I used to feel blindsided every time an annual insurance premium or car maintenance bill came due. That was until I started using a sinking fund. Fast forward to today, I’ve paid off a $600 vet bill, a $1,200 car repair, and even a $2,000 vacation all in cash.

If you’re tired of dipping into your emergency fund or credit card for predictable expenses, this guide is for you. We’ll explore exactly what is a sinking fund, what sinking funds mean in budgeting, why it matters, and how to build one.

Let’s dive in.

Key Takeaways

- A sinking fund is a dedicated savings pot for planned, specific expenses, helping you avoid financial surprises and debt.

- Setting up a sinking fund involves choosing a goal, estimating costs, setting a target date, and dividing the total into manageable monthly amounts.

- Keeping your sinking fund in a high-yield savings account or sub-account ensures safety, liquidity, and better interest earnings.

- Automating contributions and tracking progress with tools like YNAB, Qapital, or simple spreadsheets increases consistency and motivation.

- Avoid common mistakes like mixing sinking funds with emergency savings, underestimating costs, or skipping regular reviews.

1. What is a sinking fund?

A sinking fund is a dedicated pot of money that you save up over time for a planned, specific expense. Unlike a general savings account, sinking funds are purposeful; they help you avoid financial surprises.

What does sinking funds mean in budgeting?

In budgeting, a sinking fund is a simple system to break down big, expected costs into smaller, manageable monthly amounts. Instead of scrambling when a bill comes due, you’ll already have the cash set aside.

“A sinking fund is your future self’s best friend,” says Rachel Cruze, personal finance author and speaker. “It keeps you out of debt and gives you financial peace.”

Why is it called a “sinking” fund?

The term “sinking fund” has its roots in corporate finance. Traditionally, businesses used a sinking fund as a strategic tool to gradually set aside money over time for a specific financial obligation, most commonly to repay bonds or long-term debt. The idea was that the company would “sink” small amounts of money into this fund regularly, thereby avoiding a large, sudden outflow of cash when the debt matured.

In this context, “sinking” refers to the methodical reduction of a financial liability. Companies might even buy back portions of their outstanding bonds before maturity using the money in the sinking fund, which helps manage debt levels and maintain investor confidence.

In personal finance, the concept is similar but applied to individual goals. A sinking fund is used to systematically save for a known future expense, such as a vacation, car repair, or annual insurance premium. Instead of tapping into emergency funds or going into debt when the expense arises, individuals “sink” money into this fund little by little, making the eventual cost easier to manage.

While both uses share the same fundamental principle, saving gradually for a known future expense, the key difference lies in the purpose:

- In business, a sinking fund primarily serves as a debt management strategy.

- In personal finance, it functions more as a budgeting tool to avoid financial strain or borrowing.

In both cases, the metaphor of “sinking” reflects the slow, steady movement of funds into a designated reserve, creating financial stability over time.

2. Sinking Fund vs Other Savings

Many people confuse what is a sinking fund with a regular savings or emergency fund. Understanding the difference helps you use your money more effectively.

| Feature | Sinking Fund | Savings Account | Emergency Fund |

|---|---|---|---|

| Purpose | Specific, planned expenses (e.g., holidays, bills) | General future needs or larger savings goals | Unplanned, urgent expenses (e.g., job loss) |

| Usage Timing | Known timing, used on or around a set date | Flexible, used whenever needed | Unpredictable, used only in emergencies |

| Examples | Car insurance, Christmas, vet bills | Vacation, home down payment | Medical emergencies, job loss, urgent repairs |

| Frequency of Contributions | Regular, based on goal deadline | Often irregular or flexible | Regular or one-time, depending on strategy |

3. Why you should use a sinking fund

Using a sinking fund offers several important benefits that can transform how you manage your finances. By proactively setting aside money for known future expenses, you gain greater control, reduce financial stress, and avoid common pitfalls. Here are the key reasons why incorporating a sinking fund into your financial plan is so valuable:

- Avoid debt for planned expenses: Use funds you’ve saved instead of relying on credit cards or loans, helping you stay debt-free.

- Improve financial control and peace of mind: Having money reserved for upcoming costs reduces stress and makes your finances more predictable.

- Make budgeting more realistic: Anticipating future expenses allows for more accurate monthly budgeting without surprises.

- Eliminate guilt when spending large amounts: Since the money is designated for specific purposes, you can spend confidently without feeling guilty or worrying about day-to-day cash flow.

View more: What is leverage in future trading

4. How to set up your own sinking fund (step-by-step)

Setting up a sinking fund is a smart way to save for future expenses without stress. Here is a simple step-by-step guide to help you create your own sinking fund and stay in control of your money.

Step 1: Choose the goal or expense

Decide what you’re saving for. Start with something concrete and realistic:

- Holiday travel

- Kids’ school supplies

- Annual car inspection

- New laptop

Example: Say you want to upgrade your phone next year.

Step 2: Estimate the total cost

Research the full cost of your goal. Don’t forget:

- Taxes

- Shipping

- Installation/setup fees

Example: New iPhone: $1,200 + $100 tax and setup = $1,300 total

Step 3: Decide on a target date

When do you need the money? Pick a clear, non-negotiable date.

Example: You want the phone by November – 10 months from now.

Step 4: Divide the total by the months remaining

Take your total and divide by the number of months left.

Example: $1,300 / 10 months = $130/month

That’s your monthly savings target.

Step 5: Pick the best storage option

Choose a safe, accessible place that won’t tempt you to dip in early:

- High-yield savings account (e.g., Ally Bank, Capital One 360)

- Cash envelopes (great for short-term, tangible goals)

- Sub-accounts within your main bank

“Using named savings buckets in your bank can mentally separate your money and reduce the temptation to spend it,” notes Erin Lowry, author of Broke Millennial.

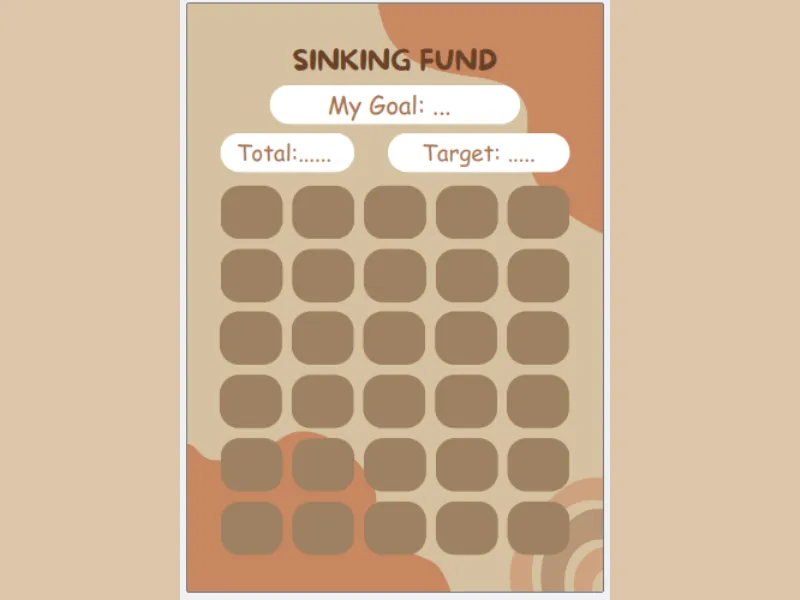

Step 6: Automate and Track Progress

To stay consistent with your sinking fund savings, automation and regular tracking are essential. Here are some popular tools that I recommend to help manage your budget effectively:

- YNAB (You Need A Budget): YNAB is a popular budgeting app designed to give every dollar a job, helping users take control of their finances. Key features include real-time syncing across devices, goal tracking, detailed financial reports, and debt payoff planning. YNAB also provides educational resources to build better money habits. Security is a top priority, with bank-level encryption and multi-factor authentication protecting your data.

- Qapital: This app focuses on automated, goal-based savings by allowing users to set up custom rules such as rounding up purchases or scheduled transfers. Highlights include customizable savings goals, spending insights, and unique integrations like Apple Health rewards. Qapital secures user data with 256-bit SSL encryption and ensures deposits are FDIC insured up to $250,000.

- Google Sheets or Notion Templates: These flexible platforms let you create or use pre-made budgeting templates tailored to your personal needs. Both offer free versions with optional paid plans that unlock advanced features. You can customize layouts, track multiple savings goals, and share your sheets with family or financial advisors. They also support integration with other apps via add-ons or APIs.

- Printable Templates: For those who prefer a hands-on, offline approach, printable trackers offer a straightforward way to monitor savings progress visually. These templates are usually free or low-cost downloads. The physical act of filling them out can increase motivation and provide a satisfying sense of accomplishment. Plus, they require no internet or device, offering complete privacy and simplicity.

- Additional Tip: To stay on track, set calendar reminders to review your progress monthly. Coloring in a printable tracker or updating your app’s progress bar can provide a visual boost to motivation, reinforcing the habit of saving steadily over time.

Set calendar reminders to track progress monthly. You can also color in a printable tracker for motivation.

5. Types of sinking funds to consider

Here are some smart ideas:

- Annual bills: insurance, subscriptions, HOA dues (HOA – Homeowners Association)

- Home & car maintenance: oil changes, air conditioner repairs, gutter cleaning

- Technology upgrades: laptops, phones, tablets

- Celebrations: birthdays, weddings, Christmas, graduations

- Back-to-school costs: uniforms, supplies, activity fees

Pro Tip: Start small. Once you understand what a sinking fund is doing for your finances, you’ll want to expand.

See more related articles:

6. Common mistakes to avoid when using a sinking fund

- Mixing It with Emergency Savings: Keep these separate. Use different accounts or at least label them clearly.

- Underestimating the True Cost: Always overestimate. Add 10–15% buffer for taxes, inflation, or surprises.

- Skipping Monthly Reviews: Set a reminder. Review goals every month or quarterly at a minimum.

- Giving Up Too Soon: Consistency beats perfection. If you fall behind, adjust, not abandon.

“Good budgeting isn’t about being perfect,” says Tiffany Aliche, The Budgetnista. “It’s about being consistent and kind to yourself.”

7. FAQs

A sinking fund is a way to save money for a planned expense by putting aside small amounts regularly.

Absolutely. In fact, it’s best to have different sinking funds for different goals.

You should keep your sinking fund in a high-yield savings account or a bank account that supports sub-savings, such as Ally or Capital One 360. These accounts offer safety by being FDIC insured, ensuring your money is protected. They also provide high liquidity, allowing easy access when you need funds without penalties.

No. A sinking fund is for expected expenses; an emergency fund is for surprises like job loss or medical bills.

You can either delay the purchase or find ways to increase your contributions temporarily.

Yes. Try apps like You Need A Budget (YNAB) or Qapital to organize and automate your savings.

To keep your motivation high while building an emergency fund, divide your overall goal into manageable steps and track your progress regularly. Automate contributions to stay consistent, and give yourself small rewards when you hit key milestones. You can also look for ways to cut spending or earn extra income to accelerate your savings.

8. Conclusion

Learning what is a sinking fund changed how I budget and how I live. I no longer dread annual expenses or feel guilty for enjoying a vacation. Instead, I prepare in advance and enjoy the payoff debt-free.

Start today: pick one goal and follow the steps above. You’ll quickly see how this one habit creates a ripple effect of financial calm.

Liked this guide?

- Save this post for reference

- Share your journey below: What sinking fund will you start first?

Learn more about managing your finances by exploring the Strategy Section and Budgeting Strategies on H2T Funding.