The first big question for a new trader isn’t what to trade, but how. You’re immediately hit with dozens of styles: day trading, swing trading, and scalping. It’s easy to get stuck right there.

So, we built this guide at H2T Funding to break down 17 main types of trading strategies across forex, crypto, and stocks, showing how each works in real market conditions. Instead of guessing or copying others, you’ll learn how to match a strategy with your personality, risk tolerance, and available time. By the end, you’ll have a clear starting point and a practical framework to test the strategy that fits your trading goals.

Key takeaways

- A trading strategy is a structured set of rules guiding when to enter, manage, and exit trades, helping traders avoid emotional decision-making.

- The best trading strategy depends on the trader, not the market; your personality, risk tolerance, schedule, and goals dictate the right fit.

- Short-term strategies (scalping, day trading, breakout, momentum) require high focus, fast execution, and strong emotional control.

- Medium- to long-term strategies (swing, position, trend, fundamental, carry trade) favor patience, lower stress, and structured analysis.

- Advanced methods like algorithmic trading, arbitrage, and pairs trading offer unique edges but require technical expertise and robust tools.

- Successful execution of any strategy relies on three pillars: risk management, proper position sizing, and strong trading psychology.

1. What is a trading strategy (and why do you need one)?

A trading strategy is simply your personal set of rules for the market. It answers the question, What exactly needs to happen for me to enter or exit a trade? Without clear rules, you’re not really trading; you’re just reacting to the market’s noise based on feelings like fear or greed.

It’s also easy to confuse specific active trading strategies with broader types of trading styles. Your style is the big picture, like deciding if you’re a day trader who finishes by 4 PM or a swing trader who holds positions for a week.

Your strategy, on the other hand, is the specific checklist you follow before you ever click the mouse. It’s the how behind your trades.

2. Top 17 types of trading strategies

Alright, let’s get into the strategies themselves. To keep things from getting overwhelming, we’ve broken down 17 of the most common approaches into four logical groups. This will help you see how they connect and find the category that feels most natural to you.

- Scalping trading

- Day trading

- End-of-day trading

- Swing trading

- Position trading

- Trend trading

- Range trading

- Breakout trading

- Reversal (mean reversion) trading

- Momentum trading

- Gap trading

- News trading

- Fundamental trading

- Carry trad

- Algorithmic trading

- Arbitrage

- Pairs trading

Scroll down to dive into each strategy and find the one that fits your trading style.

2.1. Strategies grouped by timeframe

This is the best place to start. The simplest way to filter through different strategies is by asking one question: How long do I plan to be in a trade? The answer, whether it’s minutes or months, will shape your entire approach to the market.

2.1.1. Scalping trading

Scalping is the fastest form of active trading. Scalpers are in and out of the market in minutes, sometimes even seconds. The goal isn’t to catch a big trend; it’s about skimming dozens of tiny profits throughout the day.

This style demands intense focus and quick decision-making. It works best in markets with high liquidity and low trading costs, as a few pips can make or break a trade.

To execute this approach effectively, scalpers must also clearly understand how leverage works, as it can significantly amplify both gains and losses when trading at such high speed.

2.1.2. Day trading

As its name suggests, day trading involves opening and closing all your positions within the same day. The hard rule is no overnight exposure, which eliminates the risk of news gaps forming against you while you sleep.

Day traders concentrate on the market’s intraday rhythm, typically making a handful of well-planned trades rather than the constant activity of a scalper.

Because of this, many beginners often ask can you make a living as a day trader, given the discipline, capital, and consistency it requires.

2.1.3. End-of-day trading

For those who can’t watch the screen all day, end-of-day trading offers a calmer alternative. Decisions are made based on the price action around the market close.

A trader analyzes how the day ended and then places a trade meant to be held for at least 24 hours. This approach requires far less screen time, but it still demands a disciplined daily routine.

To apply this method effectively, traders need to know how to understand trading charts so they can accurately interpret price behavior at the close of each session.

2.1.4. Swing trading

Swing trading is the art of catching a market swing over a period of a few days to several weeks. It’s a popular middle ground. You’re not glued to your chair like a day trader, but you’re more involved than a long-term investor. This style gives you more time to think through your trades and is less affected by the market’s short-term noise.

2.1.5. Position trading

Position trading is the longest-term approach, where trades can last for months or even years. This is less about short-term chart patterns and more about a pure trend following approach, focusing on major, long-term market trends.

A position trader might buy into a market based on fundamental shifts in an economy and hold on through the many ups and downs along the way. This long-term view is sometimes confused with investment techniques like dollar-cost averaging, but position trading remains an active strategy focused on major trends.

Because trades are held for such extended periods, position traders must clearly understand what a broker is in trading to ensure they choose a reliable intermediary for long-term market exposure.

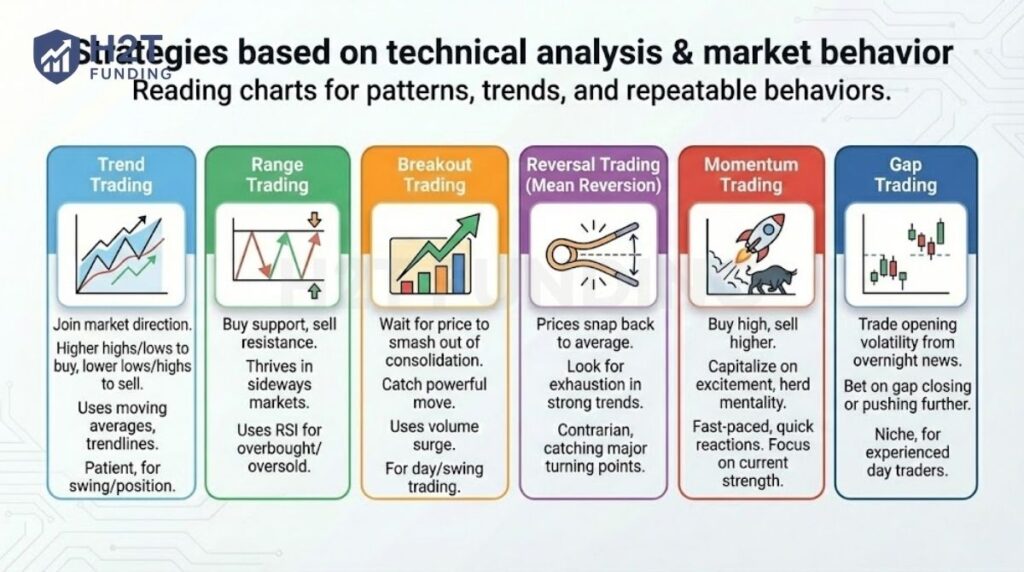

2.2. Strategies based on technical analysis & market behavior

This next group of strategies is all about reading the trading charts. Traders using these methods believe that all the information they need is reflected in a market’s price action. They look for patterns, trends, and repeatable behaviors to find their trading opportunities.

2.2.1. Trend trading

Instead of predicting the future, you focus on a market that’s already moving in a clear direction and join the momentum. If the market is making higher highs and higher lows, you seek opportunities to buy. If it’s forming lower lows and lower highs, you watch for setups to sell.

Trend traders often use tools like moving averages to confirm the direction of the underlying market trends. It’s a patient approach that works well for swing trading and position trading, as the goal is to ride the trend for as long as it lasts.

To better identify and confirm these directional moves, traders often rely on trendlines in trading to visualize and validate the strength of an ongoing trend.

2.2.2. Range trading

Not all markets are trending. Often, a price will get stuck between a clear floor (support) and a ceiling (resistance), bouncing between them like a pinball. Range traders love this. Their plan is straightforward: buy near the support level and sell near the resistance level.

This strategy thrives in quiet, sideways markets where there’s no clear winner between buyers and sellers. Traders often use specific trading indicators like the Relative Strength Index (RSI) to help identify overbought conditions near the top of the range and oversold conditions near the bottom.

2.2.3. Breakout trading

While range traders work inside the box, breakout traders wait for the price to smash out of it. They look for these periods of consolidation and place their bets on the direction of the eventual breakout. The goal is to catch the powerful move that often follows, right as a new trend begins.

A surge in trading volume is often the key signal they look for, confirming that the move has real conviction behind it. This is a popular strategy for both day trading and swing trading because it focuses on capturing moments of high volatility.

2.2.4. Reversal trading (Mean reversion)

Reversal trading is built on the idea that prices can only stretch so far from their average before they snap back, much like a rubber band. Reversal traders actively look for signs of exhaustion in a strong, established trend, aiming to enter a trade right as it starts to turn around.

It’s a contrarian approach that requires a strong stomach, as you are essentially stepping in front of a moving train. However, successfully catching a major market turning point can be one of the most profitable forms of trading.

2.2.5. Momentum trading

Momentum trading is about finding the strongest asset in the market and jumping on board. The motto isn’t buy low, sell high. It’s buy high, and sell even higher. You’re capitalizing on the excitement and herd mentality that is currently driving a price aggressively in one direction.

This is often a fast-paced strategy that requires quick reactions. Momentum traders aren’t concerned with an asset’s long-term value; they only care about its current strength and whether they can ride that wave before it fizzles out.

2.2.6. Gap trading

A gap occurs when a market opens significantly higher or lower than its previous closing price, often due to overnight news. This leaves a blank space, or gap, on the price chart. Gap traders specialize in trading this opening volatility.

They might bet that the price will reverse and close the gap, returning to the previous day’s level. Others may expect the initial shock to push the price even further in the same direction. It’s a niche technique almost exclusively used by experienced day trading specialists.

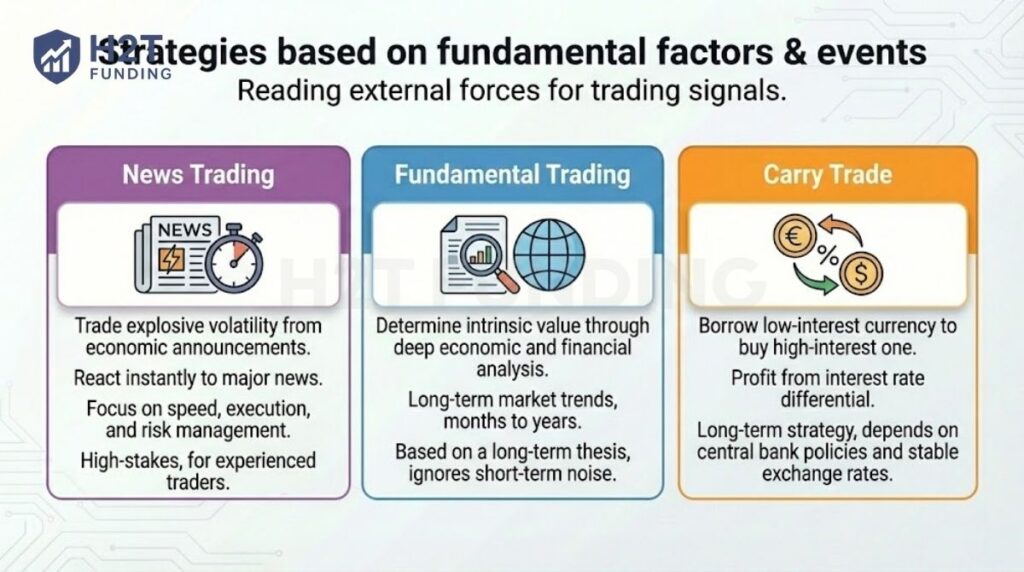

2.3. Strategies based on fundamental factors & events

This group of strategies steps away from the charts and looks at the real world for trading signals. Instead of focusing on price patterns, these traders are concerned with economic reports, interest rates, and geopolitical news. They believe that an asset’s true value is driven by these external forces.

2.3.1. News trading

News trading is a specialized form of active trading that thrives on chaos. Traders prepare for major economic announcements, like interest rate decisions or jobs reports, and trade the explosive market volatility that follows. The goal is to react instantly, as the most significant moves happen in the first few seconds and minutes after the release.

This is not about technical analysis; it’s about speed, execution, and having an iron-clad risk management plan. Spreads can widen dramatically, and slippage is common, making news trading a high-stakes game reserved for experienced traders who can stay calm under immense pressure.

2.3.2. Fundamental trading

Fundamental trading is about being a financial detective. A trader digs deep into the economic health of a country or the financial statements of a company to determine an asset’s intrinsic value. They believe that in the long run, the price will reflect this underlying value, regardless of short-term noise.

This strategy informs the long-term market trends and requires a much longer investment horizon. Instead of chasing quick profits, a fundamental trader builds a long-term thesis and may hold a position for months or even years. The approach is the foundation of most position-trading styles.

2.3.3. Carry trade

Primarily used in the Forex market, the carry trade is a unique strategy focused on earning interest. The idea is to borrow a low-interest currency (such as the Japanese Yen) and use it to buy a higher-interest one (like the Australian Dollar).

The trader profits from the interest rate differential, essentially getting paid to hold the position. This long-term strategy depends on strong fundamental analysis of global central bank policies. The approach can be highly profitable as long as the exchange rate between the two currencies remains relatively stable.

2.4. Advanced & quantitative strategies

These are not your typical chart-reading strategies. They are highly specialized methods, like pair trading and arbitrage, often used by hedge funds and proprietary trading firms to gain a very small, but consistent, edge over the market.

2.4.1. Algorithmic trading (High-Frequency Trading – HFT)

This isn’t a single strategy, but a method of execution. Algorithmic trading uses computer programs to place trades based on predefined rules. It removes human emotion and can analyze and react to market data far faster than any person could.

The most extreme version is high-frequency trading (HFT), where firms use incredibly powerful computers to execute millions of orders in fractions of a second. They often profit by exploiting tiny price discrepancies or by providing liquidity to the market through advanced methods like market making.

2.4.2. Arbitrage

Arbitrage is the closest thing to a risk-free trade in finance. The goal is to profit from a price difference in the same asset across two different markets. Imagine buying a stock for $100.00 on the New York Stock Exchange and simultaneously selling it for $100.01 on another exchange.

These opportunities are incredibly small and last for mere milliseconds before they are found and closed. For this reason, arbitrage is almost exclusively the domain of high-speed algorithmic traders.

2.4.3. Pairs trading

In pairs trading, the goal is to find two assets that are normally joined at the hip, like two major oil companies, and trade the temporary breakdown in their relationship. If Shell’s stock soars while BP’s lags, for example, a trader might short Shell and buy BP.

The profit doesn’t come from predicting where the oil market is headed. Instead, the bet is simply that the historical connection between the two stocks will pull back together, earning a profit from their convergence.

3. Quick comparison: Which strategy is right for you?

We’ve covered a lot of ground. To make it easier to see how all 17 strategies stack up, we’ve put them into a simple comparison table. Use this as a quick filter to see which approaches align with your available time, your comfort with risk, and your current skill level.

| Strategy | Best For… | Pros | Cons |

|---|---|---|---|

| 1. Scalping | Full-time traders in highly liquid, volatile markets. | High volume of opportunities; no overnight risk; quick feedback on trades. | Extremely high stress; very sensitive to trading costs & spreads; requires constant focus. |

| 2. Day Trading | Traders who can dedicate full days to intraday volatility. | Avoids overnight risk; multiple opportunities in one session; clear end to the day. | Mentally draining; vulnerable to choppy, directionless markets; requires high discipline. |

| 3. End-of-Day | Part-time traders with a consistent daily routine. | Low time commitment (30-60 mins); avoids intraday noise; less stressful. | Fewer trading opportunities; positions are exposed to overnight news gaps. |

| 4. Swing Trading | Balanced traders in moderately trending markets. | Captures larger price moves; more time for decisions; less screen time needed. | Exposed to weekend and overnight risk; requires patience to let trades develop. |

| 5. Position Trading | Patient, long-term thinkers are focused on major economic trends. | Very low stress; huge profit potential from major market trends; rides out minor volatility. | Capital is tied up for long periods; it must endure significant drawdowns. |

| 6. Trend Trading | Patient traders who can identify and follow a clear market direction. | Simple, clear logic (follow the leader); can be extremely profitable in strong trends. | Prone to failure and whipsaws in sideways markets; requires discipline not to exit early. |

| 7. Range Trading | Traders who thrive in quiet, consolidating, or sideways markets. | Works when most other strategies fail; has very clear entry and exit points. | Sudden breakouts can cause large losses; it can be tedious waiting for the price to move. |

| 8. Breakout Trading | Decisive traders who can act on sudden bursts of volatility. | Enters at the very start of a new trend; high profit potential from strong moves. | High rate of false breakouts that quickly reverse; requires fast execution. |

| 9. Reversal Trading | Contrarian traders with strong analytical skills and nerve. | Excellent potential risk-to-reward ratios; can catch major market turning points. | High psychological pressure (trading against the crowd); very difficult to time correctly. |

| 10. Momentum | Fast-reacting traders who can handle extreme volatility. | Capitalizes on strong market emotion; can generate profits very quickly. | Very high risk (catching a falling knife); requires precise timing to get out. |

| 11. Gap Trading | Specialized day traders focused on market opening volatility. | Capitalizes on clear price imbalances; opportunities are defined and are quick. | Extremely fast-paced and risky; often requires specialized pre-market data. |

| 12. News Trading | Extremely fast traders who can manage chaotic market conditions. | Profits from the most volatile moments in the market; action is predictable (by time). | Extremely high risk of slippage and wide spreads; requires institutional-grade speed. |

| 13. Fundamental | Analytical, long-term thinkers with a macroeconomic view. | Based on tangible economic data, it provides strong conviction for long-term holds. | It can take a very long time for a thesis to play out; it ignores short-term sentiment. |

| 14. Carry Trade | Long-term Forex traders focused on interest rate differentials. | Can earn a positive income (swap) just for holding a position. | Vulnerable to sudden changes in interest rate policy or exchange rate volatility. |

| 15. Algorithmic | Programmers and quantitative analysts with strong backtesting skills. | Removes emotional trading; executes with speed and precision 24/7. | Requires significant technical skill to build and maintain; can fail spectacularly if flawed. |

| 16. Arbitrage | Quantitative firms with high-speed technology and market access. | Theoretically risk-free when executed perfectly. | Opportunities are microscopic and last for milliseconds; they require huge capital and tech. |

| 17. Pairs Trading | Statistical thinkers looking for market-neutral profits. | Market-neutral (unaffected by overall market direction); based on statistics. | Requires complex analysis to identify pairs; correlations can break down unexpectedly. |

Seeing everything laid out like this makes one thing clear: there is no best strategy, only what’s best for. You might already see a few that seem like a good fit, and others you can immediately cross off your list. This table is your starting point.

Before choosing a strategy, make sure it aligns with prop firm rules, as these can directly limit how you trade.

4. Trading strategies in forex, crypto, and stocks: What’s the difference?

Many trading strategies can technically be applied across all markets. Scalping, swing trading, trend trading, or position trading exist in forex, crypto, and stocks alike. However, the way these strategies are executed and the stress they create can feel completely different depending on the market.

Each market has its own structure, trading hours, liquidity, and volatility profile. From experience, most traders don’t fail because their strategy is bad, but because they chose a market that doesn’t fit their temperament or lifestyle.

| Market | Trading hours | Volatility | Liquidity | Strategies that fit best | Key considerations |

|---|---|---|---|---|---|

| Forex | 24/5 | Medium | Very high (major pairs) | Scalping, day trading, trend trading, carry trade | Tight spreads, high leverage, and strict risk management are required |

| Crypto | 24/7 | Very high | Uneven (depends on coin) | Momentum, breakout, swing trading | Sudden news moves, emotional markets, and strong risk control are needed |

| Stocks | Fixed exchange hours | Low–medium | High (large caps) | Swing trading, position trading, and fundamental trading | Earnings, company news, lower leverage |

A common pattern seen among newer traders is starting in crypto because of the excitement, then moving to forex or stocks once they realize consistency matters more than adrenaline. On the flip side, traders who enjoy structure and routine often feel most comfortable in forex, while long-term thinkers naturally gravitate toward stocks.

The most important lesson is this: don’t force a strategy into a market just because others are profitable there. If you can’t watch charts all day, active intraday strategies will eventually wear you down. If high volatility keeps you up at night, crypto will quickly become a liability instead of an opportunity.

The right combination of market and strategy should feel demanding, but sustainable. When it fits, trading becomes a process you can repeat calmly, not a constant emotional battle.

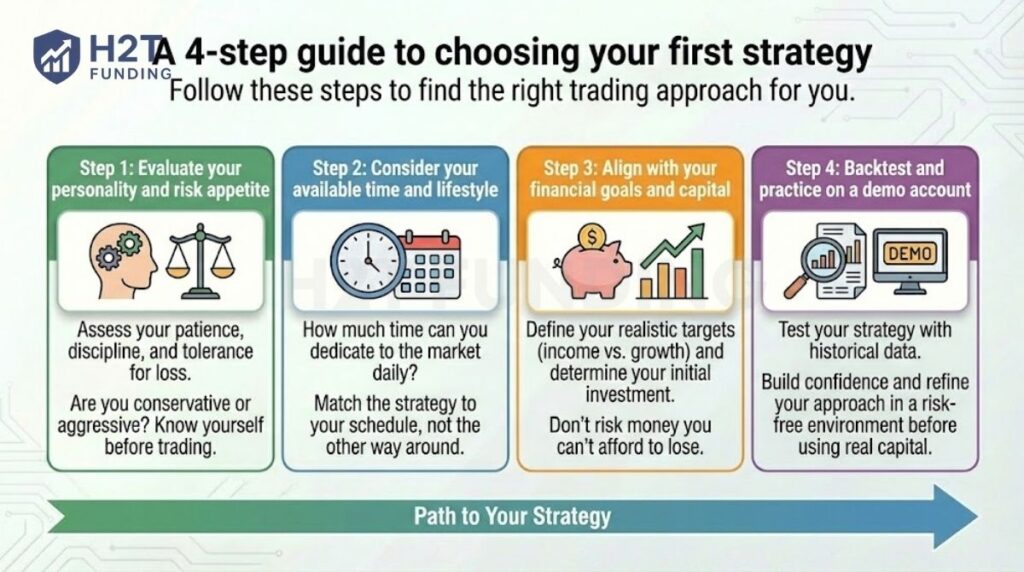

5. A 4-step guide to choosing your first strategy

Okay, you’ve seen the options. Now comes the most important part: matching one to your life. Don’t just pick what sounds cool or profitable on paper; use these four steps to find what actually fits.

- Step 1: Evaluate your personality and risk appetite

- Step 2: Consider your available time and lifestyle

- Step 3: Align with your financial goals and capital

- Step 4: Backtest and practice on a demo account

Let’s walk through each of these steps in more detail below.

5.1. Step 1: Evaluate your personality and risk appetite

How do you handle pressure? Be honest. If a losing trade will ruin your day, high-action styles like scalping are probably out. Your trading method shouldn’t be a source of constant anxiety; it needs to match your natural wiring.

5.2. Step 2: Consider your available time and lifestyle

Now, let’s talk about your real life. The clock on the wall is a huge factor. You simply can’t day trade if you aren’t available to watch the market. A quick look at your daily schedule will tell you if you need a flexible approach like swing trading.

5.3. Step 3: Align with your financial goals and capital

You also have to know your why. Is the goal to help with this month’s bills, or is it to build a fund for the next decade? A quick-income goal fits the world of active trading, while a long-term vision is what position trading was built for.

5.4. Step 4: Backtest and practice on a demo account

And finally, don’t even think about using real cash until you’ve practiced. Open a demo account and treat it like the real thing. This is where you find the flaws in your trading plan and get your mistakes out of the way for free. It’s your training ground.

Answering these questions honestly does more than just point you to a strategy. It gives you a logical starting place that’s grounded in your reality. Self-awareness is the foundation for everything that comes next.

This preparation is especially important if your goal is to trade with a firm, as knowing how to pass a prop firm challenge requires discipline, consistency, and a well-tested strategy.

6. Core principles for executing any strategy successfully

Choosing a strategy is like picking the right tool for the job. But even the best tool is useless if you don’t know how to handle it. These three principles are the bedrock of disciplined trading, and they are arguably more important than the specific strategy you choose.

6.1. Risk management: Protect your capital at all costs

Let’s get one thing straight: your main job isn’t to hunt for massive wins. It’s to play defense. Risk management means you define all your potential exit points, especially your stop-loss, before you ever risk a cent. It’s the single rule that prevents one bad trade from blowing up your account.

6.2. Position sizing: Never risk too much on a single trade

This is all about how much skin you put in the game on any single idea. Your focus has to shift from what’s my upside? What’s my absolute max loss? Keeping each trade to a tiny fraction of your account means you can be wrong five times in a row and still be fine. It’s what keeps you in the game.

6.3. Trading psychology: Master your emotions to stay disciplined

Here’s the hard truth: the best strategy in the world is useless if your head isn’t right. This is about the discipline to follow your own rules when you’re feeling the pressure. Trading psychology is your defense against emotional trading, stopping you from making those gut decisions based on fear or greed that you almost always regret later.

These three ideas all work together. Small position sizes keep your emotions calm. A clear risk plan removes the guesswork. Your strategy finds the trades, but these principles are what will allow you to survive long enough to see them pay off.

To consistently apply these principles, traders must learn how to be more disciplined in their trading, as discipline is what keeps rules intact under pressure. At the same time, knowing how to calculate lot size in forex ensures your risk and position sizing stay aligned with your plan.

7. FAQs

There is no such thing. Profitability comes from the trader’s skill, discipline, and how well their chosen strategy fits the current market. The most profitable strategy will always be the one you can execute consistently and without emotion.

Slower strategies like swing trading or position trading are often better for beginners. These styles often target markets with sufficient liquidity while reducing the pressure to be perfect on every entry.

While experienced traders sometimes do, beginners should avoid this. Your goal should be to master one strategy first. Trying to juggle multiple systems before you’ve found consistency with one is a common and costly mistake.

You should review your trades regularly (weekly or monthly), but avoid changing your core strategy based on a few losses. Only consider adjustments after a large sample size of trades (50+) or a significant, lasting change in market behavior.

Generally, trading is broken down into four types based on timeframe: scalping (seconds/minutes), day trading (within one day), swing trading (days/weeks), and position trading (weeks/months/years).

This is not a universal rule but a set of personal guidelines some traders use. One common interpretation relates to risk-reward, suggesting traders aim for a 3:1 reward-to-risk ratio on average, with the best trades reaching 5:1, and so on. It’s a framework for discipline, not a market law.

The 90-90-90 rule is a popular cautionary saying in trading: 90% of new traders lose 90% of their money within 90 days. While not an official statistic, it serves as a powerful reminder of the risks involved and the absolute necessity of education and discipline.

The best trading strategy is the one that fits you. It must align with your personality, your schedule, and your financial goals. There is no one-size-fits-all answer.

There are countless types of trading strategies, as traders constantly create new variations. However, nearly all of them are built upon the core concepts and foundational categories we’ve covered in this guide.

While trading can be broken down in many ways, a common grouping includes scalping, day trading, swing trading, position trading, and algorithmic trading. These top 5 trading strategies cover a wide range of timeframes and levels of automation.

Yes, the core principles of these methods apply across markets. However, the types of trading strategies in forex differ from the types of trading strategies in the stock market because each market has unique volatility and trading hours. Many people search for types of trading strategies PDF to study, but understanding the live application in your chosen market is key.

8. Conclusion

We’ve walked through 17 different types of trading strategies, but the goal was never for you to memorize a list. It was to help you find a starting point. A good strategy is more than just a set of rules; it’s a business plan that is custom-fit to your personality, your schedule, and your personal goals.

Finding that fit is the first step. The real work is in the execution, applying discipline and solid risk management day in and day out. That is what separates hopeful amateurs from consistent traders.

Your learning journey doesn’t end here. To deepen your understanding and explore more advanced concepts, we encourage you to read other articles in our Prop Firm & Trading Strategies section at the H2T Funding blog.