A successful trader evaluation is worthless if a surprise rule gets you disqualified or you face payout delays. This is the real challenge traders face when comparing prop firms. The Blueberry Funded vs FundedNext debate centers on a crucial trade-off: do you prefer the clear stability of a broker-backed firm, or the immense flexibility of a global industry giant?

Blueberry Funded champions a structured path with transparent, static rules, making it a strong choice for traders who value predictability and stability. In contrast, FundedNext thrives on variety, offering multiple funding models for those seeking aggressive scaling and diverse challenges.

Dive into H2T Funding’s data-driven comparison to find the partner that truly aligns with your trading strategy!

Key Takeaways

- Blueberry Funded focuses on structured 1-Step and 2-Step evaluations, while FundedNext offers a broader range, including multiple evaluation types and instant accounts.

- Blueberry Funded primarily uses clear static drawdown limits, which are often simpler for risk management. FundedNext employs both static and more complex trailing drawdowns depending on the chosen challenge.

- Both firms offer competitive profit splits, but their scaling programs differ. FundedNext provides a faster potential path to a 90% split and a higher account cap, rewarding aggressive consistency. Blueberry Funded’s scaling is steady and integrated within its established broker ecosystem.

- Both provide access to popular platforms like MT4 and MT5. However, their available tradable assets, commission structures, and rules around news trading and EAs vary, catering to different trading styles.

- Blueberry Funded appeals to traders who value transparency and a stable, broker-backed environment. FundedNext is better suited for those who want maximum flexibility in challenge types and aggressive scaling opportunities.

1. Overview of FundedNext and Blueberry Funded

In the prop trading landscape, Blueberry Funded and FundedNext serve distinct trader needs through different strategic approaches. Blueberry Funded leverages its broker-backed foundation to offer a stable and highly transparent environment. It focuses on providing clear trading rules and quality execution, making it a reliable choice for disciplined traders.

FundedNext, on the other hand, operates as a global giant with a massive community and a strong marketing presence. The firm is known for its wide variety of evaluation models, giving traders immense flexibility to choose a path that fits their style. This focus on choice and aggressive scaling attracts a broad spectrum of traders worldwide.

High-Level Firm Comparison

| Criteria | Blueberry Funded | FundedNext |

|---|---|---|

| Founded / Trust | 2024 (Backed by Blueberry Markets) | 2022 (Established Global Brand) |

| Evaluation Models | 1-Step, 2-Step, Instant Funding | 1-Step, 2-Step, Instant, Lite Models |

| Account Sizes | $1,250 to $200,000 | $2,000 to $200,000 |

| Asset Classes | Forex, Indices, Commodities, Crypto | Forex, Indices, Commodities, Crypto |

| Trading Platforms | MT4, MT5, TradeLocker, DxTrade | MT4, MT5, cTrader, Match-Trader |

| Profit Split | Starts at 80%, scales up to 90% | Starts at 80%, scales up to 95% |

| Minimum Days | 3-5 days, depending on the model | 2-5 days, depending on the model |

| Scaling Programs | Yes, up to $2 Million | Yes, up to $4 Million |

| Execution Speed | Broker-backed, low-latency | Standard prop firm execution |

| Commissions | Standard ($7/lot on FX & Gold) | Low, competitive rates |

| Payouts | Bi-weekly (14 days) | Bi-weekly or On-Demand |

| Risk Restrictions | Primarily Static Drawdowns | Mix of Static & Trailing Drawdowns |

This data reveals a clear divergence in philosophy. Traders who prioritize rule clarity and a secure ecosystem may lean towards Blueberry Funded. Those wanting maximum flexibility in challenges and more aggressive scaling will find FundedNext’s offerings compelling. To understand these differences in detail, let’s break down each firm’s specific offerings.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Blueberry Funded and FundedNext websites before purchasing any challenge.

Blueberry Funded

#1

Account Types

1-step, 2-step, rapid, and instant funding

Trading Platforms

MT4, MT5, DXTrade, TradeLocker

Profit Target

5% – 10%

Our take on Blueberry Funded

Blueberry Funded positions itself as a structured and reliable partner for serious traders. Its broker-backed model emphasizes rule clarity and a stable trading environment, appealing to those who prioritize consistency over high-risk strategies. The firm’s transparent conditions are designed to foster long-term relationships with profitable traders.

| 💳 Challenge Fee | $25 – $1,500 |

| 👥 Account Types | 1-step, 2-step, rapid, and instant funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $1,25K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, Stocks, Futures |

FundedNext

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

FundedNext has built its reputation on offering unparalleled flexibility and a massive global reach. It caters to a wide spectrum of traders by providing a diverse menu of evaluation models and aggressive scaling opportunities. This approach empowers traders to select a challenge that perfectly matches their risk appetite and strategy.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

Read more:

2. Core models and key trading rules of Blueberry Funded vs FundedNext

The core rules and evaluation models are where the philosophies of Blueberry Funded and FundedNext truly diverge. These differences directly impact a trader’s trading strategies and approach to strategy development, influencing their risk management and overall path to a funded account. Understanding these nuances is crucial for selecting the right firm.

2.1. Evaluation process, profit targets & minimum days

A prop firm’s evaluation process directly determines how attainable a funded account is. The profit targets and trading day requirements set the pace and difficulty of the challenge. A lower target with fewer required days generally presents a quicker, though not necessarily easier, path to funding.

| Criteria | Blueberry Funded (Prime 2-Step) | FundedNext (Stellar 2-Step) |

|---|---|---|

| Evaluation Structure | Two distinct phases. | Two distinct phases. |

| Profit Target | Phase 1: 8% Phase 2: 6% | Phase 1: 8% Phase 2: 5% |

| Minimum Trading Days | 5 Days | 5 Days |

| Evaluation Difficulty | Higher Phase 2 target demands more consistent profitability. | A slightly lower Phase 2 target is more forgiving for traders. |

In summary, FundedNext offers a marginally more forgiving evaluation process due to its lower Phase 2 profit target. Blueberry Funded, with its 6% target in the second phase, requires a slightly higher degree of consistent performance to pass. Both firms have similar minimum trading day requirements.

2.2. Drawdown & daily loss limits

Drawdown rules are arguably the most critical component of any prop firm challenge. They define the boundaries of your risk and are the primary reason traders fail evaluations. The type of drawdown, static or trailing, has a massive impact on trading freedom and complexity.

| Criteria | Blueberry Funded | FundedNext |

|---|---|---|

| Max Loss | 10% (Static) | 10% (Static) |

| Daily Loss Limit | 4% (Based on Initial Balance/Equity) | 5% (Based on Initial Balance/Equity) |

| Drawdown Type | Primarily Static: The maximum loss is calculated from the initial balance and does not move. This is simpler to track. | Mix of Static & Trailing: Offers static on Stellar challenges but uses trailing drawdowns on other models, which can be more complex. |

| Rule Strictness | The 4% daily loss is tighter, requiring disciplined intraday risk control. | The 5% daily loss offers more breathing room for intraday volatility. |

Overall, Blueberry Funded’s reliance on static drawdowns provides simplicity and predictability, which is excellent for risk management. However, its 4% daily loss limit is stricter. FundedNext offers a more generous 5% daily loss limit in its popular Stellar models, but traders must be cautious of the more complex trailing drawdowns in its other programs.

2.3. News, overnight & automation policies

A firm’s policies on news trading, holding positions, and using automation define the types of strategies that can succeed. These rules can either empower or restrict a trader, depending on their preferred style.

| Policy | Blueberry Funded | FundedNext |

|---|---|---|

| News Trading | Restricted on some models (e.g., Prime Challenge has a 2-minute rule before/after news). | Allowed: Traders are free to trade during all high-impact news events without restriction. |

| Overnight Trading | Allowed: No restrictions on holding trades overnight. | Allowed: No restrictions on holding trades overnight. |

| Weekend Trading | Allowed: No restrictions on holding trades over the weekend. | Allowed: No restrictions on holding trades over the weekend. |

| Automation / EAs | Allowed: EAs and bots are permitted. Traders should use proper backtesting tools and conduct thorough forward testing to ensure their strategies comply with the rules, as prohibited methods like HFT are monitored. | Allowed: EAs are permitted, but with rules against identical strategies on multiple accounts. HFT and tick scalping are banned. |

| Allowed Strategies | Prohibits gambling, HFT, and grid trading. Focuses on sustainable methods. | Prohibits a wide range of strategies, including HFT, tick scalping, group hedging, and arbitrage. |

Ultimately, FundedNext provides greater freedom for news traders and those with discretionary styles. Blueberry Funded is slightly more restrictive regarding news events on certain accounts, reinforcing its focus on strategies that are not solely reliant on volatility. Both firms permit EAs but have clear rules against exploitative trading techniques.

Read more:

3. Fees, refunds, and cost efficiency: Blueberry Funded vs FundedNext

The upfront cost and refund policies of a prop firm are critical factors in determining its overall value and help traders manage their initial financial risks. An affordable challenge is attractive, but true cost efficiency comes from transparent fee structures, achievable refund conditions, and a clear path to profitability without hidden charges.

| Criteria | Blueberry Funded | FundedNext |

|---|---|---|

| Fee Type | One-time fee for each challenge. | One-time fee for each challenge. |

| Refund Policy | Yes, but not explicitly detailed. Most industry-standard firms refund the fee with the first payout. | Yes, Refundable Fee: The initial fee is returned to the trader with their first payout from the funded account. |

| Challenge Cost | Competitively priced (e.g., $55 for $5k Prime Challenge). | Competitively priced (e.g., $59 for $6k Stellar 2-Step). |

| Transparency | Generally clear: Fees are stated upfront with no hidden charges mentioned. | Highly transparent: The refund policy is a key marketing point, ensuring traders know they can recoup the initial cost. |

| Added Fees | No mention of added fees beyond standard commissions and swaps. | No added fees. Traders are responsible for standard withdrawal gateway charges. |

| Payout Cycle | 14 Days. | 14 Days (or On-Demand for Stellar Instant). |

Overall, both firms offer strong cost efficiency with competitive, transparent pricing. FundedNext holds a slight edge in clarity. It’s heavily promoted refundable fee policy assures traders that their upfront cost will be returned upon reaching the funded stage.

Both firms maintain a standard bi-weekly payout cycle, ensuring traders can access their earnings regularly. Neither firm appears to have hidden fees, making them both cost-effective options for traders confident in their ability to pass the evaluation.

4. Profit split and scaling programs of Blueberry Funded vs FundedNext

A firm’s payout structures and scaling programs are the ultimate measures of its commitment to a trader’s long-term success, which is a key factor in the overall trading experience. While a high initial split is appealing, the potential to manage larger capital and earn a greater share over time is what truly defines a career-oriented prop firm. These programs reward consistency and are a key factor in the Blueberry Funded vs FundedNext debate.

| Criteria | Blueberry Funded | FundedNext |

|---|---|---|

| Profit Split | Starts at 80%, with an option to scale up to 90%. | Starts at 80%, scaling up to 95%. Also offers a 15% reward share from the challenge phase profits. |

| Scaling Plans | Yes, up to $2 Million. Traders can increase their account balance by 25% every 3 months by meeting a 10% net profit target and processing at least 4 payouts. | Yes, up to $4 Million. Traders can scale their account by 40% every 4 months by achieving 10% accumulated growth and receiving at least two payouts. |

| Payout Frequency | Bi-weekly (every 14 days). | Bi-weekly (every 14 days) or On-Demand for certain accounts. |

| Minimum Payout | Yes, a minimum of $100 in profit is required to request a payout. | Not explicitly stated, but payouts are based on profitability. |

| Withdrawal Conditions | Requires completing the KYC process and meeting minimum active trading day requirements for the cycle. | Requires KYC completion and meeting profitability criteria over a four-month review period for scaling. |

In this category, FundedNext offers a more aggressive and potentially lucrative path for highly consistent traders. However, traders should consider that these scaling plans are based on hypothetical results and be wary of survivorship bias when evaluating long-term potential. The higher profit split ceiling of 95%, a larger maximum allocation of $4 million, and the unique 15% reward from the challenge phase provide significant financial incentives.

Blueberry Funded presents a very strong and stable alternative. Its scaling plan is straightforward and generous, with a clear path to a $2 million allocation and a 90% split. While not as aggressive as its competitor, its broker-backed infrastructure may offer more peace of mind to traders as they scale to larger account sizes.

5. Trading platforms and tradable assets on Blueberry Funded and FundedNext

A prop firm’s trading environment, defined by its platforms, asset availability, and execution quality, is where a strategy succeeds or fails. The right combination of tools and conditions allows a trader to execute their plan seamlessly. Both firms provide robust environments, but with subtle differences catering to specific needs.

| Criteria | Blueberry Funded | FundedNext |

|---|---|---|

| Trading Platforms | Excellent Variety: Offers MT4, MT5, TradeLocker, and DxTrade, providing a wide range of choices for traders. | Industry Standard: Provides MT4, MT5, cTrader, and Match-Trader, covering the most popular platforms. |

| Asset Classes | Comprehensive: Full suite of Forex, Crypto, Metals, Energy, and Indices. | Comprehensive: Wide range of Forex, Indices, Commodities, and Crypto. |

| Execution Speed | Broker-Backed Advantage: Leverages the infrastructure of Blueberry Markets, suggesting potentially faster and more reliable execution. | Standard Prop Firm Execution: Provides a reliable simulated environment that mirrors real market conditions. |

| Commissions & Fees | Transparent: A standard commission of $7 per lot on FX pairs and Gold. Lower on other assets. | Competitive: Offers very low commissions, aiming to maximize trader profitability. |

| Trader Dashboard | Modern & User-Friendly: Provides a clear and intuitive dashboard for tracking progress and managing accounts. | Highly Developed: Features a comprehensive dashboard with detailed analytics and account management tools. |

In terms of the trading environment, the Blueberry Funded vs FundedNext comparison shows two highly capable firms. Blueberry Funded distinguishes itself with its broker-backed execution, which may offer a tangible edge in speed and data quality for latency-sensitive traders. Their overall trading conditions are designed for stability.

FundedNext counters with an exceptionally broad platform offering that includes cTrader and Match-Trader, which are favored by many manual traders. Their analytics dashboards provide robust tools for tracking key performance metrics. These platforms also support algorithmic traders performing walk-forward analysis and automated parameter optimization.

Both firms offer competitive assets and commissions while adhering to industry compliance regulations. Ultimately, the choice depends on a trader’s priority: the execution advantage of a broker-backed firm or the platform flexibility of a global leader.

6. Payout reliability and trust: Blueberry Funded vs FundedNext reviews Reddit and Trustpilot

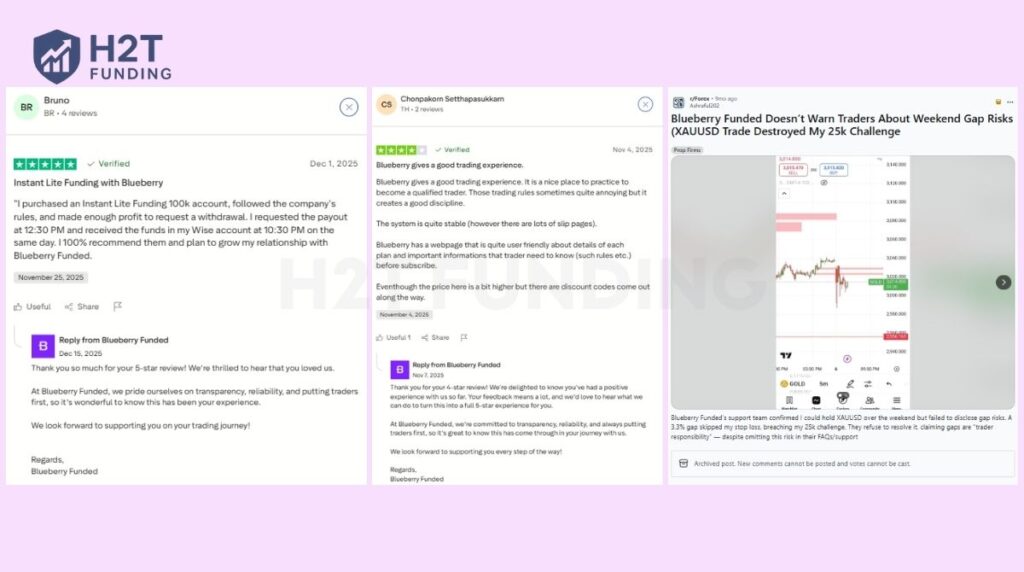

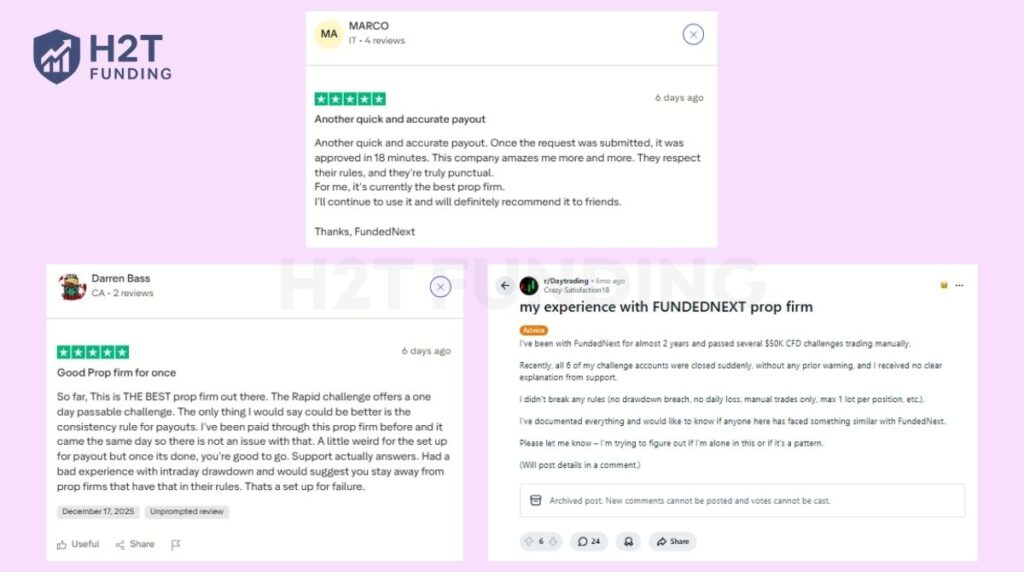

A prop firm’s promises are ultimately tested by its community. Unfiltered reviews from Trustpilot and Reddit are the most accurate measure of a firm’s integrity. They reveal real-world experiences with payout reliability, client support responsiveness, and fair rule enforcement.

Below are screenshots of authentic trader feedback. These have been selected to provide a balanced perspective, showcasing both the strengths and potential frustrations traders experience with each firm.

For the broker-backed firm (Blueberry Funded):

For the global firm (FundedNext):

The community feedback paints a clear picture. The broker-backed firm is frequently praised for its legitimacy and consistent payouts when traders follow the rules to the letter. However, negative reviews consistently point to frustration with strict rule enforcement, where minor mistakes can lead to breaches.

The global firm enjoys overwhelmingly positive reviews, particularly regarding its lightning-fast payouts and responsive support. While less frequent, negative feedback is often severe. These complaints usually involve account terminations due to complex, back-end rules.

Traders often feel that issues like “excessive margin usage” or “device sharing” were not clearly explained beforehand. This suggests a trade-off: traders at the global firm may enjoy more flexibility upfront, but face a different kind of risk related to less transparent operational rules.

7. Which prop firm is easier to pass: Blueberry Funded vs FundedNext?

Based on a direct comparison of their core evaluation rules, FundedNext is marginally easier to pass for most traders. This conclusion stems from its more forgiving profit targets and daily drawdown limits in its most popular challenge models. However, “easier” does not always mean “better,” as the complexity of a firm’s rules also plays a significant role.

This Blueberry Funded vs FundedNext comparison breaks down the key factors that determine evaluation difficulty.

| Criteria | Blueberry Funded | FundedNext | Winner |

|---|---|---|---|

| Profit Target | Higher Phase 2 target (6%) requires more sustained performance. | Lower Phase 2 target (5%) provides a slight advantage and requires less profit generation to pass. | FundedNext |

| Drawdown Strictness | Tighter daily loss limit (4%) demands precise intraday risk control. | More generous daily loss limit (5%) offers more breathing room for price fluctuations. | FundedNext |

| Rule Complexity | Simpler, primarily static drawdown rules are easier to track and avoid accidental breaches. | A mix of static and trailing drawdowns can be confusing and presents a hidden layer of difficulty. | Blueberry Funded |

| Overall Difficulty | Requires higher discipline due to stricter daily limits and a higher final target. | More forgiving targets and daily limits make the path to passing slightly more accessible. | FundedNext |

Ultimately, the answer depends on a trader’s strengths. A trader who struggles with hitting high profit targets but is excellent at managing daily risk may find FundedNext easier. Conversely, a trader who prefers simple, predictable rules and can consistently perform may find the structure of Blueberry Funded to be a better fit, even with its stricter limits.

Read more:

8. Who should choose Blueberry Funded or FundedNext?

The best prop firm is not a one-size-fits-all solution; it is the one that best aligns with an individual trader’s style, experience, and goals. The final decision between these two industry leaders depends entirely on what you prioritize in a funding partner.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | Blueberry Funded | Its simple, static drawdown rules are far easier for new traders to understand and manage, reducing the risk of accidental breaches from complex trailing calculations. |

| Forex Traders | Both | Both firms offer a comprehensive range of currency pairs, competitive spreads, and low commissions, making them equally excellent choices for dedicated Forex traders. |

| Scalpers & News Traders | FundedNext | It has no restrictions on news trading, providing the freedom needed to capitalize on volatility. The 5% daily loss limit also offers more room for the quick fluctuations inherent in scalping. |

| Swing Traders | Blueberry Funded | The broker-backed environment and clear, static drawdown limits are ideal for traders holding positions for several days, as they provide a stable and predictable framework. |

| Risk-Averse Traders | Blueberry Funded | Its emphasis on rule clarity and a predictable, broker-backed ecosystem appeals to traders who prioritize security and transparency over aggressive, high-risk models. |

| Automated Traders (EAs) | Both | Both firms allow the use of EAs but have strict policies against exploitative strategies like HFT or copy trading from others. Traders must ensure their bot complies with each firm’s specific rules. |

| Cash-Flow Focused Traders | FundedNext | The firm offers a 15% profit share from the challenge phase. Combined with extremely fast payout processing, often within hours, it is the superior choice for traders needing quick and regular access to their earnings. |

In conclusion, your choice should be a strategic one. If you are building your career and prioritize a stable foundation with clear, unchanging rules, the broker-backed firm offers an ideal environment. If your strategy thrives on flexibility, speed, and maximizing every profit opportunity, the global firm’s diverse and aggressive models are tailor-made for your success.

9. FAQs

Yes, FundedNext is widely considered a reliable and legitimate prop firm. It has an excellent Trustpilot score of 4.5 from over 52,000 reviews, where traders frequently praise its fast payouts, responsive customer support, and transparent operations.

Yes, community reviews confirm that Blueberry Funded processes payouts consistently and reliably for traders who adhere to all of their rules. As a broker-backed firm, it leverages an established financial infrastructure, which adds to its credibility and dependability in processing withdrawals.

Yes, Blueberry Funded is trusted, particularly by traders who value transparency and a secure trading environment. While its Trustpilot score is lower than its competitor’s, positive reviews consistently highlight the firm’s clear rules, broker-backed security, and fair payout process as key reasons for their trust.

Blueberry Funded is generally the better choice for beginners. Its primary use of simple, static drawdown limits is much easier to track than the complex mix of static and trailing drawdowns offered by FundedNext. This simplicity helps new traders focus on their strategy without the risk of an accidental breach from a confusing rule.

The main difference is the drawdown type. Blueberry Funded primarily uses static drawdowns, where the loss limit is fixed based on your initial balance. FundedNext offers both static and trailing drawdowns, depending on the challenge, which can be more complex as the loss limit moves up with your profits.

Both firms operate on a similar bi-weekly (14-day) payout schedule. However, FundedNext also offers an “On-Demand” withdrawal option for some of its accounts, giving traders potentially faster access to their earnings.

Yes, both firms permit EAs and other forms of automated trading. This allows traders to implement a quantitative strategy using automated analysis. However, both firms have strict rules prohibiting exploitative techniques like HFT, tick scalping, or using identical strategies across multiple accounts.

FundedNext offers more aggressive long-term scaling opportunities. The firm provides a path to a higher maximum account allocation ($4 million vs. $2 million) and a larger profit split (up to 95% vs. 90%). This makes it more lucrative for highly consistent traders over the long term.

Both firms support the industry’s most popular platforms. Blueberry Funded offers MT4, MT5, TradeLocker, and DxTrade. FundedNext provides MT4, MT5, cTrader, and Match-Trader.

10. Conclusion

Ultimately, the Blueberry Funded vs FundedNext decision comes down to a fundamental choice between stability and flexibility. If your strategy thrives in a structured, predictable environment with the security of a broker-backed ecosystem, then Blueberry Funded is the logical choice.

Conversely, if you demand maximum flexibility, a wide array of challenge options, and the most aggressive scaling plan in the industry, FundedNext is built for you. Its model empowers traders to choose their own path and rewards high performance with rapid payouts and significant capital growth.

Ready to compare other leading prop firms? Explore more in-depth analyses and head-to-head comparisons on the H2T Funding blog to find your perfect match.