In YM futures trading, the question YM how many ticks is 34 points? has a clear and simple answer: 34 points equals 34 ticks. That’s because 1 point on the E-mini Dow (YM) always equals 1 tick.

For traders, understanding these contract specifications is fundamental to accurate risk management and profit/loss (P&L) calculation. Just like why having a solid trading plan matters, mastering these details gives you a stronger edge in the market.

In this article, H2T Funding delivers the clear, no-nonsense answer you’ve been looking for and explains the core mechanics of the YM contract so you can trade with certainty.

Key takeaways:

- In YM futures, 1 point equals 1 tick, so 34 points correspond to 34 ticks exactly.

- Each tick in YM is worth $5.00 per contract, enabling straightforward profit and loss calculations.

- By contrast, in NQ futures, 1 point equals 4 ticks, with each tick valued at $5.00, making 10 points equal 40 ticks.

- Knowing the tick structure of different contracts like YM and NQ is crucial for effective risk management and trade execution.

- Mastering these fundamentals empowers traders to apply advanced strategies confidently, including scaling and volatility-based stops.

1. Understanding points and ticks in YM futures

Before diving into the math, it’s exciting to understand what points and ticks mean in YM futures contracts. They’re the heartbeat of the market, small but powerful movements that shape every trade. Mastering their differences can give short-term traders the clarity and confidence to act decisively.

1.1. What is a point?

A point represents a one-dollar move in the value of the underlying Dow Jones Industrial Average. For example, if the YM futures price moves from 39,000 to 39,001, it has moved 1 point.

Most importantly, the point is the language traders speak when describing market changes. In YM futures, mastering this unit means you can read the market faster, react smarter, and trade with greater confidence.

1.2. What is a tick?

A tick is an essential price movement in the E-mini Dow futures contract. In YM, one tick equals 1 point, the smallest measurable increment.

Day traders, scalpers, and high-frequency traders live by tick-level data. Tracking these micro changes can sharpen your entries, perfect your exits, and uncover volatility patterns hidden beyond the point level, giving you a precision edge in fast-moving markets.

2. YM how many ticks is 34 points?

So, how many ticks is 34 points in YM futures? Based on the 1-to-1 contract specification, the formula is direct:

34 points × 1 tick/point = 34 ticks.

This formula works every time, for any point value. Whether you’re managing risk, setting stop-losses, or locking in profits, quick and accurate tick conversions keep you one step ahead.

Just remember: Number of ticks = Number of points. It’s fast, reliable, and unshaken by market swings, giving you the confidence to backtest strategies, track intraday moves, and trade with greater precision.

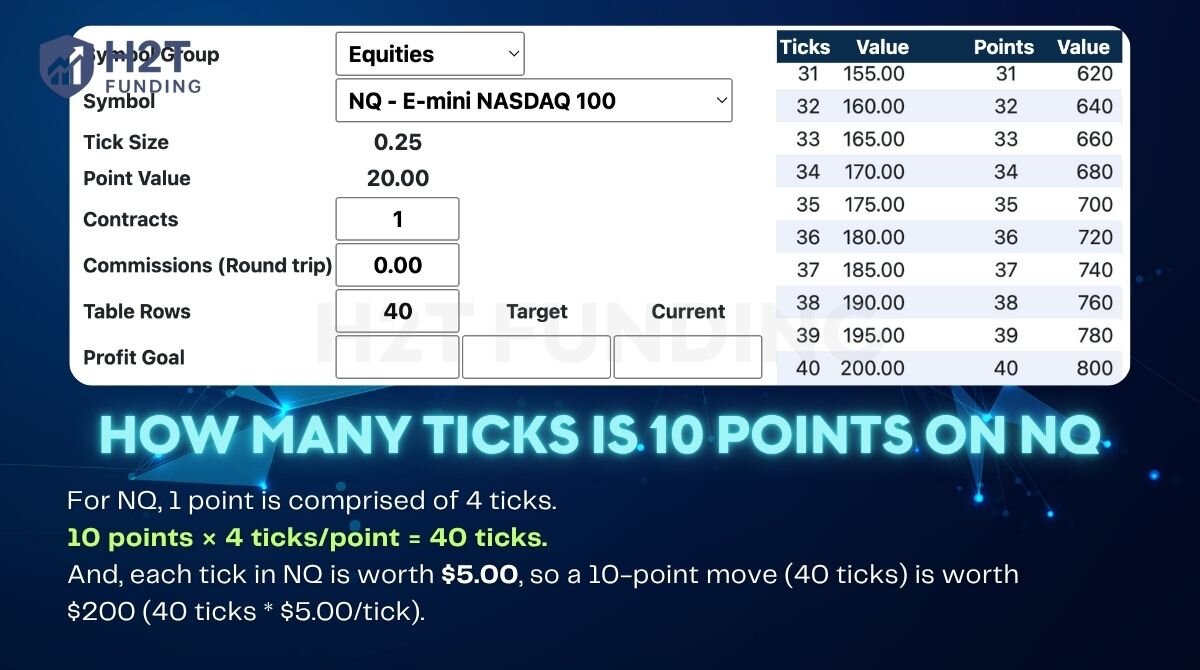

3. How many ticks is 10 points on NQ?

To highlight why knowing contract specifications is important, it’s useful to compare YM to the E-mini Nasdaq-100 (NQ), which has a different structure. For NQ, 1 point is comprised of 4 ticks.

10 points × 4 ticks/point = 40 ticks.

And, each tick in NQ is worth $5.00, so a 10-point move (40 ticks) is worth $200 (40 ticks * $5.00/tick).

This rule never wavers, making it a powerful tool to:

- Accurately setting stop-loss and take-profit levels.

- Calculating precise risk/reward ratios.

- Ensuring consistency in backtesting strategies.

Continue reading our related articles:

4. How much is a tick worth in YM trading?

Understanding the monetary value of a tick is key to managing risk, setting confident stop-loss levels, and calculating potential returns. Knowing exactly how much each price move is worth in dollars helps you act decisively, from single trades to larger positions.

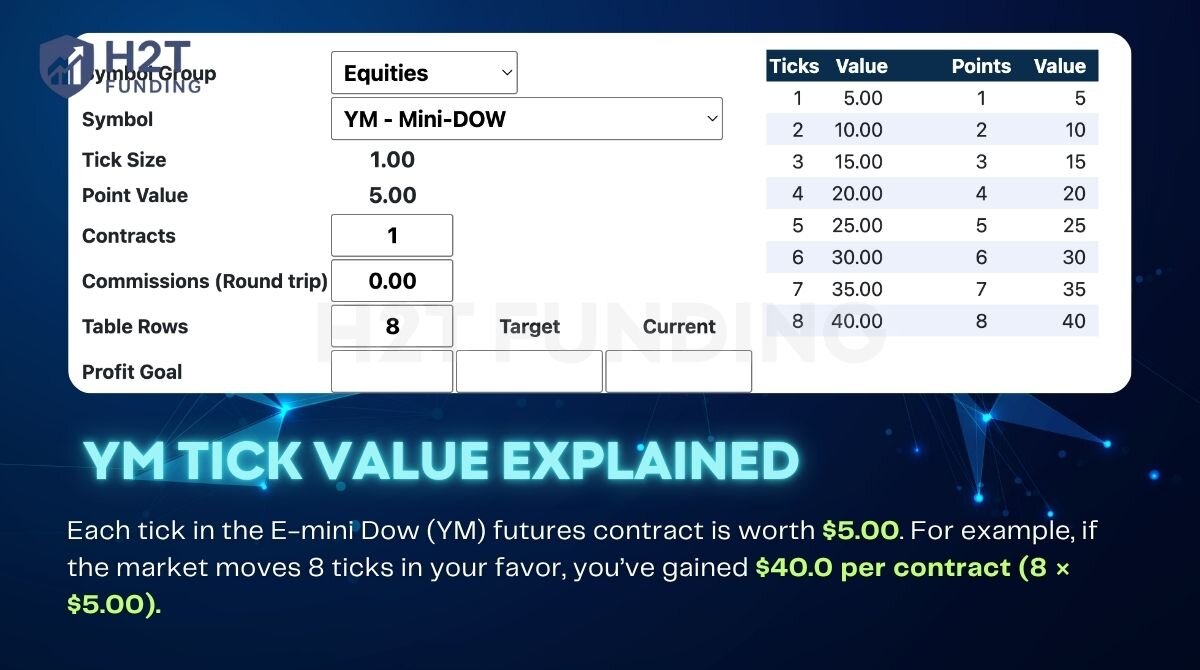

4.1. YM tick value explained

Each tick in the E-mini Dow (YM) futures contract is worth $5.00. This means that for every single tick, the price moves up or down, your position’s value changes by $5.00 per contract.

This fixed tick value is critical for calculating profit, loss, and risk, and to truly master this, you need to understand drawdown and risk limits in trading accounts. Whether you’re up 10 ticks or down 20, knowing the dollar value helps you stay in control of your trading decisions.

For example, if the market moves 8 ticks in your favor, you’ve gained $40.0 per contract (8 × $5.00). Multiply this by the number of contracts you’re holding, and you have a clear dollar figure for your gains or losses.

4.2. Calculating profit and loss

Once you understand the tick value, calculating profit and loss (P&L) becomes much more straightforward. The key is converting point movements into ticks and then multiplying by the tick value per contract.

Let’s look at a simple example: You enter a long position on YM, and the price rises by 10 points. Since 1 point equals 1 tick, that’s a movement of 10 ticks.

Now multiply the ticks by the tick value: 10 ticks × $5.00 = $50 per contract. So, your profit from that trade would be $50, not including commissions or fees.

This same logic applies in the opposite direction when calculating losses. Understanding this math allows traders to set realistic targets, manage risk effectively, and avoid surprises during market volatility.

Further reading to expand your knowledge: How to pass prop firm challenges using risk-to-reward strategies

5. YM futures points to tick conversion table

Having a quick-reference table can save you time and reduce errors during fast-paced trading sessions. Instead of doing the math manually each time, you can use this guide to track and simplify all your trading metrics as a framework for building your own point-to-tick conversion chart in YM futures.

| Points | Ticks |

|---|---|

| 1 | 1 |

| 5 | 5 |

| 10 | 10 |

| 25 | 25 |

| 30 | 30 |

| 34 | 34 |

| 50 | 50 |

| 100 | 100 |

This table is especially useful when you’re managing multiple positions or scaling into trades. Keep it on hand to support faster decisions with greater confidence.

6. Community insight

On trading forums like Reddit, some traders have begun to question whether YM futures (Dow Jones Futures) are being overshadowed by the more talked-about indices like NQ (Nasdaq-100) and ES (S&P 500).

So the question stands: Is YM the hidden gem for disciplined futures traders?

When I first started trading futures, I naturally gravitated toward NQ because of its volatility; the fast moves felt exciting and potentially more profitable. But over time, I noticed that NQ also punished impatience and lack of discipline brutally.

I gave ES a shot too, but it often felt “heavy,” as many traders say, more like a slow grind that tested your patience than your technical skill.

It wasn’t until I started watching YM closely that I realized its unique strength: it respects technical levels more consistently. The price action is cleaner, and while it doesn’t always move as fast, I found myself making better decisions and experiencing fewer whipsaws.

Now, I still monitor all three indices, but YM has become my go-to when I want to focus on precision, especially during high-impact news sessions or when volatility gets out of hand on NQ.

If you’re feeling overwhelmed by NQ’s chaos or frustrated with ES’s sluggishness, give YM a deeper look; you might be surprised by how “calmly profitable” it can be.

For more insight into our blog: What is a trendline in trading?

7. Frequently asked questions (FAQs)

1 point on YM always equals 1 tick. This is a fixed rule in the contract specification.

1 tick equals 1 point.

Each tick in YM futures is worth $5.00 per contract. This fixed monetary value allows traders to quickly calculate profit and loss based on how many ticks the price moves in their favor or against them.

The tick size refers to the minimum price fluctuation of the contract. For YM, the tick size is 1.0 index point. This means the price moves in minimum increments of 1.0 point (e.g., from 39,000 to 39,001).

30 points = 30 ticks.

25 points = 25 ticks.

The number of points is the number of ticks.

8. Conclusion: You’ve mastered YM ticks, what’s next?

In summary, the answer to the question YM how many ticks is 34 points? It is 34 ticks. This is a direct result of the E-mini Dow’s simple contract structure, where 1 point equals 1 tick, and each tick carries a value of $5.00.

But this is just the beginning. Mastering the basics of ticks and points gives you the confidence to explore beginner-friendly trading strategies that actually work, such as scaling, volatility-based stops, and intraday pattern recognition.

If you’re ready to elevate your trading skills, head over to the Prop Firm & Trading Strategies section at H2T Funding. You’ll find trusted insights on technical analysis, strategies, and capital-efficient approaches tailored for serious traders.