Finding the best prop firms UK can feel frustrating, especially if you’ve already wasted money on firms with hidden rules or delayed payouts. Many traders jump in hoping for fast funding, only to face unclear terms, denied withdrawals, or strict consistency limits.

In this guide, we’ve analyzed and compared the most reputable UK prop firms, looking at fairness, payout speed, and trader support, so you can avoid costly mistakes. Whether you’re rebuilding after a setback or searching for your first reliable firm, this list will help you trade with confidence and long-term stability.

1. What are prop firms and how do they work in the UK?

Prop firms, short for proprietary trading firms, are companies that allow UK traders to trade financial markets using the firm’s own trading capital instead of personal funds. In return, traders share a percentage of their profits, a structure known as profit splits. This model creates a partnership where both sides benefit from skilled, consistent trading.

Unlike retail trading, where you risk your own savings, prop trading offers access to substantial capital, often ranging from £10,000 to over £500,000. The firm covers losses within preset limits, while traders focus on strategy, risk management, and growth.

Here’s how it generally works:

- Step 1 – Evaluation: Traders pass a challenge proving consistent profit without breaching risk or prop firm rules.

- Step 2 – Funded account: Once successful, traders receive a live account to trade with the firm’s capital.

- Step 3 – Profit sharing: Profits are divided through agreed profit splits (typically 70–90%).

Today, the UK prop trading market is one of the most active in Europe, attracting both retail and professional traders. Its firms blend flexible funding options with reliable broker partnerships, giving traders fair opportunities, clear rules, and faster payouts.

2. Top 27 best prop firms UK

For UK-based traders, Funded Trading Plus and Alpha Capital Group stand out for their transparency, local support, and community focus. Both firms cater specifically to UK traders with GBP account options, fast local payouts, and strong customer service. Their rule clarity and regulation-backed structure make them top picks for traders seeking reliability within the UK market.

| Firm | Profit Split | Rating | Actions |

|---|---|---|---|

|

75% – 90% |

4.2

|

Open an account |

|

50% – 100% |

4.9

|

Open an account |

|

80% – 90% |

4.8

|

Open an account |

|

80% – 100% |

4.4

|

Open an account |

|

80% – 95% |

4.5

|

Open an account |

|

90% – 100% |

4.4

|

Open an account |

|

80% |

4.8

|

Open an account |

|

80% – 100% |

4.5

|

Open an account |

|

80% |

4.7

|

Open an account |

|

80% – 100% |

4.4

|

Open an account |

|

80% |

4.5

|

Open an account |

|

90% – 100% |

4.4

|

Open an account |

|

80% – 90% |

4.1

|

Open an account |

|

80% – 90% |

4.3

|

Open an account |

|

80% – 100% |

4.5

|

Open an account |

|

80% – 100% |

4.5

|

Open an account |

|

50% – 100% |

4.2

|

Open an account |

|

80% |

4.5

|

Open an account |

|

50% – 100% |

4.2

|

Open an account |

|

70% – 99% |

3.9

|

Open an account |

|

80% |

4.2

|

Open an account |

|

75% – 90% |

4.3

|

Open an account |

|

70% – 80% |

4.4

|

Open an account |

|

50% – 80% |

4.3

|

Open an account |

|

60% – 95% |

3.8

|

Open an account |

|

80% – 90% |

3.7

|

Open an account |

|

80% – 90% |

4.8

|

Open an account |

Below is the 2026 list of the best prop firms UK, featuring reliable companies known for transparency, solid platforms, and fast payouts. Explore each firm’s detailed review next to find your ideal prop trading partner.

RebelsFunding

#1

Account Types

1-step, 2-step, 3-step, 4-step, and instant funding

Trading Platforms

RF-Trader

Profit Target

5% – 10%

Our take on RebelsFunding

Rebels Funding offers a modern approach to prop trading, focusing on flexibility and trader freedom. What stands out is the no time limit policy, traders can progress at their own pace without pressure from deadlines. For UK traders, this is a refreshing change, especially for those balancing trading with full-time work.

The firm provides up to $640,000 in simulated capital, up to 90% profit splits, and refund options reaching 200%, which are generous compared to most competitors.

However, while their conditions are fair, the platform performance could be smoother. A few Trustpilot users mentioned occasional lag or slow load times, which may affect fast scalpers or those using EAs.

Rebels Funding’s transparent model and varied pricing plans make it suitable for traders at every level. Still, beginners may find the multiple tiers and scaling systems confusing at first. Overall, it’s a strong, flexible choice for those who value freedom over strict timelines and steady profit potential.

| 💳 Challenge Fee | €26 – €650 |

| 👥 Account Types | 1-step, 2-step, 3-step, 4-step, and instant funding |

| 💰 Profit Split | 75% – 90% |

| 💵 Account Size | $1K – $320K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | RF-Trader |

| 🛍️ Asset Types | Forex, Crypto, Energies, Metals, Equities, Indices |

The5ers

#2

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

The 5%ers can be considered one of the best forex prop firms UK for me, mainly because of their long track record and focus on trader development. Founded in 2016, it has grown to support more than 250,000 traders worldwide, offering flexible programs and consistent payouts, qualities that matter deeply to UK traders looking for reliability.

What stands out is the firm’s transparency and fast payouts. On average, withdrawals are processed in just 16 hours, and the firm offers profit splits ranging from 80% to 100%. Its various programs, including High Stakes, Bootcamp, and Hyper Growth, cater to different skill levels, allowing traders to scale gradually with no strict deadlines.

However, not everything is perfect. While most users praise The5%ers’ support and conditions, some reviews mention rule changes after funding and confusion about spread widening during high-volatility periods. These cases are exceptions, but they highlight the need for traders to read each plan’s terms carefully before committing.

The5%ers remains one of the most trusted and trader-oriented firms for UK traders. It offers structured challenges, quick payouts, and clear opportunities for long-term growth.

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

FTMO

#3

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO is one of the most best prop firms forex UK in the prop trading world and has earned that status through consistency and scale. With over 3 million traders worldwide and a 4.8/5 Trustpilot rating, the firm’s reputation speaks for itself. For UK traders, FTMO offers stability, fast payouts, and a globally trusted evaluation process.

The firm’s structure is simple: pass the two-step FTMO Challenge and Verification to trade up to $200,000 in simulated capital. Profit splits reach up to 90%, and fees are refundable once traders pass. The inclusion of FTMO Academy, performance coaching, and free trials shows the firm’s commitment to skill development, not just profit collection.

However, not all feedback is positive. Some traders report strict enforcement of rules, occasional disputes over daily loss calculations, and slow responses to negative reviews. While these issues don’t outweigh FTMO’s credibility, they remind traders to manage risk carefully and document every trade.

Despite minor concerns, FTMO remains one of the most transparent and proven firms for UK traders who value professional structure, reliable payouts, and a serious approach to trading discipline.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

FXIFY

#4

Account Types

1-step, 2-step, 3-step, and Instant Funding

Trading Platforms

MT4, MT5, DXTrade, TradingView

Profit Target

5% – 10%

Our take on FXIFY

FXIFY gives a modern, polished impression right from its dashboard and funding options. I like how flexible their setup is; traders can choose between instant funding, single-phase or multi-phase evaluations, and even futures accounts. For UK traders, that variety makes it easy to find a plan that fits both budget and strategy.

The strongest point is their on-demand payout system. Traders can request withdrawals as soon as they close a profitable trade, with up to 90% profit share. Having that freedom is rare and gives FXIFY an edge over slower firms. That said, some users report delayed payouts and minor support response lags, so patience may be needed.

Transparency is mostly solid, though a few Trustpilot reviews mentioned wallet-related confusion and communication issues. These seem isolated, but they show FXIFY still has work to do in consistency and post-funding reliability. Overall, it’s a capable and promising firm,one that rewards skill, but also tests traders’ tolerance for structure and verification.

| 💳 Challenge Fee | $39 – $4,249 |

| 👥 Account Types | 1-step, 2-step, 3-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $1K – $400K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradingView |

| 🛍️ Asset Types | Forex, Metals, Equities, Crypto, Commodities, Stocks, Indies |

FundedNext

#5

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

FundedNext stands out as one of the most balanced firms for traders looking for freedom and fair rewards. The no time limit rule and payouts processed in as little as five hours make it especially appealing to UK traders who want consistent access to capital without unnecessary stress. The 15% performance bonus during the challenge phase also adds a refreshing incentive for disciplined trading.

Its wide selection of funding programs, including 1-step and 2-step challenges, instant funding, and futures accounts, makes it flexible for different trading styles. The platform offers strong leverage, raw spreads, and full support for EAs and news trading. It’s designed for traders who prefer structure but still want control over their pace.

Still, FundedNext isn’t flawless. Some users have reported slow support response or accounts being flagged after profit spikes, which can feel frustrating. Others mention inconsistent communication about account closures. These cases seem isolated, but they’re worth noting if you plan to scale aggressively.

Despite a few hiccups, FundedNext delivers a clear edge with its payout speed, global accessibility, and transparent pricing. It’s a solid choice for traders who value structure and performance rewards but still want flexibility to trade at their own pace.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

Apex Trader Funding

#6

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

Apex Trader Funding offers a generous structure that immediately stands out, especially the 100% payout on the first $25,000 and 90% beyond that. For UK traders looking to grow in the futures market, this is an appealing setup. The one-step evaluation and ability to trade during news or holidays make it ideal for traders who prefer flexibility over complex rules.

The payout frequency is also a plus; traders can withdraw profits every eight days, one of the fastest cycles in the industry. The firm supports multiple trading platforms, including NinjaTrader and Tradovate, giving traders solid tech options.

That said, Apex’s reputation has been mixed lately, with some traders citing inconsistent rule enforcement and delays in payout approvals. A few reviews mention accounts being flagged or reset without clear explanations, raising concerns about transparency.

For almost all traders, Apex remains one of the strongest options for futures funding with 4.5/5 star on Trustpilot. It rewards skill and persistence but requires careful adherence to rules and clear communication with support to avoid misunderstandings.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

My Funded Futures

#7

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading

Profit Target

6%

Our take on My Funded Futures

My Funded Futures (MFFU) has built a strong name around simplicity and transparency. The firm’s one-step evaluation and no activation fees make it beginner-friendly while still appealing to experienced traders. UK traders will appreciate how easy it is to get started without facing hidden costs or complex qualification stages.

A standout feature is the weekly payout option. Traders can access profits faster, which supports better cash flow and flexibility. Each plan: Scale, Core, and Pro, offers clear limits and up to a $100K payout cap, making it easy to scale based on experience.

The platform integrates with TradingView, NinjaTrader, Quantower, and Tradovate, ensuring smooth access for different trading styles. It also supports automated and copy trading, which adds more flexibility for those using algorithmic setups.

On the downside, several reviews mention slow or inconsistent customer support. Some users have reported login or setup issues when linking to trading platforms. These are occasional but still worth noting, especially for traders managing multiple funded accounts.

Overall, My Funded Futures delivers a clear and efficient model with fast payouts, simple rules, and fair pricing. It’s a practical option for UK traders who want a straightforward path to funding without unnecessary restrictions.

| 💳 Challenge Fee | $77 – $477 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading |

| 🛍️ Asset Types | Futures Contracts |

Funding Pips

#8

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

Funding Pips has positioned itself as a modern and flexible proprietary trading built by traders, for traders. The firm offers multiple challenge types: zero-step, one-step, and two-step, giving traders full control over how they want to qualify. For UK traders, this flexibility and the high profit split (up to 100%) make it a standout option.

One of its main strengths lies in its reward cycle options. Traders can choose how they get paid: weekly, bi-weekly, monthly, or even on demand. This adaptability is rare and adds convenience for those managing trading as a full-time income. The platform also integrates well with MetaTrader 5, Match-Trader, and cTrader, ensuring compatibility with most trading setups.

However, Funding Pips has received mixed reviews about rule transparency and support quality. Some traders have complained about unclear rule explanations, particularly regarding the 3% loss limit and consistency score, which have led to failed challenges. While the firm responds to most issues promptly, a clearer dashboard and detailed pre-purchase disclosure would improve the overall experience.

Despite these drawbacks, Funding Pips remains one of the better global options for UK traders who value reward flexibility and a fast evaluation process. Its streamlined system and platform diversity give it a professional edge that suits both independent traders and algo users.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

Alpha Capital Group

#9

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader, DXTrade, TradeLocker

Profit Target

4% – 10%

Our take on Alpha Capital Group

Alpha Capital Group stands out as a professional and data-oriented proprietary trading firm built for traders who value structure and transparency. With flexible programs, Alpha One, Pro, and Three, it caters to different skill levels through 1-step, 2-step, and 3-step evaluations. The setup process is straightforward, and payouts can be requested on demand once objectives are met.

A major highlight is its zero-commission model and execution partnership with ACG Markets, which simulates real institutional conditions. The firm’s proprietary dashboard is another strong point, offering real-time market insights, performance tracking, and risk analysis, ideal for traders who rely on data to refine their strategies.

Customer feedback on Trustpilot is mostly positive (4.6/5 stars over 14K reviewers), with many praising the user-friendly platform and professional support team. However, some traders have raised concerns about execution slippage and rule enforcement after payouts, especially around inactivity and news trading restrictions.

Overall, Alpha Capital Group delivers a balanced mix of technology, education, and fair funding opportunities. It’s a reliable choice for UK traders who prefer analytical tools, detailed performance feedback, and an institutional-style environment over purely flexible trading conditions.

| 💳 Challenge Fee | $40 – $1,097 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT5, cTrader, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Metals, Commodities, Indices |

E8 Funding

#10

Account Types

1-step

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker

Profit Target

6%

Our take on E8 Funding

E8 Markets has built a strong reputation as a tech-driven proprietary trading firm that blends flexibility, transparency, and global accessibility. With its sleek platform design and multi-market access, including forex, futures, and crypto, the firm appeals to traders who want variety without complexity.

The firm’s 1-step, 2-step, and 3-step evaluations give traders freedom to choose their preferred path. E8 also stands out for its on-demand payouts and custom account setup, where traders can adjust profit targets, drawdown limits, and payout percentages. This level of personalization is one of the best among major prop trading firms.

Its MetaTrader 5, cTrader, and TradeLocker integrations, along with TradingView-powered analytics, make the platform highly adaptable. The evaluation process is straightforward, and UK traders can access detailed performance tracking tools that update in real time.

Still, some traders report downsides such as activation fees after passing evaluations, strict consistency rules, and issues with execution on TradeLocker. While payouts are reliable, the 35–40% consistency rule may feel restrictive for traders who rely on short-term spikes or news trading.

In summary, E8 Markets provides a balanced combination of technology, customization, and fair payouts. It’s a strong option for traders who want flexibility and professional-grade tools, though newcomers should review its rulebook carefully before starting.

| 💳 Challenge Fee | $40 – $4,460 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $500K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto, Energy, and Futures |

Maven Trading

#11

Account Types

1-step, 2-step, 3-step, and instant funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

3% – 8%

Our take on Maven Trading

Maven Trading has become a notable choice among UK traders seeking affordable access to prop funding. With multiple challenge types: 1-step, 2-step, 3-step, and instant funding, it offers traders at any level a chance to get started quickly without major upfront costs.

One of its strongest points is accessibility. Challenges start from just $13–$19, and all fees are refundable after a few withdrawals. Maven also supports major trading platforms such as MetaTrader 5, MatchTrader, and cTrader, making it easy for traders to work in familiar environments.

Traders appreciate the fast payouts, often processed within 24 hours, and the supportive customer service team, which receives consistent praise on Trustpilot. Many also note that the firm’s rule transparency and Discord community make the onboarding process smooth and beginner-friendly.

However, Maven isn’t without its flaws. Some traders report frustration over rule enforcement differences between the challenge and funded phases. Others have experienced issues with the RisePay payout system or lost accounts due to strict drawdown interpretations. The 20% consistency rule on instant funding can also limit flexibility for short-term or aggressive trading styles.

Maven’s structure suits disciplined UK traders who want a cost-effective path to scaling up and value clarity over complexity. It’s especially fitting for those who prioritize affordable challenges, reliable payouts, and strong platform support over looser rule flexibility.

| 💳 Challenge Fee | $13 – $440 |

| 👥 Account Types | 1-step, 2-step, 3-step, and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $2K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 3% – 8% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities |

Topstep

#12

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep has built a strong reputation among UK traders and global futures traders for its structured, no-nonsense approach. I like how it focuses on developing discipline and consistency, traits many prop firms overlook. The Trading Combine can be completed in as little as two days, offering a clear and fast path to funding.

The platform’s approach stands out for its real coaching integration. Traders gain access to live mentorship, group coaching, and educational sessions. These programs help improve long-term consistency, a major advantage for those serious about mastering futures trading.

Topstep also earns praise for its fast payouts, intuitive interface, and supportive community of over 100,000 members. The built-in TradingView-powered charting, automated account tracking, and optional risk tools make the experience user-friendly without sacrificing professionalism.

That said, the 50% consistency rule and activation fee after passing can be annoying. I’ve seen reports about chart lag and support delays, which need improvement. Still, Topstep stands out as a firm that genuinely helps traders grow, especially those who want to trade futures seriously.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

For Traders

#13

Account Types

1-step, 2-step, 3-step, and Instant Funding

Trading Platforms

MT5, cTrader, TradeLocker

Profit Target

4% – 9%

Our take on For Traders

For Traders has quickly gained attention among UK traders for its flexibility and solid technology. What stands out is how easy it is to start; the low-cost challenges and instant account options make it accessible for both beginners and active traders testing new strategies.

I like the platform variety: MetaTrader 5, cTrader, and TradeLocker all run smoothly, supported by fast servers and clean interfaces. The 48-hour payout guarantee and the ability to trade Forex, Crypto, and Futures from one account show the firm’s strong technical setup.

Customer support also deserves credit. Many traders praise their 24/7 assistance and quick responses through Discord and live chat. It’s clear that For Traders puts effort into maintaining a strong trader community and transparent communication.

Still, some reviews point to strict rule enforcement, especially around drawdowns, martingale-style trading, and inactivity. These limitations can frustrate traders who prefer looser conditions. That said, For Traders remains one of the more balanced and transparent prop firms for UK traders who want reliability without hidden terms.

| 💳 Challenge Fee | $23 – $839 |

| 👥 Account Types | 1-step, 2-step, 3-step, and Instant Funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $6K – $100K |

| ⏱️ Time Limit | 180 days for 3-step challenge |

| 🎯 Profit Target | 4% – 9% |

| 📊 Trading Platforms | MT5, cTrader, TradeLocker |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, Futures |

SeacrestFunded

#14

Account Types

1-step, 2-step, 3-step, …

Trading Platforms

MT5, Match Trader, TradingView

Profit Target

5% – 10%

Our take on SeacrestFunded

Seacrest Funded stands out as a broker-backed proprietary trading firm offering a transparent structure and realistic trading conditions. Regulation under the FSCA provides a stronger sense of credibility compared to many offshore firms, a point that appeals to UK traders seeking trust and professionalism.

The platform combines flexibility with discipline. Traders can use different strategies, including scalping or swing trading, and benefit from no time limits on evaluations. This freedom allows traders to progress at their own pace while maintaining clear performance targets.

Its broker integration enhances the overall experience. Execution speed, spreads, and liquidity reflect institutional-grade standards, creating an authentic trading environment. The VIP program is also a notable incentive, rewarding consistent traders with faster payouts and higher profit splits that can exceed 90%.

Despite these strengths, Seacrest Funded isn’t without drawbacks. Leverage is capped at 30:1, which can feel restrictive for traders used to higher ratios. EA use and copy trading are limited to personal setups only, and some traders have raised concerns about slow support responses during disputes.

Even so, the firm’s structure and transparency make it a reliable choice for those prioritizing long-term stability and regulated backing.

| 💳 Challenge Fee | $40 – $500 |

| 👥 Account Types | 1-step, 2-step, 3-step, … |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, Match Trader, TradingView |

| 🛍️ Asset Types | Forex, Indices, Crypto, Commodities |

Top One Trader

#15

Account Types

1-step, 2-step, and instant funding

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker, TradingView

Profit Target

0% – 10%

Our take on Top One Trader

Top One Trader delivers a competitive mix of flexibility, affordability, and fast payouts that’s hard to ignore. It caters well to UK traders looking for instant funding and quick evaluation programs with no time limits. The firm’s transparency and well-documented rules also create a sense of trust that many prop firms still lack.

The payout process is one of the fastest in the industry, often completed within two hours. This efficiency, combined with strong customer support, makes the experience smoother for traders who value quick access to their earnings. The firm also offers multiple platforms, including MetaTrader 5, TradeLocker, and cTrader, ideal for traders with diverse styles.

However, the Equity Stability Score (ESS) and consistency requirements can be restrictive, especially during payout requests. These measures aim to promote disciplined trading but may frustrate aggressive or short-term traders. Some reviews also mention unclear rule enforcement during breaches, suggesting that communication could be improved.

Despite those challenges, Top One Trader remains one of the more reliable and trader-oriented firms. It’s especially suitable for those who prioritize quick payouts, flexible account options, and structured growth opportunities in a clear, rule-based system.

| 💳 Challenge Fee | $64 – $2537 |

| 👥 Account Types | 1-step, 2-step, and instant funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 0% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker, TradingView |

| 🛍️ Asset Types | Forex, Metals, Indices, Crypto |

Funded Trading Plus

#16

Account Types

1-Step, 2-Step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader, DXTrade

Profit Target

5% – 10%

Our take on Funded Trading Plus

Funded Trading Plus (FTP) is known for its transparent rules and trader-first approach. The firm offers multiple programs, from instant funding to two-phase challenges, without enforcing consistency rules or time limits. For UK traders, this freedom allows steady progress without unnecessary pressure.

FTP’s biggest strength lies in its clarity and trust. Traders can hold positions over the weekend, trade news events, and expect payouts within 24 hours. The firm’s 5-Star Customer Promise and Prop Firm One partnership add credibility, supporting both manual and copy traders.

FTP also provides competitive scaling options, reaching up to $2.5 million, and profit splits as high as 100%. Platforms like MT5 and cTrader give flexibility, while leverage up to 30:1 keeps risk reasonable. It’s a structured yet trader-friendly setup.

That said, FTP isn’t the cheapest choice. The program fees are higher, and each trader can only manage two funded accounts. Some limitations apply to EA strategies, but these don’t overshadow the firm’s reliability or fairness.

| 💳 Challenge Fee | $119 – $4,500 |

| 👥 Account Types | 1-Step, 2-Step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, DXTrade |

| 🛍️ Asset Types | Forex, Indices, Commodities, Metals, Crypto |

City Traders Imperium

#17

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, Match Trader

Profit Target

5% -10%

Our take on City Traders Imperium

City Traders Imperium (CTI) stands out for combining education and prop trading under one ecosystem. Its programs offer flexible paths, from 1-step and 2-step challenges to instant funding, with up to 100% profit splits and no time limits. For UK traders, CTI’s regulated setup and focus on trading discipline make it a solid, growth-oriented choice.

The firm provides top-tier tools and platforms, including MT5 and Match-Trader, along with add-ons like risk calculators, journals, and economic calendars at no extra cost. CTI Academy further supports traders with structured learning for long-term consistency. Payouts are usually processed within five days, and scaling can reach up to $4 million for strong performers.

CTI also earns praise for fair rules and transparency, traders can hold positions overnight, trade news events, and use EAs with open-source code. However, there are restrictions on device usage and copy trading from other users, which may limit convenience for some.

While a few reviews mention payout delays and strict compliance checks, the firm’s quick customer responses and professional conduct generally resolve these issues. Overall, CTI balances opportunity with structure, ideal for traders who want both freedom and accountability.

| 💳 Challenge Fee | $29 – $4,799 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2,5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% -10% |

| 📊 Trading Platforms | MT5, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, Commodities |

QT Funded

#18

Account Types

2-step, 3-step, and instant funding

Trading Platforms

MT5, cTrader, TradeLocker

Profit Target

5% – 8%

Our take on QT Funded

QT Funded stands out as a UK-based prop firm known for its flexibility and modern structure. Traders can choose between instant funding or multi-step evaluations through the QT Prime and QT Power programs. The process is simple, accessible, and designed for traders who value speed and clear rules.

Payouts are impressively fast, often completed within 24 hours. With platforms like MT5, cTrader, and TradeLocker, traders enjoy low commissions, 1:30 leverage, and smooth execution. This multi-platform support makes QT Funded suitable for both beginners and professional day traders.

Scaling potential is strong, with a $400K total allocation cap and an optional 35% consistency rule for higher payouts. The firm’s clear structure rewards discipline without imposing unnecessary limits. It’s a balanced model that supports steady trader growth.

Customer support receives consistent praise for responsiveness and professionalism. While EA and copy trading approvals can feel strict, they ensure a fair environment for all. Overall, QT Funded blends trust, flexibility, and performance that appeal to serious UK traders.

| 💳 Challenge Fee | $54 – $1300 |

| 👥 Account Types | 2-step, 3-step, and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 8% |

| 📊 Trading Platforms | MT5, cTrader, TradeLocker |

| 🛍️ Asset Types | FX, Metals, Indices, Crypto, Other Commodities |

Fintokei

#19

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT4, MT5, cTrader, TradingView

Profit Target

2% – 10%

Our take on Fintokei

Fintokei has quickly become one of the more dynamic and modern prop firms in the trading space. Its tiered programs, from StartTrader to ProTrader Swing, give traders at every level a clear progression path. The structure is simple, transparent, and easy to follow, making it appealing to both new and experienced UK traders.

The firm’s instant payout system is a major advantage, with many users reporting same-day transfers. Fintokei also supports realistic trading conditions through simulated spreads, no-commission indices, and leverage up to 1:100. This setup closely mirrors live market behavior while keeping costs low.

Another strong point is its backing by the Purple Group, a reputable fintech company that adds credibility and resources. Fintokei’s scaling plan reaches up to $4 million, giving traders room to grow sustainably. The firm enforces solid risk rules, including limits on over-leveraging and aggressive trading, ensuring a fair environment.

Some traders mention minor slippage and platform limitations, particularly during high volatility. However, Fintokei’s support team is responsive and transparent when resolving issues. Overall, it’s a well-balanced firm offering fast payouts, strong risk controls, and professional backing.

| 💳 Challenge Fee | $99 – $1,299 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $10K – $400K |

| ⏱️ Time Limit | No time limit (StartTrader up to 180 days) |

| 🎯 Profit Target | 2% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView |

| 🛍️ Asset Types | FX, Metals, Energies, Indices, Cryptocurrencies |

PipFarm

#20

Account Types

1-step, 2-step, and instant funding

Trading Platforms

cTrader

Profit Target

5% – 12%

Our take on PipFarm

PipFarm positions itself as a modern, high-reward prop firm with a focus on flexibility and scaling potential. Traders can choose between Classic, Endurance, and Consistency modes, each offering different paths based on risk tolerance and strategy. This flexibility appeals to UK traders who value adaptable trading conditions and transparent rules.

The firm offers up to 99% profit share, which is among the highest in the industry. Its scaling program allows accounts to grow up to $1.5 million, rewarding traders who demonstrate consistent results. The Experience Program also adds gamification, giving rank-based perks like higher profit shares, lower commissions, and bonus gifts.

A standout feature is Payout Protection, allowing traders to keep profits even after breaching rules. Combined with weekly payout options and a “Friday Payday,” this makes PipFarm particularly attractive for active day traders seeking regular returns.

However, recent Trustpilot feedback highlights mixed user experiences, especially regarding delayed payouts and account closures tied to risk violations. While PipFarm’s platform is innovative, it may still be refining consistency in customer communication. It’s a promising prop firm with strong potential, but traders should proceed with caution.

| 💳 Challenge Fee | $40 – $1,200 |

| 👥 Account Types | 1-step, 2-step, and instant funding |

| 💰 Profit Split | 70% – 99% |

| 💵 Account Size | $2.5K – $100K |

| ⏱️ Time Limit | 365 days |

| 🎯 Profit Target | 5% – 12% |

| 📊 Trading Platforms | cTrader |

| 🛍️ Asset Types | Forex, Metals, Indices, Cryptocurrencies, Oil |

The Trading Pit

#21

Account Types

1-step, 2-step

Trading Platforms

cTrader, MT4, MT5, Tradovate, Quantower, R | Trader Pro, NinjaTrader 8

Profit Target

5% – 10%

Our take on The Trading Pit

The Trading Pit stands out for its multi-asset approach, offering evaluations for CFDs, futures, and stocks under a clear two-phase or one-phase challenge. The structure is straightforward, with transparent trading rules and accessible funding tiers. UK traders benefit from fair profit splits and an international reputation for reliability.

Its profit share of up to 80% and flexible evaluation paths make it suitable for traders with varying strategies. The firm’s partnership with Pinorena Capital adds credibility and ensures a solid backing for long-term sustainability. Educational tools like eBooks, webinars, and podcasts show a real investment in trader development.

Payouts are typically smooth, and the firm’s rules emphasize consistency and risk control rather than restrictive micromanagement. The inclusion of copy trading, EA allowances, and scaling potential creates room for skilled traders to expand while maintaining discipline.

Despite its strong foundation, The Trading Pit receives mixed reviews on support responsiveness and account closures linked to rule enforcement. While not perfect, its transparent approach and global reach make it a solid choice for experienced UK traders who value professionalism and structure.

| 💳 Challenge Fee | $49 – $1,139 |

| 👥 Account Types | 1-step, 2-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | cTrader, MT4, MT5, Tradovate, Quantower, R | Trader Pro, NinjaTrader 8 |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto & Stocks CFDs |

Hantec Trader

#22

Account Types

1-step, 2-step, and instant funding

Trading Platforms

MT4, MT5

Profit Target

4% – 10%

Our take on Hantec Trader

Hantec Trader offers a realistic and structured prop trading environment powered by Hantec Markets Mauritius, a regulated broker with over 30 years of experience. It provides real-market-like conditions, fast execution, and flexible programs suited for both beginners and seasoned UK traders.

With up to 90% profit rewards and funding options reaching $200,000, traders can choose between 1-step or 2-step evaluations. The programs feature on-demand payouts, weekend holding, and news trading, giving users more control over their trading styles. Its strong infrastructure and clear rules promote long-term consistency.

The firm’s scaling plan and platform flexibility make it a credible option for traders seeking growth. Copy trading through Prop Firm One expands earning opportunities, while fast customer support adds reliability. Overall, Hantec Trader suits traders who value transparency and disciplined performance.

| 💳 Challenge Fee | $19 – $999 |

| 👥 Account Types | 1-step, 2-step, and instant funding |

| 💰 Profit Split | 75% – 90% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit – 30 days |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5 |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto |

Trade The Pool

#23

Account Types

1-step

Trading Platforms

Trader Evolution

Profit Target

6% – 15%

Our take on Trade The Pool

Trade The Pool specializes in U.S. stock trading, offering access to real market data and a structured evaluation model. The platform focuses on capital preservation and risk control, which helps traders develop consistency and discipline. Its design is ideal for those seeking a long-term approach rather than short bursts of profit.

With buying power up to $200,000, traders can start small and scale gradually. Programs like Day Trade Flex and Swing Flex give traders flexibility to match their style, supported by fair payout structures and clear rules. The firm also provides 100+ hours of training materials and community access to help traders learn effectively.

The platform’s user-friendly interface and transparent rules make it easy to navigate. Trade The Pool’s educational focus sets it apart, turning trading into a skill-building process. For UK traders interested in U.S. equities, it’s a structured and secure environment to practice risk management.

| 💳 Challenge Fee | $47 – $1,475 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 70% – 80% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | 60 days |

| 🎯 Profit Target | 6% – 15% |

| 📊 Trading Platforms | Trader Evolution |

| 🛍️ Asset Types | Stocks, ETFs, Including penny stocks |

ATFunded

#24

Account Types

1-step, 2-step

Trading Platforms

MT5

Profit Target

5% – 8%

Our take on ATFunded

ATFunded stands out as a broker-backed prop firm supported by ATFX, a globally trusted name in trading. This partnership ensures institutional-grade execution, tight spreads, and transparency, qualities often missing in independent prop firms. Its programs are designed for UK traders who value stability and fair challenge conditions.

The ATFunded Pro offers a simple one-phase model with a 6% profit target and no time limit, ideal for traders seeking a faster route to funding. Meanwhile, the two-phase challenge provides a more forgiving structure with balanced risk limits. Both options include a clear payout process and a realistic drawdown model.

Traders can access up to $200,000 in funding and enjoy scalable payouts from 50% to 80%. The platform also supports copy trading through ATFX, adding extra income potential for consistent performers. ATFunded provides a professional path for traders who want to grow in a regulated environment.

| 💳 Challenge Fee | $25 – $920 |

| 👥 Account Types | 1-step, 2-step |

| 💰 Profit Split | 50% – 80% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 8% |

| 📊 Trading Platforms | MT5 |

| 🛍️ Asset Types | Forex, Metals, Oil, Indices, Crypto CFDs |

Instant Funding

#25

Account Types

1-step, 2-step, and instant funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Instant Funding

Instant Funding offers traders immediate access to funded accounts, removing the long evaluation process. It’s designed for UK traders who want to trade right away while maintaining transparency and strict trade ethics. With options for MetaTrader, cTrader, and Match-Trader, it caters to a wide range of traders globally.

The firm stands out for its on-demand payouts and loyalty system, rewarding traders with PlusPoints and discounts of up to 50% on future purchases. Instant Funding provides flexibility through add-ons like news trading or increased profit splits, making it adaptable to different trading styles.

Despite some user complaints about payout disputes, the firm maintains a proven record of over $14 million paid since launch and supports more than 60 instruments. Its no-consistency-rule model and fast processing make it ideal for experienced traders who prefer instant capital and straightforward terms.

| 💳 Challenge Fee | $25 – $5,499 |

| 👥 Account Types | 1-step, 2-step, and instant funding |

| 💰 Profit Split | 60% – 95% |

| 💵 Account Size | $2 – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, Commodities |

Blueberry Funded

#26

Account Types

1-step, 2-step, rapid, and instant funding

Trading Platforms

MT4, MT5, DXTrade, TradeLocker

Profit Target

5% – 10%

Our take on Blueberry Funded

Blueberry Funded is a broker-backed prop firm offering flexible challenges with clear scaling opportunities. Supported by Blueberry Markets, it provides traders with access to regulated infrastructure and industry-standard platforms like MetaTrader and TradeLocker. The firm’s goal is to balance transparency, fair evaluation, and steady growth for its users.

Traders can choose between multiple challenge types, from rapid to synthetic, and scale up to $2 million in simulated capital. The scaling plan rewards consistent profits with up to 90% profit splits and a 25% balance increase every three months. For UK traders, this makes it an appealing option for structured, long-term trading growth under reliable broker supervision.

While its scaling system and variety of challenges stand out, recent user feedback highlights concerns about customer support and sudden account terminations. Traders who prefer firms with faster responses or looser rules may find Blueberry more rigid. However, disciplined traders focused on rule-based strategies can benefit from its broker-grade stability.

| 💳 Challenge Fee | $25 – $1,500 |

| 👥 Account Types | 1-step, 2-step, rapid, and instant funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $1,25K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, Stocks, Futures |

Breakout

#27

Account Types

1-step, 2-step

Trading Platforms

Breakout Terminal

Profit Target

5% – 10%

Our take on Breakout

Breakout has quickly become one of the most trusted crypto-focused prop firms, especially after its acquisition by Kraken. It offers fast evaluations, instant payouts, and a modern trading dashboard that’s easy to navigate. Traders can earn up to 90% profit splits with flexible 1-step or 2-step challenges designed for both beginners and pros.

The firm’s standout feature is its on-demand withdrawals, allowing traders to cash out within minutes, a rare perk in the prop industry. UK traders may find this particularly attractive, as Breakout’s fast processing and simple rules reduce friction and waiting time. The daily loss limits and low drawdown targets keep risk transparent and manageable.

While its technology and payout system earn strong praise, some traders mention platform stability issues and slippage on high-volume trades. Overall, Breakout delivers a strong crypto prop model that balances innovation, fairness, and speed.

| 💳 Challenge Fee | $45 – $1,500 |

| 👥 Account Types | 1-step, 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | Breakout Terminal |

| 🛍️ Asset Types | Cryptocurrencies |

3. How we selected the best prop firms in the UK

Choosing the right prop trading firm in the UK is about trust, structure, and support. For this list, each firm was evaluated based on transparency, fairness, and how well it serves UK traders with different goals and trading styles.

Here’s what we looked for when selecting the best prop firms:

- Clear trading rules and transparency: Every firm must publish straightforward trading conditions, including profit targets, drawdown limits, and refund options.

- Fair profit splits and reasonable fees: Top firms reward traders fairly, typically offering 80–90% profit splits with low or refundable challenge costs.

- Realistic evaluation challenges: We prioritised firms with achievable targets, flexible timelines, and clear criteria, not those designed to fail traders.

- Strong trader support: Reliable customer service, fast communication, and active help channels were key in identifying trader-focused firms.

- Active trading community: A vibrant community with peer discussions, Discord groups, or mentorship programs adds long-term value.

- Accessibility for different trading strategies: The best firms accommodate various trading styles, allowing both manual and algorithmic traders to perform freely.

In summary, only firms that demonstrated fairness, flexibility, and consistent trader support made it to this list. These companies combine realistic evaluation challenges with active trading communities. They offer UK traders a transparent and rewarding path to funded trading success.

4. How to choose the right prop firm as a UK trader

Finding the right prop firm as a UK trader can feel overwhelming, especially with so many options claiming to offer the “best funding”. The smartest approach is to focus on stability, fairness, and how well a firm supports your overall trading experience.

Here are key things to consider when making your choice:

- Reputation and sustainability: Look into the firm’s background and trader reputation on platforms like Trustpilot. Choose one that’s transparent, well-reviewed, and not overly dependent on third-party tools that can cause sudden shutdowns. Firms with in-house trading software are usually more secure and future-proof.

- Fees and profit-split model: Check if the firm’s pricing and payout structure make sense. Most firms charge between $50 and $600 for evaluations, depending on account size and challenge type. Some, like FundedNext and Maven Trading, refund fees after funding, while others may add small activation or platform costs post-evaluation.

- Trading support tools and education: Go for firms that enhance your performance through powerful dashboards, analytics, and integrated trading platforms. Tools like TradingView or MetaTrader make analysis smoother, while solid trader education resources and responsive support teams help you stay on track.

- Fit with your trading style and goals: The firm should match your preferred trading instruments and approach, whether short-term, swing, or long-term. A good prop firm provides flexibility, a clean interface, and a hassle-free withdrawal process so you can focus on trading, not red tape.

- Asset focus: Choose a firm that matches the markets you trade most. If you focus on forex, firms like The5%ers or FTMO are among the most reliable. For futures, Apex Trader Funding and Topstep stand out, while stock traders may prefer Trade The Pool for its real-market data and transparent structure.

In short, the best prop firm for UK traders is one that combines reliability, fairness, and flexibility. Look for a trader-friendly structure that aligns with your goals, provides room to grow, and keeps you in control of your trading journey, not the other way around.

Traders exploring the best prop trading firms in the UK or the best prop firms in the UK will find that transparency and payout speed matter more than flashy marketing promises.

May you need to know: Easiest Prop Firms to Pass in 2026 and Get Funded

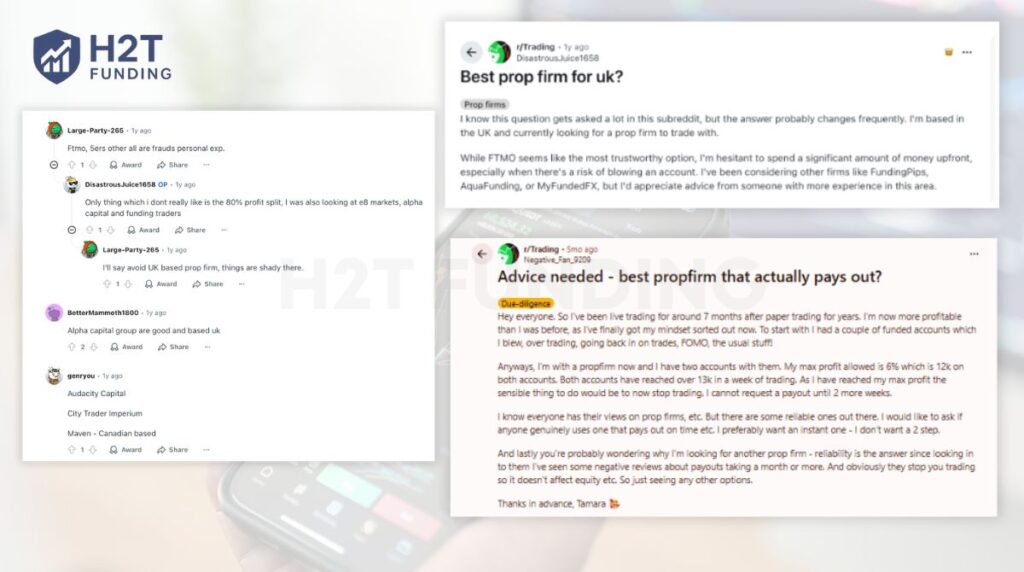

5. Best prop firms UK Reddit: What real traders say

When it comes to finding reliable prop trading firms in the UK, Reddit is one of the best places to hear from real traders. The discussions there give an honest look at what’s working, and what’s not, for traders at different levels of experience.

Many UK traders on Reddit highlight FTMO as a trustworthy choice but express concern about the high evaluation costs and the risk of losing the account after one mistake. Others mention alternatives like FundingPips, AquaFunding, or MyFundedFX as more affordable options with flexible profit splits.

Some users warn against smaller UK-based firms that lack transparency, while others recommend Alpha Capital Group and City Trader Imperium for their strong local presence and reliable payouts.

Reddit users emphasize doing your homework before committing funds. Look beyond marketing, check trader reviews, payout proof, and trading platforms compatibility. The community agrees that the best prop firm isn’t just about high profit splits. It’s about trust, trading experience, and consistent support that helps traders grow steadily in the long term.

In many discussions, Reddit users also rank several of the best prop trading firms in the UK. These rankings highlight the best prop firms in the UK based on verified payout proofs and transparency in their evaluations.

Explore more prop firms if you are a beginner trader: Best Prop Firms For Beginners

6. UK regulations and tax considerations for prop traders

Trading with a prop firm in the UK is fully legal, but there are important details traders need to understand. Most proprietary trading firms operate under general business law rather than specific financial regulations because traders use simulated accounts, not client funds. This means UK traders can join both domestic and international firms without breaching FCA rules.

When it comes to taxes, HMRC treats prop traders as self-employed or independent contractors. Any profit splits or payouts received from trading should be declared as income. Keeping detailed records of trades, withdrawals, and fees is essential for accurate reporting.

It’s also wise to check whether your accounts are tied to UK or overseas entities. Understanding the regulatory jurisdiction can help you avoid unexpected complications, especially if the firm uses third-party trading platforms or operates across borders.

For traders focusing on the futures market, see our guide on Best Futures Prop Firms.

7. Tips to maximise success with UK prop firms

Over the years, I’ve seen many traders fail not because of strategy, but because of poor discipline. Prop trading success in the UK depends on mindset just as much as skill.

Here’s what I’ve found most effective:

- Build solid risk management habits: Control your position size, set loss limits, and never risk more than you can afford. Proper risk management keeps you in the game when markets turn volatile.

- Focus on consistency: Aim for stable trading performance rather than chasing big wins. A consistent record shows that prop firms are reliable and scalable.

- Leverage education and community: Take advantage of a firm’s educational resources and trading groups. Engaging with other traders can help refine your trading strategies and sharpen your decision-making.

- Track and review goals: Use a trading journal to monitor progress and adjust your approach. Define your trading goals clearly and measure results over time.

To sum up, mastering prop trading as a UK trader takes patience and structure. Stay disciplined, learn continuously, and surround yourself with a supportive community; that’s how you turn prop funding into a long-term trading career. For an in-depth look at trusted firms, check out our prop firm review.

8. FAQs

Yes. Prop firms can operate legally in the UK as long as they do not manage client money or give financial advice. Most firms only offer evaluation programs and simulated accounts, so they are allowed under current rules.

Beginners often prefer firms with simple rules, clear profit targets, and fair drawdown limits. Good beginner-friendly firms usually offer strong support, learning materials, and no time pressure during challenges.

Yes. Most US prop firms accept traders from the UK. You only need to pass identity checks and use common payout methods such as bank transfer, Wise, PayPal, or crypto.

Yes. Prop firm payouts are normally treated as self-employment income. You must report your earnings to HMRC and pay tax based on your income level. Keep records of all payouts to make reporting easier.

Prop firms usually allow forex, indices, gold, oil, crypto, and sometimes stock CFDs. Each firm sets its own rules for leverage, spreads, and lot sizes, so check the conditions before you start.

Most prop firms support MT4, MT5, and cTrader. Some also allow TradingView execution or their own custom platforms. All these platforms work normally in the UK.

9. Conclusion

Choosing the best prop firm isn’t just about profit splits or account size; it’s about trust, transparency, and long-term potential. As a trader, I’ve learned that success depends on finding a firm that matches your trading style, supports your growth, and respects your discipline.

Before joining any program, take time to research the firm’s reputation, trading conditions, and regulatory background. Focus on consistency, solid risk management, and ongoing learning. For traders focused on forex, checking out the best forex prop firms UK can be a great starting point to find flexible programs and fair evaluation models.

Hopefully, with the comprehensive list of 27 Best Prop Firms UK from H2T Funding, you can confidently choose the right firm. That aligns with your goals and experience, setting the foundation for a sustainable, rewarding trading journey.