With leverage, you can trade bigger positions using only a small portion of your money. It’s a powerful tool that can amplify both your profits and your losses, making it essential to understand before diving into leveraged trading.

Have you ever searched for “what is leverage in trading” or “how to use leverage safely”? Or wondered how traders with small accounts manage to open large positions in forex or crypto markets?

The answer lies in leverage, a widely used tool in forex, crypto, and stock trading. Whether you’re learning about forex leverage meaning, looking for forex leverage explained, or curious about how crypto and stock traders amplify their trades, it all starts here.

The more you know about leverage, the better you can assess when and how to use it effectively. This guide breaks it down for beginners in simple terms, with real-life analogies and a “what is leverage in trading example” to clarify each concept.

Key takeaways:

- Leverage allows traders to control larger positions with a small amount of capital, increasing both potential profits and potential losses.

- It’s widely used in forex, crypto, and stock trading, especially through derivative instruments like CFDs, options, and futures.

- Understanding margin trading basics is key, since leverage works on a ratio basis (e.g., 10:1, 50:1), meaning for every $1 of your capital, you can trade $10 or more, depending on the market and broker.

- Highly leveraged markets include: Forex, shares, indices, commodities, ETFs, and cryptocurrencies, each carrying unique leverage risks.

- Regulations restrict maximum leverage, especially in the U.S., with limits like 1:50 for major forex pairs and 1:5 for cryptocurrencies.

- Risk management is crucial: Use stop-losses, proper position sizing, demo accounts, and risk-reward ratios to stay disciplined.

1. What is leverage in trading?

In simple terms, leverage allows traders to borrow funds from their broker to control positions larger than their own capital. With a small deposit, you can trade much bigger amounts, turning even minor price changes into meaningful gains or sharp losses

Although modern online platforms have made leveraged trading accessible worldwide, the concept itself has been around for more than a century. In the early 1900s, U.S. traders often used extremely high leverage with little regulation. While some made quick profits, many faced devastating margin calls and liquidations when markets turned.

Over time, regulators introduced stricter margin requirements and capped maximum leverage ratios to protect retail traders. These rules show that leverage has always carried potential, but its safe use depends on discipline, clear risk controls, and understanding the boundaries set by regulation.

I have a video to share about laverage, please watch it!

Next, let’s break down how forex leverage works in practice and why it’s the most common form of leverage traders use today.

1.1. Forex leverage explained simply

For example, imagine leverage like a seesaw. With the right balance, a small effort on one side can lift a heavy load on the other. In trading, this means:

- 10:1 For every $1 you have, you can trade as if you have $10

- 50:1 Common in forex, $1 becomes $50 of trading power

- 100:1 or more. Seen in crypto, where $1 gives you access to $100 or more

This concept is attractive because it gives traders the opportunity to make larger profits from small price movements. However, your losses can increase just as fast, which is why most beginner guides on forex leverage emphasize discipline. Understanding how to use leverage safely is the key to protecting your trading account and avoiding margin calls.

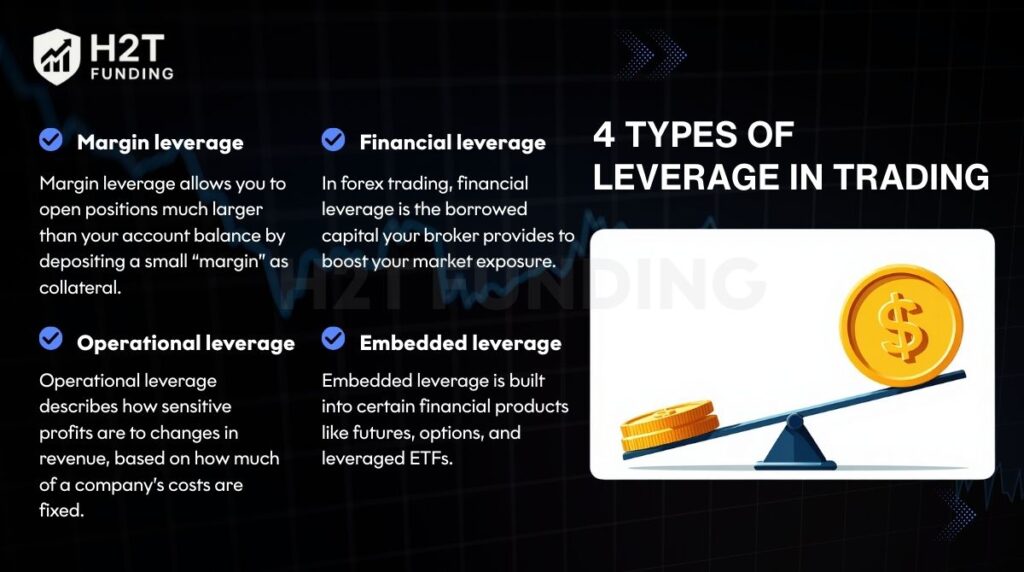

1.2. 4 types of leverage in trading

Leverage comes in different forms, each shaping how traders manage risk and returns. For forex traders, margin leverage and financial leverage are the most practical tools, while operational leverage and embedded leverage provide valuable context for how markets behave.

Let’s break each type down with simple explanations and examples.

1.2.1. Margin leverage

Margin leverage is the most direct form of leverage used by forex traders. It allows you to open positions much larger than your account balance by depositing a small “margin” as collateral. For example, if you have $1,000 and use 20:1 leverage, you can trade $20,000 worth of EUR/USD. A 1% market move now equals a $200 swing, compared to just $10 without leverage.

This mechanism is attractive because it lowers the barrier to entry. Traders can participate in global forex markets with limited capital and still benefit from relatively small price changes. At the same time, margin leverage magnifies risks; if prices move against you, losses can exceed your deposit quickly, leading to a margin call or forced liquidation.

To manage margin leverage effectively, traders must monitor their margin level and apply strict risk controls. Using stop-loss orders, scaling positions, and avoiding maximum leverage offered by brokers are essential steps to stay safe.

1.2.2. Financial leverage

In forex trading, financial leverage is the borrowed capital your broker provides to boost your market exposure. For instance, with $2,000 in your account and 50:1 leverage, you can open a $100,000 position in EUR/USD. A 1% rise in the pair equals a $1,000 profit, which is half of your account value. But the same 1% drop wipes out $1,000, showing how leverage can work both ways.

This type of leverage makes forex accessible for retail traders because it lowers the entry barrier. Instead of needing large upfront capital like in the stock market, you can trade major currency pairs with relatively small deposits. However, regulators cap leverage to reduce the chance of retail traders blowing up their accounts too quickly.

1.2.3. Operational leverage

Operational leverage describes how sensitive profits are to changes in revenue, based on how much of a company’s costs are fixed. In trading, this helps explain why some stocks react strongly to small shifts in sales. A business with high operational leverage can see earnings surge in good times, but losses expand quickly when revenue falls, making its shares more volatile for traders.

1.2.4. Embedded leverage

Embedded leverage is built into certain financial products like futures, options, and leveraged ETFs. It gives traders amplified exposure without borrowing directly from a broker. For example, a 2x ETF on the S&P 500 aims to double the daily returns of the index. While this can boost gains, it also carries hidden risks like compounding effects and volatility drag, which may lead to very different results over longer periods.

By understanding all four types, traders can recognize where leverage helps, where it hurts, and how to use it responsibly. If you’re new to trading, start with the basics, test leverage on a demo account, practice disciplined risk control, and explore our deeper guides on forex trading strategies to build a strong foundation.

1.3. Leverage vs Margin

New traders often confuse leverage and margin because both relate to position sizing. In reality, they serve different purposes, and understanding this distinction is key to managing risk in forex trading.

- Leverage: A ratio that shows how much larger your trade size is compared to your own funds. For example, 50:1 leverage means every $1 in your account controls $50 in the market.

- Margin: The actual deposit you set aside with your broker to open and maintain a leveraged position. Think of it as collateral that grants you access to leverage.

Margin-based leverage can be calculated as:

Margin-Based Leverage = Total Transaction Value / Margin Required

For example, trading one standard lot of USD/CHF ($100,000) with a 1% margin requirement means you deposit $1,000, giving 100:1 leverage. If the margin required drops to 0.25%, just $250 is enough for the same trade, equal to 400:1.

| Margin-Based Leverage | Margin Requirement |

|---|---|

| 400:1 | 0.25% |

| 200:1 | 0.50% |

| 100:1 | 1.00% |

| 50:1 | 2.00% |

However, what matters more in practice is real leverage, which reflects how much exposure you are actually using compared to your account equity:

Real Leverage = Total Transaction Value / Trading Capital

If you have $10,000 and open a $100,000 trade, your real leverage is 10:1. Doubling the position to $200,000 increases it to 20:1. Real leverage is usually lower than the margin-based maximum because traders rarely risk their entire account on one trade.

For risk management, many traders limit each position to no more than 2–3% of their capital. This ensures that even if the trade goes against them, normal price swings will not wipe out their margin or trigger forced liquidation.

1.4. Markets use leverage

Leverage is a core feature of derivative trading, enabling traders to control large positions while committing only a small portion of capital upfront. Instead of owning the asset, you’re speculating on its price movement through products like CFDs, options, or futures. This approach can amplify both gains and losses, depending on market direction.

So, which markets can you trade using leverage? Here’s a breakdown of the most commonly leveraged markets:

- Forex (Foreign exchange): The forex market is the most actively traded and highly leveraged market. Traders can access exposure to currency pairs with ratios often ranging from 30:1 to 100:1, depending on the region and broker.

- Shares (Equities): You can speculate on stock price movements without owning the shares directly. Leveraged share trading allows you to access popular global stocks like Apple or Tesla with just a fraction of their actual price.

- Indices: Major global indices such as the S&P 500, FTSE 100, and DAX can be traded using leverage, giving broad market exposure with relatively small capital requirements.

- Commodities: Precious metals (like gold and silver), energy products (like oil and gas), and agricultural commodities can be traded using leverage to maximize exposure to global supply and demand shifts.

- ETFs (Exchange-Traded Funds): ETFs offer exposure to diversified baskets of assets (stocks, sectors, commodities, or currencies), and with leverage, traders can magnify their exposure to the performance of these baskets.

- Cryptocurrencies (via derivatives): Bitcoin, Ethereum, and other digital assets can be traded with leverage through crypto CFDs or futures, though with higher volatility, risks are elevated.

Leveraged trading is widely available across financial markets. However, due to its potential to amplify losses, traders must understand both the mechanics and risks before engaging in any leveraged position.

1.5. Regulatory limits on leverage by asset class

Leverage regulations are implemented to protect traders, especially retail participants, from excessive risk exposure. Across global markets, the maximum allowable leverage varies by both asset class and regulatory jurisdiction. In the United States, where rules are among the strictest, leverage caps are defined and enforced by specialized regulatory bodies.

| Asset Class | Max Leverage | Regulator |

|---|---|---|

| Forex (Major Pairs) | 1:50 | CFTC / NFA |

| Forex (Minor Pairs) | 1:20 | CFTC / NFA |

| Forex (Exotic Pairs) | 1:10 | CFTC / NFA |

| Stocks | 1:4 (intraday) / 1:2 (overnight) | SEC |

| Futures (non-Forex) | 1:30 | CME |

Note: Not all instruments within the same asset category qualify for the highest leverage ratio. For instance, major currency pairs benefit from higher limits due to liquidity, while exotic or volatile assets are assigned lower ratios to mitigate risk.

Additionally, some products, such as forex spot trading, are more restricted in the U.S. compared to other regions. Traders often access these markets through regulated futures or index derivatives rather than traditional retail platforms.

2. How leverage works: A practical example

Imagine you start with $1,000 in your trading account.

- Without leverage: You buy $1,000 worth of EUR/USD

- With 50:1 leverage, you can control $50,000 of EUR/USD

Comparison: Leveraged vs Unleveraged

| Feature | Without Leverage | With 50:1 Leverage |

|---|---|---|

| Trade Size | $1,000 | $50,000 |

| 1% Price Move | $10 gain/loss | $500 gain/loss |

| Risk | Limited | Significantly Higher |

The principle is the same across different markets. Take stocks, for example: buying 50 Tesla shares at $200 each would normally cost $10,000. With 5:1 leverage, you’d only need $2,000 margin to hold the same exposure. A modest $10 rise per share now means a $500 profit, which is a 25% return on your margin, far greater than the 5% gain you’d have without leverage.

Cryptocurrencies often push this further. Imagine opening a 2 BTC position at $30,000 each. The full cost is $60,000, but with 20:1 leverage, you only put down $3,000. If Bitcoin climbs by 5%, that’s a $3,000 gain, effectively doubling your initial stake. Of course, a 5% drop would erase it just as quickly.

These illustrations show why leverage attracts traders: it makes small market moves meaningful. At the same time, they highlight why discipline and risk control are non-negotiable when trading with borrowed exposure.

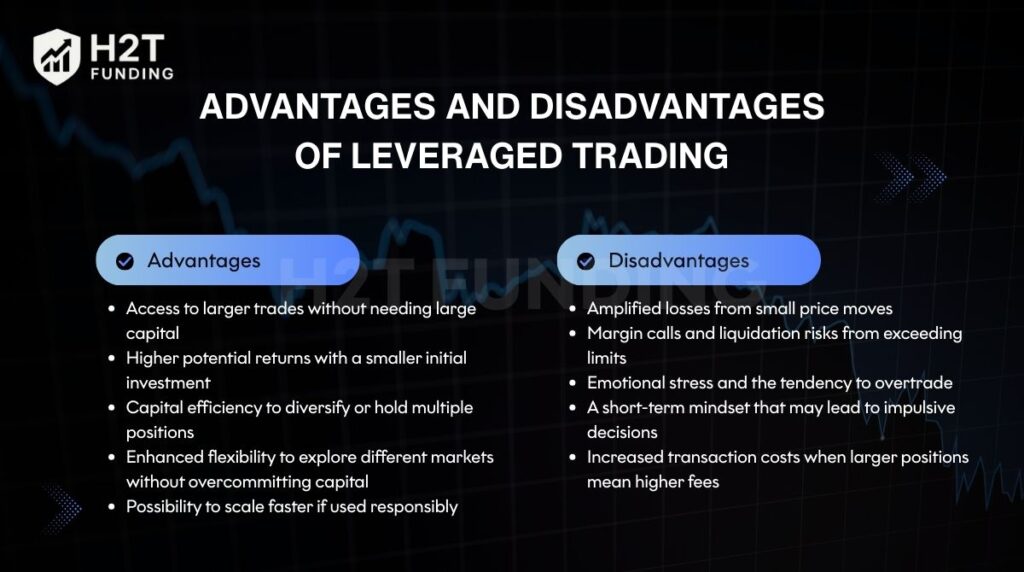

3. Advantages and disadvantages of leveraged trading

When asking what is leverage in trading, it’s important to look at both sides of the story. Leverage can give traders access to larger opportunities with limited capital, but it also increases the risks of losses if used carelessly. Understanding its pros and cons is the first step toward using it wisely.

3.1. Advantages

- Access to larger trades without needing large capital

- Higher potential returns with a smaller initial investment

- Capital efficiency to diversify or hold multiple positions

- Enhanced flexibility to explore different markets without overcommitting capital

- Possibility to scale faster if used responsibly

3.2. Disadvantages

- Amplified losses from small price moves

- Margin calls and liquidation risks from exceeding limits

- Emotional stress and the tendency to overtrade

- A short-term mindset that may lead to impulsive decisions

- Increased transaction costs when larger positions mean higher fees

In short, leverage can be either a growth engine or a trap. The difference lies in how you manage it. Responsible use, realistic expectations, and disciplined risk management will let you benefit from its strengths while minimizing the downsides.

4. Understanding margin calls and liquidation

Once you start trading with leverage, you’ll need to manage your margin levels carefully. This section explains key concepts like margin calls and liquidation to help protect your capital in volatile markets.

4.1. Maintenance margin and margin calls

If your account balance drops below the maintenance margin, your broker issues a margin call. At that point, you’ll need to add money or exit trades. Not taking action can result in your trades being liquidated.

Brokers often have strict policies on margin requirements. Knowing the difference between initial margin and maintenance margin is key to managing your trades safely.

4.2. What is liquidation?

Liquidation occurs when your losses consume your margin. The broker forcibly closes your trades to prevent further losses. This can happen faster than expected in volatile markets.

Tip: Always monitor your margin level and use stop losses.

See more related articles:

5. Risk management when using leverage

If you’re asking what leverage is in trading and how to use it safely, risk management is your answer. To succeed with leverage, you must approach it with discipline and structure. It’s not just about making trades, but managing risk like a professional.

5.1. Set stop-loss orders

Always decide your exit before entering a trade. For example, if you buy EUR/USD at 1.0800 with a 50-pip stop-loss, you know your maximum loss upfront. Combine this with a take-profit at 100 pips to keep a 1:2 risk-reward.

Tip: Place stop-loss levels at logical market points, like below recent support, not just at round numbers.

Continue reading: Trailing stop loss versus trailing stop limit: Key differences

5.2. Use proper risk-to-reward ratios

Successful traders rarely risk $1 unless they aim to make at least $2 or $3 in return. This 1:2 or 1:3 risk-to-reward ratio ensures that even with some losing trades, profitable ones can cover the losses. The key is consistency; apply the ratio to every setup, not just the trades you feel most confident about.

5.3. Position sizing strategies

Large positions can quickly drain your margin, leaving little room for error. Use formulas to calculate size:

Position Size = Account Balance x Risk % / Stop-Loss Distance

A common guideline is the 1% rule, risking only 1% (or max 2–3%) of your account on a single trade. This way, a losing streak won’t wipe you out, and you’ll have capital left to recover.

5.4. Diversify your exposure

Don’t put all your money into one trade, pair, or asset class. Spread risk across different instruments: currencies, commodities, or indices. Diversification reduces the impact of sudden shocks in any single market and creates a smoother equity curve over time.

5.5. Use demo accounts first

Test your strategies using demo accounts before applying leverage in live markets. It helps you feel more comfortable and in control. You’ll make fewer mistakes once you’ve practiced enough.

5.6. Control emotions and stay informed

Over-leveraging often comes from greed or fear. Keeping emotions in check is just as important as technical skills. Stay disciplined, avoid revenge trading, and never risk capital out of frustration. Also, be aware of economic announcements and market news; volatility from events can trigger unexpected losses if you are not prepared.

Managing leverage is keeping it at a level you can handle while giving your trades room to succeed. If you’re new, start small, test on demo accounts, and focus on building consistency. Once you master these basics, you’ll be ready to explore more advanced strategies with confidence.

6. Additional tips for smart leverage use

Leverage can be a powerful ally, but only if you know how to control it. Beyond the basics of stop-losses and position sizing, these practical tips will help you avoid common mistakes and use leverage more effectively.

- Start small and scale up: Begin with low leverage, such as 5:1 or 10:1, and increase gradually as your skills and confidence improve. Even professionals rarely use the maximum ratios brokers advertise.

- Avoid overleveraging: Controlling $100,000 with only $1,000 might sound attractive, but it leaves almost no room for error. Set clear personal limits that match your risk tolerance.

- Monitor volatility: Leverage is most dangerous during major events like economic data releases or earnings reports. Sudden spikes can wipe out positions faster than expected.

- Stay informed: Keep track of macro trends, central bank decisions, and technical signals. The more informed you are, the better you can adjust leverage to current market conditions.

Leverage rewards discipline but punish carelessness. By starting small, setting limits, and staying aware of the market environment, you can use it as a tool for growth instead of a shortcut to losses.

7. FAQs

If you trade with only $100, it’s best to start small, such as 5:1 or 10:1. This lets you open modest positions while keeping losses manageable. Using higher leverage on a small account often leads to margin calls very quickly.

A 1:500 leverage means every $1 in your account controls $500 in the market. With $100, you could open trades worth $50,000. While the potential profits are high, the risk of wiping out your margin is also extremely high.

With 20x leverage, your $100 gives you access to $2,000 in trading power. A 1% price move in the market would mean a $20 gain or loss, which equals 20% of your account. That’s why position sizing is critical when using leverage.

10x leverage means your capital is multiplied ten times in trading power. For example, $500 with 10x leverage lets you open a $5,000 position. Both gains and losses are magnified by the same factor.

Leverage is borrowed capital from your broker that lets you control bigger trades than your balance. For example, with $1,000 and 50:1 leverage, you can trade $50,000 worth of EUR/USD. A 1% change in price could mean a $500 swing in your account.

Leverage in crypto means borrowing capital to open larger positions. Exchanges may offer high ratios, such as 20x or even 100x. Because crypto is more volatile than currencies, the risk of rapid liquidation is much higher.

Yes. Especially in volatile markets or with unregulated brokers. However, many regulated brokers offer negative balance protection to cap your losses.

Not exactly. Leverage is a ratio. Margin is the actual amount you put up as collateral to access that leverage.

Yes, but it also increases losses. Leverage is a double-edged sword that should be used with care.

Leverage = Total Position Size / Account Equity Example: A $10,000 trade with $1,000 equity equals 10:1 leverage.

The broker could liquidate your trades automatically. This is known as liquidation. It protects the broker from losses but leaves you with diminished capital.

Usually no. Leverage is set when you open the trade. However, you can manually adjust exposure by adding or closing positions.

8. Conclusion

So, what is leverage in trading at its core? It’s a powerful tool, but also dangerous if misused.

Leverage in trading allows you to maximize opportunities. However, it comes with risks that can wipe out your account quickly if not handled with care. By understanding how leverage works, using proper risk management, and starting conservatively, you can trade with more confidence and less stress.

Next Steps:

- Begin with demo trading to build your foundation

- Study real-world cases of successful leveraged trades

- Start slow and grow as you learn the ropes.

Leverage is a tool. Use it wisely, and it can elevate your trading career. Abuse it, and it can end it.

You can read more practical tips and guides like this in the Strategy section and Prop Firm & Trading Strategies of H2T Funding. If you found this guide useful, share your thoughts or questions about leverage in the comments, and let us know how you manage risk in your own trading.