Finding the best prop firms for US traders isn’t easy. Many top names worldwide don’t accept American traders due to strict regulations, but several trusted firms still do. In 2026, prop firms like Lark Funding, Maven Trading, E8 Markets, and Funded Trading Plus stand out for their flexible rules, fast payouts, and solid reputation with U.S. clients.

This guide from H2T Funding will break down everything you need to know before joining a prop firm, from how challenges work to which companies truly welcome U.S. traders. By the end, you’ll know exactly which prop trading fits your trading style, budget, growth goals, and how to get funded faster without breaking any rules.

1. What is a prop trading challenge?

A prop trading challenge is a skill test set by proprietary trading firms to evaluate whether you can trade profitably while managing risk. It’s the gateway to earning access to the firm’s capital through a structured evaluation process.

Instead of risking your own money, you prove your consistency and discipline through a structured evaluation, often called a challenge.

Most prop firms offer one of these models:

- Phase 1 – Initial Evaluation: Traders must reach a set profit target, usually between 8% and 10%, without exceeding daily or total drawdown limits. This first stage in the evaluation process tests your trading discipline, profit consistency, and risk management.

- Phase 2 – Verification: Once you pass Phase 1, you move to a second stage with a smaller target (around 5%) under the same rules. The second phase of the evaluation process ensures traders can sustain profits without overleveraging or emotional trading.

Understanding each step of the evaluation process helps traders avoid violations and move smoothly toward funded status.

Key components of every challenge

- Profit Target: The percentage of growth you must achieve to qualify for funding.

- Drawdown Limits: Maximum daily and total losses allowed.

- Time Limits: Some firms set deadlines (e.g., 30 trading days), while others offer unlimited time.

- Trading Rules: May include restrictions on lot size, weekend trading, or news events.

For U.S. traders, understanding each firm’s terms is crucial. Many prop firms operate under international regulations, meaning rules, payout systems, and trading platforms may differ from U.S. standards.

Knowing exactly how each challenge works, including platform options, helps you avoid violations, maintain compliance, and pass your evaluation smoothly.

2. 15 Best prop firms for US traders in 2026 (Latest updated list)

Prop trading firms continue to shape the way U.S. traders access capital, offering flexible challenges, fast payouts, and fair profit splits. This updated 2026 list features the top 15 firms that combine transparency, realistic rules, and reliable funding for American traders.

| Firm | Profit Split | Rating | Actions |

|---|---|---|---|

|

80% – 90% |

4.5

|

Open an account |

|

80% |

4.5

|

Open an account |

|

80% – 100% |

4.4

|

Open an account |

|

80% – 100% |

4.5

|

Open an account |

|

80% – 100% |

4.4

|

Open an account |

|

50% – 100% |

4.9

|

Open an account |

|

90% – 100% |

4.4

|

Open an account |

|

90% – 100% |

4.4

|

Open an account |

|

60% – 90% |

4.5

|

Open an account |

|

80% – 90% |

4.1

|

Open an account |

|

80% – 100% |

4.5

|

Open an account |

|

50% – 100% |

4.2

|

Open an account |

|

80% – 100% |

4.5

|

Open an account |

|

80% – 90% |

3.9

|

Open an account |

|

75% – 90% |

4.9

|

Open an account |

See the full breakdown below to explore which trading firms best fit your trading goals.

Lark Funding

#1

Account Types

1-step, 3-step, and instant funding

Trading Platforms

DXTrade, TradingView, cTrader, Match Trader

Profit Target

3% – 10%

Our take on Lark Funding

Lark Funding is a U.S.-based prop firm launched in 2022, built to make prop trading simple and fair. The firm’s mission is clear: remove stress, delays, and confusion from the evaluation process. It gives traders an open path to prove their skills and get funded fast.

What makes Lark Funding stand out is its no-time-limit structure. Traders can move at their own pace without worrying about countdowns or minimum trading days. Whether you pass in one day or take a month, your progress depends only on your performance.

The Pass Assist system is another highlight. The platform automatically recognizes your success the moment you reach the target, no manual checks, no last-minute pressure. Combined with fast payouts and a high profit split, this makes Lark Funding one of the most trader-friendly setups today.

Behind the tech, there’s real human support. Traders get 24/7 help from experienced professionals, not bots. Add in CDBO certification for transparency and compliance, and it’s easy to see why many traders trust Lark Funding as a reliable U.S. prop firm.

| 💳 Challenge Fee | $105 – $4,500 |

| 👥 Account Types | 1-step, 3-step, and instant funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 3% – 10% |

| 📊 Trading Platforms | DXTrade, TradingView, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto, Stocks |

Maven Trading

#2

Account Types

1-step, 2-step, 3-step, and instant funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

3% – 8%

Our take on Maven Trading

Maven Trading was established in November 2022 and has quickly gained attention in the prop trading community for its low entry cost and transparent challenge models. The firm offers four account types: 1-step, 2-step, 3-step, and instant funding, all designed for traders seeking flexible, no-time-limit evaluations.

Its main appeal lies in the affordable challenge fees starting at just $13, making it accessible for beginners while maintaining realistic trading targets. Maven also allows traders to operate on MT5, cTrader, and Match Trader, covering multiple asset classes including forex, indices, commodities, and crypto.

The firm enforces a set of strict but clear consistency and risk management rules, particularly for instant funding accounts, ensuring disciplined trading and sustainable performance. A Trustpilot rating of 4.6/5 from nearly 5,000 reviews reinforces its solid reputation and customer satisfaction.

Overall, Maven Trading positions itself as a cost-effective, rule-focused, and transparent prop firm suitable for both new and experienced US traders who value flexibility and clear conditions.

| 💳 Challenge Fee | $13 – $440 |

| 👥 Account Types | 1-step, 2-step, 3-step, and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $2K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 3% – 8% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities |

E8 Funding

#3

Account Types

1-step

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker

Profit Target

6%

Our take on E8 Funding

E8 Markets is a global prop firm known for offering simulated capital with real payouts and zero trading risk. With over $61 million paid out to traders and more than 350,000 active users, it has grown into one of the most recognized names in the prop trading industry.

The firm is popular among U.S. traders thanks to its transparent model: no brokers, no deposits, and instant payouts. Its E8 Challenge programs are designed for every experience level with access to diverse trading instruments, including forex, futures, and crypto pairs.

E8 Markets stands out for its custom-built trading environment, fast payouts within 24 hours, and a community of over 45,000 active traders. Its flexible structure allows traders to scale their accounts while keeping up to 100% profit splits, which makes it a solid option for professionals and beginners alike.

With a Trustpilot rating of 4.4/5 from nearly 3,000 reviews, E8 Markets maintains a strong reputation for reliability, transparency, and user-focused support.

| 💳 Challenge Fee | $40 – $4,460 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $500K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto, Energy, and Futures |

Funded Trading Plus

#4

Account Types

1-Step, 2-Step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader, DXTrade

Profit Target

5% – 10%

Our take on Funded Trading Plus

Funded Trading Plus (FT+) is a London-based proprietary trading firm known for its transparency, trader freedom, and fast payout process. The firm allows traders to use simulated funds with real payouts processed in as little as one day. Its flexible approach: no time limits, no minimum trading days, and multiple payout options, makes it a top choice for both beginners and professional U.S. traders.

What stands out most about FT+ is its clear rule structure and focus on trader autonomy. There are no consistency rules, no hidden restrictions, and traders can hold positions overnight or over the weekend, depending on their chosen program. This freedom is rare among prop firms and gives U.S. traders greater flexibility in managing longer-term or news-driven strategies.

The firm’s payout system rewards consistent performance, offering up to 100% lifetime profit splits as traders hit milestones. Programs like Experienced, Prestige Lite, and Prestige Pro come with scaling opportunities and on-demand withdrawals, backed by a fast, risk-reviewed process.

Funded Trading Plus holds a 4.6/5 Trustpilot rating based on more than 2,500 reviews. This strong feedback highlights its reliability and excellent customer support, securing its place among the world’s most trusted prop firms.

| 💳 Challenge Fee | $119 – $4,500 |

| 👥 Account Types | 1-Step, 2-Step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, DXTrade |

| 🛍️ Asset Types | Forex, Indices, Commodities, Metals, Crypto |

FXIFY

#5

Account Types

1-step, 2-step, 3-step, and Instant Funding

Trading Platforms

MT4, MT5, DXTrade, TradingView

Profit Target

5% – 10%

Our take on FXIFY

FXIFY has quickly become one of the most recognized global prop firms, serving traders in over 200 countries with a network of 200,000+ active users. The firm combines flexibility, transparency, and technology-driven programs that appeal strongly to U.S. traders who value quick payouts and diverse trading options.

With over $30 million paid out and a record $117,000 single payout, FXIFY proves its reliability through consistent results. Traders can choose from five funding programs: One Phase, Two Phase, Three Phase, Instant Funding, and Lightning Challenge, each designed for different trading goals and experience levels.

U.S. traders particularly appreciate FXIFY’s no time limits, on-demand withdrawals, and realistic drawdown rules. The firm also supports multiple platforms like MT4, MT5, DXTrade, and TradingView, allowing traders to work with the tools they’re most comfortable using.

FXIFY holds a 4.3/5 Trustpilot rating from over 4,000 reviews, reflecting its strong reputation for reliability, fast payouts, and responsive customer support.

| 💳 Challenge Fee | $39 – $4,249 |

| 👥 Account Types | 1-step, 2-step, 3-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $1K – $400K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, DXTrade, TradingView |

| 🛍️ Asset Types | Forex, Metals, Equities, Crypto, Commodities, Stocks, Indies |

The5ers

#6

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

The 5%ers has established itself as one of the most respected prop firms in the world, trusted by over 18,000 traders with an impressive 4.8/5 Trustpilot rating. The firm is well-known for its structured approach to trader development, educational resources, and transparent funding pathways.

U.S. traders often choose The 5%ers for its unlimited trading time, low entry requirements, and clear scaling plans that make long-term growth achievable. The firm combines prop funding with coaching and education through live trading rooms, webinars, and one-on-one mentorship sessions, giving traders the feel of a professional trading desk environment.

Programs such as Bootcamp, Hyper Growth, and High Stakes cater to different risk profiles, from steady account progression to aggressive instant funding. The 5%ers also stands out for its rule transparency and professional trader support system, making it a solid option for U.S. traders seeking reliable funding with guided growth opportunities.

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

Apex Trader Funding

#7

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

Apex Trader Funding is one of the trusted futures prop firms for U.S. traders. It offers quick payouts, flexible trading hours, and transparent rules that appeal to both beginners and professionals. With over 100,000 accounts funded, Apex focuses on creating a simple path from evaluation to live trading.

Apex gives traders up to 20 live accounts and lets them keep 100% of the first $25,000 in profits, then 90% afterward. The system uses a trailing drawdown that stops once your profit target is hit on Rithmic accounts, while Tradovate accounts continue trailing throughout the challenge.

For me, what makes Apex stand out is its one-step evaluation, no daily drawdown, and payouts every 8 days. The firm supports multiple platforms, including Rithmic, Tradovate, and WealthCharts, and allows trading during news and holidays. However, Apex enforces strict consistency and risk management rules to ensure responsible trading behavior.

The firm has a strong reputation backed by a 4.5★ Trustpilot rating from over 15,000 reviews. Traders praise its clear rules, quick support, and smooth integration with NinjaTrader. But Apex has some reviews mentioning strict ID verification and limited customer support responsiveness.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

Topstep

#8

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep is one of the most established futures prop firms in the United States, and one of the few firms that actually originated in the U.S. and caters primarily to American traders. With over a decade in operation, Topstep has helped thousands of futures traders transition into live capital trading through its signature Trading Combine® program.

That said, the firm isn’t without its caveats. The monthly subscription structure and strict overnight-trading restrictions can feel limiting for more advanced traders. Still, Topstep offers a risk-managed approach and a fast evaluation proces. Its strong educational support also makes it an excellent choice for futures traders looking for a reliable U.S.-based funding route.

Global traders may find Topstep’s profit-sharing and inactivity rules less flexible than E8 or FT+. However, U.S. traders often view it as the benchmark for regulatory compliance, reputation, and payout reliability, qualities they value more than aggressive leverage or lenient trading rules.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

Crypto Fund Trader

#9

Account Types

1-step, 2-step, instant funding, and Ascend account

Trading Platforms

MT5, Match Trader, BYBIT

Profit Target

5% – 10%

Our take on Crypto Fund Trader

Crypto Fund Trader (CFT) was founded in November 2022 in Switzerland (Confoederatio Helvetica) and operates as one of the first crypto-focused proprietary trading firms. The firm provides evaluation programs for traders across crypto, forex, indices, stocks, and commodities, allowing access to up to $300,000 in demo capital and scaling up to $1.28 million.

For U.S. traders, CFT offers a unique advantage: it accepts participants globally, including the U.S., and provides a fully virtual trading environment. There’s no real capital involved, making it an accessible and regulation-friendly choice for American traders looking to develop their crypto and multi-asset strategies safely.

CFT stands out for its wide instrument coverage (900+ financial markets), 0-pip spreads, and no time limits during evaluations. The firm’s flexible rules allow news trading, giving traders more freedom to operate during volatile sessions. Its operations are supported by 50+ global professionals across offices in Spain, Switzerland, and Dubai, emphasizing a strong international foundation.

With a Trustpilot score of 4.5/5 from over 1,000 reviews, CFT has established solid credibility and transparency. The firm’s clear scaling structure, educational tools, and transparent payouts make it a reliable prop option for both beginners and experienced traders worldwide.

| 💳 Challenge Fee | $39 – $1,560 |

| 👥 Account Types | 1-step, 2-step, instant funding, and Ascend account |

| 💰 Profit Split | 60% – 90% |

| 💵 Account Size | $2,5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, Match Trader, BYBIT |

| 🛍️ Asset Types | FX, Indices, Crypto |

For Traders

#10

Account Types

1-step, 2-step, 3-step, and Instant Funding

Trading Platforms

MT5, cTrader, TradeLocker

Profit Target

4% – 9%

Our take on For Traders

For Traders is one of the rapidly growing prop firms, recognized for its flexible trading rules and wide global reach. The firm supports over 60,000 traders across 130+ countries and has paid out more than $7 million, reflecting solid credibility and consistent growth.

Its Instant Master and Challenge programs cater to both experienced traders and beginners, offering transparent rules and accessible scaling options. U.S. traders, in particular, appreciate For Traders’ clean structure, competitive pricing, and support for MetaTrader 5 with raw spreads and low commission fees.

The firm stands out for its fast reward processing times, often under 24 hours, and a strong focus on trader discipline through consistency, margin, and inactivity rules. For Traders provides a balance of opportunity and responsibility, making it a reliable option for those who value structured growth and realistic trading parameters.

| 💳 Challenge Fee | $23 – $839 |

| 👥 Account Types | 1-step, 2-step, 3-step, and Instant Funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $6K – $100K |

| ⏱️ Time Limit | 180 days for 3-step challenge |

| 🎯 Profit Target | 4% – 9% |

| 📊 Trading Platforms | MT5, cTrader, TradeLocker |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, Futures |

Ment Funding

#11

Account Types

1-step

Trading Platforms

Match Trader, DXTrade, cTrader, Gooey Trade

Profit Target

10%

Our take on Ment Funding

Ment Funding stands out for its simplicity, a single-phase evaluation with no minimum or maximum trading days. The firm offers capital up to $2M and scaling up to $5M, appealing to traders who prefer full flexibility without time pressure. Its 10% target and raw spread execution make it competitive among premium prop firms.

For U.S. traders, Ment Funding provides a rare balance of freedom and structure. The firm’s 24/7 Discord support and transparent rules create an accessible environment for both forex and futures traders. However, the absence of MT5 support and relatively high one-time fees may deter some advanced users used to more flexible platforms.

With no consistency rules, fast payout access, and a clear scaling roadmap, Ment Funding caters especially to disciplined traders seeking steady capital growth and autonomy. It’s a strong pick for U.S. traders who value transparency, no time limits, and realistic profit-sharing terms.

| 💳 Challenge Fee | $325 – $21,000 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 75% – 90% |

| 💵 Account Size | $25K – $2M |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 10% |

| 📊 Trading Platforms | Match Trader, DXTrade, cTrader, Gooey Trade |

| 🛍️ Asset Types | Forex, Crypto, Indices, Commodities, Stocks, Futures |

Bright Funded

#12

Account Types

2-step

Trading Platforms

cTrader, DXTrade, MT5

Profit Target

5% – 8%

Our take on Bright Funded

BrightFunded is a fast-growing prop firm known for lightning-fast payouts and a flexible trading model. The company offers traders up to $400K in funding, lightning-fast payouts, and unlimited scaling potential. Its 2-step evaluation has no time limit, which gives traders full flexibility to prove their skills.

The firm’s strongest appeal lies in its 4-hour average payout time and weekly withdrawal options. Many U.S. traders appreciate these features, especially those used to faster payout cycles compared to traditional U.S.-based prop firms. BrightFunded also allows a 15% profit splits during the evaluation, something rarely seen elsewhere.

BrightFunded supports MT5, DXtrade, and cTrader, enabling access to forex, indices, crypto, and commodities. This makes it an attractive choice for traders who prefer multi-asset strategies. The 1:100 leverage and no consistency rules help traders maintain freedom in their trading style.

Despite its strengths, BrightFunded has received mixed feedback on spreads and execution speed. A few traders reported slippage during high-volatility periods. Still, with its scaling plan, flexible structure, and global accessibility, BrightFunded stands out as a solid option, especially for U.S. traders who value speed, automation, and consistent payouts.

| 💳 Challenge Fee | €55 – €975 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 8% |

| 📊 Trading Platforms | cTrader, DXTrade, MT5 |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto |

City Traders Imperium

#13

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, Match Trader

Profit Target

5% -10%

Our take on City Traders Imperium

City Traders Imperium (CTI) stands out for combining a prop firm and trading academy into one ecosystem. Founded in 2018, CTI has built a strong reputation with a transparent payout system and unlimited time limits across all challenges. It allows access to global financial markets through MT5 and Match-Trader, offering low latency and multi-asset trading.

The firm’s Instant Funding programs appeal to experienced traders who prefer to skip evaluations. U.S. traders especially find CTI attractive thanks to its global accessibility and fast payouts in less than 24 hours. The option to scale up to $4M per trader makes it one of the few firms matching institutional-level potential.

CTI’s VIP Program adds another layer of incentive, offering weekly or on-demand payouts, coaching, and even monthly trader salaries for elite traders. Unlike many firms, CTI allows news trading, overnight holding, and full use of EAs (with source code), giving traders more autonomy.

Still, the firm has faced criticism over inconsistent support and strict enforcement of device/IP rules. Some traders reported delayed upgrades or unclear account restrictions. Despite that, CTI remains a solid and trustworthy option for U.S. traders seeking stability, growth, and flexible trading freedom.

| 💳 Challenge Fee | $29 – $4,799 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2,5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% -10% |

| 📊 Trading Platforms | MT5, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, Commodities |

Top One Trader

#14

Account Types

1-step, 2-step, and instant funding

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker, TradingView

Profit Target

0% – 10%

Our take on Top One Trader

Top One Trader has quickly earned attention in the prop trading space with one of the fastest payout systems in the industry, averaging just 90 minutes. The firm supports cTrader, MetaTrader 5, Match-Trader, and TradeLocker, giving traders broad flexibility across platforms. Its structure of 1-Step, 2-Step, Instant Funding, and Instant Prime programs fits both beginners and professionals.

For U.S. traders, the firm’s instant access model and 24/7 support are major advantages, particularly since many U.S.-based prop firms lack real-time response. The ability to scale up to $5M with consistent performance makes it appealing for disciplined traders focused on growth.

Still, Top One Trader’s strict news-trading limits, IP restrictions, and consistency rules may frustrate short-term or high-frequency traders. U.S. users also need to note that cTrader access is blocked for U.S. IPs, a serious limitation if that’s their preferred platform.

Despite a few operational constraints, Top One Trader stands out for its payout speed, diverse platforms, and transparent scaling structure. It’s an especially strong choice for U.S. traders who value quick access to funds, multi-platform freedom, and flexible growth potential.

| 💳 Challenge Fee | $64 – $2537 |

| 👥 Account Types | 1-step, 2-step, and instant funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 0% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker, TradingView |

| 🛍️ Asset Types | Forex, Metals, Indices, Crypto |

DNA Funded

#15

Account Types

1-step, 2-step, rapid, and instant funding

Trading Platforms

TradeLocker

Profit Target

5% – 10%

Our take on DNA Funded

DNA Funded offers a clean and beginner-friendly prop trading model with multiple options, from 1-Phase and 2-Phase evaluations to Rapid and Instant Funding. Its flexible rules, weekend holding permission, and news-trading allowance make it appealing for swing and position traders.

For U.S. traders, the firm’s simple structure and use of TradeLocker make it easy to access. However, the absence of MT5 or cTrader support can be limiting for more advanced users. The 10-minute news restriction window is reasonable, but the absence of Expert Advisors (EAs) could discourage algorithmic traders.

Despite some mixed customer feedback and payout delays reported online, DNA Funded continues to attract retail traders with affordable challenge fees, 3-day minimums, and instant-funding options. It’s a good fit for manual U.S. traders seeking low-barrier access and straightforward evaluations, not ideal for automation-heavy or high-frequency strategies.

| 💳 Challenge Fee | $49 – $1209 |

| 👥 Account Types | 1-step, 2-step, rapid, and instant funding |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | 10 days for rapid challenge |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | TradeLocker |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Read more:

3. Why it’s harder for U.S. traders to join prop firms

For many American traders, joining a prop firm isn’t as straightforward as it looks. While prop trading is booming worldwide, strict U.S. financial regulations make it harder for international firms to legally serve clients in the United States.

3.1. Strict U.S. financial regulations

U.S. prop traders fall under the supervision of the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These agencies require firms to meet complex registration, compliance, and reporting standards.

Many overseas prop firms simply avoid the cost and risk of complying with these laws, choosing not to accept U.S. clients at all.

3.2. Legal liability and compliance risks

Serving American traders exposes firms to potential lawsuits and regulatory investigations. Without a U.S. legal entity or representation, it’s risky for foreign prop firms to handle payouts, taxation, and client verification, which is why many prefer to restrict U.S. residents entirely.

3.3. Broker and platform limitations

Another issue comes from broker restrictions. Many brokers partnering with prop firms don’t accept U.S. clients, especially offshore brokers.

In addition, MetaQuotes, the company behind MT4 and MT5, has restricted U.S.-based access to its trading platforms. As a result, many firms now rely on alternatives like cTrader, Match-Trader, DXtrade, or TradeLocker to stay compliant and serve U.S. users.

3.4. Market access and product restrictions

Certain international prop firms can’t legally offer access to U.S. futures contracts or equities, limiting what markets American traders can trade. Futures-focused U.S. firms like Topstep or Ment Funding fill that gap by offering regulation-compliant funding programs for U.S. traders only.

In short, U.S. traders face a more complex landscape than their global peers. Some of the best global firms, such as FTMO, no longer accept U.S. traders due to these regulations.

However, several firms like Lark Funding, BrightFunded, Maven Trading, and Funded Trading Plus continue to provide reliable, U.S.-friendly options with compliant platforms and clear rules.

4. Key criteria to evaluate when choosing a prop firm for the U.S. traders

To identify the best prop firms for US traders, we reviewed each company based on transparency, trading freedom, payout structure, and real trader feedback. Our ranking reflects how well each firm serves U.S. clients. We consider not only profit splits but also realistic trading conditions, quick withdrawals, and compliance with international standards.

4.1. Acceptance of U.S. residents

The first criterion is whether a prop firm officially accepts U.S. traders and operates within a transparent compliance framework. We assess how clearly each firm discloses its U.S. participation policy, payout procedures, and verification requirements, ensuring traders are protected under international trading standards.

4.2. Challenge structure & difficulty

We assess how fair and flexible each firm’s evaluation process is, including its funding model, profit targets, drawdown rules, and time limits. Firms with flexible rules and realistic goals in their evaluation process tend to create better long-term trader performance.

4.3. Profit split, payout speed & scaling options

We look closely at payout conditions, how much of the profit traders can keep, how fast payments are processed, and how scaling programs are structured. Firms that provide high or progressive profit splits, fast and transparent payout cycles, and clearly defined scaling milestones receive higher scores in this category.

4.4. Tradable markets & platforms

U.S. traders often seek exposure to multiple financial markets, from forex and indices to crypto and futures. Many of the best prop firms for US traders now support modern platforms like MetaTrader, cTrader, Match-Trader, DXtrade, and TradeLocker. Broad platform compatibility and stable execution environments add significant value for long-term consistency.

4.5. Risk & trading rules transparency

Fair, easy-to-understand rules are critical. We consider how clearly a firm defines its limits for daily loss, maximum drawdown, or news trading, as well as whether automated or copy trading tools are permitted. Firms that balance freedom with disciplined risk policies are ranked higher for fostering long-term trader sustainability.

4.6. Reputation, support & legal/tax considerations

Finally, we review verified feedback from real traders, customer support responsiveness, and the firm’s general standing in the industry. This includes community engagement, refund policies, transparency in communication, and the availability of real human support, all key indicators of reliability and trust.

Each firm is assessed across these six pillars to provide an honest, data-driven ranking. The result is a list that highlights prop firms offering realistic funding paths, reliable payouts, and safe trading conditions for U.S. traders.

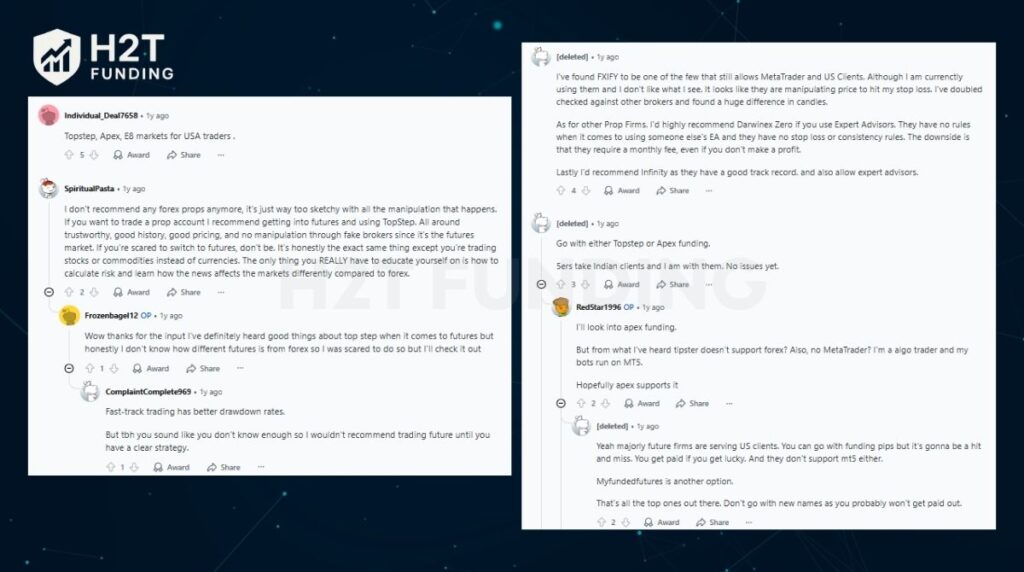

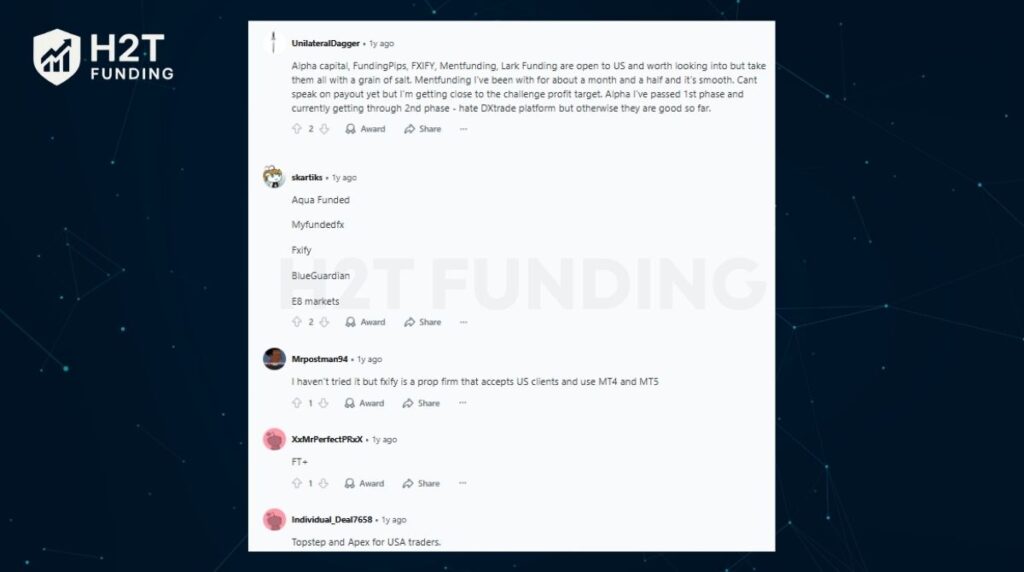

5. Best prop firms for US traders Reddit

When it comes to finding honest opinions about the best prop firms for U.S. traders, Reddit is one of the most valuable sources. Real traders share their experiences, the good, the bad, and the ugly, across different platforms and funding programs.

Most on Reddit agree that Topstep and Apex Trader Funding are the best prop firms for U.S. traders in futures, offering regulation-friendly programs and fast withdrawals. Others like Lark Funding, E8 Markets, Maven Trading, and FXIFY remain top forex choices for American traders.

Some traders warn about shady forex prop firms that delay payouts or manipulate prices. Those who prefer safety often move to futures firms like Topstep. Others say FXIFY, Ment Funding, and Lark Funding are still reliable forex firms for U.S. clients using MT5, DXtrade, or TradeLocker.

Several traders share smooth experiences with FXIFY and Ment Funding, noting fast payouts and reliable support. Alpha Capital, FundingPips, and Lark Funding also get praise for flexible programs and quick scaling, though users suggest testing each platform before committing.

Overall, according to Reddit users, the best forex prop firms for US traders are FXIFY, Lark Funding, Ment Funding, and Funded Trading Plus. For those trading futures, Topstep and Apex Trader Funding are the top choices. These firms earn praise for clear rules, fast payouts, and reliable platforms.

6. Tips to pass a prop trading challenge successfully

After passing several prop firm challenges myself, I’ve learned that success rarely comes from one “perfect trade.” It comes from consistency, control, and respecting the rules each firm sets.

Most traders fail not because their strategies are bad, but because they underestimate how psychological and structured these challenges really are. Here’s what truly makes a difference.

- Master the rules: Before placing your first trade, read every line of the firm’s guidelines. Know your profit target, daily and total drawdown, and what counts as a violation. The smallest misunderstanding can cost you the entire account.

- Trade your strengths: Stick to what you know. If you’re a day trader, don’t suddenly switch to swing trading during the challenge. The market rewards consistency, not experimentation.

- Control your risk: Keep every trade within a 1–2% risk limit and use stop-losses religiously. This one habit has saved my challenge accounts more times than I can count.

- Stay emotionally neutral: There’s no room for revenge trading. A funded account isn’t earned by chasing losses; it’s earned by staying calm after them.

- Practice before going live: Use demo environments that mirror the firm’s real conditions. It’s training your mindset for drawdowns and time pressure.

- Track your performance: Keep a trading journal. Write down why you entered and exited each position, and review patterns in your wins and losses. Self-awareness is your best trading edge.

- Protect your funded status: Once you hit your target or get funded, stop trading aggressively. Secure your position, withdraw profits, and build slowly from there.

Every successful prop trader I know treats trading challenges as opportunities to prove discipline, not luck. Follow the rules, trust your process, and treat every evaluation like it’s your first real account. That’s how you turn a challenge into consistent funding.

7. Common mistakes U.S. traders should avoid

I’ve made a few of these mistakes myself when I first started trading with prop firms, and I still see other traders fall into the same traps today. The truth is, it’s not always your strategy that causes failure; it’s often small oversights that could’ve been prevented with a bit more attention to detail. Here are some of the big ones to watch out for.

- Joining firms that don’t actually serve U.S. traders: It’s easy to assume that if a firm’s website lets you buy a challenge, you’re good to go. But that’s not always true. Some firms quietly block U.S. payouts later on. Always check their policy page or ask support before paying the fee.

- Forgetting drawdown and lot-size rules: Every prop firm has its own limits, and they’re there for a reason. When I ignored them early on, I blew accounts that were still profitable on paper. Treat those numbers as your lifeline, not suggestions.

- Trading through VPNs or banned brokers: I get it; sometimes you just want access to MT5 or better spreads. But using VPNs to bypass regional restrictions almost always backfires. Firms track IPs, and one mismatch can cost your funded account.

- Overtrading to hit the goal faster: Most traders fail their challenges not because of drawdowns, but because they chase targets too aggressively. The best thing I learned was to slow down; one good trade a day can do more for you than ten rushed ones.

- Not reading payout terms carefully: Some firms reset your drawdown after a payout or have hidden fees for crypto withdrawals. Understanding those details upfront saves you from nasty surprises later.

I’ve learned that trading with prop firms is more about patience than prediction. When you take time to learn the rules, trade within limits, and pace yourself, passing the challenge becomes a lot less stressful, and keeping your funded account becomes much easier.

8. FAQs about prop firms for U.S traders

As of 2026, FTMO has reintroduced limited access for U.S. residents through its new FTMO x OANDA partnership. Traders in the U.S. can now access FTMO’s training resources and trade in a Rewards Account using simulated capital. The 5%ers, on the other hand, still do not accept new U.S. clients. The firm previously allowed U.S. traders but has paused onboarding indefinitely to comply with financial regulations.

Yes. Topstep is one of the few prop firms officially based in the United States and operates under transparent regulatory oversight. The firm focuses exclusively on futures trading and follows CFTC and NFA guidelines, making it one of the safest and most compliant options for American traders. Most other prop firms are headquartered internationally but remain legally accessible to U.S. residents through simulated trading programs.

Yes. All payouts from prop firms are considered taxable income under U.S. law. Traders typically report them as self-employment income. Each firm’s tax documentation varies; some issue payment confirmations, while others rely on transaction records. It’s best to keep your payout statements organized and consult a tax professional for proper reporting.

Several prop firms now offer instant funding programs that let traders skip the evaluation phase. Popular examples include Funded Trading Plus, Maven Trading, Top One Trader, and Ment Funding. These programs require a higher upfront fee but allow traders to start trading immediately with simulated capital and real payouts once profit targets are reached.

For most U.S. traders, cTrader, DXtrade, and TradeLocker are the best alternatives to MetaTrader 4/5, which remain restricted for some regions. These platforms offer low latency, reliable execution, and compliance with U.S. trading regulations. Futures traders, meanwhile, often use TopstepX or NinjaTrader for professional-grade order management.

Strict regulations from the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) make it costly for foreign firms to serve American clients. To avoid compliance risks, many firms exclude U.S. residents entirely. Others create separate simulated or educational programs to stay within legal limits.

Using a VPN or a false address to bypass regional restrictions is strongly discouraged. Prop firms actively monitor IP data, and discrepancies can result in account termination without refund. Always trade transparently; it’s not worth losing your progress or payouts over a technical violation.

Most firms now process bi-weekly or on-demand payouts, depending on the trader’s performance and account type. Some, like BrightFunded and Top One Trader, handle withdrawals in just a few hours, while others have standard 7–14 business day cycles. Always check the firm’s payout terms before joining.

Yes, many prop firms now support multi-asset trading, including crypto, stocks, and indices. Platforms like Match-Trader, TradeLocker, and cTrader allow smooth execution across asset classes. However, crypto access can depend on each firm’s broker partner; check asset availability in advance.

Start small with a low-cost evaluation or demo challenge. Focus on firms that clearly accept U.S. traders, provide transparent rules, and offer refunds or educational trials. Avoid instant funding programs until you’re confident in your strategy and risk management. Building consistency first is far more valuable than scaling too quickly.

9. Conclusion: Finding the right prop firm for you

Finding the best prop firms for US traders takes patience and research. Regulations and platform limits make it important to choose firms with clear rules, fair drawdowns, and fast payouts. The options featured here stand out for their transparency, realistic targets, and proven track records with U.S. clients.

Each firm offers something different, from instant funding to long-term scaling programs. Focus on what fits your trading styles, whether you prefer flexibility, structure, or hands-on support. Testing your strategy through smaller evaluations first can build confidence before managing larger accounts.

Above all, stay consistent, trade responsibly, and grow steadily. A thoughtful approach to prop trading helps U.S. traders build lasting success with funded capital. For more insights and in-depth reviews, visit the best prop firm, your trusted source for transparent comparisons and funding updates from H2T Funding.