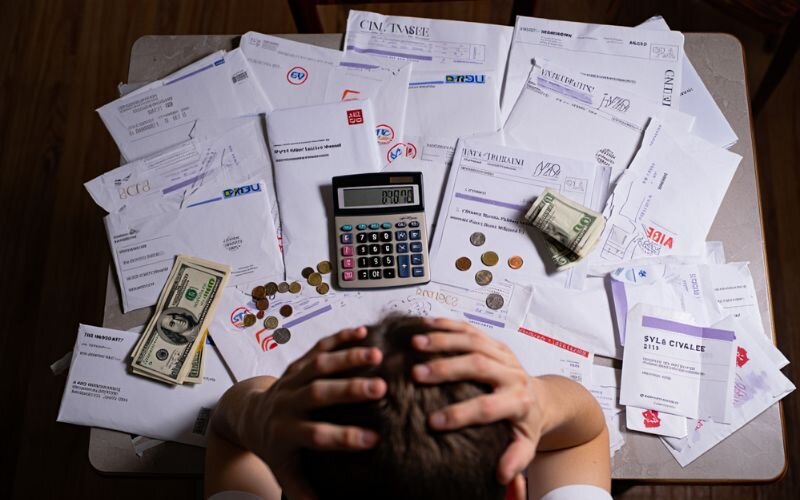

Do you ever lie awake with money worries, wondering if you’re doing enough for your kids’ future? For many young families, the squeeze from living costs, old debts, and childcare bills can feel like a constant source of stress.

In fact, a study by the American Psychological Association identified money as a top stressor. But the good news is that finding the best budget tips for young families isn’t about restriction; it’s about reclaiming your peace of mind and control.

This guide shares practical budgeting strategies that families just like yours have successfully put into action, helping to ease the pressure, build savings, and achieve long-term goals together.

1. Why is budgeting crucial for a young family?

For young families, budgeting is more than just a financial tool; it’s a foundation for long-term well-being. At a life stage where every dollar must stretch across housing, childcare, food, and future plans, clarity and intention in spending are essential.

Consider my friends, Richards and Sophia. After their first child was born, they felt they were managing okay because their paychecks always came on time. What they didn’t see was how daily coffees and a few “too-tired-to-cook” delivery dinners were slowly inflating their credit card balance.

It wasn’t until their car needed a $400 repair that they had a gut-wrenching realization: they had no real safety net. That feeling of panic is exactly what happens when a family operates without a clear financial map.

That’s why budgeting matters.

- It brings financial clarity: A family budget shows exactly where your money comes from and where it’s going. You can spot spending patterns, identify leaks, and make informed decisions instead of reacting blindly to bills.

- It reduces conflict: Budgeting helps couples move from stressful, reactive conversations to purpose-driven planning. A friend once told me that budgeting turned arguments with her spouse into calm, monthly check-ins; they finally felt like partners, not opponents.

- It accelerates family goals: Whether it’s saving for a down payment, planning a vacation, or building an education fund, budgeting allows you to prioritize what truly matters and move toward those goals faster.

- It builds a strong safety net: Life is unpredictable. A clear budget helps you prepare for unexpected expenses, like medical emergencies or job changes, by building emergency funds and reducing debt.

Ultimately, the best budget tips for young families begin with a mindset shift: from surviving month-to-month to proactively designing your financial future.

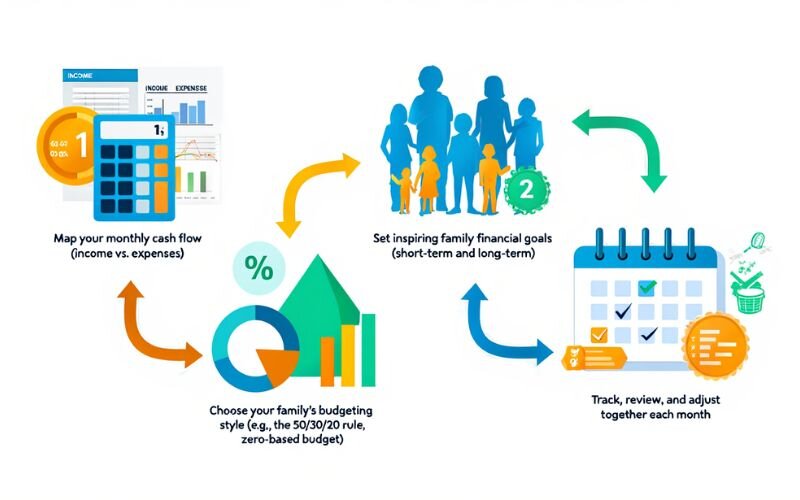

2. How to start a family budget: A 4-step framework

Starting a family budget doesn’t have to be overwhelming. With just four clear steps, any young couple can gain control of their finances, align on shared priorities, and start saving with confidence. Whether you’re new to budgeting or looking to refresh your approach, this simple framework will guide you.

2.1. Step 1: Map your monthly cash flow (income vs. expenses)

Before you can optimize your family budget, you need to know exactly how much money is coming in and where it’s going. This is known as mapping your monthly cash flow, a foundational step in any financial plan.

Start by calculating your total monthly income from all sources. This includes not only your salaries but also freelance work, side gigs, child support, and any recurring benefits. Be honest and consistent, use net income (after taxes) for accuracy.

Next, list out all monthly expenses, dividing them into two main categories:

- Fixed expenses: Rent or mortgage, insurance premiums, loan repayments, and tuition fees; these are predictable and usually stable.

- Variable expenses: Groceries, fuel, dining out, entertainment, subscriptions,and shopping; these can fluctuate monthly.

To get the most accurate picture, review your bank statements and digital wallets from the past 1–2 months. You may be surprised to find how small purchases add up.

For example, a family earning $4,500/month may discover that $600 goes to dining out alone, a potential area for cost control.

Here’s a basic table to organize your cash flow:

| Income | Amount (USD) |

|---|---|

| Salary (primary job) | $3,500 |

| Freelance projects | $800 |

| Tax benefits/credits | $200 |

| Total Income | $4,500 |

| Expenses | Amount (USD) |

|---|---|

| Fixed Expenses | |

| Rent | $1,200 |

| Insurance | $250 |

| Car loan | $300 |

| Tuition fees | $400 |

| Variable Expenses | |

| Groceries | $500 |

| Dining out | $600 |

| Entertainment | $200 |

| Subscriptions | $100 |

| Total Expenses | $3,550 |

This snapshot helps you identify if you’re living within your means, or if it’s time to cut back and redirect funds toward your financial goals.

2.2. Step 2: Set inspiring family financial goals (short-term and long-term)

A budget without goals is just a spreadsheet. What transforms it into a powerful tool is a shared vision and family financial goals that reflect your values and aspirations. Setting clear objectives gives purpose to every dollar you save or spend, turning routine budgeting into long-term motivation.

Start by sitting down as a family, just you and your partner, or even with older children, and talk openly about what matters most. What are you working toward together? Try to separate your goals into two categories:

- Short-term goals (within 12 months)

These are immediate priorities that help stabilize your financial footing.- Build an emergency fund covering 3–6 months of expenses

- Pay off credit card debt

- Save for a modest family trip

- Buy a secondhand car or upgrade a household appliance

- Long-term goals (1 year or more)

These define your bigger picture and require consistent effort.- Save for a house down payment

- Create a college fund for your child

- Contribute regularly to a retirement account

- Build a sinking fund for major repairs or renovations

By anchoring your budget in clear goals, you’ll make daily financial decisions with more intention and less regret.

Read more related articles: What are financial goals? How to set financial goals and stay on track

2.3. Step 3: Choose your family’s budgeting style (e.g., the 50/30/20 rule, zero-based budget)

There is no one-size-fits-all budget; the best budgeting tips for young families recognize that every household is different. Choosing a budgeting style that fits your lifestyle, income consistency, and personality is crucial for staying consistent.

Here are three common methods that work well for families:

- The 50/30/20 Rule: This is one of the simplest and most beginner-friendly frameworks.

- 50% of income goes toward needs (housing, utilities, groceries, insurance)

- 30% toward wants (dining out, subscriptions, travel)

- 20% toward savings and debt repayment

- Zero-Based Budget: Ideal for families who want maximum control. In this method, every dollar is assigned a purpose, whether it’s for bills, debt, or savings, until your monthly income minus expenses equals zero. It requires more tracking but offers unmatched clarity.

- Envelope System: Best for cash-based spenders. You divide spending categories (like groceries, gas, or entertainment) into physical envelopes. Once the money in an envelope runs out, no more spending in that category. While old-fashioned, it’s effective for limiting variable expenses.

Pick a method that feels natural. The best system is the one you’ll actually stick with.

2.4. Step 4: Track, review, and adjust together each month

A family budget isn’t something you set once and forget; it’s a living plan that needs regular check-ins. Schedule a monthly “financial date night” with your partner to review your spending, celebrate small wins, and tweak the plan where needed.

Tracking progress together not only strengthens your financial habits but also your relationship. For example, one couple I worked with used to dread money talks, until they turned them into pizza-and-budget nights. They found that even when they overspent in one category, discussing it calmly helped them realign quickly.

Use simple tools like budgeting apps or Google Sheets to compare actual expenses vs. your plan. Did you overspend on groceries? Under-save for your emergency fund? That’s okay, adjust next month’s budget accordingly.

This habit of consistent tracking and teamwork transforms budgeting from a chore into a shared journey toward financial peace.

Explore more related articles:

3. 12 best budget tips for young families to thrive

Once you’ve laid the groundwork with a clear budget, the next step is mastering the daily habits that make it work. These budgeting tips for families are practical, proven, and designed to help young households stretch every dollar without sacrificing quality of life. Let’s explore what works in real life.

3.1. Master the grocery with smart meal planning

Food is often one of the largest and most flexible areas in a family budget. That’s why smart grocery planning is one of the most effective money-saving tips for families. With a few habits, you can cut food costs significantly, without compromising on nutrition or enjoyment.

Here’s how to win at meal planning:

- Plan weekly meals: Sit down every weekend to decide what the family will eat. This avoids daily “What’s for dinner?” stress and impulse orders.

- Shop once a week with a list: Sticking to a pre-planned list reduces spontaneous purchases.

- Buy seasonal and local produce: It’s fresher, often cheaper, and supports your local economy.

- Take advantage of promotions: Use store loyalty apps or digital coupons for extra savings.

- Cook in batches: Double recipes and freeze portions to save time and reduce food waste.

These small changes can significantly improve your ability to stick to a consistent food budget, especially over the long term.

Continue reading: 15 Grocery budget tips for smart shopping

3.2. Reduce child-related costs without compromise

Raising children comes with significant expenses, but many of these costs can be reduced with smart choices, without affecting your child’s well-being or development.

- Accept hand-me-downs: Reusing items from friends or family is both budget-friendly and sustainable.

- DIY baby food: Preparing food at home from fresh ingredients is often cheaper and healthier than store-bought options.

- Research public assistance programs: In some areas, families may qualify for support with education, healthcare, or childcare costs.

- Limit unnecessary extras: Focus spending on essentials. Avoid buying too many toys, gadgets, or brand-name items that offer little added value.

By applying these strategies, families can manage child-related expenses more effectively while maintaining a high quality of care.

3.3. Discover free and low-cost family entertainment

You don’t need a big budget to enjoy meaningful time as a family. In fact, some of the most valuable moments come from simple, low-cost activities that bring everyone together without putting pressure on your finances.

Look for options like:

- Local parks and green spaces: Picnics, bike rides, or just letting kids explore outdoors are both relaxing and cost-free.

- Libraries: Many offer free storytimes, workshops, or weekend activities that are perfect for young children.

- Museum free days: Check your city’s museums or cultural centers—most have monthly admission-free days.

- At-home experiences: Movie nights, board games, cooking together, or DIY craft projects can be just as fun as going out.

- Seasonal events: Community festivals, markets, and holiday parades often offer free entertainment for the whole family.

What matters most isn’t how much you spend, but how intentional you are with your time. Planning ahead for free or low-cost fun keeps your budget intact and your family connection strong.

3.4. Slash household bills: from utilities to subscriptions

Household bills can quietly eat into your budget if you’re not paying attention. The truth is, many of us are overpaying, not because we spend recklessly, but because we haven’t reviewed what we’re paying for in months or even years.

Start with monthly subscriptions. Streaming platforms, fitness apps, digital news, and cloud storage; they add up. If you’re not using a service weekly, it’s worth canceling or pausing it. One shared streaming account is usually enough for the whole family.

Next, look at utilities. Small habits here make a real difference:

- Unplug unused electronics

- Switch to LED bulbs

- Limit water heater usage

- Use natural light during the day

Finally, compare service providers. Whether it’s the internet, electricity (where deregulated), or mobile plans, prices change, and loyalty doesn’t always pay off. Many providers offer better rates for new sign-ups or customers who renegotiate.

When you treat household expenses like any other budget category, with regular review and adjustments, you’ll often find hidden savings without changing your lifestyle much at all.

3.5. Automate your savings for consistent progress

One of the most effective ways to build savings, especially when life gets busy, is to remove willpower from the equation. That’s where automation comes in.

The idea is simple: set up an automatic transfer from your salary account to a separate savings account right after payday. Even a small fixed amount, transferred consistently, builds momentum. This approach is often called “paying yourself first.” You treat savings like a fixed expense, not something you do if there’s money left at the end of the month.

To make it work:

- Use a separate savings account with limited access to avoid temptation

- Set a reminder to review and adjust the amount every 3–6 months

- Align your automated savings with specific goals (e.g., emergency fund, travel, education)

What automation gives you is discipline without daily effort. Once it’s set, you’re saving in the background, consistently, quietly, and with minimal friction. That consistency is what turns short-term effort into long-term progress.

3.6. Plan ahead for large, irregular expenses (e.g., holidays, car repairs)

Some of the most disruptive financial stress comes from expenses that aren’t monthly, but still entirely predictable. Holidays, car maintenance, annual insurance, school fees; these aren’t surprises. But if you don’t plan for them, they feel like emergencies.

The solution is to use sinking funds. This means setting aside a small amount each month for a specific, irregular expense you know is coming.

Here’s how it works:

- Identify big, non-monthly expenses in your year ahead

- Estimate the total cost and divide it by the number of months until it’s due

- Set up a separate space, whether in a spreadsheet or a labeled savings account, to track each fund

For example, If your summer holiday is expected to cost $1,200 and it’s six months away, saving $200 per month will get you there without disrupting your regular budget.

This approach brings structure to your planning and removes the need to dip into emergency savings, or worse, go into debt, just because timing wasn’t on your side.

3.7. Get kids involved in money conversations early

Financial literacy should start at home. By involving your children in basic budgeting and spending decisions early on, you’re not only teaching them valuable life skills but also encouraging a culture of transparency and teamwork in the household.

Here’s how to start:

- Use real-life examples: Involve them in small decisions like choosing between eating out or cooking at home.

- Visualize goals: Create a savings jar or digital chart for shared family goals, like a weekend trip or a new toy.

- Offer pocket money with a purpose: Set basic rules, save a portion, spend a portion, to help them practice delayed gratification.

When kids feel included in financial decisions, they tend to become more mindful and supportive of the family’s budgeting efforts.

3.8. Track your spending to uncover hidden patterns

You can’t fix what you don’t measure. Many families struggle not because of large purchases, but because of consistent small leaks in their budget. Tracking your spending, even for just one month, often reveals surprising patterns.

Try these practical methods:

- Use a free app or a simple spreadsheet to log daily expenses.

- Group spending by category (e.g., groceries, eating out, transportation).

- Review weekly to spot problem areas or impulse buys.

This process helps you see your money clearly and allows you to adjust proactively, before your account balance takes a hit.

3.9. Prioritize needs over wants, define them clearly

In family budgeting, the line between need and want can blur. The key is to define these clearly with your partner and children to avoid unnecessary spending and financial friction.

A quick rule of thumb:

- Needs keep the family stable: housing, utilities, food, education, and basic clothing.

- Wants to enhance comfort, but aren’t essential: subscriptions, new gadgets, trendy clothes, dining out.

Have open discussions about this distinction and make it a habit to delay gratification, waiting 72 hours before any non-essential purchase. Often, the “want” disappears after a few days of thought.

3.10. Review and adjust your budget regularly

Your budget is a living tool, not a set-it-and-forget-it document. As life evolves, kids grow, income shifts, and priorities change; it’s essential to review and recalibrate your plan regularly.

Here’s how:

- Set a recurring monthly “money check-in” with your partner.

- Assess what worked and what didn’t: Were there unplanned expenses? Did you meet your savings target?

- Update any outdated categories or goals.

Making budget reviews a habit ensures your plan stays relevant and effective and helps you avoid financial surprises.

3.11. Use the cash envelope method to manage discretionary spending

Digital payments make it easy to overspend without realizing it. For non-essential categories like dining out, clothing, or entertainment, the cash envelope system adds discipline through physical limits.

- Assign envelopes to each spending category

- Withdraw cash for the month and allocate accordingly

- Once the envelope is empty, spending in that category stops.

This old-school method increases awareness, encourages intentionality, and can help break impulse-buying habits.

3.12. Optimize your housing costs strategically

Housing is often the largest single expense for families. Reviewing your housing situation periodically can open up significant savings.

- Refinance your mortgage if lower interest rates are available

- Downsize to a smaller home if space needs change

- Rent out a room short-term (where legally permitted)

- Consider energy-efficient upgrades to lower long-term utility costs

For young families, every dollar saved and spent wisely is an investment in stability, opportunity, and peace of mind. Whether it’s through meal planning, cutting unnecessary bills, automating savings, or including your children in financial discussions, these habits form the foundation of a resilient household.

4. Free tools and templates to simplify your family budget

You don’t need fancy software to build a solid family budget. In fact, some of the most reliable tools are free and simple enough for anyone to use, even without a background in finance.

Here are a few proven options:

- Google Sheets or Microsoft Excel: Great for custom tracking. You can download free budget templates tailored for families, complete with income and expense categories.

- Other budgeting apps: Many apps offer features like goal tracking, spending alerts, or shared access for couples. Choose one that suits your habits and comfort level.

To get started quickly, download a ready-made template: Download free family budget spreadsheet here

Using the right tools keeps your budget organized, transparent, and easier to stick to, especially when multiple family members are involved.

5. Frequently asked questions (FAQs)

The best approach is to start with a clear overview of your income and expenses, then set realistic goals that both partners agree on. A simple method like the 50/30/20 rule makes it easier to allocate money effectively. Regular monthly reviews help you stay on track and adjust as life changes.

When money is tight, focus on covering essentials first and cutting back on non-essentials. Meal planning, buying secondhand, and using public resources can lower daily costs. Even small savings matter when they’re consistent and intentional.

Start the conversation by focusing on shared goals, not restrictions. Explain how a budget can reduce stress and support your long-term plans. Involve your partner in decisions from the beginning to build trust and commitment.

6. Conclusion: Your journey to financial peace starts today

The first step toward financial clarity is often the hardest, but it’s also the most powerful. Applying these best budget tips for young families isn’t about being perfect; it’s about being proactive.

Every dollar you save and every open conversation you have about money is a brick laid for a more secure, less anxious future for the people you love most. Your journey starts with one small decision today.

Choose one small step from this guide and apply it this week. Consistency will take you further than intensity. For more practical insights, explore other guides in the Budgeting Strategies section of H2T Funding to keep your momentum going.