The forex market opens at 5:00 PM EST on Sunday (Sydney session) and closes at 5:00 PM EST on Friday (New York session). So if you’re asking what time does the forex market opens and closes, this is the exact global schedule. A rolling schedule creates a true 24-hour market from Monday to Friday, allowing traders worldwide to participate almost any time.

Let’s break down the global forex trading hours into a simple guide. H2T Funding’ll walk through the main time zone schedules, cover the four key trading sessions, and pinpoint the overlapping periods that bring higher liquidity and stronger price moves.

Key takeaways:

- The forex market opens at 5:00 PM ET on Sunday (Sydney session) and closes at 5:00 PM ET on Friday (New York session).

- Trading hours roll through Sydney, Tokyo, London, and New York sessions instead of one central exchange.

- Liquidity is highest during overlaps, with the London–New York window offering the strongest moves.

- Daylight saving shifts in the US and UK move session hours by one hour forward in summer and back in winter, while Tokyo and many Asian markets stay unchanged.

- Holidays and the daily rollover at 5:00 PM New York reduce liquidity and often widen spreads.

1. How does the Forex market work?

The forex market is a decentralized global market where banks, brokers, and investors trade currencies directly with each other. Unlike the stock market, there is no central foreign exchange market that opens and closes at fixed times.

Instead, forex operates 24 hours a day, five days a week. Trading begins when the Sydney market opens on Monday morning (local time) and continues until the New York session closes on Friday evening. This structure allows traders in different time zones to participate at almost any hour.

Since the forex market doesn’t have a single opening time, it operates through four major trading sessions: Sydney, Tokyo, London, and New York. Understanding the forex market hours is crucial, as each session has distinct characteristics.

2. Forex trading hours: What time does the forex market open?

If you’re wondering what time the forex market opens, the answer depends on your time zone and whether Daylight Saving Time is in effect. The forex market runs 24 hours a day, five days a week, but it doesn’t open everywhere at once.

Trading begins each week on Monday morning in New Zealand (8:00 AM local time), then rolls into the Sydney session at 9:00 AM local time (9:00–10:00 PM GMT Sunday, depending on DST). The market closes on Friday evening in New York (9:00–10:00 PM GMT), staying shut through the weekend.

What makes forex hours tricky is that they shift with Daylight Saving Time (DST). The U.S. and U.K. “spring forward” in March/April and “fall back” in October/November, but not on the same dates. Australia’s DST is in the opposite months. Japan does not observe DST at all.

To simplify, we can look at the session timings based on the Northern Hemisphere’s seasons. Note that local session times (e.g., 8:00 AM – 5:00 PM) generally do not change; what changes is their conversion to GMT/UTC.

Forex Trading Sessions (GMT/UTC)

| Session | Local Time | Northern Summer (approx Apr–Oct) – GMT/UTC | Northern Winter (approx Oct–Mar) – GMT/UTC |

|---|---|---|---|

| Sydney | 8:00 AM – 5:00 PM | 22:00 – 07:00 (AEST) | 21:00 – 06:00 (AEDT) |

| Tokyo | 8:00 AM – 5:00 PM | 00:00 – 09:00 (JST) | 00:00 – 09:00 (JST) |

| London | 8:00 AM – 5:00 PM | 07:00 – 16:00 (BST) | 08:00 – 17:00 (GMT) |

| New York | 8:00 AM – 5:00 PM | 12:00 – 21:00 (EDT) | 13:00 – 22:00 (EST) |

Note: Sydney’s times are inverted because its summer (AEDT) is the Northern Hemisphere’s winter. Tokyo’s time remains constant. DST shifts cause 1-hour differences between seasons in the US, UK, and Australia.

To manage this, traders should set clear routines. Having a simple trading plan helps you focus on the best hours and avoid low-liquidity times.

2.1. What time does the forex market open on Sundays?

The forex market officially starts a new week on Sunday evening GMT, even though most traders think of Monday as the beginning. The very first trades come from Wellington, New Zealand, before Sydney joins shortly after.

- In GMT, the market opens at 9:00–10:00 PM on Sunday (varies with Australian DST).

- In ET (New York time), that’s 5:00 PM Sunday.

- In Vietnam (ICT), it equals 5:00 AM on Monday.

This period is often called the Sunday open, but liquidity is usually thin. Spreads are wider, and price movements can be erratic because major financial centers like London and New York are still closed. Many professional traders wait until the Asian session is fully active before entering positions, using this window mainly to check for weekend gaps or early sentiment in currency pairs.

2.2. What time does the forex market open in South Africa?

In South Africa (SAST, GMT+2), the market opens late on Sunday night when the Sydney session begins. This is around 12:00 AM SAST (Monday) during Northern Summer (AEDT) or 1:00 AM SAST (Monday) during Northern Winter (AEST).

A unique factor for South African traders is the daily rollover that happens at 5:00 PM New York time. This corresponds to 11:00 PM SAST (Northern Summer/ US on EDT) or 12:00 AM SAST (Northern Winter/ US on EST).

During this brief period (2–5 minutes), most brokers pause trading, spreads widen sharply, and liquidity is very low. It is best to avoid entering or exiting positions at this time.

Trading times in South Africa typically line up as follows:

| Session / Event | SAST (Northern Hemisphere Summer) | SAST (Northern Hemisphere Winter) |

|---|---|---|

| Weekly Opening | 12:00 AM (Monday) | 1:00 AM (Monday) |

| London Session | 9:00 AM – 6:00 PM | 10:00 AM – 7:00 PM |

| New York Session | 2:00 PM – 11:00 PM | 3:00 PM – 12:00 AM |

| Daily Rollover | 11:00 PM | 12:00 AM |

For most South African traders, the London and New York sessions are the best times to trade. The most active trading periods are the session overlaps, which occur between 2:00 PM and 6:00 PM SAST (summer) or 3:00 PM and 7:00 PM SAST (winter).

These periods offer the highest liquidity and strongest price movements, conveniently aligning with local working hours and the evening.

2.3. What time does the forex market open in London?

The London session is the largest forex market in the world, handling more than a third of global transactions each day. It opens at 8:00 AM local time year-round and closes at 5:00 PM local time. The exact GMT conversion shifts with daylight savings.

| Season | London Local Time | GMT | EST/EDT (New York) | Vietnam (ICT) |

|---|---|---|---|---|

| Summer | 8:00 AM – 5:00 PM | 7:00 AM – 4:00 PM | 3:00 AM – 12:00 PM | 2:00 PM – 11:00 PM |

| Winter | 8:00 AM – 5:00 PM | 8:00 AM – 5:00 PM | 3:00 AM – 12:00 PM | 3:00 PM – 12:00 AM |

The London session is known for high liquidity and strong price movements, especially in EUR, GBP, and CHF pairs. Activity rises even more when London overlaps with New York in the afternoon, making it the most active window of the week.

2.4. What time does the forex market open in New York?

The New York session is the second most important forex market, driving large price moves thanks to US economic data and Wall Street activity. It opens at 8:00 AM local time and closes at 5:00 PM local time. The GMT equivalent changes with daylight saving.

| Season | New York Local Time | GMT | London Local Time | Vietnam (ICT) |

|---|---|---|---|---|

| Summer | 8:00 AM – 5:00 PM | 12:00 PM – 9:00 PM | 1:00 PM – 10:00 PM | 7:00 PM – 4:00 AM |

| Winter | 8:00 AM – 5:00 PM | 1:00 PM – 10:00 PM | 1:00 PM – 10:00 PM | 8:00 PM – 5:00 AM |

This session is crucial because it overlaps with London in the early afternoon. During this overlap, spreads tighten and volatility increases, making it the most active trading window of the week for pairs like EUR/USD, GBP/USD, and USD/JPY.

2.5. What time does the forex market open in the UK?

Forex trading hours in the UK coincide with the London session, the world’s largest forex hub. The market opens at 8:00 AM local time year-round and closes at 5:00 PM local time. Since the UK observes Daylight Saving Time, the GMT equivalent shifts between Summer and Winter.

Here’s how it looks across different time zones:

| Season | UK Local Time | GMT | EST/EDT (New York) | Vietnam (ICT) |

|---|---|---|---|---|

| Summer | 8:00 AM – 5:00 PM | 7:00 AM – 4:00 PM | 3:00 AM – 12:00 PM | 2:00 PM – 11:00 PM |

| Winter | 8:00 AM – 5:00 PM | 8:00 AM – 5:00 PM | 3:00 AM – 12:00 PM | 3:00 PM – 12:00 AM |

The UK session is highly liquid and volatile, especially for EUR, GBP, and USD pairs. The most active time comes in the afternoon, when London overlaps with New York, creating the tightest spreads and strongest price swings.

2.6. What time does the forex market open in Australia (Sydney session)?

The Sydney session is the first major market to open each week, starting on Monday at 8:00 AM local time. Australia observes daylight savings in opposite months (Oct–Apr), so Sydney’s summer corresponds to the Northern Hemisphere’s winter. This shifts the GMT opening hour depending on the season.

Here’s a quick conversion of Sydney session hours:

| Season | Sydney Local Time | GMT (Starts Sunday) | EST/EDT (Starts Sunday) | Vietnam (ICT, Starts Monday) |

|---|---|---|---|---|

| Aus. Summer | 8:00 AM – 5:00 PM | 9:00 PM – 6:00 AM | 5:00 PM – 2:00 AM | 4:00 AM – 1:00 PM |

| Aus. Winter | 8:00 AM – 5:00 PM | 10:00 PM – 7:00 AM | 6:00 PM – 3:00 AM | 5:00 AM – 2:00 PM |

The Sydney session usually has lower liquidity and wider spreads compared to London and New York, but it sets the stage for the week ahead. Traders often use this window to check for weekend gaps and early market sentiment before Tokyo opens.

2.7. What time does the forex market open in Kenya?

Kenya uses EAT (GMT+3) and doesn’t observe DST. The week typically begins around 1:00 AM Monday EAT when Sydney opens; it ends near 1:00 AM Saturday EAT when New York closes.

| Session | Kenya Time (EAT) – Summer | Kenya Time (EAT) – Winter |

|---|---|---|

| Sydney | 1:00 AM – 10:00 AM | 12:00 AM – 9:00 AM |

| Tokyo | 2:00 AM – 11:00 AM | 2:00 AM – 11:00 AM |

| London | 10:00 AM – 7:00 PM | 11:00 AM – 8:00 PM |

| New York | 3:00 PM – 12:00 AM | 4:00 PM – 1:00 AM |

For Kenyan traders, the most active periods are during the London session and the London-New York overlap in the evening. These hours provide the tightest spreads and strongest market moves, ideal for short-term trading strategies.

The forex market runs nonstop from Monday to Friday, but each region opens at different times. By knowing the schedule and overlaps, you can focus on the most active periods and avoid quiet hours with wide spreads.

Learning how to be more disciplined in your trading will help you avoid emotional decisions and trade more effectively across sessions.

3. Main trading sessions and characteristics

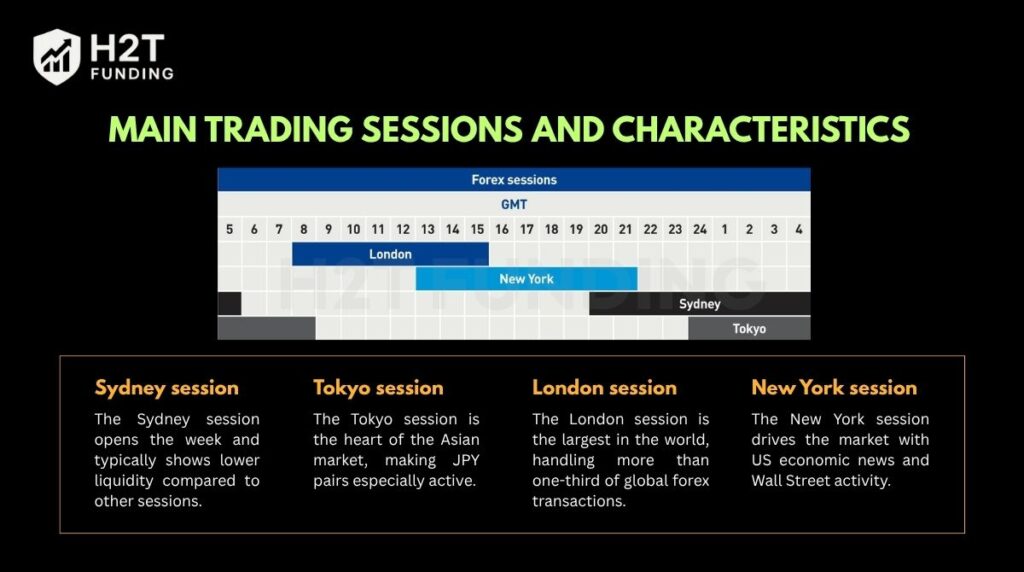

The forex market is divided into four main trading sessions, each shaped by the financial centers driving it. These forex market time frames help traders identify the best moments of liquidity and volatility across Sydney, Tokyo, London, and New York.

You can learn more about these concepts in our guide on what is support and resistance are.

3.1. Sydney session

The Sydney session opens the week and typically shows lower liquidity compared to other sessions. Price movements are modest, spreads are wider, and trading market activity is limited to regional currencies like AUD and NZD. It is best used for checking weekend gaps and preparing for the more active sessions ahead.

3.2. Tokyo session

The Tokyo session is the heart of the Asian market, making JPY pairs especially active. Although trading volume is higher than in Sydney, volatility remains moderate. Many traders use this period for range-bound strategies, while those trading USD/JPY, EUR/JPY, and GBP/JPY find more opportunities.

Learn how to use them effectively in our article how to trade using indicators.

3.3. London session

The London session is the largest in the world, handling more than one-third of global forex transactions. Liquidity is high, volatility increases, and major pairs like EUR/USD, GBP/USD, and USD/CHF see strong moves. The session’s overlap with New York in the afternoon produces the most active and profitable trading window of the week.

3.4. New York session

The New York session drives the market with US economic news and Wall Street activity. It often sees sharp reactions to data such as Nonfarm Payrolls, CPI, or Fed announcements. Liquidity remains high, especially during the overlap with London, but tapers off toward the close on Friday evening.

Each trading session brings its own rhythm to the forex market. Knowing these patterns, traders can align their strategies with the times of day when liquidity and volatility are strongest.

4. How do trading hours affect individual forex pairs?

Not all FX pairs move the same way across sessions. Their activity often depends on whether one or both currencies are tied to a market that is currently open. This is why knowing the trading schedule helps you choose when to focus on a specific pair.

For example, EUR/USD and GBP/USD usually surge in activity when both London and New York are active, since these regions dominate trading in the euro, pound, and US dollar. By contrast, USD/JPY sees more liquidity during Asian or US hours, while pairs like EUR/JPY often pick up speed as London opens.

Liquidity and volatility also shift with the economic calendar. When key data such as US Nonfarm Payrolls or European inflation figures are released, the related pairs can spike, regardless of the session. Traders may choose to trade during volatile periods for bigger swings or during quieter hours for range-bound setups.

There is no single “perfect” time to trade forex, but aligning your strategy with the session most relevant to your chosen pair improves consistency. Over time, traders develop a rhythm; some prefer the fast pace of overlaps, while others thrive in the calmer sessions.

To read market behavior clearly, learn how to understand trading charts and use them to confirm price trends and entry signals.

5. Session overlap time and why it matters

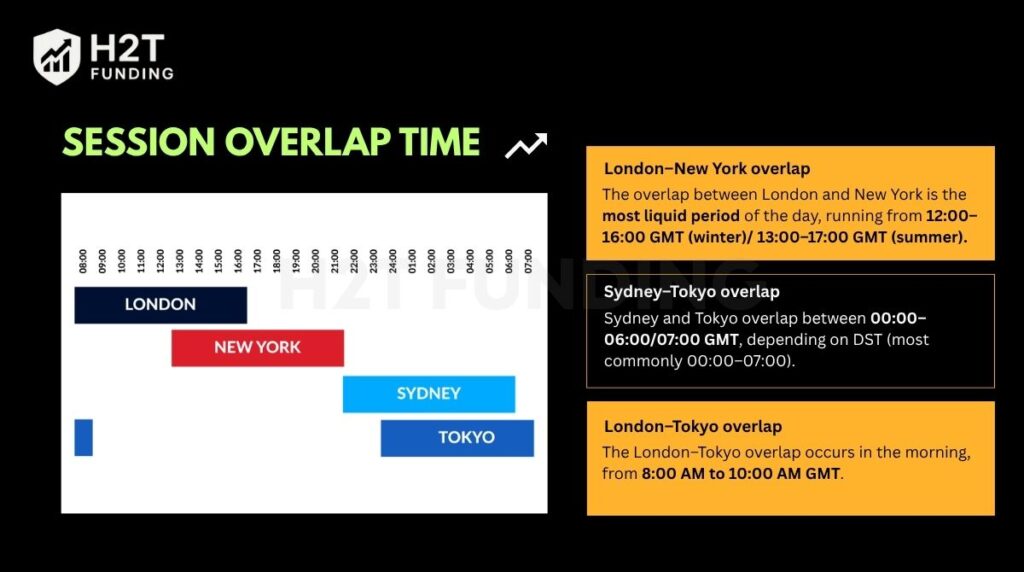

One of the most important features of the forex market is that trading sessions can overlap. When two major markets are open at the same time, liquidity rises, spreads tighten, and price movements often become more pronounced. These overlaps are seen as the best opportunities for active traders.

5.1. London–New York overlap

The overlap between London and New York is the most liquid period of the day, running from 12:00–16:00 GMT (winter)/ 13:00–17:00 GMT (summer). Together, these two hubs account for the majority of global forex transaction volume, and pairs like EUR/USD and GBP/USD can see sharp swings.

This window often provides the tightest spreads and the highest volatility, making it a prime time for day traders and scalpers. Some estimates put it near 70%, which helps tighten spreads and reduce slippage for active traders, according to StreetInsider 2025.

5.2. Sydney–Tokyo overlap

Sydney and Tokyo overlap between 00:00–06:00/07:00 GMT, depending on DST (most commonly 00:00–07:00). While not as volatile as the European window, it does provide steady movement, especially in Asian pairs. Traders focusing on AUD/JPY, NZD/USD, or USD/JPY often find this period useful, as both regional markets are active.

5.3. London–Tokyo overlap

The London–Tokyo overlap occurs in the morning, from 8:00 AM to 10:00 AM GMT. This overlap is relatively short and quieter compared to others, but it can still create opportunities in cross pairs like EUR/JPY. Activity is usually lower because US traders are not yet active, but it sometimes sets the tone for the upcoming London session.

| Overlap | GMT Time | Key Pairs | Characteristics |

|---|---|---|---|

| London – New York | 13:00–17:00 GMT (summer)12:00–16:00 GMT (winter) | EUR/USD, GBP/USD, USD/JPY | Highest liquidity, strongest volatility |

| Sydney – Tokyo | 00:00–07:00 GMT (may shift seasonally) | AUD/JPY, NZD/USD, USD/JPY | Moderate activity, regional focus |

| London – Tokyo | 08:00 – 10:00 | EUR/JPY, GBP/JPY | Short overlap, lower liquidity |

Understanding these overlaps is crucial because they shape when the market offers the best trading conditions. Traders who align strategies with overlaps can access tighter spreads and higher volatility, while those who trade outside of these hours may face quieter markets and wider spreads.

6. When is the best time to trade forex?

There is no single “perfect” moment to trade forex, but certain hours consistently offer better conditions. To decide what time the forex market opens matters most to you, it’s best to align your strategy with session overlaps that fit your trading style.

The best times usually coincide with high liquidity and strong volatility, when multiple markets are active at once. This is why many traders plan their entries around session openings and overlaps.

6.1. Trading during the London session

The London session is often the most attractive window, as liquidity surges right after the open. Major pairs such as GBP/USD and EUR/GBP tend to move sharply, especially when London overlaps with New York. For European traders, this morning rush provides some of the clearest intraday opportunities.

6.2. Trading during the New York session

The New York session brings another wave of volatility, fueled by US economic data and Wall Street activity. Pairs like EUR/USD, GBP/USD, and USD/JPY often see their heaviest trading volumes here. The overlap with London, from early afternoon GMT, is widely considered the most profitable stretch of the week.

6.3. Trading during the Tokyo session

The Tokyo session is calmer, with fewer sharp moves compared to London or New York. However, it is a good time for traders focusing on JPY crosses such as USD/JPY or EUR/JPY. The overlap with Sydney can also boost activity in AUD/JPY, a pair known for its volatility in the Asian market.

6.4. Adapting trading style to session hours

Scalpers and day traders often prefer the fast-paced overlaps, while swing traders may look for quieter periods to spot longer-term setups. The key is to match your strategy with the session that best fits the currency pairs you trade and the risk level you’re comfortable with.

It’s a common observation among traders that the London–New York overlap tends to offer the cleanest moves, especially for major pairs like EUR/USD. In contrast, the Sydney open can often be a source of frustration, with prices stalling for hours amid wide spreads.

For newcomers, focusing on these active overlaps where market signals are stronger is often a more effective approach than navigating the quieter periods.

7. Forex market opening and closing hours table (2026)

This consolidated table simplifies the session times across key regions: GMT, EST (New York), and Vietnam (ICT) for 2025, including daylight savings adjustments.

| Session | Local Time | GMT (Summer / Winter) | EST/EDT (New York) | Vietnam (ICT) |

|---|---|---|---|---|

| Sydney | 8:00 AM – 5:00 PM (AEDT/AEST) | 9:00 PM – 6:00 AM (Summer)10:00 PM – 7:00 AM (Winter) | 5:00 PM – 2:00 AM (EDT)6:00 PM – 3:00 AM (EST) | 4:00 AM – 1:00 PM (Summer)5:00 AM – 2:00 PM (Winter) |

| Tokyo | 8:00 AM – 5:00 PM (JST) | 11:00 PM – 8:00 AM (Year-round) | 7:00 PM – 4:00 AM | 6:00 AM – 3:00 PM |

| London | 8:00 AM – 5:00 PM (BST/GMT) | 7:00 AM – 4:00 PM (Summer)8:00 AM – 5:00 PM (Winter) | 3:00 AM – 12:00 PM | 2:00 PM – 11:00 PM (Summer)3:00 PM – 12:00 AM (Winter) |

| New York | 8:00 AM – 5:00 PM (EST/EDT) | 12:00 PM – 9:00 PM (Summer)1:00 PM – 10:00 PM (Winter) | 8:00 AM – 5:00 PM | 7:00 PM – 4:00 AM (Summer)8:00 PM – 5:00 AM (Winter) |

Note: Sydney’s summer (AEDT) occurs during the Northern Hemisphere’s winter.

Keeping this table handy helps traders know when the market is most active and avoid trading during thin liquidity hours. Bookmarking or saving it ensures you always plan trades around the most profitable overlaps.

8. Difference between the forex market and the stock market in terms of operating hours

One of the biggest differences between forex and stock trading is how long the markets stay open. The forex market runs 24 hours a day, five days a week, following the global time zones of Sydney, Tokyo, London, and New York.

In contrast, stock markets operate on fixed daily schedules, usually tied to a single country or foreign exchange.

For example, the New York Stock Exchange (NYSE) opens from 9:30 AM to 4:00 PM EST, Monday to Friday. Once the session closes, trading largely stops except for limited after-hours activity. This fixed structure contrasts with forex, where traders can place orders at almost any time between Monday morning and Friday night.

| Feature | Forex Market | Stock Market |

|---|---|---|

| Operating Days | 24 hours a day, Mon–Fri | Limited to local business hours, Mon–Fri |

| Global Coverage | Sydney, Tokyo, London, New York sessions | Each exchange has its own hours (e.g., NYSE, LSE, TSE) |

| Accessibility | Continuous, rolling sessions across time zones | Restricted to a single-country schedule |

| Liquidity Patterns | Peaks during overlaps of major sessions | Peaks at market open and close |

For traders, this means forex offers more flexibility but also requires discipline to avoid overtrading, while stocks provide a more structured rhythm with clear daily start and end points.

9. Instructions for converting forex market hours to the local time zone

Forex market hours are often published in GMT, but traders operate in many different time zones. To avoid confusion, it’s important to know how to convert times correctly and account for daylight savings.

Common conversions of forex sessions

| Session | GMT | EST/EDT (New York) | JST (Tokyo) |

|---|---|---|---|

| Sydney Open | 9:00 PM (Summer)10:00 PM (Winter) | 5:00 PM (EDT)6:00 PM (EST) | 7:00 AM |

| Tokyo Open | 11:00 PM | 7:00 PM | 8:00 AM |

| London Open | 7:00 AM (Summer)8:00 AM (Winter) | 3:00 AM (EDT)3:00 AM (EST) | 4:00 PM (Summer)5:00 PM (Winter) |

| New York Open | 12:00 PM (Summer)1:00 PM (Winter) | 8:00 AM | 9:00 PM (Summer)10:00 PM (Winter) |

Tips for accurate conversion:

- Always start from GMT: Most market schedules list GMT as the base.

- Adjust for daylight savings: UK and US shift clocks in Spring and Autumn; Japan does not.

- Check your trading platform: Times are usually displayed in your device’s local clock.

- Use an online converter: Many brokers provide tools that instantly show session hours in your time zone.

Keeping a table like this ensures you don’t miscalculate and enter trades during low-liquidity hours.

See more:

10. Common mistakes about forex trading hours

Many beginners misunderstand how the forex market operates. While it does run continuously from Monday to Friday, there are pitfalls that can cause costly errors if you don’t pay attention to the details.

10.1. Thinking that forex is open 24/7

A common mistake is assuming forex is available every day without pause. In reality, the market closes late Friday in New York and reopens Monday morning in Sydney. Trying to trade on weekdays is impossible, except through limited crypto or synthetic markets that are not true forex.

10.2. Trading during thin liquidity hours

Another mistake is trading right when the Sydney session opens, where spreads are often wider and liquidity is low. This can eat into profits, especially for scalpers using tight stop losses. It’s usually wiser to wait for Tokyo or London to open before entering the market.

10.3. Ignoring global holidays

The forex market doesn’t follow a single country’s holiday calendar, but liquidity drops sharply when major financial centers are closed. For example, trading slows during Christmas, New Year, Easter, and the US Thanksgiving. Some brokers also adjust their schedules on public holidays.

How to calculate holidays: Check official calendars of key markets (US, UK, Japan, Australia). If banks are closed, expect lower liquidity. Many brokers publish a holiday trading schedule each year; bookmarking this helps avoid surprises.

10.4. Forgetting about daylight savings

Overlooking DST changes in London and New York can lead to miscalculating overlap hours. Even a one-hour shift can change the volatility window you’re trying to target. Always confirm current session times in GMT or with a reliable time zone converter.

Example: When London moves to BST (GMT+1), the overlap with New York shifts 1 hour earlier.

By avoiding these mistakes and preparing ahead of time, traders can focus on the most liquid hours, reduce unnecessary costs, and stay aligned with global market conditions.

11. FAQs

The forex market opens each week on Monday morning in Sydney, which corresponds to 10:00 PM GMT on Sunday. Depending on your time zone, this may appear late Sunday evening or early Monday morning.

The market closes at the end of the New York session on Friday, around 9:00–10:00 PM GMT (varies with US DST). After that, trading halts until the next weekly opening. Times in GMT shift by one hour when the US moves between EDT and EST.

No, the forex market is closed on weekends. Some brokers may offer crypto or synthetic products, but these are not the same as spot forex.

The London–New York overlap (1:00 PM – 5:00 PM GMT) is usually the most profitable. Liquidity is at its highest, spreads are tighter, and volatility increases, creating the best opportunities for active traders.

The London session runs from 8:00 AM to 5:00 PM local time. In GMT, that is 7:00 AM – 4:00 PM (Summer) or 8:00 AM – 5:00 PM (Winter). In EST, it’s 3:00 AM – 12:00 PM, and in Vietnam (ICT), it’s 2:00 PM – 11:00 PM (Summer) or 3:00 PM – 12:00 AM (Winter).

The quietest hours are usually at the start of the Sydney session, when only Australia and New Zealand markets are active. Liquidity is thin, spreads are wider, and price action can be slow.

No, the forex market closes on Friday evening (New York time) and reopens on Monday morning (Sydney time). Weekend trading is not available for regular FX pairs.

Beginners should focus on the London or New York sessions, where liquidity is strong and price movements are clearer. The London–New York overlap is especially useful for learning how trends form and react to news.

Not exactly. Forex is open 24 hours a day from Monday to Friday, but it closes over the weekend. Unlike crypto markets, it is not active 7 days a week.

12. Conclusion

Understanding what time does the forex market opens is essential for building an effective trading plan. By knowing when each session starts, how overlaps create liquidity, and which hours tend to be quieter, traders can align their strategies with the market’s natural rhythm.

If you want to expand your trading skills beyond market hours, explore our dedicated section on Prop Firm & Trading Strategies at H2T Funding. There, you’ll find in-depth guides on evaluation challenges, risk management techniques, and advanced strategies designed to help traders perform better in real market conditions.