When every expense seems important, the real challenge is deciding what to pay first. This is the core problem in determining what should be prioritized when creating a budget. The solution follows a simple, powerful rule: cover your needs first, build your security second, plan for the future, and fund your wants last.

The article is designed to give you more than just the rule; it provides a clear framework to apply it. H2T Funding will break down this priority system step-by-step, helping you organize your finances and create a solid plan for your money.

Key takeaways

- A strong budget always begins with the 4-tier priority system: Essentials → Safety Net → Future Goals → Wants. This prevents financial chaos and ensures you’re always covering what matters most first.

- Priority 1 (Foundation) must protect your basic needs: housing, food, utilities, transportation, and healthcare.

- Priority 2 (Safety Net) includes building a starter emergency fund, eliminating high-interest debt, and securing proper insurance.

- Priority 3 (Future) shifts your budget toward long-term progress: retirement contributions, saving for life goals, and building a full 3–6-month emergency fund.

- Priority 4 (Wants) should only be funded after essentials and goals are handled. These include dining out, entertainment, hobbies, travel, and other miscellaneous lifestyle expenses.

- A simple starting framework is the 50/30/20 rule: 50% for essential needs, 30% for lifestyle wants, and 20% for savings and debt. It provides a quick benchmark before you dive into the priority tiers.

1. What does it mean to prioritize when creating a budget?

Prioritizing in a budget means deciding which expenses and financial goals are most important and allocating your income accordingly. Essentials like housing, food, utilities, and debt come first, while discretionary spending is funded later. This approach reduces stress and ensures your money supports your long-term goals.

Key aspects of prioritizing your budget

- Separate Needs from Wants: Cover essentials first: rent, groceries, utilities, and minimum debt payments. Wants, like entertainment or dining out, come after.

- Rank Financial Goals: Urgent goals, such as building a starter emergency fund or paying off high-interest debt, take priority over less critical objectives.

- Track and Adjust: Monitor spending to identify where to cut back and reallocate funds to your top priorities. Budgets should evolve as your financial situation changes.

- Use a Priority-Based Method: Align your resources with high-priority, evolving needs. This prevents reactive spending and creates a clear, actionable plan.

By focusing on what matters most, prioritizing ensures your financial habits support stability and growth. It turns a list of bills into a structured tool for control and progress.

2. Why a priority-based budget is your key to financial control

If your budget feels like a random list of bills, it’s not really doing its job. You’re left playing a stressful game of financial whack-a-mole, paying whichever bill is loudest, leaving you feeling constantly a step behind. That isn’t a plan; it’s just reacting.

And if this sounds familiar, you’re definitely not alone. Just look at the national numbers: U.S. credit card balances recently climbed to a massive $1.23 trillion (according to the Federal Reserve Bank of New York). That figure is just a reflection of millions of people caught in that same reactive loop.

That’s where a priority-based budget comes in. It helps you clarify what your priorities are when making budget decisions before the bills arrive, focusing on what truly matters most to your financial well-being. This approach helps you actively steer your money, moving away from those overwhelming debt figures and towards genuine security.

3. The 4-priority pyramid: What should be prioritized when creating a budget

The easiest way to organize your budget categories list is to picture a pyramid. It has four levels, and the rule is simple: you can’t move up to the next level until the one below it is fully funded. This approach forces you to build from a strong financial base.

Here’s how the pyramid breaks down, starting from the most essential level at the bottom:

- Priority 1: Securing your foundation

- Priority 2: Building your safety net

- Priority 3: Investing in your future

- Priority 4: Allocating for wants

Note: This order isn’t rigid for everyone. For example, if you already have a full emergency fund, it may make sense to invest for retirement while still paying down debt, depending on your personal situation. The pyramid is a guide, not a strict rule.

Let’s take a closer look at what goes into each level.

3.1. Priority 1: Securing your foundation

Think of this as the ground floor of your budget. These are the absolute must-haves for living, and your only job at this stage is to make sure they’re fully paid for before you even think about anything else.

Covering these core needs is critical as they make up the bulk of household spending. According to the U.S. Bureau of Labor Statistics, the average American household now spends around $6,440 per month, largely driven by the following.

- Housing: Your rent or mortgage payment is the top priority here, the non-negotiable cost of keeping a roof over your head. Also included are mandatory expenses like property taxes and basic renter’s or homeowner’s insurance.

- Food: Focus strictly on essential groceries needed for meals prepared at home. It’s crucial to separate grocery spending from your entertainment budget; things like dining out, coffee runs, and takeout belong in a higher tier.

- Utilities: To make your home functional, you need to cover basic utilities. Prioritize services like electricity, water, and heating gas or oil. For most households, a basic internet connection for work or school also falls into this essential category.

- Transportation: This covers what it costs you to get to work and earn an income. That could be your car payment, gas, a bus pass, or necessary maintenance and insurance. It doesn’t include road trips or other fun travel.

- Basic healthcare: Your physical well-being is a non-negotiable priority. Budget for your monthly health insurance premiums, which act as a shield against catastrophic medical costs, as well as any critical, recurring prescriptions you rely on.

With a solid foundation in place, you can now shift your focus to the next crucial level: building a financial safety net to protect you from the unexpected.

3.2. Priority 2: Building your safety net

You’ve got your basic bills covered, which is huge. The next step is to build a buffer so that one piece of bad luck doesn’t ruin all your progress. This is your financial safety net, and it’s what lets you handle a surprise without going into a panic.

- Tackle high-interest debt aggressively: Once you have that small cash fund, you can turn your attention to your most expensive debt. For most people, that’s credit card debt. The high interest rates mean it’s actively costing you money every single month. Getting rid of it is one of the smartest things you can do for your finances.

- Start an emergency fund: First things first, get a small pile of cash saved up, maybe around $1,000. This is your flat tire fund. It’s there to cover a small, annoying expense so you don’t have to reach for a credit card and slide backward into debt.

- Essential insurance coverage: Last, take a serious look at your insurance. Your emergency savings are for the small hits. Insurance is for the big things that could wipe you out. Make sure you have the right coverage for your car, your home or apartment, and your life, especially if anyone else depends on your income.

These three items, a starter savings fund, a plan for costly debt, and proper insurance, work together to protect you. You’re no longer just reacting to life and are ready to start planning for your future.

Tip: Use a simple app or spreadsheet to track where every dollar goes; it’s the only way to adjust your categories accurately.

3.3. Priority 3: Investing in your future

Okay, your defenses are set. Now it’s time to actually start building something. This is the stage where your money stops being just for bills and emergencies. It becomes a tool you can use to build the life you really want.

- Saving for retirement: Paying your future self is a non-negotiable. Most U.S. financial planners recommend contributing 10–15% of your gross income toward retirement through a 401(k), IRA, or Roth IRA. Small, consistent contributions might not feel like much now, but they can grow into a huge asset over time thanks to compounding investments.

- Down payments, education, and more: Here is where the big, exciting goals live. Are you saving for a house? Putting money aside for education? Building up cash to start a business? Having a specific savings bucket for these goals is what makes the day-to-day discipline of budgeting feel worth it.

- Building your full emergency fund: You might wonder why we’re coming back to this. Your starter fund was for small surprises. A full emergency fund is for major life events, like a job loss. The widely recommended baseline is at least 3 months of essential expenses, which aligns with most financial planning standards.

Once you’re consistently funding this tier, you’ve moved past just being stable. You have a plan for today, a defense for tomorrow, and a clear strategy for your biggest goals. You’ve earned the right to enjoy the final part of the pyramid.

3.4. Priority 4: Allocate for wants

So, you’ve handled your essentials, built a safety net, and started investing. What’s left? The fun stuff. This is the top of the pyramid, where your budget items list shifts to your lifestyle, knowing that you’ve already handled your responsibilities.

- Entertainment, dining out, and hobbies: A budget shouldn’t feel like a punishment. This is the cash for movies, dinners out, and your favorite hobbies. You’ve planned for it, so enjoy it.

- Personal spending and shopping: This is a broad category for things that make you feel good. It covers everything from new clothes and gadgets to Personal care items like haircuts or gym memberships. It can also include Miscellaneous household supplies that aren’t bare necessities but improve your quality of life.

- Travel and vacations: Taking a break is good for you. Saving up for a trip and paying for it with cash means you can actually relax. No coming home to a credit card bill that ruins the memories.

- Gifts and donations: Being generous is a great feeling. When you budget for gifts and donations, you can give to people and causes you believe in. It becomes a thoughtful part of your plan, not a surprise expense.

This is what makes a budget stick. It’s not just about paying bills. It’s about building a financial plan that lets you live the life you actually want.

4. What are some key components of successful budgeting?

Many people ask what should be considered when setting a budget. The answer is more than just tracking numbers; it’s about creating a plan that fits your life and goals. A budget works best when it balances essentials, savings, debt repayment, and discretionary spending while allowing flexibility for unexpected changes. Here are the key components:

4.1. Setting clear financial goals

Define short- and long-term goals to give your budget direction. Examples include building an emergency fund, saving for retirement, paying off debt, or putting money aside for a major purchase. Personalizing goals to your priorities keeps you motivated and focused.

4.2. Accurate income calculation

Know exactly how much money you have coming in each month, including wages, bonuses, freelance work, or passive income. For irregular income, average earnings over several months are used to create a realistic baseline. This ensures your budget is grounded in reality.

4.3. Tracking all expenses

Record both fixed costs (rent, insurance, utilities) and variable expenses (groceries, entertainment, dining out). Tracking helps you see where your money is going and identify areas to reduce spending. Apps or simple spreadsheets can make this process easier and more consistent.

4.4. Prioritizing essential expenses

Always cover your “needs” first: housing, food, utilities, transportation, and debt minimums. Wants like dining out, streaming, or hobbies come later. Prioritizing essentials prevents financial stress and ensures your foundation is secure.

4.5. Building an emergency fund

Set aside 3–6 months’ worth of living expenses to protect against unexpected events. Even small, consistent contributions matter. A robust emergency fund reduces reliance on credit and gives confidence to tackle bigger goals.

4.6. Managing debt strategically

Include debt repayment in your budget plan, prioritizing high-interest debt first. Tracking your progress and reducing debt frees up money for savings and investments, turning a reactive cycle into a proactive strategy.

4.7. Saving for long-term goals

Think beyond immediate needs. Allocate funds for retirement, education, or major life purchases. This ensures financial stability and prevents last-minute scrambling for big expenses.

4.8. Regular review and adjustment

Budgets aren’t static. Review weekly or monthly to track progress, adjust for changes in income or spending, and realign with goals. Life is dynamic, and flexibility ensures your budget remains practical and effective.

Integrating these components, your budget becomes a living tool, guiding your spending, supporting your goals, and helping you stay in control of your finances.

5. 5 smart tips for an effective budget

Knowing your priorities is one thing; actually sticking to them when life gets busy is another. Here are five simple tips that we personally use and recommend to make your budget feel less like a chore and more like a tool that works for you.

5.1. Automate what matters most

The easiest way to save money is to never see it in the first place. Don’t wait until the end of the month and hope there’s money left over. Set up automatic transfers from your checking to your savings and debt payment accounts, scheduled for the day right after you get paid. You’ll be paying yourself first, effortlessly.

5.2. Have a 15-minute weekly check-in

A budget goes stale if you ignore it. You don’t need a complicated spreadsheet, just 15 minutes once a week, maybe Sunday morning with your coffee. Look at what you spent last week and what bills are coming up this week. This quick check-in is the single best habit for catching problems early.

5.3. Use digital envelopes to separate your funds

The old cash envelope system worked for a reason: it made you see your money differently. You can do the same thing digitally. Open a few extra savings accounts to create your own budget categories and subcategories, giving them specific names like Car Repairs, Vacation Fund, and Holiday Gifts. It’s much harder to raid your Vacation Fund for a pizza than it is to pull from a generic savings account.

5.4. Practice value-based spending on wants

For your wants category, we teach a simple filter: ask Does this really add value to my life? before buying. It’s a powerful question that helps you cut back on mindless spending. You’ll quickly find you have more money for the things that truly matter to you.

5.5. Plan for the big, predictable expenses

It’s rarely the daily coffee that blows up a budget; it’s the $500 car registration or the annual insurance payment you forgot was coming. These aren’t surprises. If you know a $600 bill is due in six months, start putting aside $100 a month for it now in a separate fund. The expense is no longer an emergency, just a part of the plan.

These small habits can transform your budget from a static document into an active, effective tool for managing your money.

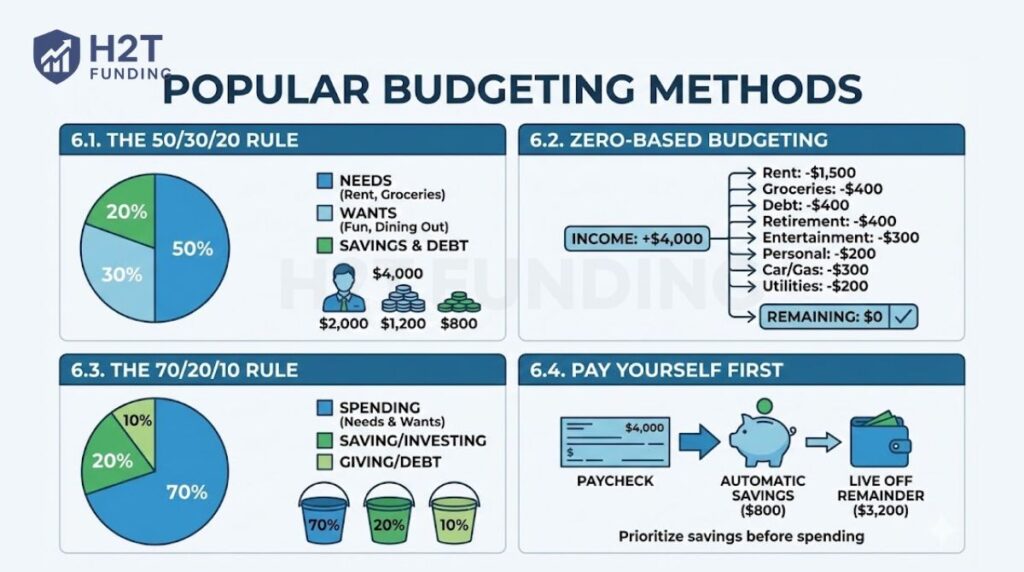

6. How to implement these priorities: Popular budgeting methods

So, the priority pyramid shows you what to spend your money on. The next question is how. You don’t need a spreadsheet with 100 budget categories to be effective; sometimes the simplest approach is best. This is especially true when you’re making big financial decisions, like deciding whether to take a tax-free lump sum before the budget, which requires clear priorities more than detailed tracking.

Here are a few popular methods people use to put their priorities into practice.

6.1. The 50/30/20 rule

The 50/30/20 rule is probably the most common starting point for a reason: it’s simple. It’s a rough guide that splits your after-tax pay into three main jobs.

Here’s how it works:

- 50% for Needs: This is for all the stuff in Priority 1, like your rent and groceries.

- 30% for Wants: That is for everything in Priority 4, the fun stuff.

- 20% for Savings & Debt: This slice goes toward Priorities 2 and 3, like paying off cards and saving for the future.

If your monthly take-home pay is $4,000, you’d aim for $2,000 for needs, $1,200 for wants, and $800 for savings and debt. This rule is especially useful as a benchmark if you’re earning well and want to sanity-check your lifestyle. It works particularly well when setting up the best budget for a single person on a $100k salary.

6.2. Zero-based budgeting

Zero-based budgeting is for people who like to be in total control. The goal is to make your income minus your outgoings equal zero. Every single dollar has a job, so nothing gets lost in the shuffle.

You list your income, then subtract every bill, every purchase, and every savings transfer until you’ve accounted for all of it.

For example, on that same $4,000 of income:

| Category | Amount |

|---|---|

| Income | +$4,000 |

| Rent | -$1,500 |

| Groceries | -$400 |

| Debt Payment | -$400 |

| Retirement | -$400 |

| Entertainment | -$300 |

| Personal Spending | -$200 |

| Car/Gas | -$300 |

| Utilities | -$200 |

| Remaining | $0 |

6.3. The 70/20/10 rule

Think of the 70/20/10 rule as a slightly more flexible version of the 50/30/20 rule. It groups your spending and adds a specific category for giving back or boosting your investments.

It goes like this:

- 70% for spending: All of your needs and wants go into this big bucket.

- 20% for saving/investing: This is strictly for your savings goals.

- 10% for giving/debt: Use this for charity, donations, or to make extra debt payments.

6.4. Pay yourself first

One core principle of successful budgeting is to pay yourself first before funding discretionary spending. It isn’t really a system, but it might be the most powerful idea here. It flips budgeting on its head. Instead of saving what’s left, you save the very first bill you pay.

It’s simple:

- Your $4,000 paycheck comes in.

- Before you do anything else, an automatic transfer sends your savings goal ($800, for example) to a separate account.

- You then live off the $3,200 that’s left.

This tiny change in order guarantees your future is being funded, not just getting the leftovers.

7. Popular tools and apps for making your budget work

A plan is great, but trying to track every dollar in your head is a recipe for disaster. Luckily, you don’t have to. The right tool can automate the tedious parts of budgeting, giving you a clear picture of your finances without the headache. Here’s a quick comparison of some of the best options available.

| Tool | Best For | Key Feature | Cost |

|---|---|---|---|

| YNAB (You Need A Budget) | Hands-on, proactive budgeters who follow the zero-based method. | Focuses on intentional spending, category aging, and building a one-month buffer. | Subscription Fee |

| Monarch Money | Great for users who want detailed net worth tracking across multiple institutions. | Syncs with all your accounts to automatically track spending and net worth. | Subscription Fee |

| EveryDollar | Simple, digital zero-based budgeting with a clean interface. | Very easy to plan your month and track spending categories. | Free & Paid Versions |

| A simple spreadsheet | The DIY-er who wants total customization and no cost. | Completely flexible to your needs and 100% free. | Free |

Ultimately, the best tool is the one you will consistently use. Don’t be afraid to try a free trial or build a simple spreadsheet to see which method fits your personal style best. If your income is irregular, consider using tools specifically for budgeting with irregular income.

8. Common mistakes when setting budget priorities

Even the best intentions can go off track if you mismanage your priorities in budgeting. Understanding common mistakes helps you avoid pitfalls and keep your finances on solid ground. Here are the key errors people often make:

8.1. Setting unrealistic or rigid goals

A budget that is too strict or impossible to maintain often leads to frustration and abandonment. Life is unpredictable; seasonal expenses, unexpected bills, or fluctuating income can throw even the most disciplined plan off balance.

8.2. Neglecting emergency savings

Failing to prioritize an emergency fund leaves you exposed to financial shocks like medical bills, car repairs, or temporary job loss. Even a small starter fund can prevent debt accumulation when surprises happen.

8.3. Forgetting irregular or one-time expenses

Quarterly bills, annual insurance payments, holiday gifts, or vehicle maintenance are easy to overlook. Not accounting for these irregular costs can make a solid budget crumble mid-year.

8.4. Not tracking spending

If you don’t monitor where your money actually goes, you’ll likely overspend in certain areas without realizing it. Tracking helps you see patterns, adjust priorities, and avoid reactive spending.

8.5. Using gross income instead of net

Budgeting based on income before taxes and deductions often leads to overspending. Always calculate based on your take-home pay to create a realistic plan.

8.6. Overcomplicating your budget

Too many categories, overly detailed spreadsheets, or multiple tools can make budgeting feel overwhelming. Complexity can discourage consistency; simple tracking works best.

8.7. Ignoring wants and personal value

Some people forget to allocate “fun money” or personal goals. Excluding small discretionary expenses can make a budget feel like punishment and reduce long-term adherence. Allocating even a modest amount for things you enjoy helps maintain balance.

8.8. Refusing to adjust fixed expenses

Many assume rent, subscriptions, or car payments are unchangeable. In reality, negotiating bills, refinancing loans, or downsizing can free up money for higher-priority goals. Flexibility is key to aligning your budget with your evolving life circumstances.

8.9. Not reviewing or updating regularly

A budget isn’t static. Life changes, income shifts, new expenses, or evolving goals require regular reviews. Missing this step can lead to outdated priorities and wasted effort.

8.10. Focusing on perfection over progress

Some people give up after a small mistake, thinking they’ve failed. Real budgeting is iterative. Consistent adjustments, learning from missteps, and celebrating small wins are far more effective than striving for a flawless plan.

Tip from my experience: Your budget is personal. Even if experts suggest strict percentages or rigid priorities, adapt them to your lifestyle. For instance, if you’ve already built a starter emergency fund, it may make sense to split extra funds between debt repayment and retirement savings. The key is aligning spending with what truly matters to you while maintaining a flexible structure.

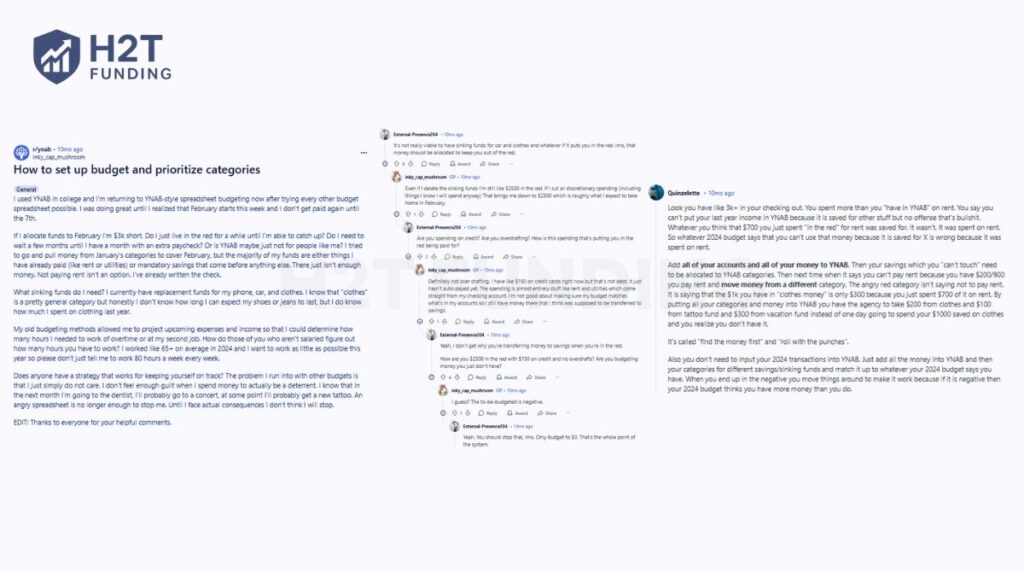

9. Discussion on what should be prioritized when creating a budget on Reddit

If you feel like you’re the only one struggling with this, you’re not. Spend a few minutes on Reddit in places like r/budget, and you’ll see these same questions pop up all the time. People are trying to get ahead, but they’re stuck on the first step: where to begin.

You’ll see posts from people with steady jobs who still feel like they’re drowning. Their income is consistent, but their bills for rent, car payments, groceries, and debt seem to pile up faster. They want to start saving, but it feels impossible.

The advice from the community almost always echoes the pyramid approach we’ve talked about. The top comments consistently tell people to lock down their four walls first: your rent, your food, your utilities. Only after those are handled should you worry about anything else.

But the conversation doesn’t stop there. You’ll also find threads from people trying to use specific tools like YNAB, who are confused about why they’re in the red even when they have money in the bank. This usually happens when they try to fund future goals before covering their immediate needs.

These discussions show that it’s a common mistake to try to save for something in the future when you haven’t yet allocated enough money for this month’s rent. The community and the software both guide people back to the same core idea: handle your immediate, essential priorities first.

What all these real-world conversations prove is that no matter what system or app you use, the principle is the same. A budget that works is always built on a solid foundation of your most essential needs.

10. FAQs

The three main categories are typically Needs, Wants, and Savings/Debt. Needs are your absolute essentials, like rent and groceries. Wants are for your lifestyle, like dining out. The final category is for getting ahead financially by paying off debt and building your wealth.

The most common advice is to do both, in a specific order. First, save a small starter emergency fund of around $1,000 to handle small surprises. After that, you should aggressively prioritize paying off any high-interest debt (like credit cards), as it will save you the most money.

When your income is irregular, build your budget based on your lowest estimated monthly earnings. Use that baseline amount to cover only your most essential needs (Priority 1). In months where you earn more, use that extra money to fund your other goals, like savings and debt repayment.

The most important thing is that consistency beats perfection. You will make mistakes, and that’s okay. The goal isn’t to have a flawless budget from day one, but to get back on track and keep making little, consistent progress over time.

A quick, 15-minute check-in once a week is great for staying on track. You should do a more detailed review once a month to set up your plan for the next month. It’s also critical to re-evaluate your entire budget after any major life event, such as a new job or a move.

You should always prioritize your spending in this order: first, your essential needs (housing, food, utilities). Second, your financial security (a safety net and paying off high-interest debt). Last, you can allocate the remaining funds to your wants and lifestyle spending.

The 70/20/10 rule is a simple budgeting guideline. It suggests you use 70% of your take-home pay for all your spending, 20% for savings, and the remaining 10% for either giving to charity or making extra debt payments.

The five basic elements you need for any budget are your total income, fixed expenses, variable expenses, debt payments, and your specific savings goals. These savings goals can also include funds for things like home maintenance or professional services such as tax preparation.

Your absolute top priority should always be your foundational needs, often called the four walls. Before any other bill gets paid, you must ensure you have allocated money for your housing, food, basic utilities, and essential transportation. This is the bedrock of all financial stability.

You should prioritize your spending in this order: essentials (housing, food, utilities, transportation), financial security (emergency fund and paying off high-interest debt), future goals, and finally, discretionary spending or wants.

The first priority is covering your essential needs, your “four walls”: housing, food, basic utilities, and essential transportation. Everything else comes after these are fully funded.

The nine priorities of the budget are: 1. Rent or mortgage. 2. Utilities. 3. Groceries. 4. Transportation. 5. Basic healthcare. 6. Emergency fund. 7. High-interest debt repayment. 8. Retirement savings. 9. Discretionary spending (wants).

11. Conclusion

The answer to what should be prioritized when creating a budget isn’t a secret formula. It’s a simple shift in perspective. By focusing on the Priority Pyramid: Foundation, Safety Net, Future Goals, and Wants, you replace financial chaos with a clear, step-by-step plan.

Mastering your personal budget is the foundational skill for all financial success. The discipline you build here, making conscious decisions and sticking to a plan, is exactly what separates successful investors and traders from the rest.

This guide is your starting point. To explore more advanced techniques and find a system that perfectly fits your lifestyle, we encourage you to dive deeper into our Budgeting Strategies section at H2T Funding. Your path to financial control continues there.