The Audacity Capital vs FTMO debate comes down to a clear choice based on your trading personality. In short, FTMO is best for systematic traders seeking structure and aggressive scaling, while Audacity Capital suits traders who prioritize instant funding and weekend flexibility to avoid evaluation pressure.

Choosing the wrong firm often leads to failure, not from a lack of trading skill, but from misunderstood rules on consistency or drawdown. At H2T Funding, we’ve reviewed dozens of prop firms, and we know that the fine print is what separates a funded trader from a frustrated one.

Dive into this in-depth analysis to understand the crucial psychological and strategic differences before you commit your time and money.

Key takeaways

- Audacity Capital provides instant funding programs that bypass a lengthy challenge, while FTMO requires passing a rigorous two-step evaluation process (Challenge and Verification) to prove profitability and discipline.

- FTMO is known for its strict, non-negotiable rules regarding maximum daily loss, overall drawdown, and trading consistency. Audacity Capital also has clear drawdown rules but offers a structure that may feel less restrictive, focusing on protecting the firm’s equity without the pressure of a pass/fail challenge clock.

- In the FTMO vs Audacity Capital matchup, FTMO offers a more aggressive and clearly defined Scaling Plan, allowing traders to manage up to $2 million. Audacity Capital also provides scaling opportunities, but its model is often seen as better for generating steady, frequent income from the start.

- FTMO’s rule-based system is ideal for systematic traders with a proven, consistent strategy. In contrast, traders who prioritize mental capital and want to avoid evaluation stress often lean towards Audacity Capital funded-first approach.

- Confident traders with a solid track record may prefer FTMO for its high scaling ceiling and industry reputation. Newer, yet consistently profitable, traders might find Audacity Capital instant funding model a less intimidating entry point into the prop trading world.

1. Overview of Audacity Capital and FTMO

Audacity Capital vs FTMO presents a choice between two distinct prop trading philosophies. FTMO represents the industry-standard, a structured path requiring traders to prove their skill through a rigorous two-step evaluation. In contrast, Audacity Capital offers a faster, more direct route to capital with its instant funding models, focusing on long-term consistency over short-term challenges.

Each firm is designed for a specific type of trader, and understanding their core differences is the first step in learning how to choose a prop firm that aligns with your goals. This overview breaks down their key features, from founding principles to risk rules.

Criteria Table – A High-Level Comparison

| Criteria | Audacity Capital | FTMO |

|---|---|---|

| Founded / Trust | Established in 2012 (London). A long-standing, trusted name. | Founded in 2015 (Prague). An industry pioneer with a massive global presence. |

| Evaluation Models | 2-Step Challenge, 1-Step Challenge, & Instant Funding. | Standardized 2-Step Evaluation (Challenge & Verification). |

| Account Sizes | $5,000 to $240,000. | $10,000 to $200,000. |

| Asset Classes | Forex, Indices, Metals, Energies, Crypto. | Forex, Indices, Commodities, Stocks, Crypto. |

| Trading Platforms | MT5, DXtrade. | MT4, MT5, cTrader, and DXtrade. |

| Profit Split | Up to 90%. | Up to 90%. |

| Minimum Days | 3-5 days, depending on the program. | 4 days per evaluation phase. |

| Scaling Programs | Steady, doubles account based on performance. Can scale to $2M. | Aggressive Scaling Plan, 25% capital increase every 4 months. |

| Execution Speed | Direct partnership with commercial liquidity providers. | Simulated trading environment with potential delays up to 200ms. |

| Commissions | Competitive spreads and standard commissions apply. | Transparent, standard commissions based on the platform. |

| Payouts | Bi-weekly after the first 30-day period. | Bi-weekly, with an average 8-hour processing time. |

| Risk Restrictions | Static absolute drawdown; complex daily drawdown rules. | Strict, static drawdown limits based on the initial balance. |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Audacity Capital vs FTMO websites before purchasing any challenge.

This table reveals a clear divide. FTMO’s structured approach appeals to disciplined, systematic traders who are confident in their ability to meet clear targets under pressure. Audacity Capital attracts traders who value flexibility, want to bypass evaluation stress, and prefer to start on a funded account immediately. Let’s explore each firm in more detail.

Audacity Capital

#1

Account Types

1-step, 2-step and instant funding

Trading Platforms

MT5, DXTrade

Profit Target

5% – 10%

Our take on Audacity Capital

Audacity Capital positions itself as a long-standing partner for traders, built on a legacy of trust since 2012. The firm’s standout feature is its variety of funding paths, especially the Funded Trader Program, which offers a direct route to a live trading environment.

This model is built for traders who have already proven their skills and want to avoid the psychological toll of a pass-or-fail challenge. It focuses on consistent risk management from day one.

| 💳 Challenge Fee | $49 – $2,399 |

| 👥 Account Types | 1-step, 2-step and instant funding |

| 💰 Profit Split | 50% – 90% |

| 💵 Account Size | $3K – $240K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, DXTrade |

| 🛍️ Asset Types | Forex, Indices, Commodities, Metals, Crypto |

FTMO

#2

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO is a dominant force in the prop trading industry, and its two-step Evaluation Process is the benchmark many other firms have followed. It is designed to rigorously test a trader’s discipline, risk management, and ability to generate consistent profits.

The firm’s reputation is built on transparency, a massive global community, and a clear path to significant capital. For traders wondering how to pass the FTMO challenge, the firm offers a structured process for those ready to prove their edge under a defined set of rules.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Read more:

2. Audacity Capital vs FTMO comparison: Core models and key rules

The primary difference between Audacity Capital and FTMO lies in their funding models and the strictness of their trading rules. It’s a classic clash between a direct path to capital versus a structured evaluation. This section directly compares the most critical rules that determine a trader’s success.

2.1. Funding model & evaluation difficulty

Audacity Capital makes getting funded easier upfront with its instant models, while FTMO demands traders prove their worth through a difficult two-phase evaluation. The choice here defines the entire trading experience, from initial pressure to long-term expectations.

| Criteria | Audacity Capital | FTMO |

|---|---|---|

| Evaluation Required | Optional (Instant funding available) | Yes, mandatory 2-step process |

| Profit Target | 10% target to scale/payout (FTP model) | 10% (Phase 1) & 5% (Phase 2) to pass |

| Time Pressure | None (Unlimited period) | None (Unlimited period) |

| Psychological Stress | Lower initial stress (no challenge), but immediate live market pressure. | High, due to the pass/fail nature of the evaluation and strict targets. |

| Overall Difficulty | Easier to begin, focuses on long-term consistency. | Harder to begin, requires meeting specific, high-pressure targets. |

In short, Audacity Capital is easier to start, removing the initial barrier to entry. FTMO is harder but potentially more durable for traders who can thrive within a structured, rule-heavy system.

2.2. Drawdown, consistency & risk rules

FTMO enforces simpler, static drawdown rules, whereas Audacity Capital introduces more complex consistency metrics and a different daily drawdown calculation. These rules are where most traders fail, making this comparison vital.

| Criteria | Audacity Capital | FTMO |

|---|---|---|

| Max Drawdown | 10-15% fixed absolute drawdown based on the program. | 10% fixed maximum loss from the initial balance. |

| Daily Loss Limit | 3-7.5% of balance or equity at rollover (whichever is higher). | 5% of the initial balance at the start of the day. |

| Trailing Drawdown | No, the maximum drawdown is fixed. The daily drawdown resets daily. | No, both daily and max loss are static and do not trail. |

| Consistency Rules | Yes, a formal Consistency Score is calculated as a hard requirement. | Implicit rules against gambling-like behavior; no formal score. |

| Rule Strictness | High, with complex consistency metrics that the risk team can review. | Very high, with strict, non-negotiable pass/fail conditions. |

2.3. News, overnight & strategy policies

Both firms offer significant freedom in trading strategies, but they have critical differences regarding news trading on their main funded accounts. These policies directly impact your trading style and freedom.

| Policy | Audacity Capital | FTMO |

|---|---|---|

| News Trading | Allowed on Ability Challenge; Restricted on Funded Trader Program. | Allowed during evaluation; Restricted on the standard FTMO Account. |

| Overnight Trading | Yes, generally allowed across programs. | Yes, but standard accounts must close positions before the weekend. |

| Weekend Trading | Yes, holding positions over the weekend is permitted. | No, positions must be closed (Swing accounts are the exception). |

| EA / Automation | Yes, permitted, except for HFT or arbitrage strategies. | Yes, permitted, but warns against common third-party EAs. |

| Allowed Strategies | Most styles are fine, but Martingale, DCA, and HFT are explicitly forbidden. | Most styles are allowed but must be replicable and not exploit the system. |

Ultimately, Audacity Capital provides greater flexibility for swing and position traders, primarily by allowing traders to hold positions over the weekend. However, both firms enforce similar restrictions against news trading on their main funded accounts, a crucial rule to remember. While both permit EAs, they are aligned in their strict prohibition of exploitative strategies, seeking genuine and replicable trading skills.

3. Audacity Capital vs FTMO review: Fees, refunds, and cost efficiency

When comparing Audacity Capital vs FTMO, cost efficiency goes beyond just the initial fee. The true value lies in the refund policy, the likelihood of achieving it, and any hidden costs. Both firms use a one-time fee model with the promise of a refund upon success, but their structures present different value propositions.

This section breaks down the costs to help you determine which prop firm offers a better financial fit for your investment.

| Criteria | Audacity Capital | FTMO |

|---|---|---|

| Fee Type | One-time program fee. | One-time Challenge fee. |

| Refund Policy | Yes, refunded with the first payout from a live account. | Yes, refunded with the first profit split from the FTMO Account. |

| Challenge Cost | Variable, based on account size (e.g., ~$351 for the $120k Ability Challenge). | Variable, based on account size (e.g., €540 for the $100k FTMO Challenge). |

| Transparency | High. Fees and rules are clearly stated on the website. | Very high. Considered an industry leader in transparent pricing. |

| Added Fees | Standard commissions and swap fees apply to all accounts. | Simulated commissions are applied to emulate real market conditions. |

| Payout Cycle | First payout after 30 days, then bi-weekly (every 14 days). | Bi-weekly by default, with an average 8-hour processing time. |

Both firms operate on a similar get-refunded-on-success model, making the true cost dependent on your ability to become a funded trader. The fees are not for profit but cover the operational costs of providing the trading infrastructure.

Audacity Capital’s instant funding model has no refund, as there is no challenge to pass. For its challenge programs, the refund is tied to your first payout, which requires a 30-day wait. FTMO’s refund is tied to the first profit split, which can be requested after 14 days on the funded account. Therefore, while costs appear similar, the path to recovering your initial investment varies significantly.

4. Audacity Capital vs FTMO debate: Profit split and scaling potential

The ultimate goal in the Audacity Capital vs FTMO debate is long-term profitability, which hinges on profit splits and scaling potential. FTMO offers a more aggressive and straightforward scaling plan, while Audacity Capital provides a steady path to growth with attractive profit share incentives tied to performance.

This comparison breaks down how each firm rewards its traders and what it takes to grow your account, helping you decide which model aligns better with your financial ambitions.

| Criteria | Audacity Capital | FTMO |

|---|---|---|

| Profit Split | Starts at 75%, scales up to 90% based on performance. | Starts at 80%, scales to 90% upon meeting Scaling Plan criteria. |

| Scaling Plans | Account balance doubles after achieving set performance goals. | 25% capital increase every 4 months if the net profit is at least 10%. |

| Payout Frequency | Bi-weekly (every 14 days) after the initial 30-day period. | Bi-weekly by default, available 14 days after the first trade. |

| Minimum Payout | No specified minimum, but payouts are tied to profit targets for scaling. | No minimum amount is specified for profit splits. |

| Withdrawal Conditions | Must have a Consistency Score above 50 to request a payout. | Must be in profit and request a payout no earlier than 14 days. |

FTMO’s path to a 90% split and a larger account is faster and more structured, rewarding consistent high performance every four months. Audacity Capitals’ scaling plan is slower, based on a three-month review cycle, but offers the powerful incentive of doubling your account size in a single step.

For traders aiming to compound capital aggressively, FTMO’s Scaling Plan is a major advantage. For those who prefer a steadier growth model and a performance-based increase in their profit share (from 75% to 85% or 90%), Audacity Capital presents a compelling alternative.

5. FTMO vs Audacity Capital: Platforms and tradable markets

In the FTMO vs Audacity Capital comparison, both firms provide access to institutional-grade technology and a wide range of markets. FTMO offers a broader selection of popular trading platforms, including the widely used MT4, while Audacity Capital emphasizes its direct partnership with commercial liquidity providers for superior execution.

Your choice here will depend on your preferred platform and the specific assets you trade. This section details the technological and market offerings of each firm.

| Criteria | Audacity Capital | FTMO |

|---|---|---|

| Trading Platforms | MT5, DXtrade. | MT4, MT5, cTrader, and DXtrade. |

| Asset Classes | Forex, Indices, Metals, Energies, Crypto. | Forex, Indices, Commodities, Stocks, Crypto. |

| Execution Speed | Partners directly with commercial liquidity providers, avoiding retail brokers. | Simulates real market conditions, which may include execution delays up to 200ms. |

| Commissions & Fees | Standard commissions and swap fees apply to emulate market conditions. | Applies simulated commissions to provide an accurate trading environment. |

| Trader Dashboard | Provides a modern dashboard with real-time analytics and payout tracking. | Offers a comprehensive Account MetriX and other proprietary analysis tools. |

FTMO clearly wins on platform variety, offering cTrader and the legacy MT4 platform, which many traders and EAs still rely on. Audacity Capital’s focus on MT5 and DXtrade, combined with its direct liquidity partnerships, may appeal to traders who prioritize execution quality over platform choice.

Both firms provide access to the most popular financial markets, ensuring you can trade your preferred instruments. The key difference is subtle but important: FTMO’s environment is a high-quality simulation, while Audacity Capital highlights its direct-to-liquidity execution model, which may offer a more authentic trading experience for some.

6. Payout & trust: Audacity Capital and FTMO Reddit and Trustpilot reviews

A prop firm’s reputation is built on one core promise: paying traders what they are owed, reliably and on time. To gauge this, we turn to unfiltered trader feedback from platforms like Trustpilot and Reddit, where real experiences, both good and bad, are shared.

(Note: Information collected and updated on Jan 10, 2026)

Below, will analyze the public sentiment surrounding both firms and highlight key reviews that offer valuable insight into their payout reliability and rule enforcement.

Sentiment Summary

| Metric | Audacity Capital | FTMO |

|---|---|---|

| Payout Reliability | Generally positive, with many traders confirming successful payouts. However, some complaints arise regarding denials based on strategy violations. | Overwhelmingly positive. Widely regarded as the industry standard for fast, reliable payouts. |

| Rule Enforcement | Perceived as strict, especially regarding the Consistency Score, and prohibited strategies like Martingale. | Rules are extremely clear and strictly enforced, which is both a strength (transparency) and a weakness (high failure rate). |

| Support Quality | Frequently praised for being fast, responsive, and helpful. | Excellent and professional support is a common theme in positive reviews. |

| Common Complaints | Some traders report payout disputes related to consistency and strategy rules. | The difficulty of the challenge and the strictness of the daily drawdown rule. Some profitable traders complain about hidden risk rules. |

Here are some specific user reviews that provide a balanced perspective on each firm. For a comprehensive article, capturing screenshots of these comments would offer powerful social proof.

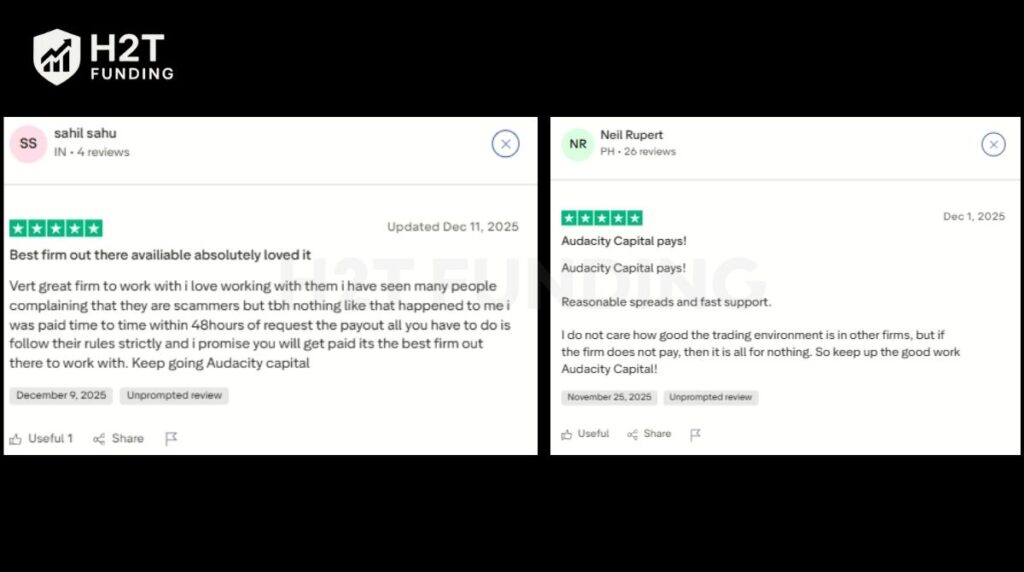

On platforms like Trustpilot and Reddit, Audacity Capital receives praise for its fast support and reliable payouts. Many traders, like Sahil Sahu and Neil Rupert, confirm they’ve been paid without issue.

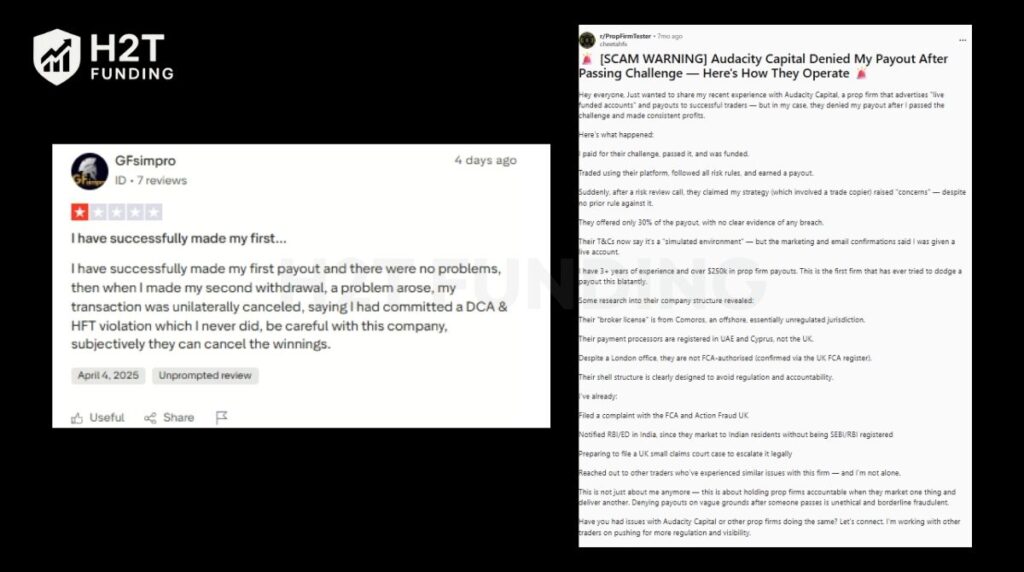

However, criticism often centers on payout denials due to strict and sometimes subjective interpretations of their trading rules, as highlighted in detailed posts by users GFsimpro and cheetahfx.

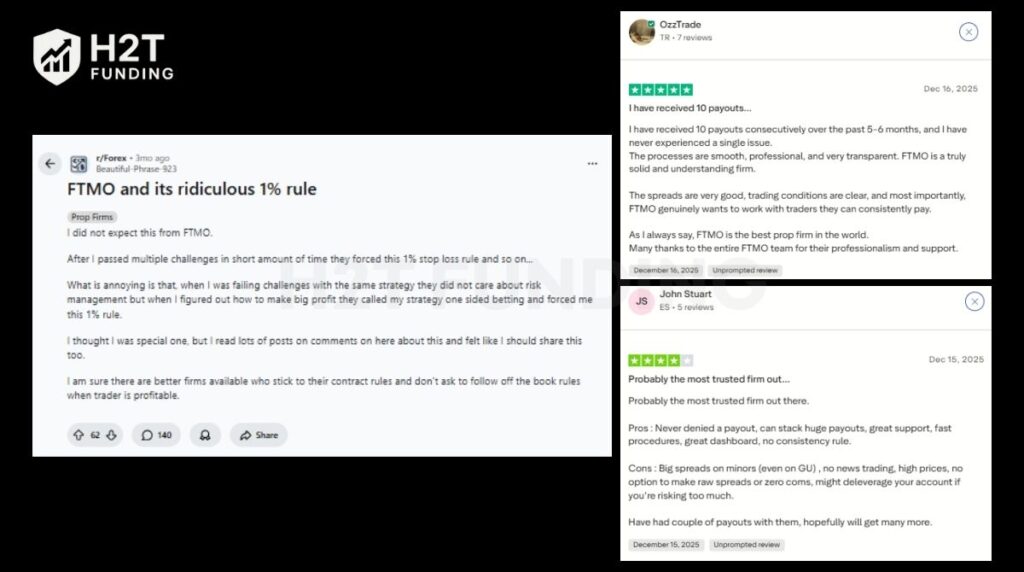

FTMO is widely celebrated on Trustpilot and Reddit as the gold standard for reliability. Users like OzzTrade and John Stuart praise the firm for its flawless payout record and professionalism. The primary criticisms are not about payments but about the high difficulty and what some traders, like user Beautiful-Phrase-923, describe as ridiculous or hidden risk rules imposed on profitable traders.

The community consensus is clear. In the FTMO and Audacity Capital trust debate, FTMO is the undisputed leader in payout reliability and transparency. Traders almost universally agree that if you follow FTMO’s rules, you will get paid. The complaints are about the difficulty of following those rules.

Audacity Capital also has a strong base of satisfied traders who confirm payouts. However, the recurring theme of payout denials linked to complex consistency rules or prohibited strategies raises a significant red flag for traders whose style might fall into a gray area. Trust is built on predictability, and in this regard, FTMO’s black-and-white rules, while challenging, leave less room for subjective interpretation during a payout review.

7. Audacity Capital vs FTMO: Which prop firm is easier to pass?

For traders seeking the quickest path to a funded account, Audacity Capital has a lower initial barrier to funding. Because its flagship Funded Trader Program has no traditional pass/fail challenge, but ongoing risk and consistency review. By offering instant funding, it completely removes the primary barrier that causes most traders to fail at other prop firms.

However, if we compare their multi-step challenges directly, the answer becomes more nuanced. Let’s break down the difficulty of their respective evaluation programs.

| Criteria | Winner | Analysis |

|---|---|---|

| Profit Target | Draw | Both firms require a 10% profit target in Phase 1 and a 5% target in Phase 2. The required performance is identical. |

| Drawdown Strictness | FTMO | FTMOs 5% daily and 10% max drawdown rules are static and simpler to track. Audacity’s 7.5%/5% daily and 15%/10% max drawdowns seem more generous but come with complex calculation rules that can be harder to manage. |

| Rule Complexity | FTMO | FTMO’s rules are straightforward: hit the profit target without breaching drawdown limits. Audacity Capital introduces a Consistency Score and more subjective reviews of trading style, adding an extra layer of complexity. |

| Overall Difficulty | Audacity Capital | Despite the rule complexity, Audacity Capital’s unlimited trading period and more generous drawdown numbers (on paper) make its challenge slightly less pressured. But the true winner is its instant funding model, which removes the concept of passing altogether. |

If your goal is to simply manage a funded account as quickly as possible, Audacity Capital is the clear winner. Its instant funding and one-step challenge options offer a significantly lower barrier to entry than FTMO’s mandatory two-step evaluation. You can bypass the high-pressure, pass-or-fail environment entirely.

However, easy is not always better. FTMO’s difficult challenge acts as a powerful filter, ensuring that only disciplined and consistent traders get funded. While it’s harder to pass, traders who succeed often find themselves better prepared for long-term success.

8. FTMO and Audacity Capital: Which prop firm suits your trading style

Choosing between FTMO and Audacity Capital ultimately depends on your individual trading style, experience level, and psychological makeup. A model that empowers one trader can feel restrictive to another. There is no single best choice, only the right fit for you.

This breakdown matches different trader profiles to the most suitable firm, helping you align your strategy with the right funding partner.

| Trader Type | Best Choice | Why? |

|---|---|---|

| Beginners | Audacity Capital | The instant funding model offers a less intimidating start. It allows new but profitable traders to focus on risk management in a live environment without the immense pressure of passing a difficult, time-sensitive challenge. |

| Systematic Traders | FTMO | FTMOs’ clear, non-negotiable rules are perfect for traders with a proven, rule-based strategy. If your system can consistently meet the targets within the drawdown limits, FTMO offers a straightforward path to significant capital. |

| Swing Traders | Audacity Capital | Audacity Capital allows holding trades over the weekend, which is essential for most swing trading strategies. FTMO’s standard account requires closing positions on Friday, making it less suitable for this style. |

| Scalpers | FTMO | FTMOs’ simulated environment with clear rules is generally more accommodating for high-frequency strategies. Audacity Capital explicitly prohibits High-Frequency Trading (HFT) and focuses more on longer-term consistency. |

| Risk-Averse Traders | FTMO | While counterintuitive, FTMO’s strict drawdown rules force extreme discipline. This rigid framework can be beneficial for traders who need external constraints to manage their risk effectively. |

| Traders Aiming for $1M+ Capital | FTMO | FTMO’s Scaling Plan is more aggressive and transparent. It offers a clear, structured path to managing accounts up to $2 million, making it the superior choice for traders with ambitions of managing very large capital. |

In essence, your choice boils down to a simple trade-off. Choose FTMO for its high scaling potential and structured, transparent rules if you are a disciplined, systematic trader. Choose Audacity Capital for its instant funding and greater flexibility if you are a swing trader or prioritize reducing psychological pressure at the start of your funded journey.

9. Common mistakes traders make when choosing Audacity Capital or FTMO

Traders often fail not because their strategy is flawed, but because they overlook critical, firm-specific rules that lead to preventable mistakes. Choosing between Audacity Capital and FTMO requires understanding these common pitfalls. Awareness of these traps is the first step toward avoiding them.

9.1. Common mistakes with Audacity Capital

Audacity Capital’s unique model has its own set of traps that traders frequently fall into, often related to its consistency rules and the psychology of instant funding.

- Treating Instant Funding as Zero Pressure: Many traders mistakenly believe that no challenge means no test. The reality is that the live market becomes the test from day one. This leads them to trade recklessly, hitting their drawdown early and jeopardizing their ability to secure a payout later. Instant funding requires more discipline, not less.

- Ignoring the Consistency Score: Focusing solely on the profit target is a classic error. A single, massive winning day can skew the Consistency Score below the required threshold (typically 50). Consequently, traders find themselves profitable but unable to withdraw their earnings because their performance is deemed inconsistent.

- Accidentally Using Prohibited Strategies: Audacity Capital explicitly forbids strategies like Martingale and Dollar-Cost Averaging (DCA). Traders who habitually add to losing positions to average down can unintentionally violate these terms. This often leads to account termination during a payout review, even if the account is in profit.

9.2. Common mistakes with FTMO

FTMO’s structured challenge is legendary, but its strict, black-and-white rules are a minefield for the unprepared. These are the most common errors that cause traders to fail.

- Underestimating the Challenge’s Psychological Pressure: Many traders enter the FTMO Challenge with a gambling mindset, aiming to hit the 10% target as quickly as possible. This high-risk approach encourages over-leveraging and revenge trading after a loss, making it incredibly easy to breach the Maximum Daily Loss limit and fail.

- Miscalculating the Daily Loss Limit: This is the most infamous FTMO mistake. Traders forget that the 5% daily loss is static, calculated from the initial balance at the start of the day. After securing some profit, they incorrectly calculate their risk based on the new, higher equity, leading to an accidental breach.

- Ignoring Rule Changes on the Funded Account: Successful traders often assume the rules that applied during the challenge carry over to the funded account. They then violate the 2-minute news trading rule or hold positions over the weekend on a standard FTMO Account. These are simple but costly mistakes that result in losing a hard-won account.

In summary, success with either firm requires more than just a good strategy. It demands a deep understanding of their specific rules. For Audacity Capital, the focus must be on long-term consistency. For FTMO, it is about maintaining extreme discipline within a rigid, high-pressure framework.

10. FAQs

Neither firm is definitively better; they serve different traders. Audacity Capital is better for those who want instant funding and weekend holding, while FTMO is better for systematic traders seeking a highly structured path with aggressive scaling and a top-tier industry reputation.

For beginners who are already profitable but find the evaluation pressure of FTMO too high, Audacity Capital’s instant funding programs can be a better starting point. They allow traders to focus on risk management in a live environment without the stress of a pass/fail challenge.

Audacity Capital offers several funding programs. You can choose a multi-step evaluation (Ability Challenge) similar to other firms, or you can opt for their Funded Trader Program, which provides an instant funded account without a challenge, allowing you to start trading and earning a profit share from day one by following their risk rules.

No, Audacity Capital currently does not offer services to residents of the United States. Their services are also restricted in countries like Syria, Iran, and North Korea.

Yes, as of 2025, FTMO provides services to clients in the United States through a strategic partnership with OANDA. This allows US-based traders to access their evaluation process and funding programs.

No, you cannot pass FTMO in one day. FTMO requires a minimum of 4 trading days for both the Challenge phase and the Verification phase. This means the absolute fastest you can become an FTMO Trader is 8 trading days.

The 2-minute rule applies to FTMO Traders on a standard funded account (not during the challenge). It prohibits opening or closing trades on a specific instrument within a window of 2 minutes before and 2 minutes after a major news release. Violating this rule can lead to the termination of the account.

The 90-90-90 rule is a general trading industry statistic, not a specific FTMO rule. It states that 90% of new traders lose 90% of their capital within the first 90 days. FTMO’s strict evaluation process is designed to find the traders who can overcome these odds through discipline and proper risk management.

Most traders fail due to a combination of psychological pressure and poor risk management. The two most common reasons are breaching the Maximum Daily Loss limit during an emotional trading session and failing to meet the profit target due to an inconsistent or flawed strategy.

Both FTMO and Audacity Capital offer scaling plans that allow successful traders to manage accounts well over $1 million. FTMOs’ Scaling Plan allows traders to manage up to $2 million, and Audacity Capital’s plan also enables scaling to a $2 million account by consistently meeting performance targets.

Better depends on your needs. For traders seeking faster funding or weekend holding, firms like Audacity Capital or The5ers are strong alternatives. For those who want similar structured challenges but with slightly different rules, FundedNext and Alpha Capital Group are also highly-regarded competitors.

Audacity Capital is a London-based proprietary trading firm founded in 2012. They are known for offering various funding programs, including an “Instant Funding” model that allows traders to bypass a multi-step evaluation. They focus on funding traders who can demonstrate long-term consistency and responsible risk management.

FT-MO’s “1% Rule” is not a strict, enforced rule but rather a strong recommendation for professional risk management. The firm suggests risking no more than 1% of your capital per trade to encourage a sustainable trading style. While violating this guideline won’t cause an immediate breach, it signals high-risk behavior. Consequently, consistently risking too much on single trades can lead to warnings or even account termination by their risk team.

11. Conclusion

The Audacity Capital vs FTMO debate ends with a simple question: Do you want to prove your skill in a rigorous test, or do you want to demonstrate it directly in the market from day one? FTMO remains the industry benchmark for structured, transparent evaluations that reward discipline and consistency with aggressive scaling.

In contrast, Audacity Capital carves its niche by offering a direct path to capital, appealing to profitable traders who want to bypass evaluation stress. With its instant funding models and weekend-holding flexibility, it is perfectly suited for experienced swing traders and those who prioritize mental capital.

For more in-depth comparisons and to find the perfect prop firm for your unique trading style, explore other expert reviews on the H2T Funding blog.