Many traders lose their funded Apex accounts because of small, preventable mistakes. Apex Trader Funding rules are detailed, from the Daily Loss Limit and Trailing Drawdown to the 7-Day Rule, and missing even one can instantly reset your account.

At H2T Funding, we’ve seen many traders fail not because they were unskilled, but because they didn’t fully understand the rules. This guide will help you master Apex funding rules in 2026, so you can trade confidently, stay compliant, and secure your payouts without risk.

Key takeaways

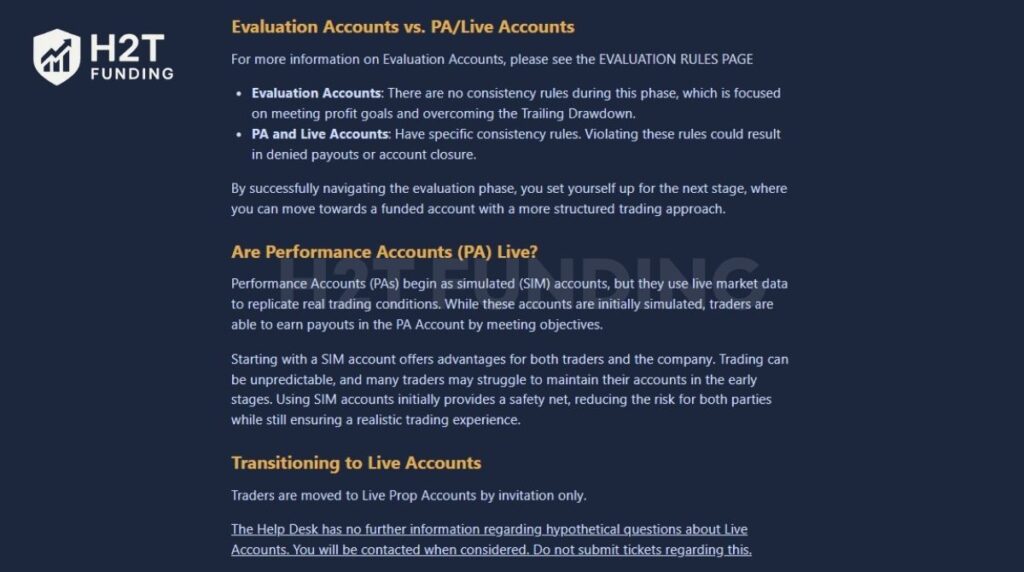

- Apex offers three stages: Evaluation, Performance (PA), and Live accounts, guiding traders from simulation to real payouts with increasing rule complexity.

- The most critical Apex rules traders fail are the trailing drawdown, the 30% consistency rule, and the 30% negative P&L rule, all of which apply even to unrealized profits.

- Apex enforces professional risk management through contract scaling limits and strict position sizing consistency.

- Payout eligibility requires at least 8 trading days, including 5 profitable days ($50+ each), with no rule violations.

- During the first three payout cycles, traders must stay above the safety net level and keep no single day’s profit above 30% of total payout-period gains.

1. What are the types of Apex Trader Funding accounts?

Apex Trader Funding builds a step-by-step path that helps traders grow from simulation to real payouts. Each stage focuses on risk management, trading discipline, and consistent results under live market conditions. The system includes three key account types:

- Evaluation account: This is the starting phase where traders use a simulated account with live market data. The goal is to hit the profit target while managing the trailing drawdown. There’s no daily loss limit or consistency rule here. You must trade at least seven active days and avoid breaching the max drawdown to pass the evaluation.

- Performance Account (PA): Once you pass, you move to a payout-eligible simulated account. Apex introduces core trading rules such as Contract Scaling and the 30% consistency rule. These ensure traders maintain control, avoid high-risk behavior, and trade within structured Apex Trader Funding rules. Violations can cause payout denial or account reset.

- Live Account: This final stage is available by invitation only for traders who show steady performance in their PA account. Trades occur in real market conditions, and profits become fully live payouts. It marks a trusted partnership where Apex funds disciplined, consistent traders.

In short, Apex’s funded accounts are designed to reward patience and structure, not luck. Understanding these Apex trader rules early will make the evaluation and payout stages much easier.

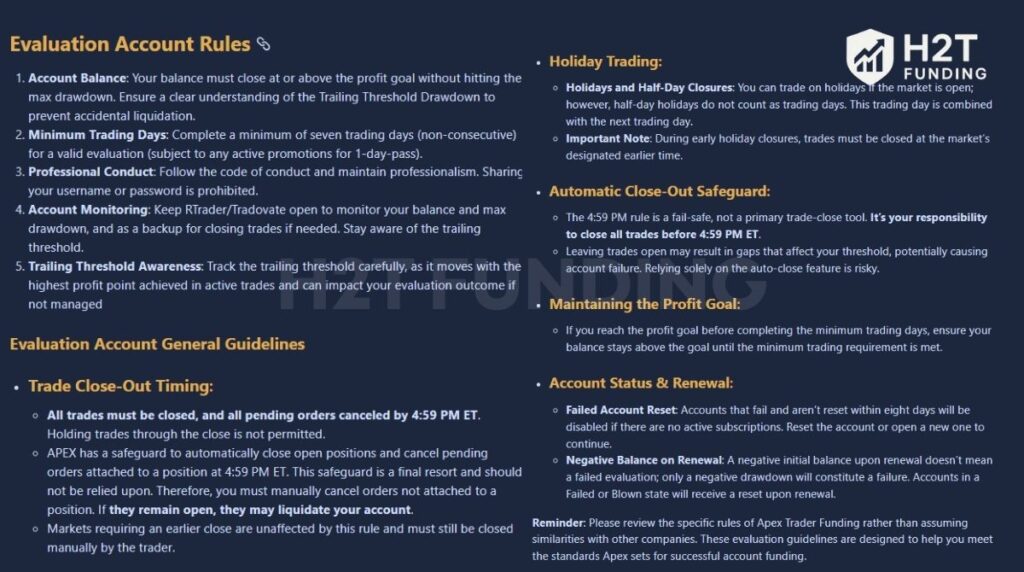

2. Apex Trader Funding rules

Apex Trader Funding’s rules are designed to protect both the trader and the capital behind them. Every guideline, from drawdowns to consistency and scaling, exists to help you develop the discipline needed to trade like a professional. These are the core Apex Trader Funding account rules that decide whether you keep or lose your PA account.

Let’s go through the core ones you’ll face in both evaluation and funded accounts. If you’re new to Apex, you can read a full overview of how Apex Trader Funding works here.

2.1. Trailing drawdown (maximum loss)

The trailing drawdown is the cornerstone of Apex’s risk control system. It defines the maximum loss your account can sustain before being closed. The threshold moves up as your account balance reaches new highs, following your peak unrealized profit. Once your balance hits the safety net (starting balance + drawdown limit + $100), the drawdown stops trailing and becomes fixed.

For example, a $50,000 plan starts with a $2,500 drawdown. When your balance reaches $52,600, the safety net locks in, and the trailing threshold no longer moves. This means even if your account later drops, you won’t lose your funded status as long as you stay above that fixed level.

The trailing drawdown prevents reckless risk-taking and ensures consistent risk management. Many traders fail their evaluation because they don’t realize it trails on unrealized profits. Always monitor it in your dashboard and close trades before hitting the threshold.

Pro tip: Think of the trailing drawdown as a moving stop for your entire account. If you protect it like you would a trade, your funded account will last longer.

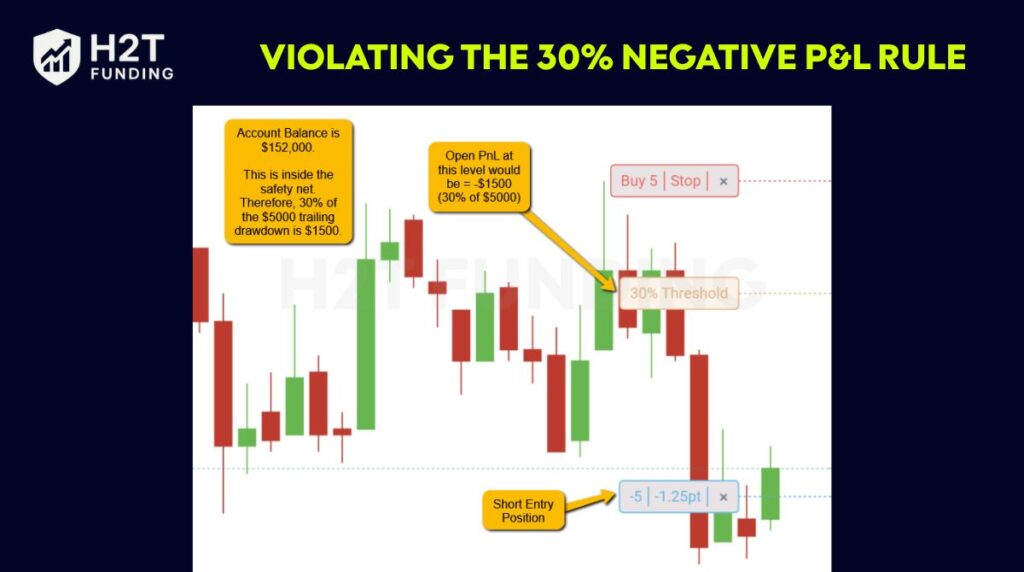

2.2. 30% negative P&L rule (maximum adverse excursion)

The 30% negative P&L rule limits how much a single trade can move against you. Instead of focusing on daily losses, it measures the risk of one position relative to your start-of-day profit. This rule is one of Apex’s most effective safeguards against oversized, emotional trades.

Say you begin the day with $4,000 in profits. Your maximum open loss on any trade can’t exceed $1,200 (30% of that amount). If your profits are small or the account is new, the limit is calculated using the trailing threshold instead, for example, $750 on a $50k account. As your balance grows, Apex gives more flexibility: once you double your safety net, your loss cap rises to 50%.

Handled correctly, this rule teaches powerful risk control. It stops you from letting one bad decision erase multiple good days. Brief dips above 30% aren’t fatal if corrected quickly, but repeated or severe breaches may result in payout denial or account closure. It’s all about maintaining control even when trades turn against you, a habit every funded trader must master.

2.3. Contract scaling rule

The Contract Scaling Rule is designed to promote steady, controlled growth. When you first start a Performance Account, you can trade only half of your maximum contract limit. Once your end-of-day balance passes the trailing threshold stop (starting balance + drawdown + $100), you unlock full contract access starting from the next session.

For example, in a $50,000 PA account with a 10-contract limit, you can initially trade up to five contracts. When your balance reaches $52,600, the trailing drawdown stops, and you can then use all ten contracts freely. This ensures traders don’t over-leverage early in their accounts before building enough cushion.

If you accidentally exceed the limit, Apex expects you to close the excess contracts immediately. Ignoring it can result in your payout being denied and the account being reset to the previous day’s balance. Repeated violations may cause full account termination, a clear sign that scaling responsibly is non-negotiable in professional trading.

2.4. 30% consistency rule (windfall rule)

The 30% Consistency Rule ensures traders don’t rely on one lucky trading day to inflate their profits. It requires that no single day’s gain accounts for more than 30% of the total profit in a payout cycle. This is the core Apex Trader Funding 30 rule that causes the most payout delays for new traders.

Imagine your account has earned $5,000 since the last payout. If one day produced $1,800 in profit, over 30% of your total, you’ll need to continue trading until that day’s weight falls below the limit. The rule resets after every approved payout and is removed entirely after your sixth payout or transfer to a live prop account.

If you want to avoid payout denial, you must fully understand all Apex Trader Funding consistency rules.

2.5. Contract size consistency rule

Apex evaluates not only profit but also how you size your trades. The Contract Size Consistency Rule requires traders to use contract sizes that reflect a stable, methodical approach. Gradual scaling up as your account balance grows is expected, but erratic changes, such as trading ten contracts one day and two the next, suggest inconsistency.

Strategic adjustments are allowed when market volatility shifts or your account shrinks, but those must align with a defined trading strategy. Starting big, losing, and then reducing size to secure payouts is viewed as undisciplined behavior. Traders who manipulate position sizes to “game the system” risk payout forfeiture or account suspension.

2.6. 30% negative consistency rule

While the 30% Consistency Rule manages profit concentration, the 30% Negative Consistency Rule limits excessive losses. It states that no single trading day should end with losses exceeding 30% of your total gains during the current payout period. If your total profit is $5,000, you shouldn’t lose more than $1,500 in one session.

This rule prevents emotional trading after big wins and promotes steady drawdown recovery. It doesn’t penalize traders for small fluctuations, but repeated deep losses within short periods show poor risk management. Maintaining losses under control helps keep your funded account stable and your payout eligibility intact.

2.7. One-direction rule (no hedging)

Apex enforces a one-direction rule, which prohibits holding both long and short positions in the same instrument at the same time. This prevents artificial exposure and helps maintain clear, trackable risk. Traders can reverse direction only after closing the previous trade entirely; partial hedging or offsetting within the same market is not allowed.

The rule keeps your trading data transparent and your risk management consistent. It’s designed to mirror institutional standards, where simultaneous hedging in the same asset is considered risk duplication rather than protection. Maintaining a single directional bias ensures better discipline and cleaner execution in volatile market conditions.

2.8. News trading rule

The Apex Trader Funding news trading rule restricts trading around high-impact economic events such as FOMC, CPI, and NFP releases. Traders must avoid opening or closing positions within two minutes before and after scheduled announcements. Holding open trades through these events is allowed only if the position was opened well in advance and not managed during the restricted window.

This protects both traders and the firm from market volatility spikes that can cause unpredictable slippage. Violating this rule, even once, can result in a full account reset or payout denial. The best practice is to check the economic calendar daily and plan your trades away from high-risk news times.

If your account is closed, you might also be wondering if failed Apex accounts can be written off on taxes.

2.9. Automation & copy trading restrictions

Automation, high-frequency systems, and trade copier tools are strictly prohibited in all Apex Funded accounts. Apex allows the use of ATM strategies or bracket orders, but traders must remain in full control of entries and exits. Any use of third-party signals, mirrored trades, or shared IPs across accounts is considered a compliance breach.

These rules prevent system manipulation and ensure that all trading performance reflects genuine skill, not algorithmic advantage. Violations typically result in account closure or permanent funding suspension. In short, Apex rewards traders, not bots, for their precision, timing, and trading discipline.

2.10. Max contracts rule

Every Performance Account comes with a fixed contract limit based on its size. The Max Contracts Rule ensures you never exceed that ceiling. For instance, a $50,000 account allows a maximum of 10 contracts; anything above that violates Apex rules.

This cap maintains consistent risk-to-reward ratios across all traders. Opening too many contracts, even briefly, increases exposure far beyond the intended funding plan. If you mistakenly exceed the limit, Apex allows immediate manual correction without penalty, but failing to act or repeating the mistake can lead to payout denial or full account reset.

Trading within your contract limits builds professional discipline and forces you to focus on precision rather than size, a key mindset for long-term trading success.

2.11. Dollar-cost averaging (DCA) rule

The Dollar-Cost Averaging (DCA) Rule allows traders to scale into positions, but only within Apex’s risk parameters. You can add contracts to improve your average entry price, provided you remain within your max contract and scaling rules. The intent is to enhance position flexibility, not to average down indefinitely on losing trades.

Used properly, DCA helps smooth entry timing and manage volatility during unpredictable market conditions. But overusing it turns into reckless averaging, which contradicts Apex’s core principle of strict risk control. Always plan your ads before entering the trade and track how each one affects your drawdown buffer.

2.12. Adding to the trade rule

Apex allows traders to add to winning positions if it aligns with a valid trading strategy. You can increase position size gradually as the trade moves in your favor, a practice that supports scaling with momentum rather than against it. This approach mirrors how professionals build size in trending markets while maintaining a positive risk-to-reward profile.

However, adding to losing trades without a pre-defined trading plan is viewed as undisciplined behavior. Each add-on increases drawdown pressure and can easily breach your trailing threshold. Apex expects traders to scale only when it strengthens trade logic, not as a reaction to emotion or fear of missing out.

2.13. Safety net & payout compliance

Apex uses a Safety Net system to protect both traders and firm capital during early payouts. For the first three payout cycles, a small buffer remains in the account, acting as a cushion against future drawdowns. Once traders show consistent profits and responsible withdrawals, this safety net is removed, granting full payout eligibility.

During this period, the payout structure requires meeting the 7-Day Rule and maintaining profit consistency. Any payout request that violates the 30% rule or open-position guidelines can be denied. Following these payout parameters ensures smooth withdrawals and prevents compliance holds during the withdrawal process.

2.14. Probation & monitoring

When traders breach minor Apex trading rules, the firm may place them on probation rather than immediately terminating the account. This phase involves closer monitoring and tighter limits for a set period, usually one to two weeks. If your account is under review, it may impact payout conditions, including the Apex consecutive days requirements.

Repeated or severe violations, however, lead to a funded account suspension or permanent removal from the program. Probation serves as both a warning and a learning opportunity, a way to reinforce consistent, professional behavior before rejoining normal payout eligibility.

Together, these rules form the backbone of Apex’s funding model, a system built on discipline, structure, and respect for risk. Every rule that protects your account today also builds the foundation for sustainable profits, stable payouts, and professional growth in the future.

3. Apex Trader Funding payout rules

Getting funded is great, but getting paid consistently is the real objective. Apex Trading Funding payout rules are designed to ensure traders don’t rely on one lucky day, over-withdraw too early, or request payouts without enough buffer.

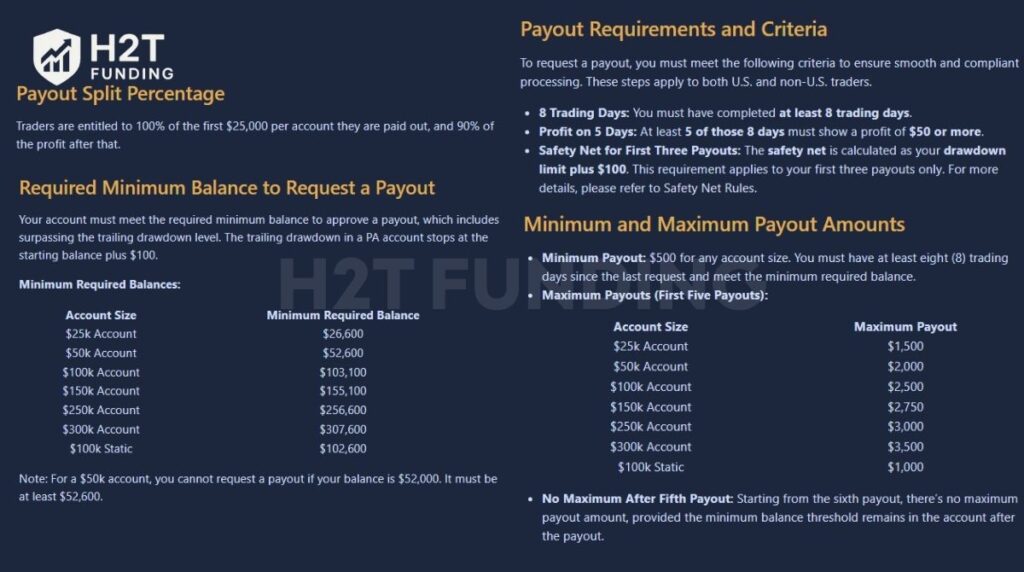

Apex payout structure is simple:

- Traders keep 100% of the first $25,000 per account

- After that, traders keep 90% of profits

Here are the core Apex Trader Funding new rules for payout you must follow. These Apex Trader Funding withdrawal rules apply to every PA account, regardless of account size.

3.1. Payout requirements (who qualifies to withdraw)

To request a payout, your Performance Account (PA) must meet these minimum conditions:

- At least 8 trading days

- At least 5 of those days must be profitable ($50+ profit per day)

- No rule violations

These trading days start counting after your last payout request, or from the beginning of the account if you have never requested a payout before.

3.2. Minimum required balance (most common reason payouts get denied)

Apex requires your account to stay above a specific balance level before payout approval. In PA accounts, the trailing drawdown eventually locks at:

Starting Balance + $100

That means you must exceed the minimum required balance to request a payout.

Minimum balance requirements:

| Account Size | Minimum Required Balance |

|---|---|

| $25k | $26,600 |

| $50k | $52,600 |

| $100k | $103,100 |

| $150k | $155,100 |

| $250k | $256,600 |

| $300k | $307,600 |

| $100k Static | $102,600 |

Example: A $50k account cannot request a payout at $52,000. It must reach $52,600 or higher.

3.3. Safety net rule (first three payouts)

For the first three payout cycles, Apex applies a Safety Net requirement. This ensures your account keeps a buffer and doesn’t get drained too early.

The safety net is calculated as: Drawdown Limit + $100

After traders prove consistent performance through early payouts, this safety net requirement is removed.

3.4. Minimum payout and payout limits

Apex payout rules also define how much you can withdraw per cycle.

Minimum payout: $500 for any account size

Below is the updated Apex Trader Funding payout list showing the maximum payout limits by account size. For the first five payouts, Apex applies maximum withdrawal limits:

| Account Size | Max Payout (First 5 payouts) |

|---|---|

| $25k | $1,500 |

| $50k | $2,000 |

| $100k | $2,500 |

| $150k | $2,750 |

| $250k | $3,000 |

| $300k | $3,500 |

| $100k Static | $1,000 |

Starting from the 6th payout, Apex removes the maximum payout cap, as long as your account still meets the required minimum balance after the withdrawal.

Once you submit a payout request, you can continue trading immediately. You do not need to pause trading while waiting for approval.

However, you must trade carefully. If your account balance drops below the minimum requirement after submitting the request, the payout will be denied.

3.5. Payout timeline

Most payouts follow this general timeline:

- Apex reviews requests within 2 business days

- If approved, funds are sent within 3–4 business days

- Banks/payment providers typically process deposits within 3–7 business days

Most traders receive payouts within 5–11 business days total. If your dashboard shows “PAID” but you haven’t received funds, Apex recommends waiting up to 7 additional business days before contacting support.

3.6. Payout methods (US vs international traders)

Apex uses different payout systems depending on your location.

- US traders receive payouts via ACH direct deposit

- International traders receive payouts through Plane, Apex’s global payment partner

International traders will receive an email invitation from Plane after the first payout approval to link their local bank account. A key requirement is that the bank account country must match the residency country listed in Apex.

Note: Each Apex PA account is treated as a separate account. This means you can request payouts on multiple accounts at the same time, and each account has its own payout limits and eligibility requirements.

4. Illustrative examples of rule violations

Understanding the rules is one thing; seeing how they play out on real charts is another. The following examples illustrate common Apex Trader Funding rule violations that often lead traders to lose their funded accounts. Each example shows what went wrong and how to stay compliant.

4.1. Violating the trailing drawdown rule, misunderstanding the safety net

In the chart below, the trader opened a 5-contract long on a $50,000 account and earned 26 points ($2,600). This pushed the balance to $52,600, the safety-net level, locking the trailing drawdown at $50,100. However, if the trader lets the trade run without realizing this, even a small reversal could trigger a trailing drawdown breach and close the account.

Many traders fail because they don’t realize the drawdown trails unrealized profits, not just closed ones. Always monitor your trailing threshold and know exactly when it stops moving.

Tip: Treat your trailing drawdown like a global stop-loss for your account. Once you hit the safety net, protect your profits and avoid holding trades unnecessarily.

4.2. Violating the 30% negative P&L rule, letting a trade go too far

Here, the account balance is $152,000, within the safety-net zone. Under Apex rules, the maximum open loss per trade can’t exceed 30% of your trailing drawdown, which equals $1,500 in this case. The trader’s short position went $1,500 against them without an exit, breaking the maximum adverse excursion (MAE) limit.

This mistake usually happens when traders ignore stop losses or fail to track open P&L. Even if the trade isn’t closed, Apex still flags the violation.

Tip: Use platform alerts to notify you when unrealized losses approach 25% of your daily profit. Acting early keeps you compliant and saves payouts from being denied.

4.3. Violating the 5:1 risk-to-reward ratio rule, setting stops too wide

In this example, the trader went long with a 4-point profit target but a 20-point stop loss, a 5:1 inverted ratio. Apex allows a maximum of 5:1 risk relative to reward, not the other way around. The setup exposes the trader to far greater losses than potential gains, which violates Apex Trader Funding risk management rules.

Even if the trade wins, Apex views it as poor trading discipline and may reset the account for repeated misuse.

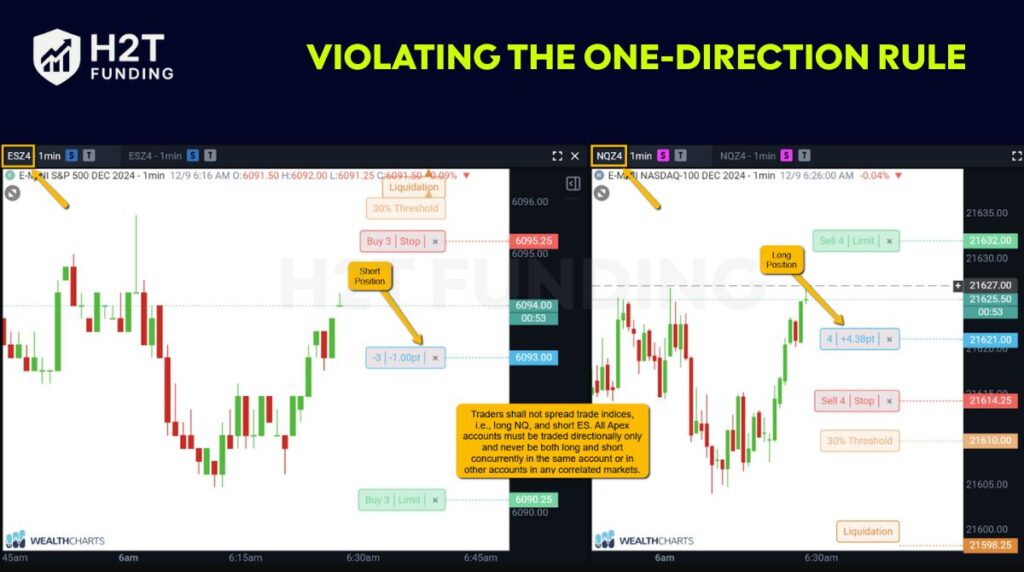

4.4. Violating the one-direction rule, opening opposite trades on correlated markets

The last chart shows a trader shorting ES (S&P 500) while going long NQ (NASDAQ) simultaneously. While these are different symbols, Apex considers this a hedging violation because both indices are highly correlated. The One-Direction Rule prohibits taking opposite positions on the same or correlated instruments.

This behavior distorts exposure data and undermines risk transparency. Apex flags such trades as rule manipulation, leading to profit removal or permanent account termination.

Each of these cases shows how quickly small mistakes can snowball into serious compliance issues. Apex’s rules, from drawdown limits to position sizing, aren’t meant to restrict you; they’re designed to protect your funded account and payout eligibility.

And if you ever get a violation, you should also know can you reset a funded Apex account and what the consequences are.

5. Checklist to stay compliant with Apex rules

A funded trading account rewards consistency, not speed. The simplest way to stay funded is to build a daily checklist, a short routine that keeps every rule front of mind before placing a single order. Here’s a quick-reference guide you can save, print, or keep beside your trading screen.

| Rule | Main Requirement | Quick Reminder |

|---|---|---|

| Trailing drawdown | Never let your account equity fall below the trailing threshold. | Check your Apex dashboard after every trade; once the safety net locks, treat it as a hard stop. |

| 30% consistency rule | No single day’s gain can exceed 30% of your payout-period profit. | Spread profit across multiple days; avoid one-day “windfall” trades. |

| 30% negative P&L rule | Don’t let any trade lose more than 30% of total profit for the payout cycle. | Use alerts to monitor unrealized loss; close early if a trade turns heavily against you. |

| 5:1 risk-to-reward rule | Your stop loss can’t be more than 5× your profit target. | If your target is $100, your stop must stay at or below $500. Adjust before entry. |

| Contract scaling | Trade only half your max size until balance clears the safety net. | Build a cushion first, then scale up responsibly. |

| Contract size consistency | Keep contract size steady relative to account growth. | Avoid random jumps from 2 to 10 contracts without reason. |

| News trading restriction | Don’t open/close positions within 2 minutes before or after major news. | Check the economic calendar each morning; pause trading around high-impact events. |

| One-direction rule | Never hold both long and short in the same or correlated markets. | Trade one directional bias at a time; ES and NQ count as correlated. |

| Automation & copy trading | Manual execution only, no bots or trade copiers. | Stay logged in personally; Apex funds traders, not algorithms. |

| Payout rules | Meet 7 active trading days and the consistency criteria before withdrawal. | Track progress in a log; request payout only when all boxes are ticked. |

| Reset policy | Double-check the account ID before resetting; resets are final. | Apex won’t restore or refund accidental resets. |

| Platform connections | Only one active Rithmic/NinjaTrader connection at a time. | Log out of other platforms before trading live. |

| Weekend holding | Don’t hold open trades from Friday to Sunday. | Close all positions before market close. |

| Daily discipline | Follow your pre-trade plan and stop after hitting limits. | Review risk and setup checklist before each session. |

Mastering Apex trading rules is about protecting your profits once you’re funded. Each rule, from the trailing drawdown to the 30% consistency limits, is designed to help traders manage risk like professionals. Understanding the Apex Trader Funding evaluation rules and applying them consistently ensures you stay compliant across both evaluation and live trading phases.

Pro tip: Keep this checklist handy and review it before every session. Whether you’re learning from Apex Trader Funding rules, Reddit discussions, or tracking the official Apex trader funding payout list, the goal is the same: steady profits, consistent payouts, and full control of your trading future.

6. Compare Apex rules with other prop firms

Every prop firm enforces its own trading framework, and understanding how they differ helps traders choose the best fit for their style. Apex Trader Funding focuses on flexibility and affordability, while others like FTMO, Topstep, and FTUK emphasize discipline, consistency, or transparency.

| Feature / Rule | Apex Trader Funding | FTMO | Topstep | FTUK Instant Funding |

|---|---|---|---|---|

| Drawdown Type | Trailing (locks at safety net: start + DD + $100) | Dynamic (moves with equity) | Trailing on EOD balance (not intraday) | Static or hybrid (varies by program) |

| Profit Target | 6% of balance (e.g., $3K on $50K) | 10% in Challenge, 5% in Verification | 6% of the starting balance | 6–10% depending on tier |

| Max Daily Loss | None fixed, trailing covers total risk | 5% of the starting balance | 2% per day (hard stop, trading halts for the day) | 2–3% depending on plan |

| Max Total Loss | Reaches trailing threshold (≈ 5% of account) | 10% overall | 4–6% trailing | 8–10% total |

| Consistency Rule | 30% rule: no day >30% of total profit | 50% rule during Combine (Topstep equivalent) | 50% profit concentration limit | “Consistency Score”: top day <20–40% of total profit |

| Minimum Trading Days | 7 for first payout (PA stage) | None required | 2 active days per Combine | None for instant accounts |

| Scaling Plan | Start with 50% contracts until the above safety net | No restriction | Position limits (e.g., 5–15 micro contracts) | Must follow the lot size consistency |

| News Trading | Not allowed ±2 min around high-impact news | Allowed (Swing), restricted (Normal) | Directional trades only; hedging prohibited | Allowed on newer programs (post-Feb 2025) |

| Overnight / Weekend Holding | Overnight allowed, no weekend trades | Swing accounts only | Prohibited (close by session end) | Allowed both (depends on the add-on) |

| Automation / EA Use | Not allowed, manual execution only | Allowed, if risk-managed manually | Not allowed | Partially allowed (some EAs banned) |

| Payout Rules | First $25,000 per account; then 90% profit split | 80–90% profit share | Biweekly payouts, variable split | Payout allowed after “Consistency Score” passed |

| Reset Policy | $85–$105 (no refund, resets all data) | Free retry after pass/fail window | Monthly reset is the same as the plan cost | Paid resets; only if DD is breached |

| Refund / Promotions | Refund on first payout; frequent 80–90% discounts | Refund after Challenge pass | None | No refund, but scaling bonuses |

| Unique Strength | Affordable, fast evaluation, flexible payouts | Global reputation, strong education | Excellent trader coaching | Instant funding with flexible risk settings |

When comparing prop firms, Apex stands out for offering traders genuine flexibility without lowering professional standards. Its trailing drawdown, 30% consistency rule, and structured payout policy make it one of the most practical programs for traders focused on risk control and steady growth.

While FTMO and Topstep emphasize strict discipline and slower scaling, Apex Trader Funding gives traders quicker access to payouts and a smoother path from evaluation to funded status. The firm’s clear Apex Trader Funding payout rules and transparent Apex trading rules help traders focus on performance instead of hidden restrictions.

7. User reviews and community ratings (Reddit & Trustpilot insights)

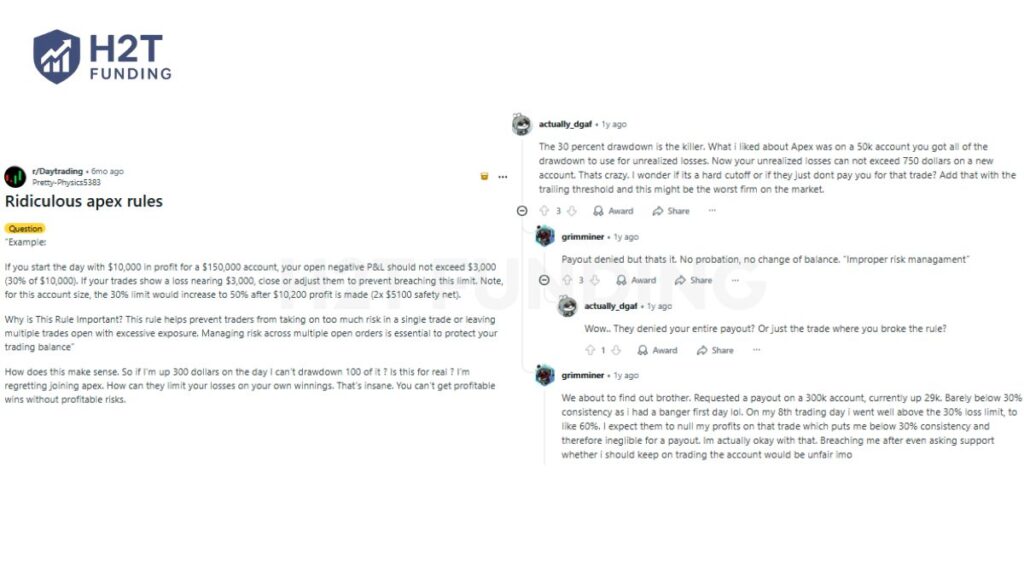

On Reddit, threads such as “Apex trader funding rules Reddit” and “Apex trader funding payout Reddit” reveal a wide range of trading experience. Many traders appreciate Apex’s transparency, quick funding process, and realistic evaluation model, but they also point out that strict consistency and drawdown rules can catch newcomers off guard.

For instance, one Redditor described losing payout eligibility after breaching the 30% consistency rule, even though their overall account remained profitable. Others noted that Apex’s new negative P&L cap, limiting open losses to 30% of starting profit, feels too restrictive during volatile sessions.

Still, most discussions agree that Apex’s rule structure promotes long-term discipline. Traders who take the time to understand the Apex Trader Funding evaluation rules report smoother payouts and fewer compliance issues.

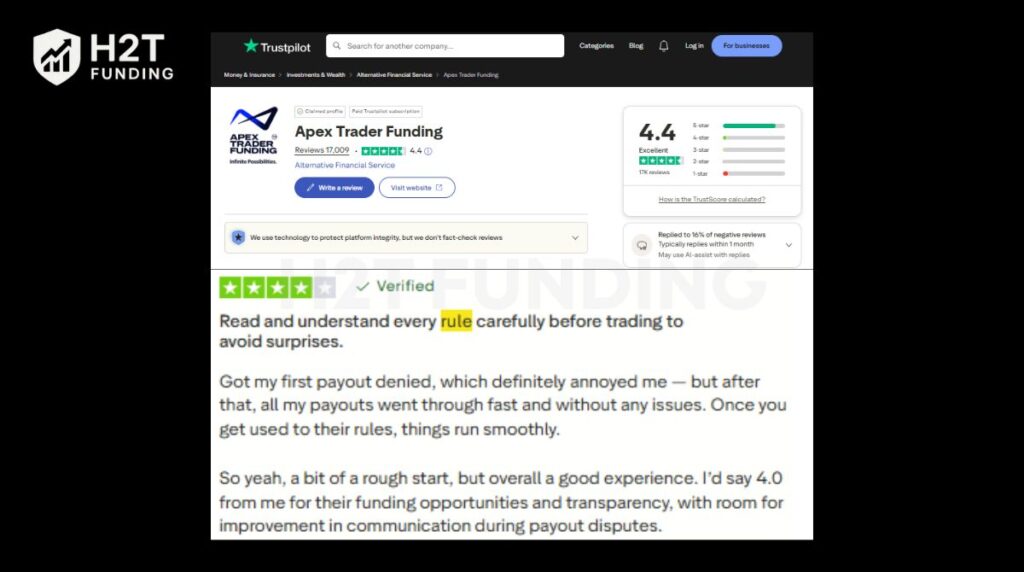

As of February 5, 2026, on Trustpilot, Apex holds an average rating of 4.4/5 from over 17,000 reviews, a strong score among prop trading firms. Most reviewers praise the firm’s fast support response and consistent payout reliability. Verified users frequently mention that after learning the rules, the payout process becomes quick and seamless.

Some traders, however, feel that Apex’s risk management system could be communicated more clearly during onboarding. The most common complaint involves payout denials tied to misunderstood drawdown or consistency calculations. Despite this, reviewers generally credit Apex for its fairness and transparency once traders adapt to the rules.

Between Reddit and Trustpilot, Apex earns a reputation as one of the more transparent firms in the prop trading space. While some traders voice frustration over rules like the 30% consistency limit, the majority agree these safeguards make traders more disciplined and protect long-term payouts.

8. Common mistakes traders make

Most traders don’t lose Apex accounts because they lack skill. They lose them because they underestimate how strict the Apex compliance rules are. Small mistakes that seem harmless in normal trading can instantly lead to payout denial, account reset, or termination.

Below are the most common Apex Trader Funding rule mistakes traders make, especially during the PA payout stage.

8.1. Violating the 30% consistency rule (windfall profit mistake)

One of the fastest ways to lose payout eligibility is letting one strong day dominate your total profit. Apex monitors profit distribution closely, and if a single day accounts for more than 30% of your payout-cycle profit, your payout request can be delayed or denied.

This usually happens when traders “go big” after a few slow days or try to force a payout with one oversized trade.

Best practice: Spread profits across multiple sessions instead of relying on one lucky day.

8.2. Ignoring trailing drawdown and thinking it only applies to closed trades

Many traders mistakenly believe that drawdown only matters after closing positions. In reality, Apex trailing drawdown reacts to your account’s peak performance and can be affected by unrealized profit.

A trade that looks safe can quickly turn into a violation if the market reverses and you give back too much profit.

Best practice: Treat trailing drawdown like a hard account-level stop loss and avoid holding trades too long once you’re near the safety net.

8.3. Triggering the 30% negative P&L rule (MAE) on a single trade

The 30% negative P&L rule is another common trap. Traders often assume they can “wait it out” if the trade isn’t closed yet, but Apex monitors open losses. If a single position goes too far against you, it can trigger a violation even if you later recover.

Best practice: Use bracket orders or alerts and cut losing trades early before unrealized drawdown becomes too large.

8.4. Requesting payouts too early or without meeting the trading day requirements

Many payout requests are denied simply because traders miscount eligible trading days or forget that payout requirements restart after each request.

Even if your account is profitable, Apex requires a minimum number of trading days and profitable sessions before a payout can be approved.

Best practice: Track your trading day count carefully and request payouts only when all conditions are clearly met.

8.5. Over-leveraging and inconsistent contract sizing

Another common mistake is changing contract size too aggressively. For example, trading 1–2 contracts for weeks and suddenly switching to 10 contracts just to hit payout numbers raises red flags.

Even if it’s technically within the max contract limit, Apex expects stable risk behavior and disciplined scaling.

Best practice: Scale gradually and keep position sizing consistent across sessions.

8.6. Trading during restricted news windows

Apex news trading restrictions are strict. Many traders lose accounts simply because they entered or exited within the restricted time window around major announcements like CPI, FOMC, or NFP.

News spikes can create slippage and unpredictable moves, which is why Apex treats violations seriously.

Best practice: Check the economic calendar daily and avoid trading near high-impact releases.

8.7. All-in trading to chase a payout

This is one of the most destructive habits. Some traders trade clean for days, then take one oversized position to force the account above the payout threshold.

Even if it works, it often violates consistency rules, MAE limits, or creates contract scaling issues. If it fails, the trailing drawdown gets hit instantly.

Best practice: Focus on steady daily growth, not payout chasing.

8.8. Trading the wrong or expired futures contract

This is a less common mistake, but it happens often enough to be dangerous. Some traders accidentally trade an expiring futures contract without rolling to the active one. And may lead to unexpected volatility, liquidity issues, or even account closure, depending on platform conditions.

Best practice: Always confirm you’re trading the correct front-month contract.

Apex rules reward traders who operate like professionals: consistent size, controlled risk, and steady growth. If you avoid these common mistakes, payouts become far easier, and your funded account becomes much more sustainable long term.

9. Apex Trader Funding FAQs

If you break an Apex rule, your payout can be denied, and in severe cases, your funded account may be closed. Minor infractions may lead to probation or temporary suspension, but repeated violations usually result in a full account reset. Apex enforces these rules to protect both trader discipline and firm capital.

The 5:1 rule limits your risk-to-reward ratio on any trade. You can’t risk more than five times what you’re targeting in profit. For example, if your take-profit is $100, your stop-loss cannot exceed $500. This rule helps prevent oversized losses and promotes better risk management, one of the core principles of Apex trading rules.

The 7-day rule means you must have at least seven active trading days in your Performance Account before requesting your first payout. Apex counts only days with executed trades, not idle sessions. This ensures your profits come from consistent trading activity, not one lucky trade.

The 30% consistency rule prevents traders from having one oversized profit day that dominates their results. No single day’s gain can exceed 30% of your total profit for that payout cycle. For example, if your total profit is $5,000, your largest single-day gain can’t be more than $1,500. This encourages smooth equity growth and sustainable performance.

In 2026, Apex introduced an updated payout structure: your first payout becomes available after 7 active trading days, capped at $2,000. Subsequent payouts are processed biweekly with a 90% profit split. Traders must remain compliant with consistency, scaling, and news trading rules to stay eligible.

Yes, but with strict timing restrictions. Apex prohibits opening or closing trades within two minutes before and after major economic announcements, such as NFP, CPI, or FOMC. Holding a position through the news is allowed only if it was opened well in advance and not managed during that restricted window.

You may hold trades overnight if your plan allows it, but not over the weekend. All open positions must be closed before the Friday market close. This rule protects traders from weekend gaps or volatility that could violate the trailing drawdown.

Apex doesn’t have a strict withdrawal limit, but your payout is subject to consistency and safety net conditions. For early payouts, only the first $2,000 can be withdrawn until your profit buffer grows. Later payouts can reach 90% of your total profit, depending on your trading performance and account stability.

Apex supports Rithmic, Tradovate, and NinjaTrader platforms, all connected to live market data. These platforms provide real-time execution and risk-tracking features, ensuring compliance with Apex’s risk control systems. Choose the one that fits your trading style best.

Once you pass the evaluation phase, your account transitions into a Performance (PA) Account, where you start earning real payouts. You’ll receive onboarding instructions via email, and after paying the activation fee, you can begin live trading under the Apex-funded account rules.

The best way to stay compliant is to track your trailing drawdown, follow the scaling plan, and avoid trading during restricted news times. Many traders use spreadsheets or dashboards to monitor equity levels daily.

The Apex Trader Funding 50K activation fee typically costs around $140 to $160 for the lifetime option or $85 per month for the recurring plan. The exact amount depends on whether you choose a Rithmic or Tradovate connection. Apex often runs promotions with heavy discounts, so the activation cost can drop significantly during sales.

No, getting a payout from Apex is straightforward as long as you follow the consistency and scaling rules. You need at least 7 active trading days and five days with a $50+ profit before requesting your first withdrawal. Once approved, payouts are processed quickly, usually within a few business days.

After passing your evaluation and paying the activation fee, your Performance (PA) Account is typically active within 24 to 48 hours. You’ll receive setup instructions by email, including login details for your selected trading platform. Delays only occur if additional verification or payment confirmation is needed.

Apex often runs up to 80% off promotions for new and reset evaluation accounts, especially during major sales events. These offers are announced on the official Apex website, through email newsletters, and shared widely in trading communities like Reddit. To make it easier for traders, H2T Funding regularly updates verified promo codes and discount links, including the Apex 80% off code, on our Offers page. You can check there anytime for the latest active discounts before purchasing your account or renewal.

10. Conclusion

Success with Apex Trader Funding rules comes from understanding structure and discipline. The system rewards traders who manage risk carefully, follow consistent limits, and respect evaluation requirements rather than chasing fast profits.

Apex offers a balance between flexibility and accountability, making it a solid choice for traders who value transparency and realistic payout conditions. Those who learn its rules often find the funded phase smoother and more sustainable.

For more insights like this, explore the Prop Firm & Trading Strategies section on H2T Funding. We will break down funding rules, payout systems, and practical trading tips to help you trade smarter and grow with confidence.