Have you ever watched your account balance evaporate after just a few trades because of high leverage? You’re not alone. The allure of big profits using borrowed capital is a powerful one, but it often ends in the painful reality of magnified losses. This experience often forces traders to ask one of the most critical questions of their career: Can you make money in forex without leverage?

Yes, you absolutely can. But it’s not as simple as just turning off a switch. Making money without leverage demands a completely different mindset, one focused on strategy, patience, and yes, a healthier amount of capital. In this guide, H2T Funding explores the practical realities of trading without borrowed funds, helping you decide if this is safer.

Key takeaways:

- Profit is possible, but slower: can you make money trading forex without leverage? Yes, but your profit potential is directly tied to your own capital, leading to smaller, more gradual gains.

- Drastically reduced risk: The primary benefit is the elimination of margin calls and the amplification of losses, offering superior capital protection.

- Significant capital is required: To make meaningful returns without leverage, a substantial trading account balance is necessary.

- A different psychological approach: Trading without leverage fosters discipline, patience, and a long-term perspective, removing the stress and greed often associated with high-leverage environments.

- Ideal for specific traders: This method is best suited for long-term investors, traders with large capital, and beginners focused on learning the ropes without the risk of blowing up an account.

1. What is leverage in forex trading?

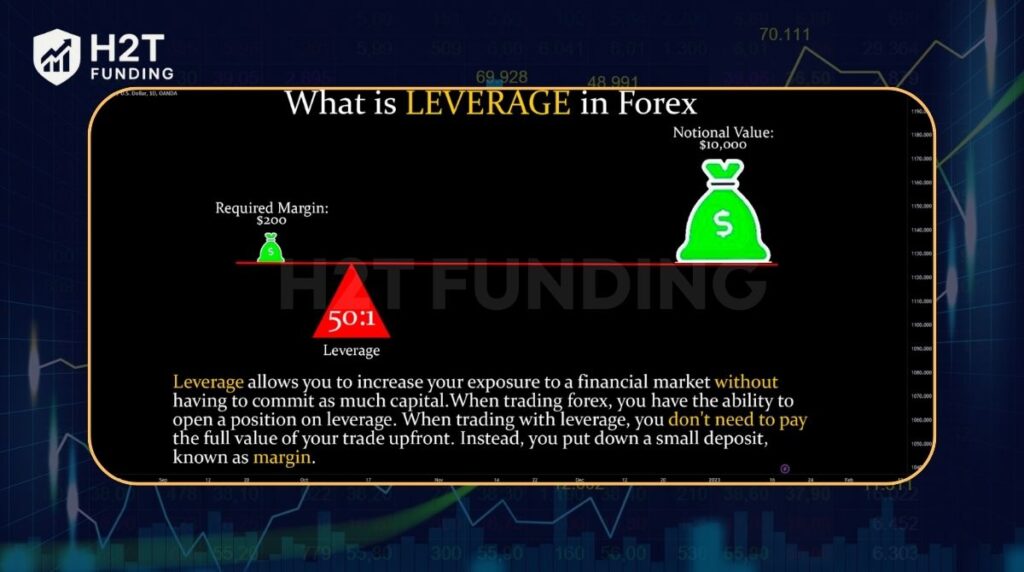

In forex, leverage is essentially a loan provided by your broker. It allows you to control a large position in the market with a relatively small amount of your own money, which is held as a deposit known as margin.

For example, with 100:1 leverage, you can control a $100,000 currency position with just $1,000 of your own capital.

To better understand how leverage amplifies both gains and losses, let’s look at a practical scenario. Imagine you have a $1,000 account and you want to open the largest possible position with your capital. Let’s see what happens if the market moves 1% in your favor (profit) or 1% against you (loss).

| Metric | Low Leverage | Medium Leverage | High Leverage |

|---|---|---|---|

| Leverage Ratio | 1:10 | 1:100 | 1:500 |

| Your Capital (Margin) | $1,000 | $1,000 | $1,000 |

| Profit (if price moves +1%) | +$100 | +$1,000 | +$5,000 |

| Loss (if price moves -1%) | -$100 | -$1,000 | -$5,000 |

| Maximum Position Size | $10,000 | $100,000 | $500,000 |

| % Gain/Loss on Initial Capital | 10% | 100% | 500% (Account Wipeout) |

To see how leverage affects the capital required for a trade, let’s look at an example. The table below shows the margin needed for a trader with a $1,000 account to open the same trade, a single micro lot (0.01 lots), using different leverage ratios. A micro lot controls 1,000 units of currency, which we’ll value at $1,000 for this illustration.

| Account balance | Leverage | Margin required (for 0.01 Lot) | Lot size | Pip value |

|---|---|---|---|---|

| $1,000 | 1:1 | $1,000 | 0.01 | ~$0.10 |

| $1,000 | 1:30 | ~$33.33 | 0.01 | ~$0.10 |

| $1,000 | 1:100 | ~$11.00 | 0.01 | ~$0.10 |

| $1,000 | 1:500 | ~$2.00 | 0.01 | ~$0.10 |

As you can see, higher leverage significantly reduces the margin needed to open a position, freeing up your capital. However, while leverage magnifies your potential profits from small price movements, it also equally magnifies your potential losses.

2. Can you make money in forex without leverage?

Can you make money in forex without leverage? Yes, you can absolutely generate profit in the forex market without using leverage. However, the scale of that profit will be directly proportional to the capital you invest. Since currency pairs typically experience small daily price fluctuations, the returns on an unleveraged account will be modest compared to a leveraged one.

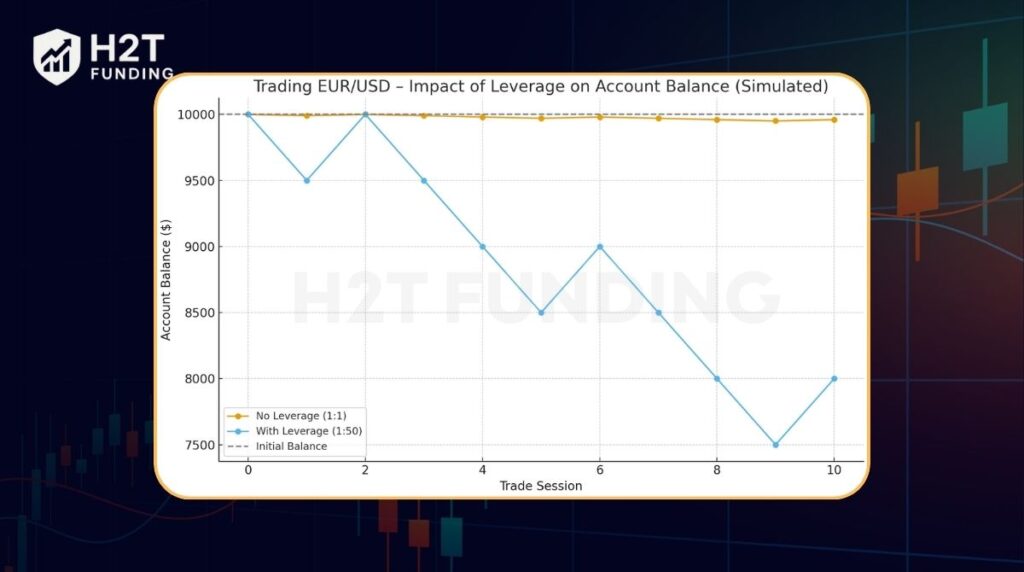

This approach transforms forex trading from a high-speed, high-stakes endeavor into a more traditional, long-term investment strategy focused on capital preservation and steady growth. To see exactly how leverage affects profit in forex, let’s compare a practical example of a trade with and without it.

Example:

- Trading Capital: $10,000

- Currency Pair: EUR/USD

- Trade: Go long (buy)

- Profit Target: A 100-pip move in your favor

Case 1: Trading without leverage (1:1)

With a $10,000 account balance, you can buy $10,000 worth of EUR/USD. A 100-pip move on this position size would result in a profit of approximately $100. This represents a 1% return on your capital. The trade is safe, and your risk is contained, but the profit is slow.

Case 2: Trading with leverage (e.g., 1:50)

With 1:50 leverage, your $10,000 in funds can command a $500,000 position. That same 100-pip move in your favor would now generate a gain of approximately $5,000, representing a 50% return on your investment. The potential for such earnings is immense, but the downside is just as severe. An identical price swing against you would inflict an equivalent loss, erasing half of your account from a single trade.

This comparison clearly shows that while profit is smaller without leverage, the risk to your account balance is dramatically reduced.

3. Compare trading with leverage and without leverage

While both leveraged and non-leveraged trading operate on the same fundamental principles of speculating on currency price movements, the practical experience and outcomes can be worlds apart. In either approach, a trader relies on technical or fundamental analysis to predict the direction of currency pairs.

While both trading methods operate on the same principles of speculating on currency price movements, the experience of trading forex with leverage is vastly different from trading without it. To understand these differences clearly, let’s compare the two approaches side-by-side.

| Feature | Trading with leverage | Trading without leverage |

|---|---|---|

| Profit potential | Magnified returns: Allows for significant profits even from small price movements. | Direct returns: Profit is limited to the actual percentage gain of the trade. |

| Risk exposure | Magnified losses: High risk of rapid account depletion and exposure to margin calls. | Limited risk: Maximum loss is capped at the capital invested; no risk of margin calls. |

| Capital needed | Low: A small account can control a large market position. | High: Requires substantial capital to open positions of a meaningful size. |

| Trading psychology | High stress: Can trigger emotional decisions like greed, fear, and over-trading. | Low-stress: Promotes a patient, disciplined, and calm approach to trading. |

| Accessibility | High: Accessible to traders with a small amount of starting capital. | Limited: More suitable for traders with a large account balance. |

4. Pros and cons of forex without leverage

Trading without borrowed funds offers a distinct set of advantages and disadvantages that cater to a specific type of trader.

Pros:

- Significantly reduced risk: This is the most significant advantage. You cannot lose more than the capital you put into a trade, and the concept of a margin call is entirely eliminated.

- Promotes discipline and better habits: Without the shortcut of leverage, you are forced to rely on sound analysis, solid risk management, and patience, building the foundations of a sustainable trading career.

- Less emotional stress: Knowing that a single trade cannot wipe out your account reduces the mental pressure and emotional decision-making that plagues many leveraged traders.

- No associated costs: You avoid any potential fees or interest charges (swaps) that can be associated with borrowing funds from a broker for leveraged positions.

- Realistic profit potential based on historical price movement: Even without leverage, there is a potential to earn meaningful returns if you trade wisely.

- EUR/USD: This pair has an average daily volatility of approximately 70-100 pips. For instance, if you open a buy position for one standard lot (100,000 EUR) and the market moves 80 pips in your favor, your profit would be $800. To execute this trade, your account would need sufficient capital to purchase €100,000 (e.g., around $108,000 at an exchange rate of 1.0800).

- GBP/USD: This pair is typically more volatile, with an average daily movement of about 80-150 pips. A similar trade capturing a 100-pip favorable move would result in a $1,000 profit.

Example:

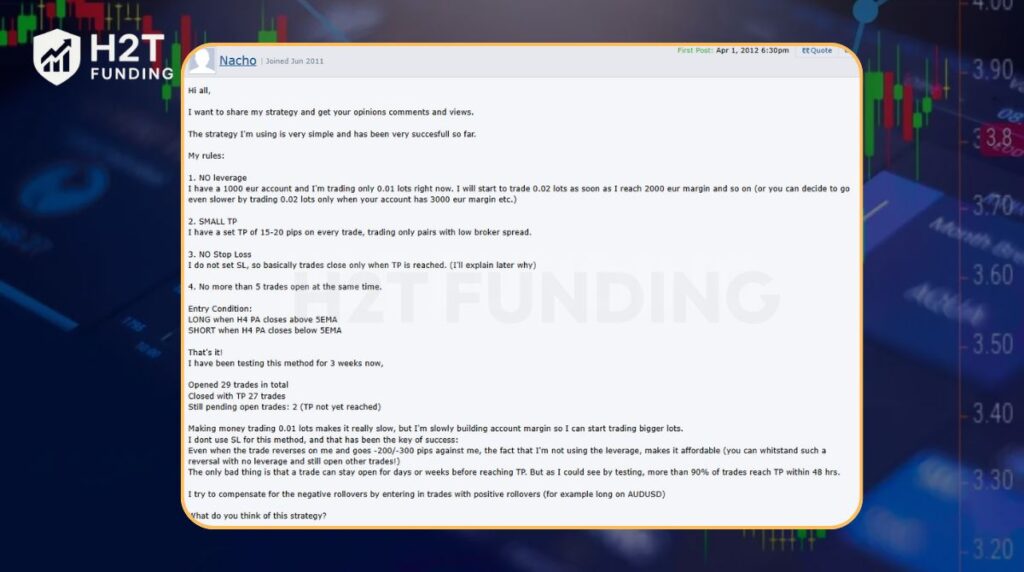

A trader shared that they trade without leverage using a €1,000 account, placing only 0.01 lots per trade. They target small profits of 15–20 pips and avoid stop losses. In three weeks, they opened 29 trades and 27 hit their profit targets. Even when prices moved 200–300 pips against them, the lack of leverage made these swings manageable.

This demonstrates that trading without leverage can still be profitable. By focusing on small, predictable intraday movements, managing trade size carefully, and avoiding excessive risk, traders can steadily grow their accounts over time. This approach also reduces emotional stress and prevents catastrophic losses, turning forex trading into a more controlled and sustainable investment strategy.

Cons:

- Lower return potential: The returns are much smaller. Earning a substantial income requires a very large amount of capital.

- Requires large capital: To make profits that are worth the time and effort, you need a significant starting account balance, often cited as $10,000 or much more.

- Slow account growth: Building your trading account will be a much slower and more gradual process.

- Limited diversification: With a smaller account, you may only be able to open one or two positions at a time, limiting your ability to spread risk across different currency pairs.

5. Who should trade Forex without leverage?

While leverage is a standard tool in retail forex, a no-leverage approach is highly suitable for certain individuals:

- Long-term investors: Those who view currency movements as a long-term investment and are not concerned with daily volatility will find this method aligns with their goals.

- Traders with large capital: An investor with a trading account of $50,000, $100,000, or more may find leverage unnecessary and uncomfortable, preferring to protect their substantial capital from amplified risks.

- Beginners focused on education: New traders who want to learn market dynamics, practice analysis, and develop discipline can do so with real money but without the catastrophic risk of blowing up their account. It’s an excellent way to transition from a demo account.

- Risk-averse individuals: Anyone who has been burned by leverage in the past or has a very low tolerance for risk may prefer this safer approach to the market.

Checklist to start trading without leverage

- Decide your starting capital: determine how much you are comfortable risking. Beginners: $500–$2,000, Advanced: $10,000+

- Select trading instruments: focus on major pairs with low spreads and predictable volatility (EUR/USD, GBP/USD, USD/JPY)

- Set up your trade size: trade small lots relative to your account and never risk more than 1–2% per trade

- Define entry and exit rules: use technical setups like price action or moving averages and set small, achievable take profit targets (15–50 pips)

- Risk management: maintain a minimum 1:1.5 risk/reward ratio and avoid leverage to protect your account from large losses

- Monitor open trades carefully: limit to 3–5 trades at a time, adjust lot sizes as the account grows, and consider rollover effects

- Review and refine strategy: keep a trading journal, analyze success rates and average pips gained/lost, and adjust rules based on historical results

6. Forex brokers without leverage

Trading forex without leverage means using your own capital to open positions, effectively setting your leverage to 1:1. This approach reduces risk exposure and eliminates margin calls, but it requires higher capital to achieve meaningful returns. Many brokers allow you to adjust leverage settings to 1:1, though not all advertise this feature explicitly.

Brokers supporting no-leverage trading:

- FXTM: Offers accounts that allow traders to set leverage to 1:1. Traders can start with any amount and trade micro lots while managing risk carefully.

- FBS: Allows clients to trade without leverage, provided their account balance is $15,000 or more. This setup is suitable for traders who prefer to use their own capital without borrowing.

- XTB: Provides access to real trading with 1:1 leverage on stocks and ETFs. For forex and other CFDs, leverage is higher, but traders can opt for lower leverage settings.

Considerations for trading without leverage:

- Higher capital requirements: Without leverage, you need more capital to open positions of significant size. For instance, trading 0.01 lots on EUR/USD requires approximately $1,000.

- Lower profit potential: Since you’re using your own funds, the potential for profit is lower compared to trading with leverage. However, this also means the risk of loss is reduced.

- Reduced risk of margin calls: Trading without leverage minimizes the risk of margin calls, as you’re not borrowing funds from the broker.

When selecting a broker for no-leverage trading, ensure they offer the ability to adjust leverage settings to 1:1 and check for any minimum deposit requirements or account balance thresholds. It’s also advisable to verify the broker’s regulatory status and reputation in the industry.

7. Forex money-making methods without direct trading or leverage

If the capital requirements for no-leverage trading seem too high, there are other ways to profit from the forex market without engaging in direct, leveraged trading yourself:

- Join forex affiliate programs: Promote a trusted broker and earn commissions based on the trading activity of the clients you refer.

- Provide forex signal services: If you are a skilled analyst, you can sell your trade signals to other traders for a subscription fee.

- Copy trading: Platforms like eToro allow you to automatically copy the trades of professional, successful traders. While these traders may use leverage, your involvement is passive, and you can control your overall risk allocation.

- Invest in a managed forex account (PAMM/MAM): You can invest your capital into an account managed by a professional fund manager who trades on behalf of multiple investors and takes a percentage of the profits.

- Automate trading with forex robots (EAs): Use or develop Expert Advisors (EAs) to trade automatically based on a pre-defined strategy. This still involves trading but removes the manual and emotional elements.

8. Platforms and brokers that support leverage-free trading

Understanding how to trade forex without leverage starts with setting up your trading account correctly. Finding a no-leverage broker is less about a specific feature and more about how you configure your account. Virtually all reputable brokers allow you to reduce your leverage. To trade without leverage, you simply need to request that your leverage be set to 1:1.

In addition to selecting the right broker, it’s helpful to know how to choose a prop firm if you’re considering funded trading options. The key is to find a firm that matches your trading style, risk tolerance, and account size.

When choosing a broker, look for one that:

- It is well-regulated in a major jurisdiction.

- Explicitly allows you to set your leverage level to 1:1.

- Offers account types with competitive spreads and low commissions, as these costs will be more noticeable on smaller percentage gains.

Some brokers that offer flexible leverage settings include XTB, IG Group, and AvaTrade, though you should always verify with the broker directly based on your region and their current offerings.

9. Managing risk when trading forex with or without leverage

Even without leverage, forex trading is not risk-free. The market can fluctuate, and losses are still possible. Understanding what a drawdown is in trading is essential, as it measures the decline from a peak to a trough in your account balance. Applying sound risk management principles, such as controlling trade size and limiting risk per trade, helps minimize drawdowns and protect your capital.

- Use stop-loss orders: Always define your maximum acceptable loss on a trade with a stop-loss order.

- Proper position sizing: Never risk your entire account on a single trade. A common rule is to risk only 1-2% of your total account balance per trade.

- Understand volatility: Be aware of the typical price movements of the currency pairs you trade to set realistic profit targets and stop losses.

- Continuous education: The market is always changing. Dedicate time to ongoing learning through educational resources to refine your strategy.

10. Forex without leverage Reddit

Exploring discussions on Reddit about trading forex without leverage reveals a range of perspectives from both beginners and experienced traders. While some view it as a prudent approach to mitigate risk, others question its practicality due to limited profit potential.

Key Insights from Reddit Discussions:

- Understanding leverage: A user shared their apprehension about using leverage, stating, “I suppose I don’t fully understand leverage and how quickly I could lose everything. I have a lot to learn and would rather make small gains to start instead of losing everything right away.”

- Profitability concerns: Another trader noted, “Without any leverage, I don’t think the prices in forex will move enough to make it worthwhile for you, unless you’re putting in large sums of money.”

- Alternative strategies: Some Redditors suggest that trading without leverage might be more feasible with substantial capital or by focusing on instruments like stocks, which can offer higher returns without the need for leverage.

These discussions highlight the importance of understanding leverage and its implications on trading strategies. For those considering trading without leverage, it’s crucial to assess personal risk tolerance, capital availability, and the potential returns to make informed decisions.

11. FAQs

Yes, it is possible. You can request your broker to set your account leverage to 1:1, meaning you only trade with your own capital.

You can technically open an account with a small amount. However, to make trading worthwhile and see any meaningful profit, a starting capital of at least $5,000 to $10,000 is often recommended. To trade larger lot sizes, you would need significantly more.

Leverage is not necessary to make a profit, but it is necessary to make a significant profit with a small amount of capital. Without it, profits are much smaller and more gradual.

There are no brokers that exclusively offer “no leverage.” Instead, most regulated brokers allow traders to request 1:1 leverage, which is the equivalent of trading without any borrowed funds.

Yes, it is substantially safer. It eliminates the risk of a margin call and prevents losses from being magnified, which is the primary reason traders lose their capital quickly.

For the majority of retail traders with smaller account balances, leverage is considered necessary to make trading forex worthwhile due to the small percentage movements in currency prices. However, it is not a requirement to participate in the market.

Yes, forex trading is absolutely possible without leverage, provided you have sufficient capital and adjust your profit expectations accordingly.

To effectively manage trades and see returns that justify your time, an account balance of over $10,000 is a realistic starting point for trading mini lots. To trade a standard lot, your account would need to exceed $100,000.

Attempting to turn $10 into $1000 would require taking on an extreme level of risk using the highest possible leverage. It is more akin to gambling than professional trading and has an exceptionally high probability of resulting in the loss of your capital. A sustainable trading career is built on realistic goals and sound risk management, not high-risk gambles.

Yes, trading forex without leverage is generally considered more aligned with Halal principles. The main reason is that it helps you avoid Riba (interest), as you are not borrowing funds. This eliminates overnight interest charges (swaps) common in leveraged trading. For full compliance, using a swap-free or Islamic account is recommended.

Yes, you can start trading with $100, but it comes with limitations. With such a small account, your ability to diversify trades or withstand market swings is limited. It’s ideal for practice, learning risk management, and understanding market behavior, rather than expecting significant profits right away.

No, 1:500 leverage is generally too high for beginners. While it can magnify gains, it also greatly increases the risk of large losses. Beginners are better off using low or no leverage to focus on learning proper risk management, building discipline, and protecting their capital while gaining experience in the forex market.

12. Conclusion

Can you make money in forex without leverage? The answer is a definitive yes, but it’s a path that requires both patience and significant capital. Are you a trader who prioritizes preserving your funds over the thrill of quick, amplified gains? If so, this method offers a viable and much safer way to engage with the world’s largest financial market.

However, the primary barrier for many talented traders is the substantial capital required to make this approach worthwhile. This is precisely where modern solutions like proprietary trading firms can bridge the gap.

Under our Prop Firm & Trading Strategies section, H2T Funding is built on this very principle. We seek disciplined traders who have honed their skills and provide them with the funded accounts necessary to trade effectively without risking their own savings.