Saving money doesn’t have to be stressful or complicated. For many people, especially freelancers, gig workers, and busy professionals, choosing to automate savings is one of the smartest financial habits they can build. Instead of relying on willpower, automation turns saving into a routine process that happens quietly in the background.

According to a 2023 Fidelity survey, people who use an automated savings account are 35% more likely to reach their financial goals. By consistently setting aside even small amounts, you reduce stress, avoid impulsive spending, and let your money grow through compound interest.

In this article, H2T Funding will guide you through 6 simple and effective steps on how to automate savings based on our experiences. These steps are backed by proven strategies and tools from financial institutions, helping you build long-term stability with less effort.

Key takeaways

- Automating savings means setting up systems, like automatic deposits or transfers, to move money into a savings account without manual effort.

- An automatic savings plan helps you save consistently and reduce stress by making the process effortless.

- Simple methods such as direct deposits, scheduled transfers, round-up apps, and recurring investments fit different lifestyles.

- Starting small, leveraging compound interest, and building a strong savings mindset accelerate long-term financial goals.

1. What does automate savings mean?

Automating savings means creating systems to move money into a savings account without manual effort. You set up recurring automatic deposits based on your budget and goals. This ensures steady growth and supports a strong savings mindset.

The process involves scheduling transfers, like weekly or monthly, from your checking account to a savings account. Tools such as bank apps or direct deposits handle these transfers automatically. You can also use apps to save small amounts, like spare change. This removes the need for constant decision-making and helps you stop overspending.

Here’s a real-world example from my friend Sarah, a freelance graphic designer. Her income was always fluctuating, and saving felt like a losing battle; big client payments would vanish on bills before she even thought about saving.

On a whim, she tried Qapital to round up her purchases and set a simple rule: transfer $100 to savings the moment a client paid. After about six months, she was shocked to see she’d put away nearly $1,500. She told me the best part wasn’t the money, but finally feeling like she was in control.

Automating savings like Sarah did promotes financial discipline by taking the decision-making out of your hands. It aligns your actions with your goals, whether that’s building an emergency fund or setting money aside for retirement. And because there’s no need to remember or manually transfer money, it reduces stress while ensuring steady progress.

2. Why should you automate your savings?

Automating your savings transforms the way you manage money by making it effortless and efficient. Instead of relying on discipline to save manually, automation sets up systems to move funds to your savings account consistently. It also protects you from overdraft fees when your spending plan is clear and aligned with regular transfers.

- Consistent savings: Automation ensures money is saved regularly, regardless of your schedule or forgetfulness, creating a reliable habit.

- Time efficiency: Eliminates the need to manually transfer funds, saving you time for other important tasks or financial planning.

- Reduced spending temptation: By moving money to a savings account automatically, it’s less accessible for impulsive or unnecessary purchases.

- Maximized compound interest: Regular contributions allow your savings to grow faster through compound interest, boosting long-term wealth.

- Lower financial stress: Removes the mental burden of deciding when or how much to save, offering peace of mind.

- Fewer impulsive decisions: Keeps funds out of your checking account, reducing the likelihood of unplanned spending.

- Emergency fund growth: Builds a financial safety net for unexpected expenses, such as medical emergencies or car repairs.

- Retirement savings boost: Consistently adds to retirement accounts, ensuring steady progress toward a secure future.

- Goal achievement: Supports specific objectives, like buying a home, funding education, or planning a dream vacation.

For me, the game-changer was deciding to auto-transfer 10% of every single invoice. It wasn’t always a lot, but it was consistent. That simple habit built my emergency fund to over $3,000 in about eight months, something I honestly thought was out of reach. I barely feel the transfer, but I definitely feel the security.

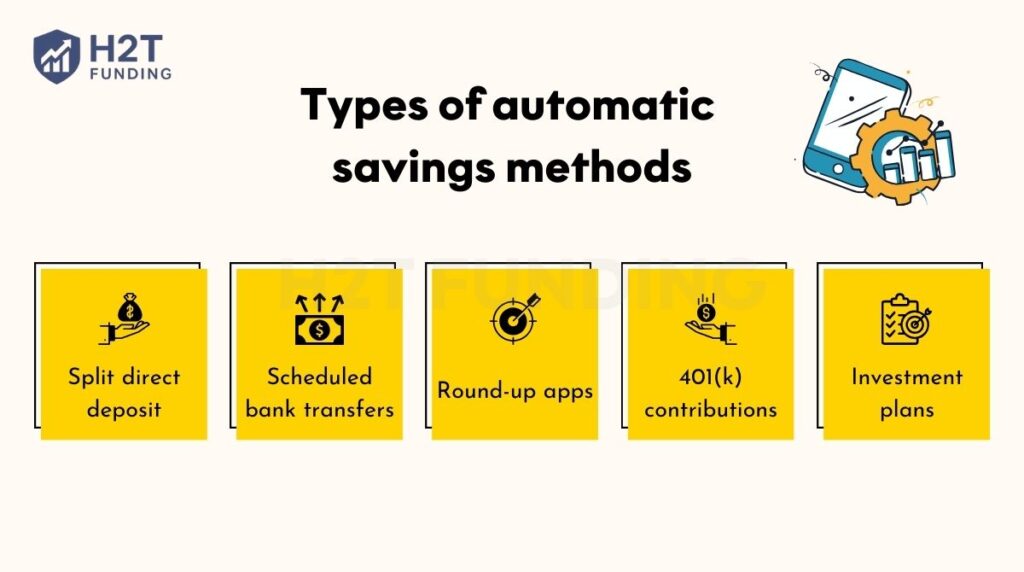

3. Types of automatic savings methods

Automating your savings can be achieved through various methods, each designed to make saving effortless and tailored to your financial habits. Whether you have a steady paycheck or irregular income, these approaches help you build wealth consistently.

Here are five practical ways you can automate your savings:

- Split direct deposit

- Scheduled bank transfers

- Round-up apps

- 401(k) contributions

- Recurring investment plans

Start with just one method today and see how easy saving can become.

3.1. Split direct deposit

Arrange for a portion of your paycheck to go directly into a savings account. This is ideal for employees or self-employed individuals with regular income. Setting it up with your employer or bank ensures savings are prioritized before spending. It’s a seamless way to save without thinking about it.

3.2. Scheduled bank transfers

Link your checking and savings accounts to set up recurring transfers, such as weekly or monthly. This method works well if both accounts are at the same bank for easy setup.

For freelancers with variable income, scheduling transfers after major payments, like quarterly invoices, aligns with cash flow. It also works if you need to auto-transfer money from one bank to another, ensuring consistency across accounts.

3.3. Round-up apps

Use apps like Acorns, Qapital, or Chime to round up purchases to the nearest dollar and save the difference. For example, a $4.75 coffee purchase rounds to $5, with the $0.25 saved automatically. These apps are perfect for those who prefer small, incremental savings without adjusting their budget. You can also explore the best budgeting apps to find the right fit for your lifestyle.

3.4. 401(k) contributions

Automate retirement savings by enrolling in an employer-sponsored 401(k) plan. A fixed percentage of your paycheck is deducted and invested before you see it.

This method not only builds long-term wealth but may also include employer matching, amplifying your savings. Pairing this with frameworks like the zero-based budgeting method ensures that every dollar has a purpose.

3.5. Recurring investment plans

Another powerful option is setting up recurring investments in ETFs or index funds, such as a Fidelity recurring investment ETF. By committing a fixed amount each month, you dollar-cost average into the market without worrying about timing. This method supports long-term growth and keeps you disciplined even when markets fluctuate.

Each of these methods takes the effort out of saving and helps you stay consistent. Whether it’s a simple bank transfer or a recurring investment, automation keeps your goals on track. By choosing the option that fits your lifestyle best, you build steady progress toward long-term financial security.

See more related articles:

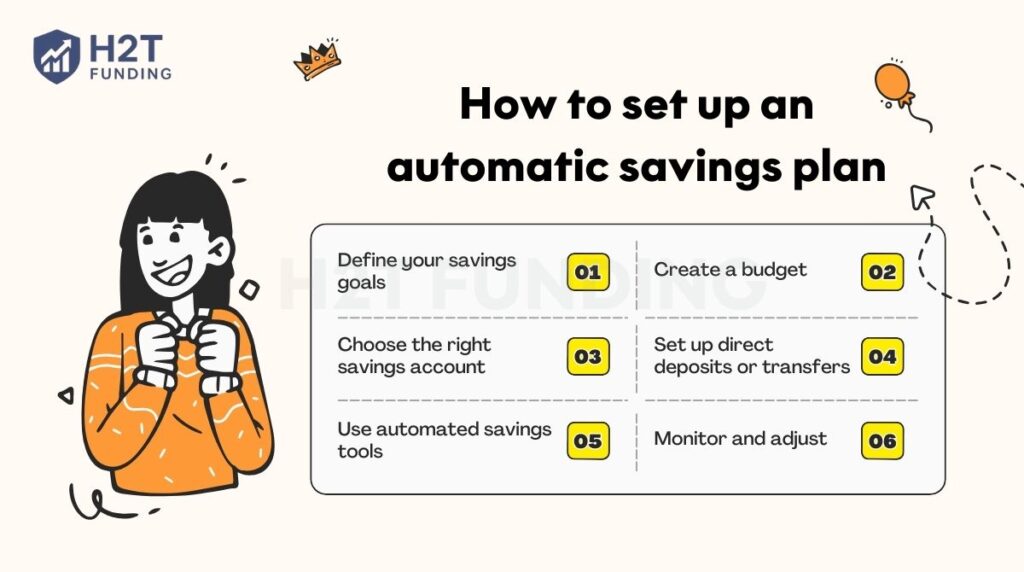

4. How to set up an automatic savings plan

Setting up an automatic savings plan is a powerful way to build wealth effortlessly and achieve your financial goals. An automatic savings plan ensures consistent contributions toward your goals without requiring manual transfers each month.

Whether you’re saving for an emergency fund, a dream vacation, or long-term investments, the following steps will guide you to create a sustainable and effective savings strategy:

- Step 1: Define your savings goals

- Step 2: Create a budget

- Step 3: Choose the right savings account

- Step 4: Set up direct deposits or transfers

- Step 5: Use automated savings tools

- Step 6: Monitor and adjust

Follow these steps today and let automation take the stress out of saving.

Step 1: Define your savings goals

Start by identifying what you’re saving for, such as an emergency fund, a home down payment, or a big trip. Set a specific amount and a timeline to achieve it (e.g., $5,000 for a vacation in 12 months).

Clear goals help you determine how much to save monthly and keep you motivated. For instance, if you’re planning how to save for a big purchase, breaking it into smaller monthly targets makes the process realistic. Saving $10,000 in two years means setting aside $417 per month ($10,000 ÷ 24).

Step 2: Create a budget

Review your income and expenses to find out how much you can realistically save each month. Use budgeting tools or apps to track your spending and identify areas to cut back. A well-planned budget ensures your savings plan is sustainable without straining your finances.

For more guidance, check out this detailed guide on how to create a personal budget to set clear spending limits and free up money for savings. Aim to allocate a fixed percentage, like 10–20% of your income, to savings.

Step 3: Choose the right savings account

Select a savings account that aligns with your goals, such as a high-yield savings account for better interest rates. Online-only banks like Ally or Marcus often offer higher yields and lower fees compared to traditional banks.

Compare account features, including interest rates, minimum balance requirements, and withdrawal restrictions. A dedicated savings account keeps your funds separate and focused on your goals.

Step 4: Set up direct deposits or transfers

Arrange for a portion of your paycheck to go directly into your savings account through your employer’s payroll system. Alternatively, schedule automatic transfers from your checking to your savings account, ideally timed with your paydays.

Contact your bank to set up recurring transfers, ensuring consistency. For example, if you bank with Bank of America, you can follow their step-by-step guide on how to automatically transfer money from checking to savings Bank of America for a hassle-free setup.

For freelancers, align transfers with your income schedule, such as after client payments. If you receive payments online, you can even set up automatic transfers from PayPal to move funds directly into your savings account.

Step 5: Use automated savings tools

Leverage apps like Oportun, Chime, or Digit to simplify saving. These tools offer features like rounding up purchases to save the difference or AI-driven savings based on your spending habits.

For example, Digit analyzes your income and expenses to transfer small amounts automatically. Check for fees and compatibility with your bank. Choosing the right automatic savings app can make this process seamless and personalized to your habits.

Step 6: Monitor and adjust

Regularly review your savings progress, such as every three to six months, to ensure you’re on track. Adjust contributions if your income or expenses change, or if you achieve a goal and set a new one. Use online banking or budgeting apps to track your account balance and stay motivated. If needed, consult a financial advisor to refine your strategy.

Setting up an automatic savings plan is all about clarity, consistency, and commitment. Start applying these steps, and you’ll steadily move closer to financial security and peace of mind.

5. Tips to maximize your automated savings

Maximizing your automated savings plan ensures you get the most out of your efforts while building wealth efficiently. By fine-tuning your approach, you can accelerate your financial goals and make saving a seamless part of your routine. Here are practical strategies to optimize your automated savings:

- Begin with small amounts: Start with a manageable contribution, like $25 per month, to build the savings habit without overwhelming your budget. Gradually increase the amount as you grow more comfortable or as your income rises. This approach makes saving sustainable and encourages long-term consistency.

- Leverage compound interest: Start saving as early as possible to take full advantage of compound interest, where your savings earn interest on both the initial amount and accumulated interest. Even small, early contributions to a high-yield savings account can grow significantly over time.

- Integrate with other financial strategies: Combine automation with budgeting tools to track spending and free up more money for savings. Avoid common pitfalls by learning about budgeting mistakes to avoid. Automatic investment apps can also help you invest spare change or fixed amounts regularly without manual effort.

- Consult a financial advisor: For complex goals, such as saving for retirement or a large purchase, seek guidance from a qualified financial professional. They can help tailor your savings plan, recommend suitable accounts, and align automation with your long-term objectives. A financial advisor can also guide you on setting up a recurring investment Fidelity plan to ensure consistent contributions to your portfolio.

An automated savings plan works best when it feels simple and natural. Focus on steady contributions, use smart tools, and let time grow your money. With consistency, your savings will turn into lasting financial security.

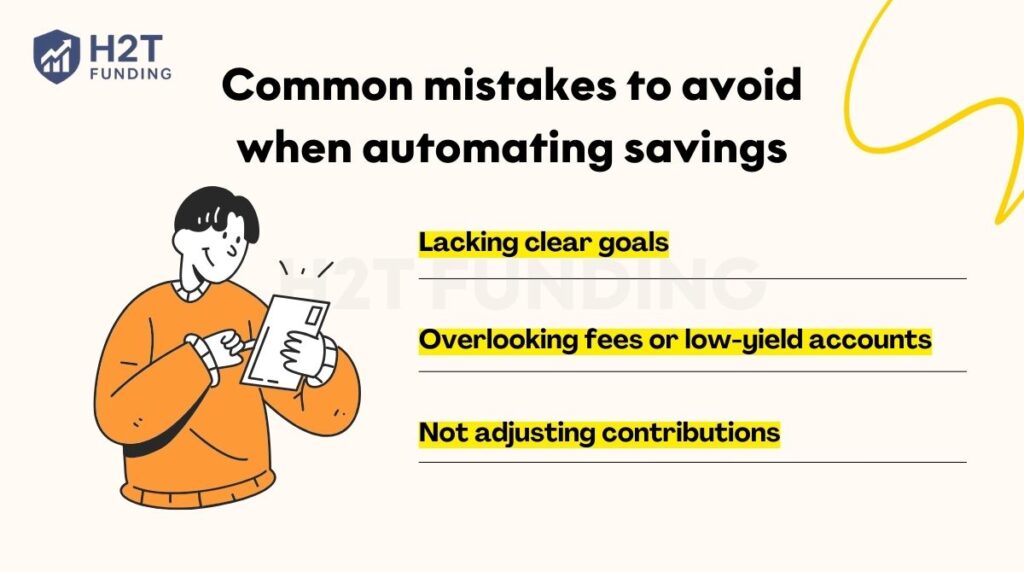

6. Common mistakes to avoid when automating savings

While automated savings is a powerful tool, certain pitfalls can hinder your progress.

Avoiding these common mistakes ensures your savings plan remains effective and aligned with your financial goals:

- Lacking clear goals: Without specific objectives, like saving for an emergency fund or a home, your plan may lack direction. Vague goals can lead to inconsistent contributions or overcomplicating the process with too many accounts or tools.

- Overlooking fees or low-yield accounts: Choosing accounts with high fees or low interest rates can erode your savings growth. Always compare account options and prioritize high-yield savings accounts to maximize returns and minimize costs.

- Not adjusting contributions: Failing to update your savings plan when your income or expenses change can stall progress. Regularly review your budget and adjust automated transfers to reflect life changes, such as a raise or new financial obligations.

Read more: How does Apex Funded Trader work?

7. FAQs about automating savings

Automating savings ensures you save regularly without needing to remember or decide each time. It reduces impulsive spending and leverages compound interest to grow your wealth over time.

You can set up direct deposits to send a portion of your paycheck to a savings account. Alternatively, schedule recurring bank transfers or use apps that round up purchases to save small amounts effortlessly.

Popular apps like Acorns, Qapital, Digit, and Chime simplify saving with features like round-up savings or goal-based automation. Each offers unique tools, such as AI-driven transfers or visual progress tracking, to suit different needs.

Yes, automating transfers to high-yield savings accounts maximizes interest earnings over time. Restricted access to these accounts also discourages unnecessary withdrawals, keeping your savings intact.

Automating savings means setting up systems that transfer money into your savings account without you having to do it manually. Examples include direct deposits, scheduled bank transfers, or apps that round up purchases and save the difference. This approach makes saving consistent and effortless.

The $27.40 rule is a savings method where you set aside $27.40 every day. Over the course of a year, this adds up to $10,000. It’s a simple way to break a big goal into manageable daily contributions.

Saving $10,000 in 3 months requires aggressive planning and discipline. You need to cut non-essential expenses, boost income through side hustles or overtime, and commit to saving over $3,000 each month. This strategy may not be realistic for everyone, but it works if you have a high income or significant expenses to trim.

Automatic saving is another way of describing automated savings. It refers to money being moved into your savings account on a set schedule or through tools without manual action. The goal is to make saving a habit that runs in the background of your daily life.

8. Conclusion: Start automating your savings today

Automate savings is a simple yet powerful way to build wealth without the stress of manual effort. It promotes financial discipline, ensures consistent progress, and helps you achieve goals like building an emergency fund or planning for retirement.

By leveraging tools like direct deposits, bank transfers, or apps, you can automate savings effortlessly and watch your money grow through compound interest. Take control of your financial future by setting up an automate savings plan with your bank or an app.

Start small to build the habit, and adjust your contributions over time for long-term success.

To learn more about managing your finances, explore H2T Funding’s Cash Flow & Saving Strategies section. You’ll find practical guides on budgeting basics, choosing high-yield savings accounts, or investing for beginners.