Finding the best futures prop firms can feel overwhelming: high fees, vague rules, and delayed payouts often make it hard to know who to trust. After testing and researching dozens of firms, I’ve narrowed it down to the top 16 futures prop firms that truly stand out in 2026.

Among them are FundedNext Futures, FXIFY Futures, Topstep, and MyFundedFutures, firms known for fair funding, fast payouts, and transparent trading rules.

In this guide, you’ll see how each firm works, what makes them different, and how to choose the one that aligns with your trading goals. It’s everything you need to pick a prop firm that supports your growth, not limits it.

1. What is a futures prop firm? What are the best futures prop firms?

A futures prop firm is a company that provides traders with capital to trade futures contracts without risking their own money. Instead of depositing large amounts, traders use the firm’s funds to open positions on regulated exchanges like CME, NYMEX, or CBOT. In return, they share a portion of their profits with the firm, usually keeping between 80% and 100%.

These firms give traders access to professional trading platforms, real-time market data, and strict risk controls. Every trader must follow defined rules for drawdown, daily loss limits, and consistency to protect the firm’s capital. Passing an evaluation or challenge is the first step before getting a live funded account.

When it comes to performance and reliability, several names dominate the industry as the best futures trading prop firms. In 2026, top contenders include FundedNext Futures, FXIFY Futures, Topstep, and MyFundedFutures, all recognized for their fair rules, fast payouts, and transparent fee structures.

Among the top futures prop firms, each offers unique advantages:

- FundedNext Futures: One-step evaluation, no time limit, and 100% profit split after funding.

- FXIFY Futures: Advanced in-house dashboard, flexible Direct-to-Sim-Live model, and payouts within 48 hours.

- Topstep: Trusted legacy firm with educational support, TradingView integration, and daily payout processing.

- MyFundedFutures: Futures-only firm with instant withdrawals and low commissions.

For traders seeking the best prop firms for futures trading, these firms combine flexibility, fairness, and speed. They stand out across multiple reviews, including those on the best prop firms for futures Reddit discussions. Some also rank among the best prop firms for options trading thanks to their CME access and scalable funding plans.

If you’re ready to explore in detail, continue reading below to find the Top 16 best futures prop firms (2026 Updated List).

2. Top 16 best futures prop firms (2026 Updated list)

Looking for the most reliable funding programs this year? Here’s a handpicked list of the best futures prop firms in 2026, ranked by payout speed, trading rules, and overall trader experience.

| Firm | Profit Split | Rating | Actions |

|---|---|---|---|

|

80% |

4.5

|

Open an account |

|

80% – 100% |

3.9

|

Open an account |

|

90% – 100% |

4.4

|

Open an account |

|

80% – 95% |

4.6

|

Open an account |

|

90% – 100% |

4.4

|

Open an account |

|

80% |

4.7

|

Open an account |

|

80% |

2.4

|

Open an account |

|

80% |

4.7

|

Open an account |

|

95% |

4.8

|

Open an account |

|

70% – 90% |

4.9

|

Open an account |

|

80% – 90% |

4.2

|

Open an account |

|

90% – 100% |

4.6

|

Open an account |

|

80% |

3.6

|

Open an account |

|

70% – 100% |

3.2

|

Open an account |

|

80% – 90% |

3.4

|

Open an account |

|

80% |

4.8

|

Open an account |

Continue reading to explore detailed insights on each prop firm and find the one that suits your trading goals.

FundedNext Futures

#1

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView

Profit Target

5% – 6%

Our take on FundedNext Futures

From a futures trader’s perspective, FundedNext Futures stands out for its transparency and simplicity. The one-time challenge fee model removes monthly costs, platform fees, or data charges, a rare advantage among futures prop firms. This allows traders to focus on performance, rather than recurring expenses.

The program supports CME mini and micro contracts across various indices, currencies, metals, energy, and agricultural products. You can trade via Tradovate or NinjaTrader, both offering real CME pricing and smooth execution. These options make it flexible for different trading styles.

A 15% profit split during the challenge and 100% after funding shows a strong commitment to fair rewards. Combined with the 24-hour payout guarantee (plus $1,000 if delayed), FundedNext Futures delivers one of the fastest and most reliable payout systems in the industry.

| 💳 Challenge Fee | $99.99 – $249.99 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView |

| 🛍️ Asset Types | CME futures |

FXIFY Futures

#2

Account Types

1-step and direct to SIM live

Trading Platforms

Project X, Quantower, NinjaTrader 8, Tradovate, TradingView

Profit Target

4% – 7%

Our take on FXIFY Futures

FXIFY Futures delivers a modern and flexible funding model built for professional futures traders. Its standout feature is the in-house trading dashboard, which uses advanced analytics to track performance, spot weaknesses, and improve trading consistency. Everything is integrated into one central platform for a smoother experience.

The firm offers one-step and Direct-to-Sim-Live accounts, with plans ranging from $15K to $150K. There are no time limits, and traders can qualify in as few as three trading days. With up to 90–100% profit splits, fast payouts, and free Level 1 data, FXIFY Futures combines speed, technology, and transparency.

Its payout process is among the best, with withdrawals every 14 days with 24–48-hour processing, and a minimum payout of $100. Supported methods include Riseworks and crypto, making it accessible worldwide. Overall, FXIFY Futures blends modern infrastructure with trader-friendly terms, offering a premium experience for futures professionals.

| 💳 Challenge Fee | $89 – $799 |

| 👥 Account Types | 1-step and direct to SIM live |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $15K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 7% |

| 📊 Trading Platforms | Project X, Quantower, NinjaTrader 8, Tradovate, TradingView |

| 🛍️ Asset Types | Futures Contracts |

Topstep

#3

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep is one of the most established prop firms for futures trading, offering a smooth path from evaluation to funding. With over a decade of experience and thousands of traders funded, it remains a benchmark in the futures prop space. Its Trading Combine® program is simple: one step, one rule, prove consistency, manage risk, and get funded.

The structure is straightforward. You can start with $50K, $100K, or $150K accounts, paying $49–$149 per month. Profit targets range from $3,000 to $9,000 (around 6%), with realistic drawdown limits and up to 15 contracts. After passing, a $149 activation fee unlocks your funded account.

What makes Topstep stand out is its TopstepX™ platform, designed specifically for futures traders. It integrates TradingView charts, the Tilt™ indicator, and a built-in trade copier, tools rarely found in other prop firms. Add to that commission-free trading, daily payout processing, and personalized coaching, and you get a complete trader ecosystem.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

My Funded Futures

#4

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading

Profit Target

6%

Our take on My Funded Futures

My Funded Futures, founded in 2023 by CEO Matthew Leech, focuses purely on futures trading. This niche approach gives traders a professional setup tailored to CME, CBOT, COMEX, and NYMEX markets. It’s a clean, transparent alternative to mixed forex-crypto prop firms.

The firm offers a one-phase evaluation with no time limits and no daily loss restrictions. Account sizes range from $50K to $150K, and traders keep 80% of profits. Fees start as low as $77, and commissions begin at $1.42 per side, making it affordable for new and experienced traders alike.

What sets it apart is its focus on speed and trust. Instant payouts, public payout certificates, and 24/7 live support reinforce credibility. While it’s still a new player, a 4.9 Trustpilot rating and positive trader feedback suggest it’s quickly earning respect among futures traders.

| 💳 Challenge Fee | $77 – $477 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading |

| 🛍️ Asset Types | Futures Contracts |

Apex Trader Funding

#5

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

As a futures trader, Apex Trader Funding has always stood out to me for one simple reason: freedom. The firm’s one-step evaluation process and absence of daily drawdowns let traders manage risk naturally, just like on a real futures desk. Founded in 2021 and based in Austin, Texas, Apex quickly became one of the most recognized names among futures prop firms.

The program offers 100% of the first $25,000 in profits and 90% beyond, a structure that strongly rewards consistency and skill. Traders can use up to 35 contracts (350 micros) depending on the account size, and trade freely during news events or even on holidays. Payouts occur every 8 days, faster than most prop firms for futures trading.

From my experience, Apex’s simple rule set and real-time data access make it ideal for traders seeking realistic conditions. The flexibility to scale, maintain multiple accounts, and trade full-sized futures contracts without daily limits makes Apex a go-to choice for serious futures professionals.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

TradeDay

#6

Account Types

Intraday, End of Day (EOD), and Static evaluation

Trading Platforms

NinjaTrader 8, Tradovate, Jigsaw Trading, TradeDayX

Profit Target

2.5% – 6%

Our take on TradeDay

TradeDay is a U.S.-based futures prop firm known for transparency and quick payouts. Founded in 2020, it has built a strong reputation with a 4.6 Trustpilot rating, offering traders a flexible, educational, and realistic funding experience. Its mission is simple: to fund disciplined futures traders and help them grow sustainably.

The firm stands out with day-one payouts, up to 95% profit share, and no payout frequency limits. It supports NinjaTrader, Tradovate, TradingView, Jigsaw, and Quantower, giving traders full freedom to choose their preferred platform. The TradeDayX Copilot membership also provides live webinars, market research, and community access for only $24/month.

TradeDay’s model focuses on professionalism. Traders face a 30% consistency rule during evaluation, 5 minimum trading days, and realistic profit targets (3K–9K). Payouts follow a tiered structure, 80% up to $50K, 90% up to $100K, and 95% beyond, making it one of the most rewarding prop firms for futures trading.

| 💳 Challenge Fee | $125 – $375 |

| 👥 Account Types | Intraday, End of Day (EOD), and Static evaluation |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 2.5% – 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, Jigsaw Trading, TradeDayX |

| 🛍️ Asset Types | Futures Contracts |

Earn2Trade

#7

Account Types

1-step

Trading Platforms

NinjaTrader 8, Finamark, R | Trader Pro

Profit Target

6% – 7%

Our take on Earn2Trade

If you’re serious about a long-term futures trading career, Earn2Trade offers one of the most structured and educational funding paths in the industry. Founded in 2016, this firm blends funding with mentorship, helping traders grow through its Trader Career Path® and Gauntlet Mini™ programs.

I find Earn2Trade especially strong for new or developing futures traders. The Trader Career Path® lets you scale accounts up to $400,000, while the Gauntlet Mini™ focuses on shorter intraday evaluations with just 10 trading days required. Both programs promote consistent growth and strict risk control, exactly what serious traders need to build sustainable results.

The firm is transparent about every rule, from the 30% consistency limit to the $100 minimum withdrawal. Earn2Trade offers 80% profit splits and weekly payouts. With a 4.7 Trustpilot rating, it stands as one of the most reputable futures prop firms for traders who value structure, education, and clear advancement.

| 💳 Challenge Fee | $68 – $550 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% – 7% |

| 📊 Trading Platforms | NinjaTrader 8, Finamark, R | Trader Pro |

| 🛍️ Asset Types | Futures (indices, energy, metals, and more) |

Leeloo Trading

#8

Account Types

Foundation, Entry (LE), Bundle (LB), and Leeloo Express™

Trading Platforms

Rithmic, NinjaTrader 8, Tradovate, Quantower

Profit Target

6%

Our take on Leeloo Trading

Leeloo Trading is one of the more flexible futures prop firms, designed for traders who want fewer restrictions and more trading freedom. Founded in the U.S. with a growing reputation, Leeloo allows traders to swing trade, hold positions overnight, and trade news, features that many other futures firms limit.

From my experience, Leeloo’s biggest advantage is its no daily drawdown and no time limit policy, letting traders progress at their own pace. The firm’s range of accounts, from $25K to $300K, includes both Foundation and Entry plans, making it accessible for beginners while offering scalability for professionals.

Traders also benefit from Leeloo Express™, a 14-day fast-track evaluation with a full refund upon qualification, and bundle accounts for managing multiple evaluations at once. With a 4.2 Trustpilot rating and simple rules, Leeloo appeals to futures traders seeking control, low-cost entry, and a relaxed trading environment.

| 💳 Challenge Fee | $26 – $675/month |

| 👥 Account Types | Foundation, Entry (LE), Bundle (LB), and Leeloo Express™ |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Rithmic, NinjaTrader 8, Tradovate, Quantower |

| 🛍️ Asset Types | Futures Contracts |

Tradeify

#9

Account Types

1-step and instant funding

Trading Platforms

Tradovate, NinjaTrader 8, Quantower, TradingView, Project X

Profit Target

6%

Our take on Tradeify

Tradeify stands out as a modern futures prop firm built for speed and transparency. Unlike traditional firms with long evaluations, Tradeify offers instant or one-day funding, letting traders jump into the futures markets without delay. Its built-in journal and clear payout structure make it appealing to traders who want fast feedback and measurable progress.

For futures traders, the flexibility to trade on CME, CBOT, COMEX, and NYMEX with top platforms like Tradovate and Project X is a big plus. The End-of-Day drawdown on Growth accounts fits intraday and swing traders, while Lightning plans serve scalpers chasing short-term opportunities.

Having used and compared several futures props, I find Tradeify’s model suits traders who value quick execution, automated payouts, and fair, rule-based funding.

| 💳 Challenge Fee | $69 – $729 |

| 👥 Account Types | 1-step and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, Quantower, TradingView, Project X |

| 🛍️ Asset Types | Futures Contracts |

Top One Futures

#10

Account Types

1-Step Elite Challenge, Instant Sim Funded, S2F Sim PRO

Trading Platforms

NinjaTrader 8

Profit Target

6%

Our take on Top One Futures

Top One Futures has quickly become one of the most trusted futures prop firms thanks to its balance between structure and trader freedom. It delivers instant funding, no hidden rules, and fast payouts, often within 24 hours.

For futures traders, this firm’s End-of-Day drawdown, simple consistency model, and transparent scaling path make it a strong choice for both short-term and disciplined swing traders.

What I like most as a futures trader is how Top One keeps the process simple: one-day evaluations, clear funding tiers, and no restrictions on news trading. The Equity Stability Score (ESS) is a smart approach; it rewards consistent risk control instead of luck-based spikes.

Combine that with a 90/10 split and a direct path to live funding after three payouts, and you’ve got one of the best futures prop firms for traders seeking longevity.

| 💳 Challenge Fee | $34 – $898 |

| 👥 Account Types | 1-Step Elite Challenge, Instant Sim Funded, S2F Sim PRO |

| 💰 Profit Split | 95% |

| 💵 Account Size | $25K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8 |

| 🛍️ Asset Types | Futures Contracts |

Alpha Futures

#11

Account Types

Zero Plan, Standard Plan, Advanced Plan

Trading Platforms

NinjaTrader 8, Tradovate, Project X, Quantower, TradingView

Profit Target

6% – 8%

Our take on Alpha Futures

Alpha Futures has built a strong reputation in the futures trading space, combining flexibility with strict discipline. The firm stands out with its three-tiered structure: Zero, Standard, and Advanced Plans, each tailored to different skill levels. Traders benefit from clear rules, fast weekly payouts, and up to 90% profit splits.

The firm’s focus on scaling contracts, transparent drawdown protection, and consistent profit structure makes it one of the most balanced programs available today.

From my perspective as a futures trader, Alpha Futures feels like a solid middle ground between accessibility and professionalism. The 2% Daily Loss Guard, 40–50% consistency rule, and the no-activation-fee policy show a trader-first mindset. Combined with weekly withdrawals and fair drawdown margins, it’s a great fit for disciplined traders who value both control and steady growth.

| 💳 Challenge Fee | $79 – $419 |

| 👥 Account Types | Zero Plan, Standard Plan, Advanced Plan |

| 💰 Profit Split | 70% – 90% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% – 8% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, Project X, Quantower, TradingView |

| 🛍️ Asset Types | Futures Contracts |

Take Profit Trader

#12

Account Types

1-step

Trading Platforms

NinjaTrader 8, Tradovate, TradingView

Profit Target

6%

Our take on Take Profit Trader

Take Profit Trader is known for its speed, clarity, and trader-first approach. The firm allows instant withdrawals once traders reach the PRO stage, removing the long payout delays typical of other futures firms. With just five trading days required to qualify, it offers one of the fastest paths to funded trading futures in the industry.

Its real-time drawdown on PRO accounts promotes tight risk control, while the end-of-day system on Test and PRO+ suits those who prefer more flexibility. Traders also benefit from up to 90% profit splits, multiple platforms (NinjaTrader, Tradovate, Quantower, TradingView), and 24/7 live support. A strong 4.5/5 Trustpilot score from over 6,700 reviews highlights its credibility and trader satisfaction.

| 💳 Challenge Fee | $150 – $360 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, TradingView |

| 🛍️ Asset Types | Futures, Agricultural, Metals, Energy |

OneUp Trader

#13

Account Types

1-step

Trading Platforms

NinjaTrader 8, R | Trader Pro, AgenaTrader, Bookmap, MotiveWave, Trade Navigator, Volfix, Sierra Chart, Jigsaw Trading, MultiCharts, Photon, InsideEdge

Profit Target

6%

Our take on OneUp Trader

OneUp Trader has long been a go-to prop firm for futures traders seeking simplicity and transparency. Its 1-step evaluation and no daily drawdown rule make it one of the easiest programs to navigate, especially for traders who value flexibility.

With a 95% profit split, free NinjaTrader license, and instant profit withdrawals, the firm offers a trader-friendly setup that rewards consistent performance rather than restrictive metrics.

The trailing drawdown stops at the initial account balance, removing the usual pressure many futures firms impose. Account sizes range up to $250K, and the first $10,000 in profits is fully yours, a major incentive for active traders. Backed by a strong 4.7/5 Trustpilot rating and fast support response, OneUp stands out as a reliable choice for traders who want a clean, fair, and efficient futures funding experience.

| 💳 Challenge Fee | $125 – $325 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, R | Trader Pro, AgenaTrader, Bookmap, MotiveWave, Trade Navigator, Volfix, Sierra Chart, Jigsaw Trading, MultiCharts, Photon, InsideEdge |

| 🛍️ Asset Types | Futures Contracts |

UProfit

#14

Account Types

1-step

Trading Platforms

TradingView, Tradovate, Tradoverse

Profit Target

6%

Our take on UProfit

Uprofit is one of my favorite picks for futures traders who want a clean, no-nonsense funding path. The evaluation starts at just $39/month, making it one of the most affordable entries in the industry. The setup feels simple, trade in a risk-free SIM environment, hit your goals, and scale into real capital.

What I really like is how modern and mobile-friendly the experience is. Trading on TradingView or Tradoverse feels smooth, and you can manage your account anytime. There’s no personal risk, no hidden payout limits, and fast withdrawals once you qualify. For me, Uprofit nails the balance between accessibility and professionalism that futures traders actually need.

| 💳 Challenge Fee | $39 – $98 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TradingView, Tradovate, Tradoverse |

| 🛍️ Asset Types | Futures Contracts |

AquaFutures

#15

Account Types

1-step, instant funding

Trading Platforms

Project X

Profit Target

6% – 8%

Our take on AquaFutures

AquaFutures is a young prop firm trying to make an impact in the futures trading space with a clean setup and fast reward system. I like their straightforward structure, clear 6% profit targets, flexible withdrawal timing, and a 48-hour payout promise. Their up-to-100% profit split gives traders strong motivation to perform well, especially for those who value fast-turnover funding models.

However, AquaFutures is still building trust. While 45% of reviews on Trustpilot are 5-star, about 39% are 1-star, mainly citing slow or unresponsive support and payout delays. This suggests the firm may be facing growing pains in customer service and operations.

Still, for futures traders seeking simplicity, affordable entry fees, and transparent targets, AquaFutures can be worth trying, but with cautious expectations until the firm matures further.

| 💳 Challenge Fee | $26 – $728 |

| 👥 Account Types | 1-step, instant funding |

| 💰 Profit Split | 70% – 100% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% – 8% |

| 📊 Trading Platforms | Project X |

| 🛍️ Asset Types | Futures Contracts |

FundingTicks

#16

Account Types

1-step and 2-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView

Profit Target

3% – 6%

Our take on FundingTicks

FundingTicks brings a polished, professional setup for futures traders who want flexibility and structure in one place. What stands out to me is the firm’s transparency, clear reward cycles, no hidden fees, and a straightforward payout system with up to 90% profit split.

The ability to trade through multiple platforms like Tradovate, NinjaTrader, and TradingView adds convenience, especially for traders who prefer to customize their workflow.

Their Trustpilot rating of 4.1/5 and reputation for responsive support are reassuring. The structured Pro+ and Zero models cater well to different trading styles, whether you prefer tight rules or faster rewards. With weekly payout options and clear consistency rules, FundingTicks feels reliable for disciplined futures traders aiming for consistent growth.

| 💳 Challenge Fee | $109/month – $599/ one-time fee |

| 👥 Account Types | 1-step and 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $25K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 3% – 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView |

| 🛍️ Asset Types | Futures Contracts |

Read more:

3. Compare futures prop firms vs. forex firms

Both futures and forex prop firms give traders access to company-funded capital, but the markets they operate in are very different. Futures trading takes place on regulated exchanges with fixed contract sizes and transparent pricing, while forex trading is decentralized, offering flexible lot sizes and continuous 24/5 access.

Here’s a simple comparison to help you understand the key differences:

| Feature | Futures Prop Firms | Forex Prop Firms |

|---|---|---|

| Market Type | Decentralised, traded through brokers (OTC) | Decentralized, traded through brokers (OTC) |

| Trading Hours | Limited to exchange sessions | 24 hours, 5 days a week |

| Contract Size | Fixed contract values (e.g., 1 E-mini S&P 500 = $50 per point) | Flexible lot sizing |

| Leverage | 1:10 – 1:50 (exchange regulated) | Up to 1:500 (broker dependent) |

| Execution Type | Real market execution with transparent pricing | Broker execution with variable spreads |

| Asset Classes | Commodities, indices, metals, bonds | Currencies, indices, commodities, crypto |

| Best For | Structured traders seeking regulated, rule-based environments | Active traders seeking flexibility and higher leverage |

In short, futures prop trading focuses on precision and professionalism, while forex prop trading emphasizes speed and flexibility.

4. How we rank the best futures prop firms

Selecting the best futures prop firms requires more than just checking profit splits or account sizes. Our evaluation process focuses on how well each firm supports traders with real funding opportunities, transparent rules, and fast, reliable payouts.

Here’s what we consider when ranking the top futures prop firms:

- Profit split and payout speed: Firms with high profit splits (90–100%) and fast withdrawal systems earn higher scores. We also prioritize those with transparent payout schedules and on-demand options.

- Evaluation process and accessibility: One-step challenges with reasonable profit targets (3–6%), no time limits, and clear drawdown rules rank higher than multi-phase or restrictive setups.

- Trading platforms and market access: Support for NinjaTrader, Tradovate, TradingView, and Rithmic reflects strong technical flexibility and real-time CME data access.

- Fees, costs, and transparency: Firms that keep monthly fees low, avoid hidden data charges, and offer one-time evaluations without renewals are favoured.

- Customer support and community: We value firms with 24/7 live chat, Discord groups, or mentoring tools, which foster trader engagement and long-term growth.

- Credibility and user reputation: Trustpilot scores, payout proof, and consistent user feedback weigh heavily in our ranking methodology.

Our process looks beyond marketing promises. We prioritize fair profit-sharing, fast funding, and authentic trader experiences, so you can choose a futures prop firm that’s not only profitable but also genuinely reliable for your trading journey.

5. Pros and cons of futures prop trading

Futures prop trading offers traders the chance to trade with firm-backed capital while learning to manage risk under professional conditions. It’s one of the most structured paths toward trading full-time. But like any model, it has both advantages and limitations.

| Pros | Cons |

|---|---|

| Access to firm-backed capital: Trade large accounts without risking your own money. | Evaluation fees and data costs: Most firms charge challenge or platform fees upfront. |

| Transparent pricing: All trades are executed on regulated exchanges like CME, offering real market prices. | Strict drawdown rules: Daily loss limits and trailing drawdowns can restrict aggressive trading styles. |

| Real-time market data: Access to live CME feeds and Level 1/Level 2 data ensures accurate execution. | Limited flexibility vs CFD firms: Futures firms enforce contract expirations and session hours. |

| Scaling opportunities: Traders can increase capital allocation after reaching profit milestones. | Profit-sharing caps: Firms usually retain 10–20% of your profits, even on funded accounts. |

| Structured mentorship: Some firms offer coaching, webinars, or Discord communities to help traders grow. | Rule-based environment: Tight regulations mean less room for creative or unconventional strategies. |

Futures prop trading is ideal for traders who value discipline, real market access, and structured growth. You gain capital and professional oversight, but must adapt to defined rules and fees.

For those seeking a realistic path toward consistent profitability, this balance of freedom and structure makes futures prop trading a strong long-term choice.

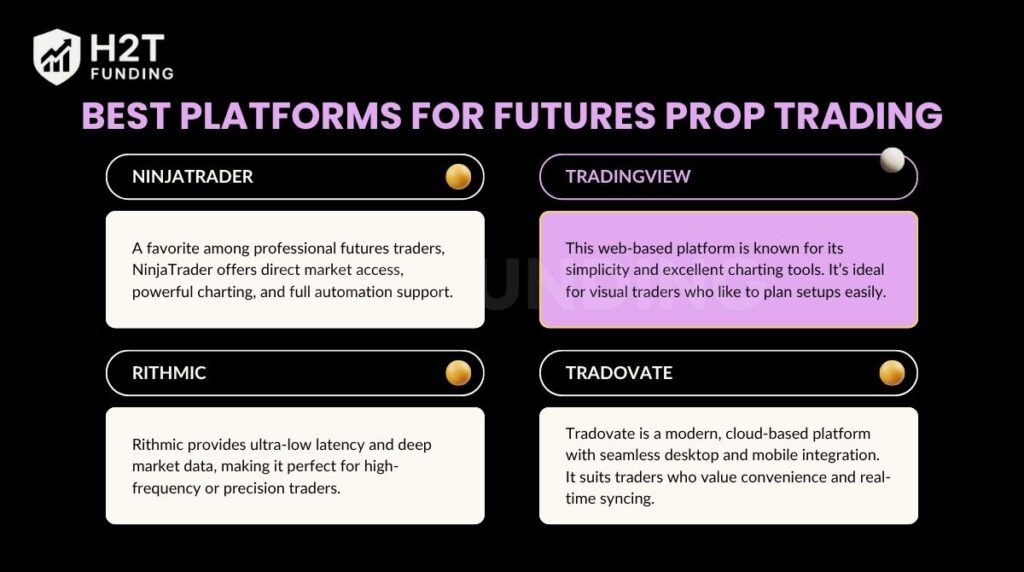

6. Best platforms for futures prop trading

Choosing the right trading platform is key to success in futures prop trading. A good platform should be fast, reliable, and compatible with your trading style, whether you’re scalping, day trading, or managing swing positions.

- NinjaTrader: A favourite among professional futures traders, NinjaTrader offers direct market access, powerful charting, and full automation support. Many top firms like Topstep, MyFundedFutures, and TradeDay use it for its stability and speed.

- TradingView: This web-based platform is known for its simplicity and excellent charting tools. It’s ideal for visual traders who like to plan setups easily. Firms such as Apex Trader Funding, Topstep, and The Trading Pit support TradingView for its user-friendly design and cross-device access.

- Rithmic: Rithmic provides ultra-low latency and deep market data, making it perfect for high-frequency or precision traders. It’s the go-to choice for firms like Apex Trader Funding, Earn2Trade, and Funded Elite that prioritize execution speed and accuracy.

- Tradovate: Tradovate is a modern, cloud-based platform with seamless desktop and mobile integration. It suits traders who value convenience and real-time syncing. Futures firms like Apex, Tradeify, and MyFundedFutures rely on it for its clean interface and quick execution.

Pick a platform that matches how you trade, not just what’s popular. If you’re focused on speed, Rithmic or NinjaTrader might be best. For visual analysis, TradingView excels. If you need mobility and simplicity, Tradovate is a great fit. The right platform helps you trade more confidently and stay consistent across futures markets.

7. Common rules and risk policies in futures prop firms

After trading with several futures prop firms, I’ve learned that most share the same core rules to protect capital and encourage discipline. Once you understand them, these rules actually make you a better, more consistent futures trader.

- Daily loss & trailing drawdown limits: Most firms set daily loss limits around 3–5% of the account. Trailing drawdown increases as your balance grows, keeping your risk controlled even when profits rise.

- Consistency rules (20–40%): Many firms require that no single trading day accounts for more than 20–40% of total profits. From experience, this keeps traders consistent instead of relying on one lucky trade.

- News trading restrictions: Some firms restrict trading around major economic releases like NFP or CPI, while others allow it with one-direction-only rules. I personally avoid trading big news events, as volatility can break drawdowns in seconds.

- Max contract limits per account: Each account tier comes with a maximum number of contracts you can trade. It’s a way to prevent over-leveraging and enforce proper risk management.

- Payout thresholds: Many firms offer 100% of your first $10,000 in profits before applying an 80–90% split. Think of it as a reward for steady, responsible trading.

These rules might seem restrictive at first, but they exist to help you trade like a professional futures trader. Once you learn to manage drawdowns, follow consistency rules, and respect limits, you’ll find yourself trading more strategically, not emotionally.

8. Tips for choosing the right futures prop firm

After trading futures for years and testing multiple prop firms, I’ve learned one key truth: the firm you choose can either support your growth or limit it. The right prop firm fits your trading style, respects your discipline, and helps you scale at your own pace.

- Match the firm to your trading rhythm: If you’re a scalper like me, you’ll want a firm that allows intraday trading and quick payouts. Swing traders, on the other hand, need firms that permit overnight positions and flexible drawdowns. I’ve seen too many traders fail simply because their firm’s rules didn’t align with how they actually trade.

- Always check payout and refund terms: Before joining any firm, I always look at payout speed and withdrawal limits. A trustworthy prop firm pays within 24–48 hours and doesn’t hide behind confusing terms. Slow or unclear payout rules are often the first red flag.

- Focus on scalability, not hype: A real futures prop firm rewards consistency with scaling opportunities, not constant re-challenges. I prefer firms that let me grow my capital based on results, not marketing promises. If they cap your progress too early, it’s not a partner worth keeping.

- Join a firm with strong community and support: Trading can get lonely, and having a firm that offers Discord groups, mentoring, or trader feedback loops makes a huge difference. The best firms listen to traders and share real insights, not just canned responses from support teams.

- Stick to solid risk management: This is where most traders struggle. I recommend starting small with micro futures (MES, MNQ, MGC) and increasing size only after you’ve proven consistency. Always set stop losses, respect drawdown limits, and diversify across instruments. I’ve lost funding before, and every time, it was due to poor discipline, not bad trades.

Pick a firm that fits you, not the other way around. The best futures prop firm is one that pays fairly, supports your learning, and gives you the room to grow, without forcing you into rigid boxes. Focus on consistency, protect your capital, and the profits will follow naturally.

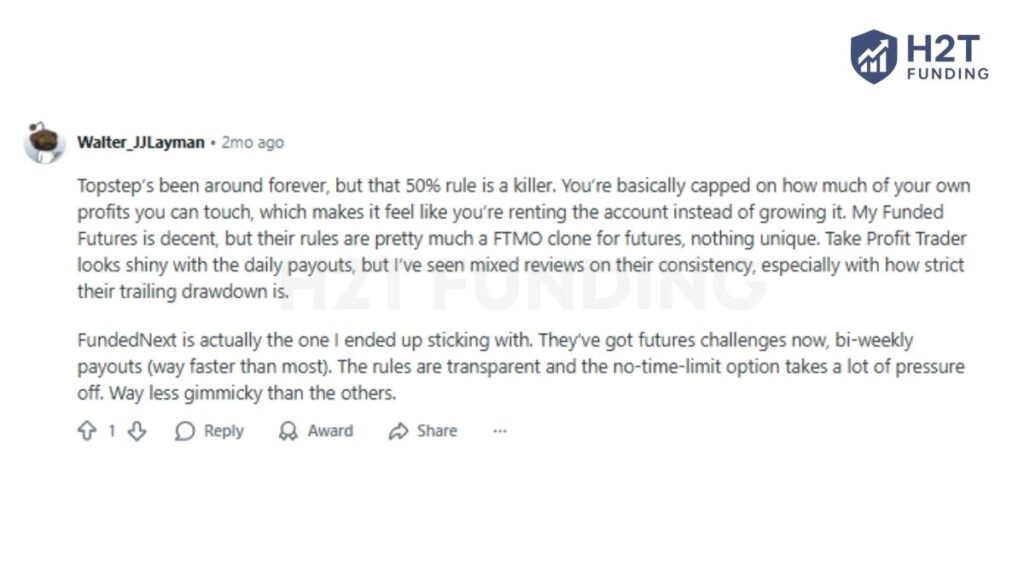

9. Best futures prop firms Reddit

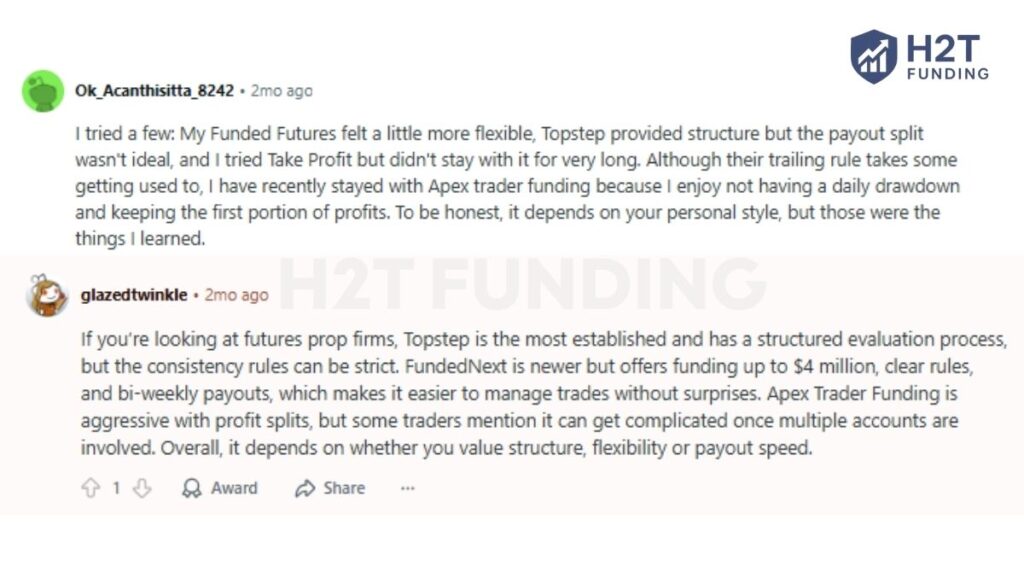

When it comes to finding the best prop firms for futures trading, Reddit discussions provide authentic insights from real traders who share both pros and cons of each platform. These conversations are especially helpful for identifying the best prop firms for futures, since they reflect genuine user experiences rather than marketing claims.

This comment shows that even among the best instant funding futures prop firms, traders value transparent evaluation models and quick withdrawals. FundedNext, for example, stands out for its no-time-limit option and bi-weekly payout cycle.

The insight shows how traders’ preferences differ between structured setups like Topstep and more flexible programs such as Apex. Both are recognized as top choices among the trading community on Reddit.

Overall, Reddit traders consistently mention FundedNext, Topstep, and Apex Trader Funding as leading names among the best futures prop firms, depending on whether they value structure, flexibility, or payout speed.

10. FAQs – Common questions about futures prop firms

As of 2026, FXIFY Futures is widely rated as the best overall futures prop firm thanks to its one-step evaluation, no time limit, and profit splits of up to 100%. It combines low entry fees, fast scaling, and real-time CME data access. FundedNext Futures ranks closely behind, offering 24-hour payouts, flexible platforms like Tradovate and NinjaTrader, and transparent rules that make it ideal for both beginners and pros.

No, FTMO and most forex-focused prop firms don’t support real futures trading. They only offer CFD (Contract for Difference) products on forex, indices, metals, and crypto through MT4, MT5, or cTrader. If you want to trade actual futures contracts on regulated exchanges like CME or NYMEX, firms such as FundedNext Futures, FXIFY Futures, or Topstep are the proper choices.

Yes, many futures prop firms are legitimate and regulated, providing real funding opportunities on licensed exchanges. The key is to choose firms that clearly state their profit split, drawdown rules, and payout policies. Reliable firms like Apex Trader Funding, Earn2Trade, and Topstep have strong reputations and transparent evaluations. Always check Trustpilot reviews and ensure the firm uses trusted data providers like Rithmic or Tradovate for authenticity.

Currently, FundedNext Futures offers the fastest payouts in the industry, promising withdrawals within 24 hours and compensating traders $1,000 if delayed. Other fast-paying firms include DNA Funded and Funded Trading Plus (FTP), both processing payouts within 3–7 business days. Fast payout speed is a major factor when choosing a futures prop firm since it reflects financial reliability and operational efficiency.

Yes, futures prop firms are suitable for beginners, especially those who want real market exposure with limited personal risk. Many firms like Earn2Trade and Topstep include educational resources, mentorship, and structured trading environments that teach discipline. However, beginners should start with smaller accounts (e.g., $25K) and focus on consistency rather than quick profits.

The single most important factor is trust and transparency. A good futures prop firm clearly explains its rules, payout structure, and evaluation process. Avoid firms with unclear risk policies or hidden fees. Secondary factors include payout speed, profit split, trading platforms, and customer support. Choose a firm that matches your trading style, for example, Apex for flexibility or Topstep for structure and education.

11. Conclusion

The best futures prop firms give traders more than profit splits or big promises. They provide fair funding, clear rules, and a trading environment that matches your style and long-term goals.

From one trader to another, I can tell you that success in funded futures trading comes down to three things: discipline, risk control, and consistency. Pick a firm that rewards steady growth, uses reliable platforms like NinjaTrader or Tradovate, and offers genuine support when you need it most.

At H2T Funding, we review and compare the top-performing futures prop firms to help traders make smarter decisions, whether you’re just starting or scaling to six figures. Explore our latest reviews and prop firm guides on H2T Funding to stay ahead and trade with confidence.