Blueberry Funded vs The5ers is a critical decision for many modern traders seeking professional capital access. Choosing incorrectly often leads to wasted evaluation fees or unexpected account breaches due to a misunderstanding of specific drawdown mechanics.

Blueberry Funded provides flexible broker-backed execution ideal for automated strategies and rapid scaling. Conversely, The5ers emphasizes capital preservation through highly structured risk rules and long-term growth. H2T Funding offers this neutral comparison to help you secure the best funding partner. Explore the full details below.

Key Takeaways

- Blueberry Funded leans toward flexible broker-backed funding, while The5ers uses a structured evaluation and scaling approach.

- Blueberry Funded is more execution-friendly for active traders, while The5ers provides clearer paths for long-term risk control.

- The5ers is established with a decade of history, making it highly reliable for consistent profit withdrawals.

- Blueberry Funded suits active EA-driven traders due to its direct connection to regulated broker infrastructure.

- Traders seeking massive capital growth should consider The5ers for its potential scaling up to $4 million.

1. Overview of Blueberry Funded and The5ers

Blueberry Funded and The5ers serve two fundamentally different trading philosophies. Blueberry Funded operates as a broker-backed firm focusing on execution flexibility and automation. The5ers is a veteran firm dedicated to long-term capital preservation and structured professional growth.

Comparison Table – Overview

| Criteria | Blueberry Funded | The5ers |

|---|---|---|

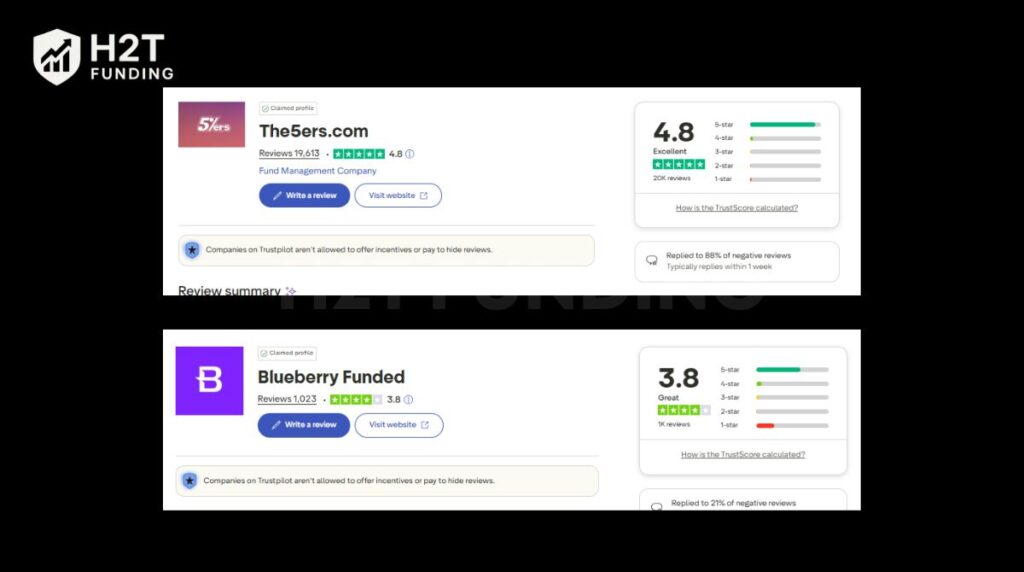

| Trustpilot Score | 3.8/5 (1,000+ reviews) | 4.8/5 (19,000+ reviews) |

| Founded / Trust | 2024 | 2016 |

| Evaluation Models | Prime (2-Step), Rapid, Instant | Hyper Growth, High Stakes, Bootcamp |

| Max Scaling | Up to $2,000,000 | Up to $4,000,000 |

| Asset Classes | Forex, Crypto, Metals, Indices | Forex, Metals, Indices, Crypto |

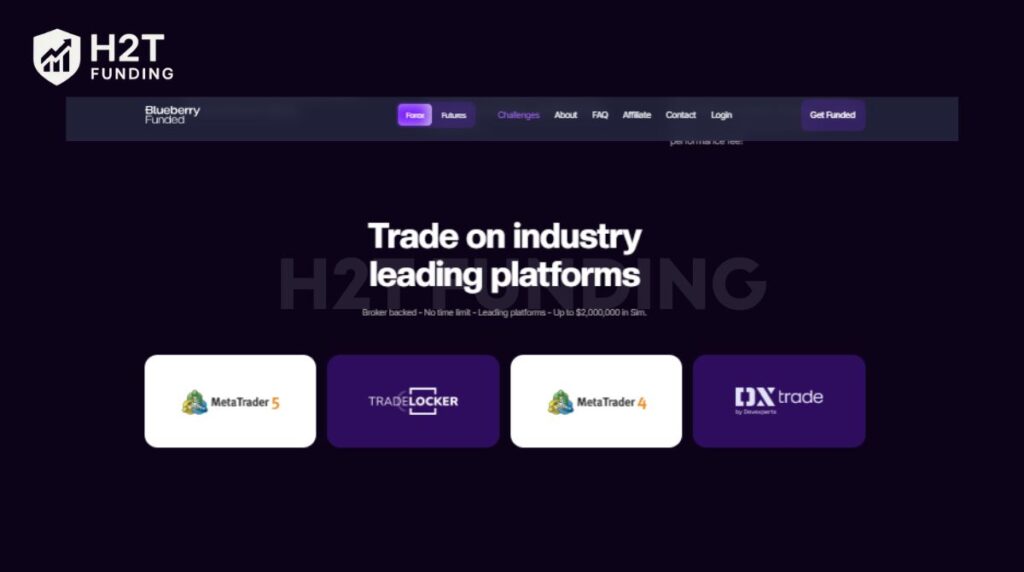

| Trading Platforms | MT4, MT5, TradeLocker, DXtrade | MT5, cTrader |

| Profit Split | 80% to 100% | 80% to 100% |

| Minimum Days | 0 to 5 days | 0 to 3 days |

| Execution Speed | Broker-grade (Low Latency) | Institutional Quality |

| Commissions | $7 per lot (FX/Gold) | Market Standard |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Blueberry Funded vs The5ers websites before purchasing any challenge.

Blueberry Funded is best for active scalpers who require regulated broker infrastructure. The5ers is the superior choice for disciplined traders seeking the industry’s highest trust and massive scaling potential. I suggest aligning your choice with your risk tolerance and platform preference.

Blueberry Funded

#1

Account Types

1-step, 2-step, rapid, and instant funding

Trading Platforms

MT4, MT5, DXTrade, TradeLocker

Profit Target

5% – 10%

Our take on Blueberry Funded

Blueberry Funded stands out as a broker-backed prop firm. They emphasize high-tier execution quality and support for automated trading. This firm leverages the 6-year expertise of Blueberry Markets to ensure a stable environment.

Traders receive direct access to regulated infrastructure. This setup provides raw spreads starting from 0.1 pips. The platform is highly EA and automation-friendly, supporting various modern trading styles.

It is the ideal fit for active scalpers. Those who prioritize speed and low-latency execution will find high value here. I note that the firm’s team brings 20+ years of combined CFD experience.

| Blueberry Funded – Key Facts | Information |

|---|---|

| General Manager | Marcus Fetherston |

| Country | St. Vincent and the Grenadines |

| Date Created | 2024 (Prop Brand) |

| Account Types | Prime, Rapid, Instant Elite/Lite |

| Audition Fees | Starts from $35 (Instant Lite) |

| Time Limit | Unlimited |

| Profit Target | 8% (Phase 1) / 6% (Phase 2) |

| 💳 Challenge Fee | $25 – $1,500 |

| 👥 Account Types | 1-step, 2-step, rapid, and instant funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $1,25K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, Stocks, Futures |

The5ers

#2

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

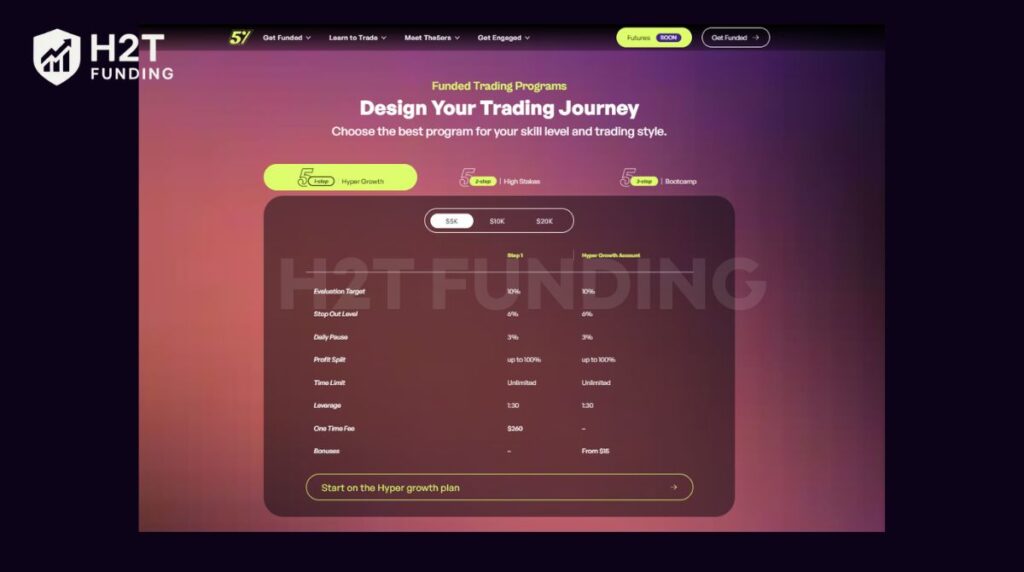

The5ers is a highly respected industry veteran. Since 2016, they have built a reputation for strict risk management and clear growth rules. They focus on finding and developing elite professional traders.

The firm operates with a capital growth mindset. Their structured evaluations favor consistency over high-risk gambles. Traders can scale their accounts up to a staggering $4 million balance.

It is the best choice for disciplined builders. Traders who value community support and long-term reliability will prefer this firm. Their 4.8 Trustpilot rating reflects immense transparency and trader satisfaction.

| Founder | Gil Ben Hur (Trader since 2007) |

|---|---|

| Country | Israel / United Kingdom |

| Active Since | 2016 |

| Account Types | Hyper Growth, High Stakes, Bootcamp |

| Profit Split | Up to 100% + Fixed Payouts |

| Max Allocation | $450,000 (Initial) |

| Community | 256K+ Traders on board |

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

Readmore:

2. Core models and key rules of Blueberry Funded vs The5ers

Understanding the core models is essential for passing your evaluation. Blueberry Funded focuses on rapid entry and broker-backed simplicity. The5ers prioritizes professional consistency through three distinct funding pathways.

2.1. Evaluation Process, Profit Targets & Minimum Days

Blueberry Funded offers the fastest route to capital. Their Instant Funding programs bypass evaluations entirely, allowing you to earn from day one. The5ers focuses on a tiered approach to reward steady performance over time.

| Criteria | Blueberry Funded (Prime) | The5ers (High Stakes) |

|---|---|---|

| Evaluation Structure | 2-Step Challenge | 2-Step Challenge |

| Profit Target | Phase 1: 8% / Phase 2: 6% | Phase 1: 8% / Phase 2: 5% |

| Min Trading Days | 5 Days per phase | 3 Days per phase |

| Time Limit | Unlimited | Unlimited |

| Evaluation Difficulty | Moderate (Standard Targets) | Moderate (Lower P2 Target) |

I find Blueberry Funded easier for instant access. However, The5ers is better for those who want shorter minimum trading days. If you are a confident trader, the 5% target in Step 2 at The5ers is highly attractive.

2.2. Drawdown & Daily Loss Limits

Risk management rules vary significantly between these firms. Blueberry Funded utilizes a Trailing Lock for its instant accounts. The5ers uses a 5% daily loss limit for its High Stakes program to ensure account longevity.

| Criteria | Blueberry Funded (Prime) | The5ers (High Stakes) |

|---|---|---|

| Max Total Loss | 10% (Static) | 10% (Static) |

| Daily Loss Limit | 4% (Fixed amount) | 5% (Based on starting equity) |

| Drawdown Type | Static (Floor never moves) | Static (Floor never moves) |

| Rule Strictness | Balanced for active traders | Stricter for high-stakes risk |

The Trailing Lock is a unique Blueberry mechanic. It trails your profit until it reaches the initial starting balance, then locks forever. The5ers daily pause at 3% (Hyper Growth) acts as a safety net for beginners.

2.3. News, Overnight & Automation Policies

Both firms permit diverse trading styles with specific restrictions. Blueberry Funded is recognized for being highly automation-friendly. The5ers allows news trading but strictly prohibits bracketing strategies during high-impact events.

| Policy | Blueberry Funded | The5ers |

|---|---|---|

| News Trading | Restricted +/- 2 mins (Prime) | Restricted +/- 2 mins (High Stakes) |

| Overnight Trading | Allowed (All programs) | Allowed (All programs) |

| Weekend Trading | Allowed | Allowed (High swaps apply) |

| Automation / EAs | Fully Supported | Supported (Must be unique) |

| Copy Trading | Allowed (Internal) | Restricted (Must own source code) |

Blueberry Funded is the superior choice for EA users. Their infrastructure is optimized for high-frequency automated strategies. The5ers prefers manual or semi-automated traders who focus on Supply and Demand principles. Always verify asset specifications on the platform before holding indices over the weekend.

3. Fees, refunds, and cost efficiency of Blueberry Funded vs 5ers

The5ers offers superior long-term cost efficiency due to its refundable fee structure, while Blueberry Funded provides a lower entry cost for traders seeking immediate market access. Your choice depends entirely on your confidence in passing the evaluation.

| Criteria | Blueberry Funded | The5ers |

|---|---|---|

| Fee Type | One-Time (Non-Refundable) | One-Time (Refundable) |

| Refund Policy | No Refund | Fee refunded upon passing |

| Challenge Cost ($100k) | $650 (Prime Challenge) | $545 (High Stakes) |

| Transparency | High (Praised for clear rules) | Exceptional (9+ years history) |

| Added Fees | Broker-style commissions ($7/lot) | Market-standard spreads/swaps |

| Payout Cycle | Every 14 Days | Every 14 Days |

My analysis shows The5ers provides better overall value for dedicated traders. The refundable fee on their High Stakes program acts as a powerful incentive for success. Blueberry Funded’s Instant programs offer a cost-effective entry point, but the fee is a sunk cost if you fail. Always factor in broker-style commissions at Blueberry when calculating potential profits.

4. Profit Split and Scaling Programs of Blueberry Funded vs The5ers

The5ers offers a more aggressive and potentially lucrative scaling plan, designed to rapidly double account sizes for consistent traders. In contrast, Blueberry Funded provides a steady, milestone-based growth path with quarterly capital increases.

| Criteria | Blueberry Funded | The5ers |

|---|---|---|

| Profit Split | 80% scaling up to 90% | 80% up to 100% + Fixed Payouts |

| Scaling Plans | Increase balance by 25% every 3 months | Double your account on every 10% milestone |

| Payout Frequency | Every 14 Days | Every 14 Days |

| Minimum Payout | $100 (Instant Accounts) | First profitable withdrawal cycle |

| Withdrawal Conditions | 3-5 active trading days per cycle | 3 profitable days per cycle (High Stakes) |

My analysis suggests The5ers is superior for ambitious capital builders. The Hyper Growth model, which doubles your account after each 10% gain, provides one of the fastest scaling tracks in the industry.

Blueberry Funded’s program is better suited for methodical traders who prefer a predictable, quarterly review cycle. The 100% split plus fixed payouts at higher tiers make The5ers exceptionally rewarding for elite performers.

5. Trading platforms and assets in Blueberry Funded vs 5ers

Blueberry Funded offers greater platform diversity, while The5ers provides access to the industry-leading cTrader platform, making it a top choice for traders in the USA. Both firms deliver high-quality execution, but their technological approaches cater to different trading preferences.

| Criteria | Blueberry Funded | The5ers |

|---|---|---|

| Trading Platforms | MT4, MT5, TradeLocker, DXtrade | MT5, cTrader |

| Asset Classes | Forex, Crypto, Metals, Indices | Forex, Metals, Indices, Crypto, Commodities |

| Execution Speed | Broker-Grade (Low Latency) | Institutional Quality |

| Commissions & Fees | $7 per lot (FX/Gold) | Market-Standard Spreads |

| Trader Dashboard | Modern & Integrated | Comprehensive Hub & Resources |

The choice comes down to platform loyalty and cost structure. Blueberry Funded is the clear winner if you require MT4, TradeLocker, or DXtrade. Their transparent $7 per lot commission is a critical factor for high-volume forex and gold traders to consider.

Conversely, The5ers’ adoption of cTrader is a significant advantage for traders seeking advanced charting tools and direct market access. I recommend that traders analyze their preferred platform and asset class to make the most informed decision, as execution environments directly impact performance.

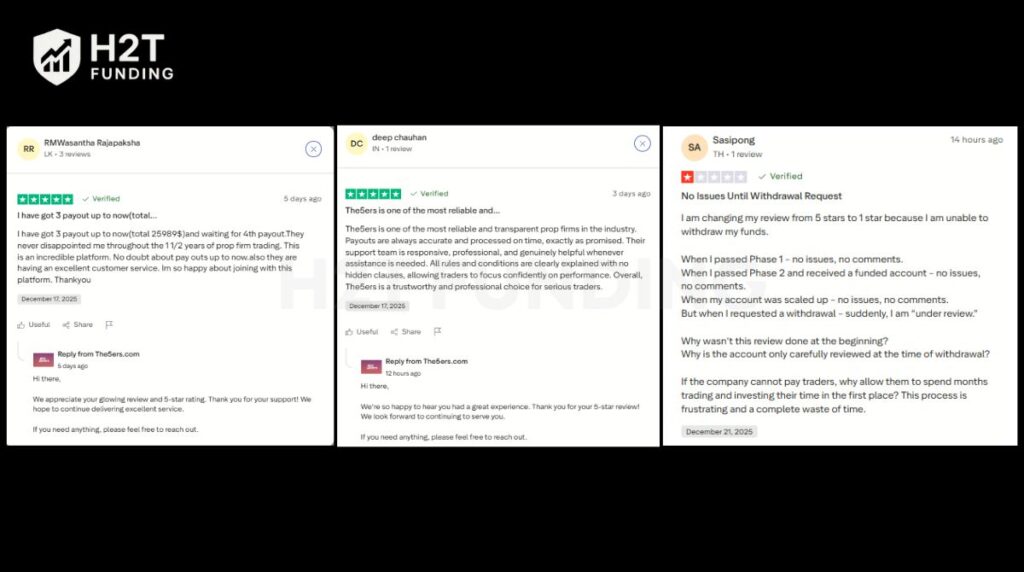

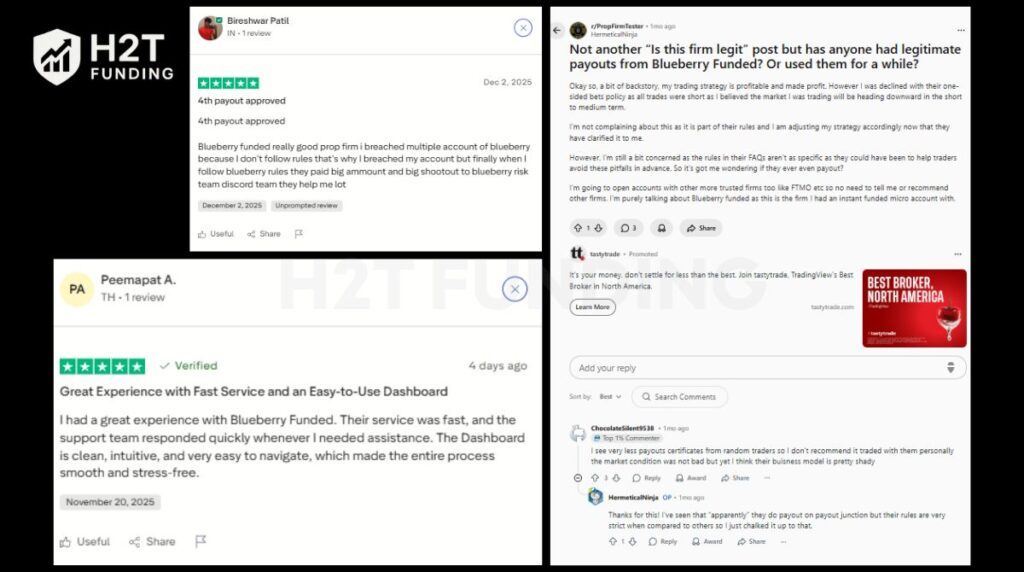

6. Payout trust and community reviews of Blueberry Funded and The5ers

While official rules are important, community feedback reveals the true trader experience. Payout reliability, support quality, and rule clarity are best measured by those who have put their capital and time on the line. We have analyzed hundreds of reviews from Trustpilot and Reddit to provide an unbiased summary.

(Note: Information collected and updated on December 23, 2025)

The consensus shows The5ers enjoys one of the highest trust ratings in the industry, built on nearly a decade of consistent payouts. Blueberry Funded also receives positive feedback, though traders consistently emphasize the critical need to understand and follow their specific, sometimes nuanced, trading rules.

With an exceptional 4.8-star rating from nearly 20,000 reviews, The5ers is overwhelmingly praised for its reliability, smooth payouts, and professional support. This sentiment is consistent across platforms.

The overwhelming sentiment for The5ers is one of trust and professionalism. While isolated issues exist, the vast majority of traders report seamless payouts and fair treatment, provided the rules are followed. The firm’s long history and high volume of positive reviews cement its status as an industry leader.

Blueberry Funded holds a 3.8-star rating on Trustpilot, with over 1,000 reviews. Community feedback is largely positive, but it comes with a strong, recurring theme: you will get paid if, and only if, you follow their specific rules to the letter. Many negative reviews stem from misunderstandings of policies like one-sided bets or lot size restrictions.

The community verdict on Blueberry Funded is clear: it is a legitimate, broker-backed firm that processes payouts reliably. However, their rules, particularly around strategies like martingale, one-sided betting, and lot size limits, are enforced strictly. Success is entirely dependent on a trader’s ability to master and adhere to every detail in the terms and conditions.

7. Which prop firm is easier to pass: Blueberry Funded vs The5ers?

Blueberry Funded is generally easier to pass for traders seeking immediate access, thanks to its Instant Funding models that completely bypass traditional evaluations. However, for standard challenges, The5ers’ rules are often clearer and more straightforward, reducing the risk of accidental breaches for disciplined traders.

The easier firm ultimately depends on your definition of the word: speed of access versus clarity of rules.

| Criteria | Blueberry Funded | The5ers | Winner |

|---|---|---|---|

| Profit Target | Phase 1: 8% / Phase 2: 6% | Phase 1: 8% / Phase 2: 5% | The5ers |

| Drawdown Strictness | Trailing Drawdown on Instant accounts | Static Drawdown on all evaluations | The5ers |

| Rule Complexity | Nuanced rules like one-sided bets | Clear, well-defined trading rules | The5ers |

| Overall Difficulty | Lower barrier to entry (Instant) | Higher premium on discipline | Blueberry Funded |

While The5ers presents more favorable targets and clearer drawdown rules in its evaluations, the ability to skip the challenge entirely makes Blueberry Funded the path of least resistance to a funded account.

If your goal is simply to start trading with firm capital as quickly as possible, Blueberry’s Instant programs are unmatched. If your goal is to pass a traditional evaluation with the clearest possible rules, The5ers has the edge.

8. Who should choose Blueberry Funded, and who should choose The5ers?

Blueberry Funded is the ideal choice for automated and short-term traders who need broker-grade execution, while The5ers is built for disciplined professionals focused on long-term capital growth and risk management. Your decision should be guided by your trading style, platform preference, and ultimate career goals.

This table breaks down the best choice for specific types of traders based on the unique strengths of each firm.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | The5ers | Their Bootcamp program offers a structured, three-step learning path. The rules are clearer and less prone to accidental breaches than Blueberry’s more nuanced policies. |

| Forex Day Traders | Either Firm | Their broker-backed infrastructure provides the low-latency execution and tight spreads essential for high-frequency trading. The 5ers have stricter rules against tick scalping. |

| Scalpers | Blueberry Funded | Their broker-backed infrastructure provides the low-latency execution and tight spreads essential for high-frequency trading. The5ers have stricter rules against tick scalping. |

| Swing Traders | The5ers | Their long-standing reputation and clear rules for holding trades overnight and on weekends provide the stability swing traders need. The scaling plan also rewards a long-term view. |

| Risk-Averse Traders | The5ers | Their entire model is built on capital preservation. With static drawdowns and a strong emphasis on risk management, it is the safer choice for conservative traders. |

| Automated Traders (EAs) | Blueberry Funded | The firm is explicitly EA and automation-friendly, leveraging its broker infrastructure to support algorithmic strategies without the strict source-code rules The5ers imposes. |

| Long-Term Capital Builders | The5ers | Their Hyper Growth program is designed for this purpose, doubling account sizes up to $4 million. This offers one of the most aggressive and rewarding scaling plans in the industry. |

If your strategy relies heavily on EAs, scalping, and broker-level execution speed, Blueberry Funded is your ideal partner. If you are a disciplined, manual trader focused on mastering risk and achieving significant, long-term capital growth, The5ers is the undisputed industry leader.

9. FAQs – People Also Ask (SEO-Optimized)

Yes, Blueberry Funded is a legitimate firm that processes payouts. Community reviews on Trustpilot and Reddit confirm that traders who strictly follow all the rules, including those on lot sizes and trading strategies, receive their profits reliably and quickly.

Blueberry Funded charges a commission of $7 per standard lot for trading on FX pairs and Gold (XAU/xxx). This is a clear, broker-style cost structure that traders should factor into their strategy.

Yes, Blueberry Funded is highly EA-friendly. Their broker-backed infrastructure is well-suited for automated and algorithmic trading strategies, making it a popular choice for traders who rely on expert advisors.

The requirements vary by program. For the standard Prime Challenge, you must achieve an 8% profit target in Phase 1 and a 6% target in Phase 2. You must also stay within a 4% daily loss and a 10% maximum drawdown limit.

Yes, The5ers is one of the most reliable and trusted prop firms in the industry. Founded in 2016, they have a proven track record of consistent payouts and hold an exceptional 4.8/5 rating on Trustpilot from nearly 20,000 reviews.

Absolutely. The5ers has a long-standing reputation for processing payouts smoothly and professionally. Successful traders frequently report receiving large withdrawals without issue, as long as they adhere to the firm’s clear and transparent risk management rules.

Like most prop firms, The5ers provides funded traders with a high-stakes simulated account. You trade with the firm’s simulated capital in a live market environment. The firm then pays you a share of the simulated profits with real money, eliminating any conflict of interest.

Blueberry Funded offers the easiest path to a funded account through its Instant Funding models, which require no evaluation. However, for traditional challenges, The5ers’ rules are generally clearer and more straightforward, making them easier to pass for disciplined traders.

The 5ers is better for beginners. Their Bootcamp program offers a structured, three-step learning process, and their clear rulebook helps new traders avoid the accidental breaches that can occur with Blueberry Funded’s more nuanced policies.

The main difference is Blueberry Funded’s Trailing Lock drawdown on its Instant accounts, which follows your profit until locking at the initial balance. The5ers exclusively uses static drawdowns in its evaluations, which provides a fixed floor that never moves, making it simpler to manage risk.

Both Blueberry Funded and The5ers allow traders to request profit withdrawals on a bi-weekly (14-day) cycle once they are funded.

10. Conclusion

The Blueberry Funded vs 5ers debate ultimately boils down to a single question: Do you prioritize execution flexibility or long-term capital preservation? Your final decision should directly reflect your trading style, risk tolerance, and professional goals.

Blueberry Funded provides a high-speed, broker-backed environment perfect for scalpers, day traders, and those who rely heavily on automated systems (EAs). Its core strength lies in its low-latency execution and direct support for diverse, active strategies.

Conversely, The5ers represents the pinnacle of structured, long-term growth. Its proven history, massive scaling plans, and unwavering emphasis on risk management make it the top choice for disciplined professionals focused on building a sustainable trading career.

Making the right choice is the first critical step toward becoming a successful funded trader. For more in-depth prop firm comparisons and unbiased reviews to guide your journey, explore the expert resources available at H2T Funding.