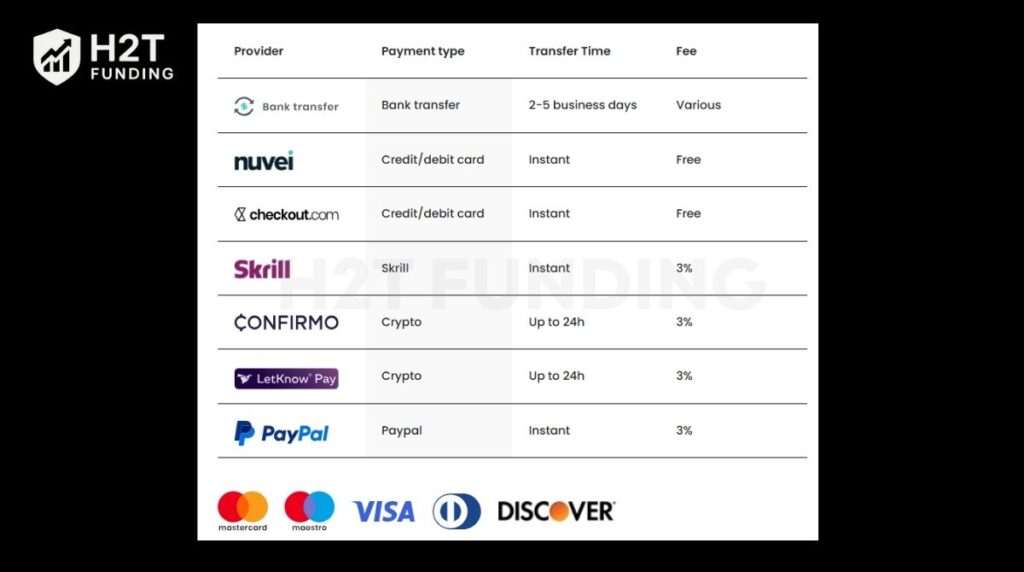

As for payment methods, FTMO offers several options: Bank Transfer, PayPal, Skrill, Mastercard, Maestro, Visa, and Discover. These are all global methods, so no matter where you are, you should have a convenient option to pay. However, depending on your country, the specific methods available might vary slightly.

So, to sum it up:

- You pay upfront for the Challenge.

- If you succeed, you get that fee refunded with your first profit.

- Payment methods are flexible, but always double-check what’s available in your region.

Honestly, I love this system because it gives you a chance to earn the entry fee back. It’s like betting on yourself, and FTMO backs it up!

8. Important terms & conditions you must know

Before you dive into the challenge, you should know the legal framework, account nature, and what you’re really committing to.

8.1. Account nature

Understand the fundamental nature of the challenge account; it’s a simulated (demo) environment, not a live funded account, even with real-market conditions.

- In fact, despite the serious trading conditions, both the Challenge and Verification stages are run within a demo environment that mimics live markets.

- So yes, you trade “as if” it’s real, with real-market spread, swaps, and liquidity. But the funds are not yours at this point.

- Why that matters: It means the fee you pay to start is basically the cost of proving your discipline.

8.2. No time limit

A significant update for traders: FTMO has removed the rigid time limits for completing the evaluation stages, reducing psychological pressure.

- Good news: FTMO removed rigid time caps for the challenge. You take as long as you need to hit the profit target.

- This means you’re not forced into rushing trades just to finish by a deadline.

- My take: Finally, we traders get to work at our rhythm and not race the clock.

8.3. Fee refund & your cost

Review the upfront cost of the challenge and understand the specific conditions required to receive a full refund of your initial fee upon success.

- There is a fee for participating in the challenge (varies by account size).

- Once you become an FTMO Trader (complete both stages successfully), this fee is refunded with your first reward payment.

- So, you pay upfront, but if you succeed, it comes back to you.

8.4. Scaling plan & growth opportunity

Passing the evaluation is just the start; this section details the optional program for increasing your account capital over time based on performance.

- After you’re trading on an FTMO Account (post-evaluation), FTMO provides a clear Scaling Plan. This growth opportunity allows you to increase your capital once consistent performance is proven, which is another key benefit for successful traders.

- Important: rules for scaling are separate from the Challenge rules; keep that in mind.

8.5. Legal & compliance considerations

Grasp the key legal distinctions of FTMO’s service; they are not a broker, and you must verify regional eligibility before participating.

- FTMO’s terms clearly state that they provide simulated trading services and are not a broker accepting deposits.

- That means you’re not opening a live funded account initially; you’ll trade in simulation and only move to a funded account after passing the evaluation.

- A key point: Check whether participation is allowed in your jurisdiction. Some regions may have restrictions.

9. Common mistakes & how to avoid them

Even the best traders slip up in the FTMO challenge, not because they lack skill, but because they ignore the small details. Let’s look at the most common traps and how you can avoid them.

- Breaking the daily loss limit: Many traders forget that the 5% daily loss rule includes both closed and open trades. A single floating loss overnight can end your challenge. Always check equity before midnight CET/CEST.

- Overtrading out of pressure: Some think trading more means faster profit; it doesn’t. The rules reward consistency, not volume. Adhering to the predefined risk limits by waiting for setups that fit your plan is crucial, even if that means sitting out for a few days.

- Ignoring the minimum trading days: You need at least four trading days to complete each phase. It sounds simple, but rushing or taking one-day wins won’t count until you’ve met this requirement.

- Risking too much per trade: Risking 3–5% per trade might feel bold, but it leaves no room for error. FTMO’s rules test how you manage your capital. Keep risk per trade at 1–2%, tops.

- Trading during major news events: High-impact news often causes volatility and slippage; both can break the loss limit before you react. FTMO encourages caution around such events.

- Emotional revenge trading: One loss shouldn’t trigger another impulsive trade. Remember, the challenge isn’t a sprint. It’s about maintaining composure and discipline.

- Forgetting to track time zones: The reset at midnight CET/CEST matters more than you think. A trade opened five minutes before reset might count toward the wrong day and break your daily loss rule.

Passing the FTMO challenge isn’t just about hitting profit targets; it’s about avoiding mistakes that end most traders early. If you can manage emotions, risk, and patience, you’re already halfway there.

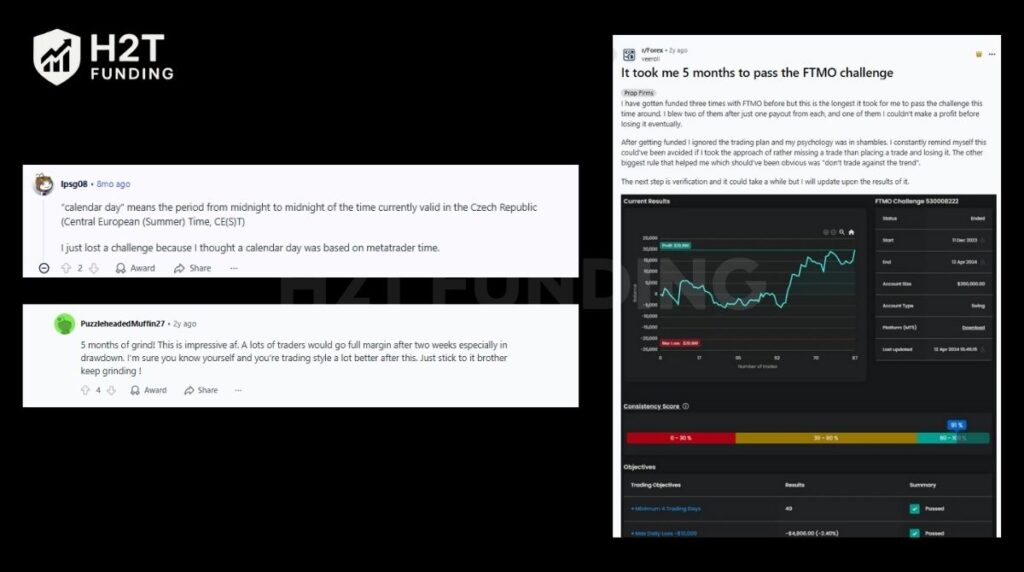

10. FTMO challenge rules Reddit

When it comes to the FTMO Challenge, the journey is rarely smooth sailing. Many traders on Reddit share their experiences, offering a glimpse into the real challenges they face and the lessons they learn along the way.

From struggling with patience to miscalculating the calendar day time zone, these stories provide valuable insights for anyone thinking about taking the challenge.

From personal experiences shared on Reddit, it’s clear that passing the FTMO Challenge requires more than just technical skills; it’s about consistency, patience, and mastering your emotions. While the profit target may seem like the main goal, many traders fail because they don’t stick to the strict rules or don’t fully understand them.

11. FAQs – Frequently asked questions

There isn’t an official “1% rule” written by FTMO, but many traders use it as a personal guideline: risk only 1% of your account per trade. It’s a smart, self-imposed limit to stay safe within FTMO’s stricter 5% daily loss and 10% overall loss rules.

This isn’t part of FTMO’s official rules either; it’s a community tip. The idea is: after entering a trade, don’t panic or close it within two minutes. Give the market space to breathe. It’s more about trader psychology than FTMO regulation.

Yes, traders in the United States can take the FTMO challenge. FTMO provides a remote evaluation, meaning you trade through their simulated environment from anywhere. There’s no restriction based on location, as long as you comply with FTMO’s Terms & Conditions.

This is a trader saying, not an FTMO rule: “90% of traders lose 90% of their capital in the first 90 days.” It’s a reminder that discipline matters. FTMO’s whole model of profit targets, loss limits, and evaluation stages is built to filter out exactly this 90%.

Follow the Evaluation Process: Hit the profit target (10% Challenge, 5% Verification). Stay under the daily and total loss limits. Trade at least 4 days. Focus on consistency over speed. And, honestly, take your time. FTMO now gives no time limit, so patience really pays off.

As of 2024, FTMO removed the time limit entirely. You can take as long as you need to meet the objectives. This change helps traders trade calmly instead of rushing.

Breaching the daily loss limit at any point during the Challenge or Verification phase will result in Account Termination. Your attempt will be considered a failure, so it’s crucial to monitor your risk closely to avoid this outcome.

FTMO allows a maximum daily loss of 5% of the initial account balance. This includes both realized and unrealized losses (floating losses). Exceeding this limit results in automatic termination of the challenge or funded account.

The FTMO Challenge phase lasts for 30 calendar days. You must meet the profit target and follow the risk management rules within this period. It’s essential to pace your trades and not rush to meet the target.

Yes, you can hold trades overnight or during news events. However, if you are using the Swing Account, it’s advised to avoid holding positions during major news events to ensure your risk exposure is within FTMO’s guidelines.

The FTMO Challenge fee varies depending on the account size you choose. Typically, it starts at $155 for a $10,000 account and increases with higher account sizes. Check FTMO’s official website for detailed pricing information.

If you fail the Challenge but have ended in profit and did not break any rules, FTMO offers a free retry. If you fail due to rule violations or a breach in the risk limits, there is no refund.

Yes, FTMO accepts payments via cryptocurrencies, including Bitcoin and other popular coins, as well as traditional payment methods like credit cards, bank transfers, and PayPal.

FTMO supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms. You can choose your preferred platform when signing up for the Challenge.

Yes, you can have multiple FTMO accounts, but you must follow all trading rules for each account. FTMO allows traders to manage multiple funded accounts as long as each account is handled independently.

Once you pass the Verification stage, it typically takes 2–5 business days to receive your funded account details and start trading with real capital.

FTMO offers a profit split of up to 90% for traders who pass the Challenge and Verification phases. The exact percentage depends on the agreement, with the trader keeping most of the profits.

FTMO does not allow extensions for the Challenge period. However, if you do not meet the requirements within 30 days, you can purchase a new challenge.

12. Conclusion

At the end of the day, understanding the FTMO challenge rules isn’t just about passing a test; it’s about becoming a disciplined, self-aware trader. Every number in those rules: 10% profit target, 5% daily loss, and 4 trading days – exists to measure your consistency, not your luck.

If you follow them with patience and purpose, you’re already standing out from 90% of traders who give up too soon. Remember, the Challenge is built to mirror the real trading world with strict risk limits, real-market conditions, and zero shortcuts. Once you accept that, trading feels calmer, more deliberate… almost freeing.

These FTMO Prop Firm Challenge Rules reflect how professional traders operate under real market conditions with risk control, emotional balance, and a methodical approach. At H2T Funding, we’ve seen countless traders grow from frustrated beginners into confident, funded traders by mastering these principles. So, take your time, respect the limits, and keep refining your plan.

If you’re serious about becoming a funded trader, explore more insights in our Prop Firm & Trading Strategies section, where we also share practical tips for educational growth and long-term success.

Once you understand the FTMO Funded Challenge Rules, it becomes clear that rule adherence and a solid trading plan are the keys to becoming a funded trader, unlocking future scaling opportunities.