Choosing the right proprietary trading firm can define a trader’s career path. In the search for the best partner to monetize your trading skills on simulated accounts, the Alpha Capital vs FTMO debate is a common one.

FTMO is widely regarded as the industry’s gold standard, known for its rigorous evaluation and reliability. Meanwhile, Alpha Capital Group has quickly gained traction as a highly flexible and trader-focused alternative, creating a compelling choice for modern traders.

H2T Funding will dissect every critical aspect, from challenge rules to payout systems, so you can confidently determine which firm truly offers the better deal for your unique trading style and goals.

Key takeaways:

- FTMO exclusively uses a 2-step evaluation (Challenge and Verification). Alpha Capital offers more flexibility with 1-step, 2-step, and 3-step challenges, catering to different trading styles.

- Alpha Capital offers profit targets as low as 4% (on 3-step plans) or 6% (on 2-step plans), compared to FTMO’s 10%. However, note that these lower-target plans may enforce tighter drawdown limits than the standard 5% daily and 10% max loss model.

- Alpha Capital offers more flexibility with lower minimum trading day requirements (e.g., 3 days) compared to FTMO (4 days). Rules around news trading differ significantly. FTMO restricts trading 2 minutes before and after high-impact news on standard accounts.

- Alpha Capital’s restrictions vary by plan: while their standard Pro plan has a similar 2-minute window, their Alpha One and Alpha Three plans impose a stricter 5-minute freeze around news events.

- Both firms offer a competitive default 80% profit split, with FTMO offering a scaling plan that can increase the split to 90%. Payouts are biweekly at both firms once funded.

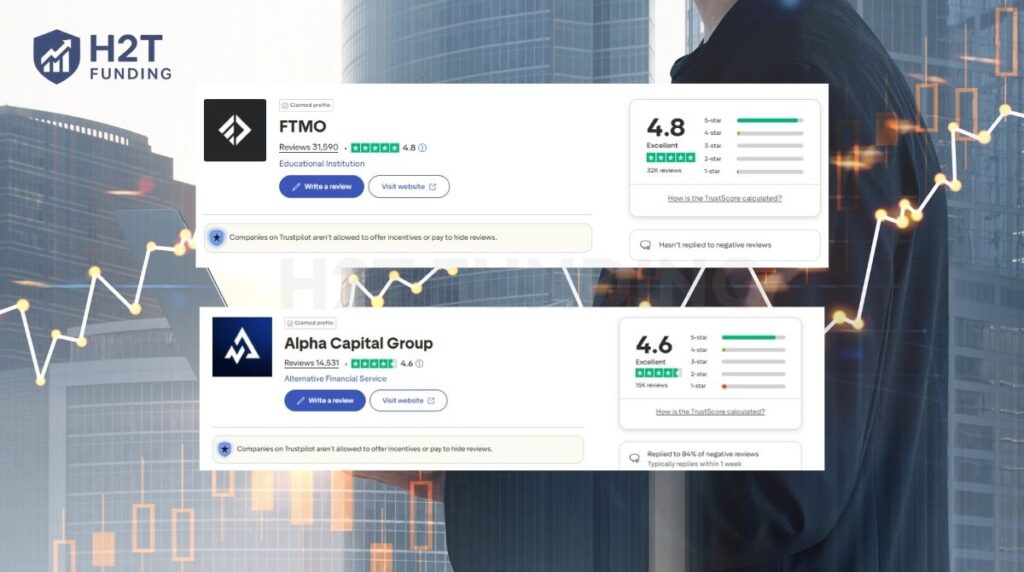

- FTMO has a longer, more established reputation as an industry pioneer with over 29,000 Trustpilot reviews. Alpha Capital is a newer but highly trusted firm with strong community backing and over 14,000 positive reviews.

- Alpha Capital distinguishes itself with a strong focus on educational content and trader support, while FTMO is renowned for its advanced performance analytics and proprietary coaching applications like the Mentor App.

- FTMO remains the go-to choice for MetaTrader 4 (MT4) loyalists, alongside MT5, cTrader, and DXtrade. Alpha Capital does not offer MT4 but provides MT5, cTrader, DXtrade, and the modern TradeLocker platform. However, it is important to note that Alpha Capital restricts US residents from using the MT5 platform.

1. Overview of FTMO and Alpha Capital Group

Before we get into the nitty-gritty of a direct Alpha Capital vs FTMO comparison, it’s important to understand the identity and philosophy behind each of these leading prop trading firms.

They come from different starting points and, honestly, cater to slightly different types of traders.

| Feature | FTMO | Alpha Capital Group |

|---|---|---|

| Rank (Trustpilot) | 4.8/5 (Excellent) | 4.6/5 (Excellent) |

| Country | Czech Republic (Prague) | United Kingdom (London) |

| Date created | 2015 | 2021 |

| Audition Fees | Starts from ~€89 ($10k account) – Refundable | Starts from $40 ($5k account) |

| Account Types | 2-Step (Normal & Swing) | 1-Step, 2-Step, 3-Step (Swing available) |

| Profit Split | 80% (Scalable to 90%) | Up to 80% |

| Account Size | $10,000 – $200,000 | $5,000 – $200,000 |

| Trading Platforms | MT4, MT5, cTrader, DXtrade | MT5, cTrader, DXtrade, TradeLocker (No MT4) |

| Markets Offered | Forex, Indices, Crypto, Commodities, Stocks | Forex, Indices, Commodities |

| Time Limit | Unlimited | Unlimited |

| Profit Target | 10% (Phase 1) / 5% (Phase 2) | Varies: 10% (1-Step), 6%–10% (2-Step), or 4% (3-Step) |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FTMO and Alpha Capital Group websites before purchasing any challenge.

With the high-level specifications laid out, you can see that both firms offer robust frameworks for traders, yet they differ in key areas like platform access and account flexibility. To truly understand which model aligns with your strategy, we need to look beyond the spreadsheet. Let’s start by examining the industry veteran that set the benchmark.

FTMO

#1

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

When you think of the prop trading industry, FTMO is often the first name that comes to mind. Founded in 2015, they are true pioneers and have built an industry-leading reputation on transparency and a consistent, structured approach.

To put it simply, their entire model is built around a signature 2-step evaluation process: the FTMO Challenge and the Verification stage. This path is designed to rigorously test a trader’s discipline and consistency.

There aren’t any shortcuts here. Because of this, FTMO is a fantastic fit for traders who have a proven strategy and thrive under clear, predictable rules. If you value a long track record and a name that carries weight in the industry, FTMO is a top contender.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Alpha Capital Group

#2

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader, DXTrade, TradeLocker

Profit Target

4% – 10%

Our take on Alpha Capital Group

Then you have Alpha Capital Group, the dynamic and fast-growing contender. Launched in 2021 from the UK, their rise has been incredibly impressive, largely because they offer something different. What really sets Alpha Capital apart? In a word: flexibility.

Instead of a single path, Alpha Capital gives you the freedom to choose between 1-step, 2-step, and 3-step evaluation routes. This is a game-changer, as it lets you pick a challenge that actually fits your personal trading style and confidence level.

They also place a huge emphasis on trader support and educational resources, showing a genuine investment in helping their traders succeed long-term. This makes Alpha Capital an excellent choice for traders who want more options and a supportive, growth-focused environment.

| 💳 Challenge Fee | $40 – $1,097 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT5, cTrader, DXTrade, TradeLocker |

| 🛍️ Asset Types | Forex, Metals, Commodities, Indices |

Read more:

2. Challenges & evaluation process: Alpha Capital vs FTMO

Alright, let’s get to the heart of the matter: the evaluation. This is where you prove you have what it takes to get funded. To be honest, this is where the core difference in philosophy between Alpha Capital Group and FTMO really shines through. One offers a single, proven path, while the other gives you a map with multiple routes to your destination.

2.1. FTMO challenge structure

FTMO has a very straightforward, “this is how we do it” approach. Their system is a two-phase journey:

- The FTMO Challenge (Phase 1): This is the first hurdle. To succeed, you need to know how to pass the FTMO Challenge by hitting a 10% profit target without violating the drawdown rules.

- The Verification (Phase 2): Once you pass the challenge, this is the final check. The profit target is lowered to a more manageable 5%, confirming your strategy is consistent.

The rules are designed to test your discipline and risk management. You have a 5% maximum daily loss and a 10% maximum overall loss. These are strict limits. You also have to trade for a minimum of 4 days in each phase to show your success wasn’t just a one-hit wonder.

It’s a tough but fair system that has become the industry benchmark for a reason, but it is important to understand the rules and how many FTMO accounts you can have to maximize your potential.

2.2. Alpha Capital Group challenges

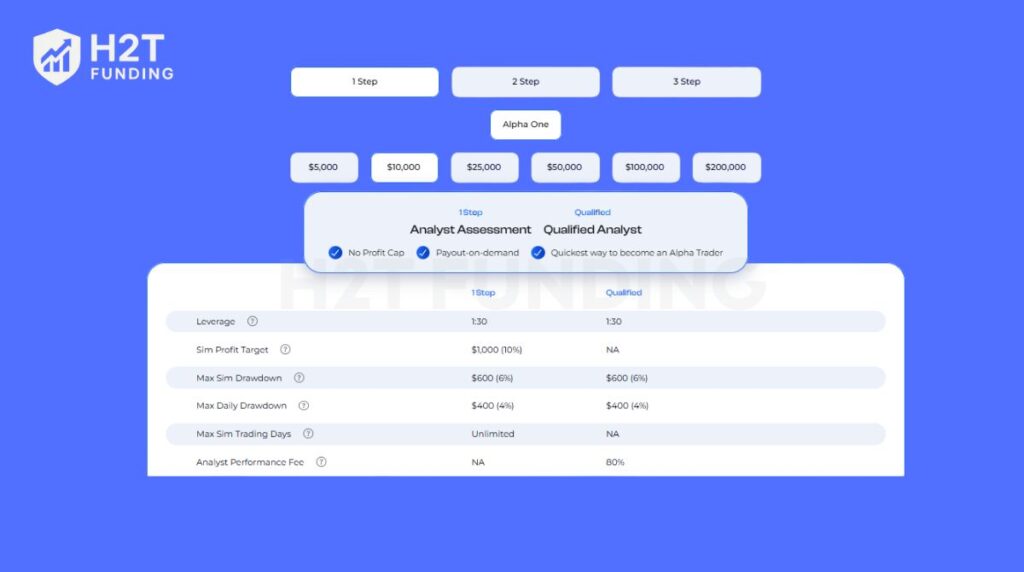

Now, this is where the FTMO vs Alpha Capital debate gets interesting. Alpha Capital breaks from the rigid mold and offers you choices, which is a huge plus in my book. You can select from:

- 1-Step Challenge: A single phase to get funded. Higher risk, faster reward.

- 2-Step Challenge: Similar in structure to FTMO, but often with more forgiving targets.

- 3-Step Challenge: Breaks the evaluation into even smaller, more manageable steps.

The key advantage here is the flexibility in profit targets. Their popular 2-step challenge offers targets starting from as low as 6%, while their 3-step evaluation requires just 4% profit per phase. That difference compared to the industry standard might not sound like much, but trust me, it can be a massive psychological relief when you’re managing a live challenge.

They also have a lower minimum trading day requirement, just 3 days. This flexibility allows you to choose a path that truly aligns with your personal trading goals and risk appetite.

Quick Challenge Comparison

To put it simply, here’s how their most popular 2-step challenges stack up side-by-side:

| Feature | FTMO (Standard Challenge) | Alpha Capital Group (Alpha Pro) |

|---|---|---|

| Evaluation Steps | 2 (Challenge + Verification) | 2 (Phase 1 + Phase 2) |

| Profit Target (P1) | 10% | 8% |

| Profit Target (P2) | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Maximum Daily Loss | 5% | 5% |

| Minimum Trading Days | 4 Days | 3 Days (Unlimited for 1-Step Alpha One) |

Refund Policy Note: FTMO guarantees a refund of the evaluation fee with the first profit split. For Alpha Capital, the refund policy may vary by specific program; traders are advised to verify the ‘Refundable Fee’ terms explicitly at the checkout screen before confirming.

Ultimately, the choice comes down to what you value more: FTMO’s proven, standardized test of skill or Alpha Capital’s more adaptable and arguably more attainable evaluation pathways.

3. Evaluation difficulty: Which is easier to pass?

If we look strictly at the numbers, Alpha Capital Group is mathematically easier to pass than FTMO.

Let’s be real for a second, trading is hard enough without high hurdles. While FTMO sets the industry standard, Alpha Capital has lowered the bar just enough to make the goal feel more reachable.

The biggest difference lies in the Profit Target. While FTMO demands 10%, Alpha Capital offers 2-step plans starting from 6%, and even a highly attainable 4% target on their 3-step challenge. That gap is significant, and I can tell you from experience, it provides a massive psychological relief when you are in the trenches of a live challenge.

To visualize the difference, I’ve broken down the key “difficulty metrics” below so you can see exactly what you are up against.

Difficulty Breakdown: FTMO vs. Alpha Capital (Standard 2-Step)

| Challenge Metric | FTMO (Standard) | Alpha Capital (Alpha Pro) | Winner |

|---|---|---|---|

| Profit Target (Phase 1) | 10% | 8% | Alpha Capital |

| Profit Target (Phase 2) | 5% | 5% | Tie |

| Max Drawdown (Buffer) | 10% | 10% | Tie |

| Min Trading Days | 4 Days | 3 Days | Alpha Capital |

| Challenge Routes | Only 2-Step | 1, 2, or 3-Step | Alpha Capital |

Honestly, it comes down to the risk-to-reward ratio required to pass. With FTMO, you are essentially asked to make a 10% profit while risking a 10% drawdown, which is a 1:1 ratio. It requires serious precision. With Alpha Capital’s Pro challenge, you only need to make 8% while still having that same 10% drawdown buffer. Simply put, you don’t have to push your winning trades quite as hard to cross the finish line.

Plus, we have to talk about flexibility. FTMO is rigid; you have to take the 2-step route. Alpha Capital, on the other hand, gives you options. If you are confident and hate the idea of a verification phase, you can just grab their “Alpha One” 1-step challenge. Sure, the target is 10% there, but you only have to do it once, not twice.

If your main goal is simply getting your hands on a funded account with the least amount of friction, Alpha Capital Group is the clear winner here. The lower targets and flexible step options give you a statistical edge. However, if you want to prove you can beat the “final boss” of prop firms and value prestige over ease, passing FTMO remains the ultimate badge of honor.

4. Trading rules & restrictions of Alpha Capital and FTMO

Okay, so you’ve passed the challenge. Congratulations! But now you have to play by the house rules to keep your funded account. This is where the fine print matters, because a simple mistake can cost you everything. Let’s be real, the trading rules can make or break your experience as a trader.

At a high level, both firms build their risk management on two core pillars that you absolutely must respect:

- Daily Loss Limit: Typically, 5% of your initial account balance. It’s a hard stop designed to prevent one terrible day from ending your career with them.

- Max Loss Limit: The total allowable drawdown, usually 10% of the initial balance. Your account equity can never dip below this line.

This is where the similarities end, and the philosophies diverge, especially in how they handle news and weekend trading.

Comparing Account Restrictions

Navigating the specific restrictions of each account type is critical to avoiding a breach. The table below breaks down how each firm handles news trading, weekend holding, and leverage across their specific programs.

| Feature | FTMO Normal | FTMO Swing | Alpha Capital (Pro) | Alpha Capital (Swing/One) |

|---|---|---|---|---|

| Weekend Holding | Not Allowed | Allowed | Not Allowed | Allowed |

| News Trading | Restricted (2-min window) | Allowed | Restricted (2-min window) | Allowed |

| Leverage | 1:100 | 1:30 | 1:100 | 1:50 (3-Step) / 1:30 (Swing) |

| Best For | Intraday Traders | Swing Traders | Intraday Traders | Swing/News Traders |

As you can see, the trade-off is consistent: if you need the freedom to hold trades over the weekend or trade through high-impact news, you must generally accept lower leverage (1:30). Conversely, if you want high leverage (1:100), you must adhere to stricter timing rules, even with Alpha Capital’s popular “Pro” account.

Hidden Pitfalls: Group Trading & Capital Allocation

While Alpha Capital offers flexibility, it has strict policies against ‘Group Trading’ and copying signals from third parties, which can lead to immediate account termination.

It is crucial to note that their risk monitoring systems are highly sensitive to overlapping behavioral patterns. Traders are strongly advised to avoid logging into multiple accounts from the same device or sharing IP addresses with other traders to prevent being flagged by the system.

Additionally, keep in mind their ‘Max Allocation per Strategy’ rule: you cannot trade the same asset and direction across multiple accounts if the total volume exceeds the $300,000 limit, even if your total account balance is higher.

5. Account types & scaling plans: Alpha Capital vs FTMO

Choosing the right account structure is crucial for your long-term roadmap. The comparison below highlights the differences between FTMO’s structured approach and Alpha Capital Group’s flexible evaluation paths, along with their respective scaling potential.

| Feature | FTMO | Alpha Capital Group |

|---|---|---|

| Core Account Types | Normal (Intraday) & Swing (Freedom) | Based on Evaluation (1-Step, 2-Step, 3-Step) |

| Leverage & Restrictions | Normal: 1:100 Lev (No weekend/news holding) Swing: 1:30 Lev (No restrictions) | Varies based on the specific challenge selected (1, 2, or 3-step rules). |

| Initial Account Sizes | $10,000 – $200,000 | $5,000 – $200,000 |

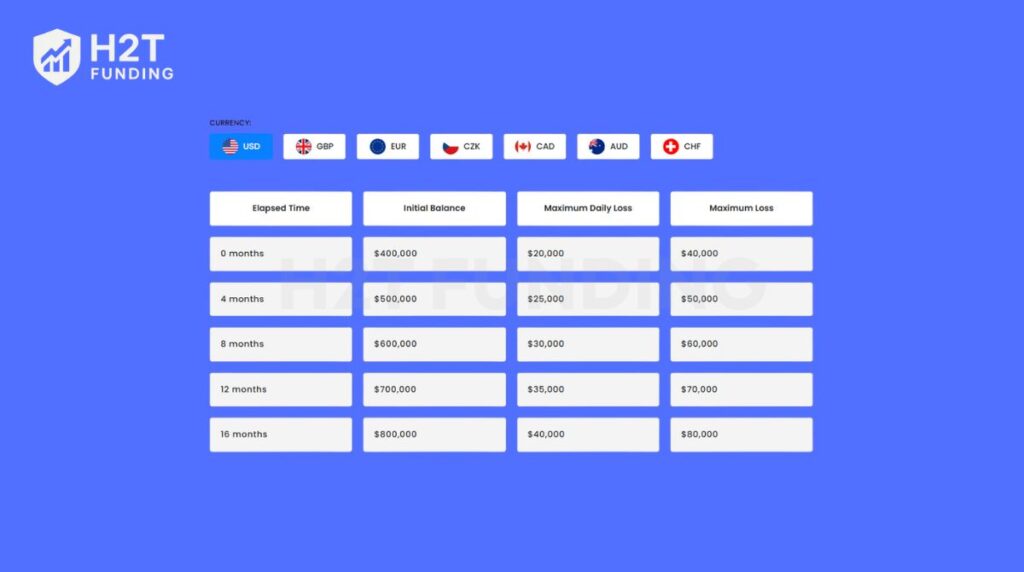

| Scaling Growth Mechanism | 25% increase every 4 months. | Performance-based capital increases. |

| Scaling Ceiling (Max Capital) | Up to $2,000,000 | Up to $2,000,000 |

| Scaling Condition | Consistent profitability. | Consistent profitability. |

In summary, while both firms offer a clear path to managing up to $2 million in capital, they cater to different needs. FTMO provides a predictable, standardized growth plan, whereas Alpha Capital offers lower entry points (starting at $5k) and greater flexibility in how you begin your journey.

Beyond the rules, the actual trading environment determines your daily experience. The table below outlines the available markets, execution quality, and permitted trading styles at both firms to help you decide which environment suits your strategy.

| Feature | FTMO | Alpha Capital Group |

|---|---|---|

| Execution Quality | Top-tier liquidity providers; no “shady offshore” issues. | Top-tier liquidity providers; professional-grade execution. |

| Allowed Trading Styles | All allowed (Scalping, Swing, EAs/Algos). | All allowed (Scalping, Swing, EAs/Algos). |

| Forex & Indices | Available (Major, Minor, Exotic). | Available (Major, Minor, Exotic). |

| Commodities & Crypto | Available (Gold, Oil, BTC, ETH, etc.). | Available (Gold, Oil, BTC, ETH, etc.). |

| Stocks | Available (Stock CFDs). | Not explicitly mentioned in this section. |

| Overall Environment | Professional-grade. | Professional-grade. |

Ultimately, both firms provide a professional-grade execution environment that accommodates all trading styles, including scalping and algorithmic trading. The main differentiator here is FTMO’s inclusion of Stock CFDs, making it the superior choice for traders who specifically require exposure to the equity markets.

6. Trading technology & platforms of Alpha Capital and FTMO

In today’s market, the technology and trading software a firm offers are a massive part of the deal. You need a platform that is stable, fast, and feels intuitive to you. A clunky interface or constant freezes can kill your edge. So, what tech stack are you working with when you join FTMO or Alpha Capital?

| Feature | FTMO | Alpha Capital Group |

|---|---|---|

| Trading Platforms | MT4, MT5, cTrader, DXtrade | MT5, cTrader, DXtrade, TradeLocker |

| Proprietary Tools | Account MetriX, Mentor App | Alpha Learning Hub |

| Key Strength | Advanced performance analytics & behavioral tracking. | Educational content & daily market breakdowns. |

| Primary Focus | Analyzing past performance to identify statistical edges and weaknesses. | Preparing traders for future market action through education. |

| Platform Variety | Includes the industry classic MT4. | Includes the modern, customizable TradeLocker. |

Ultimately, both firms provide top-tier technology. Your choice might simply come down to whether you’re an MT4 loyalist (FTMO is your only option here) or if you’re keen to try a newer platform like TradeLocker (exclusive to Alpha Capital).

7. Payouts & profit split

Let’s get to the best part: getting paid. After all the hard work of passing a challenge and trading profitably, you want to know that the withdrawals are reliable and the profit splits are fair. This is a non-negotiable, and it’s an area where both FTMO and Alpha Capital have built solid reputations.

The standard profit share at both firms is a generous 80/20 split. Simply put, you keep 80% of the profits you generate, and the firm keeps 20%. This has become the industry standard for a reason; it’s a deal that heavily favors the successful trader.

So, when do you see the money? Both firms operate on a biweekly payout schedule. At FTMO, your first payout is available 14 days after you place your first trade on the funded account. After that, you can request payouts every two weeks. They’ve also introduced an on-demand payout option for even faster access to your earnings.

Alpha Capital Group follows a very similar model. Your first payout is also eligible after 14 days of trading, with biweekly withdrawals available thereafter. The reliability of payouts is a huge trust signal for any prop firm, and I think it’s safe to say both of these firms have proven they pay their traders on time.

When it comes to getting your money, both firms offer modern and convenient methods. You can typically choose from:

- Bank/Wire Transfer: The traditional, reliable method.

- Cryptocurrency Transactions: To enhance global accessibility, both firms facilitate payouts via digital assets. FTMO provides direct cryptocurrency payout options, whereas Alpha Capital Group processes cryptocurrency transactions through authorized third-party providers like Deel.

The one key advantage FTMO offers is its scaling plan’s bonus. As you grow your account, your profit share can increase to an incredible 90%. That extra 10% on a large account is a massive incentive and a clear reward for long-term consistency. But for most traders starting out, the 80% offered by both firms is an excellent and highly motivating deal.

8. Reputation & community trust about Alpha Capital and FTMO

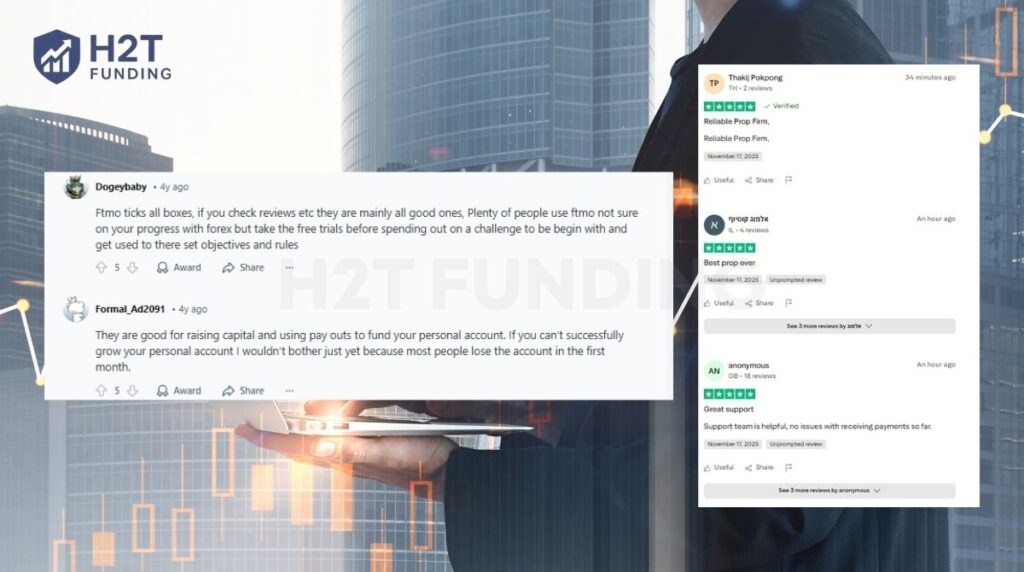

Let’s be blunt for a moment. In the world of online finance, reputation is everything. You’re entrusting a firm with not just your evaluation fee, but also your career aspirations. So, what does the trading community really think about FTMO and Alpha Capital? This is where we look beyond the glossy marketing brochures and dive deep into Community Reviews Reddit, Trustpilot, and Discord to uncover the real-world trust from actual traders.

8.1. FTMO reputation

When it comes to reputation, FTMO is the undisputed king. They have been around since 2015, which is practically ancient in the fast-moving prop firm industry. This long track record means they have weathered market storms and have consistently delivered on their promises.

You don’t have to take my word for it. When looking at the numbers in the Alpha Capital vs FTMO Truspilot battle, FTMO holds the high ground with an incredible 4.8/5 rating from over 29,000 verified reviews. That is a staggering amount of positive feedback.

It speaks volumes about their reliability, transparent rules, and dependable payouts. To put it simply, traders trust FTMO because they have earned that trust over many years of solid operation.

8.2. Alpha Capital reputation

So, can a newer firm like Alpha Capital Group even compete? Absolutely. If you scroll through any Alpha Capital vs FTMO Reddit thread, you will see that their growth since 2021 has been nothing short of explosive. While they don’t have the same long history as FTMO, they have built a fiercely loyal community in a very short time.

Their community trust is also reflected in their outstanding Trustpilot score. Alpha Capital holds a strong 4.6/5 rating from over 14,000 reviews. This shows that their focus on flexibility, trader support, and education is really resonating with people. They might be the newer kids on the block, but they have quickly established themselves as a legitimate and highly respected player.

Honestly, you can’t go wrong with either firm in this department. Both have overwhelmingly positive feedback from thousands of real traders. FTMO offers the peace of mind that comes with a long-established industry leader, while Alpha Capital provides the excitement and confidence of a rapidly growing and well-loved challenger.

9. Brokerage partners & trade execution: Alpha Capital vs FTMO

This might seem like a technical detail, but it’s incredibly important. The quality of a prop firm’s broker partners directly affects your trade execution. We’re talking about things like spreads, commissions, and that dreaded slippage. After all, what good is a funded account if your orders are filled at bad prices?

9.1. FTMO execution

FTMO takes trade execution very seriously. They work with a pool of top-tier liquidity providers to create an institutional-grade trading environment. What does this mean for you? It means you get tight spreads and reliable, fast execution.

I think it’s fair to say they’ve built a reputation for providing a stable and fair trading environment. They know that their success depends on their traders’ success, so they have a vested interest in giving you the best possible conditions to work with. You’re not trading against some shady B-book broker here; you’re getting access to real market conditions.

9.2. Alpha Capital execution

Similarly, Alpha Capital Group understands that reliable execution is a cornerstone of a good prop firm. They also partner with reputable liquidity providers to ensure their traders get excellent trading conditions.

Alpha Capital promotes an institutional-grade execution environment with low latency and competitive spreads. However, since trades are executed in a simulated environment, some community feedback notes that slippage can still occur during periods of high market volatility. Traders should factor this into their risk management when employing scalping strategies.

In all honesty, when it comes to trade execution, you’re in good hands with both firms. Neither FTMO nor Alpha Capital cuts corners in this area. They both provide the professional-level infrastructure you need to execute your strategy effectively, which is exactly what you should expect from top-tier prop trading firms.

10. Customer support & learning resources of Alpha Capital and FTMO

Let’s face it, things can go wrong. You might have a question about a rule, an issue with your platform, or a query about a payout. In those moments, fast and effective assistance isn’t just a nice-to-have; it’s essential. A prop firm’s investment in support materials also shows you how much they actually care about your success beyond just the evaluation phase.

FTMO has a reputation for professional and responsive customer support. You can reach them through the usual channels, live chat, email, and phone, and they are known for their quick and helpful replies. Beyond just troubleshooting, their key resources for traders are their powerful performance coaching tools and analytics. The feedback they provide is designed to turn you into a better, more disciplined trader, which is a huge value-add.

On the other hand, Alpha Capital Group really shines in the area of education-focused trader resources. Their support team is also highly rated for being responsive and helpful. But where they go the extra mile, I believe, is with resources like their daily market breakdowns and webinars. They put a significant emphasis on continuous learning and community engagement. This creates a really supportive environment, especially for traders who are still developing their strategies and market understanding.

So, what’s the bottom line? Both firms offer excellent customer support. Your preference might depend on what you value more. Do you want the data-driven, analytical feedback that FTMO provides to refine your existing edge? Or do you prefer the more educational, community-focused support system that Alpha Capital has built to help you grow as a trader? Either way, you’ll be well looked after.

11. Alpha Capital vs FTMO review: Which prop firm is better?

Alright, we’ve broken down all the critical details. So, who wins the Alpha Capital and FTMO showdown? The honest answer is: it completely depends on you. There’s no single “best” firm, only the firm that’s best for your specific needs, personality, and trading style.

Let’s make this really simple.

Choose FTMO if you:

- Value reputation above all else. You want to partner with the original, most established name in the industry for maximum peace of mind.

- I am a conservative and disciplined trader. You have a proven strategy and are confident you can meet their clear, albeit strict, trading objectives.

- Love data-driven feedback. You want access to their advanced analytical tools to dissect and improve your performance.

- Prefer a single, structured path. The classic 2-step evaluation is the only road you want to take to get one of their funded trading accounts.

Choose Alpha Capital Group if you:

- Crave flexibility and options. You want the freedom to choose a 1-step, 2-step, or 3-step evaluation that best suits your risk tolerance.

- Want slightly more attainable targets. That lower 8% profit target in their 2-step challenge can make a huge psychological difference.

- Thrive in a learning-focused environment. You value the educational resources, market commentary, and strong community support they provide.

- Need specific rule sets. You want to find an account type that perfectly matches your need to, for example, hold trades over the weekend without sacrificing too much leverage.

Ultimately, the best advice I can give is to be honest with yourself about your strengths and weaknesses as a trader. FTMO is the proven, prestigious choice for the confident and consistent trader. Alpha Capital Group is the modern, adaptable choice for the trader who values flexibility and a supportive growth environment.

12. FAQs

Honestly, “better” is subjective and depends entirely on your trading goals. FTMO is the industry benchmark for its reliability and structured process. However, firms like Alpha Capital Group are considered powerful alternatives, especially for traders who want more flexibility in their evaluation, lower profit targets, and a stronger focus on educational support.

Yes. Alpha Capital Group pays out performance fees based on the virtual profit generated on your simulated account. They have a reputation for timely payouts, though traders must strictly adhere to compliance rules regarding group trading and IP matching to avoid payout denials.

The regulatory landscape for prop firms can change. While FTMO has historically served traders in the USA, it’s always best to check their official website for the most current information regarding their services in specific countries, as policies can be updated to comply with local regulations.

That’s a great question, and it points to a common misunderstanding. The actual rule at FTMO is the 5% Maximum Daily Loss. This means your account equity cannot drop by more than 5% of your starting balance from the previous day in a single 24-hour period. There isn’t a “3% rule.”

Many beginners find Alpha Capital’s environment more forgiving. This is because they offer challenges with significantly lower profit targets (starting from 4% or 6% vs. FTMO’s 10%) and place a huge emphasis on educational resources like webinars and market analysis, which can be invaluable for traders who are still developing their skills.

On paper, the challenges at Alpha Capital Group are often considered more attainable. Their challenges require a profit target starting from just 6% to 8% in the first phase, compared to FTMO’s standard 10%. While no challenge is truly “easy,” the significantly lower target can reduce psychological pressure and make the goal more achievable.

Both firms offer outstanding scaling potential, with the possibility of growing your account up to $2 million. Their plans are very competitive. However, FTMO has a slight edge for highly consistent traders, as its scaling plan can also increase your profit split to an industry-leading 90%.

Yes, both firms generally permit the use of Expert Advisors (EAs) and other algorithmic strategies. However, they have strict rules against certain types of EAs, such as high-frequency trading, arbitrage, or those that exploit platform inefficiencies. It’s crucial to read their specific rules before using any automated system.

Both firms start with a highly competitive 80% profit split. However, FTMO is the winner for long-term traders, as their scaling plan allows you to eventually increase your share to 90%, rewarding consistent profitability in a way that Alpha Capital currently does not.

Yes, Alpha Capital Group is a 100% legitimate and highly respected prop trading firm. They are backed by thousands of positive reviews on Trustpilot and have a proven track record of paying out their profitable traders consistently.

Yes, they do. Both firms understand the need for modern payment solutions and offer cryptocurrency as a fast and convenient payout option, alongside traditional methods like bank transfers.

This is a key differentiator. While FTMO provides excellent data-driven analytics for performance review, Alpha Capital Group is widely considered to have the edge in traditional educational resources. They offer a more comprehensive suite of learning materials, including webinars and daily market analysis, designed to help traders grow.

13. Conclusion

At the end of the day, the Alpha Capital vs FTMO debate boils down to a fundamental choice between proven tradition and modern flexibility. There’s no wrong answer here.

FTMO offers a prestigious, time-tested pathway for traders who are confident in their ability to meet a clear set of high standards. Alpha Capital Group, in contrast, provides a more adaptable and varied approach, perfect for traders who want more control over their evaluation journey and value a strong educational foundation.

H2T Funding believes the right foundation is key, and we hope this detailed review has equipped you to make a confident decision that aligns perfectly with your personal trading style and long-term goals. Choose the path that fits you best, commit to your strategy, and take the next step toward becoming a funded trader.