The beginning of your trading career is an exciting moment, presenting a world of immense opportunity before you. It’s incredibly thrilling, but let’s be honest, it can also feel terrifying. The fear of making a wrong move and losing your hard-earned money is a very real concern for new traders.

But what if you could learn to navigate these financial waters, test your trading strategies, and become a seasoned captain without risking a single penny? This isn’t a far-off dream. It’s precisely what the best free trading simulator offers you.

Think of this simulator as your personal flight simulator for the financial markets. Just like pilots spend countless hours in a simulator before flying a multi-million dollar plane, learning controls and handling emergencies, a paper trading platform gives you that same professional advantage.

H2T Funding’s guide acts as your copilot. It’s designed to help you navigate all the available options and choose the perfect virtual trading account. You can match it to your specific goals, whether you’re interested in stocks, forex, or the often volatile world of crypto.

Key takeaways:

- The best free trading simulators are your first and best investment, allowing you to learn and test strategies without financial risk.

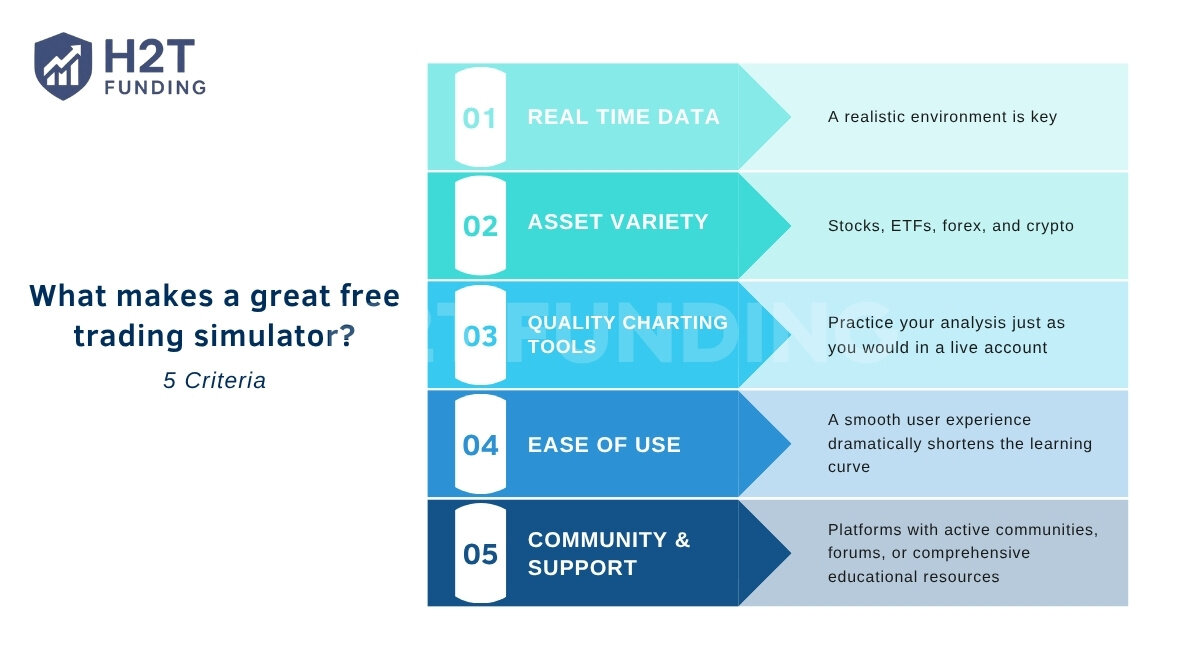

- An ideal trading simulator meets five key criteria: real-time data, asset variety, quality charting tools, ease of use, and a supportive community.

- The article recommends the ten best free trading simulators, including TradingView, eToro, Thinkorswim, TradeStation, Moomoo, MarketWatch, NinjaTrader, HowTheMarketWorks.com, ProRealTime, and Pilot Trading

- It’s crucial to choose a free trading simulator that fits your goals (e.g., eToro for beginners, Thinkorswim for options trading).

- The best free trading simulator helps you build confidence and good habits by practicing with virtual money, but remember to treat it seriously to avoid bad habits.

1. What is a stock market simulator?

A stock market simulator is a tool that replicates the live financial markets, enabling you to trade assets using virtual funds. Paper trading is the common industry term for this effective learning technique.

It functions as a personal training ground where you can develop and refine your investment strategies, explore new markets like forex or crypto, and master the functions of a trading platform.

The key advantage is the ability to gain hands-on experience with market dynamics: the speed, the volatility, and the decision-making process, all without exposing your actual capital to risk. It provides a crucial bridge between theoretical knowledge and practical, real-world skills.

2. Why a free trading simulator is your first best investment?

Forget stock tips from your uncle; your smartest first investment in your trading career is your time spent on a practice trading app. This is precisely why we consider it an essential and unavoidable stage in the process:

- Learn without the financial heartache: Everyone makes rookie mistakes. A simulator lets you make them without the gut-wrenching feeling of watching your real money disappear. It’s a space to be curious and to fail forward.

- Test drive strategies like a pro: Have you seen a strategy on YouTube or want to try day trading? A simulator is your laboratory. You can test theories, indicators, and different trading styles to see what actually clicks with your personality and risk tolerance before deploying them in the wild.

- Master your trading cockpit: Every trading platform has a unique layout. Learning where the buttons are, how to set a stop loss order, and how to read the charts before you’re in a fast-moving, high-pressure trade is crucial. Your focus should be on wrestling with trading decisions, not with a complicated user interface.

- Build genuine, battle-tested confidence: There’s a big difference between the false confidence of getting lucky and the real confidence that comes from disciplined practice. By developing and validating a strategy in a simulated environment, you build a foundation of competence that will support you through market highs and lows.

3. Who needs practice trading simulators?

The audience for these essential tools is incredibly diverse. Their benefits extend across a wide spectrum of users, each with unique goals:

- The complete beginner

This is the most obvious user. If you are starting from zero, a simulator is your classroom. It’s where you learn what a “market order” is, how leverage works, and how quickly markets can move, all without the stress of losing real money.

- The seasoned strategy tester

Experienced traders are lifelong learners. They use simulators as a laboratory to test new strategies, experiment with different technical indicators, or fine-tune their risk management rules in a live market environment without affecting their real portfolio.

- The aspiring multi-market trader

An investor who is an expert in stocks might be a complete novice in forex or crypto. A simulator provides a safe way to explore new asset classes and understand their unique behaviors and risks before committing real capital.

- The finance student

For students of business and finance, a simulator bridges the gap between academic theory and real-world application. It turns textbook concepts into tangible results, making education more engaging and practical.

4. What makes a great free trading simulator? (Our review criteria)

Not all trading simulators are created equal. To ensure our recommendations are genuinely useful, we evaluated platforms based on a clear set of criteria. This transparency helps you understand what features are most important and why they matter for an effective learning experience.

Here’s what we looked for:

- Real-time data: To truly practice, especially for short-term strategies, you need data that reflects the live market. Simulators with heavily delayed data can give a false sense of security. A realistic environment is key.

- Asset variety: Your interests might grow. A great simulator allows you to practice with a wide range of instruments, including stocks, ETFs, forex, and crypto. This flexibility allows you to explore different markets under one roof.

- Quality charting tools: Trading is a visual discipline. You need access to high-quality charting software with a good selection of technical indicators, drawing tools, and timeframes. You should be able to practice your analysis just as you would in a live account.

- Ease of use: A platform should be intuitive and easy to navigate. The goal is to learn how to trade, not to spend weeks fighting a confusing interface. A smooth user experience dramatically shortens the learning curve.

- Community & support: Learning to trade can be a solitary activity, but it doesn’t have to be. Platforms with active communities, forums, or comprehensive educational resources provide a valuable support system to ask questions and learn from others.

5. How to choose the best stock market simulators

To ensure our analysis is thorough, consistent, and trustworthy, we evaluate every trading simulator based on a standardized set of five core principles. Here is what we look at for each platform:

- Simulation quality: How realistically does the platform mimic a live trading environment? This includes the availability of real-time data, the variety of order types (market, limit, stop-loss), and how accurately it tracks portfolio performance.

- Tools & features: What resources does the platform provide for analysis and practice? We evaluate the quality of the charting software, the range of technical indicators, the variety of assets available for paper trading (stocks, forex, crypto), and any unique features like backtesting or market replay.

- Usability: How easy is it for a user to get started and operate the platform effectively? This covers the overall user interface (UI), the ease of navigation, the quality of the mobile app, and whether the design feels modern and intuitive or dated and confusing.

- Credibility & support: Can you trust the platform and the company behind it? We consider the brand’s reputation in the industry, the accuracy of its market data, and the availability of customer support or community forums for help.

- Target audience fit: Who is this simulator truly built for? We assess whether the platform is best suited for absolute beginners, active day traders, options specialists, or students, and if its feature set genuinely serves that audience’s needs or has significant limitations

6. The 10 best free trading simulators in 2026

Embarking on the trading journey can feel daunting, but thankfully, you don’t have to risk real capital from day one. Trading simulators offer a risk-free environment to practice strategies, learn market dynamics, and build confidence. To help you get started, we’ve compiled a list of the top platforms.

6.1. TradingView

Best for: Active traders and charting enthusiasts

TradingView is like the Swiss Army knife for technical analysts. Its paper trading is seamlessly integrated, allowing you to practice directly from its world-class charts.

- Pros:

- Unmatched charting tools and technical analysis capabilities.

- A large social community where you can share ideas and learn from others.

- Supports a wide range of assets: stocks, forex, and crypto.

- Cons:

- Real-time data for some markets (like futures) requires a paid plan.

- The vast number of tools can be overwhelming for absolute beginners.

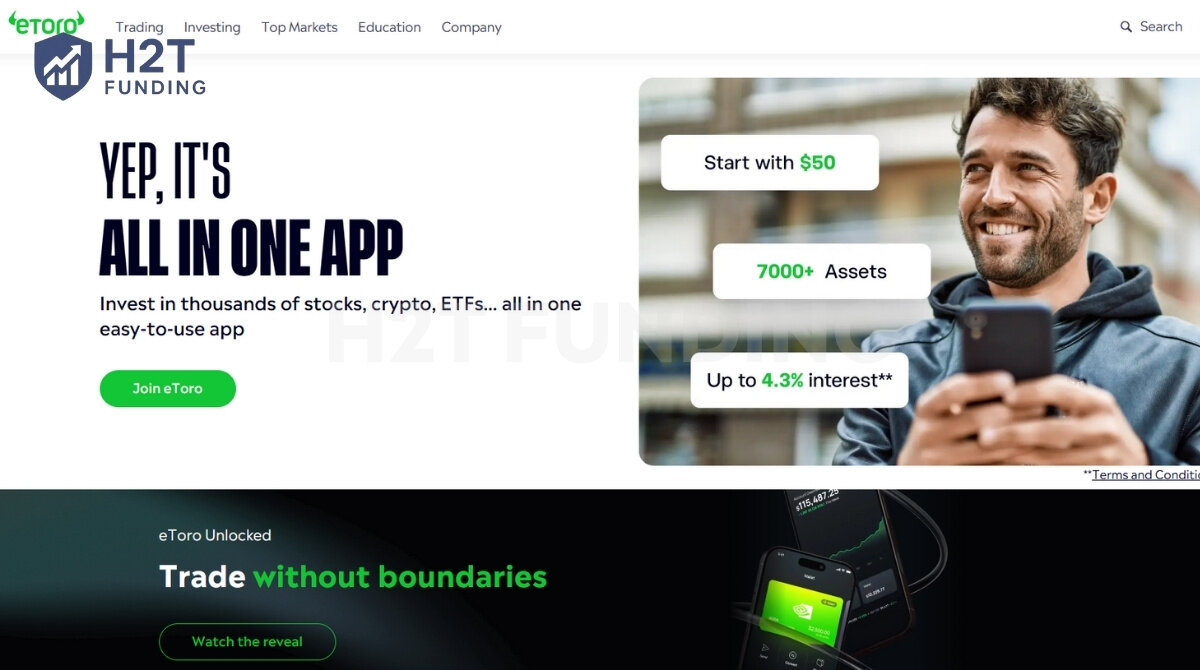

6.2. eToro

Best for: Beginners and social trading

eToro makes investing feel accessible and less intimidating by turning it into a social experience. Their $100K virtual account is an amazing playground for newcomers.

- One of the best free trading simulators

- eToro offers free stock trading, though additional fees may apply for other features.

- Pros:

- Extremely user-friendly interface.

- Unique “CopyTrader” feature lets you simulate mirroring the trades of successful investors.

- Wide asset selection, including fractional shares and crypto.

- Cons:

- Spreads in the real account can be higher than some competitors.

- Analytical tools are not as robust as dedicated platforms like TradingView.

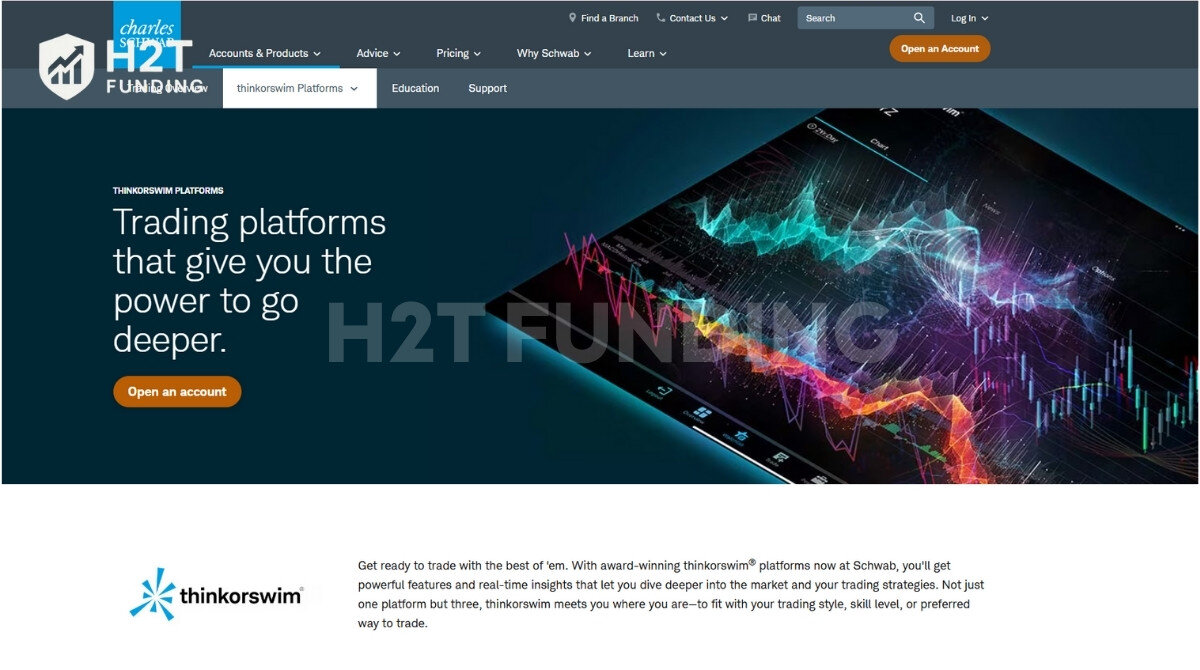

6.3. Thinkorswim (by Charles Schwab)

Best for: Aspiring day traders and options traders

The Thinkorswim paperMoney simulator is the gold standard for anyone serious about learning to trade. It is a near-perfect replica of the powerful and complex live trading platform.

- Pros:

- Incredibly realistic simulation with access to complex screening and analysis tools.

- Excellent for practicing complex options strategies.

- Includes advanced features like portfolio risk analysis and the ability to replay past trading days.

- Cons:

- A very steep learning curve; it can be overkill for a beginner who just wants to learn the basics.

- Requires a software download and can be resource intensive on your computer.

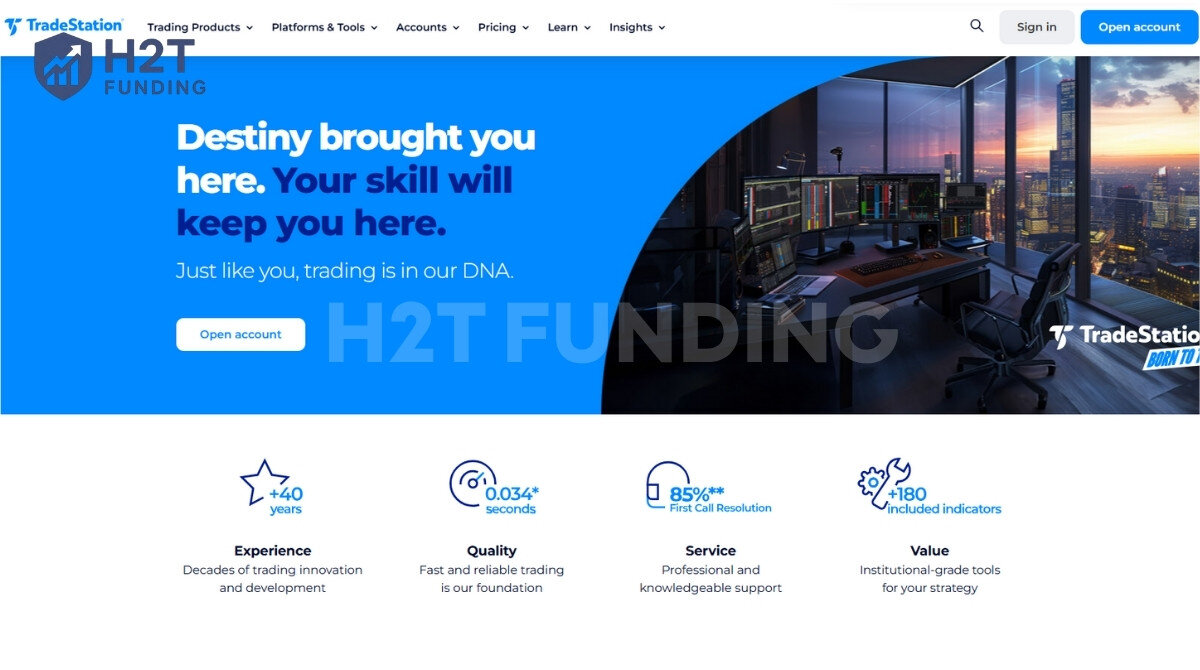

6.4. TradeStation

Best for: Systematic traders and strategy testers

TradeStation is for those who not only want to trade but also want to build and test their own trading systems.

- Pros:

- Powerful backtesting tools using the beginner-friendly EasyLanguage programming language.

- Provides decades of historical market data for thorough testing.

- Simulates stock, options, and futures trading with real-time data.

- Cons:

- The interface can feel a bit dated compared to more modern platforms.

- The platform is optimized for a systems-based mindset, which may not suit everyone.

6.5. Moomoo

Best for: Mobile-first traders and data seekers

Moomoo stands out by offering premium tools for free, especially Level 2 data, which most other brokers charge for.

- Pros:

- Free access to real-time Level 2 data, giving deep insight into the order book.

- Robust and intuitive mobile app.

- Simulates a $0 commission environment for stocks and ETFs.

- Cons:

- More focused on the US and Hong Kong stock markets; global asset selection is limited.

- The interface can feel a bit cluttered with information for new users.

6.6. MarketWatch

Best for: Simple, no frills stock practice and friendly competitions

Sometimes you just want to learn the basics without all the complex bells and whistles. The MarketWatch Virtual Stock Exchange is perfect for that.

- Pros:

- Extremely easy to use, completely web-based with no installation needed.

- “Games” feature lets you create private competitions with friends or join public ones.

- Cons:

- Charting and analysis tools are very basic.

- Data is delayed, so it’s not suitable for practicing day trading.

- More of an entertainment tool than a professional training tool.

6.7. NinjaTrader

Best for: Dedicated futures and forex traders

If futures are your playground, NinjaTrader is one of the platforms you must consider. Its simulator is robust and highly regarded by industry professionals.

- Pros:

- Excellent charting and analysis tools tailored for the futures market.

- Simulator lets you replay historical market data tick by tick, which is great for weekend practice.

- Cons:

- Not the ideal choice if you are primarily interested in stocks.

- Unlocking the full potential of the platform (including live trading) requires a lifetime license purchase or lease.

6.8. HowTheMarketWorks.com

Best for: Students and classroom learning

This is a true stock simulator for beginners, built with education as its top priority. It simplifies complex concepts into easily digestible lessons.

- Pros:

- Integrates a large curriculum with articles, videos, and glossaries.

- Teachers can easily create custom contests for their classes.

- Very friendly interface that removes unnecessary complexity.

- Cons:

- Too basic for anyone looking to test serious trading strategies.

- Lacks advanced technical analysis tools.

6.9. ProRealTime

Best for: Technical traders seeking broker neutrality

ProRealTime is a powerful European platform that offers professional-grade tools and an unlimited free paper trading simulator.

- Pros:

- Powerful charting and market scanning tools.

- Unlimited free access to the web-based paper trading simulator.

- It is broker-agnostic, allowing you to practice on one platform and trade on another.

- Cons:

- Less well known in the US, with a primarily European user base.

- Requires registration to access real-time data.

6.10. Pilot Trading

Best for: Practicing with algorithm-based signals

Pilot Trading takes a unique approach. Instead of leaving you to search, it uses algorithms to provide trading signals that you can practice acting upon.

- Pros:

- Intuitive and easy-to-use mobile-first interface.

- A unique approach that trains you to react to signals rather than overanalyze.

- Supports multiple markets, including crypto paper trading.

- Cons:

- Doesn’t teach you how to find trades or develop your own analytical strategy.

- Relies on trusting the app’s “black box” algorithms.

View more:

7. How to get started with paper trading in 3 simple steps

Beginning your paper trading journey is a smart and simple move. Whether you’re new to the financial world or have some experience, getting a feel for the market in a risk-free environment is crucial. You don’t have to worry about losing real money. With just a few simple steps, you can begin your journey to becoming a confident and proficient trader.

3 Simple Steps to Get Started with Paper Trading

- Choose a platform: Select a simulator from our list that best fits your interests and experience level. For example, if you’re a beginner, user-friendly platforms like eToro or MarketWatch can be an ideal starting point.

- Set up a virtual account: This process is usually quick and straightforward. You simply register and select the “paper trading” or “demo account” option. You’ll then be credited with virtual funds to begin practicing.

- Start trading: Take some time to familiarize yourself with the interface, analyze the market using the available tools, and place your very first practice trade. Remember, the goal is to learn, not to make a virtual profit.

8. The biggest mistake to avoid when paper trading

The single biggest pitfall of paper trading is the lack of real emotion. Since no actual money is on the line, you don’t experience the fear and greed that are powerful drivers in live markets. This can trick you into thinking you’re ready when you’re not.

Treat it seriously. Don’t make trades with $50,000 just because you can. A great tip is to adjust the virtual balance to a realistic amount you plan to start with. If you plan to trade with $5,000 of real money, practice with $5,000 of virtual money. This makes risk management feel real.

Track your trades. Analyze your wins and losses. The goal isn’t to make the most virtual money; the goal is to build good habits and a profitable strategy you can trust when you eventually go live.

9. Frequently asked questions (FAQs)

No. Any profits or losses in a simulator are entirely virtual. Its purpose is for learning and practice, not for earning an income.

While most platforms give you $100,000 or more, it’s a great practice to adjust it to an amount you would realistically trade. This makes your risk management practice much more effective.

There is no single answer. A good rule of thumb is to paper trade until you have been consistently profitable for at least 2-3 months and feel completely confident with your strategy and your platform.

Absolutely. Every platform featured on our list offers a free paper trading component. You will never need to deposit real money to access the virtual account and practice. The goal of these companies is to let you learn their system, hoping you will choose them when you are ready to trade with a live account.

This is a key question. Most free simulators provide market data that is slightly delayed, often by 15 minutes. This is perfectly fine for learning the mechanics of trading and testing longer-term strategies. True real-time data feeds are costly, so they are typically offered as a premium feature or included when you open a funded live account.

Yes, in almost all cases. Brokers and platforms encourage you to maintain access to your paper trading account. It remains an invaluable tool for testing new strategies or exploring different assets without risking your capital, even after you have become an experienced trader.

It depends on the platform’s business model. Some simulators, especially those offered as a trial for a specific broker, may have a time limit of 30, 60, or 90 days. However, many of the top platforms we’ve listed, such as TradingView, provide unlimited and non-expiring access to their paper trading features.

For someone just starting out, we recommend platforms that prioritize simplicity and have a gentle learning curve. eToro is a fantastic choice because of its intuitive design, while MarketWatch offers a straightforward, game-like experience to help you grasp the absolute basics of buying and selling.

To effectively practice day trading, you need access to high-quality tools and a realistic environment. In our view, the thinkorswim paperMoney simulator is an elite choice, providing professional-grade charting and analysis features. TradingView is also a top contender because of its unmatched charting capabilities and direct integration with paper trading.

10. Conclusion

Choosing the best free trading simulator is more than just finding a tool; it’s about investing in your education and laying the foundation for your future success. It bridges the gap between theoretical knowledge and practical application, providing a safe harbor to develop skills, test strategies, and build the confidence necessary to succeed.

Your journey starts with practice. Choose a platform from this guide that resonates with your goal, whether it’s the advanced charting of TradingView, the beginner-friendly social features of eToro, or the powerful tools of Thinkorswim. Take the next step today, open your virtual trading account, and begin your journey to becoming a confident and competent trader.

To learn more about trading and prop firms, explore additional articles from H2T Funding in our Prop Firm & Trading Strategies category!