Passing the evaluation is just the first step. For many traders using Apex Trader Funding, the real challenge arises when a payout is denied, not because of a loss, but because of a single “too profitable” day.

Specifically, the Apex Trader Funding consistency rule mandates that your single best trading day’s profit must not exceed 30% of your total accumulated profit at the time of a payout request. This rule is designed to ensure steady performance rather than relying on high-risk gambling trades.

In this comprehensive guide, H2T Funding breaks down exactly how to calculate this 30% threshold with clear examples and provides actionable strategies to fix a violation. By the end of this article, you will know exactly how to balance your profits to secure your payouts and build a long-term career with Apex.

Let’s find out now!

Key takeaways:

- The Apex consistency rule limits the best trading day to a maximum of 30% of the total profit.

- The rule applies only to Performance Accounts and Live accounts, not to evaluation accounts.

- Violating this rule can result in denied payouts, delayed approval, or even account closure.

- Consistent profit distribution builds stronger risk management, supports disciplined trading, and helps traders maintain a stable long-term relationship with Apex Trader Funding.

1. What is Apex Trader Funding?

Apex Trader Funding is a proprietary trading firm that gives traders access to company capital once they pass a simulated evaluation. After proving they can manage risk and hit profit targets, traders move on to a Performance Account (PA), where real payouts begin.

Founded in 2021 by Darrell Martin, Apex has quickly grown into a thriving global community with tens of thousands of traders across more than 150 countries. The firm has built its reputation on transparency, fast payouts, and a supportive environment that helps traders stay disciplined and confident.

Apex Trader Funding’s program is structured into two main stages, making it straightforward and beginner-friendly compared to many competitors.

Stage 1: Evaluation Stage

- Complete a single trading challenge

- Reach the required profit target

- Follow the Daily Loss Limit and Trailing Drawdown rules

- Trade for a minimum of 7 trading days

Stage 2: Performance account stage

- Continue adhering to Apex’s risk management guidelines

- Gain access to a funded Performance Account

- Start receiving real payouts

- Follow the 30% Apex Trader Consistency Rule

From my own experience, this structure helps traders focus on steady performance rather than unpredictable results. Apex Trader Funding payout methods are clear and reward those who trade responsibly. Maintaining contract size consistency, avoiding excessive news trading or hedging, and following proper risk management habits make the trading journey more sustainable.

Apex Trader Funding has earned trust by emphasizing stable growth, fairness, and transparency. Those who stay disciplined and follow the rules usually hit their payout targets sooner and grow more confident with each consistent result.

2. What is the Apex Trader Funding 30% consistency rule?

Before traders can follow any payout guideline, they first need to understand what the consistency rule actually means. This section explains how Apex defines consistency, why it matters for funded traders, and how the 30 percent threshold shapes real trading behavior.

2.1. Apex 30% consistency rule explained: Definition and purpose

The Apex Trader Funding consistency rule sets out how profits should be distributed across trading days in both Performance and Live Accounts. Under this rule, no single trading day can account for more than 30% of the total accumulated profit since the last payout or since the account became active.

This rule does not apply to Evaluation Accounts. It starts working only after traders reach the funded stage. When a payout is made, the calculation resets and begins again from new profits.

The purpose of this rule is to keep fairness among traders, strengthen risk management, and measure real trading skill. It prevents traders from depending on one high-profit day and promotes steady growth built on planning and consistency.

For example, if a trader earns $6,000 in total profit, then no single day should produce more than $1,800. If a day exceeds that number, Apex may delay the payout until the results look balanced again.

2.2. Consequences of violating the consistency rule

Apex treats the 30% consistency rule as a payout eligibility requirement, not as a trading rule violation.

Failing this rule does not automatically result in account penalties or closure.

However, it directly affects a trader’s ability to withdraw profits.

If the consistency requirement is not met, the following outcomes may occur:

- Payout delayed or denied: The payout request will be declined until trading results meet the 30% profit distribution requirement.

- Additional trading required: Traders must continue trading to rebalance profit distribution so that no single day exceeds 30% of total profit.

- Increased review at payout request: Accounts may undergo closer review during subsequent payout submissions to confirm compliance.

Failing the consistency rule does not cancel trades, reverse profits, or reset the account. It simply means the account is not yet eligible for payout. Only in cases where consistency failures are combined with other rule violations, such as contract scaling abuse, hedging, or prohibited strategies, could more serious actions be taken.

Maintaining balanced daily profits and consistent position sizing is the most reliable way to ensure smooth payouts and a long-term relationship with Apex Trader Funding.

3. How to calculate the Apex Trader Funding consistency rule

Knowing the Apex consistency rule calculator helps traders stay compliant during payouts. This can show how evenly profits are spread across trading days and confirms performance stability.

The formula is simple:

Minimum Total Profit Required = Highest Profit Day ÷ 0.3

If your total profit is smaller than this result, you have not met the consistency standard.

Example 1:

- Best day profit: $1,500

- $1,500 ÷ 0.3 = $5,000 minimum total profit required

If your total profit is only $4,000, you fail the consistency rule.

Example 2:

- Best day profit: $1,200

- $1,200 ÷ 0.3 = $4,000 minimum total profit required

If your total profit is $4,500, you pass the rule and qualify for a payout.

This rule applies to Performance Accounts and Live accounts, but not to evaluation accounts. The calculation resets after every payout cycle. After six payouts or once you transition to a Live Prop Trading Account, the consistency requirement ends.

Apex provides a built-in consistency rule calculator in the dashboard that tracks your best day, total profit, and percentage in real time. You can also verify results manually using a spreadsheet or trading journal.

A quick look at performance each day often reveals small shifts before they grow into problems. When one trading day ends up carrying too much weight, it makes sense to trade lighter or take smaller gains over the next few sessions to even things out. With steady habits and a clear head, staying compliant turns into something natural rather than something to worry about.

Furthermore:

4. Apex Trader Funding PA account rules

After completing the evaluation phase, traders move into a Performance Account (PA), where real payouts begin. At this stage, complying with the Apex Trader Funding 30% consistency rule alone is not sufficient.

PA traders must also follow multiple additional trading and risk management rules that work together to determine payout eligibility. Overlooking any of these rules can lead to payout delays or denials, even if the consistency requirement is met.

To avoid violations and maintain smooth payouts, traders should understand and apply the PA account rules outlined below.

4.1. Apex Trader Funding daily loss limit

Each Performance Account has a daily loss limit, which caps how much equity can decline within a single trading day. Reaching or exceeding this limit triggers account closure. This safeguard prevents traders from taking oversized risks that could erase several profitable days in one mistake.

Apex’s dashboard displays this limit clearly so traders can monitor it throughout the session. Keeping losses well below this threshold helps maintain eligibility for payouts and demonstrates strong risk management.

4.2. Trailing Drawdown (Safety Net)

Unlike standard drawdowns that reset daily, the Trailing Drawdown in a PA account moves up as your highest unrealized account balance increases. It continues to trail your peak balance until it reaches a fixed lock point known as the Safety Net.

The drawdown stops moving once your account balance reaches: Initial Balance + Drawdown Limit + $100

Example: On a $50,000 account with a $2,500 drawdown:

- The Safety Net is set at $52,600 ($50,000 + $2,500 + $100).

- Once your account balance touches or exceeds $52,600, the trailing drawdown locks at $50,100 ($50,000 + $100).

From that point forward, the drawdown level will never move higher, providing a permanent safety cushion for the account.

4.3. Dollar Cost Averaging (DCA) policy

Apex offers flexibility with Dollar Cost Averaging (DCA), allowing you to add to a position even if the market moves against you. Unlike many firms, there are no strict caps on entry distance.

However, this freedom comes with strict responsibility to ensure the account remains safe.

- Permitted: You can add entries freely as long as you stay within the max contract limits.

- Constraint: The accumulated drawdown must never breach the 30% Negative P&L Rule.

- Outcome: The final profit from a DCA trade must not violate the 30% Profit Consistency Rule.

4.4. Contract scaling and position size

To prevent traders from over-leveraging early on, Apex enforces a Contract Scaling Rule. This rule limits the number of contracts you can trade until your account builds a sufficient profit cushion.

You are restricted to trading 50% of your maximum allowed contracts until your End-of-Day (EOD) balance exceeds the Safety Net (Trailing Threshold + $100).

Example (50K account):

- Max contracts: 10.

- Allowed contracts: You can only trade 5 contracts initially.

- Unlocking full size: Once your balance crosses $52,600, you can trade the full 10 contracts starting the next trading session.

Important penalty note: If you accidentally trade more than the allowed limit, you must close the excess contracts immediately. Failing to do so triggers a severe penalty:

- Payout request will be denied.

- The account resets to the previous day’s balance.

- Complete 8 additional compliant trading days before requesting a payout again.

Repeated or intentional violations will lead to account termination.

4.5. 30% Negative P&L Rule (Maximum Adverse Excursion)

While the consistency rule focuses on profits, the 30% Negative P&L Rule focuses on limiting losses per trade. This rule dictates that your live, unrealized open loss on any single trade cannot exceed 30% of your total profit balance at the start of the trading day. This prevents traders from holding onto losing positions, hoping for a reversal.

For new accounts that haven’t yet built significant profit (below the Safety Net), this 30% limit is calculated based on the trailing drawdown amount.

For example, on a $50,000 account, the base is $2,500, meaning your max open loss per trade is capped at $750. As your account grows and doubles the Safety Net, Apex allows more flexibility, potentially increasing this drawdown limit to 50%.

4.6. Mandatory risk management standards

Apex requires traders to treat the PA account with professional risk management standards, explicitly banning “gambling” behaviors. This is enforced through two primary requirements:

- Risk-reward ratio: You must adhere to a maximum risk-to-reward ratio of 5:1. This means your potential risk (stop loss) cannot be more than five times your potential profit target. For example, if you are targeting a profit of 10 ticks, your stop loss cannot exceed 50 ticks.

- Mandatory stop losses: Every trade must have a pre-defined risk level. Traders are required to use either hard stop losses in the platform or strictly adhered-to mental stops. Trading without a stop loss or using the account’s liquidation threshold as a “stop” is strictly prohibited and grounds for account closure.

4.7. News trading and directional bias

You are permitted to trade during high-impact news events to capitalize on volatility. However, you must commit to a single market direction to avoid unfair gaming of the system.

Strategies that lack a clear directional bias are considered hedging and are banned.

- One-direction: You must be either Long or Short; never hold both simultaneously.

- No hedging: You cannot hold opposing positions on correlated assets (e.g., Long ES and Short NQ).

4.8. Other prohibited activities & automation

To maintain the integrity of the PA account, certain strategies are banned:

- No fully automated bots: AI, High-Frequency Trading (HFT), or “set-and-forget” bots are strictly prohibited.

- Semi-automation: Tools that assist execution (like ATM strategies or trade copiers) are allowed only if the trader is physically present and monitoring the trade.

- Account sharing: Only the registered individual can trade the account. Using copy trading services to mirror someone else’s trades is a breach of contract.

These restrictions exist to ensure traders rely on skill, planning, and risk control rather than luck or automation. By staying compliant, traders build credibility, protect their payouts, and show that they can perform consistently under real market pressure.

5. Consistency rule illustration

The best way to understand the Apex Trader Funding consistency rule is through examples. Numbers alone can feel distant, but when you see how the rule works in practice, it starts to make sense.

In fact, Apex reviews how profits are spread across trading days before approving a payout. The goal is to reward steady performance rather than one lucky trading day. Many traders, myself included, have realized that this approach encourages patience and reduces emotional pressure.

The firm measures how much each trading day contributes to your total profit. If one day accounts for more than thirty percent of the total, the account fails the check. When this happens, Apex delays the payout until the results are more evenly balanced.

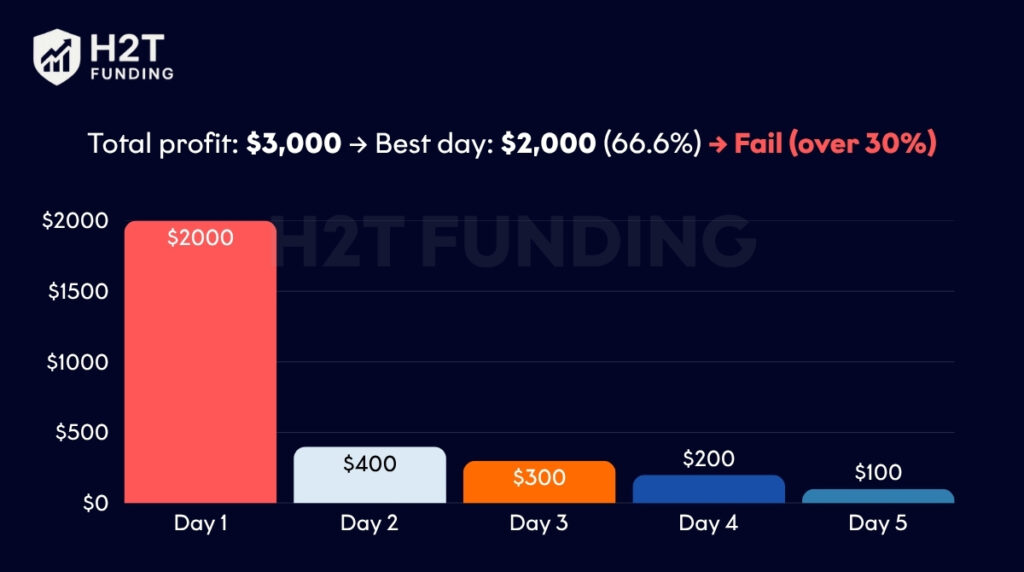

5.1. Example 1: Fail consistency

A trader completes five trading days with the following results:

- Day 1: $2000

- Day 2: $400

- Day 3: $300

- Day 4: $200

- Day 5: $100

The total profit is $3,000. The best day ($2,000) represents 66.6% of the total.

As a result, the account fails the consistency rule because one day carries too much of the overall profit.

5.2. Example 2: Pass consistency

Another trader records steady results over five days:

- Day 1: $700

- Day 2: $600

- Day 3: $400

- Day 4: $500

- Day 5: $300

The total profit is $2,500. The best day ($700) represents 28% of the total.

This trader passes the rule because no single day exceeds the thirty percent threshold.

For instance, when I first applied this rule to my own trading data, I noticed how often one good day distorted my equity curve. Learning to spread profits more evenly made my results look steadier and helped me stay calmer during losing days.

Apex automatically resets the consistency calculation after every approved payout. This gives traders a clean start for the next payout cycle. Over time, this process builds stronger habits. Traders learn to control position sizes, avoid oversized trades, and aim for sustainable growth instead of chasing large one-time wins.

Those who achieve consistent profit distribution not only meet the rule but also earn respect within the firm. It reflects solid risk management, emotional balance, and readiness for a long-term partnership with Apex Trader Funding.

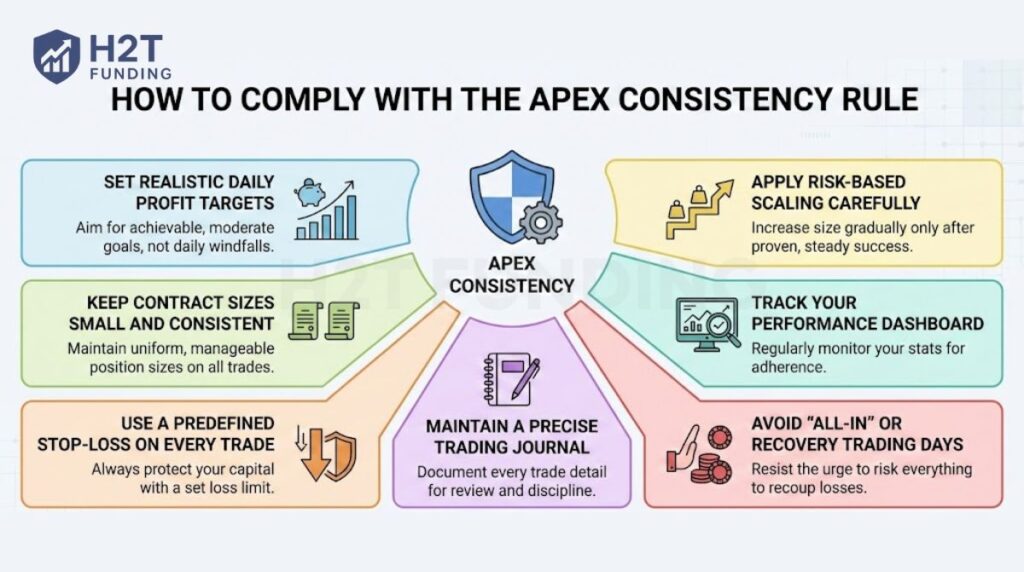

6. How to comply with the Apex consistency rule

Several traders of Apex Trader Funding are victims of the consistency rule, yet not by lacking trading ability, but by lacking planning. The consistency rule is simple to adhere to once one knows how to handle profits and position responsibly. Here are real steps to remain compliant and deny payouts.

6.1. Set realistic daily profit targets

Before each trading session, define a reasonable daily profit range rather than chasing large gains.

For example, if your overall target is $3,000, aiming for $400–$600 per day over five to seven sessions creates a natural profit distribution and keeps your best day below the 30% consistency threshold.

Traders can verify compliance at any time using the Apex 30% consistency rule calculator available in the official dashboard.

6.2. Keep contract sizes small and consistent

Large position sizes often create sudden profit spikes that violate the consistency rule. To avoid this, traders should:

- Follow Apex’s contract scaling limits

- Use similar contract sizes across sessions

- Avoid increasing size simply to accelerate profits

Stable position sizing smooths the equity curve and reduces emotional pressure.

6.3. Use a predefined stop-loss on every trade

Every trade must have a pre-determined stop-loss, which honors your 30% Negative P&L Rule and Maximum Adverse Excursion threshold. Making losses short compared to possible benefits maintains the Safety Net and helps prevent overspending your everyday reduction limitation.

6.4. Maintain a precise trading journal

Keep a record of your everyday profits, losses, and number of contracts. A clear record will allow you to see when one day’s profit begins to overwhelm. If a discrepancy is seen, decrease position sizing or accept smaller profits on the next day. Keeping a constant eye on things before the firm’s audit helps prevent it.

6.5. Avoid “all-in” or recovery trading days

Many consistency failures occur when traders attempt to recover losses quickly or push aggressively toward payout targets. Once a daily profit objective is reached, stopping for the session helps preserve gains and supports disciplined, professional trading behavior.

6.6. Track your performance dashboard

Apex offers real-time information on your highest day, total earned, and payout eligibility. Review this dashboard frequently.

If your percentage is over 30%, you are free to rebalance during future sessions prior to requesting a payout submission.

Several traders also post their payoffs and timelines of payoffs in Apex consistency rule Reddit posts, which benefits new traders by understanding how the consistency rule is analyzed for real examples.

6.7. Apply risk-based scaling carefully

If accelerating, apply controlled dollar cost averaging or position layering, remaining within the trading limitations of the firm. Refrain from increasing positions during eventful news occasions, as news trading and hedging give rise to a review of compliance.

By following these steps regularly, it also becomes clear that your winnings are a result of skill and planning, not dumb luck. It also enhances your reputation for proper trading, leading to increased payouts and smooth upgrading to a Live account.

7. Common mistakes when violating consistency rules

Even experienced traders sometimes fail the Apex Trader Funding consistency rule because they overlook simple but critical habits. Most issues can be avoided by improving planning, emotional control, and profit tracking.

7.1. Oversized trading days

Large trades are made by some traders to meet the payout target quickly. This results in a skewed profit curve and violates the consistency requirement of Apex. It catches spikes instantly, by its monitoring mechanism, resulting in denied payouts and even payout holds quite often.

7.2. Ignoring daily profit targets

Without a definitive day-by-day plan, profits swing wildly. A good day can overwhelm a few poor days, contravening your 30% rule. Smaller, steady wins evidence steady risk management, and keep your Performance Account away from gratuitous resets.

7.3. Chasing losses

Traders, after a series of losses, might double their position sizing to make a speedy recovery. Such an emotional approach tends to enhance risk and cross into a higher value of daily loss limitation or Trailing Drawdown. Apex regards it as a display of weak discipline and inconsistent trading psychology.

7.4. Overconfidence after one big win

A large winning day usually convinces traders to exit early from trading. If, however, such a win is more than 30% of the total profit, then the account breaks the rule. Smooth performance across several sessions is the only way of satisfying Apex Trader Funding payout requirements.

7.5. Lack of performance monitoring

Traders pay attention to balance, not to profit allocation. Neglecting a check of a review of the consistency of the Apex ruling calculator or personal record, small violations sum up unobserved. Control, meanwhile, guarantees observance before submission of a payout.

7.6. Breaking contract scaling or MAE limits

Breaching contract scaling or a 30% Negative P&L Rule may induce resets/payout denial even when profits appear stable. Both risk behavior and profitability are considered by Apex. Contract size consistency and having desirable greatest adverse excursion amounts are equally as critical as profit allocation.

7.7. Using restricted strategies

Some traders apply automated schemes, hedging, or news trading during periods of high volatility. They are prone to produce short-term spikes but frequently violate trading limitations and contort consistency outcomes. Semi-automated or by-hand systems based on human intuition are less risky for funded accounts.

Avoiding these blunders will keep your account regulatory and allow you to establish a stable, long-term connection to Apex Trader Funding. Repeatability is more about exhibiting controlled, reproducible trading behavior than about loss avoidance.

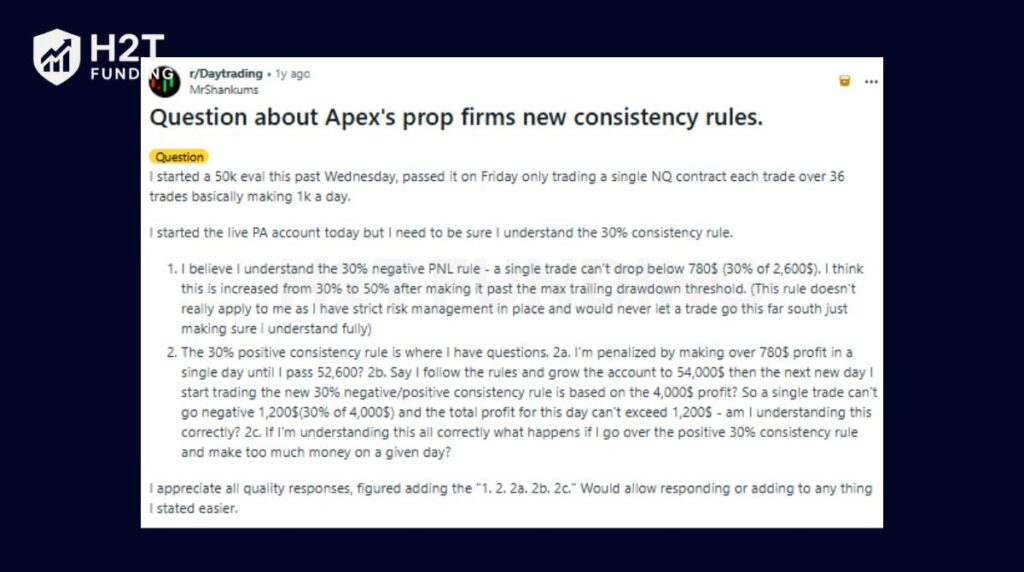

8. Real trader experiences on Reddit: How the Apex 30% consistency rule works in practice

Many traders only fully understand the Apex 30% consistency rule after applying it in a real Performance Account. While the rule is simple on paper, strong profit days early in a PA often raise confusion about payout eligibility.

In this example, the trader passed a $50K evaluation with disciplined risk management but became unsure after entering the PA. The key misunderstanding was thinking that making “too much” in one day triggers penalties. In reality, exceeding 30% does not violate any trading rule; it only delays payout eligibility.

Several experienced traders clarify that the consistency rule is based on total accumulated profit, not account balance or a daily profit cap. Apex does not cancel trades or reset accounts when the threshold is exceeded.

Community responses consistently highlight the same solution: continue trading normally. Each additional profitable day reduces the impact of the largest day and naturally brings the account back under the 30% limit. Stopping out of fear often unnecessarily delays payouts.

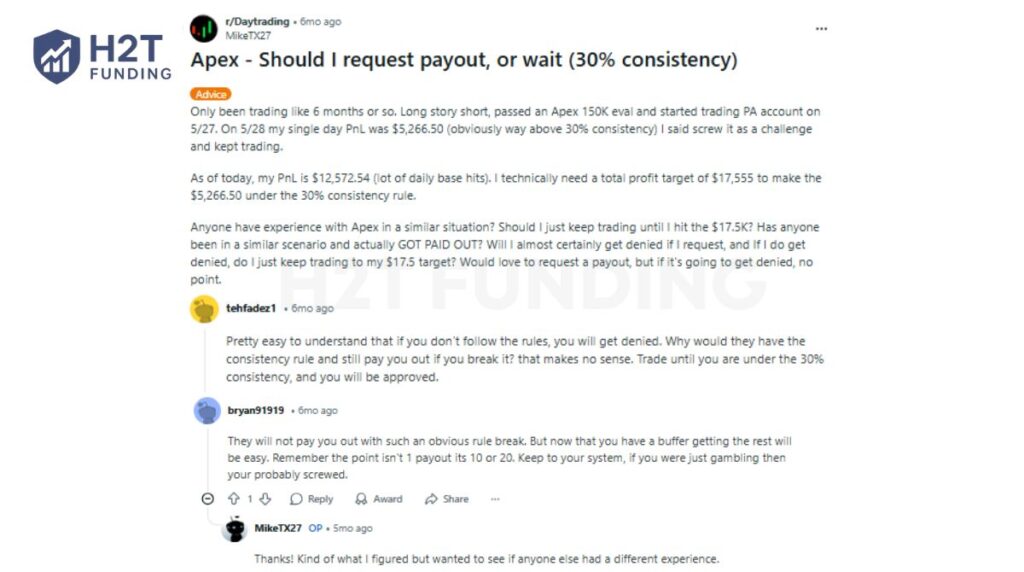

Another common real-world situation involves traders debating whether to request a payout immediately or wait until consistency improves.

In this case, traders unanimously agree that requesting a payout while clearly above the 30% threshold will result in denial. The correct approach is to keep trading, rebalance profits, and submit the payout only once the ratio is compliant.

Across all these cases, one pattern is clear: Apex enforces the 30% consistency rule exactly as written. It is not a punishment system, but a mechanical filter for payout eligibility.

9. Contrast Apex’s consistency rule with other prop firms

While many futures prop firms aim to encourage disciplined trading, each firm applies consistency rules differently depending on the account stage. Apex Trader Funding, MyFunded Futures (MFF), and Topstep all use consistency-based metrics, but the scope, strictness, and timing of enforcement vary significantly.

| Criteria | Apex Trader Funding | MyFunded Futures (MFF) | Topstep |

|---|---|---|---|

| Consistency percentage | 30% | 50% | 50% |

| Rule name | 30% Consistency Rule (Windfall Rule) | 50% Consistency Rule | Consistency Target |

| Applies during evaluation | ❌ No | ✅ Yes | ✅ Yes (Trading Combine) |

| Applies to funded / PA accounts | ✅ Yes (PA & Live, until 6th payout) | ❌ No (funded stage not affected) | ❌ No (Express & Live accounts excluded) |

| What is measured | Best trading day vs total profit | Best trading day vs total profit | Best trading day vs profit target |

| Enforcement method | Automatic payout eligibility check | Profit target increases if exceeded | Profit target increases if exceeded |

| Penalty for exceeding the limit | Payout delayed until rebalanced | Must trade additional days | Must trade additional days |

| Account breach for exceeding the rule | ❌ No | ❌ No | ❌ No |

| Reset behavior | Resets after each approved payout | No reset (evaluation only) | No reset (best day locked in) |

| Transparency | Fully visible in the dashboard | Clearly defined in rules | Dashboard shows the required additional profit |

| Trading style encouraged | Steady, repeatable PA performance | Disciplined eval performance | Gradual profit accumulation |

So, which prop firm is right for you?

- Apex Trader Funding is best suited for traders who prefer strict, clearly defined rules and are comfortable trading with discipline over multiple days. If you already have a repeatable strategy and want predictable payout criteria with minimal discretion, Apex’s 30% consistency rule provides clarity and long-term stability.

- MyFunded Futures (MFF) is a good fit for traders who want to pass evaluations quickly while still maintaining reasonable discipline. The 50% Consistency Target applies only during the evaluation phase, making it attractive for traders who can control their best day but prefer fewer restrictions once funded.

- Topstep is more suitable for traders who value flexibility and are comfortable with subjective payout reviews. Since Topstep does not enforce a fixed numerical consistency threshold, it may appeal to traders with variable strategies who prefer a less mechanical approach.

Choosing the right prop firm depends less on profit potential and more on how well your trading style aligns with each firm’s rules and evaluation philosophy.

10. FAQs

Yes. Apex Trader Funding enforces a 30% consistency rule for Performance Accounts and Live accounts. No single trading day can contribute more than 30% of the total profit earned since the last payout or since the account’s activation.

The Apex 30% consistency rule requires traders to keep daily profits balanced. If your best day’s profit is $1,500, the total accumulated profit must be at least $5,000 to qualify for payout. The rule confirms that traders generate steady gains, not one-time spikes.

The 20% consistency rule is not part of Apex’s official policy. Some traders use it as a personal guideline to maintain tighter discipline. It means that no single trading day should exceed 20% of total profits. This self-imposed rule adds a safety margin and helps prevent unexpected payout delays.

A 50% consistency rule would allow one day to represent half of the total profit, but Apex does not accept this. The firm’s system automatically flags any percentage above 30%. Using a 50% threshold will result in a failed consistency check and payout denial.

The rule is very strict. Apex’s software tracks profit distribution daily and calculates the percentage automatically. If your ratio exceeds 30%, the payout is paused until your performance becomes compliant. There are no exceptions or manual overrides.

No. Breaking the Apex consistency requirement results in a denied payout. You must continue trading until new profits rebalance the total so that no single day exceeds 30%. Consistent profit distribution is mandatory for every payout cycle.

No. The rule does not apply to evaluation accounts. It only becomes active once you pass the challenge and begin trading in a Performance Account or a Live account, where payouts are real.

You can check directly in the Apex consistency rule calculator inside your trading dashboard. It shows your best day, total profit, and current ratio in real time. You can also calculate it manually: Highest Profit Day ÷ Total Profit × 100 = Percentage. If the result is 30% or less, your account meets the rule.

If your results exceed the 30% threshold, Apex will delay your payout. You must continue trading until the percentage decreases naturally. Repeated violations may cause account closure or require a new evaluation.

The rule applies to Performance Accounts (sometimes referred to as review or funded accounts) and continues through all Live accounts until the sixth payout. After that, Apex no longer requires consistency checks.

No. The consistency rule is coded into Apex’s payout system and cannot be bypassed. The only solution is to plan your daily trades carefully, maintain contract size consistency, and follow proper risk management.

The official limit is 30%, based on Apex’s most recent clarification in 2026. The company may adjust it in the future, but all updates will appear on the official support site. Traders should always review the latest Apex Trader Funding payout rules before requesting a withdrawal.

11. Conclusion

The Apex Trader Funding consistency rule plays a central role in developing discipline and sustainable growth. It requires traders to maintain balanced profits so that no single day exceeds 30% of total gains. Following this rule ensures smooth payouts, stable performance, and lasting account protection.

Understanding and applying Apex’s core policies, such as the Trailing Drawdown, the daily loss limit, and contract scaling, helps traders build solid professional habits. When combined with effective risk management and a well-defined trading strategy, consistent profits become a natural outcome.

If you are planning to join Apex Trader Funding, focus on profit distribution from the first day. Keep daily results balanced, record every trade in your journal, and check the dashboard frequently to ensure compliance. Consistency is not only a rule; it is the foundation of long-term success in funded trading.

Continue learning more at Prop Firm & Trading Strategies on H2T Funding to strengthen your trading journey.