You’ve decided to start trading, and that’s exciting! You might be feeling a mix of anticipation and nerves, but one term keeps popping up: “What is a broker in trading?” It might sound complicated, and you’re not quite sure what it is, but you know you need one.

Don’t worry. H2T Funding will explain this in plain language, with no confusing jargon. Think of a broker as your personal ticket agent for the world of finance. They’re the ones who get you a seat at the big game. This guide will show you exactly what they do and how to find a good one you can trust.

Key takeaways:

- What is a broker in trading is a broker is your essential link to the financial markets, helping you trade assets.

- Main functions: They are responsible for processing your orders, providing a trading platform, and managing your account.

- Broker types: There are different types of brokers (full-service, discount, specialty) to fit various needs.

- Trading costs: Understand how brokers charge fees via commission or spreads to manage your budget effectively.

- Choosing a broker: Always evaluate a broker’s license, costs, platform, and reputation before you decide.

1. What is a broker in trading?

In finance, a broker is an individual or firm that acts as an intermediary, connecting investors to financial markets. They are the bridge that allows you to buy and sell assets like stocks, bonds, or currencies, as you cannot trade directly on exchanges. Brokers execute your buy/sell orders and typically charge a commission or spread for their services.

For example: If you want to buy shares of a company, you’ll place an order through a brokerage firm (which is your broker). This firm will then execute the purchase of those shares on the stock exchange for you.

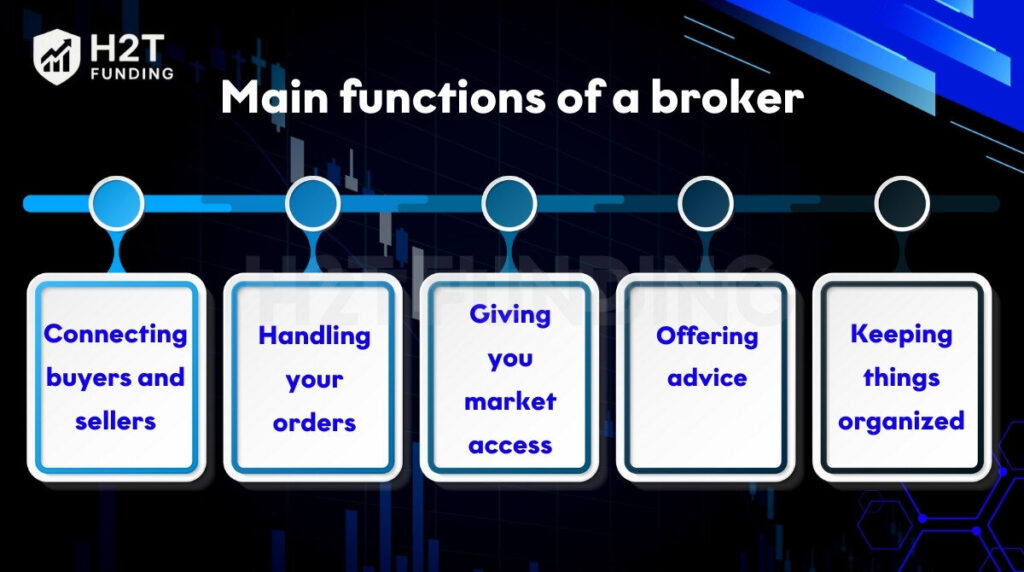

2. Main functions of a broker

Honestly, I often think of brokers as the unsung heroes of finance, quietly making our trading dreams a reality. While not mystical, their role is incredibly vital, involving a few key tasks that make trading possible for you and me.

- Connecting buyers and sellers: This is their core function. They’re the ultimate matchmakers of the financial world. When I’m eager to buy a stock, I find a seller. When I’m ready to sell, they find a buyer. It’s pretty amazing how seamlessly they link us to the vast, bustling market.

- Handling your orders: There’s such a relief when you hit ‘buy’ or ‘sell’ and know someone competent is handling all the complicated “behind-the-scenes” work. It’s more than a click; it’s a precise process of sending your order to the right place, ensuring it’s filled correctly and fast. I’d be utterly lost without them!

- Giving you market access: They are, quite simply, your official entry pass. Trying to trade without a broker is impossible! A good broker provides that essential connection and, critically, the platform you need to get into the market and start trading. It’s truly empowering.

- Offering advice: This gets interesting. Some more expensive brokers offer personalized advice. While tempting, I find most online brokers today excel at executing orders efficiently, leaving the exciting (and sometimes daunting) investment decisions squarely in your hands.

- Keeping things organized:

- Let’s be real, managing finances can be a headache. But brokers are brilliant at keeping everything neat. They manage your account, track your money, show profits and losses, and provide statements for your records. It truly feels like having a personal financial filing cabinet.

- And speaking of organization, it reminds me how vital it is to understand how to track expenses related to your trading activities, something a good broker’s statements make much easier.

3. Compare the broker’s role in trading and investing

A broker’s job isn’t one-size-fits-all. Their role and what you need from them changes dramatically depending on whether you’re trading for a quick profit or investing for the long haul.

3.1. The broker’s role for a trader

As an active trader, I feel like a sprinter, and that’s why a broker’s role is all about speed and efficiency for me.

- Executing trades instantly: This is crucial. When I hit ‘buy’ or ‘sell,’ I need those orders filled in a flash. Any delay means missed opportunities or losses, and that’s a frustration no active trader wants!

- Providing a fast platform: My trading platform is my cockpit. It must be quick, reliable, and never crash when the market gets wild. A good broker ensures their software handles the chaos, giving me confidence to act decisively.

- Offering tools for quick analysis: For sprinters like us, every second counts. A broker’s platform needs excellent charts and tools for lightning-fast decisions. I’m talking real-time data that helps me spot trends before they vanish, informing my overall approach, especially as I refine my best trading strategy for beginners.

3.2. The broker’s role for an investor

For a long-term investor, the broker’s role is more about choice and security.

- Facilitating simple transactions: Their main job is to make buying and holding assets easy and cheap over many years.

- Providing a huge selection: They give you access to a wide variety of stocks, funds, and other assets to build a diverse portfolio.

- Offering research: Many provide reports and analyses to help you decide which companies are good to invest in for the future.

- Managing accounts: They help you manage things like retirement accounts and provide clear statements for your records.

Read more:

4. The main types of brokers

Not all brokers are created equal. They generally fall into a few different categories based on the level of service they provide.

Here are the main types of brokers in trading:

4.1. Full-Service Brokers (Advisory Brokers)

Offer a comprehensive suite of services, including personalized investment advice, financial planning, portfolio management, retirement planning, market research, and access to a wide range of investment products (stocks, bonds, mutual funds, etc.). They may even offer estate planning and tax advice.

- Cost: Typically charge higher commissions and/or fees (e.g., a percentage of assets under management) due to the extensive services provided.

- Best for: Investors who are new to the market, have significant assets, prefer a hands-off approach to managing their investments, or require in-depth financial guidance. Examples include major financial institutions like Morgan Stanley or Goldman Sachs.

4.2. Discount Brokers

Primarily focus on executing trades at lower costs. They provide a platform for investors to make their own trading decisions and execute orders. While they may offer some research tools and educational resources, they generally do not provide personalized investment advice.

- Cost: Charge lower commissions per trade (sometimes even commission-free for stocks and ETFs) or minimal fees.

- Best for: Experienced investors who are comfortable making their own investment decisions, self-directed traders, or those with smaller portfolios who want to keep costs low. The rise of online trading has led to an explosion of discount brokers.

4.3. Deep Discount Brokers

Offer a bare-bones approach, focusing solely on trade execution with the lowest possible fees. They provide minimal support or additional features.

- Cost: Rock-bottom pricing, ideal for high-volume traders who prioritize cost efficiency above all else.

- Best for: Very experienced and active traders who need quick and cheap trade execution and don’t require any advisory services.

4.4. Online Brokers

These are essentially how most discount brokers operate today. They provide digital platforms (websites and mobile apps) for investors to execute trades, monitor portfolios, access market information, and conduct research independently.

- Advantages: Convenience (trade from anywhere, anytime), lower costs, and access to a wealth of information and tools.

- Considerations: Lack of personalized assistance, potential for technical glitches, and requires investors to be self-disciplined and knowledgeable.

4.5. Traditional Brokers (Offline Brokers)

These are more aligned with the old-school way of trading, involving direct interaction with a human broker via phone calls or in-person visits. They often come with physical branches.

- Advantages: Personalized guidance, human touch, and comprehensive services beyond just trading.

- Considerations: Slower trade execution, higher fees, and less control for the investor. While less common for everyday retail trading, some investors still prefer this for complex transactions or strong personal relationships.

4.6. Institutional Brokers

Work with large institutional clients such as mutual funds, pension funds, hedge funds, and corporations.

- Services: Provide specialized services tailored to the needs of large investors, including large-block trade execution, prime brokerage services (lending securities, custodial services), and advanced analytics.

- Focus: Handling significant investments and executing complex, high-volume trades.

4.7. Stock Brokers

Act as an intermediary, executing the buying and selling of stocks on behalf of investors. Different types of stock brokers offer varying levels of service and cost.

- Cost: Varies widely depending on the type of broker, ranging from very low (trade execution only) to high (including advisory and portfolio management fees).

- Best for: All types of investors, from beginners who need detailed guidance to experienced professionals who simply need a platform to execute buy/sell orders.

4.8. Specialty Brokers

Specializing in specific markets or asset classes is a very smart move. It allows you to dive deep into what you’re passionate about. Here’s a breakdown of some of the most common types:

- Forex brokers: So, what is a broker in forex trading? It’s your essential partner for accessing the foreign exchange market. They’re the ones who give you the platform and tools to buy and sell currencies, acting as your crucial link to the market.

- Commodity brokers: These are your go-to guys for executing orders for commodities like oil, gold, and agricultural products.

- CFD brokers: Provide access to contracts for difference, allowing you to speculate on price movements without actually owning the underlying asset. It’s a completely different way of trading.

- Futures brokers: As the name suggests, they specialize in futures contracts.

When choosing a broker, it’s not just about a list of features; it’s about finding a true partner for your trading journey. You have to assess your own needs, investment style, budget, and desired level of support.

For example, if you’re seriously considering a prop trading firm, it’s essential to understand how to choose a prop firm. Similarly, for those interested in trading challenges, I’d say you absolutely must look into how to pass FTMO challenge.

5. Examples of brokers

Okay, so we’ve talked about what brokers are. But it helps to see some real-world examples. You’ve probably seen some of these companies advertised.

Just to be clear, this is not a recommendation list! These are just well-known examples to show you how different brokers focus on different types of customers.

- For the beginner getting started: Think of apps like Robinhood. They made trading popular because their app is super simple to use and has a very friendly design.

- For the long-term investor: Big names like Fidelity or Charles Schwab. They are like the giant department stores of investing, offering everything from retirement accounts to financial planning advice.

- For the serious, active trader: Companies like Interactive Brokers. They are built for professionals, with advanced tools and access to markets all over the world, but their platform can be more complex for a newcomer.

You can see how they all have their own specialty. That’s why choosing one depends entirely on your personal goals.

6. How do they get paid?

Brokers are businesses, so they need to make money. It’s important you know how, so you can keep your costs low.

6.1. The spread: The small service fee hidden in the price

This is the most common fee. It’s a tiny difference between the buying price and the selling price.

Simple example: If a broker lists a price as Buy: $1.01 / Sell: $1.00, that 1-cent difference is the “spread.” They make that tiny amount on every transaction. It’s their profit, baked right into the price you see.

6.2. Commission: The clear, upfront fee

Some brokers don’t use a hidden spread. Instead, they charge a small, transparent fee for each trade, like $1. This way, you always know exactly what you’re paying.

Here’s some honest advice: Never blindly trust a “commission-free” service. Sometimes, paying a small, clear commission is actually much cheaper than using a service with higher hidden fees (a wider spread). I personally believe that understanding these kinds of hidden costs is a key skill, especially when you’re learning how to budget on a low income.

View more:

7. The 7-point checklist for choosing a good broker

This is the most important section. Choosing a bad broker is like building a house on a shaky foundation. My personal advice? Always check them out carefully, without cutting any corners.

- License and regulation: This is your #1 safety check, no exceptions. Is the broker licensed by a major government body? You wouldn’t put your life savings in an unlicensed bank, would you? The same rule applies here.

- Clear costs: Do you understand exactly how they charge you? If their fee structure is confusing and full of fine print, it’s a massive red flag. Don’t be afraid to ask for clarity.

- Easy-to-use platform: I always say the platform is your steering wheel; if you aren’t comfortable with it, you’re not in control. Try their free “demo” or “practice” account first to see if it feels right.

- Good customer service: Can you talk to a real person, fast? If you ever have a problem with your money, you don’t want to be stuck with a helpless chatbot. My advice? Test their live chat or phone support before you ever sign up.

- The right products: Do they actually offer the things you want to trade? (e.g., specific stocks, gold, etc.). If they don’t have what you’re looking for, they’re not the right fit for you.

- Easy deposits & withdrawals: Can you get your money out easily? Withdrawing your profits should be simple and fast. A slow or complicated withdrawal process is a major warning sign you should never ignore.

- Good reputation: Be a detective. What are other real people saying about them online? Look for reviews on sites like Reddit or Trustpilot, not just the fancy ads on their own website.

Remember, finding the right broker is a crucial step toward achieving your financial goals. That’s why it’s a good idea to know how to set financial goals from the very start.

8. FAQs

A broker acts as an intermediary, connecting you to the financial markets to execute your buy and sell orders for various assets like stocks, bonds, or currencies.

Generally, no, for most retail investors. Brokers provide the necessary access to exchanges where securities are bought and sold. While direct access for institutional players exists, individual traders typically need a broker.

You need a broker because they provide the platform, technology, and regulatory compliance required to place trades on public exchanges. They handle the complex process of matching your orders with other buyers or sellers.

A trader is an individual or entity who buys and sells financial instruments for their own account, aiming to profit from price movements. A broker is a firm or person who facilitates those trades on behalf of clients, usually earning commissions or fees.

No, brokers don’t inherently make you money. They provide the means to trade, but your profit or loss depends on your investment decisions and market performance. Brokers make money through fees, commissions, or spreads charged on your trades.

Yes, for individual investors, you absolutely need a broker to trade stocks. Stock exchanges are not directly accessible to the public; brokers provide that essential gateway.

There’s no single best stockbroker, as it depends entirely on your individual needs. Factors to consider include your experience level, trading frequency, desired investment products, fee sensitivity, and the tools/research you require.

A person who buys and sells stocks is typically called a trader or an investor. If they do it professionally on behalf of others, they might be referred to as a stockbroker or financial advisor.

9. Conclusion

So, what is a broker in trading? Simply put, they are your necessary partner. They are the company that gives you the key to unlock the door to the financial markets.

Your success and safety as a trader start with this one choice. Take your time, do your homework using the checklist above, and choose a partner you feel good about. The best way to learn is by doing, so go open a free practice account and get a feel for how it all works. You’ve got this.

Read more useful information at H2T Funding’s Strategies: Prop Firm & Trading Strategies.