Blue Guardian vs FTMO is a critical comparison for traders seeking reliable funding. Choosing the wrong firm can lead to unexpected account breaches from complex rules like trailing drawdowns or sudden news trading restrictions. The decision often requires balancing the need for strict, clear discipline against the demand for flexible risk management in dynamic markets.

Ultimately, FTMO excels with its transparent, structured evaluation that fosters discipline, making it a benchmark for systematic traders. In contrast, Blue Guardian provides more flexible rules and faster funding access, appealing to those who need more room to adapt their strategy.

To see how these differences impact real-world trading performance, explore this in-depth analysis by H2T Funding.

Key takeaways

- FTMO enforces a structured 2-step evaluation to ensure consistency. Blue Guardian offers more versatile pathways, including 1-step, 2-step, 3-step, and instant funding models for quicker access.

- The core difference lies here. FTMO uses a clear static maximum loss based on the initial balance. Blue Guardian employs a trailing drawdown on its instant funding models, which requires more active equity management from the trader.

- Blue Guardian generally offers more flexibility, allowing news trading during its evaluation phases. FTMO has strict restrictions on news trading for funded accounts (non-Swing), demanding a more disciplined approach.

- FTMO has built a decade-long reputation for reliable, scheduled payouts and is considered an industry leader. Blue Guardian focuses on speed and accessibility, offering a 24-hour payout guarantee to build trust.

- FTMO is the ideal choice for disciplined traders who thrive under a proven, rule-based system. Blue Guardian better serves adaptive traders who prioritize speed, flexibility, and multiple funding options.

1. Overview of Blue Guardian and FTMO

Both Blue Guardian and FTMO are established proprietary trading firms, yet they cater to fundamentally different trader profiles. FTMO champions a path of structured discipline and proven reputation, while Blue Guardian focuses on offering flexibility and rapid funding access. Understanding their core philosophies is the first step to choosing the right partner.

This high-level comparison table provides a quick glance at the key differences between the two firms.

| Criteria | Blue Guardian | FTMO |

|---|---|---|

| Founded / Trust | 2021 / Newer, building reputation | 2015 / Industry leader, highly trusted |

| Evaluation Models | Instant, 1-Step, 2-Step, 3-Step | 2-Step (Challenge & Verification) |

| Account Sizes | $5,000 to $200,000 | $10,000 to $200,000 |

| Asset Classes | Forex, Indices, Commodities, Crypto | Forex, Indices, Commodities, Stocks, Crypto |

| Trading Platforms | MT5, Tradelocker, Matchtrader | MT4, MT5, cTrader, DXtrade |

| Profit Split | Up to 85% (80% standard) | Up to 90% (80% standard) |

| Minimum Days | 5 days (with 0.5% profit) | 4 days per phase |

| Scaling Programs | Up to $2,000,000 | Up to $2,000,000 |

| Payouts | On-demand, 24-hour guarantee | Bi-weekly, highly reliable |

| Key Restriction | Trailing drawdown & consistency rule | Static drawdown & news trading rules |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Blue Guardian vs FTMO websites before purchasing any challenge.

The table highlights a clear divide in the Blue Guardian vs FTMO debate. FTMO is built for the methodical trader who values a predictable, rule-based environment and a long-standing reputation. Conversely, Blue Guardian appeals to the agile trader needing flexible models and faster capital access.

Blue Guardian

#1

Account Types

1-step, 2-step, 3-step, and instant funding

Trading Platforms

MT5, TradeLocker, Match Trader, TradingView

Profit Target

4% – 10%

Our take on Blue Guardian

Blue Guardian positions itself as a modern and adaptable prop firm. It is designed for traders who value flexible account options over a rigid, one-size-fits-all evaluation process.

From a practical standpoint, trading with Blue Guardian feels more accommodating to different styles. Their multiple evaluation models, especially the Instant Funding option, let you choose a path that fits your immediate needs. My experience suggests this approach works well for confident traders who want to bypass lengthy challenges. This freedom, however, demands strong self-discipline, especially in managing the trailing drawdown.

| 💳 Challenge Fee | $27 – $1,070 |

| 👥 Account Types | 1-step, 2-step, 3-step, and instant funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT5, TradeLocker, Match Trader, TradingView |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

FTMO

#2

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO is widely regarded as an industry benchmark for prop trading. It operates on a foundation of strict, transparent rules designed to identify and cultivate highly disciplined traders.

My experience with the FTMO Challenge feels like a professional training ground. The rules are tight and clear, particularly on drawdown and news trading. They effectively force you to develop the risk management habits essential for long-term success. Passing their evaluation feels like earning a badge of honor, backed by a firm with nearly a decade of proven reliability and consistent payouts.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Read more:

2. Blue Guardian vs FTMO: Core models and key trading rules

The trading rules are where a prop firm’s philosophy truly shows. This section details the key differences in evaluation, drawdown, and trading freedom. These rules directly affect a trader’s ability to succeed with either firm.

2.1. Evaluation process, profit targets & minimum days

The path to a funded account differs significantly between the two firms, directly impacting how easy it is to pass. FTMO uses a mandatory two-step evaluation, which acts as a thorough filter for disciplined traders. In contrast, Blue Guardian offers multiple pathways, allowing traders to choose a model that aligns with their confidence and trading style.

| Criteria | Blue Guardian | FTMO |

|---|---|---|

| Evaluation Structure | Multiple Models (Instant, 1, 2, & 3-Step) | Mandatory 2-Step (Challenge & Verification) |

| Profit Target | Varies (e.g., 8% in 1-Step, 8% & 4% in 2-Step) | 10% (Step 1), 5% (Step 2) |

| Minimum Trading Days | 5 days (with 0.5% profit) | 4 days per phase |

| Evaluation Difficulty | Varies by model; generally more accessible | High; requires proven consistency over two phases |

In the Blue Guardian vs FTMO debate, Blue Guardian offers a lower barrier to initial funding access due to its Instant Funding model. For traders confident in their strategy, this removes the evaluation barrier entirely. However, for its challenge-based models, the profit targets are comparable to FTMO’s, making the difficulty level quite similar.

2.2. Drawdown & daily loss limits

Drawdown rules are the number one reason traders fail prop firm challenges. FTMO’s static drawdown is its key strength, offering clear, predictable risk limits based on the initial account balance. Blue Guardian’s use of a trailing drawdown in its popular Instant Funding program introduces a dynamic challenge that requires constant monitoring.

| Criteria | Blue Guardian (Instant Funded) | FTMO |

|---|---|---|

| Max Loss | 6% Trailing Drawdown | 10% Static (Initial Balance) |

| Daily Loss Limit | 3% Static (Initial Balance) | 5% Static (Initial Balance) |

| Drawdown Type | Trailing (locks at start balance after 6% profit) | Static |

| Rule Strictness | Moderate (Trailing requires active management) | High (Clear, but less room for error) |

The impact of trailing vs. static drawdown cannot be overstated. A trailing drawdown follows your highest account balance, meaning a winning streak can shrink your allowable loss buffer. This can create psychological pressure not to give back profits. In contrast, FTMO’s static drawdown provides a fixed floor, which many traders find easier to manage from a risk-planning perspective.

2.3. News, overnight & automation policies

A trader’s strategy must align with a firm’s rules on specific events and tools. Blue Guardian offers significantly more freedom, especially regarding news trading. FTMO’s restrictions on high-impact news for its standard funded accounts are a critical factor for news-driven traders to consider.

| Policy | Blue Guardian | FTMO |

|---|---|---|

| News Trading | Allowed during evaluation. Restricted to funded accounts. | Restricted to standard funded accounts. Allowed on “Swing” accounts. |

| Overnight Trading | Allowed | Allowed (Close before the weekend on standard accounts) |

| Weekend Trading | Allowed | Allowed only on “Swing” accounts |

| Automation / EAs | Allowed, but must be unique | Allowed, but must be unique |

| Allowed Strategies | Hedging, Martingale, No Stop Loss | Most strategies allowed, but no “cheating” or exploiting demo environments. |

Ultimately, Blue Guardian provides a more flexible environment for active, discretionary traders who utilize news or hold trades over the weekend. FTMO is built for systematic traders who prefer a structured, restrictive framework. For those needing to bypass these rules, its “Swing” account offers a dedicated solution.

3. Fees, refunds, and cost efficiency in Blue Guardian vs FTMO

The upfront cost and potential for a refund are critical factors in choosing a prop firm. Both FTMO and Blue Guardian offer refundable fees, but their pricing structures and overall cost-efficiency vary based on the account model you select. Understanding these differences ensures you get the best value for your investment.

This table breaks down the fee structures of each firm to clarify the total cost of getting funded.

| Criteria | Blue Guardian | FTMO |

|---|---|---|

| Fee Type | One-time fee per evaluation or instant account | One-time fee per Challenge |

| Refund Policy | No refunds offered | Fee is 100% refunded with the first profit split |

| Challenge Cost | Starts at $42 for a $5k Instant account | Starts at €155 for a $10k Challenge |

| Transparency | Clear pricing with no hidden charges | Very transparent; fees are clearly stated |

| Added Fees | Optional add-ons for a higher profit split or weekly payouts | No added fees; what you see is what you pay |

| Payout Cycle | On-demand (after 14 days), bi-weekly, or weekly (with add-on) | Bi-weekly by default |

When comparing the Blue Guardian vs FTMO review on cost, the better choice depends on your goal. FTMO’s model is straightforward: pass the evaluation, and your fee is returned with your first payout, making it essentially free for successful traders. This is a powerful incentive that has become an industry standard.

Blue Guardian’s pricing is more varied due to its multiple funding models. The entry point for its smaller Instant Funded accounts is lower, offering a cheaper way to access capital quickly. However, it’s crucial to note that they do not offer refunds. This makes the upfront cost a sunk investment, which might be a deciding factor for traders on a tight budget.

Overall, FTMO is more cost-efficient for traders confident in their ability to pass the two-step evaluation. For those seeking the lowest possible entry fee to access immediate funding, Blue Guardian’s smaller account sizes present a more affordable, albeit non-refundable, option.

4. Profit split and scaling programs: FTMO vs Blue Guardian

A trader’s long-term success with a prop firm is defined by its profit split and scaling opportunities. FTMO offers a clear path to a 90% profit share and account growth, rewarding consistent performance over time. Blue Guardian provides a competitive split from the start but structures its payouts around speed and flexibility.

This comparison highlights how each firm rewards its profitable traders.

| Criteria | Blue Guardian | FTMO |

|---|---|---|

| Profit Split | 80% standard, up to 85% with add-on | 80% standard, scaling to 90% |

| Scaling Plans | Yes, grow the account up to $2,000,000 | Yes, grow the account up to $2,000,000 |

| Payout Frequency | On-demand (after 14 days), bi-weekly, or weekly | Bi-weekly by default |

| Minimum Payout | $100 for funded accounts | No specified minimum, based on profit |

| Withdrawal Conditions | Account balance must be above the initial balance | Account balance must be above the initial balance |

In the FTMO vs Blue Guardian comparison of earning potential, FTMO’s scaling plan is a significant advantage for long-term traders. By achieving a 10% net profit over four months and processing at least two payouts, a trader’s account is scaled by 25%, and the profit split permanently increases to 90%. This structured growth model provides a clear incentive for consistent, disciplined trading.

Blue Guardian, on the other hand, emphasizes accessibility and speed. Their 24-hour payout guarantee and optional weekly withdrawals appeal to traders who prioritize regular cash flow. While they also offer a scaling plan to $2,000,000, FTMO’s path to a higher profit split is more transparently defined and has become a hallmark of their brand.

In conclusion, FTMO provides a superior long-term growth structure for consistent traders, while Blue Guardian offers more immediate flexibility and faster access to earnings.

5. Trading platforms and tradable assets on FTMO and Blue Guardian

The quality of a prop firm’s technology stack directly impacts trading performance. FTMO provides a wider selection of industry-standard platforms, including MT4, MT5, cTrader, and DXtrade, catering to a broad range of trader preferences. Blue Guardian focuses on modern platforms like MT5 while also offering newer alternatives.

This table compares the trading infrastructure and market access at both firms.

| Criteria | Blue Guardian | FTMO |

|---|---|---|

| Trading Platforms | MT5, Tradelocker, Matchtrader | MT4, MT5, cTrader, DXtrade |

| Asset Classes | Forex, Indices, Commodities, Crypto | Forex, Indices, Commodities, Stocks, Crypto |

| Execution Speed | Simulated environment with fast execution | Simulated environment emulating real market conditions |

| Commissions & Fees | Raw spreads; $5 per lot on FX & Commodities | Low spreads; commissions vary by asset |

| Trader Dashboard | Yes, for tracking objectives and requesting payouts | Yes, Account MetriX for detailed analytics |

When comparing the offerings in the FTMO and Blue Guardian platforms, FTMO’s inclusion of MT4 and cTrader alongside MT5 gives it a slight edge in versatility. Many experienced traders still prefer MT4 for its vast library of custom indicators and EAs, while cTrader is favored for its advanced order types and clean interface. This makes FTMO a more accommodating choice for traders with established platform preferences.

Blue Guardian’s platform suite is modern and effective, with MT5 serving as a robust workhorse. The addition of Tradelocker and Matchtrader provides variety, but they are less established in the industry compared to FTMO’s lineup.

In terms of asset classes, both firms offer a solid range of instruments. However, FTMO includes stocks, providing an additional market for traders looking to diversify beyond traditional forex and commodity products. Both firms provide excellent, user-friendly dashboards for monitoring progress and managing the account.

6. Payout and trust analysis: Blue Guardian vs FTMO community reviews

A prop firm’s reputation is ultimately built on two things: paying its traders consistently and providing clear, fair rules. To gauge real-world performance beyond marketing claims, we analyzed feedback from communities like Trustpilot and Reddit. This provides an unfiltered look at trader experiences with both firms.

(Note: Information collected and updated on December 26, 2025)

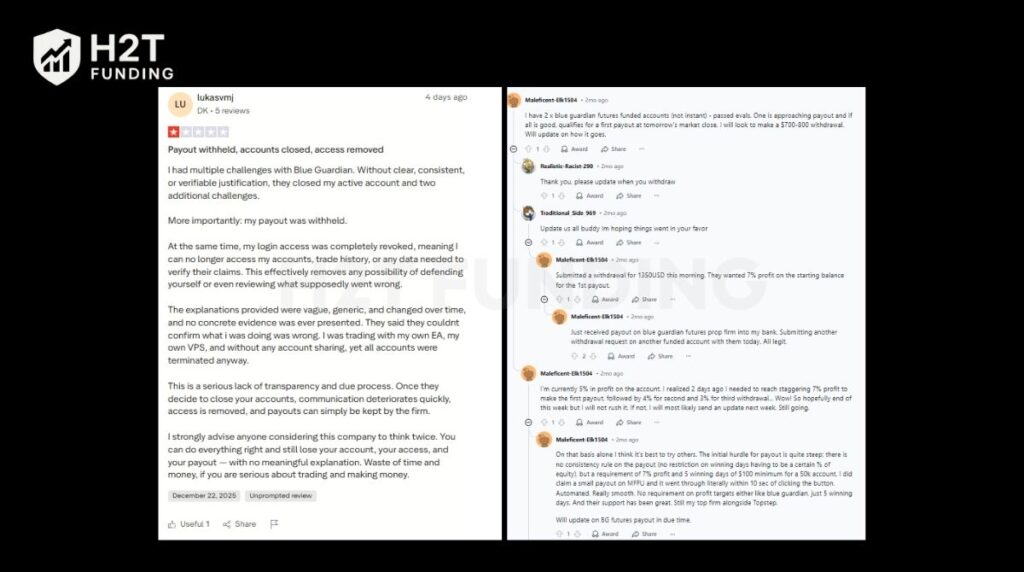

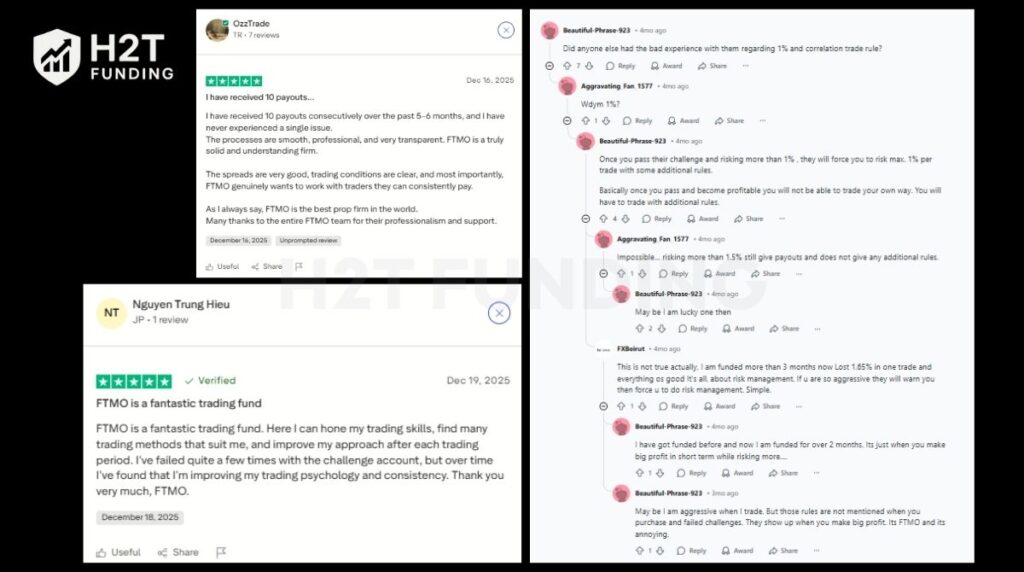

The general sentiment shows FTMO has established a rock-solid reputation for reliability over nearly a decade, earning a high degree of trust. As a newer firm, Blue Guardian has more mixed community reviews. While many traders praise its fast payouts, others raise concerns about rule clarity and dispute resolution, especially with its consistency rule.

Here is a selection of authentic, unfiltered reviews from real traders that highlight the common points of praise and criticism for each firm. These screenshots offer a transparent look into what you can expect.

Community feedback on Blue Guardian is polarized. Positive reviews frequently praise their responsive customer support and the speed of their 24-hour payout guarantee. However, a significant number of negative comments center on the consistency rule, which some traders feel is restrictive and designed to delay or deny payouts. Others have reported issues with spreads and execution during volatile market conditions.

FTMO overwhelmingly receives positive feedback, with a 4.8-star rating on Trustpilot from over 34,000 reviews. Traders consistently praise the firm’s professionalism, clear rules, and, most importantly, unwavering payout reliability. The primary criticisms leveled against FTMO often relate to its strictness. FTMO may intervene if trading behavior is deemed reckless, although this is not a publicly defined rule.

Based on extensive community feedback, FTMO stands as the more trusted and reliable choice, especially for traders who value long-term stability and clear, albeit strict, rules. The sheer volume of positive reviews regarding payouts confirms their market-leader status.

Blue Guardian presents a higher-risk, higher-flexibility alternative. While many traders are successfully funded and paid, the recurring complaints about the consistency rule and dispute handling suggest that traders must read the fine print very carefully. Their model appears best suited for experienced traders who are confident they can navigate the specific ruleset of their chosen account type.

7. Which prop firm is easier to pass: Blue Guardian vs FTMO?

For traders seeking the quickest path to a funded account, Blue Guardian is the undeniable winner. Its Instant Funding models allow you to completely bypass the entire evaluation process. However, when comparing their traditional challenge routes, the difficulty level becomes much more nuanced and depends heavily on a trader’s personal style.

This table breaks down the key factors that determine the overall difficulty of getting funded.

| Criteria | Blue Guardian | FTMO | Winner |

|---|---|---|---|

| Profit Target | Lower on some models (e.g., 8% & 4%) | Higher in Phase 1 (10%) | Blue Guardian |

| Drawdown Strictness | Trailing drawdown is harder to manage | Static drawdown is more predictable | FTMO |

| Rule Complexity | Higher (Consistency rule, varied models) | Lower (Clear, standardized rules) | FTMO |

| Overall Difficulty | Lower barrier to entry, but complex rules | Higher barrier to entry, but simpler rules | Blue Guardian |

The verdict in the Blue Guardian vs FTMO comparison for ease of passing leans toward Blue Guardian for one primary reason: choice. A trader can simply purchase an Instant Funded account and start trading for profit splits immediately, making it the easiest option on the market for direct funding access.

However, if we only consider the evaluation challenges, the answer is less clear. Blue Guardian’s lower profit targets in its 2-step challenge are an advantage. But this is offset by FTMO’s more trader-friendly static drawdown. Many traders find a predictable 10% maximum loss easier to navigate than a trailing drawdown or a complex consistency rule.

In conclusion, Blue Guardian is the easier firm to get funded with quickly. But for traders going through a formal evaluation, FTMO’s simpler, more transparent rule structure may present an easier path to success.

8. Who should choose Blue Guardian or FTMO?

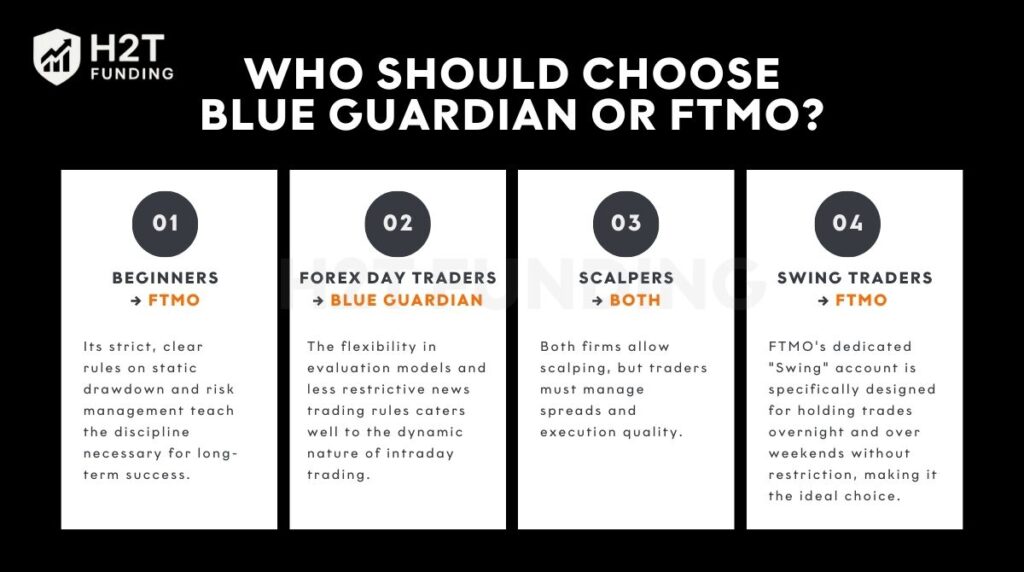

Choosing between Blue Guardian and FTMO depends entirely on your trading style, risk tolerance, and long-term goals. While one firm may seem better on paper, the optimal choice is the one whose rules and structure align perfectly with how you trade. This breakdown provides clear recommendations for different trader profiles.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | FTMO | Its strict, clear rules on static drawdown and risk management teach the discipline necessary for long-term success. It’s an excellent training ground. |

| Forex Day Traders | Blue Guardian | The flexibility in evaluation models and less restrictive news trading rules caters well to the dynamic nature of intraday trading. |

| Scalpers | Both | Both firms allow scalping, but traders must manage spreads and execution quality. FTMO’s reputation for solid execution may give it a slight edge. |

| Swing Traders | FTMO (Swing Account) | FTMO’s dedicated “Swing” account is specifically designed for holding trades overnight and over weekends without restriction, making it the ideal choice. |

| Risk-Averse Traders | FTMO | The static drawdown provides a predictable and fixed risk limit, which is far easier to manage for traders who prioritize capital preservation. |

| Automated Traders | FTMO | While both allow EAs, FTMO’s wider platform selection (including MT4) and established infrastructure offer a more stable environment for automated systems. |

| Cash-Flow Focused | Blue Guardian | The 24-hour payout guarantee and optional weekly withdrawals make it the superior option for traders who need frequent and fast access to their profits. |

FTMO is the clear choice for traders who are building their careers and value structure, reputation, and disciplined growth. Blue Guardian is better suited for established, confident traders who know their strategy inside and out and prioritize speed, flexibility, and immediate access to capital. Choosing the firm that complements your natural trading behavior is the key to unlocking your funding potential.

9. FAQs

Yes, Blue Guardian is a legitimate prop firm that offers funded trading accounts and pays out its successful traders. While it is a newer company than FTMO, numerous traders have publicly verified receiving payouts, confirming its legitimacy. However, traders should carefully read their rules, especially the consistency and drawdown policies, before signing up.

Based on community feedback, Blue Guardian does process payouts, and they offer a 24-hour payout guarantee. Many traders report receiving their funds quickly. However, some users have reported payout denials due to disputes over rule violations, particularly the consistency rule. Their consistency depends on the trader strictly adhering to all terms.

Yes, as of 2025, FTMO provides services to clients in the United States through a strategic partnership with OANDA. This allows US-based traders to access the FTMO Challenge and funded accounts.

Blue Guardian’s services are generally available to traders in the USA. They do not list the United States as a restricted country in their terms of service.

The FTMO “2-minute rule” refers to their restriction on news trading for standard funded accounts. FTMO Traders are not allowed to open or close any trades on the specified instruments within a window of two minutes before and two minutes after a high-impact news release.

The Blue Guardian consistency rule is a policy designed to ensure a trader’s profitability is not reliant on a single lucky trade. For their Instant Funded accounts, it states that profits from one trading day cannot be greater than or equal to 20% of the total profits made. If it is, the trader must continue trading until that single day’s profit falls below the threshold before a payout can be requested.

Officially, FTMO’s primary rules are the 5% daily loss and 10% maximum loss limits. However, they reserve the right to intervene if they deem a trading style to be reckless “gambling.” Many profitable traders report being contacted by FTMO and asked to adhere to an unwritten rule of risking no more than 1-1.5% per trade idea to maintain their funded account.

No, you cannot pass the FTMO Challenge or Verification in one day. FTMO requires a minimum of four trading days for each phase of the evaluation process, meaning the fastest a trader can get funded is in eight trading days.

For FTMO, the minimum is four trading days for the Challenge and another four trading days for the Verification. For Blue Guardian’s evaluation models, the minimum is five trading days, where a day is only counted if it closes with at least a 0.5% profit.

FTMO is generally considered better for beginners. Its strict, clear rules and static drawdown limits provide an excellent framework for learning professional risk management and discipline, which are essential skills for new traders.

FTMO has easier and more predictable drawdown rules. Its 10% maximum loss is static and based on the initial account balance, making it simple to calculate and manage. Blue Guardian’s trailing drawdown on its Instant Funding accounts is more complex and can be more psychologically challenging for traders to handle.

10. Conclusion

The Blue Guardian vs FTMO debate ultimately comes down to a choice between flexibility and structure. Blue Guardian caters to the agile, confident trader who thrives with fewer restrictions and values rapid access to capital. Its multiple funding models and lenient rules on news and weekend trading empower discretionary strategies.

Conversely, FTMO remains the industry benchmark for traders who seek a disciplined, transparent, and highly reputable path to funding. Its rigid 2-step evaluation, static drawdown, and clear, time-tested rules create a stable environment that fosters long-term consistency. For traders who value reliability and a structured growth plan over immediate access, FTMO is the undisputed choice.

Choosing the right firm is a critical step in your trading journey. To explore how other leading prop firms stack up, read more in-depth comparisons and reviews on the H2T Funding blog and find the perfect partner to elevate your career.